Beverage Can Market Expected to Reach $54.06 Billion by 2025 Globally: Rapid Growth in the U.S., Mexico, and China

Discover the latest trends in the global Beverage Can Market, expected to reach $54.06 billion by 2025, with rapid growth in the U.S., Mexico, and China.

- Last Updated:

Beverage Can Market Q1 and Q2 2025 Performance Insights

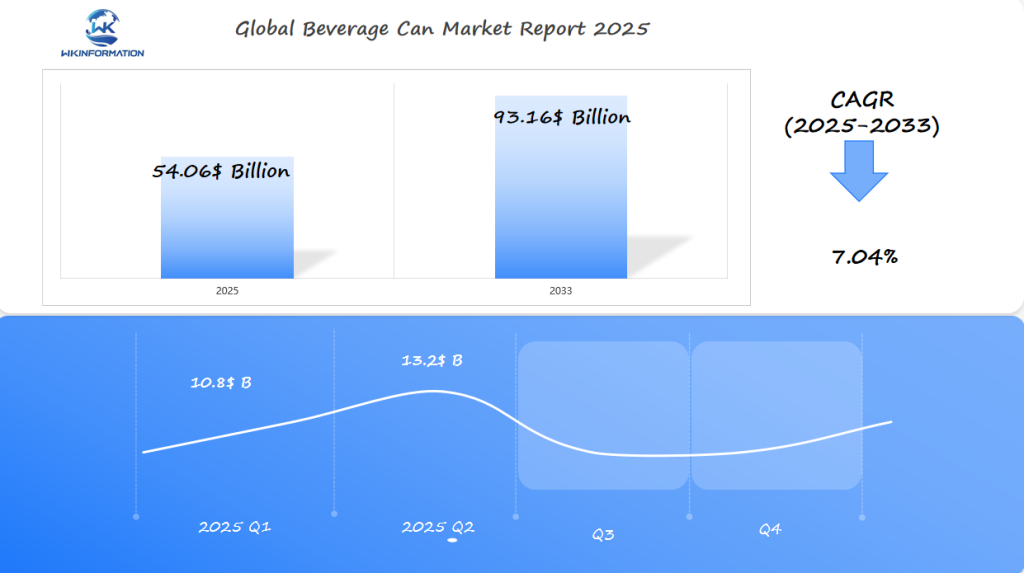

The Beverage Can market is projected to reach a substantial $54.06 billion valuation by the end of 2025, expanding at a CAGR of 7.04% through 2033. Early estimates suggest the market will achieve approximately $10.8 billion in Q1 and $13.2 billion in Q2.

The notable jump in Q2 can be attributed to seasonal consumption patterns, particularly the rise in beverage sales during warmer months, alongside increased demand for sustainable packaging solutions.

Regional Growth Drivers

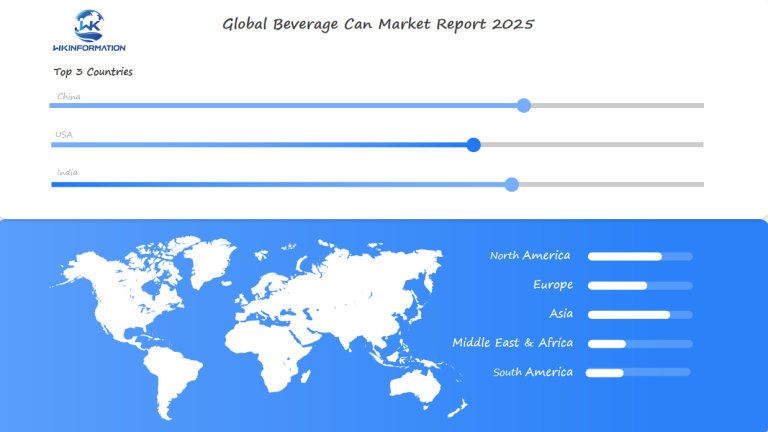

The United States, Mexico, and China are expected to lead global growth:

- The U.S. market benefits from a combination of strong craft beverage innovation and a pivot toward recyclable packaging.

- Mexico’s expanding beverage manufacturing industry, particularly in beer and carbonated drinks, drives steady can usage.

- Meanwhile, China’s rising middle class and preference for convenient beverage options contribute to surging demand for beverage cans.

These dynamics collectively reinforce the sector’s solid performance trajectory in early 2025.

Supply Chain and Industry Chain Structure in the Beverage Can Market

Industry Chain Structure of the Beverage Can Market

-

Upstream (Raw Materials and Inputs)

-

Aluminum or Steel Suppliers: Aluminum is the dominant raw material (around 95% of cans); steel is used in some regions.

-

Key suppliers: Alcoa, Rio Tinto, RUSAL, Norsk Hydro.

-

-

Coatings & Inks: Used for interior lining and external printing to prevent corrosion and enhance branding.

-

Suppliers: AkzoNobel, PPG Industries, Valspar.

-

-

Can End and Tab Components: Ends are often produced separately from the can body.

-

-

Midstream (Manufacturing and Processing)

-

Can Manufacturers: Companies that fabricate the body and ends of the cans, usually using two-piece drawing and wall ironing (DWI) process.

-

Major players: Ball Corporation, Crown Holdings, Ardagh Group.

-

-

Printing & Coating: Surface printing for brand logos and regulatory info.

-

Quality Control & Packaging: Cans are checked for leakage, cleanliness, and are shrink-wrapped or palletized.

-

-

Downstream (Distribution and End Users)

-

Beverage Companies: Soft drink, beer, energy drink, and juice manufacturers fill the cans.

-

Examples: Coca-Cola, PepsiCo, Anheuser-Busch InBev, Monster Beverage.

-

-

Distributors & Retailers: Cans are distributed to supermarkets, vending machine operators, convenience stores, etc.

-

Consumers: End users purchase and consume beverages in cans.

-

New Trends Fueling Expansion in the Beverage Can Industry

The beverage can industry is about to undergo a major change, thanks to new manufacturing methods and eco-friendly packaging. This shift is mainly driven by what consumers want and government regulations, pushing manufacturers to embrace sustainable practices without sacrificing quality or appearance.

Sustainable Practices in the Beverage Can Industry

The industry’s move towards sustainability is clear in:

- The creation of more efficient manufacturing processes

- The use of recyclable materials

As a result, beverage cans are becoming more environmentally friendly, appealing to the growing number of eco-conscious consumers.

Innovations in Beverage Can Manufacturing

Manufacturers are continually innovating to improve the production process of beverage cans. Advances in technology have enabled the development of lighter, more durable cans that are also more cost-effective to produce. For instance, the use of aluminum and tin-free steel is becoming more prevalent due to their recyclability and lower environmental impact.

Sustainable Packaging Solutions

The move towards sustainable packaging is a key trend in the beverage can industry. Companies are exploring various eco-friendly packaging options, including cans made from recycled materials and designs that minimize waste. This not only helps reduce the environmental footprint of the beverage industry but also enhances brand reputation among consumers who prioritize sustainability.

- Increased use of recycled materials in can production

- Development of more efficient packaging designs

- Adoption of eco-friendly coatings and linings

As the beverage can industry continues to evolve, it is likely that we will see further innovations in manufacturing and packaging. These advancements will be crucial in meeting consumer demands for more sustainable products and complying with increasingly stringent environmental regulations.

Market Constraints Challenging the Growth of Beverage Cans

Despite its growth prospects, the beverage can market is challenged by constraints such as raw material price volatility.

The beverage can industry relies heavily on metals like aluminum and tinplate steel, making it vulnerable to supply chain disruptions. Fluctuations in the prices of these raw materials can significantly impact production costs and profitability.

Challenges in Raw Material Sourcing

One of the primary challenges facing the beverage can market is the sourcing of raw materials. The industry’s dependence on aluminum and steel means that any disruption in the supply of these materials can have far-reaching consequences.

Key Challenges

- Price Volatility: Fluctuations in raw material prices can affect production costs and profitability.

- Supply Chain Disruptions: Events like natural disasters, trade wars, and logistical issues can disrupt the supply chain.

- Sustainability Concerns: The industry faces pressure to adopt sustainable practices, which can be challenging given the current reliance on non-renewable resources.

To mitigate these challenges, manufacturers are exploring alternative materials, improving recycling rates, and investing in supply chain resilience.

Geopolitical Trends Impacting the Global Beverage Can Supply and Demand

Geopolitical factors, including trade policies and tariffs, are playing a crucial role in shaping the global beverage can industry. These factors are affecting the supply chain, manufacturing costs, and demand for beverage cans worldwide.

Trade Policies and Tariffs

Changes in trade agreements and the imposition of tariffs have significant implications for the global beverage can market. Tariffs on raw materials such as aluminum and steel can increase manufacturing costs, making it challenging for companies to maintain profitability.

The impact of trade policies and tariffs is not uniform across regions. Some countries may benefit from protectionist policies, while others may face increased costs and reduced competitiveness.

Impact on Global Supply Chain

The global supply chain for beverage cans is intricate, involving multiple countries and stakeholders. Disruptions due to geopolitical tensions can lead to delays, increased costs, and inventory management challenges.

The following table illustrates the potential impact of tariffs on the global supply chain:

| Region | Tariff Implication | Impact on Supply Chain |

| North America | Increased tariffs on steel imports | Higher manufacturing costs, potential delays |

| Europe | Tariffs on aluminum imports | Increased costs, potential shift to alternative materials |

| Asia | Reduced tariffs on raw materials | Increased competitiveness, potential for expanded production |

The global beverage can market is highly interconnected, and changes in trade policies and tariffs can have far-reaching consequences. Companies must navigate this complex landscape to remain competitive.

Type-Wise Breakdown and Analysis of the Beverage Can Market

The beverage can market is segmented into different types based on the material used, with steel and aluminum being the primary materials. This segmentation is crucial as it influences both consumer preference and manufacturer production decisions.

The choice between steel cans and aluminum cans is significant in the beverage can market. Each type has its unique advantages and disadvantages.

Steel Cans vs. Aluminum Cans

Steel cans are known for their strength and durability. They are often used for packaging beverages that require a high level of protection from external factors. On the other hand, aluminum cans are preferred for their lightweight and corrosion-resistant properties, making them ideal for beverages that need to be easily transportable.

The market share of steel cans versus aluminum cans varies based on regional preferences and the type of beverage being packaged. For instance, in some regions, steel cans might be more prevalent due to their strength, while in others, aluminum cans might dominate due to their portability.

A detailed analysis of the type-wise breakdown reveals that both steel and aluminum cans have their own market segments. The choice between them often depends on factors such as cost, consumer preference, and the specific requirements of the beverage being packaged.

- Steel cans offer superior strength and are often used for beverages that require more robust packaging.

- Aluminum cans are favored for their light weight and recyclability, making them a popular choice for many beverage manufacturers.

The beverage can market’s type-wise breakdown indicates a competitive landscape where both steel and aluminum cans coexist, each serving different needs and preferences.

Diverse Applications Driving Demand in the Beverage Can Market

The beverage can market is experiencing significant growth due to its diverse applications across various beverage types. This growth is driven by consumer preferences for different packaging options.

Beverage cans are widely used for packaging soft drinks, beer, and energy drinks. The demand for these cans is influenced by the type of beverage being packaged and consumer preferences for packaging.

Beverage Types and Packaging Preferences

The type of beverage being packaged plays a crucial role in determining the demand for beverage cans. For instance, soft drinks and beer are commonly packaged in cans, driving demand for these products.

Consumer preferences for packaging also impact the demand for beverage cans. Eco-friendly packaging options are becoming increasingly popular, with many consumers opting for beverages packaged in recyclable cans.

The demand for beverage cans is also influenced by the growing trend of premiumization in beverages. Manufacturers are using cans to package premium beverages, driving demand for high-quality cans.

- The rise of energy drinks and craft beers has driven demand for specialty cans.

- Consumers are increasingly preferring cans over glass bottles due to their convenience and portability.

- The use of cans for packaging beverages is also driven by their ability to preserve the flavor and quality of the beverage.

Global Regional Performance Trends in the Beverage Can Market

The global beverage can market is experiencing different performance trends in various regions, influenced by consumer preferences and economic conditions. This diversity is driven by several factors, including regulatory environments and market demand.

Regional Market Analysis

Regional market analysis is crucial for understanding the dynamics of the global beverage can market. Different regions exhibit unique trends based on local consumer preferences, economic stability, and regulatory frameworks.

In North America, the demand for beverage cans is high due to the popularity of canned beverages. Europe also shows a significant demand, driven by environmental concerns and the shift towards sustainable packaging. In contrast, emerging markets in Asia-Pacific are witnessing rapid growth due to increasing urbanization and changing consumer preferences.

Emerging Markets

Emerging markets, particularly in the Asia-Pacific region, are presenting new opportunities for growth in the beverage can market. Countries like China and India are experiencing rapid urbanization, leading to increased demand for packaged beverages.

The growth in emerging markets is driven by factors such as increasing disposable incomes, changing lifestyles, and the expansion of the middle-class population. These markets offer significant potential for manufacturers to expand their production capacities and explore new consumer bases.

The regional performance trends in the global beverage can market highlight the importance of adapting to local market conditions and consumer preferences. As the market continues to evolve, understanding these trends will be crucial for stakeholders to make informed decisions.

U.S. Beverage Can Market: Growth Outlook and Investment Trends

The U.S. beverage can market is poised for significant growth, driven by increasing demand for sustainable packaging solutions.

The beverage can industry in the United States has been witnessing a substantial shift towards eco-friendly packaging, driven by consumer preferences and environmental concerns. This trend is expected to continue, driving the growth of the market.

Market Size and Growth Prospects

The U.S. beverage can market has been expanding rapidly, with the market size expected to increase significantly over the forecast period. The growth is attributed to the rising demand for canned beverages, driven by their convenience, portability, and sustainability.

Mexico’s Emerging Beverage Can Manufacturing Strength

Mexico is becoming a key player in beverage can production due to its close location to major markets and affordable manufacturing costs. The country’s strategic position enables efficient transportation and prompt delivery to important markets, such as the United States.

Manufacturing Capacity

Mexico’s manufacturing capacity for beverage cans has been increasing steadily. This growth is driven by significant investments in new production facilities and the expansion of existing ones. The country’s competitive advantages, including lower labor costs and favorable trade agreements, make it an attractive location for manufacturers.

Key investments have been made in:

- State-of-the-art manufacturing technologies

- Expansion of production facilities

- Workforce development programs

Export Trends

The export trend for Mexican-made beverage cans is also on the rise. With the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), Mexico enjoys preferential trade terms with its major export markets. This has facilitated the growth of exports, particularly to the U.S. market.

The main drivers of export growth include:

- Favorable trade agreements

- Competitive pricing

- High-quality products

As a result, Mexico is becoming an increasingly important player in the global beverage can market, with its manufacturing capacity and export trends expected to continue growing in the coming years.

China’s Leadership in the Global Beverage Can Market

China has become a major player in the global beverage can market, thanks to its large production capacity. The country’s position as a leader in this industry is due to its significant investments in manufacturing infrastructure and technology.

The China beverage can market is known for its large production facilities, which allow the country to meet both domestic and international demand. China’s dominance in the market is further strengthened by its advantages in terms of cost and efficiency.

Production Capacity and Market Share

China’s production capacity for beverage cans is substantial, with numerous manufacturers operating across the country. The nation’s production capacity is not only sufficient to cater to its domestic market but also enables it to export a significant volume of beverage cans to other countries.

The country’s market share in the global beverage can market is considerable, making it one of the leading players internationally. China’s ability to maintain its market share is attributed to its continuous investments in technology and manufacturing processes.

Several factors contribute to China’s leadership in the global beverage can market. These include its vast manufacturing capabilities, competitive production costs, and strategic investments in the industry. As a result, China is well-positioned to maintain its dominance in the global market.

The global beverage can market is expected to continue evolving, with China’s role remaining pivotal. The country’s ability to adapt to changing market trends and consumer preferences will be crucial in sustaining its leadership position.

Forecasting Future Developments in the Beverage Can Industry

The beverage can industry is on the verge of a major change driven by new trends and cutting-edge technologies. As the industry continues to grow, it is important to understand the factors that will influence its future.

Innovations in Packaging

One of the main forces behind this change is packaging innovations. The rise of more eco-friendly packaging options, such as cans made from recycled materials and designs that reduce waste, is gaining popularity. Additionally, improvements in coating technologies are enhancing the strength and recyclability of beverage cans.

Emerging Trends and Technologies

One of the key emerging trends is the use of digital printing on beverage cans. This technology allows for high-quality, customizable designs, enabling brands to stand out in a crowded market. Additionally, digital printing reduces the need for largeprint runs, making it more feasible for smaller brands to enter the market.

Another significant trend is the integration of smart packaging technologies. These include features such as freshness indicators, temperature sensors, and NFC tags that enhance consumer engagement and provide valuable data to manufacturers.

The industry is also witnessing a shift towards more sustainable manufacturing practices. This includes the use of renewable energy sources, reduction of water waste, and implementation of recycling programs. As consumers become increasingly environmentally conscious, manufacturers are adapting to meet these expectations.

Furthermore, advancements in materials science are leading to the development of lighter, stronger cans that are more efficient to transport and store. This not only reduces costs but also minimizes the environmental footprint of the industry.

The future of the beverage can industry will be shaped by a combination of technological innovation, changing consumer preferences, and the need for sustainability. By embracing these emerging trends and technologies, manufacturers can stay ahead of the curve and meet the evolving demands of the market.

Competitive Benchmarking in the Beverage Can Market

The global beverage can market is becoming increasingly competitive, with companies employing various strategies to gain a competitive edge. Competitive benchmarking is crucial in this landscape, where major players continually adapt to changing consumer preferences and technological advancements.

Key Players in the Beverage Can Market

Here are some of the key players in the beverage can market:

- Ball Corporation – United States

- Crown Holdings – United States

- Silgan Containers – United States

- Ardagh Group – Ireland

- ORG – China

- CPMC Holdings – China

- Baixicans – China

- Toyo Seikan – Japan

- Can Pack Group – Poland

- Can-One Berhad – Malaysia

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Beverage Can Report |

| Base Year | 2024 |

| Segment by Type |

· Steel Cans · Aluminum Cans |

| Segment by Application |

· Carbonated Soft Drinks · Alcoholic Beverages · Fruit & Vegetable Juices |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The beverage can market is expected to keep growing, thanks to more people wanting these products, new manufacturing techniques, and changes in what consumers like. It’s important for everyone involved in this industry to understand global market trends so they can navigate this ever-changing field.

The future looks bright for the industry, with new trends and technologies set to influence how the beverage can market develops. The performance of different regions, like the growth happening in the U.S. and Mexico’s rising manufacturing power, will have a big impact on the worldwide market.

As the beverage can market continues to change, businesses in the industry need to stay updated on the latest news and adjust to what consumers want. By prioritizing sustainable practices and creative packaging solutions, the industry is likely to keep growing.

Global Beverage Can Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Beverage Can Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Beverage CanMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Beverage Canplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Beverage Can Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Beverage Can Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Beverage Can Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofBeverage CanMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected value of the global beverage can market by 2025?

The global beverage can market is anticipated to reach $54.06 billion by 2025.

Which regions are driving the growth of the beverage can market?

The growth is driven by increasing demand in various regions, particularly in the U.S. and Mexico.

What are the key factors influencing the demand for beverage cans?

The demand for beverage cans is driven by their diverse applications across various beverage types, including soft drinks, beer, and energy drinks, as well as consumer preferences for packaging.

How are innovations in manufacturing impacting the beverage can industry?

Innovations in manufacturing, particularly the adoption of sustainable packaging solutions, are transforming the industry by producing cans that are eco-friendly and appealing to consumers.

What challenges is the beverage can market facing?

The market faces challenges such as fluctuations in raw material prices and availability, including metals like aluminum and tinplate steel, which make it vulnerable to supply chain disruptions.

How do trade policies and tariffs impact the global beverage can supply and demand?

Changes in trade agreements and tariffs can affect the cost of raw materials and the competitiveness of manufacturers in different regions, significantly impacting the global supply chain.

What is the difference between steel cans and aluminum cans in the beverage can market?

Steel cans and aluminum cans have different advantages and disadvantages, influencing consumer preference and manufacturer production decisions.

Which countries are becoming important in the global beverage can manufacturing industry?

Mexico is becoming an important player, with increasing manufacturing capacity and export trends, while China continues to lead with significant production capacity and market share.

What are the future developments expected in the beverage can industry?

The industry is set for future developments driven by emerging trends and technologies, including innovations in packaging, manufacturing processes, and sustainability.

How competitive is the beverage can market?

The market is characterized by intense competition among key players, with companies adopting various strategies to gain a competitive edge, including investments in manufacturing capacity, sustainability initiatives, and marketing campaigns.