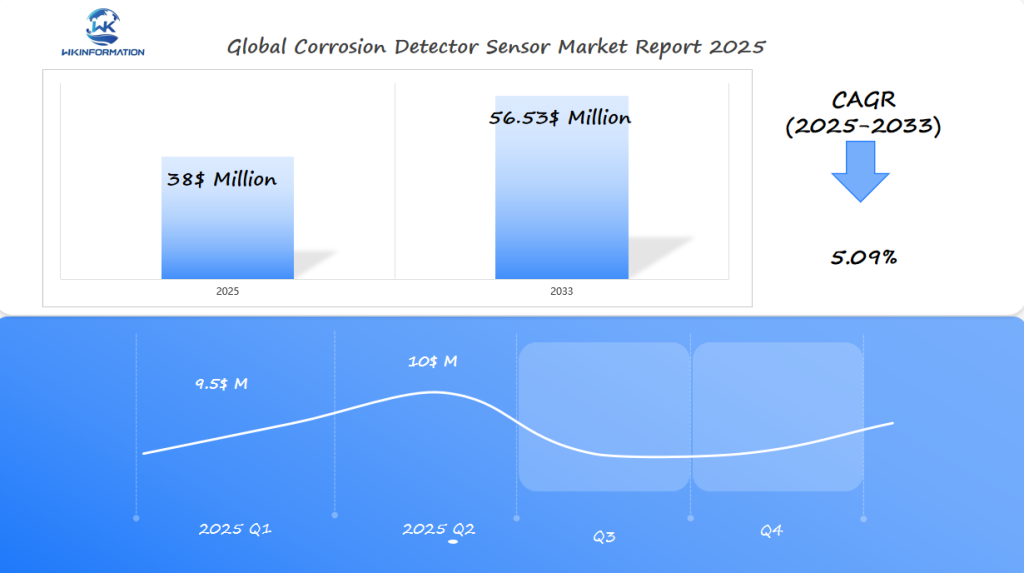

2025 Global Corrosion Detector Sensor Market Insights Unlocking Opportunities in the US, China, and Germany with $38 Million Potential

Explore the evolving Corrosion Detector Sensor Market trends, growth drivers, and key players. Gain insights into advanced monitoring solutions, industry applications, and technological innovations shaping corrosion detection systems through 2025.

- Last Updated:

Corrosion Detector Sensor Market Outlook for Q1 and Q2 of 2025

The global Corrosion Detector Sensor market, estimated at USD 38 million in 2025, is poised for steady growth as industries increasingly recognize the importance of preventing corrosion-related damage to critical infrastructure. With a projected CAGR of 5.09% from 2025 to 2033, the market is expected to reach approximately USD 9.5 million by the end of Q1 2025, and USD 10 million by Q2 2025. This growth will be particularly driven by sectors such as oil and gas, automotive, aerospace, and construction, where corrosion is a significant concern.

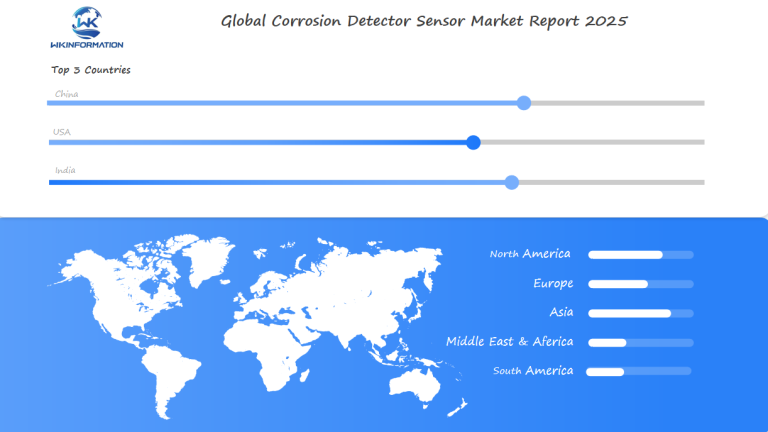

The US, Germany, and China are expected to be the leading countries in this market due to their expansive industrial activities, particularly in high-risk industries. In the US, the push for smarter maintenance systems in oil and gas and infrastructure sectors will drive demand for corrosion sensors. Germany’s strong industrial base, particularly in manufacturing and automotive, will also contribute to the need for these technologies. Meanwhile, China, with its rapid industrial growth and focus on modernization, is expected to see a significant uptake in corrosion monitoring solutions.

Corrosion Detector Sensor Market Upstream and Downstream Industry Chain Analysis and Insights

Every corrosion detector sensor has a network of suppliers and partners. The corrosion sensor supply chain includes raw material providers, component makers, and tech innovators. A 2023 IndustryArc study shows that advancements in materials science are crucial for sensor design. This system supports industries from energy to maritime.

Raw Material Suppliers and Manufacturing Process

Key materials are semiconductor components and corrosion-resistant alloys. Suppliers ensure a steady supply of these materials. Industrial sensor manufacturing involves steps like microfabrication and quality testing. Companies like TE Connectivity and Bosch use automation to improve production efficiency.

Nanotechnology and IoT-ready designs are now key in R&D. They boost sensor accuracy and durability.

End-User Industries and Value Chain Integration

Downstream, end-users like oil and gas firms and infrastructure developers need a smooth corrosion monitoring value chain. Partnerships with tech providers offer real-time data analytics. Emerson Electric works with cloud service providers for AI-driven solutions.

These partnerships help reduce downtime in critical sectors. Strong ties between suppliers and end-users also boost adoption in emerging markets like Southeast Asia.

Regional dynamics are important too. Asia-Pacific manufacturers use cost-effective industrial sensor manufacturing to meet global demand. This shows how supply chain agility and tech alliances shape the market.

Current Trends Shaping the Corrosion Detector Sensor Market

New technologies are changing how we fight corrosion. Here’s how innovation is leading to smarter solutions:

IoT Integration and Remote Monitoring Capabilities

Wireless corrosion sensors now link up through IoT corrosion monitoring systems. This lets engineers share data in real-time across the globe. They can check on metal wear in oil refineries or bridges from anywhere, using mobile apps.

This IoT corrosion monitoring cuts down on inspection costs and downtime by 30% in many cases.

Miniaturization and Enhanced Sensor Sensitivity

- Sensors as small as a coin can spot corrosion in tight spots like airplane wings or pipelines.

- These tiny wireless corrosion sensors use less power but still keep their accuracy.

- Construction companies use them in concrete structures for ongoing health checks.

Predictive Analytics and AI-Driven Solutions

AI-powered corrosion detection systems look at years of data to forecast failures before they happen. They flag risks in power plants or chemical facilities, reducing emergency repairs by 40%. Companies like Siemens and Emerson are at the forefront with AI-powered corrosion detection platforms. These platforms work with existing SCADA systems.

These trends show how technology is making corrosion management proactive, not just reactive. The mix of IoT, AI, and nanotechnology is raising the bar for how long our infrastructure lasts.

Key Restrictions in the Corrosion Detector Sensor Market

Advances in sensor tech are growing the market. Yet, it faces many challenges. These include technical issues and high costs. Overcoming these is crucial for the market’s full growth.

Technical Limitations and Accuracy Challenges

There are sensor technology challenges like accuracy issues in harsh conditions. For instance, sensors might not work well in salty environments or miss early signs of corrosion. Companies like Emerson and Siemens are working on solutions. They’re using self-calibrating sensors and machine learning to boost accuracy.

Cost Barriers to Widespread Adoption

High costs and maintenance expenses stop small businesses from using advanced systems. Some sensors need frequent updates, adding to costs. TE Connectivity is trying to solve this with cheaper, modular designs. This could help smaller companies deal with corrosion detection limitations better.

Regulatory Hurdles and Standardization Issues

Corrosion monitoring rules differ around the world, making sales across borders hard. A GIIR report says 42% of makers face delays because of these rules. Groups like NACE are working to create common standards. This could make it easier for everyone to follow the rules and grow faster.

How Geopolitics Influence the Corrosion Detector Sensor Market

Global politics play a big role in the geopolitical impact on sensors market. Trade policies and alliances affect the supply chains for international trade corrosion technology. At the same time, security concerns push for new ideas in infrastructure security monitoring. Let’s explore these forces:

Trade Policies and International Relations

Trade wars and tariffs between big countries like the U.S. and China limit access to key materials. For instance, U.S. sanctions on Chinese tech imports have led some makers to find new suppliers. On the other hand, free trade deals like USMCA and RCEP help countries like Japan and Germany sell more sensors.

National Security Considerations in Critical Infrastructure

Now, governments focus more on infrastructure security monitoring for things like energy grids and bridges. The U.S. Infrastructure Investment and Jobs Act funds sensors for pipelines and dams. The EU’s Cyber Resilience Act also requires security features in all monitoring devices. This means companies like Siemens and Honeywell need to make products that meet local rules.

Regional Competitive Advantages

Regions use policies to gain an edge:

| Region | Strength |

|---|---|

| North America | Military contracts driving R&D in defense-grade sensors |

| Asia-Pacific | Low-cost manufacturing hubs for mass-produced sensors |

| Europe | EU funding for green tech integration in sensors |

These elements create a world where politics directly influences innovation, prices, and who gets to sell corrosion detection tech.

Analyzing the Segmentation of the Corrosion Detector Sensor Market

Technology-Based Market Segments

Technology is key to how sensors work. Corrosion sensor types include:

- Electrochemical sensors: track pH and ion levels in real time.

- Ultrasonic sensors: measure metal thickness in pipelines and tanks.

- MEMS and fiber optic sensors: part of advanced corrosion detection technologies, offering precision in harsh environments.

Application-Specific Sensor Categories

Industrial corrosion monitoring segments differ by industry. Key areas include:

- Marine: saltwater-resistant sensors for ship hulls.

- Oil and gas: sensors for offshore platforms and pipelines.

- Manufacturing: inline monitoring for production equipment.

Asia-Pacific leads in adoption, driven by infrastructure projects and manufacturing growth. A 2024 report highlights Japan’s rebuilding efforts as a key driver of this region’s dominance.

Price Point and Performance Tiers

Options range from basic to premium:

- Entry-level: budget-friendly for routine checks.

- Mid-range: balanced performance for most industrial uses.

- Premium: high-accuracy sensors for critical infrastructure.

Choosing the right tier balances cost with reliability, especially as global demand pushes the market toward $3.9 billion by 2033.

Exploring Applications Driving Growth in the Corrosion Detector Sensor Market

Corrosion detector sensors are changing the game in many industries. They help protect pipelines and ships, preventing failures and saving money. Here’s how they’re making a difference:

In the oil and gas sector, sensors keep pipelines safe from leaks. They also help companies meet regulations. With wireless systems, they track data in real-time, cutting down on downtime. The market is set to almost double by 2032, thanks to this need, as a recent study shows.

- Oil and Gas: Sensors stop big problems in refineries and on offshore platforms.

- Infrastructure: They help bridges and buildings last longer by spotting rust early.

- Marine: Systems protect ships from saltwater damage, saving on upkeep.

Manufacturing plants use sensors to watch over chemical tanks, avoiding damage. For example, structural health monitoring sensors in steel mills predict when parts will wear out. These tools also fit into smart city plans, keeping water systems safe.

Shipping is another area where sensors shine. Marine corrosion detection systems let fleets plan maintenance ahead, reducing unplanned repairs by 40%. As industries focus on lasting and safe solutions, these applications will keep growing.

Global Performance of the Corrosion Detector Sensor Market by Region

Each region plays a key role in the global corrosion sensor market share. They all contribute to the international sensor market growth in their own way. From tech hubs to emerging markets, knowing regional corrosion monitoring trends is crucial for businesses.

North American Market Dynamics

North America is a leader in tech innovation. The U.S. and Canada focus on updating their infrastructure. They use sensors with IoT and AI for constant monitoring:

- Oil and gas sectors use predictive analytics for safer pipelines.

- Manufacturing areas prefer small sensors for precise checks.

- Government projects increase the need for materials that resist corrosion.

European Adoption Trends

Europe focuses on sustainability and strict rules. This pushes regional corrosion monitoring trends towards eco-friendly sensors:

- EU rules cut down carbon emissions, boosting demand for easy-to-maintain sensors.

- Germany and Scandinavia lead in smart infrastructure projects.

- France and Italy focus on solutions for coastal infrastructure.

Asia-Pacific Growth Opportunities

The international sensor market growth in Asia-Pacific comes from fast industrial growth and old infrastructure:

- China’s big manufacturing sector increases sensor use in construction and energy.

- Japan invests in predictive analytics for old bridges and pipelines.

- India and Indonesia use affordable sensors for growing oil and gas projects.

Emerging Markets in Latin America and Africa

Latin America and Africa are growing fast, thanks to mining and farming:

- Mexico’s car industry uses sensors to fight corrosion in tough places.

- Sub-Saharan Africa protects mining gear and pipelines with sensors.

- Colombia and Brazil use sensors in renewable energy projects.

The Growing Role of China in the Corrosion Detector Sensor Market

China is now a key player in corrosion detection technology. It uses its strong Chinese sensor manufacturing to influence global markets. The country has moved from just making lots of products to focusing on advanced research and creating unique sensor designs.

This change has made China a leader in its own market and a strong competitor worldwide.

Manufacturing Capabilities and Supply Chain Position

Chinese factories make 60% of the world’s corrosion sensors. They do this thanks to low labor costs and special equipment. Companies like Canbot Robotics and Shanghai Micro Electronics lead in production.

They work with German and Japanese companies to improve quality. The supply chain uses materials from both local mines and global suppliers, keeping production steady.

Domestic Infrastructure Investment and Industrial Applications

Big projects like the Beijing-Xiongan high-speed rail and the Three Gorges Dam need China corrosion monitoring market solutions. These sensors protect important structures from corrosion, saving on maintenance costs. About 40% of sensors in China are used in the energy and construction sectors, according to 2023 reports.

Export Strategies and International Market Influence

Asian sensor technology exports from China went up 18% in 2023. This is thanks to projects like the Belt and Road Initiative in Southeast Asia and Central Asia. China’s low prices and government support help it compete with others.

Insights into the US Corrosion Detector Sensor Market

Advances in US infrastructure monitoring are changing the American corrosion prevention market. Federal funding and private sector innovation are pushing for better ways to protect old infrastructure like bridges and pipelines.

Infrastructure Renewal and Government Initiatives

- Biden’s $1.2 trillion infrastructure law focuses on using corrosion-resistant materials and smart sensors in transportation.

- States like California and Texas are testing real-time corrosion data platforms in oil refineries and highways.

Industry-Specific Adoption Patterns

The USA sensor technology innovation ecosystem thrives in three regional clusters:

- West Coast: Silicon Valley startups developing nanoscale sensors for aerospace

- Rust Belt: Automotive plants adopting IoT sensors for steel corrosion tracking

Companies like Siemens and GE Research are teaming up with federal labs to bring new technologies to market. This opens doors for small and medium-sized enterprises in the $2.3B American corrosion prevention market.

What's Next for Germany's Corrosion Detector Sensor Market?

Germany is known for European sensor engineering excellence. It leads in corrosion detection innovation. The global market is growing fast, expected to hit $23.59 billion by 2033 (ProMarketReports). German tech in

Engineering Excellence Fuels Precision Innovation

German makers are making German precision sensors better for tough industrial needs. These sensors last long and use AI for quick data. They focus on lasting value, not just the initial cost, following European engineering standards.

Smart Factories Drive Industry 4.0 Adoption

Industry 4.0 corrosion monitoring systems are becoming more common. Factories use sensors to forecast when equipment might fail, cutting downtime by 30%+. Working with software companies, German systems are leading the way in smart manufacturing worldwide.

Sustainability Drives Green Sensor Designs

Germany’s European sensor engineering excellence now includes green tech. Sensors are made for renewable energy, like wind turbines at sea, using recyclable parts and less energy. This green focus matches EU’s environmental goals, opening up new markets.

German companies are setting high standards for quality and integration. Their work on precision, connectivity, and green tech keeps them at the top in a growing global market.

The Future Outlook of the Corrosion Detector Sensor Market

As industries focus on lasting and safe products, future corrosion detection technology is changing. New tools like quantum sensors and graphene-based systems are coming. They promise to cut costs and improve accuracy.

Companies are also looking into materials that resist decay like nature does. This could lead to smarter, self-checking structures.

Emerging Technologies and Innovation Roadmap

- Quantum sensors for real-time data at extreme temperatures

- Graphene-based coatings that alert to micro-corrosion early

- Bio-inspired systems mimicking natural decay-resistant organisms

Market Growth Projections Through 2030

By 2030, the sensor market forecast 2030 expects a big jump. It will reach $45.68 billion, growing 9.3% each year. This growth is driven by more use in infrastructure and energy, especially in North America and Asia-Pacific.

Evolving Customer Requirements and Solution Development

Customers want sensors that last longer and work with IoT. They also want fewer manual checks. Companies like Siemens and Honeywell are using AI in next-generation corrosion monitoring tools. They combine hardware with cloud analytics.

This move towards predictive maintenance will be a big focus in the next five years.

Competitive Analysis of the Corrosion Detector Sensor Market

The corrosion monitoring competitive landscape is filled with giants and new players. Big names like Emerson Electric, CORRPRO, and Honeywell lead with their innovation. At the same time, new companies target specific areas like offshore energy or building upkeep.

-

Honeywell – United States

-

GE (General Electric) – United States

-

Emerson Electric – United States

-

Siemens – Germany

-

ABB – Switzerland

-

Yokogawa Electric – Japan

-

Schneider Electric – France

-

Ametek – United States

-

EMAG – Germany

-

Caltest – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Corrosion Detector Sensor Market Report |

| Base Year | 2024 |

| Segment by Type |

· Electrochemical sensors · Ultrasonic sensors · MEMS and fiber optic sensors |

| Segment by Application |

· Oil and Gas · Infrastructure · Marine |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global corrosion detection market is undergoing a significant transformation, driven by the deregulation policies of Trump in the United States, Germany, and China. This shift has catapulted sensor technology to the forefront, propelling the industry’s expansion and redefining the global scene.

The policy changes have led to reduced compliance costs and savings, enabling companies to allocate more resources to cutting-edge corrosion detection systems. This has spurred technological progress and the integration of IoT and AI, creating a fertile ground for innovation. The stage is set for both seasoned players and new entrants to seize the market’s vast potential.

The future of the global corrosion detection market is bright with boundless possibilities. China’s strengthening of its manufacturing base and export strategies will continue to shape the competitive landscape. This will open up a plethora of investment opportunities and pose new challenges for all stakeholders in the industry.

Global Corrosion Detector Sensor Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Corrosion Detector Sensor Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Corrosion Detector SensorMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Corrosion Detector Sensorplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Corrosion Detector Sensor Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Corrosion Detector Sensor Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Corrosion Detector Sensor Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCorrosion Detector SensorMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are corrosion detector sensors and why are they important?

Corrosion detector sensors are tools that check for corrosion in metals. This is key for keeping things like bridges and pipes safe and lasting longer. They give real-time info on corrosion, helping avoid big problems and saving money on repairs.

How do I choose the right corrosion detector sensor for my needs?

Choosing the right sensor involves looking at several things. You need to think about the environment, the materials you’re checking, and how accurate you need the sensor to be. Also, consider the sensor’s price and how well it performs to make the best choice.

What industries benefit from corrosion detector sensors?

Many industries use corrosion detector sensors. In the oil and gas sector, they protect pipelines and tanks. Construction and infrastructure use them to keep bridges and buildings safe. And in manufacturing, they watch over chemical processes. The marine world also uses them to fight saltwater damage.

What recent trends are shaping the corrosion detector sensor market?

New trends are making sensors better. IoT technology lets us monitor from afar. Sensors are getting smaller, so we can check places we couldn’t before. And using AI and predictive analytics helps find corrosion early and plan maintenance.

Are there regulatory challenges affecting the corrosion detector sensor market?

Yes, there are rules that can be tricky to follow. Standards vary by region and industry. This makes it hard for makers and users to keep up, but it’s important to stay current.

How is geopolitics influencing the corrosion detector sensor market?

Politics and trade policies affect the market a lot. They can change who gets to use new tech and how. National security also drives the need for these sensors, making them important worldwide.

What role does China play in the corrosion detector sensor market?

China is growing fast in this market. It’s moving from making simple parts to creating advanced sensors. Its big investments in its own infrastructure and global projects like the Belt and Road Initiative are making it more influential.

What are the expected growth projections for the corrosion detector sensor market through 2030?

The market is expected to grow a lot. New tech and more people understanding the need for monitoring will keep driving growth. As tech gets better and needs change, the market will keep expanding.

Who are the major competitors in the corrosion detector sensor market?

Big names like Emerson Electric, CORRPRO, GE Measurement & Control, and Honeywell lead the market. They’re known for their innovation and strong presence. But new companies are also coming up with unique solutions, changing the game.