Arecanut Market Set to Achieve $815.36 Million by 2025: Key Developments in India, Indonesia, and Thailand

Explore the dynamic arecanut market’s growth trajectory to $815.36M by 2025, analyzing crucial developments across major producing regions India, Indonesia, and Thailand. Learn about market trends, challenges, and opportunities.

- Last Updated:

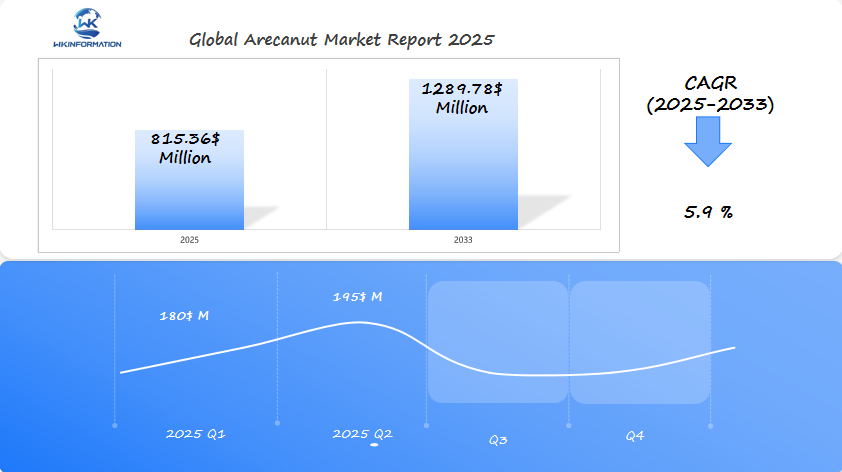

Arecanut Market Forecast for Q1 and Q2 2025

The global arecanut market is projected to reach $815.36 million in 2025, with a CAGR of 5.9% through 2033. The market is expected to experience steady growth in the first half of 2025, with Q1 estimated at around $180 million and Q2 showing a rise to approximately $195 million, driven by growing demand for arecanut in the food and beverage sector, as well as traditional uses in Asia. India, Indonesia, and Thailand are key markets for arecanut.

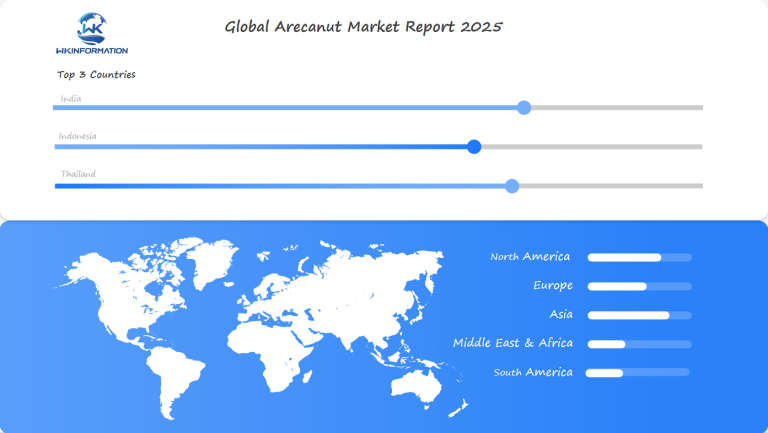

India, as the largest producer and consumer of arecanut, drives the market, with demand particularly strong in chewing products and cultural uses. Indonesia and Thailand, both important producers of arecanut, also show steady demand, primarily for traditional and export markets. These countries are crucial for understanding the market dynamics and supply-demand balance for arecanut globally.

Exploring the Upstream and Downstream Dynamics in the Arecanut Market

The arecanut industry operates through a complex network of upstream and downstream processes, creating a robust supply chain that supports its projected $815.36 million market value by 2025.

Upstream Production Processes

The upstream production processes in the arecanut industry include:

- Cultivation in controlled environments with specific soil requirements

- Harvesting at precise maturity stages for optimal quality

- Post-harvest processing including boiling, sun-drying, and grading

- Quality control measures to ensure product consistency

Downstream Applications

The downstream applications of arecanut include:

- Food Industry: Pan masala production, confectionery items

- Cosmetic Sector: Natural dyes, organic beauty products

- Traditional Medicine: Ayurvedic preparations

- Industrial Uses: Tannin extraction, textile dyeing

The Role of Distribution Network

The distribution network plays a vital role in connecting these processes. Local collectors gather arecanuts from farmers, selling to wholesale traders who supply processing units. These units then distribute finished products through:

- Regional distributors

- Export channels

- Direct-to-consumer platforms

- Retail networks

The Impact of Modern Supply Chain Technologies

Modern supply chain technologies have streamlined these processes, enabling better inventory management and quality control. Digital platforms now connect farmers directly with processors, reducing intermediary costs and improving market efficiency. This integration of technology with traditional practices has strengthened the industry’s ability to meet growing consumer demand while maintaining product quality.

Key Trends Shaping the Arecanut Industry

The arecanut industry is experiencing significant changes in production methods and consumer preferences. Here are some key trends shaping the industry:

1. Shift towards Organic Farming

Organic farming practices are gaining momentum as producers adopt sustainable cultivation techniques. Some of these techniques include:

- Natural pest control methods

- Bio-fertilizers derived from arecanut waste

- Water conservation systems

- Integrated farming approaches

2. Health-Conscious Consumers Driving Market Changes

Health-conscious consumers are driving market changes through their purchasing decisions. Recent studies have linked traditional arecanut consumption to health risks, prompting manufacturers to develop:

- Low-alkaloid varieties

- Processed alternatives with reduced health impacts

- Natural extracts for therapeutic applications

3. Innovation as a Key Factor in Market Growth

Innovation is emerging as a critical factor in market growth. Manufacturers are responding to changing demands with new product developments such as:

- Cosmetic ApplicationsNatural hair dyes

- Organic skincare products

- Dental care formulations

- Food Industry AdaptationsSugar-free pan masala alternatives

- Fortified arecanut products

- Natural food colorants

4. Collaborations for Safer Processing and Novel Applications

Research institutions are partnering with producers to develop safer processing methods and identify novel applications. These collaborations have resulted in enhanced extraction techniques and specialized product formulations for pharmaceutical uses.

5. Increased Demand for Certified Organic Products

The market is seeing increased demand for certified organic arecanut products, particularly in export markets. Producers are implementing rigorous quality control measures and traceability systems to meet international standards and consumer expectations.

Barriers to Growth in the Arecanut Market

The arecanut industry faces significant regulatory challenges due to established health risks. Scientific studies have linked regular arecanut consumption to:

- Oral submucous fibrosis

- Increased risk of oral cancer

- Dental health complications

- Cardiovascular issues

These health concerns have led to strict regulations in several countries, with some implementing partial bans on arecanut-based products. The FDA has classified arecanut as a potentially harmful substance, requiring mandatory warning labels on products containing this ingredient.

Market growth faces additional challenges beyond health regulations:

- Supply Chain Disruptions: Weather-dependent cultivation creates unpredictable harvest yields

- Quality Control Issues: Inconsistent processing standards across different regions

- Price Volatility: Fluctuating market prices affect farmer incomes and industry stability

- Limited Storage Infrastructure: Inadequate facilities lead to post-harvest losses

Consumer awareness campaigns have created a complex market dynamic. While these initiatives protect public health, they’ve impacted traditional arecanut markets. Recent surveys indicate a 15% decrease in consumption among younger demographics in key markets like India and Indonesia.

The industry’s response includes:

- Implementing stricter quality control measures

- Developing alternative processing methods

- Investing in research for safer consumption practices

- Creating transparent supply chain documentation

Health regulations continue shaping market access, particularly in developed countries where stringent food safety standards apply. These restrictions have pushed manufacturers to explore new product formulations and alternative applications for arecanut derivatives.

Geopolitical Factors Influencing Arecanut Production and Export

Trade policies create significant ripples across the arecanut market landscape. India’s implementation of minimum import prices and strict quality standards has reshaped regional trade dynamics, pushing exporters to adapt their practices or seek alternative markets.

Key Trade Policy Impacts:

- Import duties ranging from 108% to 150% in India protect domestic producers

- Indonesia’s export regulations require certification of product quality

- Thailand’s bilateral trade agreements with China and Malaysia affect pricing structures

The diplomatic relationships between producing nations directly influence market access. India’s trade tensions with neighboring countries have led to increased scrutiny of arecanut imports, creating opportunities for Indonesian and Thai exporters in alternative markets.

Supply Chain Dynamics:

- Cross-border tensions affect transportation routes

- Currency fluctuations impact profit margins

- Regional trade agreements shape market access

Recent shifts in international relations have created new trade corridors. China’s Belt and Road Initiative has opened additional routes for arecanut transportation, reducing logistics costs for Southeast Asian producers.

Price Influencing Factors:

- Bilateral trade agreements

- Export quotas

- Quality certification requirements

- Transportation infrastructure development

The establishment of the ASEAN Economic Community has streamlined trade processes among Southeast Asian nations, benefiting Indonesian and Thai exporters through reduced tariffs and simplified customs procedures.

Arecanut Market Segmentation by Type: What You Need to Know

The arecanut market features two distinct varieties: red and white arecanuts, each with unique characteristics and market applications.

Red Arecanuts:

- Harvested from unripe, green nuts

- Processed through boiling and sun-drying

- Rich, deep color preferred in traditional markets

- Higher tannin content

- Popular in pan masala production

- Dominant market share in South Asian regions

White Arecanuts:

- Derived from fully ripened nuts

- Processed through sun-drying without boiling

- Milder flavor profile

- Lower tannin concentration

- Preferred in pharmaceutical applications

- Growing demand in Western markets

Regional preferences shape market dynamics significantly. South Asian countries show strong demand for red arecanuts, particularly in India where traditional consumption patterns drive sales. White arecanuts see increasing adoption in Southeast Asian markets, with Thailand and Indonesia leading consumption.

Market data indicates price variations between the two varieties:

- Red arecanuts command premium prices due to intensive processing

- White arecanuts offer cost advantages in bulk processing

- Price differentials vary by 15-20% depending on quality grades

Consumer preferences continue evolving with emerging health consciousness and changing cultural practices. The red variety maintains dominance in traditional markets while white arecanuts gain traction in modern applications.

Applications Driving the Global Demand for Arecanut

The arecanut market thrives through diverse applications across multiple industries. Pan masala stands as the primary driver of arecanut demand, representing 65% of global consumption. This chewable tobacco product combines arecanut with various spices and flavoring agents, creating a cultural staple in South Asian countries.

Food Industry Applications:

- Natural food coloring agent in processed foods

- Ingredient in traditional confectionery products

- Flavor enhancer in specific regional cuisines

- Base material for specialty beverages

Emerging Industrial Uses:

- Organic cosmetics production (face masks, hair care products, natural exfoliants)

- Pharmaceutical preparations

- Dental care products

- Agricultural fertilizers

The cosmetics sector has embraced arecanut extracts for their antioxidant properties. Leading beauty brands now incorporate these extracts in anti-aging formulations and skin brightening products. Research indicates a 15% annual growth in arecanut-based cosmetic products.

Traditional medicine practices utilize arecanut in various preparations. The pharmaceutical industry has started exploring its potential therapeutic properties through clinical studies. This scientific interest has sparked new product development in health supplements and alternative medicine formulations.

The agricultural sector uses arecanut waste as organic fertilizer, creating a sustainable cycle of production. This application has gained traction among organic farmers, particularly in India and Southeast Asia.

Regional Insights into the Arecanut Market

The arecanut market exhibits distinct regional characteristics across different geographical zones:

Asia-Pacific

- India dominates with 85% market share

- Bangladesh and Myanmar show steady consumption patterns

- China demonstrates growing interest in arecanut-based products

Middle East

- UAE serves as a major trading hub

- Rising demand in specialty food products

- Strong market for traditional pan masala preparations

North America

- Emerging market for organic arecanut derivatives

- Growing interest in natural food coloring applications

- Strict regulatory framework affecting import volumes

Europe

- Limited but increasing demand in cosmetic industries

- UK leads European imports, primarily from Thailand

- Focus on sustainable sourcing practices

The regional distribution patterns highlight significant variations in consumption habits and regulatory frameworks. Cultural practices strongly influence market dynamics, with traditional consuming regions maintaining stable demand while new markets emerge in response to innovative applications. Price sensitivity varies across regions, with developed markets showing willingness to pay premium prices for certified organic products.

Local processing capabilities play a crucial role in market development, with regions possessing established processing infrastructure showing stronger market presence. The availability of substitute products and regional health regulations create distinct market environments across different geographical areas.

India’s Dominance in the Global Arecanut Industry

India is the clear leader in the global arecanut industry, producing about 54% of the world’s supply. Several key factors contribute to India’s dominance:

1. Production Strongholds

- Karnataka leads domestic production with a 35% share

- Kerala contributes 25% of national output

- Assam accounts for 15% of total production

2. Market Infrastructure

- Advanced processing facilities in major growing regions

- Established network of 2,500+ registered traders

- Robust cold storage facilities exceeding 100,000 metric tons capacity

The Indian arecanut industry employs sophisticated cultivation techniques, including integrated pest management and precision farming methods. Local farmers utilize advanced irrigation systems and organic farming practices to maintain high-quality yields.

3. Price Control Mechanisms

- Minimum Support Price (MSP) implementation

- Government-backed cooperative societies

- Regular market interventions to stabilize prices

The country’s research institutions, particularly the Central Plantation Crops Research Institute (CPCRI), drive innovation through:

- Development of disease-resistant varieties

- Implementation of sustainable farming practices

- Creation of value-added products

Indian arecanut exports reach major markets including UAE, Singapore, and Nepal, with annual export values exceeding $50 million. The domestic market remains strong, supported by cultural practices and traditional usage in ceremonies and celebrations.

Indonesia’s Role in Arecanut Supply Chains

Indonesia plays a crucial role in the global arecanut market, significantly influencing the dynamics of the supply chain. Its strategic location in Southeast Asia makes it an important center for arecanut trade, serving not only Asian markets but also regions beyond.

Key Production Regions:

- North Sulawesi

- Sumatra

- East Java

- Bali

The arecanut industry in Indonesia thrives due to its favorable growing conditions, with tropical climate zones allowing for year-round cultivation. Local farmers utilize traditional farming methods that have been passed down through generations, resulting in high-quality yields that command premium prices in international markets.

Market Strengths:

- Advanced processing facilities enabling efficient post-harvest handling

- Strong logistics infrastructure supporting seamless export operations

- Established trade relationships with major importing countries

- Competitive labor costs reducing production expenses

Indonesian arecanut exports have shown steady growth patterns, particularly in serving markets such as China, Taiwan, Vietnam, and Middle Eastern countries.

The country’s processing sector has evolved to meet international standards by implementing quality control measures and certification programs. Indonesian processors specialize in both raw and processed arecanut products, adapting to diverse market requirements and consumer preferences.

Local government initiatives support sustainable arecanut farming practices, encouraging farmers to adopt modern agricultural techniques while preserving traditional knowledge. These efforts have helped maintain Indonesia’s competitive edge in the global arecanut supply chain.

Thailand’s Impact on the Global Arecanut Market

Thailand’s role in the global arecanut market is distinct from other major producers, with specific features that make it unique. The country’s production reached its highest point in 2015 and has since maintained steady yield rates per hectare.

Key Export Markets

Thailand exports arecanut to several countries, including:

- United Kingdom

- Malaysia

- Singapore

- Myanmar

Production Strengths

The arecanut industry in Thailand has several advantages that contribute to its success:

- Advanced agricultural technology

- Efficient post-harvest processing

- Strong quality control measures

- Established export infrastructure

Government Support

The Thai government plays an active role in supporting arecanut farmers through various initiatives:

- Agricultural subsidies

- Technical training programs

These efforts have proven beneficial in maintaining consistent production levels, even in the face of regional climate challenges.

Specialized Processing Methods

Thailand stands out from other producers due to its specialized processing methods, particularly in the production of white arecanut varieties. The processors in Thailand have developed proprietary techniques for nut preparation, which enables them to create products that meet the specific requirements of buyers from Europe and Asia.

Recent Developments

Several recent developments in Thailand’s arecanut sector include:

- Implementation of sustainable farming practices

- Investment in automated processing facilities

- Development of value-added arecanut products

- Expansion of cold storage infrastructure

These initiatives demonstrate Thailand’s commitment to enhancing its competitiveness in the global market.

Strategic Focus on Quality

Rather than prioritizing large-scale production, Thailand has strategically decided to focus on quality over quantity. This approach has established the country as a reliable supplier of premium arecanut products worldwide.

What’s Next for the Arecanut Industry?

The arecanut industry is expected to grow significantly, with market projections exceeding $815.36 million after 2025. Industry analysts predict a steady growth rate of 5.51% from 2024 to 2033, driven by new applications and market adaptations.

Key Factors Driving Growth

Several factors are contributing to the growth of the arecanut industry:

- Technological Integration – Smart farming practices and automated processing systems are set to revolutionize arecanut cultivation

- Product Diversification – Research initiatives focus on developing new arecanut-based products for cosmetics and pharmaceuticals

- Sustainable Practices – Growing adoption of eco-friendly cultivation methods and organic certification programs

Shifting Consumer Preferences

Consumer preferences are changing, with a greater emphasis on:

- Natural and organic products

- Sustainable sourcing

- Transparent supply chains

- Health-conscious alternatives

These evolving preferences create opportunities for:

- Development of arecanut-based wellness products

- Implementation of blockchain technology for supply chain transparency

- Creation of value-added products with reduced health risks

The Industry’s Transformative Period

The industry is currently undergoing a transformative period where traditional practices are being combined with modern innovations. Market leaders are investing in research and development to create safer alternatives while still respecting cultural significance. This adaptation strategy aims to find a balance between consumer health concerns and potential market growth.

Regional markets are experiencing different rates of adoption for these changes, with Asia-Pacific leading the way in sustainable practices and product development. The future of the industry depends on its ability to adapt to changing consumer needs while also maintaining production efficiency.

Competitive Dynamics in the Arecanut Market

The global arecanut market has several dominant players who control significant portions of the market. Some of the leading companies in this industry include:

- GM Group – Vietnam

- Surya Exim – India

- R.K. Trading – India

- Biotan Pharma – India

- Shri Ganesh Prasad Traders – India

- Marlene Traders Co. Ltd. – Thailand

- Viet D.E.L.T.A Industrial Co. Ltd. – Vietnam

- Maganlal Shivram and Company – India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Arecanut Market Report |

| Base Year | 2024 |

| Segment by Type |

· Red Arecanuts · White Arecanuts |

| Segment by Application |

· Food Industry · Industrial Uses |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The arecanut market’s projected growth to $815.36 million by 2025 reflects its strong market position despite regulatory challenges. India, Indonesia, and Thailand continue to shape the industry through innovative production methods and strategic market adaptations. The sector’s evolution spans multiple applications – from traditional uses to emerging opportunities in cosmetics and food coloring.

The industry’s future success depends on:

- Balancing health concerns with market demand

- Adopting sustainable farming practices

- Developing new product applications

- Strengthening international trade relationships

Global Arecanut Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Arecanut Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Arecanutplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Arecanut Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Arecanut Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Arecanut Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofArecanut Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream processes involved in arecanut cultivation?

Upstream processes in arecanut cultivation include seed selection, land preparation, planting, irrigation, fertilization, pest management, and harvesting. These steps are crucial for ensuring optimal yield and quality of the arecanut.

What downstream applications utilize arecanut?

Arecanut is widely used in various downstream applications including food products like pan masala, cosmetics, and as a food coloring agent. Its versatility makes it valuable across multiple industries.

What key trends are currently shaping the arecanut industry?

Current trends include a shift towards organic farming practices, increased health awareness among consumers leading to preferences for arecanut-based products, and innovations that cater to changing market demands.

What barriers does the arecanut market face regarding growth?

The arecanut market faces several barriers including stringent health regulations due to consumption risks associated with oral cancer, market challenges that limit growth potential, and the need for consumer awareness initiatives to sustain demand.

How do geopolitical factors influence the production and export of arecanut?

Geopolitical factors play a significant role in shaping trade policies affecting exporting countries like India, Indonesia, and Thailand. International relations can impact supply chains and pricing dynamics within the global market for arecanuts.