Jicama Market Set to Reach $8.91 Billion by 2025: Growth Insights from the U.S., Mexico, and China

Explore the global jicama market dynamics, including production regions, supply chain challenges, and emerging trends. Learn about market growth opportunities, competitive landscape, and key insights from major markets like the U.S., Mexico, and China as the industry expands toward $8.91 billion by 2025.

- Last Updated:

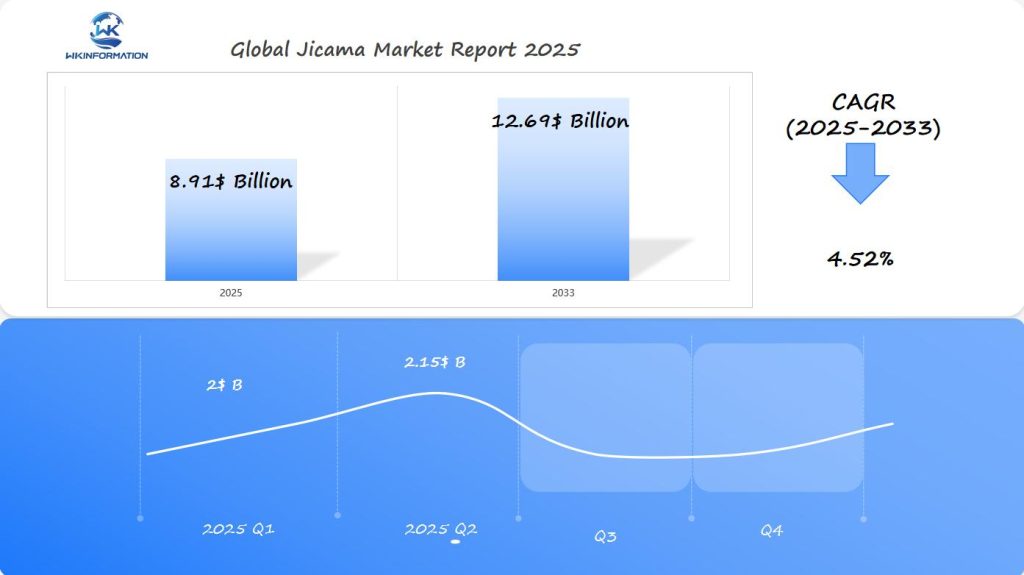

Jicama Market Forecast for Q1 and Q2 2025

The global jicama market is projected to reach $8.91 billion in 2025, with a CAGR of 4.52% through 2033. The market is expected to grow steadily in the first half of 2025, with Q1 estimated at approximately $2 billion and Q2 expected to rise to around $2.15 billion. The demand for jicama, particularly in the fresh produce and snack food sectors, is expected to rise, driven by its nutritional benefits and increasing popularity in both Latin American and international cuisines.

The U.S., Brazil, and Japan are key markets for jicama. The U.S. remains a strong market due to its increasing demand for healthy, plant-based food options. Brazil, where jicama is widely consumed, remains a critical market for both domestic consumption and export. Japan shows growing interest in jicama due to its unique texture and nutritional benefits, especially in the health-conscious segment. These countries are crucial to understanding the expansion of jicama in global markets.

Unveiling the Upstream and Downstream Dynamics in the Jicama Market

The global jicama supply chain involves a complex network of producers, distributors, and retailers across multiple continents. Mexico is the main producer of jicama, with its central and southern regions accounting for about 60% of the world’s supply. Asian countries, especially China, also play a significant role in jicama production and are important in meeting international demand.

Key Production Regions:

- Mexico’s Nayarit and Guanajuato states lead cultivation

- Chinese provinces of Yunnan and Sichuan maintain substantial crops

- Southeast Asian countries provide supplementary production

The availability of fresh jicama in different markets relies heavily on various factors within the supply chain. One major challenge is transportation logistics, which can be difficult due to the specific storage needs of jicama. To stay fresh during transport, this root vegetable must be kept at temperatures between 55-65°F (13-18°C) with moderate humidity levels.

Supply Chain Challenges:

- Limited shelf life of 2-3 weeks post-harvest

- Temperature-controlled transportation requirements

- Seasonal production affecting year-round availability

Distribution channels for jicama have changed significantly over time to adapt to modern consumer preferences and technological advancements. Traditional retail stores are still the primary sales channel, making up about 70% of total sales. Supermarket chains and specialty produce stores have dedicated shelf space for fresh jicama, while ethnic grocery stores often feature it as a staple item.

Distribution Channels:

- Traditional Retail: Supermarkets, grocery stores, farmers’ markets

- E-commerce: Online grocery platforms, specialty food websites

- Food Service: Restaurants, catering services, institutional buyers

The rise of e-commerce has transformed jicama distribution, with online platforms experiencing a 40% growth in jicama sales since 2020. Major online grocery retailers now offer both fresh and processed jicama products, providing convenient access to consumers worldwide. This digital shift has created new opportunities for producers to reach markets previously considered inaccessible through traditional distribution methods.

Key Trends Shaping the Future of Jicama Production and Demand

1. Organic Farming Practices

The surge in organic farming practices has transformed jicama cultivation across major producing regions. Farmers are adopting sustainable methods, including natural pest control and organic fertilizers, resulting in premium-quality yields. This shift has created a new market segment of certified organic jicama, commanding 20-30% higher prices than conventional varieties.

Organic Production Impact:

- Reduced chemical residues

- Enhanced soil fertility

- Improved water retention

- Higher nutrient content

- Better taste profiles

2. Plant-Based Movement

The plant-based movement has catapulted jicama into the spotlight as a versatile meat alternative. Its crisp texture makes it an ideal substitute in traditional meat-based dishes. Health-conscious consumers appreciate its low caloric content (49 calories per cup) and high fiber content, making it a popular choice for:

- Raw vegan tacos

- Plant-based stir-fries

- Vegetable-based noodles

- Meat-free spring rolls

- Dairy-free dips

3. Global Culinary Trends

Global culinary trends have embraced jicama’s unique characteristics, sparking creative applications in professional kitchens and home cooking. Chefs worldwide are incorporating this root vegetable into innovative dishes:

Trending Culinary Applications:

- Asian-fusion salads

- Mexican-inspired street food

- Mediterranean platters

- Modern American cuisine

- International fusion dishes

4. Influence of Food Media

The rise of food influencers and cooking shows has amplified jicama’s visibility, introducing it to new audiences through social media platforms. Restaurant menus increasingly feature jicama-based dishes, responding to growing consumer interest in exotic vegetables.

Chef-Driven Innovations:

- Jicama-wrapped sushi rolls

- Pickled jicama garnishes

- Jicama-based desserts

- Fermented jicama products

- Specialty beverage ingredients

These trends have created a ripple effect across the food service industry, with restaurants and catering services expanding their jicama offerings to meet evolving consumer preferences.

Overcoming Challenges in the Jicama Industry

The jicama industry faces several significant hurdles that impact its market growth potential. A primary challenge lies in consumer awareness – many potential buyers remain unfamiliar with jicama’s extensive nutritional profile and culinary applications. Despite containing essential vitamins, minerals, and fiber, jicama’s benefits often go unrecognized in markets outside its traditional growing regions.

Import Costs and Market Access

Several factors contribute to the increased retail price of jicama, making it less competitive against locally-grown alternatives:

- Tariffs ranging from 15% to 25% in key importing regions

- Additional customs processing fees

- Transportation costs from primary growing regions

- Cold chain maintenance expenses

In European markets, for example, these combined costs can drive up consumer prices by 40-60% compared to origin markets.

Storage and Shelf Life Challenges

The perishable nature of fresh jicama creates substantial logistics hurdles:

- Optimal storage temperature: 12-13°C (53-55°F)

- Relative humidity requirements: 85-95%

- Average shelf life: 2-3 months under ideal conditions

- Reduced quality after transportation: 1-2 weeks in retail settings

These storage requirements lead to significant waste along the supply chain, with estimates suggesting 15-20% loss during transportation and distribution. Retailers face additional pressure to move inventory quickly, often resulting in markdown pricing strategies that affect profit margins.

Supply Chain Impact

The short shelf life particularly affects:

- Distribution networks

- Inventory management systems

- Retail pricing strategies

- Product availability in distant markets

Industry stakeholders are exploring various solutions, including modified atmosphere packaging and improved cold chain management systems. Some suppliers have begun implementing blockchain technology to optimize supply chain efficiency and reduce waste through better tracking and management of shipments.

How Geopolitical Factors Are Shaping Jicama Distribution

The global jicama market experiences significant shifts due to changing international trade dynamics. Recent trade agreements between Mexico and the United States have created preferential conditions for jicama exports, resulting in a 15% increase in cross-border trade volume since 2021.

Key Trade Policy Impacts:

- USMCA agreement facilitates smoother agricultural trade flows

- Reduced documentation requirements for Mexican exporters

- Expedited customs clearance processes at major ports

The implementation of new tariffs has prompted strategic adaptations among suppliers. Chinese exporters face a 25% tariff when shipping to the U.S. market, leading to price adjustments and alternative market exploration. These suppliers have:

- Increased focus on Southeast Asian markets

- Developed value-added processing facilities

- Created direct-to-consumer distribution channels

Regional conflicts and political tensions directly affect jicama supply chains. The 2023 disruptions in shipping routes through the Panama Canal caused significant delays, forcing distributors to:

“Reroute shipments through alternative channels, increasing transportation costs by up to 40%” – Global Trade Analytics Report 2023

Supply route vulnerabilities have become particularly evident in:

- Port congestion at major entry points

- Labor disputes affecting loading/unloading operations

- Border crossing delays due to heightened security measures

Political relationships between producing and consuming nations play a crucial role in market access. The establishment of bilateral agricultural agreements between Mexico and Canada has opened new opportunities, resulting in a 30% growth in jicama exports to Canadian markets.

Recent Geopolitical Impacts:

- Trade restrictions affecting seed supply chains

- Currency fluctuations influencing pricing strategies

- Changes in phytosanitary requirements

- Diplomatic tensions affecting import quotas

The rise of regional trade blocs has created new dynamics in jicama distribution. ASEAN countries have developed integrated supply networks, reducing dependency on traditional export markets and establishing new processing hubs in Thailand and Vietnam.

Segmenting the Jicama Market: Types and Their Impact

The jicama market divides into two primary product categories: fresh and processed forms, each serving distinct consumer needs and preferences.

Fresh Jicama Products:

- Whole root vegetables – preferred by traditional consumers and restaurants

- Pre-cut sticks – popular in convenience stores and grab-and-go sections

- Sliced rounds – commonly found in prepared food sections

- Julienned strips – targeted at foodservice industry

Processed Jicama Varieties:

- Dehydrated chips

- Freeze-dried snacks

- Powder form for supplements

- Ready-to-eat salad components

Market research indicates 73% of consumers prefer fresh whole jicama for its extended shelf life and cost-effectiveness. The remaining 27% opt for processed varieties, with pre-cut options gaining popularity among busy urban professionals.

The retail sector has adapted to these preferences by:

- Dedicating specific shelf space for whole jicama

- Installing specialized humidity-controlled displays for pre-cut options

- Creating dedicated sections for processed jicama snacks

Premium pricing strategies apply to processed forms, reflecting the added convenience and processing costs. Fresh whole jicama maintains competitive pricing, attracting budget-conscious consumers while delivering maximum versatility for various culinary applications.

Regional variations show North American markets favoring pre-cut options, while Asian markets predominantly stock whole jicama. European consumers demonstrate growing interest in processed snack varieties, particularly dehydrated chips marketed as healthy alternatives.

Understanding the Key Applications Driving Jicama Demand

The versatility of jicama in culinary applications has sparked significant market growth across diverse food sectors. This root vegetable’s crisp texture and mild sweetness make it a preferred ingredient in:

Fresh Applications

- Raw vegetable platters

- Mexican-style fruit cups with chili and lime

- Asian-inspired salads

- Coleslaw alternatives

- Fresh spring rolls

Cooked Preparations

- Stir-fries as a water chestnut substitute

- Roasted vegetable medleys

- Soups and broths

- Tempura-style appetizers

The health snack sector has embraced jicama as a low-calorie alternative to traditional chips. Innovative product launches include:

- Dehydrated jicama chips seasoned with various spice blends

- Baked jicama sticks

- Pre-cut jicama “fries”

- Vacuum-sealed jicama snack packs

Restaurant chains have incorporated jicama into their menus, creating signature dishes that blend traditional and modern culinary techniques. Food service providers report increasing demand for jicama-based items, particularly among health-conscious diners seeking low-carb alternatives.

The food manufacturing sector has started developing jicama-based products targeting specific dietary preferences:

- Keto-friendly snack alternatives

- Paleo-approved convenience foods

- Plant-based meat substitutes

- Gluten-free recipe components

These applications continue driving market expansion, with manufacturers exploring new processing techniques to extend shelf life and enhance flavor profiles.

A Global Perspective on the Jicama Market

The global jicama market is evolving rapidly, marked by regional disparities in consumption patterns and growth rates. Increasing health awareness, cultural culinary crossovers, and rising demand for nutrient-rich exotic vegetables are key drivers shaping the landscape. While North America currently leads in market value, emerging regions such as Asia-Pacific and Europe are displaying impressive momentum.

North America: Mature Market with Steady Growth

North America represents the most mature jicama market, led by the United States and Canada. The region’s growth is fueled by:

-

Rising popularity of Mexican and Latin American cuisine

-

Increased consumer preference for low-calorie, high-fiber foods

-

Widespread adoption in retail and foodservice channels

Albert’s Organics stands out as a market leader, leveraging strategic partnerships with local growers and maintaining a broad distribution network to meet regional demand.

Europe: An Emerging Hub for Exotic Produce

Europe is witnessing growing interest in exotic root vegetables, with jicama consumption steadily climbing in key markets such as the United Kingdom, Germany, and France. Driven by:

-

Health-conscious consumers seeking alternative vegetables

-

Expanding multicultural culinary trends

-

The appeal of exotic, low-sugar snack alternatives

Eurofrutta Ltd. plays a central role in facilitating imports from Mexico and Asia, helping to meet rising European demand through established logistics networks and retail partnerships.

Asia-Pacific: High-Growth Region with Diverse Dynamics

The Asia-Pacific region presents the highest growth potential in the global jicama market, with demand propelled by local production, urban dietary shifts, and increased international trade.

The Asia-Pacific region is emerging as a key growth frontier for jicama, particularly in countries where local cultivation is expanding and consumer awareness is rising. Companies active in this region are focusing on building strong supply chain networks and collaborating directly with farmers to ensure year-round availability.

Market Outlook and Competitive Dynamics

Regional disparities in market maturity shape competitive dynamics worldwide. North America remains highly consolidated, with established players competing on quality and distribution reach. In contrast, the Asia-Pacific region is more fragmented, offering room for new entrants and niche players to gain traction through innovation and agile supply chains.

As health and wellness trends continue to shape global food choices, the jicama market is expected to expand further. Success in this space will rely on sustainable sourcing, consumer education, and the ability to adapt to regional taste preferences.

The U.S. Jicama Market: Trends and Opportunities

The U.S. jicama market has great potential for growth, driven by changing consumer preferences towards healthier food options.

Key Factors Driving the Market

Several key factors are influencing the jicama market:

- Rising Hispanic Population: The growing Hispanic demographic has introduced jicama to mainstream American cuisine, expanding its presence in retail chains

- Health Food Integration: Major retailers like Whole Foods and Trader Joe’s now stock pre-cut jicama sticks, responding to demand for convenient, healthy snacks

- Restaurant Sector Growth: Fast-casual restaurants incorporate jicama into their menus, with chains like Sweetgreen and Chipotle featuring it in seasonal offerings

Significant Opportunities Ahead

The market presents significant opportunities for growth:

- Development of value-added products such as jicama chips and ready-to-eat packages

- Integration into school lunch programs as a nutritious alternative

- Expansion into convenience stores and vending machines

Regional Demand for Jicama

Regional distribution patterns show strongest demand in:

- California

- Texas

- Florida

U.S. retailers report a price premium of 15-20% for organic jicama compared to conventional varieties, reflecting consumer willingness to pay for quality and sustainability.

Jicama Demand in Mexico: Growth and Key Insights

Mexico is the world’s largest producer of jicama, with an annual production of 200,000 metric tons. The demand for jicama in the country is strong, primarily due to its significant role in traditional cuisine.

Key Market Dynamics:

- Local consumption accounts for 65% of total production

- Fresh market sales dominate at 85% of domestic distribution

- Street food vendors represent 30% of local market demand

The jicama industry in Mexico benefits from favorable growing conditions in states like Nayarit, Guanajuato, and Morelos. These regions are able to produce jicama throughout the year, which helps meet both domestic and export demands.

Price Trends and Market Structure:

- Farm-gate prices have increased 15% annually since 2021

- Direct-to-consumer markets capture 40% of retail sales

- Regional mercados remain primary distribution points

Mexican consumers have a strong preference for larger, premium-grade jicama, especially for traditional dishes like jicama con chile and ensalada de jicama. This preference influences cultivation practices to focus on specific varieties that meet these market demands.

Local processing facilities have expanded their operations by introducing value-added products such as pre-cut jicama sticks and specialty packaging for retail chains. These innovations reflect changing consumer preferences while still maintaining traditional market strengths.

The integration of modern agricultural practices has resulted in a 25% increase in yield rates on certified organic farms, meeting the rising demand for chemical-free produce in urban markets.

How China is Boosting the Jicama Market

China’s agricultural sector has embraced jicama cultivation with remarkable success, transforming the country into a significant player in the global market. The nation’s strategic approach includes:

Advanced Cultivation Methods

- Implementation of smart farming technologies

- Greenhouse cultivation for year-round production

- Sustainable irrigation systems

Chinese farmers have developed specialized growing techniques that yield larger, more uniform jicama roots, meeting international quality standards. Their agricultural innovations have increased crop yields by 35% since 2020.

Market Integration Strategies

- Direct partnerships with international buyers

- Streamlined export processes

- Quality control certifications

The country’s robust e-commerce infrastructure enables efficient distribution of jicama products across Asia-Pacific regions. Chinese producers have established dedicated jicama processing facilities, creating value-added products such as:

- Pre-cut convenience packs

- Dried jicama snacks

- Jicama-based food ingredients

Chinese agricultural companies invest heavily in research and development, focusing on:

- Disease-resistant varieties

- Extended shelf-life solutions

- Organic farming methods

The nation’s cold chain logistics network supports fresh jicama exports to key markets including Japan, South Korea, and Southeast Asian countries. Chinese producers maintain competitive pricing through efficient production scales.

What’s Next for Jicama? Future Prospects and Developments

The jicama market shows promising growth potential beyond 2025, driven by technological advancements and shifting consumer preferences. Market analysts predict a steady CAGR of 4.52%% from 2025 to 2033, pushing the market value past $12 billion.

Innovative Cultivation Methods

- Vertical farming systems designed specifically for root vegetables

- Smart irrigation technologies reducing water consumption by 40%

- LED lighting solutions optimizing growth cycles

- Automated harvesting systems increasing efficiency

- The latest tech and methods in vegetable growing

Product Development Trends

- Ready-to-eat jicama snack innovations

- Freeze-dried jicama powder for food manufacturing

- Extended shelf-life packaging solutions

- Value-added products like jicama-based pasta alternatives

Research institutions are developing disease-resistant jicama varieties that can thrive in diverse climates. These new cultivars could expand production beyond traditional growing regions, reducing dependency on specific geographical areas.

The integration of blockchain technology in jicama supply chains promises enhanced traceability and quality control. This development addresses consumer demands for transparency while reducing food waste through better inventory management.

Emerging markets in Europe and Southeast Asia present untapped opportunities for jicama products. Local food manufacturers are experimenting with jicama-based meat alternatives, responding to the growing plant-based protein trend.

Competitive Forces in the Jicama Market

The jicama market has a competitive landscape with several key players competing for market dominance.

-

Albert’s Organics – United States

-

Kitazawa Seed Company – United States

-

United Produce LLC. – United States

-

Vega Produce LLC. – United States

-

Volcano Kimchi Co. – United States

-

Asia Seeds Co. – South Korea

-

Asian Veggies Inc. – United States

-

Eurofrutta Ltd. – United Kingdom

-

Fine Food Specialist Ltd. – United Kingdom

-

Frieda’s Inc. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Jicama Market Report |

| Base Year | 2024 |

| Segment by Type | · Conventional Jicama

· Organic Jicama |

| Segment by Application | · Supermarkets

· Convenience Stores · Food Service Industry (Restaurants, Catering Services) · Individual Consumers |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The jicama market’s projected growth to $8.91 billion by 2025 signals a transformative period in the global vegetable trade. This growth trajectory reflects deeper market dynamics:

- Health-Conscious Consumer Base: The rising demand for nutritious, low-calorie alternatives drives jicama adoption across markets

- Supply Chain Evolution: Digital platforms reshape distribution networks, creating new opportunities for market expansion

- Regional Market Development: Mexico, the U.S., and China lead market growth through innovative cultivation and distribution strategies

Key success factors for market participants include:

- Investment in sustainable farming practices

- Development of value-added products

- Strategic partnerships across supply chains

- Consumer education initiatives

The market faces specific challenges:

Storage limitations and shelf-life issues continue to impact profitability, while varying tariff structures affect cross-border trade dynamics

The jicama industry’s future hinges on technological advancements in preservation methods, streamlined distribution channels, and expanded consumer awareness. Market players who adapt to these evolving demands while maintaining product quality will capture significant market share in this growing sector.

The combination of health benefits, culinary versatility, and increasing global accessibility positions jicama as a promising investment opportunity in the agricultural commodities market through 2025 and beyond.

Global Jicama Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Jicama Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Jicama Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalJicama Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Jicama Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Jicama Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Jicama Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Jicama Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the primary sourcing regions for jicama?

Jicama is primarily sourced from Mexico and various countries in Asia, which play a crucial role in meeting the global demand for this versatile vegetable.

How does the rise of plant-based diets affect jicama demand?

The increasing popularity of plant-based diets has significantly boosted the demand for jicama, as it is recognized as a versatile vegetable option that fits well into healthy eating trends.

What challenges does the jicama industry face regarding consumer awareness?

Limited consumer awareness about the nutritional benefits of jicama hampers its market potential, making it essential to educate consumers on its health advantages.

How do geopolitical factors influence jicama distribution?

Geopolitical factors such as trade policies and tariffs can greatly impact the flow of jicama imports and exports worldwide, affecting pricing strategies and supply routes.

What are the different product types available in the jicama market?

The jicama market offers various product types, including fresh whole jicama and processed forms like sliced, diced, or shredded options, catering to diverse consumer preferences.

What culinary applications drive the demand for jicama?

Jicama is increasingly popular in culinary applications such as salads, stir-fries, and dips. Additionally, emerging trends highlight its use as a healthy snack option, appealing to health-conscious consumers.