$8.12 Billion Camera Actuator Market Set for Explosive Growth in the U.S., Japan, and South Korea by 2025

The camera actuator market is set to grow steadily from 2025 to 2033, driven by advancements in imaging tech, smartphone demand, and multi-camera setups.

- Last Updated:

Projected Market Insights for Camera Actuator in Q1 and Q2 of 2025

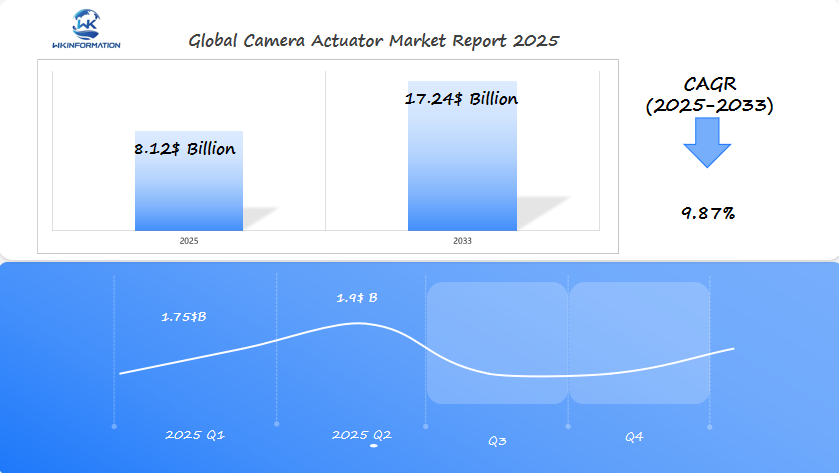

The Camera Actuator market is expected to reach $8.12 billion in 2025, with a CAGR of 9.87% from 2025 to 2033. In Q1, the market is anticipated to generate around $1.75 billion, driven by the increasing demand for high-performance actuators in smartphone cameras, automotive applications, and surveillance systems. By Q2, the market is expected to rise to approximately $1.9 billion, as the integration of camera modules into emerging technologies such as augmented reality (AR), virtual reality (VR), and autonomous vehicles further accelerates.

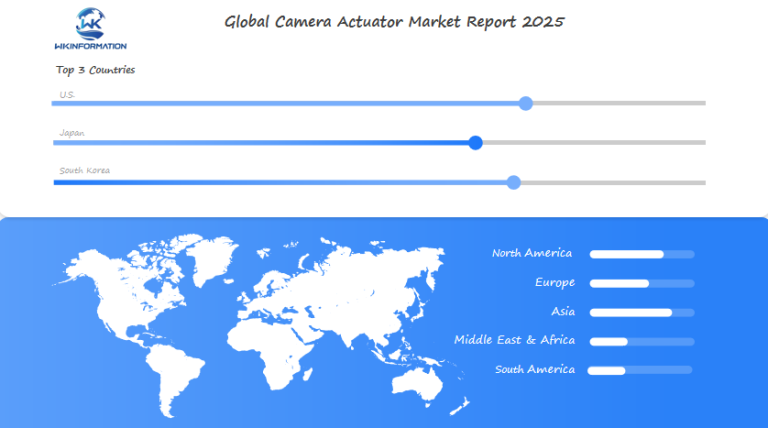

The U.S., Japan, and South Korea are the leading markets, with South Korea and Japan having a stronghold in the consumer electronics sector, while the U.S. benefits from its strong automotive and technology industries. As the demand for high-quality, high-speed camera actuators continues to rise, the market is poised for strong growth.

Key Takeaways

- Camera actuator market expansion ties directly to smartphone and automotive innovation.

- South Korea’s tech giants and Japanese manufacturers dominate production capabilities.

- AI integration is a core driver of camera actuator growth in emerging applications.

- U.S. consumer electronics demand is a major contributor to market scaling.

- Global competition focuses on miniaturization and energy-efficient designs.

Exploring the Upstream and Downstream Industry Chains for Camera Actuators

The making and use of advanced camera actuators depend on a big network of suppliers and users. Upstream, companies like TDK and Alps Alpine make the core parts. They use special materials like rare-earth magnets and strong alloys.

Downstream, Sony and Samsung put these parts into phones, drones, and car sensors. This makes a cycle where the need for advanced camera actuators pushes for better parts and devices.

- Upstream Players: Focus on raw materials and precision components.

- Downstream Users: Assemble actuators into consumer electronics and industrial tools.

- Key Link: Collaboration between suppliers and assemblers ensures product reliability and market expansion.

Good partnerships between these groups help avoid delays and save money. For example, TDK’s motor designs help Sony’s camera modules get better. This chain’s smooth work helps the global tech market grow, especially in places like South Korea and Japan.

Emerging Trends in Camera Actuator Design and Application

Camera technology is changing fast, making images better in all devices. Now, makers use light materials like graphene and special alloys. These materials are strong but don’t add much weight. New engineering tricks help these parts move quicker, perfect for 8K videos and photos in the dark.

Current Trends

Here are some current trends in camera actuator design and application:

- Adoption of piezoelectric actuators for ultra-precise motion control in drones and robotics

- Integration of AI-driven autofocus systems in smartphone cameras

- Miniaturized actuators enabling compact medical imaging tools

“The fusion of micro-electromechanical systems (MEMS) with AI is unlocking unprecedented imaging capabilities,” noted a 2023 study by the International Image Sensor Society.

Future Prospects

Car makers want better camera tech for self-driving cars. They need sensors that can spot things really small. Big companies like Sony are working with car parts makers to make this happen. These changes are also happening in healthcare and security, leading to greener and more efficient tech.

Challenges in Manufacturing High-Performance Camera Actuators

Creating advanced camera actuator designs is similar to performing delicate surgery. Every small component must align flawlessly to ensure sharp images and steady shots. Engineers encounter significant obstacles such as material degradation and temperature fluctuations that can warp components over time.

Key Challenges

Here are some of the main challenges faced in the manufacturing of high-performance camera actuators:

- Miniaturization Struggles: Making actuators smaller without losing quality is a huge task.

- Cost Pressures: Using precise tools like laser-cutting machines makes things more expensive.

- Testing Complexities: Testing these parts in real-world conditions is very time-consuming.

Solutions Being Explored

To tackle these challenges, companies are exploring various solutions:

| Challenge Solution Component misalignment | Automated calibration systems |

| Heat distortion | Heat-resistant alloys |

| Scalability | AI-driven assembly lines |

Big names like Sony and Bosch are investing heavily in camera actuator design research. Their goal is to keep costs down while maintaining quality. Testing labs use microscopes to check parts as small as 0.1 microns.

Even a tiny mistake can make images blurry. That’s why every step is crucial. New ideas like self-correcting motors and cooling systems are changing how these parts are made. Companies are trying to find a balance between being innovative and affordable.

Geopolitical Influence on the Camera Actuator Market

Global trade policies greatly affect camera actuator manufacturing in major areas like the U.S., Japan, and South Korea. Trade issues, like tariffs on Chinese tech parts, make companies spread out their production bases. Governments focus on local production to cut down on shaky supply chains.

“Supply chain resilience is now a geopolitical priority,” says a 2023 industry report, noting how U.S.-China trade wars accelerated factory relocations.

Impact on Major Players

Here’s how the geopolitical situation is influencing key players in the camera actuator market:

- U.S.: The government offers grants to boost camera actuator manufacturing at home. They aim to team up with Taiwan and South Korea in semiconductors.

- Japan: The government backs research for smaller actuators. This makes Sony and TDK top names worldwide.

- South Korea: Trade deals with the EU open up new markets. But, fights with Japan over rare materials push for cheaper production methods.

Rules like the U.S. CHIPS Act and Japan’s tech export rules change where factories go and how much they spend on R&D. Companies weigh the risks of politics against making things efficient. This reshapes the world of camera actuator manufacturing. Working together, governments and businesses keep this key sector stable for smartphones and self-driving cars.

Market Segmentation: Types and Applications of Camera Actuators

Camera actuators come in different designs and technologies. Smartphone camera actuators play a big role in the world of consumer electronics. They help drive the market’s growth. These parts are sorted by their technology, cost, and what industry needs.

Types of Camera Actuators

- Voice coil (high precision)

- Piezoelectric (compact)

- Stepper motor (affordable)

Applications of Camera Actuators

- Smartphones

- Drones

- Cars

- Medical imaging

| Type Technology Main Uses Voice Coil | Electromagnetic | Smartphone cameras, DSLRs |

| Piezoelectric | Ceramic | Autonomous vehicles, drones |

| Stepper Motor | Electromechanical | Budget smartphones, security systems |

Brands like Alps Electric and AAC Opto-Electronics make key parts for smartphones. These parts are crucial for features like optical zoom and stabilization. They help phones work better.

Consumer electronics, especially smartphones, drive the demand. This helps companies focus on areas like cars or budget phones. It’s a way to grow and meet new needs.

Camera Actuators in Smartphones, Drones, and Automotive Sectors

Camera actuators are key in smartphones, drones, and car cameras. They help smartphones take clear photos while moving. Drones use them for sharp aerial shots. Car cameras use them for safety features like lane-keeping and night vision.

| Sector | Key Features | Impact |

| Smartphones | Optical image stabilization, zoom capabilities | Sharper photos even in low light |

| Drones | 360-degree cameras, real-time tracking | Enhanced aerial data collection |

| Automotive | Lane departure warnings, parking sensors | Safer driving through automotive camera systems |

Now, car cameras work with AI to analyze road data fast. Brands like Tesla and Waymo use this for self-driving cars. Smartphones from Samsung and Apple also show off new actuator tech.

Drones like DJI’s Mavic series get better at stabilizing shots. This lets pros take amazing footage. These advancements show how actuators link hardware and software for better devices.

Global Insights into the Camera Actuator Market

The camera actuator market is growing fast, thanks to new technology and more use in gadgets. Asia-Pacific is the biggest market, thanks to China and India’s factories. North America and Europe are focusing on advanced uses like car safety systems.

Key Highlights

- Big names like Sony and Samsung make most of the products, with 60% coming from South Korea and Japan.

- New markets in Southeast Asia are starting to use advanced actuators in IoT devices, opening up new chances.

- Europe is pushing for green materials in actuators, focusing on being eco-friendly.

“Global teamwork between tech leaders and local makers is essential for reaching 2025 goals,” said a 2023 report by TechMarket Analytics. “Spending on research and development will drive future growth.”

Asia-Pacific is making the most products, but North America is leading in high-value areas like medical imaging. The camera actuator market is also growing in Latin America because of more smartphones. As global supply chains change, working together between companies is key to keeping costs down and quality up.

U.S. Market Demand for Advanced Camera Actuators in Consumer Electronics

The demand for camera actuators in U.S. consumer electronics is growing fast. This is because people want better pictures in their smartphones and wearables. Brands like Apple and Samsung are leading this change by focusing on better zoom and stabilization.

These improvements are making 4K video and AI autofocus common. This shows how fast technology is moving in this field.

Key Developments in the Industry

- Smartphone makers are adding advanced actuators for better low-light photos.

- Wearable tech companies are making actuators smaller for smaller devices but keeping image quality high.

- Gamers and content creators want actuators that help with fast video and smooth movement.

“Consumers now expect professional-grade photography in everyday devices, making camera actuators a key differentiator in product launches.”

Companies like Sony and Qualcomm are working together on new camera systems. This is making devices with high-resolution cameras more popular. Analysts think this trend will keep growing as 5G networks let people share photos instantly.

Looking ahead, there’s a chance to use AI for better camera settings and to save battery life. The U.S. market for camera technology is very competitive and always changing.

Japan’s Technological Advancements in Camera Actuator Systems

Japan is leading the way in advanced camera actuators, blending traditional knowledge with modern technology. Sony and Canon invest heavily in research and development, aiming for both high precision and compact design.

Their newest systems can move with an accuracy of one micrometer, which is crucial for high-end smartphones and industrial applications.

Japan’s advanced camera actuators technology

- Piezoelectric actuators for faster autofocus in compact devices

- Hybrid motor designs reducing power consumption by 30%

- Custom software algorithms for motion stabilization

“Our engineers have redefined what’s possible in actuator responsiveness,” said a Sony spokesperson. “These innovations directly support global tech leaders in creating next-gen imaging systems.”

Japanese companies are collaborating with Toyota to develop advanced camera actuators for self-driving vehicles, ensuring these cars have a complete view of their surroundings. Additionally, they are partnering with chip manufacturers to produce cost-effective yet high-quality products.

As the demand for these technologies grows, Japan’s commitment to precision positions it as a leader in various sectors such as healthcare and robotics.

South Korea’s Role in Camera Actuator Innovation and Production

South Korea is leading the way in camera technology innovations. This is thanks to smart investments and government support. Companies like Samsung Electro-Mechanics (SEMCO) and LG Innotek are at the forefront. They focus on making things smaller and more precise.

Their work powers devices from smartphones to drones. This is changing how we use electronics worldwide.

Government initiatives driving innovation

- Government grants fund R&D projects targeting high-resolution imaging solutions

- Partnerships with global brands boost adoption of advanced actuator designs

- SEMCO’s voice coil motor (VCM) tech sets new benchmarks in stabilization performance

“Continuous investment in camera technology innovations keeps us ahead in meeting rising market demands,” stated a SEMCO spokesperson, highlighting their 50% global market share in smartphone actuators.

Collaboration between academia and industry

In South Korea, universities and companies work together. KAIST, for example, partners with manufacturers. They focus on improving actuator materials and AI autofocus systems.

This teamwork is helping South Korea grab 35% of the $8.12B global market by 2025. As cars and robots become more common, local firms are making actuators for them. This mix of old and new makes South Korea a key player in camera technology.

The Future of Camera Actuators: Miniaturization and AI Integration

The future of camera actuators is all about making things smaller and smarter. Camera actuator design is getting a boost, leading to devices that are not just smaller but also better. This is key for the next big things like AR glasses and tiny drones.

Miniaturization and its impact

Miniaturization lets us make thinner smartphones and wearables. They’re smaller but still take great photos.

The role of AI in camera technology

AI now adjusts focus and lighting on the fly. This makes photos look better in dark places.

Industry leaders driving innovation

Big names like Sony and Samsung are at the forefront of camera actuator design. Their new models are thin and can handle drone shakes. They work with AI from Qualcomm to adjust to scenes fast—like snapping faces or landscapes.

Future predictions for camera actuators

By 2025, AI actuators will rule in cars and security systems. They promise faster, more accurate vision, even in bad weather. As camera actuator design keeps improving, we’ll see smarter, smaller lenses that mix tech and software perfectly.

Competitive Forces in the Camera Actuator Market

- Alps Alpine – Tokyo, Japan

- Mitsumi Electric Co. Ltd. – Atsugi, Kanagawa, Japan

- TDK Corporation – Tokyo, Japan

- SEMCO – Seoul, South Korea

- Jahwa Electronics – Seongnam, Gyeonggi-do, South Korea

- LG Innotek – Seoul, South Korea

- ZET – Osaka, Japan

- New Shicoh Motor – Seongnam, Gyeonggi-do, South Korea

- Haesung Optics – Seongnam, Gyeonggi-do, South Korea

- MCNEX – Seongnam, Gyeonggi-do, South Korea

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Camera Actuator Market Report |

| Base Year | 2024 |

| Segment by Type | · Voice Coil Motors (VCM)

· MEMS Actuators · Piezoelectric Actuators |

| Segment by Application | · Smartphone and Consumer Electronics

· Automotive and Industrial Cameras · Security and Surveillance Systems |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The camera actuator market is set to reach $8.12 billion by 2025. This growth comes from a mix of new ideas and worldwide teamwork. Smartphone camera actuators are key, thanks to the need for better pictures in phones like iPhones and Samsung Galaxy models.

Car camera systems are also driving progress. They help make cars safer and more self-driving, thanks to companies like Tesla and Toyota. This opens up new chances for makers.

Big steps in making things smaller and smarter, like Sony and Bosch’s latest, show how things are getting better. The U.S., Japan, and South Korea are all important in this area. They each bring their own strengths to the table.

As things get more competitive, companies need to move fast but still keep quality high. Working together, like Alps Alpine and Canon, could lead to even faster progress. We can look forward to more big steps in this field, making our gadgets and industries better.

Global Camera Actuator Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Camera Actuator Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Camera ActuatorMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Camera Actuatorplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Camera Actuator Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Camera Actuator Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Camera Actuator Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCamera Actuator Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current size of the Camera Actuator Market?

The Camera Actuator Market is expected to reach $8.12 billion by 2025. This growth is particularly noticeable in the U.S., Japan, and South Korea.

What factors are driving growth in the Camera Actuator Market?

Growth is driven by advancements in camera technology and increased demand for consumer electronics. Smartphones, drones, and automotive applications are also significant contributors.

How does the upstream and downstream industry chain work for camera actuators?

The chain starts with component suppliers and ends with product assemblers. Each part is crucial, ensuring smooth collaboration to meet market needs.

What are the emerging trends in camera actuator design?

New trends include using advanced materials and precision engineering. There’s also a focus on new partnerships to improve performance and expand uses.

What challenges do manufacturers face in producing camera actuators?

Manufacturers struggle with quality control and precision. Miniaturization adds complexity, requiring innovative solutions to maintain quality.

How do geopolitical factors affect the Camera Actuator Market?

Trade tensions, regulatory changes, and policies can greatly affect supply chains and production in key areas like the U.S., Japan, and South Korea.

What types of camera actuators are available in the market?

The market offers various types, based on features, technology, and industry use. This includes consumer electronics and specialized imaging solutions.

Where are camera actuators commonly used?

Camera actuators are commonly used in:

- Smartphones

- Drones

- The automotive sector

They enhance image capture capabilities and contribute to various technological features.

What insights can I gain from global camera actuator market statistics?

You can learn about new markets, performance, and trends worldwide. This helps understand the industry’s global growth and prospects.

What is driving demand for camera actuators in the U.S. consumer electronics market?

Demand is up due to consumer interest, product innovation, and a competitive market. This drives the need for advanced camera actuators in the U.S.

How is Japan contributing to camera actuator innovation?

Japan is a leader in technology, with strong research and development (R&D) efforts and top manufacturers. They are constantly pushing the boundaries of camera actuator quality and capability.

What role does South Korea play in the camera actuator market?

South Korea is key in innovation and production. It’s supported by investments and policies, making it a global tech leader.

What future trends should we anticipate for camera actuators?

Expect miniaturization and AI integration to change device performance and user experiences. This will happen across many sectors.

How do competitive forces shape the Camera Actuator Market?

Competition includes strategies from big players, market trends, and new company challenges. These forces affect pricing and innovation in the industry.