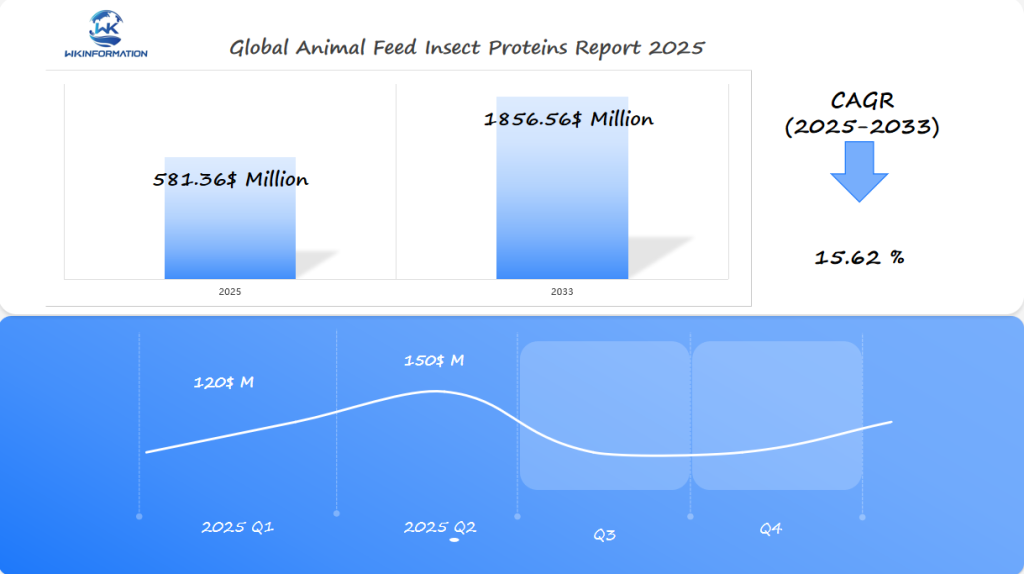

Animal Feed Insect Proteins Market Forecast to Reach $581.36 Million Globally by 2025: Sustainable Nutrition Growth in the U.S., Netherlands, and Thailand

Explore the growing Animal Feed Insect Proteins Market as sustainable alternatives gain traction. Discover market trends, key players, and growth opportunities through 2025.

- Last Updated:

Animal Feed Insect Proteins Market Forecast for Q1 and Q2 2025

The Animal Feed Insect Proteins market is forecasted to reach $581.36 million in 2025, exhibiting a remarkable CAGR of 15.62% through 2033 due to rising demand for sustainable and high-protein animal feed alternatives. The Q1 2025 market size is estimated at approximately $120 million, reflecting early-stage adoption and regulatory approvals in key markets. By Q2, the market is projected to grow rapidly to nearly $150 million, propelled by increasing livestock production and environmental concerns driving alternative protein sources.

Key Takeaways

- Global insect protein market expected to reach $581.36 million by 2025

- Sustainable protein sources offer significant environmental advantages

- Animal feed alternatives are gaining substantial market traction

- Technological innovations driving insect protein production

- Growing investor interest in sustainable agricultural solutions

Upstream and downstream industry chain analysis in insect protein for animal feed

The insect protein industry is changing how we make animal feed. It uses new farming tech and smart supply chain plans. This new way makes sustainable protein for animals.

Insect farming has changed feed making with new methods. These include:

- Climate-controlled environments

- Automated breeding systems

- AI-driven optimization techniques

- Precision waste management infrastructure

Production Processes and Innovative Technologies

Today’s insect protein makers use vertical farming. This saves space and is good for the planet. Precision breeding programs help pick the best insects for protein and nutrition.

Supply Chain Dynamics

Managing the insect protein supply chain is complex. It involves getting organic waste, breeding, processing, and sending it out. Companies are making systems to turn farm waste into protein.

End-User Industries and Applications

Insect proteins are useful in many animal feed areas. This includes:

- Poultry nutrition

- Aquaculture feed

- Livestock supplementation

- Companion animal nutrition

These new technologies show how insect protein can meet global protein needs. They also help make farming more sustainable.

Market trends promoting insect protein adoption in feed formulations

The animal feed industry is changing fast. Insect proteins are becoming a key part of this change. They offer a green and nutritious option for modern farming.

Worldwide, people see the big potential of insect-based proteins in animal nutrition. These new trends in feed making are because of many good reasons. Insects are seen as a better choice than old protein sources.

Sustainability and Environmental Factors

Insects are a great choice for sustainable feed. They have big environmental benefits:

- They have a much lower carbon footprint than traditional livestock

- They use very little water

- They can turn waste into high-quality protein

- They need less land to produce protein

Nutritional Benefits and Feed Efficiency

Insect proteins have amazing nutritional benefits. They make animal feed better in many ways:

| Nutritional Aspect | Insect Protein Advantage |

| Protein Content | Up to 70% protein by dry weight |

| Essential Amino Acids | Comprehensive amino acid profile |

| Digestibility | High bioavailability for animals |

Consumer Awareness and Sustainable Product Demand

More people want eco-friendly protein sources. They care about farming that’s good for the planet. This makes feed makers look for new, green protein options.

Insect proteins are changing animal feed for the better. They offer great environmental benefits, are very nutritious, and meet growing demand for green products.

Regulatory restrictions affecting production and use of insect proteins

The world of insect protein rules is changing fast. This brings both problems and chances for those making and using insect protein. To get through these rules, you need a smart plan for safety and following the law.

Rules for using insect protein in animal food differ a lot around the world. This makes it hard for the industry. Important things to think about include:

- Strict safety rules for making insect protein

- Testing for harmful stuff

- Keeping detailed records of how it’s made

- Following global food safety rules

Current Regulatory Landscape

The European Union leads in insect protein rules, allowing it for certain animal feeds. The U.S. Food and Drug Administration (FDA) is working on detailed rules for insect-based feed.

| Region | Regulatory Status | Key Restrictions |

| European Union | Approved for fish, chickens, pigs | Strict source material requirements |

| United States | Developing comprehensive guidelines | Limited commercial applications |

| Asia-Pacific | Emerging regulatory frameworks | Increasing research investments |

Challenges in Regulatory Compliance

Companies struggle a lot with feed safety standards. The big hurdles are:

- Showing that the protein is always good quality

- Proving it’s safe from germs

- Handling worries about allergies

- Keeping production records clear

Future Regulatory Outlook

The future for insect protein rules looks bright. More people see the value in sustainable proteins. With more research and new tech, following the rules will get easier. This will open doors for new, better feed options.

Geopolitical factors shaping supply chains and trade routes

The global insect protein trade is changing fast because of complex politics. New markets are forming and changing how food systems work.

Strategic plans are making supply chains in the insect protein industry stronger. Different areas are focusing on this new protein source by investing and setting rules.

Regional Production Hubs and Market Dynamics

Important regions are becoming key in the insect protein world:

- Europe leads in tech

- North America has big investment plans

- Asia-Pacific grows fast

International Trade Considerations

The global insect protein trade is complex. It involves dealing with tough international rules and getting into new markets.

| Region | Investment Potential | Market Maturity |

| Europe | High | Advanced |

| North America | $250-300 million | Developing |

| Asia-Pacific | Rapid Growth | Emerging |

Impact of Global Events on Insect Protein Markets

Major events such as pandemics and trade disputes force businesses to reconsider their supply chains. The ability to adjust swiftly is crucial in this evolving market.

Savvy companies are devising innovative strategies to tackle global threats. They are expanding their insect protein business globally.

Segmentation by insect protein types and processing methods

The animal feed insect protein market is changing fast. New protein sources and better processing methods are leading the way. Scientists are looking into different insects to find sustainable proteins for animals.

There are three main insect proteins in the market. Each has its own nutritional benefits and processing strengths:

- Black soldier fly protein

- Mealworm protein

- Cricket protein

Key Insect Species in Feed Production

Black soldier fly protein is leading the way. These insects convert waste into high-quality protein, making them an environmentally friendly option for animal feed.

Processing Techniques and Product Forms

Processing insect proteins involves several steps. These steps create different forms for various animal needs. The main methods are:

- Mechanical defatting

- Enzymatic protein extraction

- Thermal processing

Comparative Analysis of Insect Proteins

| Insect Type | Protein Content | Key Applications | Processing Efficiency |

| Black Soldier Fly | 42-45% | Poultry, Aquaculture | High |

| Mealworm | 50-55% | Livestock, Pet Feed | Medium |

| Cricket | 65-70% | Specialty Feeds | Low |

Each insect protein has its own benefits. Black soldier fly protein stands out for its sustainability and large-scale production. Research in insect protein processing is opening up new possibilities for animal nutrition.

Application analysis in poultry, aquaculture, and livestock feeds

Insect-based feed is changing animal nutrition in big ways. It’s a key part of making animal food more sustainable. This is especially true for livestock and fish farming.

New ways to feed animals are making old methods seem outdated. Scientists are finding that insect proteins are very beneficial. They work well in many different farming systems.

Insect Proteins in Poultry Nutrition

Poultry food is getting a big update with insect ingredients. These ingredients bring many benefits:

- Animals grow faster

- They use feed more efficiently

- It’s better for the environment

- Proteins are easily digested

Aquaculture Applications and Benefits

Feeding fish is getting a new twist with insect proteins. Black soldier fly larvae and mealworm proteins are great for fish.

| Insect Protein Source | Aquaculture Species | Protein Replacement Percentage |

| Black Soldier Fly Larvae | Tilapia | 25-40% |

| Mealworm Protein | Salmon | 30-50% |

| Cricket Protein | Trout | 20-35% |

Livestock Feed Formulations

Livestock nutrition is changing with insect-based feeds. Both types of animals do better with these new proteins.

The future of animal feed is all about these new, green proteins. They help animals stay healthy and protect our planet.

Regional perspectives on the global animal feed insect protein market

The world of insect protein markets is complex and always changing. Each region has its own path in the insect protein industry. They face different challenges and see different opportunities.

Market trends vary greatly around the world. Each area has its own way of making insect protein for animal feed.

North American Market Dynamics

North America leads in insect protein tech. The market is known for:

- Big investments from the private sector

- Top-notch research and development

- A strong set of rules for green farming

European Market Leadership and Innovations

Europe is a leader in large-scale insect protein production. It’s known for:

- Strict regulations on environmental sustainability

- Significant financial support from investors

- Collaborative research initiatives

Emerging Markets in Latin America and Africa

Latin America and Africa are starting to grow in insect protein. They offer special chances because of:

- Flexible farming setups

- Local food habits

- Plans to diversify the economy

The global animal feed insect protein market keeps changing. Looking at different regions gives us clues for the future of green protein production.

U.S. Innovations in Sustainable Animal Nutrition

The U.S. insect protein industry is growing fast. It’s thanks to new, green feed ideas. These ideas are changing how we feed animals.

Animal nutrition research is changing quickly in the U.S. New projects aim to make better, greener protein for animals. This includes both land animals and fish.

Research and Development Initiatives

Top research institutions are working hard on insect protein. They’re focusing on a few key areas:

- Optimizing insect breeding techniques

- Developing advanced processing methods

- Improving nutritional profiles of insect-based proteins

- Reducing production costs

Strategic Partnerships Driving Innovation

Insect producers and large feed companies are joining forces. These partnerships are resulting in innovative solutions that address both nutrition and environmental challenges.

Regulatory Progress and Market Acceptance

The U.S. is getting better at supporting insect protein. New rules are making it easier to bring these products to market. This boost is making investors more confident.

As research and tech get better, the U.S. is leading in green animal nutrition. The drive for innovation looks bright for insect protein in animal feed.

Netherlands: Leading the Way in Insect Farming Technologies

The Netherlands is at the forefront of insect farming, revolutionizing sustainable protein production. Dutch companies are spearheading this transformation with innovative technologies and creative solutions.

Advanced Production Facilities and Techniques

Dutch insect farming is known for its advanced methods. Top companies have built special places for breeding insects. These places use the latest technology to breed insects efficiently.

- Precision climate control systems

- Automated breeding environments

- Genetic selection for optimal protein production

Circular Economy Initiatives

The Netherlands is a leader in using the circular economy in insect farming. Companies in the Netherlands are turning organic waste into insect protein. This greatly reduces harm to the environment.

| Circular Economy Aspect | Implementation Strategy |

| Waste Utilization | Converting agricultural and food waste into insect feed |

| Energy Efficiency | Implementing renewable energy in production facilities |

| Resource Optimization | Minimizing water and land use in protein production |

Export Potential and Global Market Influence

The Netherlands is a key player in exporting insect protein. Companies like Protix work with others around the world. They help make sustainable feed solutions bigger.

Dutch insect farming is always looking to do better. They show that making protein in a green way is not only doable but also good for business and the planet.

Thailand's Growing Insect Protein Production Industry

The Asian insect protein market is changing fast, with Thailand leading the way in insect farming technologies. The country’s history of eating insects has helped build a strong protein production industry.

In Thailand, old traditions meet new farming methods. This mix of culture and technology is creating big opportunities in the Asian insect protein market.

Cultural Roots of Insect Consumption

In Thailand, insects have always been a part of food. This tradition includes:

- Widespread consumption of crickets, grasshoppers, and beetle larvae

- Rich nutritional profile of edible insects

- Deep-rooted culinary traditions spanning generations

Industrial Scale-Up Strategies

Going from eating insects to making them on a big scale needs smart plans:

- Developing advanced farming infrastructure

- Implementing scientific breeding techniques

- Creating standardized processing methods

Insect Type Protein Content Key Applications Processing Efficiency Black Soldier Fly 42-45% Poultry, Aquaculture High Mealworm 50-55% Livestock, Pet Feed Medium Cricket 65-70% Specialty Feeds Low

Government Support and Market Potential

The Thai government views insect protein as an important component of sustainable farming. Strategic investments and supportive regulatory frameworks are facilitating the growth of the industry. As a result, Thailand is becoming a strong competitor in the insect protein market.

Future development opportunities in insect protein feed ingredients

The world of insect proteins is changing fast, opening up new chances for green feed technologies. New ideas are changing how we feed animals, thanks to advanced research.

- Advanced automated farming systems

- Genetic optimization of insect species

- AI-driven breeding and harvesting techniques

- Precision nutrition algorithms

Emerging Production Technologies

Biotech is making significant progress in cultivating insect proteins. Companies are exploring vertical farming as a means to optimize space utilization and minimize environmental harm.

| Technology | Potential Impact | Development Stage |

| AI Breeding Selection | Optimize protein content | Advanced Research |

| Automated Harvesting | Reduce production costs | Early Implementation |

| Genetic Engineering | Enhanced nutritional profiles | Experimental |

Potential New Insect Species

Scientists are looking into unconventional insect species for their special nutrients. Mealworms, crickets, and black soldier fly larvae are being studied. They could be key to better, greener animal feed.

Integration with Sustainable Solutions

The future of insect proteins is about working well with other green feed options. Mixing insect proteins with algae and single-cell proteins could lead to better animal nutrition systems.

Overview of the Competitive Landscape for Insect Protein Suppliers

Key players in the animal feed insect protein market are focusing on technological advancements to enhance protein yield and sustainability. They are expanding operations in regions such as Europe and Asia-Pacific, where demand for sustainable and high-quality animal feed is increasing. Strategic collaborations with agricultural and food industry stakeholders, along with investments in scalable insect farming and processing technologies, are enabling these companies to strengthen their market presence and drive innovation in sustainable animal nutrition.

Key Players:

-

Protix (Netherlands)

-

Ÿnsect (France)

-

AgriProtein (South Africa)

-

Enterra Feed Corporation (Canada)

-

Aspire Food Group (United States / Canada)

-

InnovaFeed (France)

-

Hexafly (Ireland)

-

EnviroFlight (United States)

-

Beta Hatch (United States)

-

Entomo Farms (Canada)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Animal Feed Insect Proteins Market Report |

| Base Year | 2024 |

| Segment by Type |

· Black Soldier Fly Protein · Mealworm Protein · Cricket Protein |

| Segment by Application |

· Poultry · Aquaculture · Livestock Feeds |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Animal Feed Insect Proteins Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Animal Feed Insect Proteins Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Animal Feed Insect Proteins Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Animal Feed Insect Proteins Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Animal Feed Insect Proteins Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Animal Feed Insect Proteins Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Animal Feed Insect Proteins Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Animal Feed Insect Proteins Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current market size for insect proteins in animal feed?

The global market for insect proteins in animal feed is expected to hit $581.36 million by 2025. This growth is driven by the need for sustainable protein sources in animal nutrition.

Why are insect proteins considered a sustainable feed option?

Insect proteins are better for the environment than traditional livestock farming. They produce less greenhouse gas, use less land and water, and turn organic waste into quality protein.

Which insect species are most commonly used in animal feed production?

Black soldier flies, mealworms, and crickets are the top insects used in animal feed. Each has its own nutritional benefits and production advantages.

How are different animal sectors using insect proteins?

Insect proteins are gaining traction in poultry, aquaculture, and livestock feed. They help improve growth rates, feed efficiency, and overall nutrition in animals.

What are the key challenges in insect protein production?

Challenges include meeting regulatory standards, scaling up production, ensuring consistent quality, and overcoming consumer doubts in the animal feed industry.

Which regions are leading in insect protein market development?

Europe and North America are leading the way. The Netherlands and the United States are at the forefront of insect farming and sustainable animal nutrition research.

What technological innovations are driving the insect protein industry?

New technologies such as automated farming, AI, genetic improvements, and advanced processing are driving the insect protein industry. These advancements enhance protein extraction and quality.

How do insect proteins compare nutritionally to traditional protein sources?

Insect proteins have high-quality amino acids, excellent digestibility, and offer benefits like chitin content. They may also support animal immune systems.

What regulatory developments are impacting the insect protein market?

The European Union has approved insect proteins for some livestock feeds. Other regions are creating rules to safely include insect-based ingredients in animal nutrition.

What is the future potential of insect proteins in animal feed?

The market is expected to grow significantly. This growth is driven by sustainable agriculture, technology, and awareness of environmental issues in traditional protein production.