2025 Mining Equipment Rental Market Boom: Unlocking a $5.6 Billion Opportunity in USA, China, and India

Discover comprehensive insights into the Mining Equipment Rental Market’s growth trajectory through 2025, focusing on market leaders U.S., Australia, and China. This analysis explores key trends, technological advancements, and regional dynamics shaping the industry’s future.

- Last Updated:

Q1 and Q2 2025 Mining Equipment Rental Market Forecast: Key Regional Insights

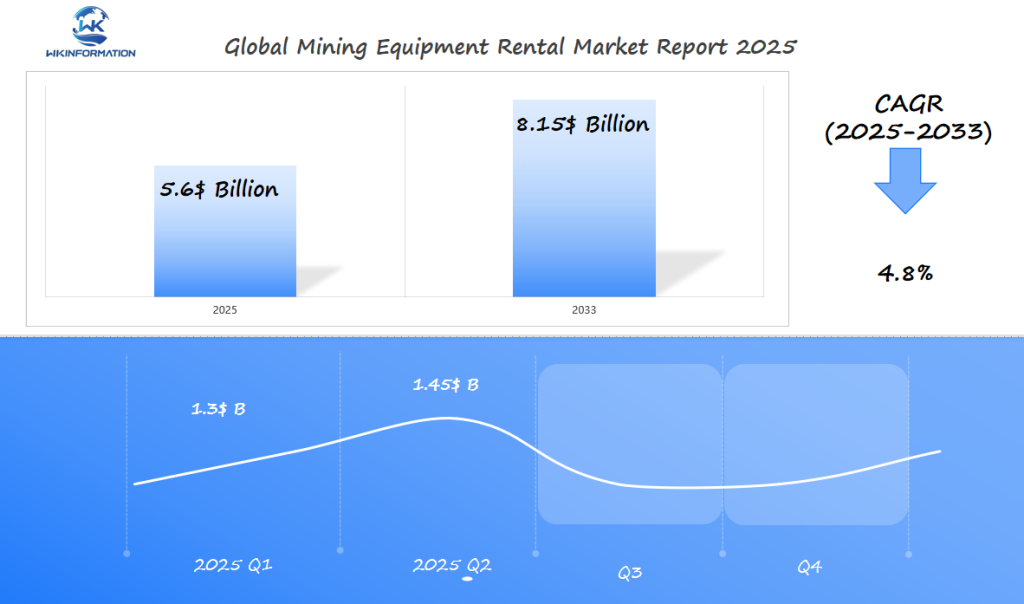

The Mining Equipment Rental market is projected to reach USD 5.6 billion in 2025, with a robust CAGR of 4.8% from 2025 to 2033. For Q1 2025, the market is expected to generate approximately USD 1.3 billion, driven by the demand for excavation and drilling equipment in active mining operations. The United States will remain a dominant player, accounting for around 35% of the market share in Q1, due to its large-scale mining operations and growing infrastructure projects. Australia will continue to be a key contributor, particularly in the coal and iron ore sectors, capturing around 18% of the market share in Q1. Meanwhile, China will also show strong demand, contributing approximately 15% to the global market as its mining activities remain central to the country’s industrial strategy. Moving into Q2 2025, market growth is expected to accelerate, reaching an estimated USD 1.45 billion, driven by the seasonal uptick in mining operations.

The U.S. will continue to lead, with a slight increase in share to 37%, while Australia’s share is forecasted to rise to 20%, and China’s market share will remain strong at around 16%. These regions—particularly the U.S., Australia, and China—are essential for understanding the mining equipment rental market’s growth trajectory. To dive deeper into regional trends, competitive dynamics, and future opportunities, we encourage you to read the Wkinformation Research sample and full report for a comprehensive analysis.

Understanding the Mining Equipment Rental Market: Upstream and Downstream Dynamics

The Upstream Industry: Building Blocks of Mining Equipment Rentals

The upstream industry in mining equipment rentals consists of the key players who lay the groundwork for this market. It primarily includes equipment manufacturers and suppliers, both of whom are vital in ensuring a consistent flow of machinery to rental services.

Key Components of the Upstream Industry:

- Equipment Manufacturers: These companies are tasked with designing and producing various mining machines such as excavators, drills, loaders, and trucks. Leading manufacturers like Caterpillar, Komatsu, and Epiroc set the standard in the industry with their innovative designs and strong production capabilities.

- Suppliers: Suppliers play a critical role in distributing these machines to rental companies. They act as middlemen, making it possible for equipment to move from manufacturers to end-users through rental services.

The Downstream Market: Impact on End-Users

The downstream industry is concerned with delivering rented machines to end-users such as mining companies and contractors. This segment has a significant influence on their operational efficiency and cost-effectiveness.

Key Players in the Downstream Market:

- Mining Companies: By choosing rental options, mining firms can gain access to state-of-the-art equipment without bearing the hefty expenses that come with buying. This flexibility enables them to respond swiftly to changes in demand or project size, thereby improving their operational agility.

- Contractors: Rentals offer an optimal solution for contractors involved in short-term projects or exploratory tasks. They get to leverage the latest technology without any long-term financial obligations, allowing them to submit competitive bids on various projects.

The interaction between the upstream and downstream sectors creates a complete supply chain that caters to the changing requirements of the mining industry. As technological advancements continue to transform both fields, prospects for growth and innovation within this supply chain are anticipated to broaden even more.

Emerging Trends Shaping the Mining Equipment Rental Market

Technological advancements are playing a crucial role in transforming the mining equipment rental market. Automation and remote monitoring stand out as game-changers, enhancing operational efficiency and safety. By integrating these technologies, rental services offer clients improved productivity and reduced downtime through real-time data analysis and predictive maintenance capabilities. This not only optimizes equipment performance but also minimizes unexpected failures, providing significant value to mining companies.

The industry is witnessing a noticeable shift towards sustainability due to intensified environmental concerns. Rental providers are increasingly offering eco-friendly and energy-efficient machinery, aligning with global trends for greener operations. The introduction of hybrid power solutions and machines with lower emissions rates cater to regulatory demands and corporate sustainability goals. These innovations not only reduce carbon footprints but also appeal to environmentally conscious clients who prioritize sustainable practices.

Economic factors further drive the trend toward rental models. Many mining companies seek cost-effective solutions to manage expenses, prompting a surge in interest for equipment rentals over outright purchases. Renting allows businesses to avoid hefty upfront costs and depreciation concerns, providing them with budgetary flexibility. This model supports operational scalability, enabling companies to adjust their equipment needs based on project demands without long-term financial commitments.

The combination of technological advancements, sustainability initiatives, and economic factors is reshaping the mining equipment rental market. Together, they create an environment that values efficiency, environmental responsibility, and financial prudence, making rental services an attractive choice for modern mining operations looking to stay competitive in a rapidly changing industry.

Key Restrictions Impacting the Growth of Mining Equipment Rental Market

The mining equipment rental market faces several challenges that can impede its growth, despite promising opportunities.

1. Regulatory Challenges

Regulatory challenges form a significant barrier for rental companies operating globally. Licensing requirements and stringent safety standards must be navigated meticulously. Each country enforces its own set of regulations, which can complicate cross-border operations for multinational firms. Failure to comply with these standards not only results in hefty fines but can also lead to operational shutdowns, severely impacting business continuity.

2. Economic Factors

Economic factors further compound these challenges. Investment in mining infrastructure remains sensitive to fluctuating commodity prices. When prices dip, mining companies often scale back operations or delay expansion plans, reducing demand for rented equipment. This cyclical nature of commodity markets introduces volatility that rental companies need to manage proactively.

3. Geopolitical Uncertainties

Geopolitical uncertainties also play a role in limiting investment. Trade tensions between major economies like the USA and China can disrupt supply chains, affecting equipment availability and pricing. Rental agreements might face renegotiations or cancellations due to shifting political climates, adding another layer of complexity to strategic planning.

These hurdles create a challenging landscape for the mining equipment rental market, requiring companies to adopt agile strategies and maintain compliance with diverse regulatory frameworks while navigating economic volatility.

Geopolitical Factors Influencing the Mining Equipment Rental Market

Geopolitical tensions can significantly disrupt equipment sourcing and rental agreements on a global scale. These tensions often lead to increased costs and operational delays, impacting the bottom lines of mining companies. For instance, trade disputes between major economies like the USA and China can result in tariffs or restrictions that complicate cross-border equipment rentals. Such geopolitical dynamics necessitate careful navigation by rental companies to maintain smooth operations.

The Role of Trade Policies

Trade Policies play a crucial role in shaping market dynamics within key regions. The USA and China, both major players in mining activities, have seen their policies affect not only bilateral relations but also the broader market landscape. For example:

- Tariffs and Export Controls: Imposition of tariffs can increase equipment costs, making rental options less attractive. Stricter export controls might limit the availability of advanced machinery, thus influencing rental pricing.

- Regional Trade Agreements: Agreements such as the USMCA (United States-Mexico-Canada Agreement) can facilitate smoother trade flows among member countries, potentially benefiting rental markets through reduced tariffs and streamlined regulations.

The Impact of International Regulations

International regulations further complicate the scene by introducing compliance requirements that vary from one jurisdiction to another. This variability can be challenging for multinational rental companies attempting to standardize their operations across borders.

Adapting to Geopolitical Shifts

The intersection of these factors creates a complex environment where mining equipment rental businesses must strategize carefully. Understanding and adapting to geopolitical shifts becomes essential for maintaining competitiveness and meeting customer needs efficiently.

Comprehensive Analysis of Mining Equipment Rental Market Segmentation by Type

The mining equipment rental market is vast, with various types of machinery available for rent to cater to diverse operational needs. Excavators and trucks are among the most commonly rented equipment, each holding significant market shares due to their essential roles in mining operations. Excavators are crucial for digging and moving large amounts of earth, making them indispensable in both surface and underground mining. Trucks facilitate the transportation of mined materials, ensuring efficient movement across mining sites.

Other notable equipment types include:

- Loaders: Used for loading materials into trucks or other transport vehicles.

- Drills: Essential for creating holes in the earth to extract minerals.

- Conveyors: Utilized for transporting materials over long distances within a mining site.

Each type of equipment serves a unique function, contributing to the market’s overall dynamics.

Long-term vs. Short-term Rentals

Rental models in the mining sector are primarily divided into long-term and short-term rentals, each offering distinct benefits and drawbacks for customers and suppliers.

Benefits of Long-term Rentals

- Stability and continuity

- Lower monthly costs

- Steady revenue stream for suppliers

- Reduced turnover costs

Drawbacks of Long-term Rentals

- Limited flexibility

- Commitment to specific equipment

Benefits of Short-term Rentals

- Flexibility and adaptability

- Ability to adjust fleet size

- No long-term financial commitments

Drawbacks of Short-term Rentals

- Higher rates

- Increased logistical efforts

Both models play vital roles in meeting the varied needs of mining operations, ensuring that companies can choose according to their operational requirements and financial strategies.

In-Depth Study of Mining Equipment Rental Market Applications Across Industries

1. Coal Mining: The Major Contributor

The coal mining segment stands out as a dominant player within the Mining Equipment Rental Market, contributing significantly to its market share. With coal mining accounting for approximately 40.1% of the market, rented equipment plays a crucial role in these operations. Essential machinery such as excavators, loaders, and haul trucks are often sourced through rental services, offering flexibility and cost-effectiveness to mining companies dealing with fluctuating production demands.

2. Gold Mining: Accessing Specialized Equipment

Beyond coal, rented machinery finds extensive use in other mineral extraction applications. Gold mining relies heavily on specialized equipment like drilling rigs and crushers, which are frequently rented due to their high purchase costs and maintenance requirements. Renting allows gold miners to access cutting-edge technology without significant capital investment.

3. Copper Mining: Efficient Ore Transportation

In the realm of copper mining, equipment such as bulldozers and conveyors are indispensable for efficient ore transportation. Rentals provide a scalable solution for projects where demand can vary significantly based on market conditions and exploration results. This flexibility is critical in maintaining operational efficiency while managing financial risk.

4. Iron Ore Mining: Avoiding Ownership Burden

Iron ore mining also benefits from rental models, particularly for heavy-duty machinery like earthmovers and crushers. These machines are vital for large-scale extraction processes, and renting them helps mining companies avoid the financial burden of ownership while ensuring they have access to modern, efficient equipment.

The diverse utilization of rented machinery across various industries emphasizes the versatility and strategic value that rental services bring to the table. By adapting to different mineral needs and operational scales, the Mining Equipment Rental Market continues to expand its reach, supporting sustainable growth in multiple sectors beyond traditional coal mining operations.

Global Mining Equipment Rental Market Regional Insights and Growth Potential

The mining equipment rental market exhibits a diverse regional landscape, with the Asia-Pacific region leading the charge. In 2024, Asia-Pacific accounted for a significant 35.6% of the global revenue share. This dominance is propelled by rapid industrialization efforts in countries like India and China, which are rich in mineral resources. These nations are investing heavily in mining infrastructure to meet their growing industrial demands, fostering a robust environment for rental services.

Asia-Pacific’s Role and Future Growth

- Industrialization: Both India and China are experiencing rapid industrial growth, creating a heightened demand for mining equipment rental services.

- Resource Richness: The presence of substantial mineral deposits in these countries supports an expansive mining sector.

- Government Initiatives: Policies aimed at boosting mining activities contribute to sustained growth in equipment rentals.

Untapped Opportunities: North America vs Emerging Markets

While Asia-Pacific leads, North America presents untapped opportunities. The region grapples with challenges but holds potential due to technological advancements and a shift towards more sustainable mining practices.

- North America:Increased focus on sustainable practices could drive demand for eco-friendly equipment rentals.

- Technological innovation offers new avenues for growth within the region.

- Emerging Markets (India/China):Projected high compound annual growth rates (CAGR) over the next five years indicate a promising expansion trajectory.

- Ongoing investments in infrastructure enhance the market’s appeal.

A comparative analysis reveals that while North America focuses on technological advancement and sustainability, emerging markets like India and China capitalize on resource availability and government support. Each region offers unique prospects, shaping the future of the mining equipment rental market on a global stage.

Strategic Overview of Mining Equipment Rental Market in USA

The mining equipment rental market in the USA is expected to grow significantly, driven by future technologies and industry innovations. The upcoming technological advancements will focus on improving operational efficiency and sustainability, which will greatly change the industry.

Technological Advancements

1. AI-Driven Fleet Management Systems

As artificial intelligence continues to evolve, fleet management systems powered by AI are becoming essential. These systems offer real-time tracking of equipment, predictive maintenance alerts, and optimized resource allocation, ensuring maximum uptime and cost efficiency.

2. Virtual Reality Training Programs

Training programs using virtual reality (VR) technology are becoming popular, providing operators with immersive experiences without the risks of real-world training. This approach not only enhances safety but also speeds up skill acquisition, leading to improved productivity.

Innovations Promoting Sustainability

1. Hybrid Power Solutions

In response to increasing environmental awareness, hybrid power solutions are being integrated into rental offerings. These solutions combine traditional fuel sources with renewable energy options such as solar or wind power, reducing carbon emissions and promoting greener operations.

2. Modular Designs

The adoption of modular designs is another innovation aimed at minimizing resource consumption. By standardizing components and enabling easy assembly and disassembly, modular designs reduce manufacturing waste and allow for more efficient recycling processes.

These advancements position the USA as a leader in sustainable mining practices while addressing the industry’s demand for cost-effective solutions. As these technologies develop further, they will likely drive more innovation within the sector, setting new standards for efficiency and environmental responsibility.

Market Dynamics and Opportunities in China’s Mining Equipment Rental Industry

Major Players and Their Influence

The mining equipment rental market in China is significantly influenced by major companies such as United Rentals, Caterpillar, and Atlas Copco. These industry giants offer an extensive range of equipment suited for various mining operations, including excavators, trucks, and drilling machines.

- United Rentals, known for its expansive global presence, continues to leverage its strong portfolio to penetrate the Chinese market effectively.

- Caterpillar remains a dominant force due to its robust product lineup and longstanding reputation for quality and innovation.

- Atlas Copco’s focus on providing cutting-edge drilling technology positions it as a preferred choice for mining companies seeking efficient solutions.

Recent Developments: Mergers & Acquisitions

Mergers and acquisitions (M&A) play a crucial role in shaping China’s mining equipment rental landscape. Recent strategic moves by these key players highlight their commitment to expanding market share and enhancing operational capabilities.

For instance:

- Caterpillar’s acquisition of certain service-oriented businesses aims to strengthen its after-sales support, which is pivotal in retaining customer loyalty.

- Atlas Copco’s recent joint ventures with local firms have enabled it to better understand regional demands and customize offerings accordingly.

Strategies for Competitive Advantage

To maintain their competitive edge, leading firms employ several strategies.

- Investing in research and development (R&D) enables these companies to innovate continually, ensuring their products meet the evolving technological needs of the mining sector.

- Emphasis on developing eco-friendly equipment aligns with China’s stringent environmental policies, appealing to environmentally conscious consumers.

- The integration of automation and remote monitoring technologies into rental fleets enhances operational efficiency and safety standards, offering clients an attractive value proposition.

By focusing on sustainability and technological advancements, these companies not only differentiate themselves but also address the increasing demand for responsible mining practices.

Understanding the dynamics within China’s mining equipment rental industry offers valuable insights into strategic growth opportunities that align with the market’s evolving needs.

Growth Prospects of Mining Equipment Rental Market in India

India’s mining equipment rental market holds promising future outlooks for mining rentals, driven by the country’s rich mineral resources and increasing infrastructure investments. The demand for cost-effective solutions is propelling the adoption of rental models, allowing companies to leverage advanced machinery without incurring substantial capital expenditures.

Key factors contributing to market growth:

- Adaptability: The changing needs of customers necessitate flexible rental models. Companies are designing contracts that offer tailored solutions, meeting the evolving demands while ensuring profitability.

- Technological Integration: With advancements in technology, rental services are incorporating automated and remotely monitored equipment. This not only boosts operational efficiency but also caters to safety standards expected by modern mining operations.

- Sustainability Focus: Rental companies are increasingly offering eco-friendly and energy-efficient machinery, aligning with India’s environmental regulations and sustainability goals.

The Indian mining equipment rental market is poised for expansion as it continues to adapt to industry demands, balancing customer satisfaction with profitability objectives. This adaptability ensures a competitive edge in a rapidly evolving sector, positioning India as a key player on the global stage.

Future Development Trends and Innovations in Mining Equipment Rental Market

The mining equipment rental market is about to undergo a significant change, driven by technological advancements and innovative solutions. Here are some of the key trends shaping the future of this industry:

Integration of Automation and Artificial Intelligence (AI)

One of the major trends is the integration of automation and artificial intelligence (AI) into rental equipment. AI-driven systems enable predictive maintenance, reducing downtime and enhancing operational efficiency. These technologies allow rental companies to offer more reliable and efficient machinery, meeting the increasing demand for productivity in mining operations.

Emergence of Remote Monitoring

Remote monitoring has emerged as another significant development, enabling real-time tracking of equipment usage, performance, and location. This innovation not only aids in optimizing fleet management but also enhances safety protocols by providing early warnings of potential malfunctions.

Focus on Sustainability

Sustainability remains a focal point, with rental companies increasingly adopting eco-friendly practices. The introduction of hybrid power solutions and energy-efficient machinery aligns with global environmental standards and meets the growing demand for sustainable operations.

Revolutionizing Operator Training with Virtual Reality (VR)

Virtual reality (VR) training programs are revolutionizing operator training within the rental sector. These immersive experiences provide operators with hands-on practice in a controlled environment, enhancing their skills without risking equipment damage or safety.

Greater Emphasis on Modular Equipment Designs

The future will likely see a greater emphasis on modular equipment designs, allowing for customization based on specific mining needs. This adaptability offers mining companies cost-effective solutions tailored to their unique operational requirements.

These trends collectively underscore a shift towards smarter, more sustainable, and adaptable rental services in the mining industry. Furthermore, recent studies such as this one from ScienceDirect highlight the ongoing evolution in mining equipment rental services, emphasizing the industry’s commitment to embracing these transformative changes.

Competitive Landscape and Key Players in the Mining Equipment Rental Market

- United Rentals – United States

- Caterpillar Inc. – United States

- Ashtead Group (Sunbelt Rentals) – United Kingdom

- Hertz Equipment Rental – United States

- Komatsu Limited – Japan

- Finning International Inc. – Canada

- Volvo Construction Equipment – Sweden

- Hitachi Construction Machinery Co., Ltd. – Japan

- Herc Rentals Inc. – United States

- Sunbelt Rentals – United States (Subsidiary of Ashtead Group, UK)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Mining Equipment Rental Market Report |

| Base Year | 2024 |

| Segment by Type | · Surface Mining Equipment

· Crushing Equipment · Underground Mining Equipment · Blasting Tools · Others |

| Segment by Application | · Coal Mining

· Metal Mining · Mineral Mining · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The mining equipment rental market is constantly changing and has many opportunities for growth. As the need for affordable and flexible solutions increases, rental models are becoming more popular among mining companies around the world. Technological advancements like automation and remote monitoring are improving operational efficiency and meeting the industry’s changing needs.

Key Factors Driving Market Growth

Several factors are driving the growth of the mining equipment rental market:

- Increasing Demand for Cost-Effective Solutions: Mining companies are looking for ways to reduce costs and improve efficiency. Renting equipment instead of buying it outright allows them to save money and allocate resources more effectively.

- Flexibility in Operations: Rental models offer flexibility in operations, allowing mining companies to scale their equipment usage based on project requirements. This flexibility is particularly beneficial in an industry where demand can fluctuate.

- Technological Advancements: The integration of technology in mining operations, such as automation and remote monitoring, requires specialized equipment that may not be feasible for companies to purchase outright. Renting such equipment becomes a practical solution.

Regional Insights

Key regions driving market growth include:

- Asia-Pacific: Countries like China and India are major players in the mining industry, with significant mineral resources and investments in mining infrastructure. These countries contribute to the market’s revenue share and also drive innovations in sustainable practices.

- North America: The United States and Canada have well-established mining industries, with a demand for rental equipment driven by both coal and metal mining activities.

Market Trends

Some notable trends in the mining equipment rental market include:

- Long-Term Rentals Maintaining Market Position: Long-term rentals continue to hold a significant share of the market due to their ability to provide stability and predictability for businesses.

- Short-Term Rentals Expected to Grow Rapidly: Short-term rentals are anticipated to experience rapid growth as mining projects become more dynamic and require flexible equipment solutions.

- Coal Mining Sector’s Contribution: The coal mining sector remains a key contributor to the rental market, reflecting its importance within the overall industry.

Competitive Landscape

Prominent players in the mining equipment rental market include:

- United Rentals

- Caterpillar

- Komatsu Rentals

These companies are adopting strategic initiatives such as mergers and acquisitions to stay competitive in a growing market.

As these trends continue, the mining equipment rental sector is expected to thrive, driven by technological advancements and a focus on sustainability.

Global Mining Equipment Rental Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Mining Equipment Rental Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Mining Equipment RentalMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Mining Equipment Rentalplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Mining Equipment Rental Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Mining Equipment Rental Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Mining Equipment Rental Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMining Equipment RentalMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the upstream industry in the mining equipment rental market?

The upstream industry in mining rentals includes essential components such as equipment manufacturers, suppliers, and raw material providers. These entities play a crucial role in ensuring that rental companies have access to high-quality machinery and tools necessary for mining operations.

How do technological advancements impact the mining equipment rental market?

Technological innovations, including automation and remote monitoring systems, are revolutionizing rental services by enhancing operational efficiency and reducing costs. These advancements allow for better fleet management and improved safety measures, making rental options more appealing to mining companies.

What are the primary economic factors affecting investment in the mining equipment rental market?

Economic factors such as fluctuating commodity prices and geopolitical uncertainties significantly limit investment in mining infrastructure. These fluctuations can create instability in demand for rented equipment, affecting both rental companies and their clients.

How do geopolitical tensions influence the mining equipment rental market?

Geopolitical tensions between countries can disrupt equipment sourcing and affect rental agreements globally. Trade policies in key regions like the USA and China also play a significant role in shaping market dynamics, impacting both supply chains and pricing strategies.

What types of mining equipment are commonly available for rent, and what are their market shares?

Commonly rented mining equipment includes excavators, trucks, and drilling rigs. The market is segmented into long-term and short-term rentals, each with distinct advantages; long-term rentals offer stability while short-term rentals provide flexibility to meet varying project needs.

Which regions are expected to dominate the global mining equipment rental market by 2024?

The Asia-Pacific region is projected to dominate the global mining equipment rental market with a 35.6% revenue share by 2024. Rapid industrialization efforts in countries like India and China are driving this growth, presenting untapped opportunities compared to established markets like North America.