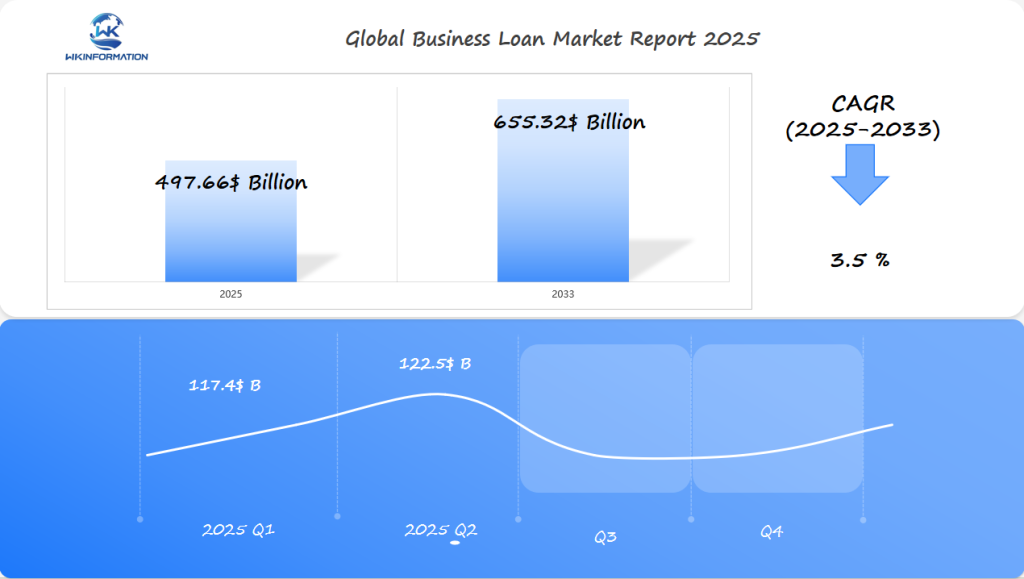

Business Loan Market Projected to Hit $497.66 Billion by 2025: Rising Demand in the U.S., China, and Germany

Explore the expanding Business Loan Market as it progresses toward $497.66 billion by 2025, driven by increased lending activities and technological advancements in financial services.

- Last Updated:

Business Loan Market in Q1 and Q2 of 2025

The Business Loan market is projected to reach $497.66 billion in 2025, with a CAGR of 3.5% from 2025 to 2033. In Q1 2025, the market size is expected to be around $117.4 billion, rising to $122.5 billion in Q2. The market is driven by increasing demand for capital among small and medium enterprises (SMEs) and the growth of digital lending platforms.

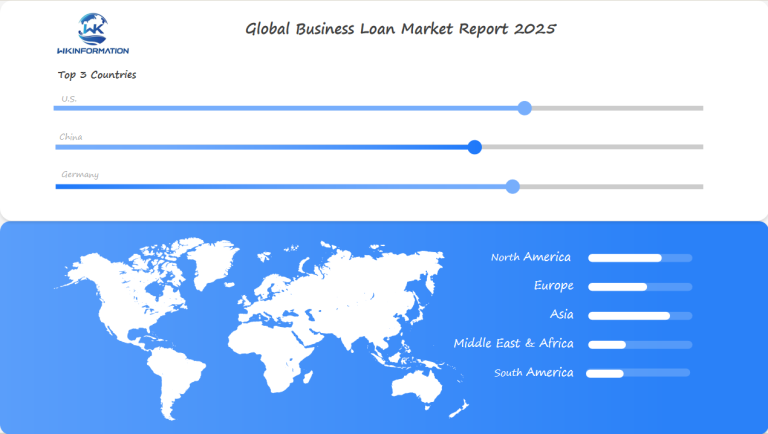

In the U.S., the expansion of fintech and peer-to-peer lending solutions plays a significant role in streamlining loan access. China, with its rapidly expanding economy, is seeing a rise in business loans driven by government-backed initiatives and increased private sector financing. Germany’s focus on supporting green energy projects and industry 4.0 innovations also boosts business loan demand. As global economic recovery progresses, businesses are more inclined to secure funding for expansion, further propelling the market’s growth.

Key Takeaways

- Business loan market expected to reach $497.66 billion by 2025

- Key markets include U.S., China, and Germany

- SBA plays a critical role in facilitating small business lending

- Digital and traditional lending platforms are expanding

- Government support is crucial for market growth

Upstream and Downstream Market Analysis of Business Loans

The business loan market is a complex system of financial interactions that drives economic growth. Market analysis shows how lending supply chains and economic impact work together in different sectors.

Upstream Factors in Lending

Upstream factors in lending include key elements that shape loan availability and conditions:

- Capital sources from banks, credit unions, and alternative lenders

- Regulatory frameworks governing financial institutions

- Technological innovations in credit assessment

- Risk management strategies

Capital Flow Dynamics

The FDIC’s Small Business Lending Survey shows big changes in business lending. Upstream market analysis shows that new tech has changed old lending ways.

Downstream effects have big impacts on businesses and economic growth:

- More access to working capital

- More job creation chances

- Help for small and medium enterprises

- Boost to business innovation

Economic Impact Assessment

Lending supply chain mechanisms affect economic strength. By understanding these connections, financial institutions can create better lending strategies. These strategies meet changing market needs.

Trends in alternative lending, peer-to-peer platforms, and digital lending

The way businesses get loans is changing fast. New digital tools and financial ideas are making it easier to get money. Now, there are more flexible and quick ways to get loans than old bank methods.

Digital loans are a big help for businesses needing money fast. They use new tech to make getting a loan simple and quick. This cuts down on the usual red tape.

Key Innovations in Digital Lending

- Advanced algorithmic credit scoring

- Real-time loan application processing

- Machine learning risk assessment

- Mobile-friendly lending platforms

P2P lending is becoming more popular. It lets people lend and borrow directly. This means better rates and quicker approvals, without middlemen.

Comparative Lending Ecosystem

| Lending Type | Processing Time | Approval Rate |

| Traditional Bank Loans | 30-45 days | 22% |

| Alternative Lending | 24-72 hours | 62% |

| P2P Platforms | 7-14 days | 45% |

Alternative lending is changing the financial world. Businesses can now find many ways to get the money they need. This helps entrepreneurs and small businesses get the funds they need to grow.

Restrictions from regulatory compliance and credit risk management

The business loan market is complex. It deals with lending rules and managing credit risk. Banks must follow rules and make smart loans to avoid risks.

Lending rules are tough for banks and financial groups. They help keep both lenders and borrowers safe. These rules set strict standards for checking credit risk.

Key Regulatory Compliance Strategies

- Implement comprehensive credit risk evaluation processes

- Develop robust internal control mechanisms

- Maintain transparent documentation practices

- Conduct regular risk assessment audits

Credit risk management uses advanced tools. These tools help banks figure out if a borrower can pay back a loan. They use complex algorithms and data to guess if a loan might fail.

Risk Mitigation Techniques

- Detailed financial background checks

- Comprehensive credit scoring models

- Stress testing potential loan scenarios

- Continuous monitoring of borrower financial health

The rules for lending keep changing. Banks need to keep up with new rules and technology. They must also find new ways to lend money that people want.

Geopolitical impact of interest rates, trade policies, and global recession risks

The global business loan market is facing big challenges. Interest rates and trade policies are changing fast. These changes affect how loans are given out and managed around the world.

Geopolitical tensions are key in deciding who gets loans and at what price. Banks have to deal with unstable economies. This is because of changing trade rules and worries about recessions.

Key Geopolitical Influences on Lending Dynamics

- Fluctuating interest rates triggered by global economic uncertainty

- Trade policy shifts affecting cross-border financial transactions

- Potential recession risks impacting lending risk assessments

Central banks are changing their money policies to avoid recessions. This change affects business loans. It means banks have to decide who gets loans and how much money they can lend.

| Geopolitical Factor | Lending Market Impact | Risk Level |

| Interest Rate Volatility | Increased borrowing costs | High |

| Trade Policy Uncertainty | Reduced cross-border lending | Medium |

| Recession Potential | Stricter credit requirements | High |

Lenders are finding new ways to deal with global risks. They use advanced tools to predict market changes. This helps them stay ahead of problems.

Strategic Adaptation in Lending Practices

Banks are using advanced technological solutions to handle risks. Digital platforms help them lend money faster. This way, they can quickly adjust to changes in the economy.

Type segmentation: short-term and long-term

The world of business loans offers many financing options. Each one is designed for different business needs. Knowing about these options helps entrepreneurs choose the best financial assistance for their goals.

Businesses can choose from many loan types. Each one is designed for a specific financial need. The main categories are:

- Short-term loans for immediate needs

- Long-term financing for big investments

- SBA programs for small business growth

Short-Term Loan Characteristics

Short-term loans give quick money with fast approval. They usually have:

- Short repayment times (3-18 months)

- Quick funding

- Higher interest rates than long-term loans

Long-Term Financing Strategies

Long-term financing is for big business investments. It’s great for:

- Buying equipment

- Buying real estate

- Big expansion projects

Application segmentation: SMEs, startups, and large corporations

The business loan market is very diverse. It offers different financing solutions for various business needs. From small microloans to big corporate loans, banks have developed special strategies for each business type.

SME loans are key in the lending world. They help small and medium businesses overcome their unique challenges. These loans usually range from $5,000 to $50,000. They provide essential working capital for new businesses.

Startup financing is a fast-growing area. It offers new funding options through venture capital and alternative lending. These options use technology to look at creditworthiness in new ways.

- Corporate lending is still mostly done by big banks

- Digital platforms make loans more accessible to small businesses

- Algorithms for assessing risk are getting better

Now, banks know that a one-size-fits-all approach doesn’t work anymore. They’re moving towards tailored solutions for SMEs, startups, and big companies. This shift focuses on meeting each business’s specific needs.

Global demand for working capital and growth financing

The world of business is changing fast. New markets and old ones are looking at money differently. This is creating a big need for new ways to lend money.

Companies everywhere want flexible ways to grow. They face tough economic times. Each area has its own way of getting money:

- Emerging markets want lots of working capital to grow fast

- Richer countries invest in growth financing for new tech

- Small and medium businesses are big in global lending

Regional Financing Dynamics

Money needs vary by region. Knowing these differences is key for companies looking to grow.

| Region | Working Capital Demand | Growth Financing Trend |

| North America | High technological investment | Venture capital driven |

| Asia-Pacific | Rapid infrastructure development | State-supported financing |

| European Union | Sustainable business models | Digital lending platforms |

Financial groups are changing how they lend. They need to keep up with working capital needs in different places. The future of lending will depend on tech, understanding risks, and being flexible.

U.S. Market Dominance in Venture Capital-Backed Startups

The United States leads in venture capital, driving innovation and economic growth. Silicon Valley is the heart of venture capital, drawing entrepreneurs and investors worldwide.

Venture capital has changed the U.S. startup scene, offering key financial support. This support lets companies grow fast and explore new technologies.

Key Characteristics of U.S. Venture Capital Landscape

- Highest global concentration of venture capital investments

- Robust startup ecosystem across multiple tech hubs

- Significant funding for emerging technologies

Startup funding in the United States is very strong. VC funding does more than just provide money. It changes whole industries, like AI, biotech, and clean energy.

China's support for state-owned enterprises and tech-driven loans

The China lending market has changed a lot. Chinese state-owned enterprises are key to the country’s economy. They use new tech to change how loans are given out.

Tech-driven loans are changing China’s finance world. Banks use new tech to make loans faster and safer. Some big changes include:

- AI-powered credit scoring systems

- Big data analytics for loan evaluations

- Blockchain-enhanced transaction security

- Mobile-first lending platforms

Government-Backed Financial Strategies

The Chinese government helps state-owned enterprises get loans. They get better rates and policies. This helps them more than private companies.

New tech is key in China’s lending market. Banks are using digital tools and data to make loans better. They use machine learning and real-time data.

Digital Lending Ecosystem

Today’s Chinese lending platforms are advanced. They use old and new tech together. This makes loans faster and more accurate for all types of businesses.

Germany's traditional banking sector adapting to digital finance

The German banking sector is at a turning point. Traditional banks are changing how they lend and offer financial services. This is because of new technology.

Digital finance is key for German banks to stay ahead. They use new tech to keep up with customers’ needs.

Key Digital Transformation Strategies

- Implementing AI-powered credit assessment tools

- Developing user-friendly online lending platforms

- Creating seamless mobile banking experiences

- Partnering with fintech startups

Digital innovation is now a must for German banks. They’re spending a lot on tech to make lending easier and cheaper. Germany banks are becoming leaders in digital finance. They’re using new tech to stay reliable and meet today’s customer needs.

Future growth in AI-powered underwriting and risk analytics

The world of business lending is changing fast thanks to AI and advanced risk analytics. Banks are using new technologies to make loan decisions faster and more accurate.

AI is changing how loans are approved. Old ways of checking credit are being replaced by smart algorithms. These algorithms can:

- Analyze complex financial data in seconds

- Reduce human bias in lending decisions

- Provide more precise risk assessments

- Accelerate loan approval timelines

Emerging Predictive Analytics Capabilities

Financial institutions are getting better at understanding borrowers. Machine learning models use more data than just credit scores. They look at:

- Social media financial behavior

- Business performance metrics

- Industry-specific risk indicators

- Real-time economic trend analysis

AI underwriting is a big step forward in lending. Banks and tech companies are spending a lot on these tools. They promise better and faster loan decisions. These technologies will help more businesses get loans. They will also help lenders take less risk.

Key competitors in the digital lending space

The digital lending world has changed a lot. Fintech competition is changing how online business loans are given out. Digital lenders are using new tech and fresh ideas to change old ways of lending.

- Online platforms focusing on small business loans

- New fintech startups taking on old banks

- Fast loan tech solutions

Emerging Competitive Strategies

Today’s digital lenders stand out with their own special offers. Data-driven decision-making and smart risk checks are key to winning in online business loans.

Top digital lenders are using smart strategies:

- AI for quick credit checks

- Easy-to-use mobile lending apps

- Custom loans for different business types

Market Dynamics and Technological Innovation

The competition is fast-paced, thanks to new tech. Digital lenders are using machine learning and predictive analytics to make loans faster and safer.

Government agencies like the Small Business Administration help by setting rules for fair lending. This encourages digital lending to grow responsibly.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Business Loan Market Report |

| Base Year | 2024 |

| Segment by Type |

· Short-Term Loan Characteristics · Long-Term Financing Strategies |

| Segment by Application |

· Microenterprises · Small Businesses · Startups · Large Corporations |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The business loan market is about to undergo significant changes. Experts predict it will experience substantial growth by 2025. New digital tools and financial platforms are transforming the way businesses borrow money.

Loans are expected to become more customized, catering to specific needs of businesses. This shift will primarily benefit small and medium enterprises (SMEs) as new technologies streamline the loan acquisition process.

The business loan market is projected to reach a value of $497.66 billion in the near future. To thrive in this evolving landscape, investors and banks must adapt to digital advancements and regulatory changes. This adaptability will enable them to seize emerging opportunities in the lending sector.

Global Business Loan Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Business Loan Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Business Loan Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Business Loan Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Business Loan Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Business Loan Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Business Loan Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Business LoanMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected size of the Business Loan Market by 2025?

The Business Loan Market is expected to grow to $497.66 billion by 2025. This growth is driven by increasing demand in key markets like the United States, China, and Germany.

What are the primary sources of business lending capital?

Business lending capital comes from many sources. These include traditional banks, alternative lending platforms, and government agencies like the Small Business Administration (SBA). Venture capital firms and digital lending technologies also play a role.

How are digital technologies impacting business lending?

Digital technologies are changing business lending. They use AI for underwriting and offer online lending solutions. This makes lending faster, more accessible, and efficient.

What types of business loans are available?

There are many types of business loans. These include short-term loans, long-term financing, and SBA loans like 7(a) loans. Microloans, working capital loans, and specialized financing options are also available for different business sizes and industries.

How do lending options differ for SMEs versus large corporations?

SMEs often get microloans and specialized SBA programs . They also use alternative lending platforms. Large corporations, on the other hand, have access to bigger corporate loans with different terms and requirements.

What role do government agencies play in business lending?

Government agencies like the SBA help with business lending. They provide loan guarantees and offer specialized loan programs. This reduces lender risks and supports small businesses that might find it hard to get traditional financing.

How do geopolitical factors impact business lending?

Geopolitical factors such as interest rate changes and global economic conditions have an impact on lending. Trade policies and recession risks are also important factors. These elements affect lending practices and the stability of the market.

What are the emerging trends in business lending?

New trends include AI-powered underwriting and digital lending platforms. Alternative financing solutions and predictive analytics are also on the rise. There’s a shift towards technology-driven lending methods.

How are different countries approaching business lending?

The United States focuses on venture capital. China supports state-owned enterprises with tech-driven loans. Germany is adapting its banking sector to digital finance innovations.

What challenges do lenders face in the current market?

Lenders face many challenges. These include regulatory compliance and managing credit risk. They must also adapt to technological changes and address AI bias. Meeting diverse business financing needs is another challenge.