Digital Signature Market Insights: $34.7 Billion Global Growth by 2025 with Key Insights from the U.S., India, and Germany

Explore the global digital signature market’s projected growth to $34.7 billion by 2025, including comprehensive analysis of digital signature market dynamics, regulatory frameworks, regional trends, and key insights from the U.S., India, and Germany. Discover how upstream and downstream components shape the industry’s evolution and impact business operations worldwide.

- Last Updated:

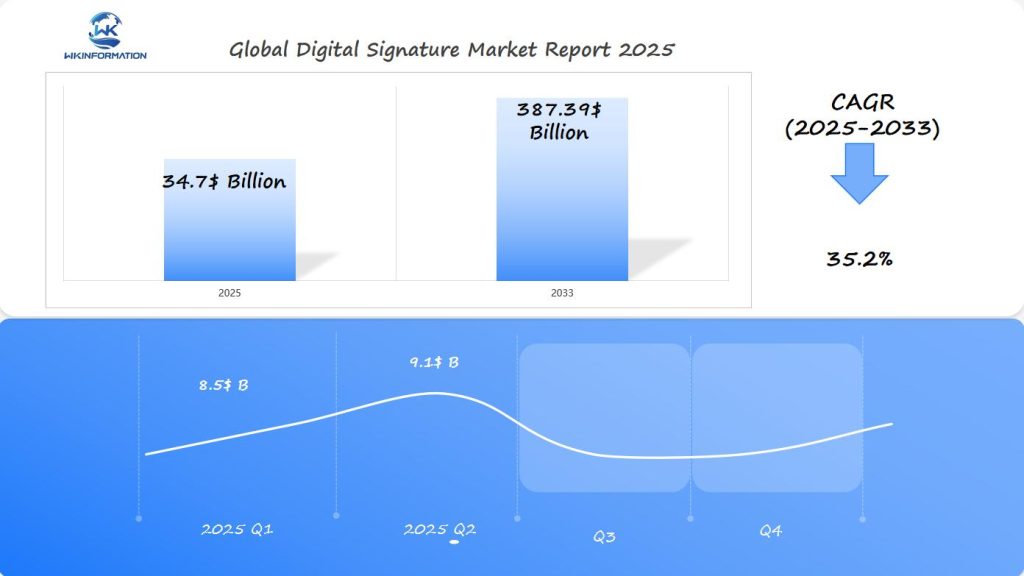

Digital Signature Market Q1 and Q2 2025 Forecast

The Digital Signature market is expected to reach $34.7 billion in 2025, with an exceptional CAGR of 35.2% from 2025 to 2033. In Q1 2025, the market will likely generate approximately $8.5 billion, driven by the increasing adoption of digital signatures in legal, financial, and government sectors. The U.S., India, and Germany are leading the way in regulatory compliance and digital transformation initiatives.

By Q2 2025, the market is expected to grow to $9.1 billion, as businesses continue to embrace electronic signatures for streamlined operations, improving document management and reducing the need for physical paperwork. The significant rise in online transactions, cloud solutions, and cybersecurity measures will propel the market further, especially with increasing demand in financial services, healthcare, and e-commerce.

The U.S. is a key driver due to stringent electronic signature regulations and the push for paperless environments. The adoption is also strong in India and Germany, where digitization of government services and cross-border digital agreements are growing.

Exploring the Upstream and Downstream Dynamics of Digital Signatures

The world of digital signatures is powered by a complex system of upstream and downstream elements that work in harmony to make secure electronic document signing possible.

Upstream Components

These are the key players who provide the essential tools and technologies for digital signatures:

- Technology infrastructure providers

- Cryptographic algorithm developers

- Digital certificate authorities

- Security protocol creators

- API developers

Downstream Components

These are the experts who integrate digital signatures into various applications and systems:

- Software integration specialists

- End-user applications

- Business process management systems

- Document management platforms

- User authentication services

The collaboration between these upstream and downstream components forms a strong foundation for digital signatures. Certificate authorities ensure that digital identities are verified and authenticated, while technology providers build the necessary infrastructure for secure signing processes. These upstream elements then flow into downstream applications where businesses and individuals use digital signatures in their everyday activities.

Key Market Influencers

Several key players have a significant impact on the digital signature market:

- Certificate Authorities: These entities issue digital certificates to verify the identities of signers.

- Technology Providers: They create tools for generating and validating signatures.

- End Users: Various sectors drive market demand through their adoption of digital signatures.

The Importance of Collaboration

The growth of this ecosystem relies on smooth cooperation among all participants involved. When certificate authorities improve their verification methods, technology providers can develop more secure solutions. As end-users implement these solutions, they provide valuable feedback that fuels upstream innovations, leading to a continuous cycle of improvement and expansion in the market.

The success of the digital signature market depends on this interconnected network, where the actions of each player directly influence the effectiveness and security of the entire ecosystem.

Trends Driving the Growth of the Digital Signature Market

The digital signature market has experienced unprecedented growth, propelled by several key trends reshaping the business landscape:

1. Remote Work Revolution

- Global shift to remote operations driving mass adoption of digital signing solutions

- 85% increase in digital signature usage during COVID-19 lockdowns

- Integration with virtual collaboration platforms and cloud services

2. Enhanced Security Requirements

- Rising cyber threats pushing businesses toward authenticated signing solutions

- Implementation of blockchain technology for tamper-proof documentation

- Advanced encryption methods ensuring document integrity and authenticity

3. Technological Innovations

- AI-powered signature verification systems

- Biometric authentication integration

- Mobile-first solutions with cross-platform compatibility

- Cloud-based signature platforms with real-time tracking

4. Industry-Specific Developments

- Healthcare sector adopting HIPAA-compliant digital signing solutions

- Banking institutions implementing eKYC verification through digital signatures

- Real estate agencies moving toward completely paperless transactions

5. Environmental Sustainability

- Paper consumption reduction initiatives

- Carbon footprint decrease through digital documentation

- Sustainable business practices driving digital transformation

The market’s technological landscape continues to evolve with innovations in:

- Quantum cryptography for enhanced security

- Smart contract integration

- Multi-factor authentication systems

- API-driven signature solutions for seamless integration

These advancements create robust digital signing environments that meet modern business needs while ensuring compliance and security standards.

Regulatory Challenges Affecting the Digital Signature Industry

The digital signature landscape faces complex regulatory requirements across different jurisdictions, creating significant compliance challenges for businesses operating globally.

Key Regulatory Frameworks:

- eIDAS Regulation (EU): Establishes strict standards for electronic identification and trust services

- ESIGN Act (US): Provides legal recognition of electronic signatures at the federal level

- IT Act (India): Governs digital signature validity and authentication processes

Compliance Requirements for Businesses:

- Implementation of robust identity verification systems

- Maintenance of detailed audit trails

- Regular security assessments and certifications

- Data protection and privacy measures alignment

- Cross-border transaction compliance

Impact on Market Growth:

Regulatory requirements create both opportunities and obstacles for market participants. Stringent compliance standards increase operational costs and implementation timelines. However, these regulations build trust in digital signature solutions, driving wider adoption across industries.

Regional Variations:

Different jurisdictions maintain varying requirements for digital signature validity. Businesses must navigate:

- Authentication level requirements

- Data retention policies

- Privacy protection standards

- Cross-border recognition rules

The complexity of regulatory frameworks has led to the emergence of specialized compliance solutions. These tools help organizations maintain regulatory adherence while streamlining digital signature implementation across multiple jurisdictions.

Geopolitical Factors Impacting Digital Signature Technology

Government policies around the world create different environments for digital signature adoption. The European Union’s eIDAS regulation sets strict standards for electronic identification, creating a unified digital market across member states. This harmonized approach is different from China’s restrictive policies, where foreign digital signature providers face market entry barriers due to data sovereignty requirements.

Supportive Initiatives by Countries

Several countries have launched supportive initiatives:

- United States: The ESIGN Act provides legal recognition for electronic signatures in interstate commerce

- India: Digital India program promotes widespread adoption of digital signatures in government services

- Singapore: National Digital Identity project integrates digital signatures into citizen services

Role of International Standards

International standards play a crucial role in market development:

- ISO 32000: Defines universal PDF digital signature standards

- X.509: Establishes public key infrastructure specifications

- ETSI standards: Ensures cross-border interoperability in the EU

Implementation Challenges of Standards

These standards face implementation challenges in different regions:

- Data localization laws in Russia and China restrict cloud-based signature services

- Middle Eastern countries require additional authentication methods

- Developing nations struggle with infrastructure requirements for advanced digital signatures

The geopolitical landscape has created regional technology clusters, with the EU focusing on qualified electronic signatures, while the U.S. market emphasizes cloud-based solutions. This regional specialization influences product development and market strategies for digital signature providers.

Digital Signature Market Segmentation: Types and Applications

The digital signature market divides into distinct categories based on signature types and industry applications, each serving specific security needs and compliance requirements.

Types of Digital Signatures:

1. Basic Electronic Signatures (BES)

- Simple digital marks or scanned signatures

- Limited security features

- Suitable for low-risk transactions

2. Advanced Electronic Signatures (AES)

- Unique identification of signers

- Enhanced security through encryption

- Tamper-evident seals

- Used in business contracts

3. Qualified Electronic Signatures (QES)

- Highest security level

- Legally equivalent to handwritten signatures

- Requires qualified certificate from trust service providers

- Essential for government and legal documents

Industry Applications:

1. Banking & Financial Services

- Loan agreements

- Account openings

- Investment contracts

2. Healthcare

- Patient consent forms

- Medical records

- Insurance claims

3. Legal

- Court filings

- Legal contracts

- Intellectual property documents

4. Real Estate

- Property agreements

- Lease contracts

- Title transfers

The market segmentation reflects varying security requirements across industries. Banks demand QES for high-value transactions, while healthcare providers use AES for patient documentation. This segmentation drives product development and pricing strategies among digital signature providers.

The Role of Applications in Shaping the Digital Signature Market

Digital signature applications transform business operations through automated workflows and enhanced security protocols. These applications deliver measurable impacts across multiple business functions:

Operational Benefits:

- 80% reduction in document processing time

- 91% decrease in paper-related costs

- 60% improvement in document tracking accuracy

Real-World Implementation Success

Banking Sector Case Study:

JPMorgan Chase implemented DocuSign’s digital signature solution across their mortgage operations, resulting in:

- 75% faster loan processing

- $1M annual cost savings

- 50% reduction in document errors

Healthcare Implementation:

Mayo Clinic’s adoption of digital signatures for patient documentation achieved:

- 85% decrease in form completion time

- Enhanced HIPAA compliance

- Improved patient satisfaction rates

Security Enhancements Through Applications

Digital signature applications incorporate multiple security layers:

- Biometric authentication

- Blockchain integration

- Audit trail documentation

- Encryption protocols

These applications create standardized workflows while maintaining compliance with industry regulations. The integration of artificial intelligence and machine learning capabilities enables smart document routing, automated verification, and fraud detection.

The healthcare sector demonstrates significant adoption rates, with 67% of providers now using digital signature applications for patient onboarding, consent forms, and medical records management. Similarly, the insurance industry reports a 45% increase in policy processing speed through digital signature implementation.

Regional Market Performance in the Digital Signature Industry

North America: The Front-Runner

North America leads the digital signature industry. The region’s success can be attributed to:

- Strong technological infrastructure

- High levels of digital literacy

- Supportive regulatory frameworks for e-signatures

- Widespread adoption across various industries

Europe: Steady Growth

Europe is also experiencing steady growth, thanks to:

- eIDAS regulations that standardize digital signatures

- The ability to conduct cross-border transactions

- A strong focus on data protection

- Government-backed initiatives for digital transformation

Asia Pacific: The Fastest-Growing Market

The Asia Pacific region is emerging as the fastest-growing market, driven by:

- Efforts to rapidly digitize

- Government support for initiatives aimed at reducing paper usage

- An expanding e-commerce sector

- Increasing penetration of smartphones

Key Factors Influencing Adoption in Different Regions

North America

- Advanced measures to ensure cybersecurity

- High adoption rates of cloud technology by businesses

- Significant investments from venture capitalists

Europe

- Strict laws governing data protection

- Harmonized standards for digital signatures across countries

- Emphasis on secure transactions between different countries

Asia Pacific

- An approach that prioritizes mobile technology

- Initiatives promoting digital payments

- The emergence of new startups in the region

Varying Adoption Rates Across Regions

Adoption rates differ significantly among regions:

- North America: 85% implementation in large enterprises

- Europe: 72% implementation in large enterprises

- Asia Pacific: 65% implementation in large enterprises (rapidly catching up)

These variations reflect the maturity of local markets, the regulatory environments in place, and the levels of technological readiness across different regions.

U.S. Digital Signature Market: Regulatory Landscape and Trends

The U.S. digital signature market operates under a robust legal framework established by two key pieces of legislation:

- Electronic Signatures in Global and National Commerce Act (ESIGN) – Grants electronic signatures the same legal status as handwritten signatures

- Uniform Electronic Transactions Act (UETA) – Provides consistent rules across states for electronic records and signatures

The U.S. market demonstrates significant growth driven by several government initiatives:

Federal Support Programs:

- Digital Government Strategy

- Cloud Smart Policy

- Federal Risk and Authorization Management Program (FedRAMP)

Market Growth Indicators:

- Rising adoption in federal agencies

- Increased implementation across healthcare systems

The U.S. regulatory environment creates distinct advantages for digital signature adoption:

- Legal Recognition

- Court-admissible evidence

- Cross-border transaction validity

- State-level acceptance

- Industry-Specific Compliance

- HIPAA compliance in healthcare

- SEC requirements for financial services

- FDA guidelines for life sciences

The U.S. market sees particular strength in sectors requiring strict documentation:

- Banking and financial services

- Healthcare providers

- Government agencies

- Real estate transactions

- Insurance companies

India’s Expanding Digital Signature Market

India’s digital signature market has changed significantly due to the Information Technology Act, 2000. This important law recognizes electronic signatures as legally valid, creating a strong system for online transactions throughout the country.

Key Elements of India’s Regulatory Framework

The rules governing digital signatures in India consist of several important parts:

- Digital Signature Certificates (DSCs) – These are issued by authorized Certifying Authorities under the supervision of the Controller of Certifying Authorities (CCA).

- eSign Services – These services enable immediate verification of digital signatures using Aadhaar biometric authentication.

- Public Key Infrastructure (PKI) – This technology supports secure implementation of digital signatures across various platforms.

How the Indian Government is Promoting Digital Signatures

The Indian government’s Digital India initiative has further boosted the growth of the digital signature market through:

- Implementation of e-governance projects

- Mandatory e-filing for company documentation

- Digital integration of banking services

- Promotion of paperless transactions in healthcare

Current Trends in Digital Signature Adoption

The Make in India program has led to more use of digital signatures in manufacturing industries, while the Jan Dhan Yojana banking initiative has increased the need for digital verification in financial services.

Sectors Leading the Way in Digital Signature Adoption

Indian businesses are quickly adopting digital signatures into their processes, with industries such as banking, insurance, and real estate being at the forefront. The government’s push for paperless documentation has resulted in a significant rise in demand for digital signature solutions among small and medium-sized enterprises.

Germany’s Approach to Digital Signature Adoption and Security

Germany’s digital signature market demonstrates robust growth potential. The German regulatory framework creates a secure environment for digital signature adoption through two key legislations:

- Trust Services Act (VDG): Implements strict security standards for digital signatures

- eIDAS Regulation: Establishes cross-border recognition of electronic signatures

Security Challenges for German Enterprises

German enterprises face specific security challenges when implementing digital signatures:

- Data Protection Requirements

- Compliance with GDPR standards

- Secure storage of signature certificates

- Protection against unauthorized access

- Technical Infrastructure

- Integration with existing systems

- Maintenance of signature validation services

- Regular security updates

Prioritizing Qualified Electronic Signatures

The German market prioritizes qualified electronic signatures (QES), which offer the highest level of security and legal validity. These signatures require:

- Personal identification verification

- Secure signature creation devices

- Qualified certificates from authorized providers

Additional Security Measures by German Businesses

German businesses implement additional security measures:

- Multi-factor authentication

- Encryption protocols

- Audit trails for signature processes

- Regular security assessments

Regulatory Oversight by the Bundesnetzagentur

The German Federal Network Agency (Bundesnetzagentur) oversees trust service providers, ensuring compliance with security standards and maintaining market integrity. This strict regulatory environment positions Germany as a leader in secure digital signature adoption across Europe.

Future Projections for the Digital Signature Industry

The digital signature market is on the verge of significant growth, with forecasts suggesting an increase from $34.7 billion in 2025 to $387.39 billion by 2033. This remarkable expansion represents a CAGR of 35.2%, driven by several key factors:

Growth Catalysts

- Rising cybersecurity threats pushing organizations toward secure authentication methods

- Accelerated digital transformation across industries

- Integration of blockchain technology with digital signatures

- Growing adoption of cloud-based signature solutions

The market’s trajectory is shaped by emerging technological innovations:

- AI-Powered Verification: Implementation of artificial intelligence for enhanced signature authentication

- Biometric Integration: Advanced biometric features combining with digital signatures

- Mobile-First Solutions: Rise of smartphone-based signing capabilities

- IoT Integration: Digital signatures expanding into smart device authentication

Industry-Specific Growth Prospects

Regional markets display varying growth patterns. North America maintains its market leadership position, while European markets demonstrate steady expansion driven by stringent regulatory frameworks.

The subscription-based model continues gaining traction. This shift indicates a strong preference for scalable, flexible signing solutions among businesses of all sizes.

Competitive Analysis: Leading Digital Signature Providers

The digital signature market has several key players who are driving innovation in the industry through strategic partnerships and technological advancements.

-

DocuSign – United States

-

HelloSign – United States

-

SunGard Signix Inc. – United States

-

SafeNet Inc. – United States

-

ePadLink – United States

-

Adobe Sign – United States

-

airSlate Inc. – United States

-

PandaDoc Inc. – United States

-

SignEasy – United States

-

Topaz Systems – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Digital Signature Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The digital signature market is expected to undergo significant changes across industries, with a projected growth from $34.7 billion to $387.39 billion by 2033 indicating widespread adoption. This growth is expected to be driven by increased market penetration in key regions:

- North America continues to hold the top position

- Germany emerges as a major player in Europe

- India speeds up adoption through progressive digital initiatives

Several factors indicate strong growth potential in the market:

- Rising demand from small and medium enterprises

- Increased implementation in the banking, financial services, insurance (BFSI) and healthcare sectors

- Enhanced security features driving enterprise adoption

- Government support through favorable regulations

The competitive landscape is constantly evolving due to strategic partnerships, technological innovations, and expanding service offerings. Market leaders are adapting their solutions to meet specific regional requirements while still adhering to global standards.

The digital signature industry is at a crucial point where technological advancement aligns with regulatory compliance. This intersection creates opportunities for:

- Enhanced workflow automation

- Reduced operational costs

- Improved security protocols

- Cross-border transaction capabilities

These market trends position digital signatures as an essential part of the global digital transformation journey, redefining how businesses carry out transactions and handle documentation in the future.

Global Digital Signature Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Digital Signature Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Digital Signature Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalDigital Signature Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Digital Signature Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Digital Signature Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Digital Signature Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Digital Signature Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream and downstream dynamics of digital signatures?

In the context of digital signatures, upstream dynamics refer to the processes and relationships involving technology providers and certificate authorities that create and manage digital signature solutions. Downstream dynamics involve end-users who implement these solutions in various applications, influencing overall market growth through their adoption and feedback.

Who are the key players in the digital signature ecosystem?

The key players in the digital signature ecosystem include technology providers, such as software companies that develop digital signature solutions; certificate authorities that issue digital certificates; and end-users from various sectors like finance, healthcare, and government who utilize these signatures for secure transactions.

What trends are currently driving the growth of the digital signature market?

Recent trends contributing to the expansion of the digital signature market include increased remote work due to COVID-19, a heightened demand for secure online transactions, and advancements in technologies such as blockchain and artificial intelligence that enhance the security and efficiency of digital signatures.

What regulatory challenges does the digital signature industry face?

The digital signature industry faces several regulatory challenges, particularly regarding compliance with laws like the eIDAS Regulation in Europe. Businesses must navigate these regulations to ensure their adoption of digital signatures meets legal requirements, which can either hinder or facilitate market growth depending on how supportive or restrictive these regulations are.

How do geopolitical factors influence digital signature technology adoption?

Geopolitical factors significantly impact digital signature technology adoption through government initiatives that promote or restrict usage. Supportive policies can enhance market growth, while potential barriers such as stringent regulations may slow down adoption. Additionally, international standards play a crucial role in ensuring interoperability across different regions.

What is the future projection for the digital signature industry?

The future projection for the digital signature industry indicates substantial growth, with forecasts estimating an increase from $34.7 billion to $387.39 billion by 2033. Factors enabling this sustained expansion include technological advancements, increasing regulatory support, and a growing need for secure electronic transactions across various industries.