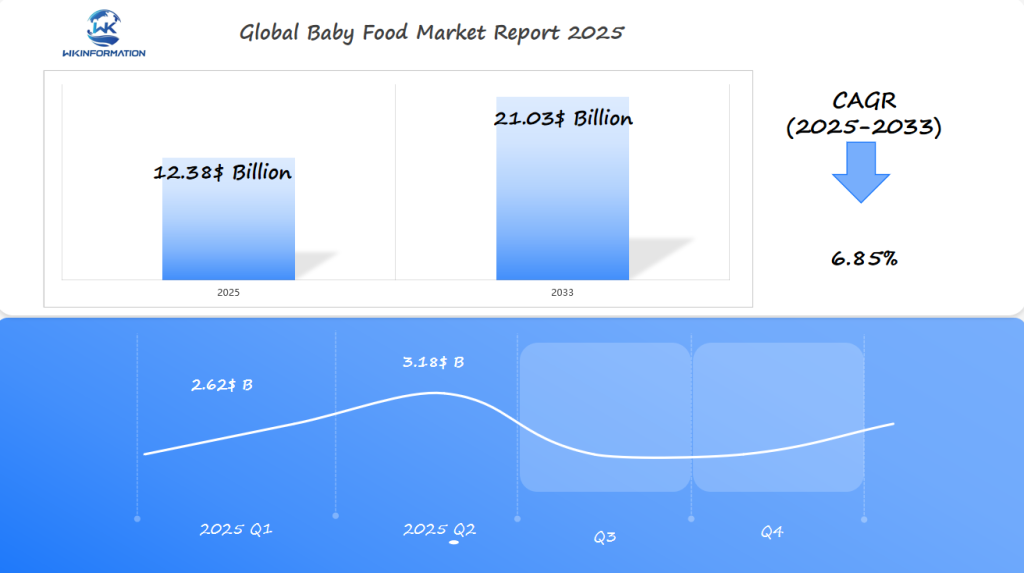

Baby Food Market Estimated to Reach $12.38 Billion Globally by 2025: Strong Demand in the U.S., China, and Germany

The global baby food market is projected to reach $12.38 billion by 2025, driven by strong demand in the U.S., China, and Germany, fueled by rising birth rates, urbanization, and a growing focus on convenient, nutritious options for infants and toddlers.

- Last Updated:

Baby Food Q1 and Q2 2025 Market Overview

The Baby Food market is projected to reach a significant $12.38 billion in 2025, driven by a healthy CAGR of 6.85% through 2033. In Q1, the market is expected to reach $2.62 billion, supported by stable birth rates and strong post-holiday restocking across major markets. Q2 is forecast to grow more significantly to $3.18 billion, driven by seasonal product promotions, rising demand for organic and fortified formulations, and expanding middle-class income in key regions.

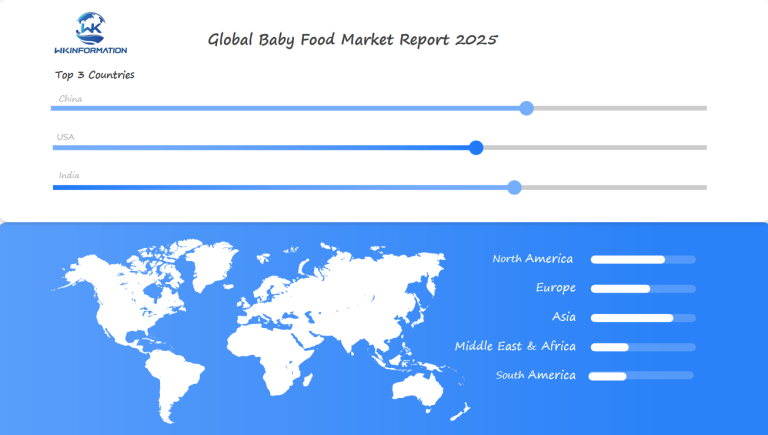

The U.S. leads with diversified product portfolios and high per capita spending. China remains a crucial market, driven by a large infant population and premiumization trends. Meanwhile, Germany plays a key role in both production and export, supported by EU regulations and trust in product safety. These three markets collectively shape innovation, regulation, and competitive dynamics in the global baby food industry.

Baby Food Market Upstream and Downstream Supply Chain Breakdown

Increasing health awareness among parents has significantly impacted the demand for organic and fortified baby foods. Parents are more informed about the benefits of nutrient-rich diets, driving a preference for products that support their babies’ health and development. Organic baby food is particularly favored as it is perceived to be free from harmful chemicals and pesticides.

The rising preference for natural and clean-label ingredients in baby food products is evident across global markets. Clean-label products feature transparent ingredient lists and minimal processing, aligning with the values of health-conscious consumers. Brands are increasingly adopting this approach to meet consumer demands for purity and simplicity in baby food formulations.

Technological advancements play a crucial role in nutrient retention during processing and packaging stages. Innovations such as high-pressure processing (HPP) help preserve the nutritional integrity of baby foods while extending shelf life. Techniques like aseptic packaging ensure that products remain safe for consumption without compromising on quality.

Diversification in flavors and textures caters to infants’ evolving taste preferences. Brands are introducing a variety of flavors, from traditional favorites to exotic blends, to appeal to young palates. Texture variations, including purees, puffs, and bite-sized snacks, offer options suitable for different stages of development, ensuring that babies receive both enjoyable and nutritious meals.

Key Points:

- Health Consciousness: Increased awareness among parents drives demand for organic and fortified baby foods.

- Natural Ingredients: Preference for clean-label products with transparent ingredient lists.

- Technological Advancements: Techniques like high-pressure processing enhance nutrient retention.

- Flavor Diversification: Varied flavors and textures cater to infants’ taste preferences.

By addressing these factors within the supply chain, manufacturers can better meet the demands of today’s discerning consumers while ensuring the delivery of high-quality baby food products.

Trend Drivers and Nutritional Shifts in the Baby Food Market

Raw Material Sourcing and Organic Ingredient Focus

Sourcing high-quality raw materials forms the foundation of the baby food supply chain. Major brands and emerging producers alike are seeking ingredients from certified organic farms to meet growing parental demand for transparency and food safety. Organic fruits, vegetables, grains, and dairy are increasingly favored due to their perceived lower pesticide residue and sustainable farming practices. Supplier partnerships often require rigorous vetting, with documentation on origin, handling, and compliance with international organic certifications.

Manufacturing Processes: Dry vs. Liquid Baby Foods

The manufacturing landscape is divided into two primary segments:

- Dry baby foods: These include cereals and powdered mixes. Advanced dehydration techniques such as freeze-drying help preserve nutrients, flavor, and color without added preservatives.

- Liquid baby foods: Products such as purees and ready-to-feed formulas are produced using thermal processing or aseptic packaging to ensure sterility while retaining nutrient value.

Quality control checkpoints are embedded throughout production—testing for contaminants, allergens, and microbiological hazards is standard before products move downstream.

Packaging Innovations for Safety and Convenience

Packaging plays a dual role in product safety and user convenience. Innovations include:

- BPA-free pouches with resealable caps for easy storage.

- Tamper-evident seals that reassure parents of product integrity.

- Portion-controlled packs designed for single servings, reducing waste.

Smart packaging technologies have also started appearing—QR codes now connect consumers to sourcing information or batch-level traceability data.

Downstream Distribution: The Rise of E-Commerce

Distribution channels have evolved rapidly:

- Traditional retail outlets: Supermarkets, hypermarkets, pharmacies, and specialty baby stores remain significant points of sale.

- E-commerce platforms: Online retailers offer direct-to-door delivery options. Subscription models allow parents to receive regular shipments tailored to their child’s age or dietary needs.

The digital shift has enabled manufacturers to reach consumers more efficiently while offering greater product variety. Real-time feedback loops through digital channels also help brands adapt quickly to changing nutritional trends or safety concerns.

Baby food supply chain agility now hinges on seamless integration between upstream suppliers focused on organic sourcing and downstream distributors leveraging technology-driven delivery systems. This interconnected approach supports the ongoing shift toward safer, cleaner, and more convenient nutrition solutions for infants and toddlers.

Regulatory Challenges and Safety Considerations in the Baby Food Industry

Global Regulatory Frameworks

Ensuring the safety of baby food products is paramount. Various global regulatory frameworks govern baby food safety, focusing on stringent mandatory labeling and ingredient disclosure requirements. Key regulations include:

- Codex Alimentarius Commission: Establishes international food standards to protect consumer health and ensure fair practices in food trade.

- U.S. Food and Drug Administration (FDA): Enforces comprehensive guidelines for infant formula, including nutrient content and manufacturing practices.

- European Food Safety Authority (EFSA): Implements strict controls on contaminants, additives, and nutritional composition in baby foods.

These frameworks mandate clear labeling of ingredients, allergens, and nutritional content to help parents make informed choices.

Common Causes of Product Recalls

Product recalls are critical events that can significantly impact consumer trust. Common causes for recalls in the baby food industry include:

- Contamination: Presence of harmful bacteria such as Salmonella or E. coli.

- Adulteration: Inclusion of undeclared allergens or unauthorized ingredients.

- Packaging defects: Issues such as broken seals that compromise product safety.

Recalls necessitate prompt action from manufacturers to remove affected products from shelves and communicate effectively with consumers to maintain trust.

Quality Assurance Practices

Manufacturers implement rigorous quality assurance practices aimed at mitigating risks associated with contamination or adulteration. These practices encompass:

- HACCP (Hazard Analysis Critical Control Points): A systematic approach to identify, evaluate, and control food safety hazards during production.

- Regular Testing: Routine testing of raw materials and finished products for contaminants and nutrient levels.

- Supplier Audits: Thorough vetting of suppliers to ensure compliance with safety standards.

By adhering to these practices, manufacturers strive to deliver safe and high-quality baby food products consistently.

Geopolitical Factors Influencing Global Trade Dynamics in Baby Food Market

Geopolitical impact on the baby food market is significant, affecting various aspects of the supply chain and pricing strategies. International trade agreements play a crucial role in shaping the export/import landscape for baby food products.

Trade Agreements and Their Role

- Trade policies such as free trade agreements (FTAs) facilitate smoother cross-border exchanges. For instance, agreements like NAFTA (North American Free Trade Agreement) allow easier access to markets between the U.S., Canada, and Mexico.

- Bilateral trade agreements between countries like China and Germany ensure reduced tariffs and streamlined regulatory processes, fostering a robust exchange of baby food products.

Tariffs and Pricing Strategies

Tariffs imposed on raw materials used in manufacturing baby foods have direct implications for pricing strategies.

- Import tariffs increase the cost of essential raw ingredients like organic fruits, vegetables, and dairy products. Manufacturers often pass these costs onto consumers, resulting in higher retail prices.

- Conversely, export tariffs can restrict manufacturers’ ability to compete internationally by inflating costs and reducing price competitiveness.

Impact on Manufacturers

Manufacturers must navigate these geopolitical factors to optimize their supply chains:

- Sourcing raw materials from countries with favorable trade agreements can mitigate high tariff impacts.

- Diversifying supplier bases helps manage risks associated with geopolitical tensions or sudden tariff changes.

Understanding geopolitical dynamics enables manufacturers to adapt their strategies effectively, ensuring consistent supply and competitive pricing in the global baby food market.

Baby Food by Type: Organic, Fortified, and Functional Variants

The baby food market offers a wide variety of products, each designed to meet specific nutritional needs and consumer preferences. The three main categories—organic, fortified, and functional variants—continue to influence purchasing decisions for parents worldwide.

1. Organic Baby Food

Organic baby food focuses on ingredients that are grown without the use of synthetic pesticides, fertilizers, or genetically modified organisms. This type of baby food appeals to parents who prioritize clean-label products and value transparency in sourcing.

Some popular examples of organic baby food include pureed fruits, vegetables, and cereals that are certified by regional organic standards.

2. Fortified Baby Food

Fortified baby food contains added nutrients such as iron, calcium, vitamin D, or DHA. These nutrients are included to address common deficiencies in infants and toddlers.

Fortified baby food plays a crucial role in supporting healthy physical and cognitive development during the early stages of life. You can often find this type of baby food in products like infant cereals, ready-to-feed formulas, and snack bars.

3. Functional Baby Food

Functional baby food is specially formulated with bioactive components such as prebiotics, probiotics, or plant-based omega-3s. These ingredients are included to provide specific health benefits beyond basic nutrition.

The focus of functional baby food is on supporting immunity, gut health, or brain development. Examples of functional baby food include yogurt melts enhanced with probiotics or grain pouches fortified with superfoods like chia or quinoa.

Baby Food by Application: Infants, Toddlers, and Special Dietary Needs

Baby food formulations are designed to align with the evolving nutritional requirements of different age groups and health considerations.

1. Infant Nutrition (0–12 months)

Breast milk substitutes such as infant formula and follow-on formulas focus on replicating essential nutrients found in human milk, including DHA, ARA, and iron.

Ready-to-feed purees with single-source ingredients (e.g., sweet potato or apple) support early introduction to solids while minimizing allergen risks.

Products often exclude added sugars and preservatives, prioritizing gentle digestion.

2. Toddler Nutrition (1–3 years)

Meal kits and finger foods offer greater texture and variety, supporting the development of self-feeding skills.

Nutrient-dense snacks are formulated to meet increased energy demands while maintaining balanced intake of vitamins, minerals, and protein.

Flavors become more diverse—introducing vegetables, grains, dairy, and mild spices—to foster broader taste acceptance.

3. Special Dietary Needs

Allergen-free, lactose-free, gluten-free, and vegan options address medical or lifestyle requirements for children with sensitivities or family preferences.

Functional products targeting digestive health (probiotics), immune support (added vitamins), or specific medical conditions (PKU-friendly formulas) extend the market’s reach.

Brands emphasize transparency in ingredient sourcing and clear labeling for parents seeking tailored nutrition solutions.

The segmentation by application enables parents to select baby food that matches their child’s developmental stage or unique dietary needs without compromise on safety or quality.

Regional Insights: U.S., China, and Germany Leading Markets for Baby Food Consumption

Asia-Pacific: Dominant Market Leader

Asia-Pacific holds the largest share of the global baby food market, accounting for approximately 64% in 2024. This dominance is driven by factors such as rising birth rates, increasing disposable incomes, and a growing middle class. Countries like China, India, Indonesia, and Vietnam are witnessing heightened demand for both conventional and organic baby food products. Notably, China’s market is characterized by a shift towards specialized nutritional products, including infant formulas catering to specific health needs.

North America: Mature Market with Premium Preferences

North America, particularly the United States, represents a mature baby food market with a significant focus on premium and organic products. In 2024, the U.S. accounted for 61.2% of the North American market share. The region’s growth is fueled by high parental awareness of infant nutrition, a strong presence of major baby food manufacturers, and robust distribution networks encompassing both traditional retail and e-commerce platforms.

Europe: Emphasis on Organic and Health-Conscious Choices

Europe is experiencing steady growth in the baby food sector, driven by increasing consumer awareness of the benefits of organic products and stringent government regulations ensuring high standards for baby food. The European Union’s Organic Regulation (EU) 2018/848, effective from January 2022, has bolstered consumer confidence in organic baby food offerings.

U.S. Baby Food Market: Innovations Driven by Healthier Sweet Baked Goods Trend

The U.S. baby food market is experiencing dynamic growth, driven by increased innovation in healthier sweet baked goods. This trend focuses on product innovations that cater specifically to babies’ taste preferences while maintaining high nutritional value and minimal sugar content.

Key Innovations:

- Nutrient-Dense Ingredients: Companies in the U.S. are focusing on incorporating nutrient-dense ingredients such as whole grains, fruits, and vegetables into baby food products. This not only ensures a balanced diet but also introduces infants to a variety of flavors and textures.

- Sugar Reduction Initiatives: There is a growing emphasis on reducing sugar content in baby foods. Brands are achieving this by using natural sweeteners like fruit purees or opting for inherently sweet vegetables like sweet potatoes and carrots.

- Fortified Products: To address specific nutritional needs, many products are fortified with essential vitamins and minerals such as iron, calcium, and vitamin D, which are crucial for infants’ growth and development.

Examples of Product Innovations:

- Organic Sweet Potato Muffins: Brands have introduced organic muffins made from sweet potatoes, providing a naturally sweet flavor without added sugars.

- Fruit and Veggie Bars: These bars combine the sweetness of fruits with the nutritional benefits of vegetables, offering a convenient snack option.

- Whole Grain Teething Biscuits: Utilizing whole grains like oats and quinoa, these biscuits serve as both a nutritious snack and a teething aid.

Market Demand Drivers:

- Health-Conscious Parents: The rising awareness among parents about the importance of early childhood nutrition is driving demand for healthier options. Parents are increasingly looking for products free from artificial additives and preservatives.

- Busy Lifestyles: The increasing number of working parents in the U.S. creates demand for convenient yet healthy baby food options that can easily fit into their busy schedules.

Challenges and Opportunities:

- Regulatory Compliance: U.S. regulations on baby food safety and labeling are stringent, ensuring that products meet high standards. This presents both a challenge and an opportunity for manufacturers to innovate within these guidelines.

- E-commerce Growth: The rise of online shopping platforms provides an opportunity for brands to reach a broader audience efficiently, offering convenience for busy parents who prefer to shop online.

By leveraging these trends and innovations, the U.S. baby food market continues to evolve, meeting the demands of health-conscious parents while ensuring that infants receive nutritious and delicious meals.

China’s Rapidly Growing Organic Baby Food Segment Supported by Policy Backing from Government Authorities

The China organic baby food market stands out in the global Baby Food Market, driven by a surge in health-conscious middle-class consumers. Parents in China are increasingly prioritizing chemical-free, traceable, and nutrient-rich ingredients for their infants—mirroring a global shift but amplified by local safety concerns following past food scandals. The preference for organic and natural baby foods has translated into robust demand growth, with Chinese brands actively promoting transparency and farm-to-table sourcing.

Key drivers behind this strong demand include:

- Rising Middle-Class Income: Higher disposable incomes enable parents to invest in premium and imported organic baby foods.

- Health Awareness: Improved access to information via digital platforms helps parents recognize the benefits of organic nutrition for child development.

Government policy plays a decisive role in shaping the regional analysis U.S. China Germany, particularly within China. Initiatives such as stricter infant formula regulations, subsidies for certified organic farms, and nationwide campaigns on early-life nutrition standards have raised the bar for product quality across all brands. Authorities mandate comprehensive ingredient disclosure and implement rigorous inspection protocols, pushing manufacturers to meet elevated standards or risk exclusion from the market.

This regulatory environment not only assures parents of safety but also encourages domestic innovation—leading to new product launches and wider availability of organic choices throughout urban centers. The China organic baby food market continues its rapid ascent as both consumer preference and government policy align towards healthier infant feeding practices.

Germany’s Unique Approach Towards Flavorful Yet Nutritious Offerings Amidst Declining Birth Rates Challenge

German manufacturers are innovating to attract consumers in a market facing declining birth rates. By focusing on developing diverse flavor profiles, they ensure baby food appeals to older infants’ palates while aligning with ongoing health trends.

Key drivers include:

- Fortification: German baby food products are increasingly fortified with essential vitamins and minerals, catering to nutritional needs.

- Flavor Innovation: Manufacturers offer unique flavor combinations that balance taste and nutrition, such as fruit and vegetable blends.

- Health Trends: There is a strong emphasis on organic ingredients and clean-label products, reflecting parents’ preference for healthier options.

These strategies help maintain strong demand for baby food in Germany amidst demographic challenges.

Future Outlook: Innovations and Sustainability Driving Growth in Baby Food Industry

The baby food industry is expected to see some major changes in the future. Here are two key trends that are likely to shape the market:

1. Personalized Nutrition Solutions

One of the main innovations we can expect is personalized nutrition solutions. This means creating products specifically designed for each infant’s dietary needs or preferences. By tailoring the offerings to individual babies, manufacturers can meet their unique nutritional requirements and also address any potential food allergies or intolerances. This approach aims to support optimal growth and development during the crucial early years of life.

2. Sustainable Packaging Alternatives

Another significant trend is the rise of sustainable packaging alternatives. With increasing environmental concerns, companies are making efforts to reduce their impact on the planet by using eco-friendly packaging materials. These sustainable options not only help minimize waste during transportation and storage but also appeal to consumers who prioritize environmentally conscious choices.

Potential Challenges for Emerging Markets

While these trends present opportunities for growth, emerging markets looking to join this upward trajectory may face certain challenges:

- Limited access to advanced processing technologies needed for producing high-quality yet affordable formulations.

- Ensuring product safety and consistency that meets international export standards set by developed economies.

Overcoming these challenges will be crucial for baby food manufacturers in these regions to succeed. As technology becomes more accessible, there is potential for emerging markets to play a significant role in global market growth by offering innovative and competitive products.

Competitive Insights in the Baby Food Product Segment

Leading brands in the baby food sector compete through innovation, brand trust, and market adaptability. Multinational players such as Nestlé, Danone, Abbott Nutrition, and Mead Johnson dominate shelf presence with expansive product portfolios. These companies invest heavily in research and development to bring forth new formulations—such as hypoallergenic blends and plant-based alternatives—that address evolving parental concerns.

- Nestlé – Switzerland

- Danone – France

- Abbott Laboratories – United States

- Mead Johnson Nutrition – United States

- Hero Group – Switzerland

- Kraft Heinz – United States

- Hipp – Germany

- Perrigo Company – United States

- Bellamy’s Organic – Australia

- Royal FrieslandCampina – Netherlands

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Baby Food Report |

| Base Year | 2024 |

| Segment by Type |

· Organic Baby Food · Fortified Baby Food · Functional Baby Food |

| Segment by Application |

· Infant Nutrition (0–12 months) · Toddler Nutrition (1–3 years) · Special Dietary Needs |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Technological advancements in food processing and packaging ensure that nutrients are retained in the products. Additionally, e-commerce platforms make it easy for consumers to access a wide variety of baby food products. Regulatory frameworks also play a role in maintaining consumer trust by enforcing safety and quality standards.

Global Baby Food Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Baby Food Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalBaby Food players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Baby Food Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Baby Food Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Baby Food Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected global market value of the baby food industry by 2025?

The global baby food market is estimated to reach a value of $12.38 billion by 2025, driven by strong demand in key regions such as the U.S., China, and Germany.

How are health consciousness and organic trends influencing the baby food market?

Increasing health awareness among parents has significantly boosted demand for organic and fortified baby foods. There is a rising preference for natural and clean-label ingredients, which is shaping product offerings to meet consumers’ expectations for healthier infant nutrition.

What are the key supply chain components in the baby food industry?

The baby food supply chain encompasses upstream suppliers sourcing raw materials, including organic ingredients, manufacturing processes for dry and liquid products, packaging innovations ensuring safety and convenience, and downstream distribution channels such as retailers and e-commerce platforms facilitating efficient delivery.

What regulatory challenges affect safety standards in the baby food market?

Global regulatory frameworks mandate strict labeling and ingredient disclosure requirements to ensure product safety. Common challenges include managing product recalls due to contamination or adulteration risks. Manufacturers implement rigorous quality assurance practices to maintain consumer trust and comply with safety standards.

How do geopolitical factors impact global trade dynamics in the baby food market?

International trade agreements influence export and import activities within the baby food sector. Tariffs imposed on raw materials can affect pricing strategies, while geopolitical developments may alter supply chain logistics, thereby impacting market accessibility and competitiveness globally.

What innovations are driving growth in the U.S., China, and Germany’s baby food markets?

In the U.S., innovations focus on healthier sweet baked goods prioritizing nutritional value over sugar content. China’s rapidly growing organic segment benefits from government policy support promoting high-quality infant nutrition. Germany emphasizes flavorful yet nutritious offerings with diverse flavor profiles fortified with essential vitamins and minerals despite declining birth rates.