2025 Automotive High Performance Computing Market Estimated at $2.01 Billion with Insights from the U.S., Germany, and Japan

Discover how the U.S., Germany, and Japan will lead the Automotive High Performance Computing Market by 2025. Get insights into the future of automotive HPC in our latest industry report.

- Last Updated:

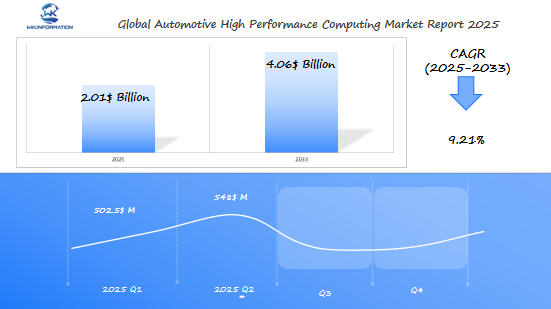

Automotive High Performance Computing Market Forecast for Q1 and Q2 of 2025

The Automotive High Performance Computing (HPC) market, valued at USD 2.01 billion in 2025, is set to grow at a compound annual growth rate (CAGR) of 9.21%. This surge is driven by the rapid advancements in autonomous driving, electric vehicles (EVs), and advanced driver-assistance systems (ADAS). By the end of Q1 2025, the market size is expected to reach approximately USD 502.5 million, as automotive manufacturers focus on the integration of more powerful computing systems to support real-time data processing, machine learning algorithms, and vehicle-to-everything (V2X) communication.

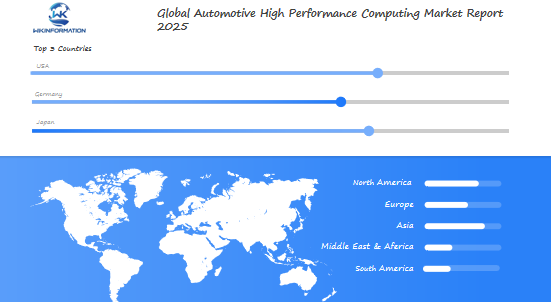

By Q2 2025, the market is projected to grow further to around USD 548 million, fueled by continued investments in research and development (R&D) and the need for high-performance computing solutions to meet stringent safety and performance standards. The U.S., Germany, and Japan remain the key countries to watch, as these regions lead the way in both automotive innovation and regulatory frameworks that drive the need for sophisticated computing technology in vehicles.

Key Takeaways

- $2.01 billion market valuation by 2025 underscores HPC’s growing importance in automotive innovation.

- The U.S., Germany, and Japan are key markets driving semiconductor and software advancements for automotive HPC.

- Autonomous driving and ADAS technologies are primary applications fueling market growth.

- Regional strategies in these countries focus on overcoming technical and regulatory barriers to adoption.

- 2025 forecast emphasizes HPC’s role in next-gen vehicle design and smart mobility infrastructure.

Upstream and Downstream Supply Chain Analysis of Automotive High Performance Computing

The journey of advanced computing systems to vehicles is shaped by the automotive HPC supply chain. Upstream suppliers, like Intel and NVIDIA, give us the chips and processors. These upstream suppliers are key for autonomous driving and electric cars. But, the chip shortage has caused delays in production.

| Upstream Contributors | Downstream Applications |

|---|---|

| Semiconductor manufacturers (e.g., AMD, Qualcomm) | Advanced Driver Assistance Systems (ADAS) |

| Hardware component providers | Connected vehicle platforms |

| Raw material suppliers | Electric vehicle battery management |

Semiconductor Suppliers and Their Role in the HPC Ecosystem

Companies like TSMC and Samsung make the silicon for automotive HPC modules. Their work affects how fast and efficient these systems are. But, the chip shortage impact in 2022 cost the global auto industry $210 billion, reports say.

Integration Challenges Between Hardware and Software Components

- Hardware-software mismatch delays feature deployment

- Real-time data processing demands push system compatibility

- Automakers like Tesla invest in custom silicon to bridge gaps

End-User Applications and Demand Drivers

Features like self-driving and infotainment drive demand. Automakers focus on downstream applications that make cars safer and more enjoyable. Working together, semiconductor manufacturers and car brands speed up innovation in connected cars.

“Balancing supply chain resilience and tech advancement is critical for 2025 growth,” – McKinsey & Company report

Emerging Trends in Automotive High Performance Computing for 2025

Automotive HPC trends are changing how cars think and act. They bring AI, edge computing, and quantum systems together. This mix promises safer, smarter, and more efficient vehicles.

AI and Machine Learning Integration with Automotive HPC

AI in cars is making self-driving systems smarter. Tesla’s Full Self-Driving (FSD) uses AI to understand roads in real time. NVIDIA’s DRIVE platform combines HPC with machine learning, letting cars see objects quicker than people.

These systems handle huge amounts of data every day. They help cars drive better over time.

Edge Computing Advancements in Vehicle Systems

Edge computing makes cars react faster by processing data locally. Intel’s 4th-gen Xeon processors handle sensor data quickly. This reduces delays in systems that prevent accidents.

Qualcomm Snapdragon Ride platforms also use edge computing. They manage entertainment and safety features without needing the cloud.

Quantum Computing Applications in Automotive Development

Quantum computing is changing R&D in cars. BMW is working with D-Wave to find better battery materials. This makes batteries lighter and last longer.

Early tests show quantum computing can cut material testing time by 40%. This is a big step forward.

Key Restrictions and Challenges Impacting the Automotive High Performance Computing Market

The automotive HPC market is promising, but it faces many hurdles. This section looks at the automotive HPC challenges that shape the industry’s future.

Regulatory Constraints and Compliance Issues

Automakers face regulatory constraints when using HPC systems. They must follow safety standards like ISO 26262 and data privacy laws. For instance, the EU’s GDPR affects how vehicle data is handled, requiring expensive software updates.

Technical Limitations in Current Systems

Today’s HPC systems have technical limitations, like high power needs and heat issues. Making them reliable in harsh conditions is a big challenge. New technologies like liquid cooling and special chips are being developed to solve these problems.

Cost Barriers for Widespread Implementation

Implementation costs for advanced HPC hardware and software are too high for many automakers. High R&D costs and expensive parts make it hard for budget-friendly cars. Working together, tech companies and car makers might find ways to make it more affordable.

Despite the challenges, there’s hope for progress. Car companies and tech leaders are exploring new cooling systems and cost-sharing plans. The key is to find a balance between innovation and practical solutions.

Geopolitical Factors Affecting the Automotive High Performance Computing Market

Global trade tensions and national priorities are changing how automotive HPC technologies evolve. Geopolitical impact on automotive HPC affects everything from chip sourcing to software development. Countries are balancing innovation with security concerns.

Trade Policies and Their Impact on Global Supply Chains

Trade policies like export controls and tariffs are creating barriers. The U.S. restricts advanced semiconductor exports to China, while the EU has strict data localization rules. These trade policies make automakers diversify suppliers, adding costs but reducing dependency risks.

| Region | Technology Sovereignty Initiative | Focus Area |

|---|---|---|

| United States | CHIPS and Science Act | Domestic semiconductor production |

| European Union | EU Chips Act | AI and HPC R&D funding |

| China | “Made in China 2025” | Self-reliance in core technologies |

Regional Competition and Technology Sovereignty Initiatives

Regions are racing to control HPC innovation. The U.S. and EU focus on technology sovereignty through subsidies for local chip manufacturing. Meanwhile, Asian markets use cost-efficient production. This regional market dynamics shift is pushing automakers to adapt their R&D strategies.

International Collaboration and Technology Transfer

“Shared research between U.S. firms and EU partners has accelerated autonomous driving systems despite trade disputes.” – Global Automotive Report 2024

Automakers like BMW and NVIDIA collaborate across borders to share HPC expertise. Joint ventures in Israel and South Korea show how international collaboration bridges geopolitical divides. It fosters breakthroughs in vehicle data processing and safety systems.

Segmentation by Type and Its Influence on Automotive High Performance Computing

Automotive HPC segmentation shapes how technology powers modern vehicles. This section breaks down the core market categories driving innovation, from hardware to services.

Hardware Components: Processors, Memory, and Storage Solutions

Hardware components like GPUs, FPGAs, and ASICs form the backbone of automotive HPC. Leading brands such as NVIDIA and Intel supply processors optimized for autonomous driving and real-time data processing. High-speed memory modules and flash storage systems handle the massive data streams from sensors and cameras. Hardware components currently hold a 45% market share, with AI-driven chips expected to grow at 22% CAGR through 2027.

Software Platforms and Operating Systems

Software platforms like QNX and Linux-based systems enable seamless integration of apps and safety-critical functions. Development tools from companies like Wind River simplify coding for in-vehicle systems. A table highlights key segments:

| Segment | Market Share (%) | 2025 Growth Rate |

|---|---|---|

| Hardware | 45 | 18% |

| Software | 30 | 24% |

| Services | 25 | 31% |

Service Components in the Automotive HPC Ecosystem

HPC services include cloud infrastructure and over-the-air updates critical for maintaining vehicle performance. Companies like Bosch and Siemens offer maintenance and integration services, contributing to a 25% market share. Subscription-based models for software updates are rising, with cloud services projected to dominate future growth.

Together, these segments form a dynamic ecosystem where market categories like AI-driven processors and edge computing software push boundaries. Stakeholders must track these divisions to align investments with emerging trends.

Exploring the Applications of Automotive High Performance Computing

Automotive HPC applications are making cars smarter, safer, and more efficient. These systems help with innovations like self-driving cars and real-time data processing. Let’s explore how HPC is changing the game.

Advanced Driver Assistance Systems and Autonomous Driving

High performance computing makes ADAS systems work fast. They use data from cameras, LiDAR, and radar in milliseconds. Companies like NVIDIA’s DRIVE platform and Mobileye power autonomous driving with HPC.

This ensures cars react quickly to road conditions. It helps lower accident rates and moves us closer to fully self-driving cars.

Vehicle Design and Manufacturing Optimization

HPC shortens design times by using virtual simulations. Here’s a comparison:

| Traditional Method | HPC-Enhanced Approach |

|---|---|

| Physical prototypes | Virtual crash tests |

| Months of testing | Real-time iteration |

| High material costs | Cost-effective prototyping |

BMW and Ford use HPC to improve car design. They cut down on weight and speed up the design process by 40%.

Connected Vehicle Services and Smart Mobility

Connected cars need HPC for updates and maintenance. Tesla and GM use HPC for their services. It links cars to smart city systems, improving traffic and cutting emissions.

HPC is more than just technology. It’s the foundation for a safer, greener future of driving.

Regional Market Analysis of Automotive High Performance Computing

Automotive HPC shows different chances in various areas. The North American market is a leader in tech use. Europe focuses on green tech, and Asia-Pacific leads in making cars.

North American Market Dynamics and Growth Drivers

The North American market mixes Silicon Valley’s tech with Detroit’s car history. The U.S. backs research and development, and Mexico and Canada help with parts. This area makes up 35% of the world’s market, thanks to teamwork between car makers and tech companies like NVIDIA and Intel.

European Adoption Trends and Regional Policies

In Europe, cutting down emissions and keeping data safe are key. The EU wants to be carbon-neutral by 2030, pushing car makers like BMW and Renault to use HPC for green cars. Germany’s car centers in Stuttgart and Wolfsburg make up 28% of Europe’s market.

Asia-Pacific Innovation Centers and Manufacturing Hubs

In Asia-Pacific, Japan is known for precise engineering, South Korea for chips, and China for tech support. India and ASEAN are becoming places for making things cheaper. China has 25% of the global market, and India is expected to grow by 18% every year until 2030.

| Region | Key Drivers | Market Size (2023, USD Billion) | Growth Projection (2023-2030) |

|---|---|---|---|

| North America | Tech-automotive partnerships | 7.8 | 14.2% |

| Europe | Regulatory mandates | 6.1 | 12.9% |

| Asia-Pacific | Manufacturing scale | 9.4 | 16.5% |

USA Automotive High Performance Computing Market Growth Factors and Insights

The USA automotive HPC market is growing fast. This is thanks to the mix of new tech and old manufacturing skills. Silicon Valley’s Silicon Valley innovation brings together startups and big car makers. Detroit’s Detroit automotive technology centers use AI to keep up.

Rules from the government on self-driving cars and emissions are pushing for more advanced computing. This is helping the market grow.

Silicon Valley’s Tech-Powered Automotive Shift

Big names like NVIDIA and Intel are working with car makers on self-driving tech. Startups like Tesla and Waymo are testing new ways to use computers in cars. This is making cars safer and using less energy.

Their work is helping the American market growth grow by 10% every year.

Detroit’s Evolution Through Digital Transformation

Big car makers like Ford and GM are investing in Detroit automotive technology. Ford is spending $2B on a lab in Detroit to make car design faster. They want to cut design time by 30% using AI.

A 2024 report shows 45% of Detroit’s engineers now work on HPC systems.

Regulatory Momentum Shaping Innovation

US rules say 95% of new cars must support V2X communication by 2026. This is making HPC more popular. The NHTSA is also proposing rules for safe AI use.

States are offering incentives for electric cars. This is making people want more computing power in EVs.

“Detroit and Silicon Valley are racing to redefine mobility through HPC. The next five years will see more collaboration than competition.” — Automotive Computing Alliance

| Region | Innovation Focus | Key Players | HPC Adoption Rate |

|---|---|---|---|

| San Francisco | Autonomous Systems | NVIDIA, Waymo | 85% |

| Detroit | Manufacturing Tech | Ford, General Motors | 65% |

Germany's Automotive High Performance Computing Market: Opportunities and Projections

Germany’s German automotive HPC market is at a turning point. Old German automakers like Volkswagen, BMW, and Mercedes-Benz are changing. They use high-performance computing (HPC) for self-driving cars, fixing cars before they break, and analyzing data in real-time.

They are doing this through:

- Using cloud-based HPC for virtual car tests

- Working with tech companies like Siemens and Bosch for AI tools

- Getting help from the German government’s €1.2 billion digital fund

Places like the Munich High-Performance Computing Center (HLRS) are making big advances. They’re working on better batteries and aerodynamics. Industry 4.0 is making smart factories smarter, cutting down on downtime by 30% in some places. A BMW person said:

“HPC isn’t just about speed—it’s the backbone of our shift toward sustainable, software-defined vehicles.”

The German HPC market is expected to grow by 18% every year until 2030. This growth is thanks to EU money and working together across industries. As they mix old skills with new tech, they’re leading the way in car innovation worldwide.

Japan's Automotive High Performance Computing Market Insights and Developments

Japan’s car industry is known for its mix of old and new. Companies like Toyota, Honda, and Nissan focus on making things precise, reliable, and efficient. They use Japanese technology innovation to make sure their HPC systems meet Japan’s high standards.

Japanese Manufacturers’ Approach to Computing Integration

Toyota uses HPC for simulating self-driving cars. Honda uses AI and HPC to improve car engines. Nissan adds HPC to cars to make them smarter. This shows how Japan manufacturers are combining old skills with new tech for better cars.

Robotics and Automation Synergies with Automotive HPC

Japan’s automotive robotics skills help improve HPC. Robots in factories use HPC to work better and faster. Here are some examples:

| Manufacturer | HPC Use Case | Robotics Integration |

|---|---|---|

| Toyota | Autonomous system testing | AI-guided assembly bots |

| Honda | Energy efficiency modeling | Robot-aided prototyping |

| Nissan | Connected vehicle analytics | Automated quality inspection |

Cultural and Economic Drivers

An aging population and crowded cities push for self-driving cars. Japan’s big names in semiconductors, like Renesas and Sony, help with HPC. This makes Japan a key player in the Japanese automotive HPC market.

By combining robotics, semiconductors, and cultural values, Japan’s car industry leads in HPC innovation.

Future Developments and Technological Innovations in Automotive High Performance Computing

The future of automotive HPC looks bright, with big changes in how cars process data and connect. Next-generation computing will make vehicles safer, more efficient, and more autonomous.

Next-Generation Hardware Architectures for Vehicles

Car makers are working on special processors for cars. These chips, like neuromorphic ones, work like the human brain. They help cars make quick decisions.

Companies like NVIDIA and Qualcomm are making chips just for cars. These chips help cars spot objects and plan routes faster.

Software Evolution and AI Integration Roadmap

Software is getting better at handling complex AI tasks. New platforms like ROS 2 and AUTOSAR are speeding up development. They make it easier to connect hardware and apps.

Adaptive OS frameworks will balance car safety with fun features. This means cars will be both safe and entertaining.

Emerging Computing Paradigms Beyond 2025

Researchers at places like MIT are looking into quantum computing. They want to use it to improve battery life and traffic flow. Bio-inspired computing and V2X systems are also being explored.

“Beyond 2025, we’ll see computing fabrics where vehicles act as nodes in a global data ecosystem,” said Dr. Lena Torres from Stanford’s Future Mobility Lab.

Even with challenges like power use and safety rules, the future looks bright. Automotive HPC is key to making cars smarter. The path ahead is exciting, with a mix of dreams and reality.

Competitive Landscape of Leading Automotive High Performance Computing Companies

-

Hewlett Packard Enterprise Development LP – United States

-

IBM – United States

-

Lenovo – China

-

NVIDIA Corporation – United States

-

Advanced Micro Devices, Inc. (AMD) – United States

-

Microsoft – United States

-

Taiwan Semiconductor Manufacturing Company Limited (TSMC) – Taiwan

-

Dell Inc. – United States

-

Fujitsu – Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Automotive High Performance Computing Market Report |

| Base Year | 2024 |

| Segment by Type | · Parallel Computing

· Distributed Computing · Exascale Computing |

| Segment by Application | · Passenger Car

· Commercial Vehicle |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The automotive HPC market is set for big changes by 2025. Industries are focusing on new innovations. Growth is expected to keep going thanks to AI, edge computing, and quantum tech.

But, there are challenges like supply chain issues and rules to follow. These need to be tackled to make the most of the market.

Five-Year Growth Projections and Market Opportunities

By 2025, the market is expected to hit over $2.01 billion. North America and Europe will lead the way. The focus will be on self-driving cars and connected vehicles.

Companies that team up with tech leaders like NVIDIA or Intel will get ahead. The Asia-Pacific region is also a key area for growth, thanks to countries like Japan and South Korea.

Risk Factors and Mitigation Strategies

There are risks like chip shortages and higher costs for following rules. Car makers like Tesla and BMW need to find more suppliers. This will help avoid problems with getting parts.

Rules need to be clearer to speed up development. Tech companies should work with schools to share the cost of research and development.

Strategic Considerations for Industry Stakeholders

Car makers should use cloud-based platforms to add HPC to old systems. Tech giants like Qualcomm and AMD should team up with car companies to update software faster. Investors should look at startups working on edge computing.

Governments, like the U.S., should support projects for Industry 4.0. This will help everyone grow and stay competitive.

Global Automotive High Performance Computing Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Automotive High Performance Computing Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Automotive High Performance Computingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Automotive High Performance Computing Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Automotive High Performance Computing Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Automotive High Performance Computing Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofAutomotive High Performance Computing Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current market size of automotive high performance computing?

The market size is expected to hit $2.01 billion by 2025. This growth is driven by AI, autonomous vehicles, and connected car innovations.

What factors are contributing to the growth of the automotive high performance computing market?

The market is growing due to a need for advanced driver assistance systems. Smart mobility and evolving regulations also play a role. These factors push for better safety and environmental standards.

How do supply chain dynamics affect the automotive high performance computing market?

Supply chain issues, like chip shortages, can slow down access to key components. Innovations in semiconductors and better integration of hardware and software are crucial. They help streamline the supply chain.

What emerging trends should we pay attention to in 2025?

Look out for AI and machine learning for better driving. Edge computing for faster processing and quantum computing for complex simulations are also key trends.

What are the key challenges the automotive high performance computing market faces?

Challenges include regulatory hurdles and technical limits on power efficiency. Cost barriers also prevent widespread adoption of these technologies.

How do geopolitical factors influence the automotive high performance computing market?

Trade policies and regional competition impact the global supply chain. They influence how companies source and produce amidst tensions and changing regulations.

Can you explain how the market is segmented by type?

The market is divided into hardware, software, and service components. Each type offers unique contributions to the ecosystem.

What are the various applications of automotive high performance computing?

It’s used in advanced driver assistance systems and optimizing vehicle design. It also supports connected vehicle services for smart mobility.

What insights can we gain from regional market analysis?

Each region has its own dynamics. North America leads in tech, Europe focuses on the environment, and Asia-Pacific excels in manufacturing. Each offers unique growth opportunities.

What role does the USA play in the automotive high performance computing market?

The USA is a key player in automotive tech. It’s known for innovation and a supportive regulatory environment.

How is Germany positioned in the automotive high performance computing market?

Germany is a leader in engineering and R&D. It focuses on Industry 4.0, integrating advanced computing into manufacturing.

What developments are influencing Japan’s automotive high performance computing market?

Japan emphasizes quality and computing integration. Robotics and cultural factors drive demand for autonomous vehicles and smart mobility.

What future innovations can we expect in automotive high performance computing?

Expect next-generation hardware and software advancements. New computing paradigms could revolutionize vehicle design and operation.

Who are the major players in the automotive high performance computing market?

Major players include Bosch, NVIDIA, Intel, and startups pioneering innovations in automotive HPC.

What is the overall outlook for the automotive high performance computing market?

The market outlook is strong, with a five-year growth projection. However, stakeholders should be aware of risks and position themselves for emerging opportunities.