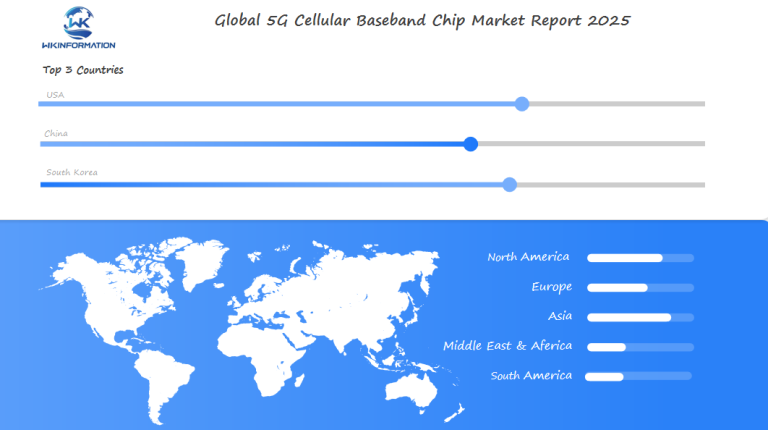

2025 Global 5G Cellular Baseband Chip Market Insights Uncovering $18.8 Billion Opportunities in the United States, China, and South Korea

The 5G Cellular Baseband Chip Market sees fierce competition between the US, China, and South Korea for 5G dominance.

- Last Updated:

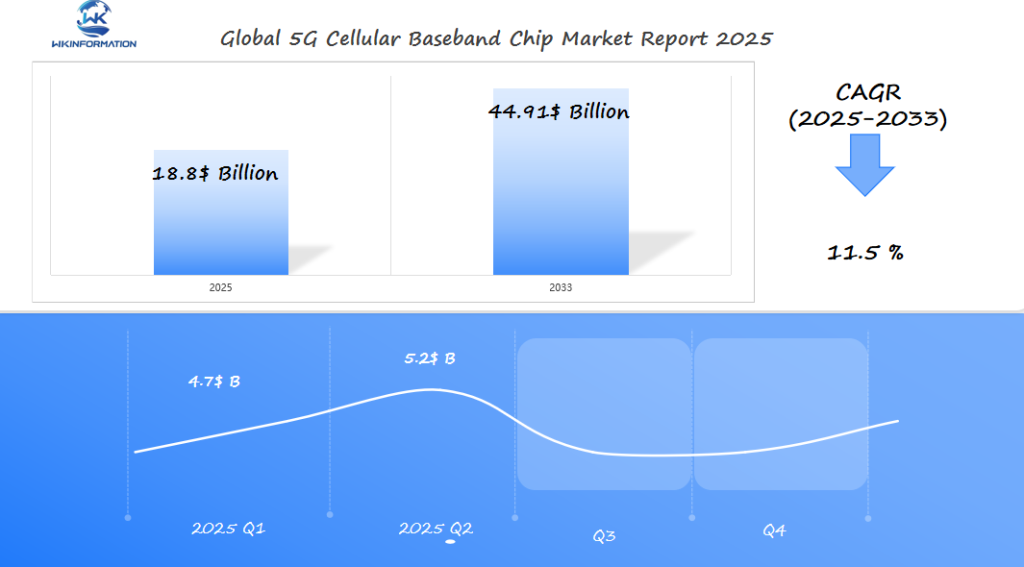

5G Cellular Baseband Chip Market Forecast for Q1 and Q2 of 2025

The 5G Cellular Baseband Chip market, valued at USD 18.8 billion in 2025, is expected to experience rapid growth, with a CAGR of 11.5% from 2025 to 2033. By the end of Q1 2025, the market size is predicted to reach approximately USD 4.7 billion, as 5G networks expand and demand for compatible devices surges. By Q2 2025, the market is expected to grow to around USD 5.2 billion, driven by the continued deployment of 5G infrastructure and the adoption of 5G-enabled devices.

The United States, China, and South Korea are the primary countries driving this market, with their advanced positions in telecommunications, mobile device manufacturing, and semiconductor development. The US will continue to lead in terms of technological innovation and infrastructure development, while China’s vast consumer market and investments in 5G technology will propel growth. South Korea, one of the earliest adopters of 5G networks, will continue to drive demand for advanced baseband chips as it scales up 5G deployment.

Key Takeaways

- U.S. and China lead the $18.8B 5G cellular baseband chip market opportunity by 2025.

- Telecom infrastructure investment is accelerating sub-6GHz and mmWave baseband chip development.

- Baseband processor market growth ties directly to 5G chipset advancements and device integration.

- Analysts expect the 2025 5G market forecast to prioritize energy-efficient solutions for consumer and industrial use cases.

- Risinging cellular modem market demand reflects global 5G network expansions and enterprise adoption.

Exploring the Upstream and Downstream Chain in the 5G Cellular Baseband Chip Market

very 5G device has a complex supply chain. It starts with raw materials and ends with devices in our hands. Each step is crucial for innovation and cost.

Key parts include semiconductor manufacturing and the chip fabrication process. These shape how much we can make worldwide.

Raw Material Suppliers and Component Manufacturing

Silicon wafers, rare metals, and special equipment are vital. Companies like TSMC and Intel lead in making chips. They use advanced methods to create working chips.

These chips then go to baseband integration phases.

- Upstream Drivers: Rare earth mining, lithography tools, and cleanroom facilities

- Manufacturing Hubs: Taiwan, South Korea, and the U.S. are at the forefront

Integration, Distribution, and End-Use Applications

Baseband integration turns chips into useful modules. Companies like Apple and Samsung use these. Telecom equipment providers like Ericsson and Huawei also depend on them for 5G networks.

Distribution networks then spread these technologies worldwide.

| Stage | Key Players | Impact |

|---|---|---|

| Upstream | Materials suppliers, semiconductor foundries | Production efficiency and cost stability |

| Downstream | Device makers, telecom providers | Market adoption rates and innovation speed |

Changes in any part, like semiconductor manufacturing delays, can affect the whole chain. Finding a balance will shape the market’s future.

Key Market Trends Shaping the Future of 5G Cellular Baseband Chips

New trends in 5G chips are changing how we connect and perform. Companies are focusing on cellular baseband innovation. They aim to make devices faster, smarter, and use less energy.

Miniaturization and Power Efficiency Improvements

Chips are getting smaller and more power-efficient. They now fit in wearables and IoT devices without losing speed. Qualcomm’s latest Snapdragon platforms, for example, cut down power use. This helps devices last longer on a single charge.

Integration with AI and Edge Computing Capabilities

Baseband chips are teaming up with AI processors for on-device learning. This move supports edge computing, making apps work faster. Samsung’s Exynos series shows this trend, adding neural processing units to modems.

Multi-mode baseband chips are also important. They work with both sub-6GHz and mm-Wave technology. This makes global connectivity smooth. Plus, integrated modem solutions combine 5G with application processors. This simplifies device design and cuts costs.

Navigating the Challenges and Restrictions in the 5G Cellular Baseband Chip Market

Creating 5G cellular baseband chips faces many technical and regulatory obstacles. These issues affect global supply chains and innovation. 5G chip production challenges come from semiconductor supply constraints and technical hurdles like baseband chip thermal issues. These problems can reduce device performance.

Companies also struggle with RF interference management. This is crucial for maintaining stable high-frequency communication.

Technical Hurdles in Advanced Node Manufacturing

- Heat dissipation in small designs causes baseband chip thermal issues. Engineers must redesign cooling systems.

- RF interference management is tough at millimeter-wave frequencies. It requires advanced shielding and antenna layouts.

- Semiconductor supply constraints can delay production. Foundries like TSMC and Samsung face limits for 3nm nodes.

Regulatory and Compliance Considerations

Meeting chip certification requirements across regions is complex. For example, U.S. ITAR regulations and EU RoHS directives must be followed. Network compatibility issues also exist due to mixed 4G/5G infrastructures. This forces chipmakers to support legacy protocols.

Qualcomm and Intel now focus on backward-compatible designs. This helps address these compatibility gaps.

“Balancing compliance with innovation is critical to avoiding market exclusion,” states a 2023 IEEE report on 5G supply chain resilience.

Despite these challenges, companies are finding ways to overcome them. Strategies like regionalized production hubs and AI-driven thermal modeling are helping.

Geopolitical Factors Influencing the 5G Cellular Baseband Chip Market

Global 5G markets face big challenges due to geopolitical tensions. Nations are focusing on keeping control over 5G technology. Trade wars between the U.S. and China have caused problems in chip supply chains.

Companies are now trying to balance their need for market access with national security. This is changing how they form partnerships.

Trade Tensions and Technology Nationalism

The U.S. has put limits on chip exports to China, affecting companies like Huawei. China has responded by limiting its own chip exports. This has made it hard for companies to find reliable suppliers.

Intel and TSMC are building factories in the U.S. to meet these new rules. This shows how trade tensions are changing the chip industry.

Strategic Industry Policies and Government Investments

Governments are using policy to gain an edge in the chip market. The U.S. is investing $52 billion in chip production with the CHIPS Act. The EU wants to take 20% of the global market by 2030 with its Chips Act.

These moves show how governments see semiconductors as key to their success. South Korea is also investing big in chip production, showing Asia’s push for 5G leadership.

Qualcomm and Samsung are focusing on making chips in their own regions. This move is about avoiding national security risks. It will shape who leads in the 5G world.

Market Segmentation Analysis of 5G Cellular Baseband Chips and Technologies

5G cellular baseband chips are split into different groups. This is based on 5G frequency bands and what they’re used for. mmWave baseband processors and sub-6GHz chipsets serve various markets. Meanwhile, consumer device chips and industrial baseband solutions meet growing needs in different industries.

Sub-6GHz vs. mmWave Baseband Solutions

The market is divided by 5G frequency bands. Sub-6GHz chipsets are used in cities and rural areas because they cover more ground and are cheaper. On the other hand, mmWave baseband processors offer super-fast speeds in crowded cities but need lots of towers.

How these networks are set up also matters. Standalone vs non-standalone 5G setups differ. Standalone networks use mmWave for dedicated 5G, while non-standalone combines 4G and 5G for wider coverage.

| Segment | Key Features | Use Cases |

|---|---|---|

| Sub-6GHz | Long-range, low latency | Rural connectivity, IoT |

| mmWave | High bandwidth, short-range | Urban hotspots, AR/VR |

Consumer vs. Industrial Application Segments

Consumer device chips are in phones and wearables, focusing on being affordable. Qualcomm’s Snapdragon X65 modem is a good example, offering good performance at a low cost. Industrial baseband solutions, however, are about reliability and security for things like factories and smart grids. Intel’s XMM 8000 series is designed for industrial IoT, with tough designs.

“Industrial segments demand 5G chips with 10x higher reliability than consumer devices.” – 2023 GSMA Report

Knowing these segments helps investors find areas with the most growth. This includes chips for cars or sub-6GHz chipsets for global coverage.

Exploring the Diverse Applications of 5G Cellular Baseband Chips

5G cellular baseband chips are changing the game in many fields. They’re not just for 5G in smartphones anymore. Now, they power self-driving cars and smart factories too. Let’s see how this tech is changing our lives and work.

Smartphones and Consumer Electronics

5G in smartphones is still big, but new areas are opening up. AR/VR connectivity chips make gaming and training super immersive. Cars get automotive 5G applications for fun and updates, and wearables track health in real time.

Industrial IoT and Enterprise Solutions

Factories use industrial IoT baseband chips to make production smoother and cut downtime. Fixed wireless access brings fast internet to far-off places. In healthcare, 5G in healthcare devices helps with remote checks and surgeries, making telemedicine more popular.

| Application | Key Features | Market Potential |

|---|---|---|

| Automotive 5G applications | Real-time traffic updates, autonomous driving data | $8.3B global market by 2025 |

| Industrial IoT baseband | Predictive maintenance, supply chain tracking | Expected 20% annual growth through 2025 |

| 5G in healthcare devices | Remote patient monitoring, telemedicine | $1.2B healthcare market expansion |

Regional Market Analysis for 5G Cellular Baseband Chips

Global 5G chip distribution shows big differences in how regions approach 5G. Spectrum policies and infrastructure readiness play big roles. This shows clear patterns in 5G baseband adoption across regions.

Market Growth Across Key Regions

APAC leads in baseband growth, thanks to China’s big push and India’s growing phone market. Europe, on the other hand, focuses on regional frequency band allocation. They use mid-band spectrums for reliable coverage in cities. Emerging markets grow slowly due to lack of infrastructure but offer chances for affordable chips.

| Region | Growth Rate (2025) | Key Drivers |

|---|---|---|

| Asia-Pacific | 14.2% | Mass smartphone production and 5G subsidies |

| Europe | 9.8% | Standardized spectrum policies |

| Emerging Markets | 16.5% | Rural network expansion plans |

Regional Technology Preferences

How regions choose frequency bands affects baseband design. Europe uses 3.5GHz, while North America mixes mmWave and sub-6GHz. Low-band chips are preferred in developing nations for wide coverage. This leads to a mix of global 5G chip distribution needs, requiring suppliers to tailor their products.

- APAC: Prioritizes cost-efficient mmWave solutions for cities

- Europe: Emphasizes interoperability between devices

- Emerging markets: Focus on sub-6GHz for rural reach

Regional rules also impact how long it takes to get certified. Companies must meet regional baseband demand while managing global supply chains. This is key to success in diverse markets.

US Market Trends for 5G Cellular Baseband Chips

The US is changing how it makes 5G cellular baseband chips. The CHIPS Act impact is key, bringing billions in funding to boost US chip manufacturing. This helps reduce our need for chips made overseas. It also helps companies like Qualcomm and Intel compete worldwide.

- Policy Priorities: The CHIPS Act focuses on US chip manufacturing, aiming for 20% of global capacity by 2030.

- Infrastructure Growth: More money for American 5G infrastructure means carriers like Verizon and AT&T use chips made in the US. This makes their networks more reliable.

Now, US baseband suppliers face a challenge. They must keep costs down while meeting carriers’ needs for fast and reliable chips. The US semiconductor policy also encourages partnerships between tech companies and the government. This helps fix supply chain problems.

For example, TSMC’s new factory in Texas is making chips for 5G. It’s aiming for 3-nanometer chips, which are very fast.

“The CHIPS Act isn’t just about factories—it’s about rebuilding a resilient ecosystem.” —半导体行业协会报告, 2024

Qualcomm is a big player, but startups like Xnor AI are coming up with new, energy-saving chips. This shows a move towards more local innovation. It’s driven by government support and plans to grow American 5G infrastructure.

As carriers finish their 5G plans, they’re focusing on making sure they use chips made in the US. This is important for both technical and political reasons.

China's Role in the Growth of 5G Cellular Baseband Chips

China’s domestic semiconductor initiative and Made in China 2025 plan are changing the 5G chip world. They focus on China baseband self-sufficiency to cut down on foreign tech. Chinese 5G chip manufacturers like Huawei’s HiSilicon and UNISOC are leading the

Domestic Innovation and Self-Sufficiency Efforts

Government support and tech parks help build Chinese 5G infrastructure. HiSilicon’s Kirin chips and UNISOC’s 5G solutions power millions of devices in China. Key achievements include:

- 2023 saw 70% of 5G baseband designs from local firms

- State-backed R&D funds exceeding $20 billion allocated since 2020

China’s Global Market Impact and Export Strategy

Exports of 5G chips to Africa and Latin America rose 40% in 2023. Key markets include:

| Region | Export Growth |

|---|---|

| Africa | 55% |

| Asia | 35% |

| Latin America | 45% |

These efforts make China a strong contender by 2025. It uses its domestic semiconductor initiative to lead in both local and global 5G markets.

South Korea's Contribution to the 5G Cellular Baseband Chip Market

South Korea’s Korean semiconductor industry is key in 5G advancements. Samsung’s Samsung baseband chips, especially Exynos modems, are in top devices worldwide. Early Korean 5G deployment helped test new tech, making Korean telecom requirements top-notch.

Samsung’s Baseband Innovation and Market Impact

- Samsung’s Exynos modems compete with Qualcomm’s Snapdragon X65, offering efficient 5G.

- Vertical integration combines chip design with manufacturing, cutting down on product cycle time.

Collaboration and Global Expansion

Device integration expertise from Samsung and SK Hynix makes 5G work well in wearables and IoT. Partnerships between KT and chipmakers speed up Korean 5G deployment standards.

“South Korea’s telecom infrastructure demands have pushed baseband innovation further than anywhere else,” said a 5G analyst at Strategy Analytics.

By matching Korean semiconductor industry strengths with global 5G needs, Samsung’s chips power over 15% of global 5G devices. This teamwork keeps ‘s tech leadership strong worldwide.

Future Outlook: Innovations in the 5G Cellular Baseband Chip Market

Engineers are working on new future baseband architecture for the 6G era. They focus on 6G readiness, making chips ready for new standards while still working with today’s networks. The aim is to move to faster, lower-latency systems without changing everything.

AI is being added directly to chips through integrated AI processing. This lets devices do tasks like network optimization and data analysis right on the chip. For example, a phone could adjust its speed based on where you are, making things smoother and saving battery.

Security is a big deal. New quantum-secure baseband solutions use encryption that quantum computers can’t break. Also, holographic communication chips are coming, offering 3D video calls and immersive AR/VR, combining wireless data with spatial computing.

There’s also big progress in low-power baseband innovation. This tech could make batteries last 50% longer in some cases. It’s for always-on IoT sensors in fields like agriculture and healthcare, lasting years without needing a charge. Qualcomm and Intel are already testing these ideas.

- Next-gen materials like gallium nitride improve heat management and signal clarity.

- AI-driven signal processing reduces interference in crowded urban areas.

- Hybrid silicon-germanium substrates cut power consumption by 30%.

These changes make baseband chips key to 6G’s goal of widespread connectivity. From smart factories to self-flying drones, the future will see baseband tech as the core of a fully connected world.

Competitive Landscape in the 5G Cellular Baseband Chip Market

-

Qualcomm – United States

-

Huawei – China

-

Samsung – South Korea

-

Intel – United States

-

MediaTek – Taiwan

-

Unisoc – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global 5G Cellular Baseband Chip Market Report |

| Base Year | 2024 |

| Segment by Type |

· Single-Mode Chip · Multi-Mode Chip · High-Performance Chips · Low-Power Chips |

| Segment by Application |

· Communication · Consumer Electronics · Automobile Electronics · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The pursuit of global 5G leadership is now more fervent than ever, with the United States, China, and South Korea at the forefront. Each nation is capitalizing on its distinct advantages to outmaneuver competitors in the 5G cellular baseband chip market. Yet, the ultimate victors will be those who successfully exploit 5G’s vast potential to spur technological advancement and stimulate economic expansion.

The 5G future beckons with boundless possibilities, poised to reshape industries, redefine urban environments, and elevate individual capabilities in ways previously unimaginable. From the advent of self-driving cars to the expansion of telemedicine, 5G’s applications are as vast as the creativity of innovators and the dedication of policymakers. To sustain global leadership in this pivotal domain, countries must persist in funding research, nurturing collaborative endeavors, and establishing stringent regulatory structures. These measures are crucial to ensure the secure and fair implementation of 5G networks.

Global 5G Cellular Baseband Chip Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: 5G Cellular Baseband Chip Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- 5G Cellular Baseband Chip Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global 5G Cellular Baseband Chip Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: 5G Cellular Baseband Chip Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: 5G Cellular Baseband Chip Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: 5G Cellular Baseband Chip Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of 5G Cellular Baseband Chip Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the main drivers of growth in the 5G cellular baseband chip market?

The main drivers are high-speed data demand, IoT device growth, and cloud computing advancements. Also, 5G adoption in sectors like automotive and healthcare boosts the market.

How does the supply chain for 5G baseband chips operate?

It starts with raw material suppliers like silicon wafers and rare earth metals. These are then used by manufacturers to make chips. The chips are sold to phone makers and telecom operators.

What trends are influencing the design of 5G baseband chips?

Trends include making chips smaller for better portability and more efficient to save battery life. They also integrate AI and edge computing. These are key for next-gen devices.

What challenges does the 5G baseband chip market face?

Challenges include managing heat and signal integrity at high frequencies. There are also regulatory hurdles, supply chain issues, and the need to innovate profitably.

How do geopolitical factors impact the 5G market?

Tensions between the US and China affect the market. These tensions can lead to trade restrictions and impact technology transfer. This affects the global supply chain and competition.

What are the primary applications of 5G cellular baseband chips?

They’re used in smartphones, consumer electronics, IoT devices, smart vehicles, and telehealth. They enable advanced connectivity in these areas.

What investment opportunities exist in the 5G baseband chip market?

Opportunities include industrial applications, AI, and edge computing. Also, companies targeting specific niches or emerging markets are promising.

How do major players like Qualcomm and MediaTek compare in the market?

Qualcomm leads with advanced tech, while MediaTek is growing fast with competitive options. Their strategies and products shape the market.

How do regional preferences affect the 5G baseband chip market?

North America wants high-performance, Europe values privacy and green tech, and Asia-Pacific adopts quickly. Each region influences 5G tech development differently.