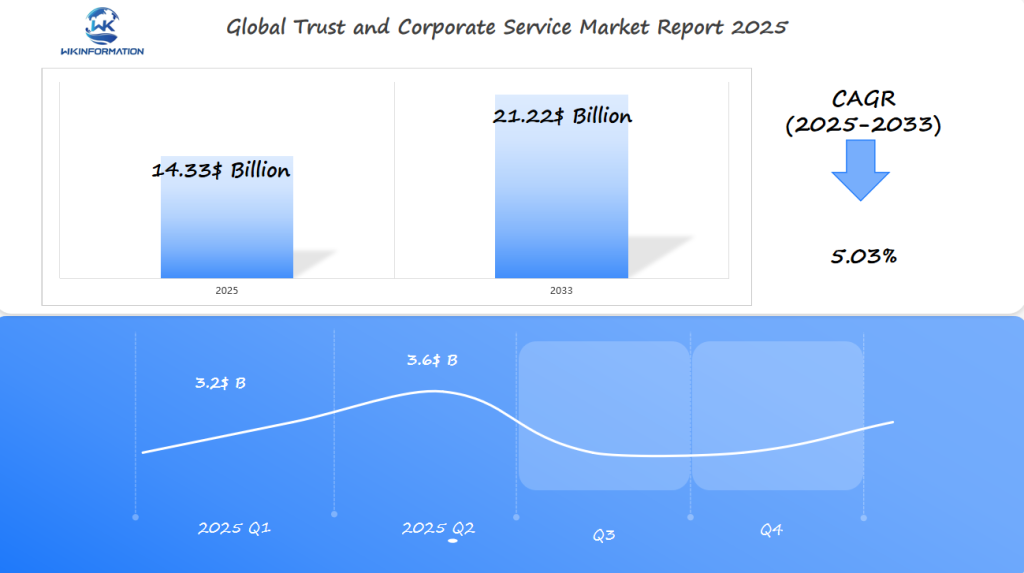

Trust and Corporate Service Market Forecast to Reach $14.33 Billion Globally by 2025 with Regulatory Shifts Reshaping the Sector in the U.K., Singapore, and the U.A.E.

Comprehensive analysis of Trust and Corporate Services market trends, growth drivers, and outlook for 2025. Examines market structure, regulatory landscape, regional dynamics across UK, Singapore and UAE. Details key developments in wealth management, compliance requirements, and service innovation.

- Last Updated:

Trust and Corporate Services Market Outlook for Q1 and Q2 2025

The Trust and Corporate Services market is forecast to reach $14.33 billion in 2025, with a CAGR of 5.03% from 2025 to 2033.

Q1 2025 Outlook

In Q1 2025, the market will likely be valued at around $3.2 billion, as businesses, particularly in emerging markets like Singapore and the U.A.E., begin to look for professional services for corporate structuring, trust formation, and legal compliance. The U.K. will also maintain steady growth in this space due to the continued complexity of cross-border business structures.

Q2 2025 Outlook

By Q2 2025, the market is expected to grow to approximately $3.6 billion, with the demand for trust and corporate services increasing as regulatory complexities rise. The U.K., Singapore, and the U.A.E. will continue to be the primary markets, with a growing emphasis on international tax planning, mergers, acquisitions, and corporate governance. The increasing wealth and global expansion of businesses will further boost demand for specialized services to ensure legal compliance and financial security.

Trust and Corporate Service market structure from upstream to downstream

Upstream (Inputs & Foundational Services)

These are the elements that enable trust and corporate service providers to operate efficiently and in compliance with legal frameworks.

1. Legal and Regulatory Frameworks

-

International laws (e.g., FATCA, CRS, AML/KYC)

-

Jurisdiction-specific regulations (e.g., U.K. Companies Act, UAE Economic Substance Regulations)

-

Tax treaties and compliance requirements

2. Professional Services

-

Legal advisors: Corporate law, trust law, tax law

-

Accounting and auditing firms

-

Compliance consultants

3. Technology and Infrastructure

-

Corporate governance software

-

Document and entity management platforms

-

KYC/AML automation tools

-

Cybersecurity and secure data hosting

Downstream (Clients & End-Use Applications)

These are the end-users and practical applications of trust and corporate services.

1. High-Net-Worth Individuals (HNWIs) & Families

-

Wealth protection and succession planning

-

Offshore trust and estate management

-

Tax-efficient structuring

2. Corporations and Multinational Enterprises

-

Cross-border entity structuring

-

Corporate governance and compliance

-

M&A and capital market support

3. Investment Funds and Institutional Clients

-

Private equity, hedge funds, real estate funds

-

Fund setup and administration services

-

Regulatory reporting and tax support

Regulatory and business service trends transforming the market

Regulatory changes and new developments in business services are reshaping the Trust and Corporate Service industry. The market is undergoing a major transformation driven by the demand for greater transparency, compliance, and efficiency.

Impact of Regulatory Changes

The introduction of new regulations is significantly impacting the Trust and Corporate Service market. Regulatory changes are aimed at improving transparency and compliance, which in turn affect how services are delivered. Companies are adapting to these changes by leveraging technology to enhance their compliance frameworks.

Some of the key regulatory changes include:

- Enhanced disclosure requirements

- Stricter compliance standards

- Increased transparency in financial reporting

Emerging Trends in Business Services

The Trust and Corporate Service market is also being shaped by emerging trends in business services, such as digitalization and outsourcing. Companies are leveraging technology to improve efficiency and reduce costs, while also adapting to changing client demands and regulatory requirements.

Some of the emerging trends include:

- Digitalization of services

- Outsourcing of non-core functions

- Use of artificial intelligence in service delivery

The combination of regulatory changes and emerging trends in business services is transforming the Trust and Corporate Service market. As companies continue to adapt to these changes, the market is expected to become more efficient, transparent, and competitive.

Restrictions and Compliance Hurdles in Trust and Fiduciary Services

Fiduciary services must navigate complex regulatory restrictions to maintain compliance. The trust and fiduciary services sector is subject to a myriad of regulations designed to prevent financial crimes and ensure transparency.

Navigating Regulatory Restrictions

Regulatory restrictions pose significant challenges for trust and fiduciary services. Service providers must comply with anti-money laundering (AML) and know-your-customer (KYC) requirements, which are critical in preventing financial crimes.

Key regulatory requirements include:

- Implementing robust AML and KYC protocols

- Maintaining transparency in financial transactions

- Ensuring compliance with changing regulatory landscapes

Compliance Challenges

Compliance challenges in trust and fiduciary services are multifaceted. Service providers must manage risk while ensuring that they adhere to regulatory requirements.

The complexity of these challenges is highlighted by the need for:

- Advanced risk management systems

- Regular training for compliance personnel

- Continuous monitoring of regulatory updates

The following table summarizes the main compliance challenges and potential solutions:

| Managing AML and KYC requirements | Implementing advanced AML and KYC protocols |

| Ensuring transparency in financial transactions | Utilizing transparent financial reporting systems |

| Staying updated with regulatory changes | Engaging in regular regulatory compliance training |

Global Political Influence on Corporate Service Environments

Global politics play a crucial role in determining the trajectory of corporate services. The complex interaction between government policies, geopolitical tensions, and trade agreements significantly influences the demand for corporate services across different regions.

Political Factors Affecting Corporate Services

The corporate services landscape is heavily influenced by political stability, regulatory changes, and government policies. For instance, changes in tax laws or regulatory compliance requirements can directly impact the demand for corporate services.

Key political factors include:

- Government policies and regulatory changes that affect corporate service operations.

- Geopolitical tensions that can disrupt business operations and influence market stability.

- Trade agreements that can either facilitate or hinder the growth of corporate services.

Regional Variations

Regional variations in political stability and regulatory environments significantly affect the corporate services market. Some regions offer more favorable business environments, attracting companies to establish operations there.

For example, regions with stable political environments and favorable regulatory frameworks tend to attract more corporate service providers. Conversely, regions with political instability may experience a decline in corporate service activities.

The table below illustrates the impact of regional political stability and regulatory environments on corporate services:

| Region | Political Stability | Regulatory Environment | Impact on Corporate Services |

| North America | High | Favorable | Increased demand for corporate services |

| Europe | Moderate | Stringent regulations | Compliance-driven corporate services |

| Asia-Pacific | Varies | Evolving regulations | Growing demand for corporate services |

Understanding these regional variations is crucial for corporate service providers to navigate the complex global landscape effectively. The following image provides a visual representation of the political stability and regulatory environment across different regions, which can serve as a useful reference for businesses seeking to expand their operations internationally.

Segmentation of Trust and Corporate Services by type

Segmentation of Trust and Corporate Services is crucial for understanding the market’s dynamics. The diverse range of services offered caters to different client needs, from wealth management to entity management.

The market can be broadly categorized into several key segments:

- Trust services: Managing assets on behalf of individuals or entities.

- Corporate services: Company formation, administration, and other related services.

Types of Trust and Corporate Services

The primary types of services include trust services, corporate services, wealth management, estate planning, and entity management. Each of these segments has its unique characteristics and regulatory requirements.

For instance, trust services require a high level of fiduciary duty and are subject to specific regulations. On the other hand, corporate services involve a range of activities, from company incorporation to ongoing administration.

Service Segmentation

Service segmentation is vital for identifying market opportunities and challenges. By understanding the different segments, service providers can tailor their offerings to meet specific client needs.

A detailed segmentation analysis reveals the following key areas:

| Service Type | Description | Regulatory Requirements |

| Trust Services | Managing assets on behalf of individuals or entities | High fiduciary duty, specific regulations |

| Corporate Services | Company formation, administration, and related services | Varying regulations based on jurisdiction |

| Wealth Management | Managing wealth for individuals or families | Regulated by financial services authorities |

The segmentation of Trust and Corporate Services by type is a critical aspect of market analysis. By understanding the different segments and their regulatory requirements, service providers can develop targeted strategies to meet client needs and comply with relevant regulations.

Functional applications in wealth, estate, and entity management

Trust and corporate services provide comprehensive solutions for wealth management, estate planning, and entity administration. These services are designed to cater to the diverse needs of individuals and businesses, ensuring that their assets are managed effectively and efficiently.

Wealth Management Services

Wealth management involves a range of services aimed at managing clients’ assets to achieve their financial goals. This includes investment management, financial planning, and portfolio management. Effective wealth management requires a deep understanding of the client’s financial situation, goals, and risk tolerance.

The key components of wealth management services are:

- Investment management

- Financial planning

- Portfolio management

- Risk management

Estate and Entity Management

Estate management involves planning and administering estates to ensure that assets are distributed according to the client’s wishes. This includes wills, trusts, and probate services. Entity management, on the other hand, involves the administration of corporate entities such as companies and trusts.

The importance of estate and entity management cannot be overstated, as it ensures that:

- Assets are protected and distributed as intended

- Corporate entities are administered in compliance with regulatory requirements

- Clients’ wishes are respected and carried out

In conclusion, trust and corporate services play a vital role in wealth, estate, and entity management. By providing specialized expertise and comprehensive solutions, these services help individuals and businesses manage their assets effectively and achieve their financial goals.

International market momentum and regional strategies

The Trust and Corporate Service market is experiencing various regional trends influenced by local economic conditions and regulatory environments. As the global economy continues to change, it is essential for service providers to understand these regional dynamics.

Regional Market Trends

Different regions are experiencing unique market trends. For instance, the Asia-Pacific region is seeing a surge in demand for trust and corporate services due to its growing economy and increasing wealth.

Key regional trends include:

- Increased demand in emerging markets

- Regulatory changes in established markets

- Growing need for digital services

Strategic Approaches

To capitalize on market opportunities, service providers must develop strategic approaches tailored to regional needs. This involves understanding local market dynamics and adapting services accordingly.

Effective strategies include:

- Developing region-specific services

- Investing in digital infrastructure

- Ensuring compliance with local regulations

U.K. market trends and trust service reform

The U.K. is leading the way in trust service reform, aiming to improve transparency and adapt to evolving client requirements. The trust and corporate service market in the U.K. is influenced by specific trends and reform initiatives, driven by the necessity for stricter regulatory compliance and the integration of digital technologies.

The U.K. trust service market is evolving to meet the demands of a rapidly changing financial landscape. Key trends include the increasing use of digital technologies and the evolution of trust services to meet changing client needs. Service providers are leveraging technology to enhance their offerings and improve client engagement.

U.K. Trust Service Market

The U.K. trust service market is characterized by a high level of regulatory scrutiny, with a focus on transparency and compliance. Trust service providers must navigate complex regulatory requirements to remain competitive. The market is also seeing a shift towards more sophisticated and tailored trust services, driven by client demand for greater flexibility and customization.

U.K. Trust Service Reform

The U.K. government has introduced several reform initiatives aimed at enhancing the transparency and integrity of the trust service market. These initiatives include the introduction of new registration requirements for trusts and the enhancement of reporting obligations for trust service providers.

A notable quote from a recent industry report highlights the significance of these reforms:

The impact of these reforms can be seen in the following table, which outlines the key changes and their expected outcomes:

| Reform Initiative | Description | Expected Outcome |

| New registration requirements for trusts | Trusts will be required to register with the relevant authorities, enhancing transparency. | Increased transparency and accountability |

| Enhanced reporting obligations for trust service providers | Trust service providers will be required to report certain information to the relevant authorities. | Improved compliance and reduced risk of financial crime |

The U.K. trust service market is expected to continue evolving in response to these reform initiatives, with a focus on enhancing transparency and meeting changing client needs.

Singapore’s role as a corporate services hub

Strategic Location and Global Connectivity

-

Singapore is positioned at the crossroads of major trade routes between Asia, Europe, and the Middle East.

-

Acts as a gateway to Southeast Asia and broader Asia-Pacific markets.

-

Time zone overlaps with major financial hubs (e.g., London, Hong Kong, Sydney), enabling smooth cross-border operations.

Business-Friendly Environment

-

Ranked consistently among the top in Ease of Doing Business by the World Bank.

-

Offers quick and efficient company incorporation, often within a day.

-

Transparent legal and regulatory frameworks promote investor confidence.

Robust Regulatory Framework

-

Strong compliance culture with clear guidelines from ACRA, MAS, and IRAS.

-

Strict adherence to AML/CFT regulations and international tax standards (e.g., FATCA, CRS).

-

Economic Substance Rules in place to enhance legitimacy of offshore entities.

U.A.E.’s financial sector positioning and service expansion

The United Arab Emirates is strategically positioning its financial sector for global relevance. This move is driven by significant developments aimed at enhancing its financial infrastructure and business environment.

U.A.E. Financial Sector

The U.A.E.’s financial sector is experiencing robust growth, driven by favorable business policies and a strategic geographic location. The country’s financial infrastructure is being continually upgraded to support this growth.

Some key factors contributing to the U.A.E.’s financial sector growth include:

- Increased foreign investment

- Advanced financial regulations

- A growing number of financial institutions

Service Expansion Initiatives

The U.A.E. is implementing various service expansion initiatives to capitalize on its growing financial sector. These initiatives include:

- Enhancing trust and corporate services

- Expanding wealth management services

- Developing innovative financial products

By focusing on these areas, the U.A.E. aims to become a leading financial hub, attracting businesses and investors from around the world.

The U.A.E.’s commitment to service expansion is evident in its efforts to create a conducive business environment. This includes regulatory reforms and investments in financial technology.

As a result, the U.A.E. is poised to play a significant role in the global financial landscape, offering a range of services that cater to diverse client needs.

New developments and directions for trust service innovation

The Trust and Corporate Service market is on the verge of a revolution with new developments in trust service innovation. This transformation is driven by the adoption of digital technologies such as blockchain and artificial intelligence, which are enhancing the efficiency, transparency, and client experience of trust services.

Innovation in Trust Services

The integration of innovative solutions is redefining the trust service landscape. Service providers are investing heavily in research and development to stay ahead of the curve and meet the evolving needs of their clients. This includes the use of advanced technologies to streamline processes, improve security, and offer personalized services.

Some of the emerging directions in trust service innovation include:

- The use of blockchain for secure and transparent transactions

- Artificial intelligence for predictive analytics and client profiling

- Digital platforms for enhanced client engagement

These emerging trends are not only improving the quality of trust services but also expanding their reach and accessibility.

As the Trust and Corporate Service market continues to evolve, it is likely that we will see even more innovative solutions emerge, further transforming the landscape of trust services and providing new opportunities for growth and development.

Competitive dynamics in the global Trust and Corporate Service market

To stay ahead, service providers are adopting competitive strategies that include leveraging technology to enhance service delivery, expanding their geographical presence, and developing specialized services. Effective competitive strategies enable companies to navigate the complex global market and achieve their business objectives.

Understanding these competitive dynamics is crucial for service providers to succeed in the global Trust and Corporate Service market. By adopting the right competitive strategies, companies can differentiate themselves and establish a strong market presence.

Here are some of the key players in the global Trust and Corporate Service market:

- Intertrust Group – Netherlands

- IQ-EQ Group Holdings – Luxembourg

- TMF Group – Netherlands

- Vistra Group – Hong Kong

- JTC Group – Jersey (Channel Islands)

- The Citco Group – Canada

- Corporation Service Company (CSC) – United States

- Tricor Group – Hong Kong

- Ocorian – Jersey (Channel Islands)

- Wilmington Trust – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Trust and Corporate Service Market Report |

| Base Year | 2024 |

| Segment by Type |

· Trust Services · Corporate Services · Wealth Management |

| Segment by Application |

· Wealth · Estate · Entity management |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global Trust and Corporate Service market is highly competitive, with many companies vying for a share of the market. The competition is influenced by factors such as the quality of services offered, adherence to regulations, and the ability to innovate.

Global Trust and Corporate Service Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Trust and Corporate Service Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Trust and Corporate ServiceMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Trust and Corporate Serviceplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Trust and Corporate Service Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Trust and Corporate Service Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Trust and Corporate Service Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofTrust and Corporate ServiceMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected size of the Trust and Corporate Service Market by 2025?

The Trust and Corporate Service Market is forecast to reach $14.33 billion globally by 2025.

What factors are driving the growth of the Trust and Corporate Service Market?

The growth is driven by regulatory changes, industry advancements, and increasing demand for trust and corporate services, including wealth management, estate planning, and entity management.

Who are the key players in the Trust and Corporate Service market?

Key players include financial institutions, law firms, and corporate service providers who deliver trust and corporate services, ensuring compliance with regulatory requirements.

How are regulatory changes impacting the Trust and Corporate Service market?

Regulatory changes are:

- Enhancing transparency and compliance

- Affecting how services are delivered

- Driving companies to adapt to new regulations

What are the main compliance challenges in trust and fiduciary services?

The main compliance challenges include:

- Meeting anti-money laundering (AML) and know-your-customer (KYC) requirements

- Managing risk

- Ensuring transparency

How do global political factors influence corporate service environments?

Global political factors, including changes in government policies, trade agreements, and geopolitical tensions, can impact the demand for corporate services and affect regional market dynamics.

What are the different types of Trust and Corporate Services?

The services include:

- Trust services

- Corporate services

- Wealth management

- Estate planning

- Entity management

Each service caters to different client needs and is subject to specific regulatory requirements.

What is the significance of Singapore and U.A.E. in the Trust and Corporate Service market?

Singapore has become a leading corporate services hub because of its business-friendly environment and regulations. On the other hand, the U.A.E. is working to become a major financial center with important advancements in its financial industry.

What are the emerging trends in the Trust and Corporate Service market?

Emerging trends include the adoption of digital technologies, such as blockchain and artificial intelligence, to enhance efficiency, transparency, and client experience.

What is the competitive landscape of the global Trust and Corporate Service market?

The market is characterized by competitive dynamics, with companies adopting strategies such as differentiation, cost leadership, and strategic partnerships to gain a competitive edge.