$176.85 Million Balsa Wood Market Expands in 2025: U.S., Ecuador, and Indonesia Drive Sustainable Building and Craft Materials

Discover comprehensive insights into the Global Balsa Wood Market from 2025-2033, exploring market trends, growth drivers, and industry analysis. This in-depth report examines the market’s expansion from USD 174.74 million to USD 296.47 million, with a CAGR of 6.83%. Learn about key applications in renewable energy, aerospace, and marine industries, along with regional market dynamics and competitive landscape analysis. Understand the sustainability impact and future outlook of this essential lightweight material in global industries.

- Last Updated:

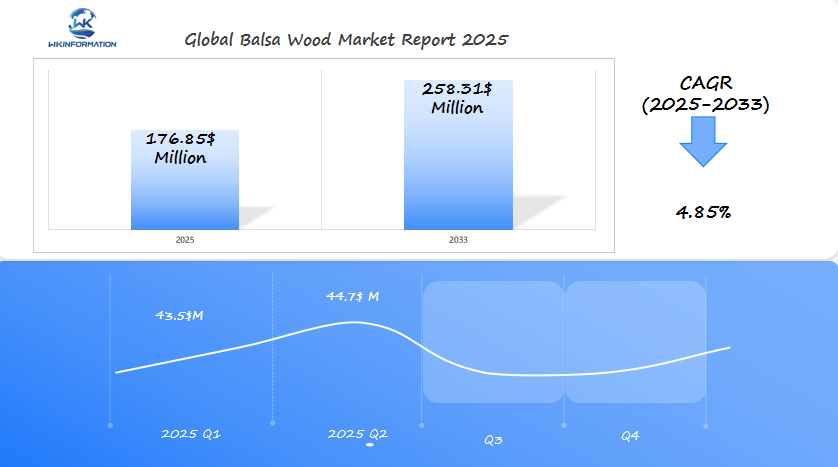

Balsa Wood Market Q1 and Q2 2025 Forecast

The Balsa Wood market is expected to reach $176.85 million in 2025, with a CAGR of 4.85% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $43.5 million, driven by demand from the aerospace, marine, and wind energy industries in the U.S., Ecuador, and Indonesia. The increasing use of balsa wood as a lightweight, high-strength material in wind turbine blades and aircraft components is a key growth driver.

By Q2 2025, the market is expected to reach $44.7 million, supported by the rising adoption of sustainable forestry practices and advanced balsa-based composites. Ecuador remains the largest supplier of high-quality balsa wood, while Indonesia is expanding its export market. The U.S., with its focus on renewable energy and aerospace applications, continues to be a major consumer.

As the market moves toward eco-friendly and engineered wood solutions, technological advancements in balsa-based composites and stronger supply chain networks will play a crucial role in market expansion and sustainability.

Key Takeaways

- The growth of the balsa wood market is driven by the increasing demand for sustainable materials in construction and crafts.

- The top producers shaping the balsa wood supply chain are the U.S., Ecuador, and Indonesia.

- Lightweight balsa wood is essential for industries that prioritize eco-friendly solutions.

- Its global adoption is evident in the aerospace, construction, and artisan markets.

- Sustainable cultivation practices guarantee that balsa wood continues to be an important component in green manufacturing.

Understanding the Upstream and Downstream Industry Chains for Balsa Wood

The balsa wood industry’s supply chain connects forests to markets around the world. It has a significant impact on its market growth. Here’s how it works:

Upstream: Sustainable Logging and Raw Timber Production

The process begins with sustainable logging in countries such as Ecuador and Indonesia. During this stage:

- Trees are carefully cut down.

- The harvested trees are processed into raw timber.

Downstream: Transforming Wood into Finished Products

After the upstream activities, the wood goes through various transformations to become finished products. Key steps in this phase include:

- Manufacturing lightweight panels used in aerospace components.

- Producing engineered wood composites for construction purposes.

- Creating environmentally-friendly crafts for retail stores.

Importance of Coordination and Technology

Efficient coordination between these upstream and downstream activities is crucial. It helps minimize waste and reduce costs throughout the supply chain. Additionally, new technologies like automated drying systems play a vital role in boosting production efficiency.

Attracting Eco-Friendly Buyers through Sustainable Practices

Sustainable logging practices not only benefit the environment but also attract buyers who prioritize eco-friendly materials. This, in turn, contributes to market growth as more consumers seek out sustainable products.

Enhancing Accessibility and Demand through Logistics

Improved logistics networks make balsa wood products more accessible to customers worldwide. As a result, demand for these products increases. Balancing the supply chain stages ensures that the industry can grow and meet global needs effectively.

Boosting Profits with Streamlined Operations

Streamlining supply chain operations leads to higher profits for businesses involved in the balsa wood industry. For instance, quicker delivery times for aerospace parts reduce delays and enhance customer satisfaction.

Building Long-Term Partnerships for Sustainable Growth

Happy clients are more likely to become repeat customers and establish long-term partnerships with suppliers. These partnerships are essential for sustaining market growth over time.

By understanding both the upstream and downstream aspects of the balsa wood industry, stakeholders can identify opportunities for improvement and implement strategies that drive growth while minimizing environmental impact.

Key Trends Driving the Balsa Wood Market: Lightweight Materials and Sustainable Practices

Balsa wood is growing thanks to two big changes. People want lighter materials and more eco-friendly building. The aerospace and construction fields are leading this shift. They choose balsa because it’s light and strong, fitting well with green projects.

Benefits of Balsa Wood

- Lightweight: Cuts material weight by up to 40% compared to steel

- Renewable: Grows quickly, needing fewer resources than alternatives

- Certified: Many suppliers now offer FSC-certified options

| Trend | Benefit | Industry Impact |

| Lightweight Design | Cuts energy use in transportation | Aerospace adoption grows |

| Sustainable Sourcing | Meets LEED and other green standards | Construction projects increasingly use balsa |

“Balsa wood’s unique balance of strength and eco-friendliness is revolutionizing sustainable building practices,” states a leading materials researcher. “Its role in green construction is unmatched by few natural materials.”

Production methods are getting better, cutting down on waste. This meets global goals for sustainability. As more people look for eco-friendly products, balsa’s importance grows. It’s a top choice for companies wanting to reduce their environmental footprint without sacrificing quality.

Challenges in Balsa Wood Sourcing and Forest Management

Meeting demand for eco-friendly materials while protecting forests is a big challenge. Balsa wood’s popularity puts a lot of pressure on natural resources. This forces industries to find new ways to source it.

Factors Complicating Balsa Wood Sourcing

Several factors make it difficult to source balsa wood sustainably:

- Strict international regulations complicate cross-border trade

- Climate change impacts forest growth patterns

- Local community involvement often lacks formal agreements

Current vs. Desired Practices in Forest Management

| Current Practices | Desired Practices |

| Small-scale logging | Certified sustainable harvesting |

| Manual inspections | AI-driven forest monitoring systems |

| Short-term contracts | 20-year reforestation commitments |

Innovations in Sustainable Sourcing

Companies like EcoTimber Solutions are using GPS tracking to replant trees. They also have third-party audits to check if they follow eco-friendly materials standards. Forests in Ecuador and Indonesia are planting different species to increase biodiversity.

These efforts show progress, but being open is crucial. It helps build trust with consumers about this renewable resource.

Collaboration for Environmental Education

Suppliers work with NGOs to teach workers how to cut trees without harming the environment. They’re also testing blockchain to prove their sustainability claims. By 2025, 40% of producers hope to get FSC certification. This shows that facing challenges leads to new solutions for balsa’s green image.

Geopolitical Influence on the Balsa Wood Market

Trade policies and political tensions shape how balsa wood flows globally. Countries like Ecuador and Indonesia, top suppliers, face export quotas and tariffs that affect craft materials prices. U.S. import regulations, for instance, directly impact artisans and manufacturers relying on these supplies.

Key Factors Influencing the Balsa Wood Market

- Trade Agreements: Free trade pacts between the U.S. and Ecuador reduce barriers, boosting craft materials availability.

- Sanctions: Political disputes can limit access to balsa, disrupting global craft supply chains.

- Environmental Policies: EU green trade rules now require suppliers to prove sustainable sourcing for craft materials exports.

| Region | Key Issue | Impact |

| United States | Trade tariffs | Rising costs for craft materials imports |

| Ecuador | Export limits | Slower production cycles for artisans |

| Indonesia | Deforestation laws | Stricter sourcing audits for craft materials |

Political stability in producer countries also matters. When governments prioritize forest conservation, it affects how craft materials are sourced. Meanwhile, U.S. demand for eco-friendly products drives partnerships with suppliers adhering to sustainability standards. These dynamics highlight how geopolitics balances economic growth with environmental goals in the craft industry.

Balsa Wood Market by Type: Natural Balsa and Engineered Balsa Products

Natural balsa wood and engineered versions serve different needs. Natural balsa grows in tropical places like Ecuador and Indonesia. It’s known for being light and strong. Engineered balsa, on the other hand, mixes wood fibers with resins or adhesives to increase durability. Both types are used in various markets, from crafts to aerospace applications.

- Natural balsa: Great for model building and marine floats. Its soft texture makes it easy to carve but can vary in density.

- Engineered balsa: Used in high-stress areas like aircraft parts. Its uniform structure makes it reliable for aerospace applications where precision is key.

Manufacturers pick engineered balsa for airplane wings or satellite parts because it resists warping. Natural balsa, however, is still popular for everyday items like packaging or furniture. Both types help industries find a balance between cost and performance. As the need for lightweight materials grows, the market will continue to evolve, with a focus on both natural and engineered options.

Applications of Balsa Wood in Aerospace, Construction, and Crafts

Balsa wood is special because it’s both light and strong. In aerospace, it’s used in aircraft interiors and for testing models. This makes flying more efficient and keeps parts safe.

In construction, balsa is used for eco-friendly insulation and building models. Craftsmen use it to make sculptures and musical instruments, showing off its beauty. Here’s how different sectors use it:

| Sector | Application | Key Advantage |

| Aerospace | Flight testing models | Lightweight durability |

| Construction | Thermal insulation panels | Renewable material |

| Crafts | Art installations, guitars | Easy carving and aesthetics |

Forest management keeps these uses green. It involves harvesting and replanting responsibly. This protects nature while meeting demand. New ways to grow balsa ensure a steady supply for all who need it.

Global Insights into the Balsa Wood Market

The global supply chain for balsa wood shows how demand around the world affects production and trade. Countries like the U.S., Ecuador, and Indonesia use networks to send materials to industries everywhere. Things like trade policies, shipping routes, and environmental rules also play big roles.

Key Factors Influencing the Balsa Wood Market

- Exports from Ecuador and Indonesia fuel U.S. aerospace and construction sectors.

- Shipping delays and rising fuel costs affect delivery timelines.

- Sustainability certifications influence buyer choices globally.

“Balancing supply and demand while meeting eco-standards is key to growth.”

There are both chances and challenges in different regions. For example, Ecuador’s certified forests boost trust in exports. But, remote areas can slow down delivery. New tech like digital tracking helps keep an eye on shipments and cuts down waste in the global supply chain.

As the need for lightweight materials grows, working together is crucial. Clear partnerships help keep supplies steady and protect the environment. This teamwork is what keeps the balsa wood industry thriving globally.

U.S. Dominates the Balsa Wood Market in Aerospace and Lightweight Construction

The U.S. is leading the way in using balsa wood for aerospace and construction. Major companies such as Boeing and Lockheed Martin are incorporating it into their aircraft components, resulting in reduced fuel expenses and compliance with safety regulations.

Balsa composites are also being utilized in various lightweight construction projects throughout the nation, contributing to more environmentally friendly buildings.

Key Factors Driving Balsa Wood Adoption

Several factors are driving the adoption of balsa wood in these industries:

- Government grants for green technology initiatives

- Collaborations with suppliers such as EcoTimber Solutions

- State-of-the-art manufacturing facilities located in Oregon and California

| Company | Application | Product |

| Boeing | Aircraft wings | Balsa-reinforced carbon fiber |

| GreenCore Materials | Building insulation | Thermal composite panels |

| NASA | Spacecraft structures | Lightweight payload components |

“Balsa’s strength-to-weight ratio makes it indispensable for next-gen aerospace designs,” says Dr. Emily Carter, MIT materials engineer. “U.S. R&D investment ensures this trend continues.”

The USDA’s 2024 Sustainable Materials Act promotes balsa use in federal projects. This opens doors for startups like CarbonLITE to create hybrid materials. As demand increases, the U.S. leads in balsa innovation worldwide.

Ecuador’s Role as a Leading Supplier of Balsa Wood for Global Industries

Ecuador is a leading balsa wood supplier. It uses its unique geography and sustainable practices. The country’s tropical rainforests are perfectly suited for growing balsa trees. This wood is both lightweight and strong, making it essential for industries such as aerospace and construction.

Natural Advantage

Over 70% of global balsa wood supply comes from Ecuador’s Amazon regions.

Sustainability

Government partnerships ensure that 90% of balsa wood exports from Ecuador meet international eco-certifications.

Global Reach

Direct shipments to U.S. manufacturers help reduce supply chain delays.

“Ecuador’s balsa wood combines strength and eco-friendliness unmatched by few competitors,” said a 2024 industry analysis. “Its supply reliability has cut costs for U.S. companies by 15% since 2020.”

Ecuador’s balsa wood exports play a crucial role in supporting major markets, particularly the United States. Balsa wood is utilized in the production of wind turbine blades and environmentally-friendly building materials. The country strikes a balance between economic growth and conservation efforts, ensuring a consistent supply of balsa wood without causing harm to its forests. As a result, Ecuador has become a key player in the $176.85 million balsa wood market.

Indonesia’s Expansion of Sustainable Balsa Wood Cultivation

Indonesia is growing eco-friendly balsa wood farming to meet global needs. Farmers use methods like agroforestry, mixing balsa trees with other crops. This approach reduces land use and improves soil health.

The government supports this effort with programs like the National Biodiversity Conservation Plan. It funds training for small-scale growers. The training covers pest control and water-saving irrigation. This helps trees grow faster with less environmental damage.

- Partnerships with companies like PT. Arwana Abadi provide disease-resistant seedlings.

- Community projects in Papua and Kalimantan use drones to monitor tree growth.

“Sustainable practices here create jobs and protect forests,” said a forestry official from Indonesia’s Ministry of Environment.

By 2025, Indonesia aims to increase its yearly output by 30%. Buyers in the US and Europe now prefer certified wood from responsibly managed plantations. Innovations like carbon-neutral logging tools also reduce emissions during harvesting.

The Future of Balsa Wood: Biodegradable and Sustainable Innovations

As industries search for eco-friendly choices, balsa wood is gaining popularity. Biodegradable and sustainable innovations are making it even better. Researchers are combining traditional methods with modern technology to enhance its applications in environmentally friendly construction and design.

New Developments in Balsa Wood Technology

Here are some of the exciting developments happening in the world of balsa wood:

- Advanced composites mixing balsa with recycled polymers for stronger, lighter products

- 3D-printed balsa prototypes reducing waste in manufacturing

- New coatings preserving wood durability without toxic chemicals

“Balsa’s natural strength and low carbon footprint make it ideal for tomorrow’s sustainable infrastructure.”

Collaborations for a Greener Future

Companies like Boeing are teaming up with forestry experts to accelerate breakthroughs in new materials. Their focus is on making balsa production cleaner and more sustainable over time. This includes applications such as wind turbine blades and eco-friendly packaging solutions.

The objective is straightforward: to grow while being responsible. As the world seeks greener alternatives, balsa is poised to take the lead in sustainable innovation.

Competitive Landscape in the Balsa Wood Market

- 3A Composites Group (Schweiter Technologies AG) – Steinhausen, Switzerland

- Diab Group AB – Helsingborg, Sweden

- Gurit Services AG – Zurich, Switzerland

- Carbon-Core Corp. – Virginia, USA

- Balsa USA Inc. – Marion, Wisconsin, USA

- CoreLite Inc. – Miami, Florida, USA

- Auszac Pty Ltd. – Queensland, Australia

- SINOKIKO Balsa Wood Co. Ltd. – Zhejiang, China

- Ecuadorian Balsa Wood Co. – Guayaquil, Ecuador

- KJP Select Hardwoods Inc. – Ottawa, Ontario, Canad

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Balsa Wood Market Report |

| Base Year | 2024 |

| Segment by Type | · Monolayer Products

· Multilayer Products |

| Segment by Application | · Wind Energy

· Aerospace · Marine · Transportation · Construction |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The balsa wood market is set to grow by 2025, thanks to the U.S., Ecuador, and Indonesia. These countries are leading the way in using balsa for both aerospace and crafts. Balsa’s light, yet strong properties meet the world’s needs while protecting our environment.

In the U.S., balsa is used in high-tech aircraft parts. Ecuador and Indonesia are focusing on sustainable sourcing. Despite challenges, new technologies in balsa and biodegradable products offer hope.

As the market changes, working together will be crucial. Companies like Boeing and eco-friendly builders are showing it’s possible to make money and protect the planet. We’re on the verge of a new era in materials science.

The future of balsa is about more than just growth. It’s about creating a greener world, one project at a time.

Global Balsa Wood Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Balsa Wood Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Balsa Wood Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Balsa Woodplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Balsa Wood Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Balsa Wood Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Balsa Wood Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Balsa Wood Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size for balsa wood by 2025?

The balsa wood market is set to grow to $176.85 million by 2025. This growth is driven by demand from the U.S., Ecuador, and Indonesia. These countries value balsa wood for sustainable building and craft materials.

What are the primary applications of balsa wood?

Balsa wood is used in various industries such as aerospace, construction, and crafting. Its lightweight and durable properties make it an ideal choice for applications like aircraft parts and architectural models.

How does balsa wood sourcing impact sustainability?

Sourcing balsa wood can be challenging due to forest management and sustainability issues. Yet, efforts are being made to keep balsa wood eco-friendly. This is done through responsible harvesting practices.

What trends are currently influencing the balsa wood market?

Trends include a growing need for lightweight materials. There’s also a focus on sustainable practices. These trends shape decisions in construction and aerospace industries.

How does geopolitical influence affect balsa wood production?

Geopolitics affects the balsa wood market through trade policies and regional politics. These factors influence production, distribution, and regulatory challenges in the industry.

What are the differences between natural and engineered balsa wood products?

Natural balsa wood is valued for its lightness and versatility. Engineered balsa products are made for high-performance uses. They’re especially useful in aerospace and lightweight construction.

What steps are being taken to ensure sustainable balsa wood cultivation in Indonesia?

Indonesia is expanding eco-friendly agricultural practices and improving forest management. This ensures a sustainable balsa wood supply while promoting responsible resource use.

Who are the major players in the balsa wood market?

The balsa wood market includes several major players who focus on innovation and sustainability to stay competitive. They achieve this through strategic partnerships and investments in eco-friendly technology.

What innovations can we expect for the future of balsa wood?

The future of balsa wood looks bright. We can expect advancements in biodegradability and new material technologies. These will highlight sustainability and eco-design, solidifying balsa wood’s green resource status.