Anchor Handling Supply Tug Market Set to Reach $10.18 Billion by 2025: Expansion in the U.S., Norway, and Singapore

Discover growth trends in the Anchor Handling Supply Tug Market, driven by offshore energy expansion. Analysis covers market dynamics, key players, and regional opportunities through 2025.

- Last Updated:

Anchor Handling Supply Tug Market in Q1 and Q2 of 2025

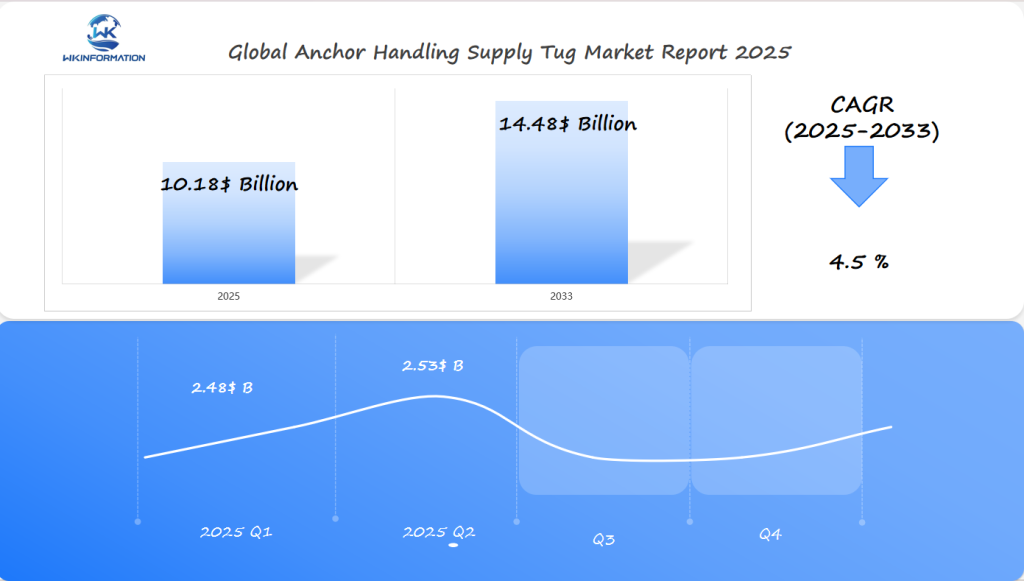

The Anchor Handling Supply Tug market is projected to reach $10.18 billion in 2025, with a steady CAGR of 4.5% through 2033. Q1 revenue is expected to be around $2.48 billion, rising to $2.53 billion in Q2. These specialized vessels are in increasing demand due to heightened offshore exploration and subsea construction activities.

Key Takeaways

- Projected market value of $10.18 billion by 2025

- United States and Norway lead maritime industry growth

- Critical support for offshore energy exploration

- Technological advancements driving market expansion

- Increasing demand for specialized maritime vessels

Understanding the Supply Chain of Anchor Handling Supply Tugs

The AHST supply chain is a complex web of industries that support offshore maritime work. It starts with getting raw materials and ends with making and using offshore support vessels. Each step is vital for delivering strong vessels to the global energy market.

Upstream Industry: Key Components for Vessel Performance

AHST makers face a complex production world that needs precise engineering and smart sourcing. The upstream part deals with key parts for vessel performance:

- Steel and specialized marine-grade materials

- Advanced propulsion systems

- Navigation and communication technologies

- Specialized anchor handling equipment

Manufacturing Ecosystem Dynamics

The downstream part of offshore support vessels has complex needs. Makers must match their tech skills with changing maritime standards. They focus on:

- Improving vessel efficiency

- Meeting environmental rules

- Building safety features

- Introducing new tech

Partnerships between AHST makers and offshore energy firms push for better vessel design and use. The global maritime world needs more advanced offshore support vessels that can handle tough environments.

Technology and Market Adaptation

New technology is transforming the AHST supply chain, introducing superior materials, automated systems, and environmentally-friendly propulsion. These advancements enable vessels to remain competitive and comply with international maritime regulations.

Trends in offshore energy projects, maritime safety, and automated ship handling

The maritime industry is going through big changes thanks to new technologies and shifts in offshore energy projects. Offshore wind energy is becoming very important, changing how ships work. This has opened up new chances for anchor handling supply tugs (AHSTs).

New technologies are making maritime safety and automated ship handling better. Some key changes include:

- Artificial intelligence in navigation systems

- Advanced sensors for watching vessels in real time

- Systems to prevent ship collisions

- Being able to control ships from far away

Innovations Driving Maritime Efficiency

Offshore wind energy projects require specialized vessels. Advanced Hybrid Support Vessels (AHSTs) now come equipped with cutting-edge technology for improved positioning and safety. These advancements facilitate intricate operations at sea while minimizing potential hazards.

Automated Systems Transformation

Automated ship handling is a big step forward in maritime tech. Modern AHSTs use smart control systems for better precision and less mistakes. These updates are key for the growing needs of offshore energy.

Experts say we’ll see more money spent on safety tech and automated systems. AHSTs will lead the way in making ships more efficient and safe.

Regulatory challenges in emissions, safety, and maritime labor standards

The anchor handling supply tug market is facing tough rules that change how it works and what technology it uses. These rules are making vessels safer and cleaner. They are also making sure workers are treated right.

- Emission reduction requirements mandated by global maritime authorities

- Comprehensive offshore safety standards for vessel operations

- Evolving maritime labor regulations protecting crew welfare

Emission Control Strategies

The International Maritime Organization (IMO) has set strict rules to cut down on emissions. Vessels must use new tech to reduce their carbon footprint. This includes:

- Low-sulfur fuel implementations

- Exhaust gas cleaning systems

- Energy-efficient propulsion mechanisms

Changes in Offshore Safety Standards

Offshore safety rules have changed to handle new risks. Now, there are strict training, equipment checks, and rules for how vessels operate. This sets high standards for the maritime workforce.

By combining rules with new tech, the anchor handling supply tug market is changing. This opens doors for companies that want to be leaders in safety and sustainability.

Geopolitical influence of global energy supply chains and shipping routes

The anchor handling supply tug market is crucial for global energy and maritime strategies. Politics heavily influence the operations of these essential sea vessels.

Shipping routes have become important battlegrounds for economic and political conflicts. The energy supply chains are highly susceptible to political tensions, which in turn impacts the deployment of anchor handling supply tugs.

Key Geopolitical Drivers of Maritime Energy Logistics

- Emerging energy exporters reshaping global trade patterns

- Strategic maritime chokepoints influencing shipping routes

Places like the South China Sea and the Strait of Hormuz are key in moving global energy. They need advanced sea support vessels that can handle complex political situations.

| Region | Geopolitical Impact | AHST Market Significance |

| Middle East | High Political Volatility | Critical Energy Supply Routes |

| South China Sea | Territorial Disputes | Strategic Maritime Operations |

| Arctic Region | Emerging Exploration Zones | Expanding Energy Frontiers |

Keeping energy safe is a top goal for countries everywhere. Anchor handling supply tugs are key in keeping global energy chains strong. They help keep sea operations going, even with political issues.

Type segmentation: anchor handling tugs, supply tugs, and multipurpose vessels

The anchor handling supply tug market is complex. It has specialized marine vessels for different offshore needs. Each type has unique abilities for maritime support, tackling challenges in offshore energy and exploration.

- Anchor Handling Tugs: Specialized vessels with strong winching systems and engines

- Supply Tugs: Ships that carry important equipment and people to offshore sites

- Multipurpose Vessels: Ships that do many things, combining different functions

Anchor Handling Tugs: Precision Maritime Support

Anchor handling tugs are key in offshore drilling. They have advanced gear to move big anchors, set up platforms, and tow in emergencies. Their design lets them work in tough sea conditions.

Supply Tugs: Logistical Lifelines

Supply tugs connect onshore bases to offshore sites. They carry vital supplies, gear, and people. This keeps operations running smoothly in distant sea areas.

Multipurpose Vessels: Technological Flexibility

Multipurpose vessels are the top in maritime engineering. They combine anchor handling and supply tasks in one ship. This makes operations more efficient and cuts costs in maritime support.

Application segmentation: offshore oil and gas, port services, and deep-sea exploration

Anchor handling supply tugs (AHSTs) are key in many maritime areas. They show great flexibility in offshore work. They are used in offshore oil and gas, port services, and deep-sea exploration. Each area is crucial for marine infrastructure.

Offshore Oil and Gas Sector Applications

In the offshore oil and gas field, AHSTs are vital. They handle complex tasks needed for energy production:

- Positioning and moving offshore drilling rigs

- Supporting platform installations

- Conducting subsea construction operations

- Providing emergency response capabilities

Port Services and Harbor Management

Port services are another key area for AHSTs. They are great at helping with navigation, making maritime logistics smoother and safer in busy harbors.

- Ship berthing and unberthing support

- Vessel traffic management

- Emergency towing and rescue operations

- Pollution control and mitigation

Deep-Sea Exploration Opportunities

Deep-sea exploration is growing, and AHSTs are key. Oceanographic research vessels and mineral exploration need these strong vessels for underwater tasks.

- Scientific research vessel support

- Underwater survey operations

- Marine geological exploration

- Autonomous underwater vehicle deployment

Global push for energy-efficient and environmentally friendly tug operations

The maritime industry is changing fast. It’s moving towards energy-efficient tugs and green operations. Offshore support vessel markets are leading the way with new green technologies. This is making maritime operations more sustainable.

Maritime operators are coming up with new eco-friendly designs. They’re focusing on:

- Hybrid propulsion systems to cut down fuel use

- Advanced LNG and hydrogen engines

- Smart power management tech

- Hull designs that save energy

Technological Innovations Driving Green Maritime Solutions

Energy-efficient tugs are getting smarter. They use the latest green tech to lower environmental harm. Intelligent navigation systems and automated power saving are changing how ships operate.

Rules and green standards are pushing for more eco-friendly operations. Shipbuilders and companies see sustainable practices as key to staying ahead.

U.S. market growth in offshore drilling and oil extraction support

The U.S. offshore drilling sector is growing fast. New developments in oil extraction support are changing the sea. Market research shows big growth chances for Anchor Handling Supply Tugs (AHST) in U.S. waters.

- Increasing investment in deep-water exploration

- Advanced technological integration in oil extraction support

- Expanding AHST market capabilities

- Stringent safety and environmental regulations

Market Dynamics and Regional Potential

The Gulf of Mexico is key for U.S. offshore drilling. New tech and smart investments are boosting the AHST market in USA. Experts predict big growth in the next years.

The U.S. offshore drilling scene is changing. It’s all about new oil extraction support ways. Technological progress and following rules are key for the future of sea work in energy.

Norway's leadership in offshore wind energy and tug operation innovation

Norway is leading the way in the Scandinavian AHST market. It’s making big strides in offshore wind energy and maritime tech. The country’s focus on tug innovation has put it at the top of maritime development worldwide.

The North Sea is key for testing Norway’s advanced maritime skills. Vessels like the Normand Frontier show Norway’s tech edge. They highlight the advanced support capabilities of Norwegian offshore vessels.

Key Innovations in Maritime Technology

- Advanced propulsion systems with reduced environmental impact

- Digitalized vessel operations enhancing efficiency

- Integrated renewable energy support capabilities

Norwegian shipyards are changing the game in the Scandinavian AHST market. They’re building multipurpose vessels that are great for offshore wind energy support. These innovations show Norway’s dedication to green maritime solutions, combining tech with care for the environment.

Strategic Market Positioning

Norway’s expertise in offshore wind projects gives it a significant advantage in global maritime logistics. Through investments in research and development (R&D), Norwegian companies are establishing new benchmarks, taking the lead in technological innovation and operational excellence.

Singapore's strategic position in global maritime logistics and tug fleets

Singapore is a key player in maritime logistics, thanks to its prime location. It’s a crucial hub for tug fleets in Southeast Asia. The city’s strategic spot at the heart of shipping routes has made it a leader in maritime innovation.

The maritime world in Singapore has many strengths. These drive its leadership in the regional maritime sector:

- Advanced port infrastructure supporting complex maritime operations

- Cutting-edge training facilities for tug operators

- Robust regulatory frameworks promoting industry innovation

- Significant investments in sustainable maritime technologies

Infrastructure and Technological Leadership

Singapore has developed special berths and maintenance facilities. This has made it a key node in the Asian tug fleets network. The nation’s maritime sector demonstrates exceptional adaptability, always ready to meet new global needs.

Economic and Strategic Implications

Singapore has expanded its role in the Southeast Asian AHST market and is now a global influencer. The city’s strategy involves a combination of technological innovation, skilled workforce, and progressive policies.

Future developments in automation and green propulsion technologies

The maritime industry is about to undergo a significant transformation, driven by AHST automation and autonomous tugs. These technologies are revolutionizing the sector, making anchor handling supply tugs more efficient and environmentally friendly.

The role of green propulsion technologies

New green propulsion technologies are playing a crucial role in this evolution. They have the potential to reduce environmental impact while enhancing performance, opening up new opportunities for sustainability in maritime operations.

Cutting-Edge Technological Advancements

- AI-powered predictive maintenance systems

- Advanced remote navigation capabilities

- Hybrid propulsion mechanisms

- Zero-emission vessel designs

Autonomous tugs are getting smarter, thanks to AI. They can plan routes and improve performance on their own. This leads to better safety and efficiency at sea.

The industry is making big strides in green propulsion technologies. Hydrogen fuel cells and advanced batteries are key to a greener sea.

Emerging Propulsion Innovations

- Hydrogen fuel cell integration

- Advanced lithium-ion battery systems

- Regenerative energy capture technologies

- Modular electric propulsion units

Marine engineers are working on advanced AHST automation. These systems could change how we manage ships. They promise to make shipping safer, more efficient, and better for the planet.

Key players in the anchor handling supply tug market

Key players in the anchor handling supply tug market are focusing on vessel modernization and fuel-efficient technologies to meet the operational demands of offshore oil and gas activities. They are expanding their services in regions such as West Africa and Southeast Asia, where offshore exploration and production are growing. Strategic partnerships with energy companies and investments in fleet upgrades are enabling these operators to improve reliability, safety, and competitiveness in a highly specialized market.

Key Players:

-

Seacor Marine (USA)

-

Bourbon (France)

-

DOF Subsea (Norway)

-

Tidewater Inc (USA)

-

Solstad Offshore (Norway)

-

Havila Shipping (Norway)

-

Swire Pacific Offshore (Singapore)

-

Maersk Supply Service (Denmark)

-

Harvey Gulf International Marine (USA)

-

McDermott International (USA)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Anchor Handling Supply Tug Market Report |

| Base Year | 2024 |

| Segment by Type |

· Anchor Handling Tugs · Supply Tugs · Multipurpose Vessels |

| Segment by Application |

· Offshore Oil and Gas · Port Services · Deep-sea Exploration |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Anchor Handling Supply Tug Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Anchor Handling Supply Tug Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Anchor Handling Supply Tug Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Anchor Handling Supply Tug Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Anchor Handling Supply Tug Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Anchor Handling Supply Tug Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Anchor Handling Supply Tug Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Anchor Handling Supply Tug Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is an Anchor Handling Supply Tug (AHST)?

An Anchor Handling Supply Tug is a special ship. It helps with offshore energy work. It moves anchors, tows structures, and carries supplies and people to sea.

How large is the Anchor Handling Supply Tug Market expected to grow?

The market is set to hit $10.18 billion by 2025. This growth comes from more offshore energy projects in the U.S. and Norway.

What are the main uses of Anchor Handling Supply Tugs?

AHSTs are essential in the offshore oil and gas industry. They perform various tasks such as moving rigs, installing platforms, conducting subsea operations, and more. Additionally, they assist with harbor management and deep-sea exploration activities.

How are environmental regulations impacting AHST operations?

Rules like the IMO 2020 sulfur cap are pushing for cleaner fuels. This means more use of LNG and hydrogen. It also leads to greener ship designs.

What technological advancements are transforming the AHST market?

New tech includes AI, automated systems, and better navigation. Predictive maintenance and autonomous tugs are also on the rise.

Which countries are leading in AHST market development?

The U.S., Norway, and Singapore are leading. Each brings its own strengths in energy, tech, and logistics to the table.

What types of vessels are included in the AHST market?

The market includes anchor handling tugs, supply tugs, and multipurpose vessels. These vessels are used for handling anchors and supplies in various offshore operations.

How do geopolitical factors influence the AHST market?

Geopolitical factors such as politics, changes in energy supply, and the significance of shipping routes have an impact on the demand for AHST (Aerial Heavy Lift Transport) vehicles. These factors play a role in determining the locations and methods of AHST usage.

What are the key safety considerations for AHST operations?

Safety is key. It includes strict equipment checks, crew training, and advanced navigation. There are also rules for operations and crew.

What future trends are expected in the AHST market?

The future looks bright. Expect more offshore wind, automation, green tech like hydrogen fuel cells, and digital tech in ship operations.