Oil and Gas Chemicals Market Set to Reach $11.03 Billion by 2025: Insights from the U.S., Saudi Arabia, and Russia

In 2025, the global market reached an estimated value of USD 85.36 billion, with projections indicating growth to USD 123.54 billion by 2033 at a compound annual growth rate (CAGR) of 4.73%. This growth is driven by increasing energy demand, rising oilfield activities, and the expanding petrochemical industry, which necessitates a variety of chemicals for drilling, production, and refining processes.

- Last Updated:

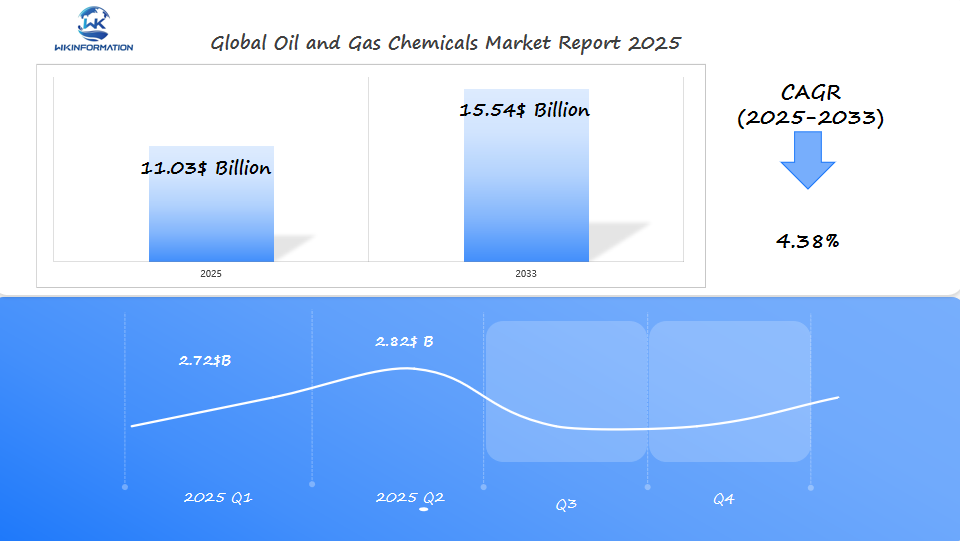

Oil and Gas Chemicals Market Forecast for Q1 and Q2 2025

The oil and gas chemicals market is projected to reach $11.03 billion in 2025, with a modest CAGR of 4.38% through 2033. Q1 revenue is anticipated at $2.72 billion, rising to about $2.82 billion in Q2, reflecting stable exploration and production activity.

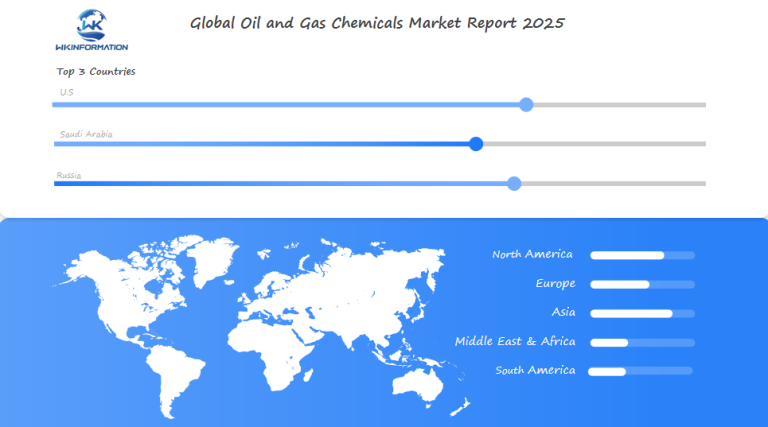

The U.S. market leads in demand due to shale gas projects and enhanced oil recovery operations. Saudi Arabia’s focus on refining capacity expansion and long-term energy projects strengthens regional chemical usage.

Russia contributes through upstream activities and its vast oil reserves, despite infrastructure challenges. Key growth drivers include green chemicals, drilling fluid innovation, and tighter environmental regulations worldwide.

Key Takeaways

- The global Oil and Gas Chemicals Market is projected to reach $11.03 billion by 2025.

- Major contributors to this growth include the U.S., Saudi Arabia, and Russia.

- Increasing energy demands are driving the market’s expansion.

- Technological advancements in extraction processes are also a significant factor.

- The market is becoming increasingly competitive with a focus on R&D.

Analyzing the Upstream and Downstream Market Forces in Oil and Gas Chemicals

Understanding the dynamics of upstream and downstream market forces is crucial for analyzing the oil and gas chemicals market. The oil and gas industry is broadly categorized into upstream, midstream, and downstream segments. The upstream segment involves exploration and production activities, where chemicals play a vital role in drilling, completion, and production operations.

Understanding Upstream Market Forces

The upstream segment is a significant consumer of oil and gas chemicals. Chemicals used in this segment are crucial for various operations, including drilling, completion, and production. The demand for these chemicals is driven by the level of exploration and production activities.

Drilling and Completion Chemicals

Drilling and completion chemicals are essential for the efficient operation of drilling and completion activities. These chemicals are used for various purposes, such as:

- Improving drilling fluid properties

- Enhancing well completion

- Reducing friction during drilling

The use of these chemicals not only improves the efficiency of operations but also helps in reducing costs and enhancing safety. The market for drilling and completion chemicals is driven by the increasing demand for energy and the growing complexity of drilling operations.

Some of the key chemicals used in drilling and completion operations include:

- Drilling fluids: These are used to lubricate the drill bit, remove rock cuttings, and maintain wellbore stability.

- Cementing chemicals: These are used to ensure the integrity of the well by providing zonal isolation.

- Completion fluids: These are used to facilitate the completion of wells by providing the necessary hydrostatic pressure and minimizing formation damage.

The demand for these chemicals is expected to grow as the oil and gas industry continues to explore and produce from more complex and challenging environments.

Key Trends Driving Oil and Gas Chemicals Market Growth

Emerging trends in the energy sector are playing a crucial role in shaping the oil and gas chemicals market. The increasing demand for energy is a significant driver of this growth, as it necessitates the exploration and production of oil and gas resources.

Increasing Demand for Energy

The global demand for energy is on the rise, driven by factors such as population growth, urbanization, and industrialization. This increasing demand is putting pressure on oil and gas producers to ramp up their exploration and production activities, thereby driving the demand for oil and gas chemicals.

According to industry experts, “The growing energy demand is a key driver of the oil and gas chemicals market, as it requires the use of specialized chemicals to enhance the efficiency and safety of exploration and production operations.”

“The energy demand is expected to continue rising, driven by emerging economies and increasing industrialization.”

International Energy Agency

Shale Gas Exploration

Shale gas exploration is another significant trend driving the growth of the oil and gas chemicals market. The use of hydraulic fracturing, or fracking, has enabled the extraction of oil and gas from shale formations, which was previously not possible.

The shale gas exploration trend is particularly prominent in regions like the United States, where it has led to a significant increase in domestic oil and gas production.

| Region | Shale Gas Production (2020) | Shale Gas Production (2025) |

| North America | 20 billion cubic feet/day | 30 billion cubic feet/day |

| Europe | 1 billion cubic feet/day | 5 billion cubic feet/day |

| Asia Pacific | 2 billion cubic feet/day | 10 billion cubic feet/day |

The increasing demand for energy and the growth of shale gas exploration are expected to continue driving the oil and gas chemicals market growth. As the market continues to evolve, companies will need to adapt to changing trends and technologies to remain competitive.

Barriers to Growth in the Oil and Gas Chemicals Industry

The growth of the oil and gas chemicals sector is not without its hurdles, including environmental and regulatory issues. The industry faces numerous challenges that could potentially hinder its progress.

The oil and gas chemicals industry is under increasing scrutiny due to its environmental impact and the regulatory frameworks that govern its operations. As the industry continues to grow, it must navigate these challenges effectively.

Environmental Concerns

Environmental concerns are a significant barrier to growth in the oil and gas chemicals industry. The extraction, processing, and transportation of oil and gas result in environmental impacts such as water pollution, air emissions, and habitat disruption. For instance, the use of chemicals in hydraulic fracturing (fracking) has raised concerns about groundwater contamination.

Regulatory Challenges

Regulatory challenges are another significant barrier. Governments worldwide are implementing stricter regulations to mitigate the environmental impacts of the oil and gas industry. Compliance with these regulations can be costly and complex, potentially hindering the growth of the oil and gas chemicals market.

| Region | Regulatory Framework | Impact on Industry |

| United States | EPA regulations on chemical usage | Increased compliance costs |

| Europe | REACH regulations | Stricter chemical registration requirements |

| Middle East | Varying national regulations | Complexity in compliance across regions |

In conclusion, the oil and gas chemicals industry faces significant barriers to growth, primarily due to environmental concerns and regulatory challenges. Addressing these issues will be crucial for the industry’s continued expansion.

Geopolitical Changes Affecting Oil and Gas Chemicals Supply Chains

Global geopolitical changes have a significant impact on the oil and gas chemicals industry, especially when it comes to supply chain dynamics. The complex system of global supply chains is sensitive to geopolitical shifts, which can result in variations in the availability and cost of chemicals.

Trade Policies and Tariffs

Trade policies and tariffs play a crucial role in shaping the oil and gas chemicals market. Tariffs imposed on chemical imports and exports can significantly affect the cost of production and the competitiveness of companies in the global market. For instance, the imposition of tariffs by one country on another can lead to retaliatory measures, creating a ripple effect throughout the supply chain.

Evolving trade agreements and policies can either facilitate or hinder the flow of chemicals across borders. Companies must navigate these complexities to maintain a stable supply chain and remain competitive.

Regional conflicts and geopolitical tensions can disrupt the production and distribution of oil and gas chemicals. Conflicts in key producing regions can lead to supply shortages and price volatility, affecting the global market. Companies must develop strategies to mitigate these risks, such as diversifying their supply sources and developing contingency plans.

The impact of regional conflicts on the oil and gas chemicals supply chain underscores the importance of geopolitical analysis and risk management in the industry.

Understanding the Oil and Gas Chemicals Market: Segmentation from Exploration to Refining

The oil and gas chemicals market is divided into different segments based on specific applications and requirements, ranging from exploration to refining. This division is essential for comprehending the various needs and challenges faced by the industry.

Exploration Chemicals

Exploration chemicals play a vital role in the initial stages of oil and gas production. These chemicals are used to enhance the efficiency of the exploration process, ensuring that potential reserves are identified accurately.

“The right chemicals can make all the difference in the exploration phase, enabling more precise and cost-effective operations.”

Production Chemicals

Production chemicals are essential for optimizing the extraction process. They help in maintaining the integrity of the equipment, managing the flow of hydrocarbons, and ensuring the overall efficiency of the production process.

The use of production chemicals is critical in addressing issues such as corrosion, scaling, and emulsion formation. By mitigating these challenges, production chemicals contribute significantly to the smooth operation of oil and gas fields.

As the oil and gas industry continues to evolve, the demand for specialized chemicals is expected to grow. This growth is driven by the need for more efficient and environmentally friendly solutions.

The market segmentation based on application highlights the complexity and diversity of the oil and gas chemicals market. By understanding these segments, companies can better tailor their products and services to meet the specific needs of the industry.

Refining chemicals are another critical segment, used to improve the quality of refined products and ensure compliance with environmental regulations. The refining process involves various chemical treatments to remove impurities and achieve the desired product specifications.

- Exploration chemicals for enhancing exploration efficiency

- Production chemicals for optimizing extraction processes

- Refining chemicals for improving product quality

By understanding the different segments of the oil and gas chemicals market, stakeholders can identify opportunities for growth and innovation. As the industry moves towards more sustainable practices, the role of chemicals in facilitating efficient and environmentally friendly operations will become increasingly important.

Applications Driving the Demand for Oil and Gas Chemicals

The oil and gas industry relies heavily on chemicals for various operations, from exploration to refining. The demand for these chemicals is driven by their applications in different stages of oil and gas production.

Drilling and Completion

Drilling and completion are critical phases in the oil and gas production process. Chemicals used during these phases play a vital role in ensuring the efficiency and safety of operations. Drilling fluids, for instance, are essential for lubricating the drill bit, removing rock cuttings, and maintaining wellbore stability.

- Specialized chemicals are added to drilling fluids to enhance their performance, including viscosifiers, defoamers, and shale inhibitors.

- The composition of drilling fluids can vary significantly depending on the geological formation and the specific requirements of the drilling operation.

Enhanced Oil Recovery

Enhanced Oil Recovery (EOR) techniques are becoming increasingly important as they enable the extraction of additional oil from mature fields. EOR methods, such as chemical flooding, involve injecting chemicals into the reservoir to reduce the viscosity of the oil, making it easier to extract.

- Chemical EOR involves the use of surfactants, polymers, and alkalis to improve oil recovery.

- These chemicals help in reducing the interfacial tension between oil and water, improving the sweep efficiency, and increasing the overall recovery factor.

The application of EOR techniques is expected to drive the demand for specialized oil and gas chemicals. As the global energy demand continues to rise, the need for efficient and effective extraction methods becomes more pressing.

Understanding Regional Factors in the Oil and Gas Chemicals Market

Regional factors are important in determining the oil and gas chemicals market. Each region has its own specific traits that affect the demand and supply of oil and gas chemicals.

North America

North America, particularly the United States, has been a significant player in the oil and gas chemicals market due to its shale gas exploration activities. The region’s market is driven by the increasing demand for energy and advancements in drilling technologies.

Key Market Characteristics:

- Increasing shale gas production

- Advanced drilling technologies

- High demand for drilling and completion chemicals

Middle East

The Middle East is another critical region in the oil and gas chemicals market, known for its vast oil reserves. Countries such as Saudi Arabia and Iraq are major contributors to the global oil supply, driving the demand for oil and gas chemicals.

Market Drivers:

- Significant oil reserves

- High production capacities

- Strategic location for global supply chains

Here’s a comparative overview of the North America and Middle East regions in terms of their market characteristics:

| Region | Key Drivers | Market Characteristics |

| North America | Shale gas exploration, advanced drilling technologies | High demand for drilling and completion chemicals |

| Middle East | Significant oil reserves, high production capacities | Strategic location for global supply chains |

The U.S. Oil and Gas Chemicals Market: Key Developments and Opportunities

Thanks to shale gas exploration, the U.S. has become a key player in the global oil and gas chemicals market. The country’s large shale gas reserves have not only boosted domestic production but also made the U.S. a significant exporter of oil and gas chemicals.

Shale Gas Exploration

Shale gas exploration has been a game-changer for the U.S. oil and gas industry. The ability to extract gas from shale formations has unlocked new reserves, driving growth in the demand for oil and gas chemicals. Specialty chemicals used in hydraulic fracturing, such as friction reducers and gelling agents, are in high demand.

The rise of shale gas exploration has also led to an increase in the production of associated liquids, such as ethane and propane. This, in turn, has driven the demand for chemicals used in the processing and transportation of these liquids.

The growth of shale gas exploration in the U.S. presents numerous market opportunities for oil and gas chemicals manufacturers. Innovative chemical solutions that enhance the efficiency and safety of shale gas operations are in high demand. As the industry continues to evolve, companies that can provide sustainable and environmentally friendly solutions are likely to gain a competitive edge.

According to industry experts, “The shale gas revolution has opened up new avenues for chemical manufacturers to develop specialized products that cater to the unique needs of shale gas operations.”

“The shale gas revolution has transformed the U.S. energy landscape, and the demand for specialized chemicals is expected to continue growing in the coming years.”

The U.S. oil and gas chemicals market is expected to continue growing, driven by the increasing demand for energy and the ongoing development of shale gas resources.

Saudi Arabia’s Dominance in the Oil and Gas Chemicals Market

Saudi Arabia is a giant in the global oil and gas chemicals market, thanks to its large reserves and impressive production capabilities. The country’s strategic advantage comes from its extensive oil reserves and advanced production facilities, making it a crucial player in the worldwide energy scene.

Oil Reserves and Production

Saudi Arabia is known for its large oil reserves, which are among the biggest in the world. The country also has impressive oil production capabilities with advanced facilities that allow it to hold a significant portion of the global oil market.

The oil and gas sector in Saudi Arabia is crucial to the national economy, making a significant contribution to the country’s GDP. The government’s strategic plans to maintain and increase production capacities further strengthen the sector’s dominance.

“Saudi Arabia’s oil reserves are a critical component of its economic strength, enabling the country to play a pivotal role in the global energy market.”

Chemical Industry Overview

The chemical industry in Saudi Arabia is an important part of the country’s economy, closely connected to its oil and gas sector. The industry has experienced significant growth due to investments in petrochemical production and other chemical manufacturing processes.

| Chemical Sector | Production Capacity | Key Products |

| Petrochemicals | High | Ethylene, Propylene, and Derivatives |

| Specialty Chemicals | Moderate | Polymers, Fertilizers |

| Basic Chemicals | High | Methanol, Ammonia |

Saudi Arabia’s chemical industry is set for further growth, driven by government initiatives and investments in new technologies and production facilities. This expansion is expected to strengthen the country’s position in the global oil and gas chemicals market.

Russia’s Expanding Role in the Global Oil and Gas Chemicals Industry

Russia’s oil and gas production capabilities are driving its growth in the global oil and gas chemicals industry. The country’s vast reserves and strategic initiatives are positioning it as a key player in the global energy landscape.

Oil and Gas Production

Russia has been one of the world’s largest producers of oil and gas, with a significant portion of its economy reliant on the energy sector. The country’s oil and gas production has been steadily increasing, driven by investments in new technologies and exploration projects.

Key Statistics:

| Year Oil Production (Million Barrels/Day) Gas Production (Billion Cubic Meters) 2020 | 10.7 | 690 |

| 2021 | 10.8 | 701 |

| 2022 | 11.0 | 715 |

Chemical Industry Developments

The growth in Russia’s oil and gas production has had a positive impact on its chemical industry. The country is witnessing significant developments in the production of chemicals used in the oil and gas sector, such as drilling fluids, completion fluids, and enhanced oil recovery chemicals.

Innovations in chemical manufacturing are enabling Russian companies to cater to both domestic and international markets, enhancing their competitiveness in the global oil and gas chemicals industry.

The expansion of Russia’s role in the global oil and gas chemicals industry is also driven by strategic partnerships and investments in infrastructure. These developments are expected to further boost the country’s presence in the global market.

Future Outlook for Oil and Gas Chemicals Market Growth

The oil and gas chemicals market is expected to experience substantial growth, driven by a combination of emerging trends and increasing demand.

Emerging Trends

The oil and gas chemicals market is witnessing several emerging trends that are poised to drive growth.

Increased focus on drilling and completion activities

One such trend is the increased focus on drilling and completion activities, driven by the need for efficient and effective extraction methods.

Growing demand for specialized chemicals

Another trend is the growing demand for specialized chemicals that can withstand the harsh conditions of deepwater and ultra-deepwater operations.

Shift towards environmentally friendly chemicals

Additionally, the industry is shifting towards more environmentally friendly chemicals, driven by regulatory pressures and growing environmental concerns. This trend is expected to continue, with companies investing in research and development to create more sustainable products.

Market projections indicate that the oil and gas chemicals market will continue to grow, driven by increasing demand from the energy sector. The market is expected to reach $11.03 billion by 2025, with a steady growth rate.

The growth will be driven by key regions such as the U.S., Saudi Arabia, and Russia, which are expected to continue their dominance in the market. The U.S. will lead the growth, driven by shale gas exploration, while Saudi Arabia and Russia will contribute through their large oil reserves and production capacities.

Competitive Dynamics in the Oil and Gas Chemicals Market

- Baker Hughes —— Houston, Texas, USA

- Halliburton —— Houston, Texas, USA

- Schlumberger Limited (SLB) —— Houston, Texas, USA

- Solvay —— Brussels, Belgium

- BASF SE —— Ludwigshafen, Germany

- Albemarle Corporation —— Charlotte, North Carolina, USA

- Dow Chemical Company —— Midland, Michigan, USA

- Clariant —— Muttenz, Switzerland

- Ecolab (Nalco Champion) —— Saint Paul, Minnesota, USA

- Huntsman International LLC —— The Woodlands, Texas, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Oil and Gas Chemicals Market Report |

| Base Year | 2024 |

| Segment by Type | · Corrosion Inhibitors

· Emulsion Breakers · Cementing Super Plasticizers · Paraffin Dispersants · Drilling Additives |

| Segment by Application | · Upstream

· Midstream · Downstream |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The oil and gas chemicals market is set for significant growth, driven by various factors including increasing energy demands and improvements in extraction technologies. As discussed earlier, the market is affected by upstream and downstream forces, geopolitical changes, and regional dynamics.

Market Outlook

The future of the oil and gas chemicals market looks promising, with emerging trends and technologies expected to drive growth. The increasing focus on efficient and environmentally friendly chemicals will play a crucial role in shaping the industry’s future.

Future Perspectives

As the market continues to evolve, companies like BASF, Dow Inc., and NALCO Champion are likely to remain at the forefront, driving innovation and meeting the demands of a changing energy landscape. The analysis suggests that the oil and gas chemicals market will experience significant growth, driven by the need for more efficient and sustainable practices.

Global Oil and Gas Chemicals Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Oil and Gas Chemicals Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Oil and Gas ChemicalsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Oil and Gas Chemicalsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Oil and Gas Chemicals Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Oil and Gas Chemicals Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Oil and Gas Chemicals Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofOil and Gas ChemicalsMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the oil and gas chemicals market?

The growth of the oil and gas chemicals market is driven by increasing demand from regions like the U.S., Saudi Arabia, and Russia, as well as trends such as shale gas exploration and enhanced oil recovery.

What are the key trends influencing the oil and gas chemicals industry?

Key trends include:

- Increasing demand for energy

- Shale gas exploration

- The need for specialized chemicals for drilling, completion, and enhanced oil recovery operations

What are the major barriers to growth in the oil and gas chemicals market?

Environmental concerns, regulatory challenges, and geopolitical shifts are significant barriers to growth in the oil and gas chemicals industry.

How do geopolitical shifts impact the oil and gas chemicals supply chain?

Geopolitical shifts, including trade policies, tariffs, and regional conflicts, can significantly impact the availability and pricing of oil and gas chemicals.

What are the different segments of the oil and gas chemicals market?

The market can be segmented into exploration chemicals, production chemicals, and refining chemicals, each with its specific requirements and challenges.

Which regions are significant in the oil and gas chemicals market?

North America, particularly the U.S. with its shale gas exploration, and the Middle East, with its significant oil reserves, are key regions in the oil and gas chemicals market.

What is the outlook for the oil and gas chemicals market?

The future outlook for the oil and gas chemicals market is promising, driven by emerging trends and increasing demand for energy.

Who are the major players in the oil and gas chemicals market?

The market is highly competitive, with several key players competing against each other. These players include companies that are involved in the production and supply of oil and gas chemicals.

What are the competitive strategies in the oil and gas chemicals market?

Market players are adopting various competitive strategies, including innovation, partnerships, and expansion into new markets. These strategies are crucial for maintaining a competitive edge in the oil and gas chemicals market.