Global Cocoa Beans Market to Reach $14.66 Billion by 2025: Key Trends and Growth Drivers in the U.S., China, and Indonesia

Discover comprehensive insights into the expanding global cocoa beans market, projected to hit $14.66B by 2025, with detailed analysis of market dynamics in key regions including the U.S., China, and Indonesia.

- Last Updated:

Cocoa Beans Market Forecast for Q1 and Q2 2025

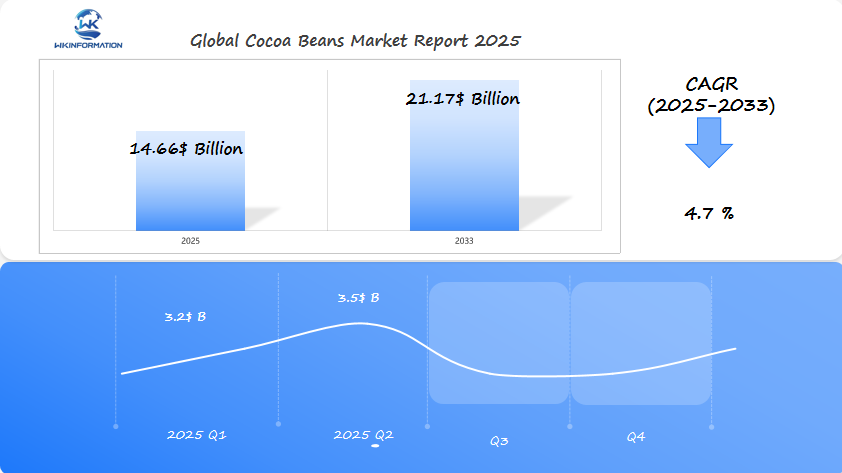

The global cocoa beans market is projected to reach $14.66 billion in 2025, with a CAGR of 4.7% through 2033. In the first half of 2025, the market is expected to grow at a steady pace, with Q1 estimated at approximately $3.2 billion and Q2 showing a rise to around $3.5 billion, driven by sustained demand for cocoa in the global food and beverage industry, particularly for chocolate production.

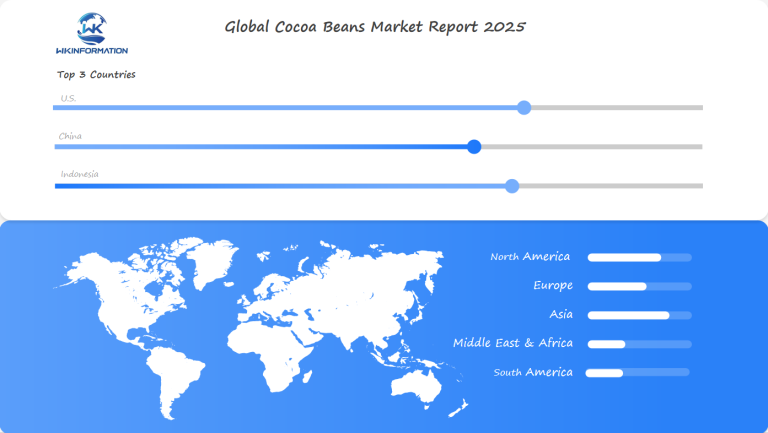

The U.S., China, and Indonesia are key markets for cocoa beans. The U.S. remains the largest consumer of cocoa products, with strong demand driven by both high-end chocolate products and confectionery. China, with its growing middle class and increasing consumption of premium chocolates, continues to expand its cocoa import volumes. Indonesia, as one of the world’s largest producers, is crucial both in terms of consumption and as a leading supplier of cocoa beans, making these countries key to understanding the global market for cocoa beans.

Exploring the Upstream and Downstream Dynamics in the Cocoa Beans Market

The cocoa beans supply chain is a complex system that involves various players across different continents. It includes everyone from small-scale farmers who grow cocoa to large chocolate manufacturers who use it in their products. This system starts with cocoa being grown in tropical areas and ends with it being distributed worldwide.

Key Regions Where Cocoa Is Grown

- West Africa is the largest producer of cocoa, with Côte d’Ivoire and Ghana accounting for 60% of the world’s supply.

- Other countries that also produce cocoa include Indonesia, Nigeria, Cameroon, and Ecuador.

- These regions have favorable conditions for growing cocoa, such as consistent rainfall, fertile soil, and suitable temperatures.

Different Stages Involved in the Cocoa Supply Chain

- Growing and HarvestingSmall-scale farmers are responsible for managing 90% of cocoa production.

- Harvesting is done manually to ensure the best quality beans.

- Fermentation, which is an important step in processing cocoa, takes place on the farms themselves.

- Processing and StorageLocal facilities are used to complete the fermentation process.

- The beans are dried to reduce moisture content and prevent mold growth.

- Quality control measures are put in place to determine the grade and price of the beans.

- DistributionLocal collectors gather beans from multiple farms.

- International traders handle large shipments of cocoa.

- Regional processing plants convert raw cocoa beans into different products.

How Distribution Channels Affect the Cocoa Market

The growth of the cocoa market is directly influenced by how well distribution channels work. Here are some ways in which this happens:

- Price stability is maintained through controlled supply flow

- Quality of cocoa is preserved during transportation

- Producers have better access to markets

- Transparency in the supply chain

The Role of Major Cocoa Producing Countries

Côte d’Ivoire and Ghana’s dominant position in cocoa production gives them certain advantages:

- They can set global price benchmarks for cocoa

- They have the power to influence international trade policies

- They can implement sustainability standards in cocoa production

- They can control the volume of cocoa supplied to manage market stability

These factors create a delicate balance between what producers can offer and what consumers demand. Distribution networks play a crucial role in connecting these two sides of the global cocoa trade system.

Major Trends Shaping the Cocoa Beans Industry

The cocoa beans industry is undergoing significant changes due to shifting consumer preferences and increased awareness of health issues. Here are some key trends influencing the industry:

1. Rise of Chocolate-Flavored Beverages

There has been a notable surge in the popularity of chocolate-flavored drinks, ranging from high-end hot chocolate to convenient ready-to-drink options. This category now represents a $25 billion market segment, with specialty coffee shops and beverage manufacturers incorporating cocoa-based beverages into their offerings.

2. Growing Demand for Dark Chocolate

Health-conscious consumers have shown a strong preference for dark chocolate varieties. Recent studies reveal a 32% increase in dark chocolate consumption over the past five years, driven by factors such as:

- Higher cocoa content (70% and above)

- Reduced sugar levels

- Antioxidant-rich properties

- Enhanced flavor profiles

3. Focus on Sustainability and Health Benefits

Product innovations in the cocoa beans industry are centered around sustainability and health advantages. Leading manufacturers have introduced:

Bean-to-Bar Chocolates

- Direct sourcing from farmers

- Transparent supply chains

- Premium pricing models

Functional Chocolate Products

- Protein-enriched variants

- Sugar-free alternatives

- Probiotic-enhanced formulations

4. Embracing Sustainable Practices

The industry is actively adopting sustainable practices through creative methods:

“Our commitment to sustainable cocoa production has led to a 45% reduction in water usage and implementation of zero-waste processing methods” – Barry Callebaut AG Annual Report

5. Meeting Consumer Demands for Specific Characteristics

Health-conscious consumers are driving the demand for cocoa products that possess particular attributes:

- Organic certification

- Fair trade practices

- Single-origin sourcing

- Raw cocoa processing

These market trends have prompted manufacturers to invest in research and development, creating new product categories that align with consumer preferences while maintaining the traditional appeal of cocoa-based products. The industry’s response includes specialized processing techniques and innovative packaging solutions to preserve the natural benefits of cocoa beans.

Overcoming Key Barriers to Growth in the Cocoa Beans Market

The cocoa beans market faces significant challenges that impact production, pricing, and market stability. These barriers require strategic solutions to maintain sustainable growth in the industry.

Environmental and Agricultural Challenges

Pest infestations pose a substantial threat to cocoa production, with diseases like pod rot and witches’ broom destroying up to 40% of global cocoa crops annually. Climate-related issues, particularly dry weather conditions, have led to:

- Reduced crop yields in West African regions

- Degraded soil quality affecting bean quality

- Shortened growing seasons

- Increased irrigation requirements

Price Volatility Impact

Price fluctuations create significant market instability:

- Short-term volatility: Daily price swings of 5-10%

- Seasonal variations: 20-30% price differences between peak and off-peak seasons

- Regional disparities: Price variations of up to 40% between different production regions

These fluctuations affect stakeholders across the supply chain:

- Small-scale farmers struggle with income predictability

- Processors face challenges in maintaining consistent profit margins

- End-product manufacturers adjust pricing strategies frequently

Competition from Alternative Products

The market faces growing competition from substitute products:

Carob

- Natural chocolate flavor alternative

- Lower fat content

- Caffeine-free option

Plant-based Alternatives

- Innovative ingredients like dates and nuts

- Appeal to vegan consumers

- Lower environmental impact

Market Response

- Product diversification strategies

- Enhanced sustainability practices

- Investment in quality improvement

- Development of unique value propositions

These challenges have prompted industry stakeholders to implement robust risk management strategies and innovative solutions to maintain market growth and stability.

Geopolitical Factors Impacting Cocoa Beans Production and Supply

Political Instability in West Africa

Political instability in West African nations creates significant disruptions in cocoa beans supply chains. Recent tensions in Côte d’Ivoire and Ghana – responsible for 60% of global production – have led to:

- Trade restrictions affecting export volumes

- Infrastructure deterioration impacting transportation

- Labor disputes causing harvest delays

- Currency fluctuations destabilizing market prices

These disruptions ripple through the global supply chain, creating uncertainty for manufacturers and consumers alike.

Border Conflicts and Their Consequences

Border conflicts between producing nations have resulted in:

- Increased smuggling activities

- Quality control challenges

- Supply chain verification issues

- Price speculation in international markets

Health Concerns and Consumer Behavior

Health concerns surrounding chocolate consumption have reshaped consumer purchasing patterns. The growing awareness of sugar content in chocolate products has triggered:

“73% of consumers now actively seek low-sugar alternatives in chocolate products” – Global Consumer Health Survey 2023

This shift in consumer behavior has prompted manufacturers to:

- Develop sugar-free alternatives

- Increase dark chocolate production

- Create portion-controlled products

- Implement clear nutritional labeling

Regional Trade Policies and Market Dynamics

Regional trade policies also play a crucial role in market dynamics. Recent changes include:

- New tariff structures affecting import costs

- Stricter quality control requirements

- Enhanced sustainability certification demands

- Modified trade agreements between producing and consuming nations

Industry Adaptations to Geopolitical Challenges

The intersection of political tensions and health consciousness continues to reshape the cocoa beans market. Manufacturers adapt their strategies through:

- Diversified sourcing locations

- Enhanced supply chain transparency

- Product reformulation initiatives

- Investment in sustainable farming practices

These adaptations reflect the industry’s response to both geopolitical challenges and evolving consumer preferences in the global cocoa market.

Cocoa Beans Market Segmentation: Key Types and Their Impact

The cocoa beans market divides into two primary segments: organic and conventional cocoa beans. Each segment serves distinct consumer preferences and market demands.

1. Conventional Cocoa Beans

- Represents 85% of global production

- Uses traditional farming methods with synthetic pesticides

- Lower production costs enable competitive pricing

- Widely available across different regions

- Preferred by large-scale manufacturers

2. Organic Cocoa Beans

- Commands 15% of market share with steady growth

- Cultivated without synthetic pesticides or fertilizers

- Certified through strict regulatory processes

- Higher yield quality and enhanced flavor profiles

- Premium pricing structure (30-50% higher than conventional)

Factors Driving Growth in the Organic Segment

The organic segment experiences rapid growth driven by:

- Rising health consciousness among consumers

- Environmental sustainability concerns

- Clean label product demands

- Increased disposable income in developed markets

Understanding the Price Differential

Premium pricing for organic cocoa beans reflects:

- Higher production costs

- Specialized farming techniques

- Certification expenses

- Limited availability

- Enhanced quality standards

Consumer Preferences and Market Segmentation

Consumer preferences significantly influence market segmentation:

- Millennials show strong preference for organic products

- Health-conscious consumers prioritize chemical-free options

- Luxury chocolate makers favor organic beans for premium products

- Corporate sustainability initiatives drive organic sourcing

Market Dynamics: Organic vs Conventional Beans

The price differential between organic and conventional beans creates distinct market dynamics:

- Small-batch producers focus on organic segments

- Large manufacturers blend both types

- Premium brands exclusively use organic beans

- Market penetration varies by region and consumer demographics

Impact on Supply Chain Management

The segmentation impacts supply chain management through:

- Separate storage requirements

- Different certification processes

- Specialized transportation needs

- Distinct quality control measures

Applications Driving Demand for Cocoa Beans Globally

The confectionery industry is the main reason why cocoa beans are in demand, making up 43% of worldwide consumption. Big chocolate companies use cocoa beans for various purposes:

- Premium Chocolate Bars: High-end manufacturers require specific cocoa bean varieties for distinct flavor profiles

- Chocolate Coatings: Used in confectionery products like cookies, wafers, and ice cream

- Chocolate Spreads: Growing demand for premium chocolate-based spreads drives cocoa bean consumption

- Pralines and Truffles: Artisanal chocolatiers use specialty cocoa beans for unique creations

The functional foods sector presents rapid growth opportunities for cocoa beans. Research highlighting cocoa’s health benefits has sparked innovation in:

Nutritional Applications

- Protein bars enriched with cocoa compounds

- Sports nutrition products featuring cocoa flavanols

- Breakfast cereals incorporating cocoa for added antioxidants

Health-Focused Products

- Sugar-free chocolate alternatives

- Cocoa-based supplements targeting heart health

- Brain-boosting snacks with concentrated cocoa content

The beverage industry demonstrates significant cocoa bean utilization through:

- Ready-to-drink chocolate milk

- Premium hot chocolate mixes

- Cocoa-based protein shakes

- Coffee products with cocoa additions

Emerging applications in the pharmaceutical and cosmetic industries showcase cocoa beans’ versatility:

- Natural cocoa butter in skincare products

- Cocoa-based pharmaceutical coatings

- Therapeutic applications utilizing cocoa’s anti-inflammatory properties

The food service sector creates additional demand through:

- Specialty chocolate desserts

- Cocoa-based beverage innovations

- Chocolate-themed cafes and experiences

These diverse applications reflect cocoa beans’ expanding role beyond traditional chocolate manufacturing, driving sustained market growth and innovation across multiple industries.

Regional Insights into the Cocoa Beans Market

Europe: The Leader in Cocoa Beans Market

Europe is a major player in the global cocoa beans market, holding a significant 39% market share. This dominance is due to the region’s rich chocolate-making traditions and advanced processing capabilities.

Key Factors Driving Europe’s Cocoa Market:

- Switzerland leads premium chocolate production with 11.3kg per capita consumption

- Belgium and Germany maintain strict quality standards in cocoa processing

- Netherlands serves as a major cocoa processing hub, handling 600,000 tons annually

The European cocoa market stands out through:

- Advanced processing technologies

- Stringent quality control measures

- Sustainable sourcing practices

- Premium product development

North America: An Evolving Cocoa Beans Market

North America is an emerging market influenced by changing consumer preferences. The region shows specific trends:

Key Trends Shaping North America’s Cocoa Market:

- Rising demand for single-origin cocoa beans

- Growth in craft chocolate manufacturing

- Increased focus on ethical sourcing

- Premium chocolate market expansion

Consumer behavior in North America indicates:

- 73% preference for dark chocolate products

- 62% willingness to pay premium for organic options

- 58% interest in bean-to-bar chocolate

Distribution Channels Impacting Cocoa Beans Market

Regional distribution networks have a significant impact on market dynamics:

Key Distribution Channels for Cocoa Beans:

- Direct-to-consumer platforms

- Specialty chocolate retailers

- Supermarket chains

- Online marketplaces

Commitment to Sustainability Initiatives

Both Europe and North America show a strong commitment to sustainability initiatives:

Sustainability Efforts in Cocoa Beans Industry:

- Fair Trade certification requirements

- Organic farming support programs

- Carbon footprint reduction efforts

- Farmer welfare initiatives

These regional characteristics influence product development, pricing strategies, and market growth trajectories in the global cocoa beans industry.

U.S. Cocoa Beans Market: Trends and Opportunities

The U.S. cocoa beans market demonstrates distinctive patterns shaped by evolving consumer preferences and market dynamics. American consumers show increasing interest in premium chocolate products, driving demand for high-quality cocoa beans.

Key Market Drivers:

- Rising popularity of bean-to-bar chocolate manufacturers

- Growing demand for single-origin cocoa products

- Increased awareness of fair trade and sustainable sourcing

The U.S. market sees significant growth in artisanal chocolate production, with small-batch producers gaining market share. These craft chocolate makers prioritize direct trade relationships with cocoa farmers, ensuring quality control and ethical sourcing practices.

Consumer Behavior Shifts:

- Health-conscious choices: Preference for dark chocolate with higher cocoa content

- Transparency demands: Interest in cocoa origin and production methods

- Premium positioning: Willingness to pay more for quality chocolate products

U.S. manufacturers adapt to these trends by developing innovative product lines. Companies introduce sugar-free alternatives, organic options, and specialty chocolate bars featuring unique flavor combinations. The market also witnesses increased investment in processing facilities to meet growing domestic demand.

Local chocolate makers partner with cocoa-producing regions to secure premium beans, establishing direct trade relationships that benefit both parties. These partnerships create opportunities for market expansion while ensuring consistent supply chains.

The Role of China in the Global Cocoa Beans Market

China’s cocoa market has great potential for growth, with chocolate consumption increasing by 15% each year. This rise in demand has turned China from a minor player into a major force in the global cocoa trade.

Key Factors Driving the Market:

- Chinese consumers are showing a greater preference for high-quality chocolate products.

- Rising disposable incomes are driving chocolate consumption in urban areas.

- Increasing awareness of the health benefits of cocoa is boosting demand.

- The expansion of retail channels is making products more accessible.

The evolution of the Chinese market has brought about significant changes in global supply chains. To meet local demand, major cocoa processors have set up processing facilities within China. Barry Callebaut’s investment in a $40 million manufacturing facility in Suzhou is an example of this trend.

Import Statistics:

- 2020: 86,000 metric tons

- 2021: 102,000 metric tons

- 2022: Projected 125,000 metric tons

Chinese consumers’ changing preferences present new opportunities for countries that produce cocoa. Indonesia, which is Asia’s largest cocoa producer, has strategic advantages in serving China’s market:

- Being geographically close reduces transportation costs.

- Having established trade relationships makes business operations easier.

- Sharing cultural similarities enhances understanding of the market.

Chinese chocolate manufacturers are actively looking for direct sourcing relationships with cocoa producers, especially in Southeast Asia. This approach helps ensure stability and quality control in the supply chain while potentially lowering costs through shorter transportation routes.

The market shows strong potential in China’s second and third-tier cities, where chocolate consumption is still relatively low compared to coastal urban centers. These regions represent untapped opportunities for expanding the market and increasing demand for cocoa.

Indonesia’s Impact on Cocoa Beans Production

Indonesia is the third-largest cocoa producer in the world, with its own unique production methods and market dynamics. The cocoa industry in Indonesia has its own set of challenges and opportunities:

Production Characteristics:

- Small-holder farmers manage 95% of Indonesia’s cocoa plantations

- Primary growing regions include Sulawesi, Sumatra, and Papua

- Average annual production reaches 200,000-250,000 metric tons

Key Industry Developments:

- Implementation of sustainable farming practices

- Introduction of disease-resistant cocoa varieties

- Government initiatives supporting farmer education programs

The Indonesian cocoa sector has undergone significant changes through the Gernas Pro Kakao national program, which aims to rehabilitate cocoa plantations and improve bean quality. This program has resulted in:

- Enhanced farming techniques

- Better post-harvest processing methods

- Increased yield per hectare

- Superior bean quality standards

Local processing capacity has grown with investments in grinding facilities. Indonesian processors now handle approximately 50% of domestically produced beans, marking a shift from pure export orientation to value-added production.

The country’s strategic location in Southeast Asia gives it an advantage in serving emerging Asian markets. Indonesian cocoa is sold at higher prices in specialized markets because of its unique flavor and organic farming methods used in certain areas.

Future Growth and Development in the Cocoa Beans Market

The cocoa beans market is on the verge of a major transformation, driven by changing consumer preferences and technological advancements. Several key trends are shaping the industry’s future:

Sustainable Farming Practices

- Implementation of advanced agricultural technologies

- Adoption of precision farming methods

- Development of drought-resistant cocoa varieties

- Integration of blockchain for supply chain transparency

Consumer-Driven Innovations

- Rising demand for single-origin chocolate products

- Growth in premium, artisanal chocolate segments

- Increased focus on fair trade certification

- Development of reduced-sugar chocolate alternatives

Market Expansion Opportunities

- Emerging markets in Asia-Pacific regions

- Growth in functional food applications

- Development of cocoa-based health supplements

- Expansion of organic cocoa farming

Technological Integration

- AI-powered crop monitoring systems

- Smart irrigation solutions

- Digital marketplace platforms

- Supply chain optimization tools

The market expects significant developments in sustainable production methods, with major companies investing in farmer education programs and sustainable sourcing initiatives. Research institutions are working on developing disease-resistant cocoa varieties to enhance crop yields and quality. The rise of direct-trade relationships between producers and manufacturers is creating new market dynamics, benefiting both farmers and end-consumers through improved price transparency and product quality.

Competitive Landscape in the Cocoa Beans Industry

The market structure encourages consolidation, with larger players acquiring smaller regional processors to expand their geographical presence. Companies differentiate themselves through quality standards, processing capabilities, and commitment to ethical sourcing practices.

- Barry Callebaut AG – Switzerland

- Cargill Incorporated – United States

- Olam International Limited – Singapore

- Blommer Chocolate Company – United States

- ECOM Agroindustrial Corporation Ltd. – Switzerland

- Guan Chong Berhad – Malaysia

- Touton S.A. – France

- Dutch Cocoa BV – Netherlands

- JB Foods Limited – Singapore

- United Cocoa Processor Inc. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Cocoa Beans Market Report |

| Base Year | 2024 |

| Segment by Type |

· Conventional Cocoa Beans · Organic Cocoa Beans |

| Segment by Application |

· Confectionery · Functional Foods · Beverage · Cosmetic |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The cocoa beans market is going through a significant change and is expected to reach $14.66 billion by 2025. Several factors are influencing this market:

- Growing consumer demand for high-quality chocolate products

- Increasing awareness of cocoa’s health benefits

- Sustainability efforts throughout the supply chain

- Expanding use of cocoa in functional foods and cosmetics

For the industry to succeed in the future, it must overcome major challenges while also taking advantage of new opportunities. This can be achieved through strategic partnerships between producers and manufacturers, as well as technological advancements that promote sustainable growth. The market has shown resilience by adapting to shifting consumer preferences and environmental issues, which positions it for further growth in global markets.

Global Cocoa Beans Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Cocoa Beans Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Cocoa Beansplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Cocoa Beans Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Cocoa Beans Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Cocoa Beans Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCocoa Beans Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key stages in the cocoa beans supply chain?

The cocoa beans supply chain involves several critical stages, including cultivation, harvesting, processing, and distribution to end consumers. Major producers like Côte d’Ivoire and Ghana play pivotal roles in meeting global demand.

What trends are currently shaping the cocoa beans industry?

Major trends in the cocoa beans industry include the rising popularity of chocolate-flavored beverages, increased consumer preference for dark chocolate variants, and innovative product developments focusing on sustainability and health benefits.

What challenges does the cocoa beans market face?

The cocoa beans market faces several barriers to growth such as supply chain disruptions due to pests and dry weather conditions, price fluctuations affecting market stability, and competition from alternative products like carob and plant-based options.

How do geopolitical factors affect cocoa beans production?

Geopolitical tensions in key production regions can disrupt cocoa bean supply chains. Additionally, health concerns regarding sugar content in chocolate influence consumer purchasing behavior.

How is the cocoa beans market segmented?

The cocoa beans market is segmented primarily into organic and conventional types. This segmentation impacts consumer preferences significantly, with organic cocoa beans often commanding premium pricing due to their perceived health benefits.

What applications are driving global demand for cocoa beans?

Key applications driving demand for cocoa beans include their extensive use in the confectionery industry and growing recognition of their potential health benefits leading to increased incorporation in functional foods.