2025 Contactless IC Card Chip Market Revolutionizing Payments with $4.39 Billion Growth in United States, China, and Japan

Discover how the contactless IC card chip market is thriving in the US, China, and Japan, with insights into Trump-era security policies, mobile wallet adoption, and technological innovations shaping the future of digital payments. Learn about market growth projections, regional differences, and the impact of the global pandemic on contactless payment trends.

- Last Updated:

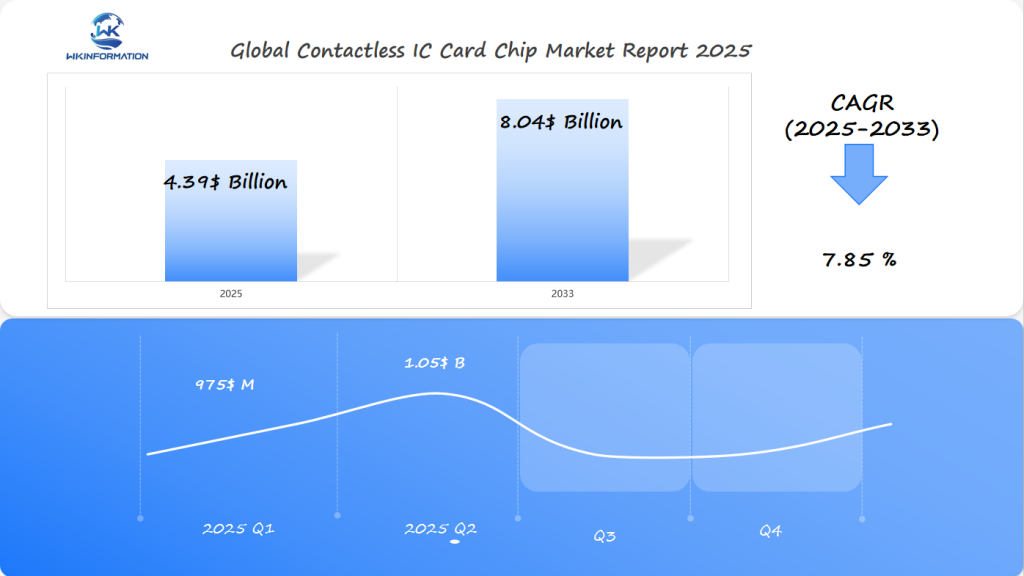

Market Forecast for Contactless IC Card Chip in Q1 and Q2 2025

The Contactless IC Card Chip market is expected to reach USD 4.39 billion in 2025, with a CAGR of 7.85%. Given the increasing demand for secure and efficient payment systems, the estimated market size for Q1 2025 is approximately USD 975 million, with a rise to around USD 1.05 billion in Q2 2025. The market growth is driven by the adoption of contactless payment technologies, particularly in sectors such as retail, transportation, and banking, as well as the increasing demand for smart cards and secure access systems.

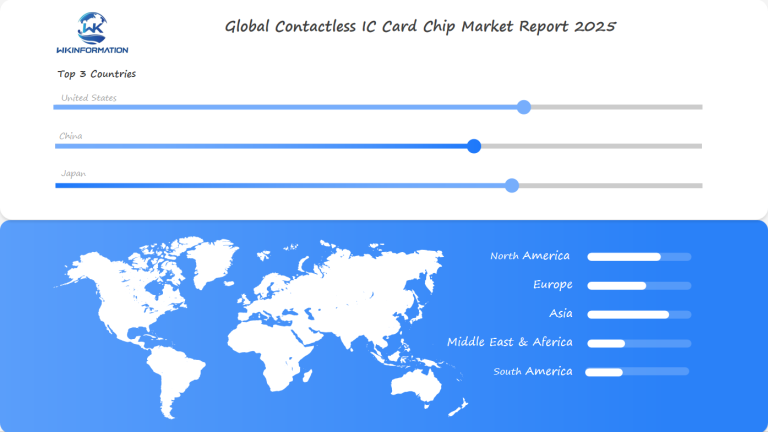

The United States, China, and Japan are expected to dominate the contactless IC card chip market. The US leads with the rapid adoption of digital payments and advanced banking technologies. China is experiencing high growth due to the extensive use of contactless payment systems in everyday transactions and public services. Japan’s focus on enhancing the security and efficiency of its payment systems and infrastructure for the 2025 World Expo also presents substantial market opportunities. Key players in the market should focus on enhancing chip security, improving manufacturing efficiency, and ensuring compatibility with global payment standards to maintain a competitive advantage.

Contactless IC Card Chip Market Industry Chain and Supply Analysis

The contactless IC card chip market is a key part of the semiconductor world. It has a complex supply chain that drives new tech and progress. As more people want easy digital payments, it’s vital to know about the chip makers and how they get their products to us.

Big names in semiconductors are changing the game with smart partnerships and new ways to make chips. The market is evolving fast because of new tech and people’s need for safe, quick ways to pay.

Key Players in the Supply Chain

- Leading semiconductor manufacturers specializing in contactless IC chips

- Global technology corporations developing advanced chip technologies

- Specialized design firms creating innovative chip architectures

- Materials suppliers providing critical components for chip production

Manufacturing Processes and Materials

Making contactless IC card chips is a complex job. Advanced nanoscale technologies help make small, powerful chips. These chips support complex payment and security needs.

Distribution Channels and End-Users

Distribution networks for contactless IC card chips cover many areas, including:

- Financial institutions

- Payment technology providers

- Transportation systems

- Healthcare networks

- Government agencies

Major Trends Influencing the Contactless IC Card Chip Market in 2025

The contactless IC card chip market is changing fast. New technologies and what people want are driving these changes. How we pay and use digital services is getting a big update.

- Accelerated mobile integration across payment ecosystems

- Enhanced biometric security features

- Seamless connectivity between devices and payment systems

Increasing Adoption of Contactless Payments

Contactless payments are growing fast. Every day, 500 million digital transactions happen in finance. This shows people love easy payment options.

Integration with Mobile Devices and Wearables

Mobile integration is changing how we pay. Over 18.8 billion IoT devices worldwide make linking phones, wearables, and payments easy. Now, we can pay with smartwatches, fitness trackers, and phones with ease.

Enhanced Security Features and Biometric Authentication

Biometric security is key in the contactless IC card chip market. Systems like facial and iris scanning protect against identity theft, which jumped 43% last year. These methods use unique traits that are hard to fake.

The security market is growing fast. It’s expected to reach $12.52 billion by 2032. This shows how important strong security is in digital payments.

Challenges and Regulatory Restrictions in the Contactless IC Card Chip Industry

The growth of contactless IC card chip technology brings big challenges. These include data protection, payment rules, and industry standards. As digital payments grow, it’s key to solve these issues for safe and reliable transactions.

Financial groups and tech companies face many rules when making contactless payments. The security and privacy world is full of big hurdles that need smart plans.

Security and Privacy Concerns

Contactless payments have special security risks. These include:

- Unauthorized scanning of card info

- Data interception during wireless use

- Advanced digital theft risks

Interoperability Issues

Standardization is a big problem in the contactless IC card chip world. Different makers and banks have trouble making things work together smoothly.

| Challenge | Impact | Potential Solution |

|---|---|---|

| Technical Incompatibility | Bad User Experience | Unified Communication Standards |

| Diverse Chip Architectures | Less Function Across Platforms | Industry-Wide Technical Specs |

Regulatory Compliance and Standards

Understanding complex legal rules is key for payment regulations. Contactless IC card chip makers must follow strict standards to keep trust and reliability.

Keeping up with new security rules is vital for the growth of contactless payments.

Geopolitical Factors Reshaping the Contactless IC Card Chip Market

The global trade scene is changing fast, especially in the contactless IC card chip market. Geopolitical issues are bringing new challenges and chances for chip makers and tech providers.

The chip industry is facing big changes due to global trade issues and shifts in economic power. Government actions are also changing how chips are made and sold, altering the tech world.

Trade Tensions and Supply Chain Disruptions

Chip shortages are a big worry for makers all over. Key points include:

- Trade limits between big countries

- Geopolitical issues hitting chip supply lines

- Costs for chip materials could rise by 15%

Localization of Chip Production

Countries are putting money into making chips at home to cut down on foreign reliance. The push for tech self-sufficiency is leading to big investments in local chip making.

Government Initiatives and Investments

National plans are forming to back home chip industries. Key areas include:

- Funding for chip research and development

- Tax breaks for chip makers

- Partnerships with tech firms

Market Segmentation of Contactless IC Card Chips by Technology and Chip Type

The contactless IC card chip market is changing fast. New technologies and different chip designs are leading the way. As digital payments and secure IDs grow, knowing about smart card types is key for those in the industry.

NFC vs. RFID Technology Comparison

NFC and RFID chips are two different ways to communicate without touching. RFID chips can talk to devices from far away, great for tracking and access control. Near Field Communication (NFC) is better for close, secure transactions like mobile payments.

- RFID Chips: Long-range identification (up to 100 meters)

- NFC Technology: Short-range, high-security communication (4 cm or less)

- Typical Applications: Tracking, payment systems, access control

Advanced Chip Configurations

Dual-interface and multi-application chips are the latest in smart card tech. These chips can do many things at once. They support different payments and IDs on various platforms.

| Chip Type | Key Features | Market Potential |

|---|---|---|

| Memory-based Chips | Static data storage | Low complexity applications |

| Microprocessor Chips | Dynamic processing | High-security environments |

| Dual-interface Chips | Multiple communication protocols | Versatile payment systems |

The tech revolution in contactless IC card chips is bringing better security, flexibility, and user experience to digital worlds everywhere.

Applications of Contactless IC Card Chips in Payments and Security Systems

Contactless IC card chips have changed digital banking and security. They offer new solutions in many areas. These chips are making our interactions with money, travel, and security systems better.

Financial Services and Digital Banking

Digital banking uses contactless IC card chips for better security and easier transactions. Some key points include:

- Credit and debit cards with embedded contactless technology

- Mobile wallet integrations

- Contactless ATM transactions

Public Transportation and Smart Transit Cards

Smart transit cards have changed how we travel in cities. They make getting around easy and fast. Cities are using contactless payment systems for quick travel.

| Region | Transit Card Adoption | Key Features |

|---|---|---|

| North America | High | NFC-enabled payment |

| Asia Pacific | Rapid Growth | Multi-application platforms |

| Europe | Mature Market | Integrated urban mobility |

Access Control and Identity Verification

Contactless IC card chips offer strong solutions for secure access. They are used in government IDs, building entry systems, and secure areas.

With over 500 million daily digital transactions in September 2024, contactless IC card chips are key in today’s tech world.

Global Contactless IC Card Chip Market Regional Demand and Forecast Analysis

The global contactless IC card chip market is growing fast in different parts of the world. Each region has its own growth patterns and demand levels. New technologies and digital changes are shaping the market.

Each region has its own path for contactless IC card chip technology growth. The market is divided into main areas, each with its own growth potential.

North America Market Outlook

North America holds about 25% of the global market. It shows strong growth potential. The United States is leading with big investments in contactless payments and digital transactions.

- Market share: 25% of global contactless IC card chip market

- Projected CAGR: 4.3% during forecast period

- Key drivers: Digital payment innovation and cybersecurity enhancements

European Market Trends

European markets are growing steadily, making up 20% of global demand. Strict rules like GDPR are shaping technology and security in contactless systems.

| Market Characteristic | European Performance |

|---|---|

| Market Share | 20% |

| Regulatory Environment | Strict Data Protection |

| Technology Adoption | Moderate to High |

Asia-Pacific Growth Projections

The Asia-Pacific region is leading with 40% of the market. Countries like China and Japan are growing fast with new technology and big investments.

- Market dominance: 40% of global contactless IC card chip market

- China’s market share: 30% of regional growth

- Key growth factors: Digital payment solutions and consumer technology integration

The global contactless IC card chip market is set for big growth. Each region has its own unique technology and economic trends.

USA Contactless IC Card Chip Market Growth and Investment Trends

The United States is seeing big changes in how we pay for things. Contactless IC card chips are leading this change in many areas. This growth is thanks to more people using digital payments and partnerships between tech and finance.

What’s driving this growth? It’s the shift in what people want and the tech improvements in finance. Cities like New York, San Francisco, and Chicago are at the forefront. They’re making digital payments a big part of their economies.

Adoption Rates in Major US Cities

- New York: 42% contactless payment penetration

- San Francisco: 38% digital payment adoption

- Chicago: 35% mobile wallet usage

Investment in Contactless Payment Infrastructure

Financial institutions are pouring money into new payment systems. This investment is helping the US market grow. It’s all about getting ready for the next big thing in payments.

Partnerships between Tech Companies and Financial Institutions

Partnerships between tech giants and banks are speeding up the use of contactless payments. Companies like Apple and Google are working with banks. They aim to make payments easy, safe, and meet what people want.

China Contactless IC Card Chip Market Expansion and Industry Insights

The Chinese semiconductor industry is leading the way in digital innovation. It’s making big changes in how we pay without touching cards. China’s focus on chip making has made it a top player in contactless IC card tech.

Key developments in the market include:

- Accelerated domestic chip production capabilities

- Robust government support for contactless technologies

- Seamless integration with social media platforms

Domestic Chip Manufacturing Capabilities

China has put a lot of money into making its own semiconductor tech. The embedded security market’s growth shows China’s tech is on the rise.

Government Support for Contactless Technology

The digital yuan is a big step forward in China’s payment system. The government is pushing for more contactless payments. This helps tech innovation grow.

Integration with Social Media and E-commerce Platforms

WeChat Pay has changed how we pay online. It links payments with social media. This makes paying online a big part of our lives.

China is a big player in the smart cards market, with 37.4% of the revenue in 2024. It keeps leading the way in contactless IC card chip tech.

Japan Contactless IC Card Chip Market Demand and Market Performance

Japan leads in contactless technology, creating new ways to pay digitally. It aims to be a society without cash, leading the world in this area.

The Japanese market loves FeliCa chips for their role in easy transactions. Contactless payment systems are everywhere, especially in Suica cards for public transport.

Adoption of FeliCa Technology

FeliCa technology has changed how people pay in Japan. It offers:

- Fast data transfer

- Strong security

- Works well with many devices

Public Transportation Integration

Suica cards are a top example of contactless tech in action. They make traveling by train, bus, and more easy and smooth.

Retail and Vending Machine Payments

In Japan, contactless payments are everywhere. Even vending machines and small shops use FeliCa chips, making it a cashless society.

Future Innovations and Smart Technology in Contactless IC Card Chips

Contactless IC card technology is changing fast. New innovations are making these chips do more than just pay for things. They’re becoming key players in our digital lives.

- IoT integration for better digital connections

- Energy harvesting to cut down on battery use

- Quantum-resistant encryption for top-notch security

Revolutionizing IoT Device Connectivity

IoT integration is turning contactless IC card chips into smart devices. They’re making homes and cities smarter by connecting devices in new ways. Contactless tech is helping the market.

Breakthrough Energy Harvesting Solutions

Energy harvesting is a big step forward for contactless chips. These chips can run forever by using energy from their surroundings. Innovative materials let them use body heat, movement, and electromagnetic fields for power.

Quantum-Resistant Security Paradigms

Quantum encryption is changing how we keep things safe. It uses new algorithms to protect against cyber threats. This tech is a big step in keeping our data safe from hackers.

| Technology | Key Advancement | Potential Impact |

|---|---|---|

| IoT Integration | Seamless Device Communication | Enhanced User Experience |

| Energy Harvesting | Self-Powered Chips | Reduced Maintenance |

| Quantum Encryption | Advanced Security Protocols | Robust Cyber Protection |

Competitive Landscape and Leading Players in the Contactless IC Card Chip Market

The contactless IC card chip market is changing fast. Leaders like NXP Semiconductors, Infineon Technologies, and STMicroelectronics are leading the way. They drive innovation and consolidation, making secure payments better.

- NXP Semiconductors – Netherlands

- Infineon – Germany

- Texas Instruments – United States

- STMicroelectronics – Switzerland

- Samsung Electronics – South Korea

- Shanghai Fudan Microelectronics Group Co., Ltd. – China

- Unigroup Guoxin Microelectronics Co., Ltd. – China

- HED – China

- Microchip Technology – United States

- Datang Telecom Technology Co., Ltd. – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Contactless IC Card Chip Market Report |

| Base Year | 2024 |

| Segment by Type |

· RFID Chips · NFC Technology |

| Segment by Application |

· Financial Services and Digital Banking · Public Transportation and Smart Transit Cards · Access Control and Identity Verification |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The contactless IC card chip market is growing steadily, driven by new ideas and a focus on secure payments. While there are challenges like limited infrastructure and different regulations, countries like the US, China, and Japan are committed to improving secure transaction technologies, creating opportunities for the future.

Future Prospects for Contactless Payments:

- Consumer Convenience: As consumers increasingly prioritize convenience, the seamless nature of contactless payments positions them as an attractive option. The integration of mobile wallets, such as Apple Pay and Google Pay, further enhances their appeal by offering quick and efficient transactions.

- Business Competitiveness: Businesses aiming to stay competitive in a digital economy must adapt by embracing contactless payment solutions. This shift not only meets consumer demand but also streamlines operations across sectors like retail, banking, and transportation.

For stakeholders keen on understanding these dynamics deeper, the Wkinformation Research report offers valuable insights. It provides comprehensive analyses of current trends across various regions while delivering strategic recommendations to capitalize on emerging opportunities within this thriving market.

As technology continues to evolve and security measures enhance trust in these systems, the future prospects for contactless payments look bright. Embracing these advancements could redefine financial transactions across global markets, ensuring both consumer satisfaction and business growth.

Global Contactless IC Card Chip Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Contactless IC Card Chip Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Contactless IC Card Chip Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Contactless IC Card Chip players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Contactless IC Card Chip Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Contactless IC Card Chip Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Contactless IC Card Chip Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Contactless IC Card Chip Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is a Contactless IC Card Chip?

A Contactless IC Card Chip is a technology that lets you make payments and do transactions wirelessly. It uses NFC or RFID, found in cards, passes, and systems for access control.

How secure are contactless IC card chips?

These chips have strong security features like encryption and biometric checks. They protect against fraud and data theft. The tech is always getting better to stay ahead of threats.

What industries use contactless IC card chips?

Many industries use these chips. They’re in banking, public transport, retail, and more. Even in healthcare and corporate security, they’re key.

What is the projected market growth for contactless IC card chips?

The market is expected to grow a lot in the U.S. by 2025. This growth is due to more people using contactless payments and better chip tech.

What technologies are used in contactless IC card chips?

NFC and RFID are the main techs used. There are also memory and microprocessor chips for different uses.

How are contactless IC card chips integrated with mobile devices?

These chips are being used in mobile wallets and wearables. This lets phones and watches act as payment and ID tools.

What challenges does the contactless IC card chip industry face?

The industry faces many challenges. These include keeping data safe, making sure systems work together, and following rules. They also need to protect against cyber threats.

Which countries are leading in contactless IC card chip technology?

China, Japan, and the U.S. are leading. They invest a lot in chip making, new payment systems, and research.

What future innovations are expected in contactless IC card chips?

We can expect new things like working with IoT devices and energy-saving tech. There will also be better encryption and more uses in smart cities.

Who are the key manufacturers of contactless IC card chips?

Big names include NXP Semiconductors, Infineon Technologies, and STMicroelectronics. There are also new startups pushing the tech forward.