2025 Coke Oven Battery Market: Unlocking $61 Million Global Growth, Driven by Demand in China, India & Germany

Discover how China, India, and Germany are shaping the future of the Coke Oven Battery Market in 2025. Explore technological innovations, sustainability initiatives, and market growth projections in this comprehensive analysis of the global steel production industry’s key players and emerging trends.

- Last Updated:

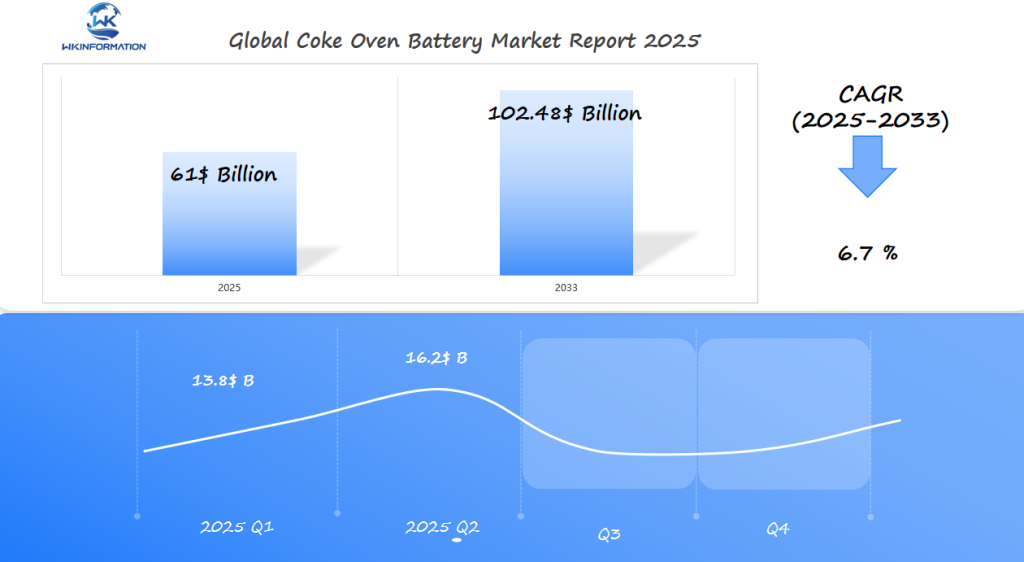

Coke Oven Battery Market Forecast for Q1 and Q2 of 2025

The global coke oven battery market is expected to reach approximately $61 million by the end of 2025, driven by the ongoing demand for steel production and related industries.

For Q1 2025, the market is projected to be valued at around $13.8 million, as the industry sees steady but cautious investment in maintenance and upgrades, especially in countries with a strong steel manufacturing base such as China, India, and Germany.

By Q2 2025, the market is forecasted to grow to approximately $16.2 million, with the demand for advanced coke oven technologies increasing as the need for higher efficiency and lower emissions becomes more critical, particularly in China and India, where steel production is rapidly growing. Germany, with its emphasis on sustainability and high-tech manufacturing, remains a key region for future growth.

The market is expected to maintain a steady Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2033, reflecting continued investment in energy-efficient and environmentally-friendly coke oven technologies. To explore detailed market trends, regional analysis, and growth drivers, we encourage you to read the full Wkinformation Research report.

Key Takeaways

- China maintains dominance in coke oven battery market production capacity.

- India’s rapid expansion targets double-digit growth in steel sector investments.

- Germany leads in green tech adoption for coke oven battery systems.

- Emerging technologies drive the $XX billion market growth forecast.

- Environmental regulations accelerate innovation in coke oven technology worldwide.

Upstream and Downstream Industry Chain Analysis: Understanding the Coke Oven Battery Supply Chain

The coke oven battery supply chain connects coal mining to steel production. Coal quality requirements are key to selecting suppliers for metallurgical coke production. Low-quality coal can harm oven heat distribution, risking damage.

Here are the main stages of the supply chain:

Raw Material Sourcing and Supply Challenges

- Coal mines provide the raw materials for battery construction materials like refractory bricks

- Transport delays can increase costs for facilities far from mines

Value Addition Through the Production Chain

High-volatile coking coal is crushed, blended, and heated in sealed ovens. Tar and benzol by-products are sold separately. Steel plants need a reliable coke oven supply chain to keep blast furnaces running smoothly.

| Material | Usage | Quality Metric |

|---|---|---|

| Bituminous coal | Raw coke feedstock | Volatility ≤ 25% |

| Refractory bricks | Oven chamber lining | Heat resistance 1300°C+ |

“80% of production costs stem from coal logistics and preprocessing,” stated a 2023 industry report.

Trend Analysis: Emerging Trends in Coke Oven Battery Technology

Coke oven battery technology is moving towards smarter, cleaner systems. Innovations in automation and environmental tech are changing how industries manage efficiency and sustainability. Here’s what’s driving change:

Automation and Digital Monitoring Systems

Battery automation cuts down on human mistakes and boosts productivity. Digital monitoring tools track temperature and gas flow in real time. This ensures optimal performance. Key benefits include:

- Automated sensors for precise temperature control

- Predictive maintenance alerts to prevent downtime

- Energy efficiency improvements via data-driven adjustments

Environmental Compliance and Emission Reduction Technologies

Strict regulations are making firms adopt emission reduction methods. Advanced scrubbers and electrostatic precipitators now capture 90% of pollutants. Companies like Siemens and Honeywell offer retrofit solutions to cut NOx and particulate emissions. Energy efficiency improvements also lower operational costs, aligning with global sustainability goals.

“The next frontier is integrating AI into emission control systems for real-time adjustments.” – Dr. Elena Torres, Clean Energy Innovations

These trends show a balance between cutting-edge coke oven technological innovations and eco-friendly practices. As industries evolve, these shifts promise safer, greener coke oven battery operations.

Restriction Analysis: Challenges in the Coke Oven Battery Market

Coke oven battery operators face big challenges from environmental regulations and old equipment. Innovation helps, but these issues hurt profits and sustainability. Let’s look at what’s holding this industry back.

Environmental Regulations and Compliance Costs

Now, environmental regulations require cleaner emissions and better waste management. In the U.S., companies must follow EPA rules. The EU has its own rules, like the Industrial Emissions Directive (IED), which can be expensive to follow.

For example, adding scrubbers to cut down sulfur oxides can cost millions a year. To comply, companies often need to:

- Upgrade flue gas treatment systems

- Monitor emissions in real-time

- Build recycling systems for waste

“Meeting new air quality rules could increase operational costs by 20% for older plants.” – World Steel Association 2024 Report

Technical Limitations and Modernization Obstacles

Old coke oven designs have battery maintenance issues like cracked refractories and uneven heating. Plants built before 2000 often lack automation, leading to slower production. To modernize, they need:

- New, heat-resistant materials for chambers

- Software for predictive maintenance

But investment barriers stop many from upgrading. Small operators can’t afford new tech, while big companies face long downtimes during upgrades. For example, updating a 50-year-old battery can take 18 months and cost $50 million.

This shows a big challenge: finding a balance between making money and moving forward. Solutions must meet both new rules and old equipment needs.

Geopolitical Analysis: How Global Politics Influence Coke Oven Battery Production and Trade

Global steel markets are influenced by more than just money. Politics now play a big role in who gets access to resources and tech. Policies and alliances make coke oven production a key part of national strategy.

Trade Policies and International Market Access

- International trade policies like U.S. Section 232 tariffs on steel imports disrupted global coke oven gas exports in 2023.

- EU carbon border taxes force producers to choose between cleaner tech or trade penalties.

- India’s import restrictions on coking coal prioritize domestic suppliers over foreign competitors.

Strategic Resource Management and National Interests

Resource nationalism leads to policies that focus on local control of coal. China’s strategic industrial policy invests in coke oven tech to secure steel dominance. Russia’s export bans during conflicts show how energy and raw material control impacts production chains.

“Resource nationalism ensures no nation becomes dependent on foreign supply chains,” stated the World Steel Association 2024 report.

Nations like Germany balance green energy goals with protecting traditional steel sectors. Meanwhile, Brazil’s iron ore exports and Australia’s coal reserves remain geopolitical chess pieces in global trade negotiations. As trade wars shift, companies must navigate these strategic industrial policy shifts to stay competitive.

Segmentation Type Market Analysis: Coke Oven Battery Market Segmentation by Type and Application

Market trends in coke oven batteries depend on coke oven types. These types fit different industries well. This analysis shows how design choices and demand shape global markets.

Battery Designs: Top-Charged vs. Stamp-Charged Systems

| Feature | Top-Charged | Stamp-Charged |

|---|---|---|

| Design | Vertical loading ports | Horizontal entry points |

| Heat Efficiency | Higher retention | Lower capital costs |

| Common Use | Large steel mills | Chemical and energy plants |

Market Applications Across Industrial Sectors

- Steel production: Primary use for coking coal processing

- Chemical manufacturing: By-product recovery for tar and ammonia

- Energy generation: Waste heat recovery systems

- Foundry operations: Customized battery setups for metal casting

Steel is the biggest market, but chemicals are growing fast. This is because of the need for by-product recovery. New markets focus on battery design comparison that fits local rules and available materials.

Application Market Analysis: The Role of Coke Oven Batteries in Steel Production

Coke oven batteries are key in making steel. They provide fuel for blast furnaces. The right metallurgical coke specifications are crucial for smelting. They help keep the temperature stable and ensure the steel quality.

Blast Furnace Integration

- Coke acts as fuel and reduces iron in blast furnaces. It needs to be perfectly integrated to avoid slag.

- Modern coke ovens adjust heat to match furnace needs and material flow.

Quality Requirements and Performance Metrics

Steel mills have strict to keep production up. Important factors include:

- Reactivity Index: Low reactivity coke helps avoid gas issues in furnaces.

- Strength Metrics: High CSR (Coke Strength After Reaction) values help prevent coke breakage during iron making.

- Ash Content Limits: Ash under 14% lowers sulfur emissions and boosts furnace efficiency.

Meeting these is vital for profit. Bad coke can mess up huge steel production. New tech like sensor controls lets for quick coke adjustments, meeting steel industry needs.

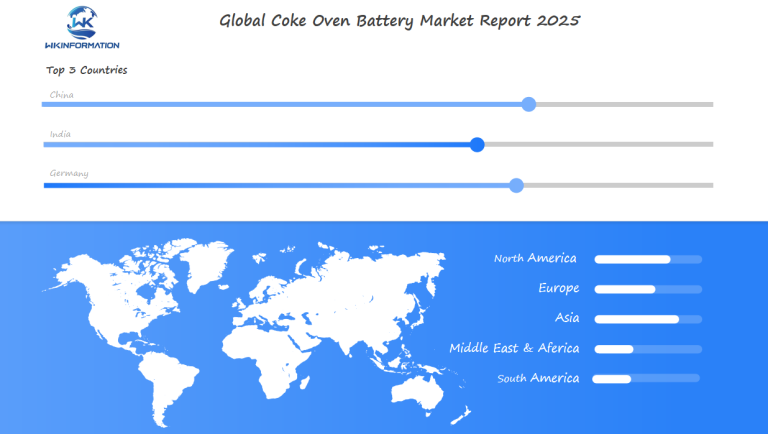

Global Coke Oven Battery Market Region Analysis: Regional Market Trends

Regional dynamics shape the global coke oven battery industry. The regional market share shows how production changes as industries follow environmental policies and demand shifts.

Comparative Analysis of Major Production Regions

- Asia: Holds over 60% of global production capacity, with China’s industrial concentration driving low-cost manufacturing hubs.

- Europe: Market share declines as emissions rules force modernization, pushing older facilities to retrofit or close.

- North America: Prioritizes high-efficiency systems but faces output limits due to aging infrastructure.

Asia’s industrial concentration in places like the Pearl River Delta and Ruhr Valley creates economies of scale. Meanwhile, Africa and South America lag in capital investment.

Growth Markets and Emerging Players

Emerging markets like Indonesia and the Middle East are boosting production to meet local steel demand. Companies such as Tata Steel and Posco are expanding in Southeast Asia.

- Emerging markets adopt modular battery designs to cut costs and accelerate deployment timelines.

- Latin America faces slower growth due to price volatility and political risks, despite iron ore reserves.

“Emerging markets will account for 40% of global growth by 2030, leveraging cost advantages and infrastructure projects.” — Global Steel Institute Report 2024

Regional competition is getting fiercer as emerging markets challenge traditional leaders through innovation and policy incentives. Investors now look for regions that balance regulatory stability with access to raw materials.

China Coke Oven Battery Market Analysis

China leads the world in coke oven batteries thanks to its huge Chinese steel industry needs and control over coking coal reserves. It produces over 60% of the world’s coke. This balance between growth and green rules is key.

Production Capacity and Technological Development

- China makes over 600 million tons of coke every year. This is thanks to better capacity consolidation.

- New ovens cut emissions by 40% compared to old ones. State-owned companies prefer these.

- Private companies team up with tech firms. They use AI to make their operations more efficient.

Environmental Policies and Market Evolution

“Pollution control is a top priority for sustainable growth.” — 2023 National Energy Policy

China’s strict environmental regulations have closed 1,200 small plants since 2020. The Blue Sky program requires new plants to meet strict emission standards by 2025. This leads to capacity consolidation as smaller ones merge with bigger ones.

Imports from Australia and Mongolia are needed to meet the demand for coking coal reserves.

Now, 70% of production is in state-owned hands. They focus on investing in carbon capture technology. This move makes China a leader in both output and green innovation.

India Coke Oven Battery Market Analysis

India’s Indian steel demand is pushing the growth of coke oven batteries. The National Steel Policy aims for 300 million tonnes by 2030. This goal is driving coke oven construction projects in states like Odisha and Chhattisgarh.

These projects need a lot of metallurgical coal imports from places like Australia and Russia. Over 80% of the raw materials come from abroad. Industrial growth policies give tax breaks to companies using green technology. This helps them meet environmental standards while staying productive.

Key challenges include:

- Unpredictable coal quality affecting oven efficiency

- Water scarcity in arid industrial zones

- High costs for retrofitting legacy facilities

Germany Coke Oven Battery Market Analysis

Germany’s coke oven battery sector is a leader in green tech. It follows strict . This approach cuts emissions and boosts efficiency.

Green Technology Integration and Innovation

Key advancements include:

- Carbon capture systems for existing plants

- Pilot projects in hydrogen steelmaking to replace coal

- Circular economy approaches recovering 95% of byproducts

Regulatory Environment and Future Outlook

EU mandates push firms to adopt cleaner methods. Challenges arise balancing European emissions standards with cost efficiency. Upcoming strategies include:

- R&D funding for carbon reduction technologies

- Phasing in hydrogen-based processes by 2030

Germany’s tech exports, like Thyssenkrupp’s low-emission designs, reflect this shift. While hurdles like higher initial costs persist, long-term gains in sustainability drive adoption.

Future Development Analysis: The Future of Coke Oven Batteries in Modern Steel Manufacturing

The steel industry is at a turning point. It must balance production efficiency with climate goals. New future steel technologies and carbon-neutral steelmaking methods are changing coke oven batteries. These changes focus on being green without losing output.

Technological Innovation and Sustainability Integration

New solutions aim to cut emissions while keeping production high. Carbon-neutral steelmaking could become the norm through:

- AI-powered sensors that improve oven temperature and gas flow

- Testing coke alternatives like hydrogen or biomass in blast furnaces

- Sealed oven designs that cut energy loss by up to 20%

Market Evolution and Adaptation Strategies

“The next decade will demand radical shifts in how coke is produced and used,” stated a 2023 report by the World Steel Association. “Investing in hybrid systems—mixing traditional and green methods—is now critical for survival.”

Companies face a challenge: adapting to change while keeping costs down. Carbon pricing policies might speed up the adoption of cleaner technologies. For example, Germany’s ThyssenKrupp is expanding pilot projects for hydrogen-based coke alternatives. Digital twins of ovens also help test low-emission designs virtually before they’re used in real life.

Success in this transition depends on global teamwork. Governments and businesses must agree on standards for carbon-neutral steelmaking. This ensures no company is left behind in the industry transformation. The path ahead is complex, but it’s the only way to move forward in a world where carbon is a concern.

Competitor Analysis: Key Players in the Coke Oven Battery Market

- ArcelorMittal

- POSCO

- Nippon Steel & Sumitomo Metal Corporation

- ThyssenKrupp AG

- Paul Wurth

- Sinosteel Equipment & Engineering ISGEC

- Heavy Engineering Corporation Graycor International Inc. GIPROKOKS

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Coke Oven Battery Market Report |

| Base Year | 2024 |

| Segment by Type |

· Top Charging · Stamp Charging |

| Segment by Application |

· Steel · Architecture · Mechanical · Other |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The coke oven gas market is changing, showing paths for growth and managing risks. Investors need to weigh new chances against challenges. This section offers key advice for those looking to succeed in this fast-paced field.

Risk Assessment and Strategic Considerations

Managing risks is key as rules get stricter worldwide. Companies in the EU, for example, must deal with higher costs for meeting emission standards. Changes to using hydrogen could also affect old systems.

Investors should look into flexible factories and partnerships with tech leaders like Siemens Energy. Also, spreading out supply chains can lower risks related to raw materials.

Growth Sectors and Capital Allocation Recommendations

Investing in areas with high growth is wise. India’s growing steel industry is a good place for battery makers, with JSW Steel’s Dhanbad plant leading the way. Germany’s push for green tech offers chances in carbon capture systems.

China’s focus on automation, seen in places like Hebei Iron & Steel, matches up with digital monitoring’s benefits. Southeast Asia’s emerging markets could also be attractive for investors looking to grow.

Global Coke Oven Battery Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Coke Oven Battery Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Coke Oven BatteryMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Coke Oven Batteryplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Coke Oven Battery Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Coke Oven Battery Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Coke Oven Battery Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCoke Oven BatteryMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current state of the coke oven battery market as we approach 2025?

China leads the coke oven battery market, making up over 60% of global production. India is growing fast, aiming to increase steel production. Germany is at the forefront with green tech and environmental rules.

What are the key players in the coke oven battery industry?

Big names include tech companies like Paul Wurth and ThyssenKrupp Industrial Solutions. Also, big steel makers that make coke themselves play a big role. They compete and innovate, shaping the market.

How does the supply chain of coke oven batteries work?

The supply chain starts with coal quality, which affects coke production. It includes logistics, preprocessing, and making coke and gas. These are key for steel making and energy.

What emerging technologies are shaping the coke oven battery market?

New tech includes automation for better efficiency, digital monitoring for tracking, and green emission capture. These advancements push the market towards being more sustainable.

What challenges are faced by the coke oven battery market globally?

Big challenges include strict environmental rules, old design limitations, and labor shortages. Costs for compliance and modernization are also big hurdles.

How do geopolitical factors impact the coke oven battery production and trade?

Global politics like trade policies, tariffs, and resource management affect material and tech flow. National steel interests can lead to trade barriers, impacting market access and competition.

What are the primary applications of coke oven batteries in industry?

Coke oven batteries are mainly used in steel making. They also serve the chemical and energy sectors. The quality of coke affects the efficiency and quality of these products.

How does the performance of coke oven batteries affect steel production?

Coke oven operations with blast furnace tech are key for steel quality. New designs improve consistency and efficiency, crucial for industrial needs.

What future developments can we expect in the coke oven battery market?

Expect tech innovation for cleaner production and alternative ironmaking. Digitalization and AI will make processes better and greener, tackling economic challenges.