Colocation Services Market Set to Reach $68.45 Billion by 2025: Key Growth Drivers in the U.S., Germany, and Japan

In 2025, the global market reached an estimated value of USD 72.53 billion, with projections indicating growth to USD 116.21 billion by 2033 at a compound annual growth rate (CAGR) of 6.07%. This growth is driven by factors such as increasing demand for data storage and management due to the rise of cloud computing, the Internet of Things (IoT), and the need for scalable and secure infrastructure solutions. Additionally, regulatory frameworks supporting data security and operational efficiency further propel the adoption of colocation services across various industries.

- Last Updated:

Colocation Services Market Forecast for Q1 and Q2 2025

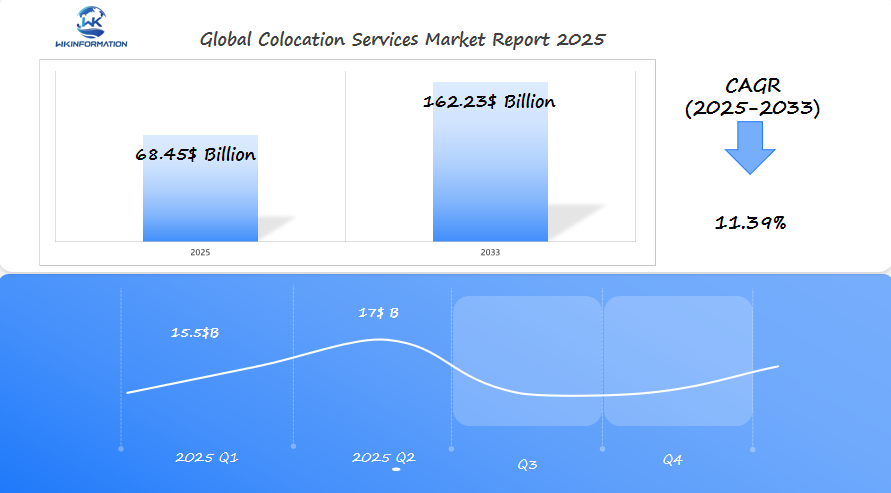

The global colocation services market is expected to reach $68.45 billion in 2025, with a CAGR of 11.39% projected through 2033. The first half of 2025 is expected to show solid growth, with Q1 estimated to reach around $15.5 billion, followed by Q2, where the market is projected to increase to approximately $17.0 billion. This growth will be driven by the continued rise in data center outsourcing and the expanding demand for cloud services.

The U.S., Germany, and Japan are the most critical regions for colocation services. The U.S. leads in market size, driven by the digital transformation in cloud computing and large-scale data-driven applications. Germany remains a central hub for data management in Europe, particularly due to data sovereignty concerns and advancements in technology infrastructure. Japan, with its high-tech industry, continues to see a rise in demand for colocation services, particularly for its expanding IT infrastructure. These regions are key for understanding the current trends and challenges in the global colocation services market.

Understanding the Upstream and Downstream Dynamics in the Colocation Services Market

The colocation services market operates through a complex ecosystem of upstream and downstream relationships that shape its growth trajectory. Understanding these dynamics is crucial for businesses navigating this rapidly expanding market.

Upstream Operations in Colocation

The upstream segment focuses on the foundational elements that enable colocation facilities to function. These include:

- Technology infrastructure providers

- Hardware manufacturers

- Power and cooling system suppliers

- Network connectivity providers

- Facility construction companies

These providers deliver essential components like servers, storage systems, and networking equipment. Their innovations directly influence the capabilities and efficiency of colocation services.

Key Upstream Influencers

Several factors impact the upstream operations in the colocation services market:

- Research and development investments drive technological advancements

- Supply chain relationships affect hardware availability and pricing

- Energy efficiency solutions impact operational costs

- Network infrastructure developments determine connectivity quality

Downstream Impact and Client Relations

The downstream segment encompasses the end-users who utilize colocation services. These clients range from small startups to large enterprises, each with unique requirements and expectations.

SME Benefits

Small and medium-sized enterprises (SMEs) benefit from colocation services in various ways:

- Cost-effective alternative to in-house data centers

- Access to enterprise-grade infrastructure

- Scalable solutions for growing businesses

- Professional security and maintenance

####Large Enterprise Advantages

Large enterprises also gain advantages from colocation services:

- Global presence through multiple facility locations

- Custom power and cooling specifications

- Dedicated support teams

- Enhanced disaster recovery capabilities

The relationship between upstream providers and downstream clients creates a dynamic market environment. Upstream innovations in areas like power efficiency and cooling technologies translate into improved service offerings for downstream users. This interconnected ecosystem drives continuous improvements in colocation services, pushing the market toward its projected $68.45 billion valuation by 2025.

Key Trends Fueling the Expansion of Colocation Services

1. Cloud Service Integration

The rapid adoption of cloud services stands as a primary catalyst in the colocation services market growth. Businesses increasingly migrate their operations to cloud platforms, creating unprecedented demand for robust data center infrastructure. This shift has prompted colocation providers to expand their facilities and enhance their service offerings to accommodate the surge in cloud-based workloads.

- Multi-cloud deployments require sophisticated infrastructure

- Hybrid cloud solutions demand flexible colocation environments

- Direct cloud connectivity options through major providers

2. IoT and AI Impact

The Internet of Things (IoT) and Artificial Intelligence (AI) technologies create substantial data processing requirements. IoT devices generate massive amounts of data that need real-time processing and storage capabilities. AI applications demand high-performance computing infrastructure, pushing colocation facilities to adapt their services:

- Edge computing solutions for IoT data processing

- High-density power configurations for AI workloads

- Advanced cooling systems for intensive computing

3. 5G Technology Influence

5G technology emerges as a transformative force in the colocation landscape. The rollout of 5G networks necessitates distributed data center architectures to support low-latency applications and edge computing requirements:

- Strategic facility locations near population centers

- Enhanced network connectivity options

- Increased power density requirements

- Support for mobile edge computing

These technological advancements drive colocation providers to innovate their service offerings. Data centers now incorporate advanced infrastructure designs to support:

- High-performance computing capabilities

- Enhanced power efficiency measures

- Improved cooling solutions

- Robust security systems

- Flexible scaling options

The convergence of these trends creates new opportunities for colocation service providers to expand their market presence and develop specialized solutions for emerging technological needs.

Overcoming Barriers in the Growth of Colocation Services

The rapid expansion of the Colocation Services Market faces several significant challenges that require strategic solutions. Understanding these barriers helps businesses make informed decisions about their data center strategies.

Cost-Related Challenges

- Initial setup costs for in-house data centers range from $10-30 million

- Power consumption expenses account for 70-80% of operational costs

- Hardware maintenance requires specialized staff and regular upgrades

- Real estate costs in prime locations drive expenses higher

Security and Compliance Hurdles

- Data breaches cost companies an average of $4.35 million in 2022

- Complex regulatory requirements vary by region and industry

- Multi-tenant environments raise security concerns

- Legacy systems often lack modern security features

Effective Solutions and Strategies

Cost Management Solutions

- Pay-as-you-grow models reduce initial investment needs

- Shared infrastructure costs across multiple tenants

- Energy-efficient technologies cut operational expenses

- Automated management systems decrease staffing requirements

Security Enhancement Measures

- Advanced physical security systems with biometric access

- 24/7 monitoring and threat detection

- Regular security audits and penetration testing

- Compliance certification programs

Risk Mitigation Approaches

- Redundant power and cooling systems

- Geographic diversity for disaster recovery

- Service Level Agreements (SLAs) with guaranteed uptime

- Third-party security partnerships

These solutions transform potential barriers into opportunities for growth. Companies implementing these strategies report 30-40% cost savings compared to maintaining in-house facilities. The adoption of standardized security protocols has reduced breach incidents by 45% in colocation facilities.

Colocation providers continue developing innovative solutions to address emerging challenges. Recent advancements include AI-powered security systems, blockchain-based access management, and sustainable cooling technologies that reduce environmental impact while maintaining optimal performance.

Geopolitical Factors Shaping the Colocation Services Industry

Regulatory Landscape

The regulatory landscape plays a crucial role in shaping colocation services across different regions. The European Union’s General Data Protection Regulation (GDPR) has created significant shifts in how colocation providers operate within European markets. Data centers must now implement strict data sovereignty measures, requiring companies to store EU citizens’ data within EU borders.

GDPR Impact on European Markets:

- Mandatory data breach notifications within 72 hours

- Enhanced security protocols for personal data protection

- Increased demand for EU-based colocation facilities

- Rising costs of compliance and infrastructure adaptation

Regional regulations create distinct market characteristics across different territories. The U.S. maintains sector-specific regulations like HIPAA for healthcare and PCI DSS for payment data, while China requires licenses for foreign companies to operate data centers within its borders.

Key Regional Regulatory Considerations:

- Data sovereignty requirements

- Cross-border data transfer restrictions

- Industry-specific compliance standards

- Local environmental regulations

Current Geopolitical Tensions

Current geopolitical tensions directly influence infrastructure investments in the colocation sector. Trade disputes between major economies affect supply chains for critical data center components. The semiconductor shortage has led to increased costs and delayed expansion projects across multiple regions.

Infrastructure Investment Impacts:

- Supply chain disruptions affecting equipment availability

- Rising energy costs due to global conflicts

- Shifting investment patterns toward politically stable regions

- Increased focus on local manufacturing capabilities

Data center operators now prioritize locations with stable political environments and reliable power infrastructure. Countries offering tax incentives and clear regulatory frameworks attract substantial investments in colocation facilities. Singapore’s temporary moratorium on new data centers highlights how government policies can reshape regional market dynamics.

Evolving Strategies

The evolving geopolitical landscape has prompted colocation providers to adopt new strategies for market expansion. Many operators now pursue multi-region deployment models to mitigate political risks and ensure service continuity across different jurisdictions.

Colocation Services Market Segmentation: Key Types and Offerings

The colocation services market divides into two primary segments: retail colocation and wholesale colocation, each serving distinct business needs and scale requirements.

Retail Colocation Services

Retail colocation provides smaller space and power requirements, typically ranging from a single rack to a cage environment. These services include:

- Dedicated rack space

- Power distribution units

- Basic network connectivity

- Technical support

- Security services

The retail segment captures 65% of the market share, driven by SMEs seeking cost-effective data center solutions without significant capital investment.

Wholesale Colocation Services

Wholesale colocation offers large-scale deployments, usually starting from 10,000 square feet or 1MW of power. Key features include:

- Customizable space configurations

- Dedicated power infrastructure

- Higher degree of operational control

- Enhanced security measures

- Flexible expansion options

Current market projections indicate wholesale colocation will grow at a CAGR of 17.2% through 2025, particularly appealing to large enterprises and hyperscale providers.

Market Fit by Enterprise Size

SME Suitability

- Lower initial investment requirements

- Flexible scaling options

- Shared infrastructure costs

- Professional management services

- Pay-as-you-grow model

Large Enterprise Benefits

- Custom power configurations

- Private suites

- Direct control over infrastructure

- Better economies of scale

- Long-term cost advantages

Revenue projections show retail colocation maintaining a dominant position through 2025, with a projected market share of 62%. Wholesale colocation services are expected to experience rapid growth, reaching 38% of the total market value by 2025, driven by increasing demand from cloud service providers and large technology companies.

Applications Impacting the Demand for Colocation Services

The demand for colocation services spans across multiple industries, with BFSI (Banking, Financial Services, and Insurance) leading the charge. Financial institutions require robust data center infrastructure to handle:

- Real-time transaction processing

- Secure customer data storage

- Trading algorithms

- Regulatory compliance systems

Healthcare organizations represent another significant driver of colocation demand. Medical facilities leverage data centers for:

- Electronic Health Records (EHR) management

- Medical imaging storage

- Telemedicine platforms

- AI-powered diagnostic tools

The e-commerce sector continues to push data center usage to new heights through:

- Inventory management systems

- Payment processing

- Customer relationship management

- Recommendation engines

Advanced technologies shape specific industry applications within these sectors. AI-driven solutions transform traditional workflows:

- Banking: Fraud detection and risk assessment

- Healthcare: Patient diagnosis and treatment planning

- Retail: Personalized shopping experiences

- Manufacturing: Predictive maintenance

- Media: Content delivery optimization

Emerging applications poised to drive future growth include:

Edge Computing Applications

- Smart city infrastructure

- Autonomous vehicle systems

- Industrial IoT platforms

Data Analytics

- Real-time business intelligence

- Customer behavior analysis

- Supply chain optimization

Virtual Reality/Augmented Reality

- Remote collaboration tools

- Training simulations

- Interactive customer experiences

The integration of quantum computing and blockchain technologies signals new requirements for colocation facilities. These technologies demand specialized infrastructure configurations and enhanced security measures to support their unique processing needs.

Regional Insights into the Global Colocation Services Market

The global colocation services market displays distinct regional patterns, with North America commanding a dominant 39% market share in 2024. This leadership position stems from the region’s robust technological infrastructure and high concentration of data-intensive industries.

Regional Market Distribution

- North America: Leading with 39% market share

- Asia-Pacific: Second largest at 28% market share

- Europe: Following at 24% market share

- Rest of World: Comprising 9% market share

Key Regional Players

North America

- Equinix

- Digital Realty

- CyrusOne

Europe

- Interxion

- Global Switch

- NTT Communications

Asia-Pacific

- SUNeVision Holdings

- ST Telemedia Global Data Centres

- GDS Holdings

Growth Rate Analysis

The market exhibits varying growth rates across regions:

- Asia-Pacific: Highest CAGR at 18.2%

- Driven by rapid digitalization

- Increasing cloud adoption

- Rising data consumption

- North America: Steady growth at 14.9%

- Mature market dynamics

- Strong enterprise demand

- Advanced technological adoption

- Europe: Growing at 16.5%

- GDPR compliance requirements

- Rising edge computing demands

- Digital transformation initiatives

The regional landscape reveals emerging opportunities in secondary markets, particularly in Southeast Asia and Latin America. These areas demonstrate significant potential due to improving digital infrastructure and increasing data center investments. Cities like Singapore, Jakarta, and São Paulo are becoming vital connectivity hubs, attracting substantial investments from global colocation providers.

Data sovereignty requirements and local regulations continue to shape regional market dynamics, influencing provider strategies and deployment decisions. This has led to increased investments in local data center facilities, particularly in countries with strict data residency laws.

U.S. Market: Trends and Opportunities in Colocation Services

The U.S. colocation services market shows strong potential for growth, with projections indicating a 14.9% CAGR through 2030. This significant expansion comes from several key factors and new opportunities.

Current Market Landscape

Here are some key highlights of the current market landscape:

- Data center investments reached $44.2 billion in 2023

- Major tech hubs driving growth include:

- Northern Virginia (largest data center market)

- Silicon Valley

- Dallas-Fort Worth

- Phoenix

- Chicago

Sector-Specific Demand

The U.S. market sees significant demand from various sectors:

- Cloud Computing: Amazon Web Services, Microsoft Azure, Google Cloud Platform

- Financial Services: High-frequency trading operations, digital payment processing

- Healthcare: Electronic Health Records (EHR), telemedicine platforms

- Media & Entertainment: Streaming services, gaming platforms

Opportunities for New Market Entrants

The U.S. market offers several opportunities for new providers:

- Edge Computing Focus: Targeting underserved secondary markets and providing low-latency solutions for IoT applications

- Specialized Services: Offering industry-specific compliance solutions, green energy data centers, and AI-optimized infrastructure

- Strategic Partnerships: Forming joint ventures with existing providers, collaborating with technology vendors, and partnering with local utilities

The market shows particular strength in emerging technologies, with AI and machine learning applications driving significant demand for specialized colocation services. New entrants focusing on these high-growth segments find increasing opportunities, especially in areas with developing digital infrastructure needs.

U.S. colocation providers report growing demand for hybrid solutions that combine traditional colocation with cloud services. This trend creates opportunities for providers offering integrated services and specialized expertise in multi-cloud environments.

Germany's Role in the Growth of Colocation Services

Germany is a key player in the European colocation services market, thanks to its strict data protection laws and strong digital infrastructure. Its strategic location has also made it an attractive destination for global data center operators looking to establish a presence in Europe.

Key Growth Drivers in Germany:

- GDPR Compliance Excellence: German data centers lead in implementing rigorous data protection measures, making them preferred choices for businesses requiring strict GDPR compliance

- Renewable Energy Integration: The country’s commitment to sustainable energy sources appeals to environmentally conscious enterprises

- Strategic Geographic Location: Germany’s central European position enables efficient data distribution across the continent

The edge computing landscape in Germany has seen remarkable development, particularly in major metropolitan areas. Berlin’s startup ecosystem has fueled demand for edge computing solutions, while Munich’s industrial sector drives innovation in IoT applications.

Berlin and Munich Edge Computing Developments:

- Berlin

- Startup-driven demand for low-latency applications

- Focus on AI and machine learning implementations

- Growing network of micro data centers

- Munich

- Industrial IoT applications

- Automotive sector driving edge computing adoption

- Smart manufacturing initiatives

The competitive landscape within Germany’s colocation market features both domestic and international players. Local operators leverage their understanding of regional regulations, while global providers bring international expertise and resources.

Market Leaders and Specializations:

- Deutsche Telekom: Nationwide infrastructure coverage

- Digital Realty: High-density computing solutions

- NTT: Enterprise-focused services

- Equinix: Interconnection-rich environments

- e-shelter: Premium data center facilities

The German market continues to attract new investments, with Frankfurt emerging as a key financial data hub. The increasing demand for edge computing solutions and the growth of Industry 4.0 initiatives create new opportunities for colocation providers to expand their service offerings.

Japan's Influence on the Colocation Services Industry

Japan is leading the way in technological innovation, with its colocation services market experiencing significant growth due to advanced infrastructure developments. The country’s major cities, Tokyo and Osaka, are the main centers for data center expansion.

Infrastructure Development in Key Cities

- Tokyo’s digital infrastructure has expanded by 45% since 2021, accommodating increasing IoT device deployment

- Osaka emerged as a secondary hub, offering geographic redundancy and disaster recovery options

- Both cities feature high-speed fiber networks supporting 5G implementation across industrial zones

Japanese tech giants like NTT Communications and Fujitsu have transformed the local colocation landscape with their AI-powered data center management systems. These innovations include:

- Automated cooling systems reducing energy consumption by 30%

- Smart power distribution networks

- AI-driven predictive maintenance protocols

The market exhibits unique characteristics shaped by local tech companies:

Technological Integration

- Advanced robotics for facility management

- IoT-enabled environmental monitoring

- Edge computing solutions for manufacturing sectors

Market Differentiators

- High emphasis on earthquake-resistant infrastructure

- Sustainable energy solutions integration

- Dense urban development driving vertical data center designs

Japanese innovation continues to shape future growth potential through:

- Smart City Initiatives

- Integration with autonomous vehicle networks

- Municipal IoT infrastructure support

- Public transportation system optimization

- Industrial Applications

- Manufacturing automation support

- Supply chain optimization

- Real-time data processing capabilities

The Japanese market’s commitment to technological advancement positions it as a crucial player in the global colocation services landscape. Local providers’ focus on AI implementation and sustainable practices creates a strong foundation for continued growth in the Asia-Pacific region.

Future Outlook: What's Next for the Colocation Services Market?

The colocation services market is expected to grow at a strong rate of 16.0% annually from 2025 to 2030, reaching over $100 billion. This growth is driven by the rapid digital transformation happening in various industries and the increasing need for data management.

Key Innovations Reshaping the Market:

- Green Data Centers: Sustainable cooling systems and renewable energy integration

- AI-Powered Management: Automated resource allocation and predictive maintenance

- Quantum Computing Support: Infrastructure adaptations for quantum-ready facilities

- Hybrid Edge Solutions: Combined edge computing and traditional colocation services

Strategic Market Entry Points:

- Regional Focus

- Target emerging markets with high digital growth potential

- Establish presence in secondary cities with lower competition

- Service Differentiation

- Develop specialized solutions for specific industries

- Offer flexible pricing models for varying business needs

- Technology Investment

- Build infrastructure supporting next-gen applications

- Implement advanced security protocols

The market transformation is speeding up with the rise of smart cities and autonomous systems. Data center providers are adapting their infrastructure to support quantum computing capabilities, while edge computing facilities are expanding to meet low-latency requirements. These developments are creating new opportunities for businesses to gain competitive advantages through strategic colocation partnerships.

Competitive Landscape in the Colocation Services Market

- Equinix Inc. — Redwood City, California, USA

- Digital Realty Trust Inc. — Austin, Texas, USA

- CyrusOne Inc. — Dallas, Texas, USA

- Iron Mountain Data Centers — Boston, Massachusetts, USA

- NTT Communications Corporation — Tokyo, Japan

- STT GDC Data Centers — Singapore

- Telehouse International Corporation — Tokyo, Japan

- TierPoint LLC — St. Louis, Missouri, USA

- Rackspace Technology Inc. — San Antonio, Texas, USA

- Global Switch — London, England, UK

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Colocation Services Market Report |

| Base Year | 2024 |

| Segment by Type | · Retail Colocation

· Wholesale Colocation |

| Segment by Application | · IT and Telecom

· Healthcare · Other Industries |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global colocation services market is growing, and businesses have a chance to take advantage of new trends and innovations. Key insights show that the industry is expected to grow significantly, driven by technological advancements and increased data traffic from IoT devices.

By embracing these changes, organizations can improve their performance and scalability. The move towards hybrid cloud solutions also offers opportunities to optimize IT infrastructure while cutting costs.

To stay ahead in this changing landscape, think about how colocation services can support your strategic goals. By using these services, companies can become more efficient and sustainable, ensuring they stay competitive in a digitally transformed business world.

Global Colocation Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Colocation Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Colocation ServicesMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Colocation Servicesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Colocation Services Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Colocation Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Colocation Services Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofColocation ServicesMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream and downstream dynamics in the colocation services market?

In the colocation services market, upstream dynamics refer to factors influencing operations such as technology providers and infrastructure investments. Downstream impact focuses on how these upstream factors affect clients, including SMEs and large enterprises, in terms of service delivery and operational efficiency.

What key trends are driving the expansion of colocation services?

The expansion of colocation services is primarily fueled by the rising adoption of cloud services, advancements in technology such as IoT and AI, and the impact of 5G technology on enhancing data center capabilities.

What challenges are faced in the growth of colocation services?

Key challenges include high costs associated with maintaining in-house data centers, data security concerns, and compliance issues that can hinder adoption. Addressing these barriers is crucial for businesses looking to leverage colocation services.

How do geopolitical factors influence the colocation services industry?

Geopolitical factors, such as regulatory environments like GDPR in Europe, significantly shape market dynamics. Additionally, regional regulations and geopolitical tensions can affect infrastructure investments in different areas.

What is the difference between retail and wholesale colocation services?

Retail colocation services typically cater to individual clients or smaller businesses with specific needs, while wholesale colocation serves larger enterprises requiring significant space and resources. Revenue projections indicate differing growth rates for each segment based on client suitability.

What future trends can we expect in the colocation services market?

Future trends suggest continued growth beyond 2025 with a projected CAGR through 2030. Innovations driven by advanced technologies may disrupt traditional service offerings, creating new opportunities for businesses entering the market.