Phone Case Market Set to Reach $27.31 Billion by 2025: Key Insights from the U.S., China, and India

Discover key insights into the phone case market’s trajectory to $27.31 billion by 2025, exploring market dynamics across major regions, emerging trends in sustainable materials, and technological innovations shaping the industry’s future. From manufacturing challenges to consumer preferences, this analysis covers crucial factors driving growth in the U.S., China, and India.

- Last Updated:

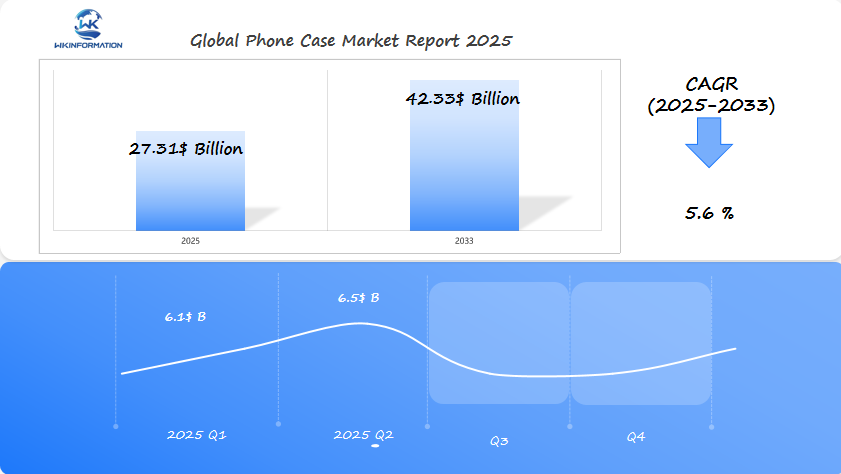

Phone Case Market Forecast for Q1 and Q2 2025

The global phone case market is expected to reach $27.31 billion in 2025, with a CAGR of 5.6% through 2033. The first half of 2025 is expected to experience consistent growth, with Q1 estimated at around $6.1 billion, followed by Q2 with a rise to approximately $6.5 billion, driven by the continued demand for smartphone accessories across global markets.

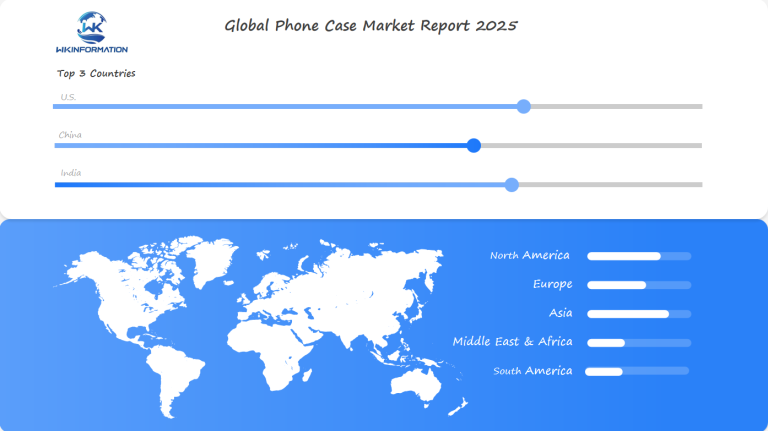

The U.S., China, and India are key regions for phone cases. The U.S. leads in market size, driven by the high adoption rate of smartphones and a growing trend of premium, customized phone cases. China, as a major production hub, plays a significant role both in manufacturing and consumption, particularly due to the size of its domestic market. India, with its rapidly expanding smartphone user base, continues to be a growing market for affordable and diverse phone cases. These countries are crucial for understanding the dynamics of the global phone case market.

Analyzing the Upstream and Downstream Forces of the Phone Case Market

The phone case market’s supply chain reveals a complex network of material suppliers, manufacturers, and distribution channels that directly influence product availability and pricing.

Upstream Supply Chain

- Raw material suppliers provide essential components:

- Silicone manufacturers

- Plastic resin producers

- Metal alloy suppliers

- Specialized coating manufacturers

The quality and availability of these materials significantly impact production costs and final product specifications. Manufacturing facilities, predominantly located in Asia, transform these raw materials into finished cases through injection molding, compression molding, and other specialized processes.

Downstream Distribution

- E-commerce platforms drive 60% of sales through:

- Amazon

- Direct-to-consumer websites

- Mobile accessory marketplaces

- Physical retail maintains significant presence via:

- Electronics stores

- Mobile carrier shops

- Department stores

This dual distribution approach creates varying price points across channels. E-commerce platforms typically offer competitive pricing due to reduced overhead costs, while brick-and-mortar stores command premium prices through immediate availability and hands-on shopping experiences.

Supply chain efficiency directly affects market dynamics. Just-in-time manufacturing helps brands respond to demand fluctuations, while strategic warehouse positioning ensures quick delivery to key markets. These factors combine to determine product accessibility and market pricing structures across different regions and sales channels.

Key Trends and Innovations Impacting the Phone Case Industry

The phone case industry has seen significant improvements in materials and design. Biodegradable phone cases made from plant-based materials like bamboo, cork, and wheat straw have become popular among environmentally conscious consumers. These eco-friendly alternatives break down naturally, reducing environmental impact without compromising device protection.

Advanced Protective Technologies

Advanced protective technologies use shock-absorbing materials and multi-layer designs to enhance protection. Some notable innovations in this area include:

- D3O impact technology, which absorbs and disperses shock upon impact

- Graphene-enhanced materials for superior strength

- Self-healing coatings that repair minor scratches

Personalization as a Fashion Statement

The rise of personalization has turned phone cases into fashion statements. Brands now offer various options to cater to individual tastes:

- UV-printed custom designs

- Interchangeable components

- Limited edition artist collaborations

- Premium material options such as genuine leather and metal frames

Consumer Preferences Shaping Product Development

Consumer preferences play a crucial role in shaping product development cycles. Users are increasingly seeking cases that strike a balance between protection and aesthetics:

- Slim profiles for pocket-friendly designs

- Clear cases that showcase the device’s aesthetics

- Anti-bacterial coatings for hygiene purposes

- MagSafe compatibility for newer iPhone models

Integration of Smart Technology

The integration of smart technology into phone cases brings additional functionality to users. Some examples of such features include:

- Built-in power banks for on-the-go charging

- NFC payment capabilities for convenient transactions

- Pop-out card holders for storing essential cards

- Heat dissipation features to prevent overheating during usage

These innovations demonstrate how the industry is adapting to changing consumer needs, going beyond basic device protection.

Barriers to Growth in the Phone Case Market

The phone case market faces significant challenges despite its projected growth. Low-cost alternatives flood the market through various channels, particularly from emerging manufacturers in Asia. These budget options create intense price competition, forcing established brands to adjust their strategies or risk losing market share.

Price Sensitivity Challenges

- Premium case manufacturers struggle to justify higher price points

- Consumer reluctance to spend more than 15-20% of device cost on protection

- Decreased brand loyalty due to availability of similar designs at lower prices

Manufacturing and Regulatory Hurdles

- Strict environmental regulations on plastic production

- Rising costs of sustainable material compliance

- Complex certification requirements for protective claims

- Labor cost increases in traditional manufacturing hubs

The market’s saturation level presents additional obstacles. Manufacturers must navigate:

- Patent infringement issues

- Quality control standards

- Supply chain disruptions

- Material cost fluctuations

Small and medium-sized manufacturers particularly feel these pressures, with many struggling to maintain profit margins while meeting regulatory requirements. The need to balance quality with competitive pricing creates a challenging operating environment, pushing some companies to explore alternative materials or production methods to stay viable in the market.

How Geopolitical Factors Affect Phone Case Production and Distribution

The U.S.-China trade relationship significantly shapes the phone case industry’s landscape. Recent tariffs between these nations have increased manufacturing costs by 15-25%, pushing companies to explore alternative production locations in Vietnam and Indonesia.

Supply Chain Disruptions

Supply chain disruptions stem from:

- Border restrictions affecting raw material transport

- Changing customs regulations

- Shipping container shortages

- Labor market fluctuations

Impact of Import/Export Regulations

Trade policies create ripple effects across the phone case market:

- Stricter quality control requirements

- Extended customs clearance times

- Higher compliance costs

- Documentation burden increases

These challenges force manufacturers to maintain larger inventory buffers, affecting their cash flow and operational efficiency.

Market Stability and Pricing

Geopolitical tensions create price volatility through:

- Currency exchange rate fluctuations

- Raw material cost variations

- Labor wage adjustments

- Transportation cost increases

Companies adopt various strategies to maintain stability:

- Diversifying manufacturing locations

- Building regional distribution centers

- Implementing dynamic pricing models

- Developing local supplier networks

The shift toward regional manufacturing hubs helps brands reduce dependency on single-country production while enabling faster market response times. This decentralization trend particularly benefits markets in Southeast Asia and Eastern Europe, where new production facilities emerge to serve local demand.

Phone Case Market Segmentation: What Types Are Gaining Traction?

The phone case market showcases distinct product categories, each capturing specific consumer segments:

1. Traditional Materials Market Share:

- Silicone cases: 45% (highest market share)

- Hard plastic cases: 30%

- Leather cases: 15%

- Other materials: 10%

Consumer preferences reveal a clear divide between protection-focused and aesthetics-driven purchases. Silicone cases dominate the market due to their balance of durability and affordability. These cases offer shock absorption and grip while maintaining a slim profile.

Premium leather cases attract business professionals and luxury consumers, commanding higher prices despite lower market share. The leather segment sees steady growth in high-end markets where brand perception matters.

2. Emerging Niche Markets:

- Biodegradable cases made from plant-based materials

- Anti-bacterial cases with specialized coatings

- Recycled plastic cases from ocean waste

- Cork-based cases for sustainability enthusiasts

The eco-friendly segment shows rapid growth, particularly among younger consumers aged 18-34. These environmentally conscious buyers prioritize sustainable materials and ethical production practices, willing to pay premium prices for green alternatives.

Custom-designed cases represent another growing niche, with consumers seeking personalized artwork and patterns. This trend particularly resonates with social media-active users who view phone cases as fashion accessories.

The Role of Different Applications in Shaping Phone Case Demand

User lifestyle and daily activities directly influence phone case selection patterns across different demographics. Sports enthusiasts gravitate toward rugged, shock-resistant cases with enhanced grip features and moisture protection. These cases often incorporate specialized materials like D3O technology for impact absorption during high-intensity activities.

Business professionals typically select slim, professional-looking cases that maintain device aesthetics while offering adequate protection. Premium leather cases and minimalist designs dominate this segment, with features like card slots and kickstands adding functionality for presentations and travel.

Specific use cases drive distinct design requirements:

1. Outdoor Adventures

- IP68 waterproof rating for underwater photography

- Drop protection from heights of 6-12 feet

- Dust-proof sealing for desert environments

2. Urban Commuters

- RFID blocking capabilities

- Compact profile for pocket storage

- Multi-card storage solutions

3. Creative Professionals

- Camera lens protection

- Tripod mounting compatibility

- Enhanced grip for stable shooting

The healthcare sector demands antimicrobial cases with smooth surfaces for easy sanitization, while construction workers seek cases meeting military-grade drop test standards. These application-specific needs continue to drive innovation in phone case design and manufacturing, creating distinct market segments based on occupational and lifestyle requirements.

Global Regional Insights into the Phone Case Market

Regional dynamics shape distinct phone case market landscapes across the globe. North American consumers prioritize brand reputation and premium protection features, willing to invest in high-end cases priced between $30-$50. European markets demonstrate a strong preference for slim, minimalist designs that maintain device aesthetics.

Key Regional Market Characteristics:

- Asia-Pacific: High demand for affordable, colorful cases with local design elements

- Middle East: Luxury phone cases with premium materials and designer collaborations

- Latin America: Value-focused purchases with emphasis on durability

The purchasing behaviors between developed and developing nations reveal notable contrasts:

Developed Nations:

- Higher adoption of specialized cases (antimicrobial, eco-friendly)

- Strong e-commerce presence for phone case purchases

- Brand loyalty influences buying decisions

- Seasonal purchasing patterns aligned with new device launches

Developing Nations:

- Price sensitivity drives market dynamics

- Preference for multi-functional cases with storage features

- Strong reliance on physical retail channels

- Growing demand for counterfeit premium brands

Market research indicates developing regions show 15-20% higher growth rates in unit sales compared to developed markets. This trend reflects increasing smartphone penetration and rising disposable incomes in emerging economies. Local manufacturers in these regions capitalize on cultural preferences, producing region-specific designs and features that resonate with local consumers.

U.S. Phone Case Market: What’s Driving the Growth?

The U.S. phone case market is experiencing strong growth due to tech-savvy consumers and changing fashion preferences. American consumers see phone cases as both protective accessories and fashion statements, resulting in significant market expansion.

Key Growth Drivers:

- Fashion-Forward Designs: Collaborations between case manufacturers and luxury brands create premium offerings

- Seasonal Collections: Phone case releases aligned with fashion seasons and trends

- Personalization Options: Custom designs and photo-printed cases gaining popularity

- Tech Integration: Cases with built-in battery packs, card holders, and pop sockets

Primary Retail Channels:

- Direct-to-consumer online sales

- Major electronics retailers (Best Buy, Apple Stores)

- Fashion boutiques and department stores

- Mobile carrier stores

The U.S. market sees strong sales through Amazon and specialty online retailers, with consumers spending an average of $20-$50 per case. Physical stores maintain relevance by offering immediate availability and hands-on product testing opportunities.

American consumers prioritize brand reputation and product quality, showing willingness to invest in premium cases from established manufacturers. This trend has attracted new market entrants, intensifying competition and driving innovation in design and functionality.

The rise of social media influence has transformed phone cases into lifestyle accessories, with younger demographics treating them as essential fashion items requiring multiple options for different occasions.

China’s Role in the Global Phone Case Market

China’s manufacturing expertise has made it a leader in the phone case industry. The country has advanced production facilities with automated systems that allow for large-scale production of phone cases at competitive prices.

Key Advantages of Chinese Manufacturers

Chinese manufacturers have several advantages that contribute to their success:

- Automated Production Lines: Use of robotics and AI-driven manufacturing processes to reduce production costs by 30-40%

- Material Innovation: Development of specialized materials for increased durability

- Supply Chain Integration: Close proximity to suppliers of raw materials and electronic components

- Skilled Labor Force: Workforce trained in precise manufacturing and quality control

Disruption by Chinese Brands

Chinese brands such as Xiaomi, Huawei, and OnePlus have disrupted the global phone case market through various strategies:

- Direct-to-consumer sales models

- Aggressive pricing strategies

- Integration of advanced features at lower price points

- Rapid product development cycles

Technological Advancements in Manufacturing

China’s advancements in manufacturing technology have allowed local brands to produce high-quality cases with features that were once only available to expensive Western brands. Chinese manufacturers are now leading the way in developing:

- Anti-bacterial coatings

- Advanced shock-absorption materials

- Heat-dissipation technology

- Wireless charging compatibility

This technological advantage, along with cost-effective production methods, has made Chinese manufacturers the preferred choice for global smartphone brands looking for reliable phone case suppliers.

India’s Impact on Phone Case Demand and Supply

India’s growing middle class has led to a significant increase in smartphone usage, which in turn has boosted the demand for phone cases. Recent data shows 72% of Indian smartphone users consider protective cases essential accessories, driving substantial market growth.

Demand Patterns in India

The demand for phone cases in India has some unique features:

- Price sensitivity remains a key factor, with consumers seeking affordable yet durable protection

- Local manufacturers focus on cases priced between ₹200-800 ($2.50-$10)

- Design preferences lean toward bright colors and traditional Indian patterns

Adaptation by Indian Manufacturers

Indian manufacturers have quickly adjusted their strategies to meet this rising demand:

- Local Production InitiativesEstablishment of manufacturing hubs in Gujarat and Tamil Nadu

- Implementation of cost-effective production methods

- Development of India-specific design elements

Smartphone Penetration and Market Competition

The smartphone penetration rate in India is expected to reach 96% by 2040, attracting both domestic and international phone case manufacturers. Local brands like Mobistyle and Indian Gadget have gained significant market share by:

- Creating region-specific distribution networks

- Offering customization options at competitive prices

- Developing partnerships with local retailers

The Role of E-commerce

The growth of e-commerce platforms has allowed smaller manufacturers to access larger markets, with online sales making up 45% of phone case purchases in urban areas. This shift towards digital shopping has prompted local manufacturers to focus on improving quality control and developing innovative packaging solutions to meet the standards of online retailing.

What’s Next for the Phone Case Industry?

The phone case industry is on the verge of significant changes driven by technological advancements and evolving consumer preferences.

1. Smart Technology Integration

Smart technology integration emerges as a game-changing trend, with manufacturers developing cases featuring:

- Built-in power banks

- NFC payment capabilities

- Health monitoring sensors

- Environmental impact sensors

- Wireless charging optimization

2. Sustainability Focus

Sustainability takes center stage in future product development. Manufacturers are investing in:

- Biodegradable materials

- Ocean-sourced recycled plastics

- Carbon-neutral production processes

- Zero-waste packaging solutions

3. Advanced Materials for Protection

The integration of advanced materials promises enhanced device protection:

- Self-healing polymers

- Impact-absorbing metamaterials

- Antimicrobial surfaces

- Temperature-regulating compounds

4. Emerging Technologies Disruption

Emerging technologies set to disrupt the market include:

- Augmented Reality integration for personalized designs

- 3D-printed custom cases

- Shape-shifting materials adapting to impact

- Smart material interfaces responding to environmental conditions

5. Opportunities with Foldable Phones

The rise of foldable phones creates new opportunities for innovative case designs, pushing manufacturers to develop flexible yet protective solutions. This shift demands advanced engineering and material science applications, potentially reshaping industry standards for device protection.

6. Collaboration between Manufacturers and Tech Companies

The market anticipates increased collaboration between phone case manufacturers and tech companies, leading to deeper integration of protective cases with device functionalities. These partnerships could yield cases that enhance rather than simply protect device capabilities.

Competitive Forces in the Phone Case Market

The phone case market is highly competitive, with major companies like Otter Products, Spigen, and Apple leading the premium segments. These industry leaders stay on top by using smart pricing strategies, creating innovative designs, and building strong brand recognition.

- Apple Inc. – United States

- Samsung Electronics Co. Ltd. – South Korea

- Otter Products LLC – United States

- Spigen Inc. – South Korea

- Urban Armor Gear LLC – United States

- Pelican Products Inc. – United States

- Moshi Corp. – United States

- Case Mate Inc. – United States

- Vinci Brands LLC – United States

- XtremeGuard – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Phone Case Market Report |

| Base Year | 2024 |

| Segment by Type |

· Silicone Cases · Hard plastic Cases · Leather Cases · Other Materials |

| Segment by Application |

· Online Sales · Offline Sales |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The phone case market is expected to grow to $27.31 billion by 2025, showing its importance in the mobile device industry. Success in this market depends on manufacturers finding the right balance between protection, design, and new ideas while dealing with complex supply chains and different preferences in various regions.

The U.S., China, and India are crucial markets, each with its own strengths and opportunities. The U.S. leads in innovation and high-end growth, China excels in manufacturing and affordable solutions, while India is an emerging player with a growing number of consumers.

Several key factors will shape the future of this market:

- Use of sustainable materials

- Incorporation of smart technology

- Ability to customize products

- Adaptation to regional markets

Companies that can effectively tackle these challenges while keeping their prices competitive and distribution strategies strong will gain a larger share of the market. The phone case industry is constantly evolving, bringing exciting changes in how we protect, style, and use our devices. This makes it an attractive sector for both investors and manufacturers.

Global Phone Case Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Phone Case Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Phone Caseplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Phone Case Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Phone Case Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Phone Case Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPhone Case Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key upstream and downstream forces affecting the phone case market?

The upstream forces include supply chain dynamics, manufacturing processes, and material sourcing for phone cases. Downstream forces focus on distribution methods, comparing online sales with brick-and-mortar stores. These forces significantly influence pricing and availability in the market.

What innovations are currently shaping the phone case industry?

Key trends include the emergence of biodegradable materials and advanced protective technologies. Additionally, there is a rise in customizable designs that cater to fashion-forward consumers, reflecting changing consumer preferences and driving product innovation.

What barriers does the phone case market face in terms of growth?

The market faces challenges such as competitive pressures from low-cost alternatives, consumer price sensitivity impacting premium products, and regulatory challenges that affect manufacturing practices.

How do geopolitical factors influence phone case production and distribution?

Geopolitical factors, particularly U.S.-China trade relations, play a significant role in manufacturing costs and supply chains. Geopolitical tensions can also impact import/export regulations for phone accessories, which affects market stability and pricing strategies.

What types of phone cases are gaining traction in the current market?

Market segmentation analysis reveals various types of phone cases such as silicone, plastic, and leather are popular. Trends show consumer preference leaning towards specific materials based on protection versus aesthetics, with niche markets like eco-friendly cases emerging.

What is driving growth in the U.S. phone case market?

Growth in the U.S. market is driven by tech-savvy consumers influenced by fashion trends related to mobile accessories. Major retail channels also contribute significantly to sales as they adapt to consumer electronics trends.