Carbon Credits Market Set to Reach $1.86 Billion by 2025: Key Growth Drivers in the U.S., China, and the U.K.

Explore the booming Carbon Credits Market projected to reach $1.86B by 2025. Discover key growth drivers in the U.S., China, and more.

- Last Updated:

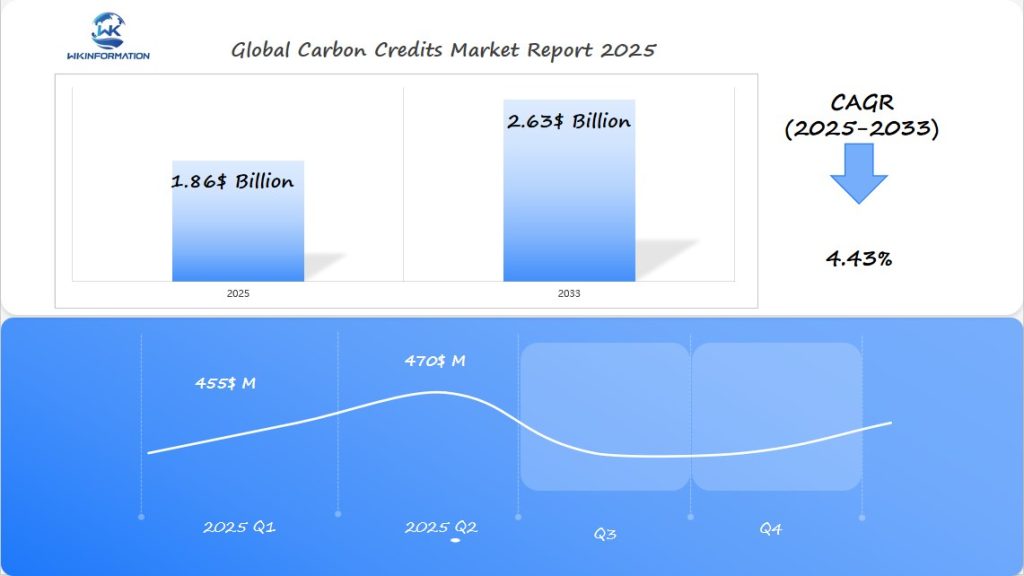

Carbon Credits Market Forecast for Q1 and Q2 2025

The carbon credits market is set to reach $1.86 billion in 2025, growing at a CAGR of 4.43% through 2033.

Q1 2025 revenue is projected at $455 million, increasing to $470 million in Q2 as regulatory frameworks strengthen globally.

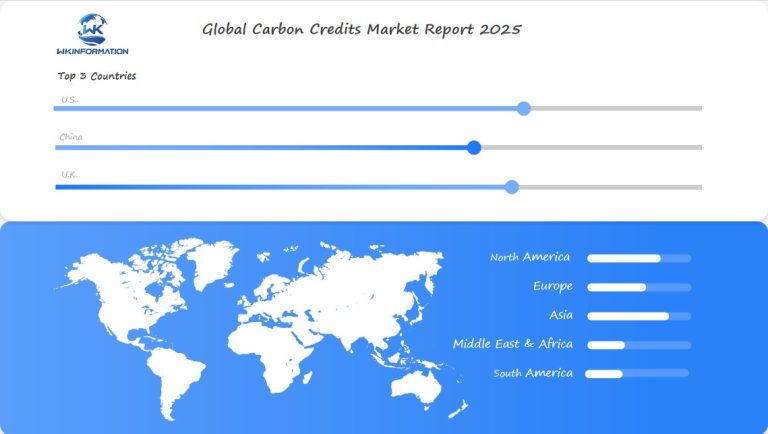

The U.S. sees growth through voluntary carbon markets and climate-driven corporate commitments. China advances via domestic carbon trading schemes and emissions reduction targets. The U.K. remains a critical player in the compliance market, actively promoting net-zero strategies.

Technological innovations in carbon tracking and verification are further enhancing transparency. Corporate ESG commitments are pushing more industries to invest in carbon credit portfolios.

Understanding the Factors Influencing the Carbon Credits Market

Upstream forces in the carbon credits market consist of project developers who create carbon offset projects. These projects can include initiatives like reforestation efforts or the installation of renewable energy sources. To ensure these projects meet specific standards, independent third-party organizations validate and verify them.

Understanding the Supply Chain Dynamics

The supply chain dynamics are critical to understanding how carbon credits are generated and traded. The process begins with the identification of projects that can reduce greenhouse gas emissions.

These projects are then developed into carbon offset projects, which are validated and verified. Once verified, the projects are issued carbon credits, which can be traded on carbon markets.

Impact of Policy on Carbon Credits Supply

Policy plays a crucial role in shaping the supply of carbon credits. Government regulations and international agreements can either encourage or hinder the development of carbon offset projects.

For instance, supportive policies like tax incentives for renewable energy projects can increase the supply of carbon credits. Conversely, regulatory uncertainty can deter investment in carbon offset projects.

- Government policies and regulations

- International agreements on climate change

- Economic incentives for project developers

The carbon credits industry is also influenced by market forces, including demand for carbon credits from companies looking to offset their emissions.

As demand for carbon credits grows, driven by corporate sustainability goals and regulatory requirements, the supply chain must adapt to meet this demand. This involves not only increasing the number of carbon offset projects but also ensuring the integrity and quality of the credits issued.

Key Trends Accelerating the Growth of the Carbon Credits Industry

The growth of the carbon credits industry is being accelerated by several key trends. As the world grapples with the challenges of climate change, the demand for carbon credits is increasing, driven by both regulatory requirements and voluntary actions by companies and individuals seeking to reduce their carbon footprint.

The carbon credits market is evolving rapidly, with several emerging trends contributing to its growth. One of the significant trends is the increasing adoption of carbon pricing mechanisms by governments around the world. This has created a financial incentive for companies to reduce their emissions, thereby driving the demand for carbon credits.

Emerging Trends in Carbon Credits Trading

Several emerging trends are shaping the carbon credits trading landscape.

1. Blockchain Technology

Blockchain technology is being increasingly used to enhance transparency and efficiency in carbon credits trading. This technology allows for the creation of a tamper-proof record of carbon credit transactions, thereby reducing the risk of fraud and ensuring that credits are not double-counted.

2. Involvement of Financial Institutions

Another trend is the growing involvement of financial institutions in the carbon credits market. Banks and other financial institutions are starting to invest in carbon credits, and some are even creating their own carbon credit funds. This influx of capital is helping to drive the growth of the market.

3. Voluntary Carbon Offsetting

The rise of voluntary carbon offsetting is also a significant trend. Companies are increasingly looking to offset their emissions by investing in projects that reduce greenhouse gas emissions elsewhere. This trend is being driven by consumer demand for more sustainable products and practices.

4. New Carbon Credit Standards

Furthermore, the development of new carbon credit standards and methodologies is making it easier for companies to generate and trade carbon credits. These standards help ensure that carbon credits are credible and represent real emissions reductions.

Challenges and Barriers in the Carbon Credits Market

As the carbon credits market continues to evolve, it must navigate a complex landscape of regulatory hurdles and market volatility. The growth of this market is dependent on effectively addressing these challenges.

Regulatory Hurdles and Market Volatility

The carbon credits market is heavily influenced by regulatory frameworks that vary significantly across different regions. This variability creates uncertainty and complexity for market participants, potentially hindering the market’s growth. For instance, differences in carbon pricing mechanisms and the lack of a unified global standard for carbon credits can lead to confusion and increased costs for companies seeking to comply with regulations.

Market volatility is another significant challenge. The value of carbon credits can fluctuate widely due to factors such as changes in government policies, economic conditions, and the overall demand for credits. This volatility can make it difficult for companies to predict their costs and revenues associated with carbon credits, thereby affecting their investment decisions and risk management strategies.

To overcome these challenges, it is essential to develop more robust and harmonized regulatory frameworks. This could involve establishing clearer guidelines and standards for carbon credits, enhancing transparency and monitoring, and ensuring consistent enforcement across jurisdictions.

Additionally, market participants can adopt strategic risk management practices to mitigate the impacts of market volatility. This might include diversifying their portfolios, engaging in hedging activities, and staying informed about market trends and regulatory developments.

By addressing these challenges and barriers, the carbon credits market can become more stable, efficient, and effective in promoting emissions reductions and supporting a low-carbon economy.

Geopolitical Impacts on Carbon Credit Regulations and Trading

The relationship between geopolitics and carbon credits is intricate, affecting market trends and regulatory systems. As nations confront the difficulties of climate change, the importance of international politics in shaping the carbon credits market grows more prominent.

Geopolitical conflicts and partnerships can either obstruct or promote the development of carbon credit rules and trading. For example, global agreements such as the Paris Agreement have played a crucial role in encouraging a coordinated worldwide approach to climate change, thus impacting carbon credit markets.

How Global Politics Influence Carbon Credits

Global politics play a crucial role in shaping the carbon credits landscape. Political stability, trade policies, and diplomatic relations between countries can all impact the demand and supply of carbon credits.

The influence of global politics on carbon credits can be seen in several areas:

- Regulatory frameworks: Governments can establish or modify regulations affecting carbon credit trading.

- Market dynamics: Political decisions can influence the supply and demand of carbon credits.

- International cooperation: Global agreements can facilitate or hinder the flow of carbon credits across borders.

| Country | Carbon Credit Regulations | Trading Mechanisms |

| United States | State-level regulations, with some federal oversight | Primarily voluntary markets, with some compliance markets |

| China | National Emissions Trading System (ETS) in place | Primarily compliance-based trading |

| United Kingdom | UK ETS post-Brexit, aligned with EU ETS pre-Brexit | Primarily compliance-based trading, with some voluntary markets |

The geopolitical landscape is constantly evolving, and its impact on carbon credits is multifaceted. Understanding these dynamics is crucial for stakeholders in the carbon credits market.

As the world continues to grapple with the challenges of climate change, the role of geopolitics in shaping the carbon credits market will remain a critical factor. Stakeholders must stay informed about geopolitical developments to navigate this complex landscape effectively.

Carbon Credits Market Segmentation: Types and Trading Mechanisms

Understanding the carbon credits market requires a look into its segmentation, including types and trading mechanisms. The market is complex, with various factors influencing its dynamics.

The carbon credits market is segmented based on the types of credits available. Different types of carbon credits cater to various needs and projects, ranging from renewable energy projects to energy efficiency improvements.

Understanding Different Types of Carbon Credits

Carbon credits are categorized mainly into two types: voluntary carbon credits and compliance carbon credits. Voluntary carbon credits are issued for projects that reduce greenhouse gas emissions and are not mandated by law. Compliance carbon credits, on the other hand, are issued under regulatory frameworks that require companies to reduce their emissions.

1. Voluntary Carbon Credits

These credits are traded on the voluntary market, where companies and individuals buy them to offset their emissions voluntarily.

2. Compliance Carbon Credits

These are traded on compliance markets, such as the EU Emissions Trading System (EU ETS), where companies are mandated to reduce their emissions.

Other types of carbon credits include Certified Emission Reductions (CERs) and Verified Emission Reductions (VERs). CERs are issued under the Clean Development Mechanism (CDM) for projects in developing countries, while VERs are issued for projects that are verified by independent auditors.

The trading mechanisms in the carbon credits market are crucial for the buying and selling of credits. Carbon credit trading can occur through various platforms, including exchanges and over-the-counter (OTC) markets.

- Exchanges: These are organized platforms where carbon credits are traded, providing a transparent and regulated environment for transactions.

- Over-the-Counter (OTC) Markets: These involve direct transactions between buyers and sellers, often facilitated by brokers.

The choice of trading mechanism depends on the type of carbon credit, the preferences of the buyer and seller, and the regulatory requirements. Understanding these mechanisms is essential for market participants to navigate the carbon credits market effectively.

How Applications Are Shaping the Demand for Carbon Credits

The growing need for carbon credits is largely driven by their applications in industries seeking to offset their emissions. As companies worldwide strive to reduce their carbon footprint, the demand for carbon credits is increasing, driven by both industrial applications and emerging uses.

Regional Insights into the Carbon Credits Market

As the world moves towards a low-carbon economy, regional insights into the carbon credits market become increasingly important. Different regions have varying levels of commitment to reducing carbon emissions, which affects the demand and supply of carbon credits.

Regional Variations in Carbon Credits Trading

Regional variations in carbon credits trading are influenced by factors such as regulatory frameworks, market mechanisms, and the level of industrial activity. For instance, regions with stricter environmental regulations tend to have more developed carbon credits markets.

Regional Variations in Carbon Credits Trading

Regional variations in carbon credits trading are influenced by factors such as regulatory frameworks, market mechanisms, and the level of industrial activity. For instance, regions with stricter environmental regulations tend to have more developed carbon credits markets.

To illustrate regional differences, let’s include a table comparing carbon credits trading in different regions.

| Region | Carbon Credits Trading Volume | Regulatory Framework |

| Europe | High | EU ETS |

| North America | Moderate | Varied by country/state |

| Asia Pacific | Growing | Emerging national systems |

Understanding the Carbon Credits Market: Regional Perspectives

As the world shifts towards a low-carbon economy, understanding the carbon credits market on a regional level becomes increasingly important. Different regions have varying levels of commitment to reducing carbon emissions, which affects the demand and supply of carbon credits.

Regional Variations in Carbon Credits Trading

Regional variations in carbon credits trading are influenced by factors such as regulatory frameworks, market mechanisms, and the level of industrial activity. For instance, regions with stricter environmental regulations tend to have more developed carbon credits markets.

| Region | Carbon Credits Trading Volume | Regulatory Framework |

| Europe | High | EU ETS |

| North America | Moderate | Varied by country/state |

| Asia Pacific | Growing | Emerging national systems |

The regional differences in carbon credits trading highlight the need for tailored approaches to carbon pricing and emissions reduction. Understanding these regional insights is crucial for stakeholders to navigate the complex global carbon credits market effectively.

The U.S. Carbon Credits Market: Key Developments and Growth Opportunities

The U.S. is becoming a key player in the global carbon credits market, driven by regulatory support and market demand. The country’s focus on reducing greenhouse gas emissions has led to the development of various programs and initiatives aimed at promoting the use of carbon credits.

One of the main factors driving the U.S. carbon credits market is the regulatory framework. The Environmental Protection Agency (EPA) plays a crucial role in shaping the market through its policies and guidelines. For example, the EPA’s Clean Power Plan and the Renewable Fuel Standard have significantly contributed to the growth of the carbon credits market.

U.S. Regulations and Market Growth

The U.S. government has implemented several regulations to reduce carbon emissions and promote the use of clean energy. These regulations have created a favorable environment for the growth of the carbon credits market. Some of the key regulations include:

- The Clean Air Act, which regulates emissions from industrial sources

- The Clean Power Plan, which aims to reduce carbon emissions from power plants

- The Renewable Fuel Standard, which promotes the use of renewable energy sources

These regulations have led to an increase in the demand for carbon credits, driving market growth. The table below highlights some of the key trends and statistics in the U.S. carbon credits market.

The growth of the U.S. carbon credits market is expected to continue in the coming years, driven by increasing demand for clean energy and the need to reduce carbon emissions. As the market evolves, we can expect to see new trends and developments emerge.

China’s Role in the Expansion of Carbon Credits Trading

China’s carbon credits market has been developing rapidly, contributing to the global carbon reduction efforts. As the world’s second-largest economy, China’s participation in carbon credits trading is crucial for achieving global climate goals.

The development of China’s carbon credits market is driven by several factors, including government policies and regulations. The Chinese government has implemented various measures to promote the growth of the carbon credits market, such as the national emissions trading system (ETS), which was launched in 2021.

China’s Carbon Credits Market Developments

The Chinese carbon credits market has seen significant growth since the launch of the national ETS. The market has become one of the largest carbon markets globally, with a wide range of participants, including power generation companies, industrial enterprises, and financial institutions.

Key developments in China’s carbon credits market include the expansion of the ETS to cover more sectors, such as petrochemicals and non-ferrous metals. Additionally, there has been an increase in the use of carbon credits for compliance purposes, driving demand for high-quality carbon credits.

- Increased participation from financial institutions

- Expansion of the ETS to new sectors

- Growing demand for carbon credits

China’s carbon credits market developments have not only contributed to the country’s climate goals but also have implications for the global carbon credits trading landscape. As China continues to expand its carbon market, it is likely to play an increasingly important role in shaping the global carbon credits market.

The U.K. Carbon Credits Market: Innovations and Trends

As the world grapples with climate change, the U.K. carbon credits market is evolving with new trends and innovations. The U.K.’s commitment to reducing carbon emissions has led to the development of a robust carbon credits trading system.

U.K.’s Approach to Carbon Credits Trading

The U.K.’s approach to carbon credits trading is characterized by a mix of regulatory frameworks and market mechanisms. The country has implemented various policies to encourage the adoption of carbon reduction technologies and practices.

Innovations in Carbon Credits

One of the key trends in the U.K. carbon credits market is the emergence of new technologies and methodologies for carbon reduction. These include advanced renewable energy technologies and carbon capture and storage (CCS) solutions.

The U.K. government has also introduced initiatives to support the development of carbon offset projects. These projects allow companies to generate carbon credits by investing in emissions reduction projects.

| Trend/Innovation | Description | Impact |

| Advanced Renewable Energy | New technologies increasing renewable energy output | Reduced carbon emissions |

| Carbon Capture and Storage | Technologies capturing CO2 emissions | Significant reduction in industrial emissions |

| Carbon Offset Projects | Projects generating carbon credits through emissions reduction | Increased supply of carbon credits |

Trends in Carbon Credits Trading

The U.K. carbon credits market is also witnessing a trend towards greater transparency and standardization. Efforts are being made to improve the verification and validation of carbon credits, ensuring that they represent real emissions reductions.

The U.K.’s innovative approach to carbon credits trading is expected to drive growth in the market and influence global trends. As the country continues to lead in carbon reduction efforts, its carbon credits market is likely to remain a key player in the global fight against climate change.

Looking Ahead: Future Growth Prospects for the Carbon Credits Market

The carbon credits market is expected to grow in the future, but its path will be influenced by a combination of opportunities and challenges. Several factors will play a role in shaping the market’s growth, including regulatory developments, technological advancements, and changes in market dynamics.

Opportunities for Growth

One of the main reasons for the anticipated growth of the carbon credits market is the increasing adoption of carbon pricing mechanisms worldwide. This means that more countries and businesses are recognizing the importance of putting a price on carbon emissions to incentivize reduction efforts.

In addition to this, there are also emerging opportunities that could further drive market growth:

- The development of new carbon credit projects such as reforestation and renewable energy initiatives

These projects have the potential to generate additional carbon credits and attract investment, which would contribute to the overall expansion of the market.

Challenges Ahead

While there are promising opportunities on the horizon, it’s important to acknowledge that the carbon credits market also faces several challenges:

- Regulatory uncertainty: Inconsistent regulations across different jurisdictions can create barriers for businesses looking to participate in the carbon market.

- Market volatility: Fluctuations in demand and supply can lead to price instability, making it difficult for stakeholders to plan their investments.

- Greater transparency and standardization: The need for clear rules and guidelines is crucial in building trust among participants and ensuring the integrity of carbon credit transactions.

Addressing these challenges will be critical in unlocking the full potential of the carbon credits market.

Opportunities and Challenges Ahead

Some of the key emerging opportunities in the carbon credits market include:

- The growing demand for carbon credits from industries such as aviation and shipping

- The increasing adoption of carbon offsetting by companies to meet their sustainability goals

- The development of new technologies, such as blockchain, to enhance the transparency and efficiency of carbon credit trading

At the same time, the market must navigate several challenges, including:

- Regulatory hurdles, such as the need for greater harmonization of carbon pricing mechanisms across jurisdictions

- Market risks, such as price volatility and the potential for market manipulation

The future growth prospects for the carbon credits market are promising, driven by emerging opportunities and shaped by the challenges that the market must overcome.

Competitive Landscape in the Carbon Credits Industry

Key Players:

-

South Pole Group – Switzerland

-

3Degrees Inc. – USA

-

Finite Carbon Corp. – USA

-

Climate Partner GmbH – Germany

-

EKI Energy Services Ltd. – India

-

AirCarbon Exchange (ACX) – Singapore

-

Xpansiv CBL Holding Group (Xpansiv) – USA

-

Climate Impact X (CIX) – Singapore

-

Moss Earth – Brazil

-

DevvStream Innovations Inc. – USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Carbon Credits Market |

| Base Year | 2024 |

| Segment by Type |

· Forestry · Renewable Energy · Landfill Methane Projects · Others |

| Segment by Application |

· Personal · Enterprise |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Carbon Credits Market is expected to grow significantly, driven by increasing demand for carbon credits trading. As discussed, various factors such as regulatory frameworks, geopolitical events, and industrial applications influence the market.

As the world continues to deal with climate change, the importance of carbon credits trading will only continue to grow. Understanding how the Carbon Credits Market works is crucial for stakeholders like investors, policymakers, and industry leaders.

By providing a comprehensive overview of the market, we can better navigate its complexities and take advantage of emerging trends.

Global Carbon Credits Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Carbon Credits Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Carbon Credits MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global Carbon CreditsPlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Carbon Credits Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Carbon Credits Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Carbon Credits Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Carbon Credits MarketInsights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected size of the Carbon Credits Market by 2025?

The Carbon Credits Market is projected to reach $1.86 billion by 2025.

What are the key growth drivers in the U.S., China, and the U.K. carbon credits markets?

The key growth drivers in these regions include:

- Increasing demand for carbon credits

- Government regulations

- Emerging trends in carbon credits trading

How do upstream and downstream forces shape the Carbon Credits Market?

Upstream forces, such as policy and supply chain dynamics, and downstream forces, such as demand and trading mechanisms, influence the Carbon Credits Market.

What are the emerging trends in carbon credits trading?

Emerging trends include new trading mechanisms, increased participation from industrial applications, and growing demand from emerging applications.

What are the challenges facing the Carbon Credits Market?

Regulatory hurdles, market volatility, and geopolitical impacts are some of the challenges facing the Carbon Credits Market.

How do global politics influence carbon credit regulations and trading?

Global politics play a significant role in shaping carbon credit regulations and trading practices, with different regions having varying approaches.

What are the different types of carbon credits available?

There are various types of carbon credits, including those generated from:

- Renewable energy projects

- Energy efficiency projects

- Reforestation efforts

How are applications shaping the demand for carbon credits?

Industrial applications, such as those in the energy and manufacturing sectors, along with emerging applications, are driving the demand for carbon credits.

What are the regional variations in carbon credits trading?

Regional variations exist due to differences in regulations, market maturity, and demand for carbon credits, with regions like the U.S., China, and the U.K. having distinct characteristics.

Who are the key players in the Carbon Credits Industry?

Key players include companies involved in carbon credits trading, project developers, and registries, such as Verra and the International Carbon Reduction and Offset Alliance.

What is the outlook for the Carbon Credits Market?

The Carbon Credits Market is expected to continue growing, driven by increasing demand, emerging trends, and expanding regional markets.