Bleached Softwood Kraft Market on Track to Hit $1.05 Billion by 2025: Key Advancements in Canada, Sweden, and Brazil

Explore the comprehensive insights into the Bleached Softwood Kraft Market, highlighting upstream and downstream processes, technological advancements, sustainability efforts, and geopolitical influences. Understand regional market dynamics in Canada, Sweden, and Brazil, alongside key trends driving demand, environmental regulations, and future growth projections towards $1.05 billion by 2025.

- Last Updated:

Bleached Softwood Kraft Q1 and Q2 2025 Market Overview

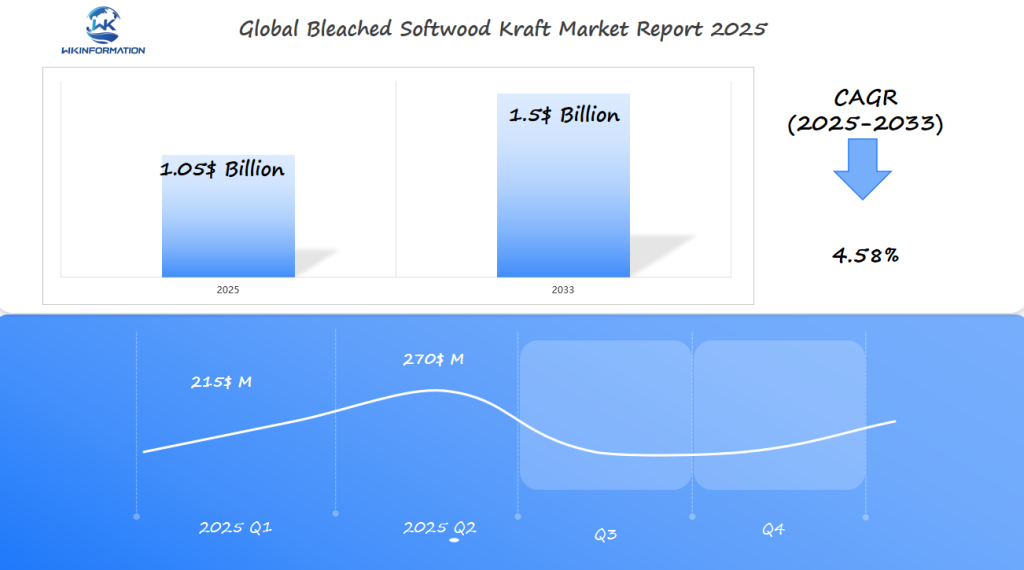

The Bleached Softwood Kraft (BSK) market is forecast to reach $1.05 billion in 2025, growing at a CAGR of 4.58%. Market activity is projected to be uneven throughout the year, with Q1 estimated at roughly $215 million, reflecting moderate paper and packaging demand after the holiday season. In contrast, Q2 is expected to grow to around $270 million, supported by increased production of hygiene and industrial packaging products.

Canada remains the largest exporter of BSK, thanks to its extensive softwood forest resources and pulp infrastructure. Sweden continues to be a key supplier in Europe, while Brazil offers competitive pricing due to its expanding eucalyptus plantations and efficient mill operations. These regions are pivotal in global pulp trade routes and capacity expansions in 2025.

Upstream and Downstream Processes in the Bleached Softwood Kraft Market

Bleached softwood kraft production relies on a structured series of upstream and downstream operations that set the stage for product quality and market adaptability.

Kraft Pulping Process: The Engine of Fiber Transformation

- Raw softwood logs are chipped and introduced to a chemical digester, where the kraft pulping process separates cellulose fibers from lignin using a mixture of sodium hydroxide and sodium sulfide.

- The resulting pulp is washed to remove residual chemicals and spent liquors, setting the foundation for high-purity fiber production.

- This method is favored for its ability to yield strong, long-fibered pulp—critical for applications demanding durability and performance.

Precision Bleaching Techniques

Softwood kraft pulp undergoes several bleaching stages designed to maximize brightness while minimizing fiber damage and environmental impact.

The choice of bleaching sequence directly affects pulp brightness, environmental footprint, and suitability for high-end applications such as tissue or specialty papers.

Raw Material Sourcing: Impact on Quality

Sourcing strategies play a pivotal role in determining finished product characteristics.

Variability in wood species, growing conditions, and harvest practices leads to differences in fiber strength, yield, and visual purity of the final product.

Downstream Applications: From Mill to Market

- Pulp Drying: After bleaching, pulp sheets are pressed and dried to achieve target moisture levels for storage or shipping.

- Packaging: Dried pulp is baled or wrapped in protective film to preserve quality during transit.

- Conversion: End-use manufacturers convert BSK into tissue paper, packaging boards, printing papers, or specialty products through refining, blending with other fibers, and forming processes tailored to customer requirements.

The interplay between advanced processing methods and precise material selection underpins the reliability of bleached softwood kraft pulp across global downstream applications.

Shifting Trends and Innovation in the Bleached Softwood Kraft Market

Market trends in BSK are undergoing a profound transformation, driven by mounting consumer demand for sustainable pulp innovations and enhanced product performance.

Sustainable and Eco-Friendly Product Demand

- Consumer expectations have shifted sharply toward eco-friendly products. Large brands and retailers now require their suppliers to prove compliance with sustainability standards, placing pressure on BSK producers to deliver pulp with lower environmental footprints.

- Certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) have become essential for market access, especially in Europe and North America.

- Leading mills are investing in closed-loop processes, water recycling technology, and alternative bleaching agents to reduce emissions.

Innovative Packaging Solutions Using BSK Fibers

Packaging solutions stand at the forefront of BSK fiber application innovation.

- E-commerce growth is fueling demand for sturdy, lightweight packaging materials made from bleached softwood kraft.

- Multilayer packaging—incorporating BSK fibers for strength and printability—has gained traction across food, pharma, and retail sectors.

- Examples include molded fiber trays, recyclable shipping boxes, and premium folding cartons, all leveraging the unique properties of softwood fibers.

Technological Advancements Elevating Efficiency and Quality

Production efficiency gains are shaping competitiveness among leading producers.

- Mills in Canada and Sweden have adopted advanced process control systems that optimize pulp yield while minimizing energy use.

- Enzyme-based pre-treatment technologies now enhance fiber quality without increasing chemical loads.

- Digitalization—such as predictive maintenance using IoT sensors—improves uptime and reduces operational costs.

Strategic Partnerships Accelerating Market Expansion

Collaboration is emerging as a core strategy for market leadership.

- Joint ventures between pulp producers and packaging converters have accelerated the rollout of new product lines tailored to sustainability-conscious markets.

- Research partnerships with universities drive innovation in fiber modification, barrier coatings, and waste minimization.

- Global brands participate directly in pilot projects to co-develop next-generation pulp-based materials that align with circular economy principles.

The interplay of these shifting trends positions the bleached softwood kraft market as a dynamic landscape where adaptation fuels ongoing growth. The move toward smarter production methods and responsible sourcing continues to reshape both supply chains and end-product applications.

Regulatory Limitations and Environmental Concerns in Bleached Softwood Kraft Production

Impact of Environmental Regulations on BSK Production Processes

Environmental regulations have a significant impact on the bleached softwood kraft (BSK) market. These regulations enforce strict guidelines on production processes to minimize environmental harm. Compliance involves substantial investments in modernizing equipment, implementing cleaner technologies, and adopting sustainable practices, which can influence production costs and operational efficiency.

Challenges Related to Emissions and Effluent Treatment in Kraft Mills

Kraft mills face considerable challenges related to emissions control and effluent treatment. The pulp industry is known for generating pollutants such as sulfur compounds and particulate matter, necessitating advanced emission control systems. Additionally, treating the effluent produced during the pulping process requires sophisticated wastewater management solutions to meet regulatory standards and protect water bodies from contamination.

Sustainable Forestry Practices and Certification Standards Influencing Supply Chains

Sustainable forestry practices are crucial for maintaining a stable supply of raw materials while preserving forest ecosystems. Certification standards like FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) play a pivotal role by ensuring that the wood used in BSK production comes from responsibly managed forests. These standards help build consumer trust and support market access for certified products.

Industry Initiatives Addressing Ecological Footprint and Carbon Emissions

The BSK industry is proactively addressing its ecological footprint through various initiatives aimed at reducing carbon emissions and promoting sustainability. Companies are investing in renewable energy sources, improving energy efficiency, and enhancing recycling processes within their operations. Collaborative efforts with stakeholders focus on developing circular economy principles, which emphasize resource conservation and waste reduction throughout the product lifecycle.

Geopolitical Impact on Bleached Softwood Kraft Production and Trade

Effects of Trade Tariffs and International Policies on Global BSK Trade Flows

Trade tariffs and international policies significantly influence the global bleached softwood kraft (BSK) market. For example, tariffs imposed by major pulp-consuming countries can alter trade patterns, affecting the profitability and competitiveness of exporting nations like Canada, Sweden, and Brazil. These tariffs can lead to increased costs for producers and disrupt established supply chains, pushing companies to seek alternative markets or adjust their pricing strategies.

Influence of Labor Strikes in Key Regions on Supply Stability

Labor strikes in key regions such as Canada and Finland have substantial impacts on supply stability. Strikes can halt production processes in kraft mills, causing delays and shortages in the global supply chain. For instance, labor disputes in Canadian pulp mills can lead to a significant reduction in the availability of softwood pulp, which then affects downstream industries reliant on these materials. Such disruptions necessitate contingency planning and may prompt shifts in sourcing strategies among global consumers.

Geopolitical Tensions Affecting Raw Material Availability and Pricing Volatility

Geopolitical tensions play a critical role in determining raw material availability and pricing volatility within the BSK market. Conflicts or political instability in regions rich in forestry resources can restrict access to essential raw materials such as wood chips and logs. This uncertainty contributes to fluctuating prices, complicating budget forecasts for producers and buyers alike. Companies must navigate these risks by diversifying their supply sources or investing in more resilient infrastructure.

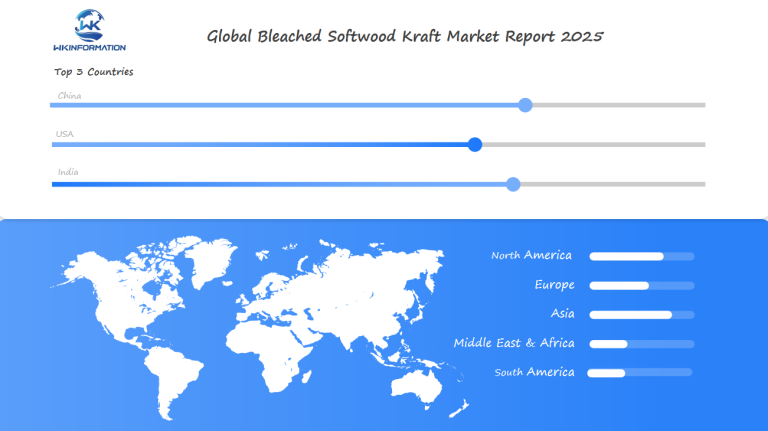

China’s Role as Largest Consumer Shaping Global Demand Patterns

China stands as the largest consumer of bleached softwood kraft pulp, profoundly shaping global demand patterns. The country’s consumption trends dictate production levels across major exporting nations. Changes in China’s economic policies or environmental regulations can either boost or diminish demand for BSK, influencing market dynamics worldwide. Producers closely monitor Chinese market signals to anticipate shifts and strategize accordingly, ensuring they meet this dominant consumer’s needs effectively.

Understanding these geopolitical factors provides valuable insights into the complexities of maintaining stable production and trade flows within the bleached softwood kraft market.

Bleached Softwood Kraft by Type: Fiber Length, Pulp Grade, and Treatment

Bleached softwood kraft (BSK) pulp is differentiated by several technical characteristics that directly influence its end-use applications and market value.

Fiber Length

- Long-fiber BSK: Sourced primarily from species like spruce and pine in Canada and Scandinavia, these pulps feature fibers typically ranging from 2.5 to 3.5 mm in length. This category is prized for imparting superior tensile strength, making it a staple in high-performance packaging and specialty papers.

- Shorter-fiber BSK: While less common, some regions process softwood species with slightly shorter fiber lengths, useful for blending with hardwood pulps to balance strength and softness in tissue products.

Pulp Grade

- Prime Grade: Designed for premium applications, such as high-quality printing paper or specialty packaging. These grades undergo rigorous screening for cleanliness, brightness, and uniformity.

- Standard Grade: Often used in bulk packaging and general paper production where ultra-high brightness is not required but cost efficiency is critical.

Treatment Methods

- Elemental Chlorine-Free (ECF) Bleaching: The dominant bleaching method today eliminates the use of elemental chlorine gas, reducing dioxin formation while delivering bright white pulp.

- Totally Chlorine-Free (TCF) Bleaching: Favored in markets demanding the lowest possible environmental footprint. TCF processes use oxygen-based chemicals but can result in higher costs.

- Enhanced Surface Treatments: Some BSK grades receive specific treatments—such as hydrophobic sizing or additional refining—to tailor surface properties for specialized uses.

These distinctions allow manufacturers to target diverse market segments and optimize their supply chains according to evolving customer demands.

Bleached Softwood Kraft by Application: Tissue, Packaging, and Printing

Bleached softwood kraft (BSK) pulp serves as a foundation for a diverse range of end-use applications. Each segment—tissue, packaging, and printing—leverages the unique characteristics of BSK fibers to meet specific product demands.

1. Tissue

BSK’s long fiber length and strength make it ideal for high-quality tissue products. Softness, absorbency, and bulk are essential in toilet paper, facial tissues, and paper towels. The superior wet strength provided by BSK enables manufacturers to produce premium tissue that maintains integrity even when wet.

2. Packaging

Rigid and durable packaging materials rely on the tensile strength and stiffness of softwood kraft pulp. Corrugated boxes, folding cartons, and molded fiber trays benefit from the structural properties BSK delivers. With sustainability at a premium, brands are shifting to renewable packaging solutions using BSK-based board grades that offer recyclability without sacrificing performance.

3. Printing

While digital communication has shifted some demand away from traditional printing papers, BSK still plays a critical role in coated and uncoated fine papers used for magazines, books, and promotional materials. Its bright appearance and smooth surface enhance print clarity while ensuring runnability in high-speed presses.

Understanding the Global Bleached Softwood Kraft Market: Regional Insights

Major Producing Regions

Key global production centers for bleached softwood kraft (BSK) include:

- Canada: A leading supplier, particularly to North America, driven by its extensive forest resources and advanced pulp mills.

- Sweden: Noteworthy for its sustainable forestry practices and significant contributions to the European market.

- Brazil: A major player due to its vast eucalyptus plantations and modernized production facilities.

Comparative Analysis of Production Volumes and Export Capacities

Canada stands out with high production volumes supported by a robust infrastructure. It maintains strong export capacities, catering primarily to the United States and other international markets.

Sweden also boasts considerable production volumes, exporting a substantial portion of its output within Europe and beyond. The country’s focus on sustainability augments its competitive edge.

Brazil shows impressive growth in production volumes, leveraging its cost-effective operations. Its export capacities are expanding rapidly, making it a crucial supplier in global markets.

Regional Demand Drivers Influencing Market Dynamics

In Canada, demand is influenced by the growing need for environmentally friendly products and packaging materials spurred by e-commerce growth.

In Sweden, sustainability initiatives drive demand as consumers and businesses prioritize eco-friendly products. The country’s policies supporting green practices further enhance market dynamics.

In Brazil, expanding industrial applications and rising domestic consumption propel demand. The country’s strategic position allows it to cater to various international markets effectively.

Infrastructure and Logistics Impacting Regional Competitiveness

Canada’s extensive transportation network and proximity to major markets like the U.S. bolster its logistics capabilities, ensuring efficient supply chain operations.

Sweden’s well-developed infrastructure supports seamless distribution within Europe. Its commitment to sustainable logistics practices enhances regional competitiveness.

Brazil’s investments in port facilities and transportation networks improve its logistics efficiency. However, infrastructure improvements remain critical to fully capitalize on its production potential.

These regional insights provide a comprehensive view of the global BSK market, highlighting key factors influencing production and trade dynamics across major producing regions.

Canada’s Bleached Softwood Kraft Market Dominance and Technology Edge

Canada is the leading player in the bleached softwood kraft (BSK) market, thanks to its vast forest resources and well-established pulp industry. The country’s dominance is supported by several key strengths:

1. Abundant High-Quality Fiber Supply

Canadian forests provide an extensive source of long-fiber softwoods, crucial for producing premium BSK pulp. This raw material advantage directly enhances the tensile strength and brightness of the final product.

2. Advanced Mill Technologies

Canadian producers consistently invest in state-of-the-art pulping and bleaching technologies. Upgrades such as oxygen delignification, closed-loop water systems, and enzymatic pre-treatment processes have pushed mill efficiency higher while reducing environmental impact.

3. Automation & Digitalization

Mills across British Columbia, Quebec, and Ontario increasingly deploy automation solutions and digital monitoring tools. These innovations deliver real-time process optimization, energy savings, and predictive maintenance—minimizing downtime and maximizing throughput.

4. Research Partnerships

Collaboration between industry leaders, universities, and government agencies drives rapid adoption of cleaner production methods. Efforts focus on lowering chlorine use, improving fiber yield, and developing specialty pulps for next-generation applications.

Canadian BSK producers also benefit from access to North American transportation corridors, ensuring reliable exports to the US and overseas. Investments in logistics infrastructure further cement Canada’s role as a dependable supplier to global markets.

Sweden’s Bleached Softwood Kraft Market: Sustainability and Policy Push

Sweden’s bleached softwood kraft (BSK) sector sets a high standard for sustainability, driven by strong national policies and a commitment to climate goals across the industry. Swedish pulp producers consistently have some of the lowest carbon emissions per ton of pulp, thanks to aggressive energy efficiency efforts and widespread use of renewable energy sources.

Key Features Shaping Sweden’s BSK Market:

- Rigorous Environmental Regulation: The Swedish government enforces strict rules on emissions, effluent treatment, and forest management. These regulations push mills to adopt closed-loop water systems, reduce chemical usage, and recover almost all process chemicals through advanced recovery boilers.

- Sustainable Forestry Practices: Certification standards such as FSC® and PEFC™ are deeply embedded in Swedish supply chains. Practically all commercial forests are managed for long-term productivity with mandatory replanting and biodiversity requirements.

- Circular Economy Initiatives: Leading producers invest in byproduct valorization—turning waste streams into bioenergy or biochemicals—minimizing landfill use and reducing the industry’s ecological footprint.

- Policy-Driven Innovation: National incentives support R&D in green technologies, including enzymatic bleaching processes and digital monitoring tools that enhance traceability and fiber quality.

These strategies position Sweden as a reference point for sustainable BSK production while maintaining global competitiveness through cost-effective operations and premium product reputation. The combination of policy alignment, technological innovation, and resource stewardship continues to shape the direction of Sweden’s role in the global bleached softwood kraft market.

Brazil’s Bleached Softwood Kraft Market Expansion and Forestry Influence

Brazil’s bleached softwood kraft (BSK) market is known for its rapid growth and strategic use of its vast forestry resources. The country’s competitive advantage comes from its large eucalyptus and pine plantations, which provide a consistent supply of high-quality raw material for pulp production. These plantations are managed using modern forestry practices, promoting both increased yield and environmental care.

Key Factors Driving Brazil’s BSK Sector

Several key factors are shaping Brazil’s BSK industry:

- Integrated Forestry-Pulp Operations: Brazilian producers often have control over the entire value chain, from planting to harvesting to pulping. This vertical integration reduces supply risks and helps them compete globally on cost.

- Favorable Climate Conditions: The year-round growing seasons in Brazil allow trees to mature faster compared to colder regions, resulting in higher productivity per hectare.

- Export-Oriented Production: Large mills in Brazil primarily focus on serving international markets, especially in Asia and Europe, and are quick to adapt to changes in global demand.

- Investments in Capacity and Technology: In recent years, there have been significant investments in new mills, projects aimed at increasing production capacity, and advanced pulping technology with the goal of boosting output while minimizing environmental impact.

Environmental Considerations in Brazil’s Market Strategy

Environmental factors play a crucial role in Brazil’s market strategy. Leading producers widely adopt certification programs like FSC and PEFC to ensure sustainable forestry management. Additionally, companies invest heavily in reforestation efforts, biodiversity protection initiatives, and social responsibility programs. These actions strengthen Brazil’s position as a trustworthy supplier for environmentally-conscious buyers seeking responsible sourcing solutions.

Future Development Strategies in the Bleached Softwood Kraft Market

Strategic focus areas for continued growth in the bleached softwood kraft (BSK) market include sustainability initiatives and digitalization efforts. By prioritizing these elements, producers are positioned to meet growing global demand while addressing environmental concerns.

Sustainability and Digitalization

- Sustainability Roadmap: The pulp industry is increasingly committed to reducing its ecological footprint. This involves adopting sustainable forestry practices, minimizing waste, and enhancing energy efficiency in production processes.

- Digitalization: Implementing advanced digital technologies such as IoT and AI can significantly improve production efficiency. These technologies facilitate real-time monitoring and predictive maintenance, reducing downtime and operational costs.

Innovation Roadmap

Emphasizing cleaner technologies is crucial for the future of BSK production. Innovations that support a circular economy are particularly important.

- Cleaner Technologies: Investment in new bleaching techniques that reduce chemical use and energy consumption can lead to more environmentally friendly production methods.

- Circular Economy Principles: Embracing recycling and reusing materials within the production cycle helps minimize waste and resource consumption, aligning with global sustainability goals.

Market Diversification

To sustain growth, diversification through new product development and geographic outreach is key.

- New Product Development: Exploring novel applications of BSK fibers, such as biodegradable packaging or specialty papers, can open new revenue streams.

- Geographic Outreach: Expanding into emerging markets where demand for sustainable pulp products is rising offers significant growth potential.

Collaborative Approaches

Addressing evolving challenges requires collaboration between producers, stakeholders, and regulatory bodies.

- Collaborative Innovation: Partnerships between companies can foster innovation by combining resources and expertise. Joint ventures in research and development can accelerate the adoption of new technologies.

- Stakeholder Engagement: Engaging with local communities, governments, and environmental organizations ensures that industry practices align with broader societal goals. This collaborative approach enhances the industry’s reputation and supports long-term sustainability.

By focusing on these strategic areas—sustainability, digitalization, innovation, diversification, and collaboration—the bleached softwood kraft market is well-positioned for continued growth and adaptation to future challenges.

Competition Overview in the Bleached Softwood Kraft Market

Competition in the bleached softwood kraft (BSK) market is defined by a mix of established multinational producers and agile regional players, each navigating volatile pricing, shifting supply chains, and evolving customer demands.

- Domtar Corporation – United States

- International Paper – United States

- Resolute Forest Products – Canada

- WestRock – United States

- Rayonier Advanced Materials – United States

- Canfor Pulp – Canada

- Mercer International – United States

- Sappi – South Africa

- UPM-Kymmene – Finland

- Stora Enso – Finland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Bleached Softwood Kraft Report |

| Base Year | 2024 |

| Segment by Type |

· Long-fiber BSK · Shorter-fiber BSK |

| Segment by Application |

· Tissue · Packaging · Printing |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Bleached Softwood Kraft Market is expected to reach $1.05 billion by 2025, thanks to innovation and strategic leadership from Canada, Sweden, and Brazil. The industry is being transformed by improvements in sustainable production methods, adherence to regulations, and efficient supply chains. Continuous investment in technology and cooperative partnerships keeps the market strong and competitive. As the demand for environmentally friendly pulp products worldwide increases, producers who swiftly adjust to market trends and environmental regulations are likely to grow and remain influential in the changing pulp industry.

Global Bleached Softwood Kraft Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Bleached Softwood Kraft Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalBleached Softwood Kraft players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Bleached Softwood Kraft Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Bleached Softwood Kraft Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Bleached Softwood Kraft Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the Bleached Softwood Kraft Market by 2025?

The Bleached Softwood Kraft Market is projected to grow to $1.05 billion by 2025, driven by advancements in key producing countries such as Canada, Sweden, and Brazil.

What are the main upstream and downstream processes involved in Bleached Softwood Kraft production?

Upstream processes include kraft pulping of softwood fibers and specialized bleaching techniques, while downstream processes involve pulp drying, packaging, and conversion into end products like tissue, packaging materials, and printing paper.

How are sustainability and technological advancements shaping the Bleached Softwood Kraft Market?

There is a rising demand for sustainable and eco-friendly pulp products alongside adoption of innovative packaging solutions using BSK fibers. Technological improvements enhance production efficiency and fiber quality, supported by strategic partnerships fostering innovation and market expansion.

What environmental regulations impact Bleached Softwood Kraft production?

Environmental regulations affect emissions control, waste management, and sustainable forestry practices within BSK production. Certification standards influence supply chains, with industry initiatives actively addressing ecological footprint reduction and carbon emissions.

How do geopolitical factors influence the global Bleached Softwood Kraft Market?

Trade tariffs, international policies, labor strikes in key regions like Canada and Finland, and geopolitical tensions impact raw material availability, pricing volatility, and supply chain stability. China’s role as the largest consumer significantly shapes global demand patterns.

Which regions dominate the global Bleached Softwood Kraft Market and what are their competitive advantages?

Canada leads with market dominance and technological edge; Sweden emphasizes sustainability efforts supported by strong policy frameworks; Brazil focuses on market expansion influenced by its vast forestry resources. These regional strengths affect production volumes, export capacities, and overall market dynamics.