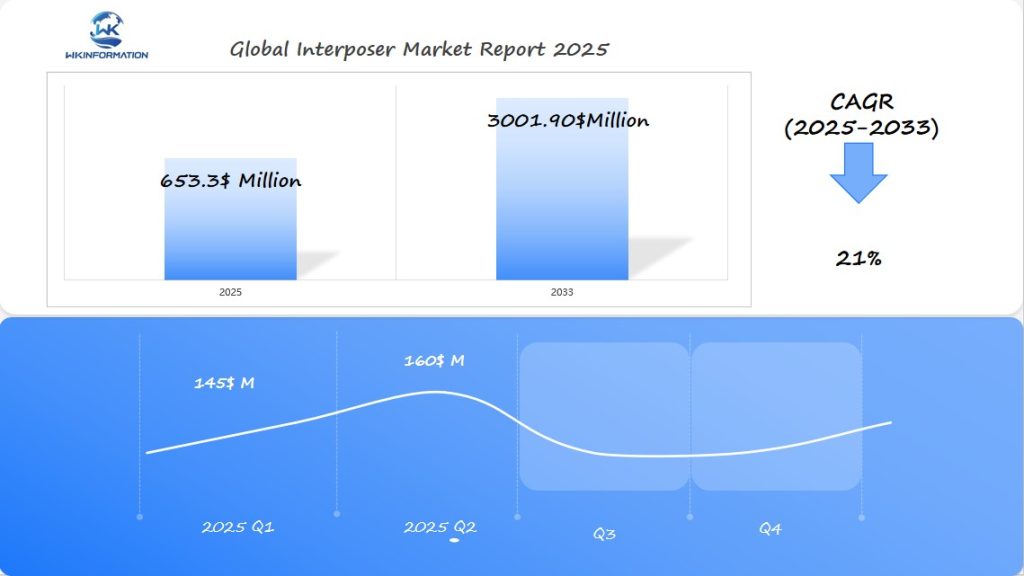

Interposer Market Set to Surge to $653.3 Million by 2025: Rapid Growth in the U.S., Japan, and South Korea

Explore the growing interposer market, key trends, barriers, and geopolitical factors shaping semiconductor packaging solutions.

- Last Updated:

Interposer Market Forecast for Q1 and Q2 2025

The global interposer market is expected to reach $653.3 million in 2025, with an impressive CAGR of 21% projected through 2033. This rapid growth is expected to be driven by the increasing demand for high-performance semiconductor technologies and advanced packaging solutions.

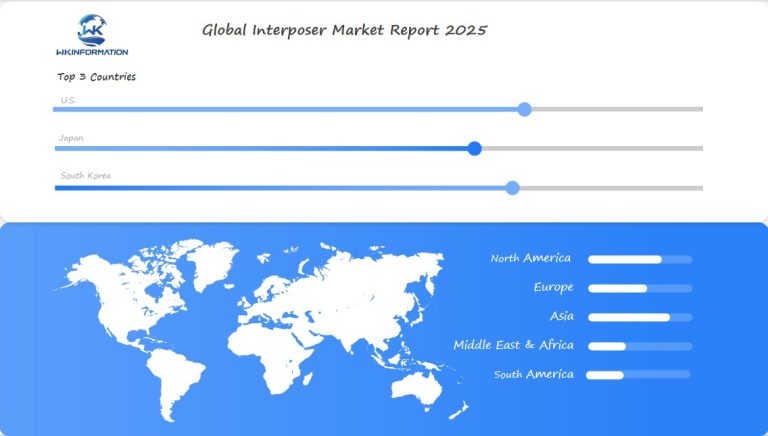

For Q1 2025, the market is forecasted to generate around $145 million, while Q2 is likely to experience a significant uptick, reaching approximately $160 million, as demand from the electronics and automotive sectors accelerates. The U.S., Japan, and South Korea are identified as key markets for interposers, with the U.S. leading in semiconductor R&D and manufacturing, Japan being a major player in electronics innovation, and South Korea contributing significantly through its robust semiconductor and tech industries. These regions are critical for a deeper understanding of the market dynamics, given their central role in the development and adoption of advanced interposer technologies.

Upstream and Downstream Forces Impacting the Interposer Market

The interposer market’s growth trajectory is shaped by complex supply chain dynamics affecting both production and demand. Understanding these forces provides crucial insights into market behavior and future opportunities.

Upstream Challenges

- Raw Material Availability: Silicon wafer shortages have created significant production bottlenecks, driving up manufacturing costs in recent months

- Equipment Dependencies: Advanced lithography tools essential for interposer production face extended lead times

- Technical Expertise: Limited availability of specialized engineering talent increases production overhead and affects scaling capabilities

Material Sourcing Complexities

- High-purity silicon wafers

- Advanced ceramic substrates

- Specialized metals for through-silicon vias (TSVs)

- Custom polymers for organic interposers

Downstream Market Forces

The demand landscape shows strong pull from multiple sectors:

- Consumer ElectronicsSmartphone manufacturers require ultra-thin interposers

- Gaming console producers seek high-performance solutions

- Wearable device makers demand flexible interposer options

- AI ApplicationsData centers need high-bandwidth memory (HBM) integration

- Edge computing devices require compact form factors

- AI accelerators demand superior thermal management

- Telecommunications5G infrastructure deployment drives demand for RF-optimized interposers

- Base station equipment requires robust thermal solutions

- Network switches need high-speed signal integrity

Supply Chain Integration

The interposer supply chain demonstrates vertical integration trends:

- Major semiconductor manufacturers acquiring specialized material suppliers

- Strategic partnerships between foundries and packaging houses

- Joint development agreements for next-generation interposer technologies

These market forces create a dynamic ecosystem where production capabilities must constantly evolve to meet changing downstream requirements. Supply chain resilience becomes critical as manufacturers balance cost pressures with increasing technical demands.

Emerging Trends in the Interposer Industry

The interposer industry is leading the way in semiconductor innovation, driven by the constant need for better performance and efficiency. Here are some of the key trends shaping the industry today:

1. Advanced Packaging Evolution

- Silicon-based interposers with through-silicon vias (TSVs)

- Glass interposers offering improved electrical performance

- Organic interposers providing cost-effective solutions

The demand for smaller devices has led to significant changes in interposer design. Manufacturers are now producing ultra-thin interposers measuring less than 100 micrometers, allowing for the creation of compact electronic devices without sacrificing performance.

2. 3D Silicon Interposer Advantages

- Enhanced thermal management capabilities

- Reduced signal latency between components

- Higher bandwidth density

- Improved power efficiency

- Better form factor optimization

The shift towards 3D silicon interposers represents a departure from traditional 2D designs. These advanced structures enable vertical stacking of components, creating high-density connections that maximize space utilization while minimizing signal delays.

3. Design Innovation Breakthroughs

- Multi-layer routing capabilities

- Advanced heat dissipation techniques

- Integrated passive components

- Flexible circuit designs

- Enhanced signal integrity solutions

Recent advancements in materials science have opened up new possibilities for interposer manufacturing. Hybrid interposers, which combine different materials like silicon and glass, offer unique advantages:

- Reduced interference between components

- Improved signal quality

- Enhanced heat transfer properties

- Better mechanical strength

- Increased reliability

The use of artificial intelligence in interposer design processes has streamlined manufacturing workflows. AI-powered tools optimize layout patterns, predict thermal behaviors, and identify potential failure points before production begins.

Barriers to Growth in the Interposer Market

The interposer market faces several significant challenges that impact its growth trajectory. These barriers create hurdles for manufacturers, developers, and industry stakeholders.

Technological Limitations

- Signal integrity issues at high frequencies

- Heat dissipation challenges in dense packaging

- Warpage problems during manufacturing

- Limited substrate size capabilities

- Complex testing and validation procedures

Manufacturing Cost Challenges

- High initial equipment investment requirements

- Expensive material costs for silicon-based interposers

- Yield management issues increasing production expenses

- Complex processing steps adding to manufacturing time

- Specialized workforce training requirements

The cost factor remains particularly significant, with manufacturers facing expenses of wafer for basic interposer production. Advanced designs can push costs, creating barriers for widespread adoption across price-sensitive markets.

Regulatory and Compliance Hurdles

- Stringent quality control requirements

- Environmental regulations affecting manufacturing processes

- Product certification delays

- International trade restrictions on semiconductor technologies

- Intellectual property protection challenges

Market-Specific Challenges

- Limited standardization across different manufacturers

- Supply chain vulnerabilities

- Competition from alternative packaging solutions

- Regional manufacturing restrictions

- Market concentration risks

These barriers create a complex landscape for interposer manufacturers. Companies must navigate technical constraints while managing cost pressures and regulatory requirements. The industry continues to seek innovative solutions through research and development initiatives, focusing on cost-effective manufacturing processes and improved design methodologies.

Geopolitical Factors Affecting Interposer Demand and Production

The interposer market is greatly influenced by global political dynamics and international relations. Trade tensions between major economies have a cascading effect on the entire semiconductor supply chain, impacting both production capabilities and market access.

Key Regional Dependencies:

- Asia-Pacific manufacturing clusters heavily depend on cross-border sourcing of components

- U.S. export controls have an impact on technology transfer and market access

- The European Union’s push for semiconductor independence affects the global distribution of supply

The concentrated nature of the semiconductor industry makes it especially susceptible to geopolitical disruptions. Taiwan’s dominant role in advanced chip manufacturing raises strategic concerns for many countries, prompting them to develop their own production capabilities.

Trade Policy Impacts:

- Tariffs imposed on semiconductor components increase production costs

- Export restrictions limit access to critical technologies

- Investment screening mechanisms can delay or prevent important acquisitions

Recent changes in global trade policies have led manufacturers to think about diversifying the locations of their production facilities. This redistribution of manufacturing capabilities opens up new opportunities for emerging markets, but it may also lead to higher costs due to investments in duplicate infrastructure.

Regional Manufacturing Considerations:

- Building resilience in the supply chain through multi-location production

- Meeting local content requirements in various markets

- Forming strategic partnerships between countries for technology development

The introduction of new semiconductor policies in major economies indicates a trend towards increased government involvement in the industry. These policies often include significant funding for domestic chip production, which creates new dynamics in the competitive landscape of the interposer market.

Exploring Interposer Market Segmentation by Type and Material

The interposer market divides into two primary categories: silicon interposers and organic interposers. Each type brings distinct advantages and limitations that influence their applications across different industries.

Silicon Interposers

- High thermal conductivity enabling efficient heat dissipation

- Superior electrical performance with minimal signal loss

- Excellent dimensional stability for precise component placement

- Compatible with existing semiconductor manufacturing processes

- Higher cost structure due to complex manufacturing requirements

Organic Interposers

- Cost-effective manufacturing process

- Greater flexibility in design modifications

- Lower thermal conductivity compared to silicon variants

- Reduced mechanical strength

- Suitable for less demanding applications

Material selection plays a crucial role in determining interposer performance characteristics. The choice of materials affects:

- Signal IntegritySilicon-based solutions offer superior signal transmission

- Lower signal degradation in high-frequency applications

- Reduced crosstalk between adjacent channels

- Thermal ManagementSilicon interposers provide better heat dissipation

- Organic variants require additional cooling solutions

- Temperature stability affects long-term reliability

- Mechanical PropertiesSilicon offers higher structural rigidity

- Organic materials provide better shock absorption

- Coefficient of thermal expansion matching with substrates

The market segmentation extends beyond basic material choices to include specialized variants:

- Glass interposers for specific optical applications

- Ceramic interposers for high-temperature environments

- Hybrid solutions combining multiple materials

These material choices directly impact manufacturing processes and end-product performance. Silicon interposers dominate high-performance computing applications, while organic variants find their place in consumer electronics where cost considerations outweigh performance requirements.

Recent developments in material science have introduced new possibilities for interposer design, including advanced composite materials that aim to bridge the gap between silicon and organic options. These innovations continue to reshape market segmentation and expand application possibilities.

How Applications Are Shaping the Interposer Market Demand

The growth of the interposer market is directly connected to its wide range of uses in various industries. The consumer electronics sector is leading this demand increase, with smartphones being a major driving force. To accommodate advanced features while keeping slim designs, modern smartphones need more intricate semiconductor packaging solutions.

Key Consumer Electronics Applications:

- Smartphones integrating multiple processing units

- Smart wearables with enhanced connectivity features

- Gaming consoles demanding high-performance computing

- Tablets with advanced graphics capabilities

The field of artificial intelligence (AI) offers significant opportunities for the interposer market to expand. AI accelerators require effective heat dissipation and excellent signal integrity – qualities that interposers are known for providing.

AI-Driven Demand Factors:

- Data center applications requiring high-bandwidth memory

- Edge computing devices with complex processing needs

- Machine learning hardware acceleration

- Neural network processing units

The rollout of 5G infrastructure is another major source of demand for interposer technology. The requirement for advanced semiconductor packaging solutions in 5G base stations and network equipment is propelling market growth.

5G Infrastructure Requirements:

- High-frequency signal management

- Thermal performance optimization

- Power distribution efficiency

- System-level integration capabilities

As the automotive industry shifts towards electric and self-driving vehicles, new uses for interposer technology are emerging:

Automotive Electronics Applications:

- Advanced driver-assistance systems (ADAS)

- In-vehicle infotainment systems

- Battery management systems

- Vehicle-to-everything (V2X) communication modules

The Internet of Things (IoT) ecosystem is another area where interposers are finding applications. Smart devices within this ecosystem require sophisticated packaging solutions to ensure proper functionality within compact designs. These specific applications necessitate interposers that can offer:

- Multi-chip integration

- Reduced power consumption

- Enhanced signal routing

- Improved thermal management

Global Interposer Market Dynamics: Trends And Insights

The global interposer market shows great potential for growth, with current estimates indicating a strong upward trend towards reaching high by 2025. According to research data, there is an expected compound annual growth rate (CAGR) of depth during the forecast in 2025.

Key Growth Factors

Several factors are driving this growth:

- Increased Demand: The semiconductor industry’s shift towards advanced packaging solutions has led to a significant increase in the use of interposers.

- Investment Trends: Major players in the industry have raised their research and development (R&D) budgets by little specifically for interposer technology.

- Geographic Distribution: The Asia-Pacific region holds a half market share, followed by North America with less.

Recent Trends in Procurement Strategies

Recent market research indicates a shift in procurement strategies, with manufacturers adopting long-term supply agreements to ensure steady availability of components. This trend has resulted in aincrease in advance booking commitments compared to previous years.

Future Projections

Industry analysts project that the market’s value proposition will strengthen as production costs decrease through technological improvements and economies of scale. The average cost per unit is expected to decline by low annually, making interposers increasingly attractive for broader applications.

The U.S. Interposer Market: Opportunities and Insights

The U.S. interposer market is at the forefront of technological innovation, driven by Silicon Valley’s semiconductor ecosystem and substantial R&D investments. American tech giants like Intel, AMD, and Qualcomm are pushing the boundaries of interposer technology through strategic partnerships with foundries and research institutions.

Key market drivers in the U.S. include:

- Data Center Expansion: The rapid growth of cloud computing facilities demands high-performance computing solutions

- Defense Applications: Military and aerospace sectors require advanced packaging solutions for mission-critical systems

- AI/ML Development: Research in artificial intelligence creates demand for sophisticated chip integration

The U.S. CHIPS Act has allocated money to strengthen domestic semiconductor manufacturing, research, and workforce development. This investment directly impacts interposer production capabilities:

- Enhanced manufacturing infrastructure

- Research funding for next-generation packaging solutions

- Development of skilled workforce in semiconductor packaging

Regional manufacturing hubs in Arizona, Texas, and New York are expanding their capabilities in advanced packaging technologies. These facilities focus on:

- 2.5D and 3D integration solutions

- High-bandwidth memory applications

- Mixed-signal device integration

U.S. manufacturers are prioritizing innovation in organic interposers, offering cost-effective alternatives to silicon-based solutions while maintaining performance standards required by emerging applications.

Japan's Influence on Interposer Market Expansion

Japan’s semiconductor industry plays a crucial role in shaping the global interposer market through its advanced manufacturing capabilities and technological innovations. The country’s expertise in materials science and precision engineering has established it as a key contributor to interposer development.

Key Market Drivers in Japan:

- Strong presence of major semiconductor manufacturers like Fujitsu and Renesas

- Advanced research facilities dedicated to interposer technology development

- Robust supply chain for specialized materials and components

Japanese companies have pioneered several breakthroughs in interposer technology, particularly in the development of glass interposers. These innovations offer superior electrical performance and thermal management compared to traditional silicon-based alternatives.

Strategic Investments and Partnerships

Japanese firms are actively forming strategic alliances with global technology leaders to enhance their interposer manufacturing capabilities:

- Joint ventures with European semiconductor companies

- Collaboration with U.S.-based chip designers

- Technology sharing agreements with South Korean manufacturers

The country’s commitment to quality control and precision manufacturing has resulted in high-reliability interposer solutions, particularly valued in automotive and industrial applications. Japanese manufacturers maintain strict quality standards, achieving defect rates significantly lower than industry averages.

Recent investments in automation and smart manufacturing processes have positioned Japanese facilities at the forefront of interposer production efficiency. These advancements enable higher throughput while maintaining the exceptional quality standards Japanese manufacturers are known for.

South Korea's Role in Interposer Growth

South Korea is a major player in the interposer market, thanks to industry leaders such as Samsung Electronics and SK Hynix. The country’s strategic investments in semiconductor manufacturing and advanced packaging technologies make it a key player in shaping the global interposer landscape.

Key Market Drivers in South Korea:

- Strong government support through initiatives like the K-Semiconductor Strategy

- Extensive R&D investments in 2.5D and 3D packaging solutions

- Robust intellectual property protection frameworks

- Advanced manufacturing facilities equipped with cutting-edge technology

South Korean manufacturers have developed proprietary interposer technologies that deliver enhanced performance metrics:

- Reduced power consumption

- Improved signal integrity through advanced TSV designs

- Higher bandwidth capabilities for next-generation computing applications

The country’s semiconductor ecosystem benefits from close collaboration between research institutions and industry leaders. The Korea Advanced Institute of Science and Technology (KAIST) partners with major manufacturers to develop innovative interposer solutions, focusing on:

- Advanced materials research

- Novel fabrication techniques

- Cost-effective production methods

- Integration optimization strategies

South Korean companies have secured significant market share through their focus on high-performance computing applications and memory-intensive devices. Their expertise in memory chip production creates unique advantages in developing specialized interposer solutions for these applications.

Future Outlook for the Interposer Market

The interposer market is expected to undergo significant changes and developments by 2033. Industry analysts predict that the interposer market will continue to grow between 2025 and 2033. This growth is primarily driven by emerging technologies and expanding applications.

Key factors driving growth:

AI and machine learning integration: The rise of AI devices requires sophisticated interposer solutions that can handle increased computational loads

6G development: Research into 6G technology creates opportunities for advanced interposer designs with enhanced signal processing capabilities

Quantum computing: The field of quantum computing requires specialized interposer solutions to manage complex quantum circuits.

Upcoming Technological Advancements:

- Next-generation materials incorporating graphene and carbon nanotubes

- Self-healing interposer designs that extend product lifespan

- Bio-compatible interposers for medical device applications

The manufacturing processes in the market are also likely to undergo significant changes. Automated production lines and AI-driven quality control systems have the potential to reduce costs while improving yield rates. These advancements could make interposer technology more accessible to smaller manufacturers, thereby expanding its market reach.

Research suggests that there may be breakthroughs in thermal management and power efficiency as well. Scientists are currently exploring innovative cooling solutions and energy-harvesting capabilities that can be integrated directly into interposer designs. This research aims to address existing limitations in heat dissipation and power consumption associated with traditional interposer technologies.

Competitive Forces in the Interposer Market

The interposer market is highly competitive, with major players competing for control.

Key Players:

- TSMC (Taiwan Semiconductor Manufacturing Company)— Taiwan

- Samsung Electronics (Semiconductor Division)— South Korea

- Intel Corporation— United States

- Amkor Technology— United States

- JCET Group (Jiangsu Changjiang Electronics Technology)— China

- ASE Technology Holding— Taiwan

- Powertech Technology Inc. (PTI)— Taiwan

- Xperi Corporation— United States

- Allegro Microsystems— United States

- Teledyne DALSA— Canada

Overall

| Report Metric | Details |

|---|---|

| Report Name | Interposer Market Report |

| Base Year | 2024 |

| Segment by Type | · Silicon Interposers

· Organic Interposers |

| Segment by Application | · Consumer Electronics

· AI · 5G Infrastructure · Automotive Electronics · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The interposer market is expected to grow to $653.3 million by 2025, showing how important it is for advancing semiconductor technology. This growth is driven by increasing demand in various industries, especially in the U.S., Japan, and South Korea.

These challenges also present opportunities for innovation and differentiation in the market. As industries like cloud computing, artificial intelligence (AI), and 5G continue to grow, there will be a greater demand for advanced packaging solutions such as interposers in semiconductor development.

The future looks promising for all stakeholders involved in the interposer market. Companies that invest in research and development, particularly in finding ways to manufacture more cost-effectively and improve performance capabilities, have the potential to capture a significant share of this rapidly changing market.

Global Interposer Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Interposer Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Interposer MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global InterposerPlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Interposer Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Interposer Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Interposer Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Interposer MarketInsights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the interposer market and why is it significant in semiconductor applications?

The interposer market refers to the sector involved in the production and utilization of interposers, which are crucial components in semiconductor packaging. They enable better connectivity between chips and improve overall performance, making them significant for various applications including consumer electronics, AI, and telecommunications.

What factors are driving growth in the interposer market?

Growth in the interposer market is primarily driven by advancements in technology, increasing demand from industries such as consumer electronics and AI applications, and trends towards miniaturization and advanced packaging techniques.

What are some emerging trends in the interposer industry?

Key emerging trends include the miniaturization of electronic components, the adoption of advanced packaging technologies like 3D silicon interposers, which provide enhanced performance compared to traditional options.

What barriers are hindering growth in the interposer market?

Barriers to growth include technological challenges related to current interposer solutions, high manufacturing costs, and potential regulatory hurdles that manufacturers may face when introducing new products.

How do geopolitical factors impact the interposer market?

Geopolitical factors such as global trade policies, regional manufacturing hubs, and geopolitical tensions can significantly affect both demand for interposers and production capabilities. These factors influence supply chain dynamics and market accessibility.

Which applications are shaping demand for interposers?

Key applications driving demand for interposers include consumer electronics like smartphones and wearables, as well as emerging technologies such as AI accelerators and 5G infrastructure that require sophisticated semiconductor solutions with advanced packaging techniques.