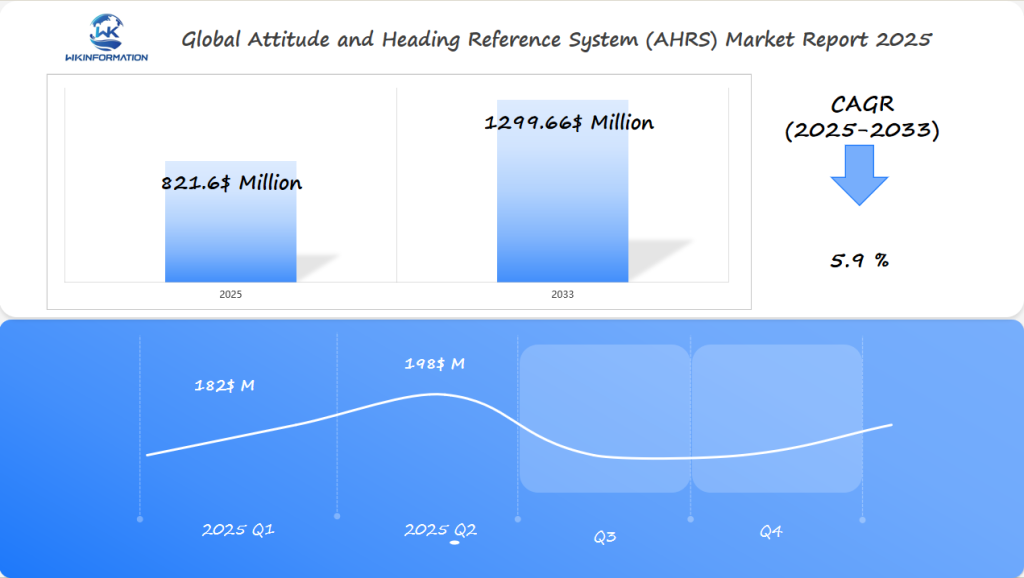

Attitude and Heading Reference System (AHRS) Market Expected to Surpass $821.6 Million by 2025: Demand Rises in the U.S., India, and Israel

Explore the growth trajectory of the Attitude and Heading Reference System (AHRS) Market as rising demand for aviation navigation solutions drives industry expansion through 2025.

- Last Updated:

Attitude and Heading Reference System (AHRS) Market in Q1 and Q2 of 2025

The AHRS market is forecast to reach $821.6 million by 2025, with an expected CAGR of 5.9% through 2033. Q1 revenue is estimated near $182 million, increasing to approximately $198 million in Q2, driven by growing demand for UAVs, general aviation upgrades, and defense applications.

The U.S. continues to lead with robust innovation in MEMS-based inertial systems and FAA-certified avionics. India is emerging as a strong regional hub for light aircraft and drone navigation systems. Israel, with its advanced defense electronics sector, is pushing miniaturized, ruggedized AHRS systems. The integration of GPS-denied navigation and sensor fusion with AI-based stabilization is gaining momentum.

Key Takeaways

- The AHRS market is expected to exceed $821.6 million by 2025.

- There is an increasing demand in both commercial and military aviation sectors.

- Technological advancements are driving system precision.

- Significant investments are being made in sensor and navigation technologies.

- There are growing applications in UAVs and aerospace platforms.

Upstream and downstream industry ecosystem for AHRS technologies

The AHRS industry is a complex web of stakeholders pushing innovation in aerospace navigation. It involves many players working together to create new navigation tech.

Key players in the AHRS world include:

- Aerospace component manufacturers

- Sensor technology developers

- Systems integration specialists

- Original equipment manufacturers (OEMs)

Component Supplier Dynamics

Aerospace part makers are crucial for AHRS. They create vital sensors and parts needed for AHRS to work. These parts, like gyroscopes and accelerometers, are key to advanced navigation.

Avionics Integration Strategies

Integrating advanced avionics requires collaboration among sensor manufacturers, software specialists, and designers. Companies such as Honeywell International Inc., Northrop Grumman Corporation, and Collins Aerospace are at the forefront of developing comprehensive AHRS solutions for both commercial and defense applications.

Industry Interconnectedness

The AHRS supply chain is very complex. Each player brings their own expertise. The success of navigation tech depends on strong partnerships between suppliers, integrators, and users.

Key trends in miniaturization, MEMS technology, and sensor fusion

The world of inertial navigation is changing fast thanks to advanced MEMS sensors for AHRS. New technologies are making miniaturized inertial systems more precise and effective in many fields.

New developments in micro-electromechanical systems (MEMS) are opening up new chances for small navigation solutions. These systems are great because they:

- Take up less space

- Use less power

- Cost less

- Work more accurately and reliably

Sensor Fusion Algorithm Breakthroughs

Sensor fusion algorithms are a big step forward in AHRS technology. They combine data from different sensors to make navigation more accurate and reliable.

Modern MEMS sensors for AHRS use advanced signal processing to beat old limits. Engineers are making more complex algorithms. These can fix weaknesses in sensors, making navigation systems stronger and more dependable.

The Impact of Miniaturization on Various Industries

The trend of making things smaller is changing how we use technology in various industries such as defense, aerospace, and business. Smaller, more efficient systems are leading to new ideas in areas like drones, portable gadgets, and precise guidance.

Regulatory and technical limitations affecting navigation integration

The aviation industry is working hard to improve Attitude and Heading Reference System (AHRS) technology. However, strict regulations from aviation authorities make it challenging to introduce new concepts into the market.

Organizations such as the FAA and EASA have stringent requirements for AHRS. These regulations ensure that navigation systems are secure and dependable, which is particularly crucial for the aerospace and defense sectors.

GPS-Independent Navigation Challenges

Creating systems that don’t rely on GPS is a big challenge. Scientists are trying to make systems that work well without GPS. This is key for both military and commercial flying.

- Enhanced sensor fusion technologies

- Advanced inertial measurement units

- Redundant navigation algorithms

Cybersecurity Vulnerabilities

Keeping avionics safe from cyber threats is a big worry. Weak spots in AHRS tech could harm entire flight systems. So, making these systems secure is a top priority.

The world of AHRS tech is shaped by rules, innovation, and security needs. Companies face tough challenges to create the next big thing in navigation.

| Certification Aspect | Key Requirements | Impact on AHRS Development |

| Safety Standards | DO-254/DO-178C Compliance | Increased Development Complexity |

| Performance Metrics | Error Tolerance < 0.1 degrees | Advanced Sensor Technology Required |

| Cybersecurity | Multi-Layer Protection Protocols | Significant R&D Investment |

Geopolitical influences on avionics export and national security

The world of AHRS technologies is getting more complex. This is because of the complex politics around it. Defense avionics rules have changed how countries share navigation tech. This has made the aerospace field more strategic and complex.

Managing AHRS exports is now a top national security issue. Governments are setting up strict rules for these sensitive technologies. They see how important they are for military and tech reasons.

Key Geopolitical Dynamics in Navigation Technology

- Stricter AHRS export controls limiting technology proliferation

- Enhanced screening of international technology transfers

- National security assessments for advanced navigation systems

- Emerging regulatory frameworks for defense technology sharing

The United States is leading in setting up defense avionics rules. These rules help keep tech advantages safe. They also try to handle the risks of sharing tech with other countries.

Because of global tensions and tech competition, countries are focusing on their own AHRS tech. They want to make their own navigation tech. This way, they don’t rely too much on others and avoid supply chain problems.

Type segmentation: MEMS-based, fiber optic gyro, and mechanical systems

The Attitude and Heading Reference System (AHRS) market has many different technologies. Each has its own strengths and weaknesses. Knowing about MEMS AHRS systems helps engineers pick the best navigation tools for their needs.

Technological Diversity in AHRS Platforms

Today, AHRS technologies fall into three main groups:

- MEMS AHRS systems: Miniature, lightweight sensor platforms

- Fiber optic gyroscopes: High-precision rotation measurement devices

- Mechanical inertial reference units: Traditional mechanical-based navigation systems

Comparative Performance Characteristics

Each technology has its own benefits:

- MEMS AHRS systems are very affordable and small

- Fiber optic gyroscopes are very stable and accurate

- Mechanical inertial reference units work well in harsh conditions

Market Evolution and Technology Integration

The world of navigation is changing fast. New hybrid AHRS solutions are coming out. They mix different sensor technologies to improve performance and reliability in many situations.

Application segmentation: UAVs, commercial aircraft, and spacecraft

The Attitude and Heading Reference System (AHRS) is key in many flying machines. It changes how we navigate in the air. Each flying machine has its own special needs and chances for better navigation.

- Unmanned Aerial Vehicles (UAVs)

- Commercial Aviation

- Spacecraft Navigation

UAV Navigation Challenges

UAVs require highly precise and dependable systems for navigation. To ensure stability and maintain their flight path, drone pilots rely on sophisticated technologies. The introduction of new sensors has significantly improved the performance and safety of drone operations.

Commercial Aviation Navigation Systems

Large aircraft rely on advanced AHRS (Attitude and Heading Reference System) for safety and efficiency. Integrated navigation solutions provide pilots with real-time information, enabling them to operate the aircraft effectively regardless of its specific model.

Spacecraft Attitude Determination

Spacecraft need the most precise AHRS. They must control their position and direction perfectly for space travel. Special sensors help them figure out their exact position in space.

Global growth of AHRS adoption in defense and commercial sectors

The global Attitude and Heading Reference System (AHRS) market is growing fast. It’s happening in both defense and commercial areas. The use of avionics is key to this growth, with big changes happening everywhere.

- Technology is moving from defense to commercial, making advanced navigation systems more common

- New countries are quickly growing their aerospace and defense industries

Regional Technology Convergence

The combination of defense and commercial technology is creating new opportunities for AHRS (Attitude and Heading Reference Systems) applications. This integration is driving innovation across various industries. Here are some areas where advanced navigation systems are being utilized:

- Unmanned aerial vehicles (UAVs)

- Commercial aviation

- Autonomous vehicles

- Precise mapping and location technologies

Market Dynamics and Strategic Implications

Different regulations and technology levels in various regions impact the growth of the AHRS market. Investments in research and development are driving advancements in navigation technology, which in turn is opening up new opportunities for global collaboration.

U.S. Market Driving R&D in Avionics and Autonomous Navigation

The United States leads in U.S. avionics research, driving new tech in autonomous navigation. Thanks to federal funding and research plans, the U.S. is a world leader in navigation tech.

- Significant military modernization programs

- Expanded deployment of unmanned aerial vehicles (UAVs)

- Increased adoption of advanced AI in inertial navigation systems

Emerging Research Frontiers

Top research places are changing navigation tech by adding artificial intelligence. Machine learning algorithms make navigation systems more accurate and flexible. This opens up new possibilities for defense and business.

The U.S. Department of Defense and tech giants are working together. They aim to create smarter systems. These systems will make better decisions, improve sensor tech, and adapt to new situations.

- Improve real-time decision-making capabilities

- Enhance sensor fusion technologies

- Create more robust and adaptive navigation platforms

The U.S. keeps leading in autonomous navigation tech by investing in research. This keeps the country ahead in the fast-changing world of avionics.

India's UAV market expansion and defense modernization

The Indian UAV industry is at a turning point. It’s seeing big changes in technology and strategy. India is becoming a big name in the world of aerospace.

Big changes in defense are making the UAV market grow fast. The government’s plans are helping to grow technology made in India.

Strategic Technological Investments

- Accelerated investment in domestic UAV technology research

- Enhanced focus on indigenous AHRS component production

- Collaborative programs with international aerospace manufacturers

The plan to modernize defense is leading to big investments in new tech. Critical sensor and avionics capabilities are being worked on. This is through focused research and development.

Market Potential and Growth Drivers

Several factors are driving the Indian UAV industry forward:

- Increasing geopolitical security needs

- Strong government support for domestic technology development

- Growing utilization of drones in military and commercial sectors

Partnerships between Indian tech companies and global firms are on the rise, leading to the production of advanced navigation systems. As a result, India is becoming a significant hub for aerospace technology.

Israel's Electronics Expertise in Tactical Navigation

Israel is a global leader in developing advanced navigation systems. They use miniaturized AHRS technology to create compact, high-performance solutions. These systems are designed for complex military environments.

- Compact design of miniaturized AHRS technologies

- Advanced electronic warfare integration capabilities

- Robust performance in extreme operational conditions

- Highly adaptable navigation systems for multiple platforms

Innovative Navigation Technologies

Israeli defense technology companies have developed advanced navigation systems that improve situational awareness and seamlessly integrate with combat systems, providing a complete tactical solution.

The worldwide defense industry highly values Israel’s miniaturized AHRS solutions. These systems are essential for unmanned aerial vehicles, military aircraft, and intricate weapon platforms.

Global Market Impact

Israel’s navigation technology export is a significant part of the global defense electronics ecosystem. Military forces around the world want Israeli tactical navigation systems. They are known for their reliability, compact design, and advanced electronic integration.

Next-gen innovation in AI-enhanced inertial navigation

The world of inertial navigation is changing fast, thanks to artificial intelligence and new sensing tech. AI is making navigation systems more precise and flexible. This opens up new chances for big tech leaps.

New tech is changing how navigation systems handle complex data. Adaptive AHRS algorithms are key in this change. They help systems adjust and get better in tough situations.

Quantum Sensing: The Next Frontier

Quantum sensors for navigation are a big step forward. They use quantum mechanics to offer unmatched accuracy.

- Enhanced precision in navigation tracking

- Real-time environmental adaptation

- Reduced susceptibility to external interference

AI-Driven Performance Optimization

Machine learning is transforming inertial navigation by allowing systems to improve over time and quickly correct navigation errors.

| Technology | Key Advantages | Potential Applications |

| AI Navigation Algorithms | Dynamic error correction | Autonomous vehicles |

| Quantum Sensors | Extreme precision | Space exploration |

| Adaptive AHRS | Real-time environmental adaptation | Military reconnaissance |

AI, quantum sensing, and adaptive algorithms are revolutionizing navigation technology. These innovations are not mere incremental improvements but rather significant transformations in the functioning of navigation systems in intricate environments.

Key players in avionics and inertial systems

The AHRS market is always changing, with top companies leading the way in avionics and inertial systems. Inertial system manufacturers are always improving to stay ahead.

The industry has both big aerospace names and new avionics startups. These companies are changing how we navigate. They show great skill in many areas.

Key Players:

-

Honeywell International — USA

-

Safran — France

-

Rockwell Collins — USA

-

Northrop Grumman — USA

-

Moog — USA

-

Meggitt — UK

-

VectorNav Technologies — USA

-

Sparton Navigation — USA

-

Lord MicroStrain — USA

-

iXBLUE — France

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Attitude and Heading Reference System (AHRS) Market Report |

| Base Year | 2024 |

| Segment by Type |

· MEMS-based · Fiber Optic Gyro · Mechanical Systems |

| Segment by Application |

· UAVs · Commercial Aircraft · Spacecraft |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The attitude and heading reference systems (AHRS) market is at a key point of change. It’s expected to grow a lot, from $821.6 million in 2025 to $1299.66 million by 2033. This growth shows how much people want better navigation technology in aerospace and defense.

New technologies will push the market forward. Things like AI in navigation, quantum sensing, and smaller MEMS tech are changing the game. These advancements are making it possible for AHRS makers to create smarter, more precise systems.

Politics and defense plans will also shape the market. Countries like the U.S., India, and Israel are spending a lot on new navigation tech. This will lead to more research and better AHRS systems. The use of AI and machine learning will make the market grow even faster.

Companies need to invest in research and keep up with rules to succeed. Those that can handle tech challenges and meet industry needs will lead the way. They’ll be the ones to bring new ideas to the global navigation tech scene.

Global Attitude and Heading Reference System (AHRS) Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Attitude and Heading Reference System (AHRS) Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Attitude and Heading Reference System (AHRS) Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Attitude and Heading Reference System (AHRS) Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Attitude and Heading Reference System (AHRS) Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Attitude and Heading Reference System (AHRS) Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Attitude and Heading Reference System (AHRS) Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Attitude and Heading Reference System (AHRS)Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is an Attitude and Heading Reference System (AHRS)?

An AHRS is a high-tech system that tells you where an aircraft is pointing. It uses sensors like accelerometers and gyroscopes. It’s key for flying safely in planes, drones, and military vehicles.

How does MEMS technology impact AHRS development?

MEMS technology improves AHRS by making sensors smaller and cheaper. These tiny sensors are perfect for small drones and gadgets. They’re dependable and perform effectively, even at a small size.

What are the key certification requirements for AHRS in aviation?

The FAA and EASA set strict rules for AHRS in flying. They want systems to be super reliable and safe. These rules help ensure that navigation tech works well in all kinds of weather.

Which industries primarily use AHRS technologies?

Many industries use AHRS, such as aviation, defense, space exploration, and drones. Each of these fields has its own specific requirements for AHRS. As a result, AHRS is manufactured in various ways to accommodate different applications.

How do geopolitical factors influence the AHRS market?

Politics can significantly impact the AHRS market. Factors such as regulations on exporting technology, defense spending, trade wars, and technological competitions between nations all have a substantial influence on this industry.

What are the main technological challenges in AHRS development?

Improving AHRS is a difficult task. There are several key requirements that need to be met:

- GPS Independence: AHRS systems should be able to operate accurately without relying on GPS signals.

- Security: It is crucial to ensure that AHRS systems are protected from potential hacking attempts and unauthorized access.

- Power Efficiency: The power consumption of AHRS systems should be minimized to enable longer operational periods without frequent recharging.

To address these challenges, scientists and researchers are exploring the use of artificial intelligence (AI) as a potential solution. AI has the ability to analyze complex data patterns, make predictions, and adapt to changing conditions, making it a promising tool for overcoming the limitations of traditional AHRS technologies.

How is artificial intelligence transforming AHRS technologies?

AI is making AHRS smarter. It helps them work better in changing situations and predicts when they might break. This makes flying safer and more reliable.

Which regions are driving innovation in the AHRS market?

The US is a major player in AHRS, with significant research activities. Israel is recognized for its tactical systems expertise. India is rapidly expanding its AHRS industry. Each of these regions contributes its unique perspectives and ideas to the field of AHRS.

What is the projected market growth for AHRS technologies?

The AHRS market is expected to grow significantly, reaching $821.6 million by 2025. This growth is driven by increased adoption in aviation, defense, and drone applications.

What future technologies might disrupt the AHRS market?

New tech like quantum sensing and AI could shake up AHRS. Quantum sensors might make navigation even better. AI could make systems more flexible in tough situations.