$319.4 Billion Surge in Air Freight Market Growth in the U.S., China, and Germany by 2025

A comprehensive analysis of the global air freight industry, exploring upstream and downstream operations, market trends, technological advancements, and growth projections across major markets including the US, China, and Germany, with insights into sustainability challenges and future innovations shaping the sector through 2030.

- Last Updated:

Air Freight Market Q1 and Q2 2025 Forecast

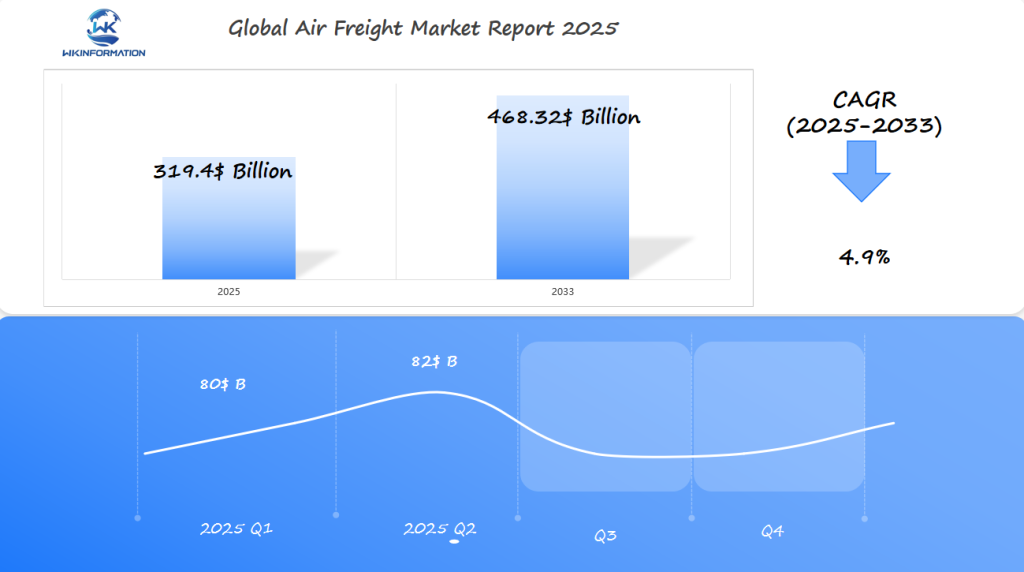

The Air Freight market is projected to reach $319.4 billion in 2025, with a CAGR of 4.9% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $80 billion, driven by rising demand for e-commerce, express delivery services, and high-value goods transportation in the U.S., China, and Germany. Increased demand for time-sensitive products such as electronics, pharmaceuticals, and luxury goods is also contributing to market growth.

By Q2 2025, the market is forecasted to reach $82 billion, fueled by innovative air cargo solutions, including automated warehouses and AI-driven logistics platforms. The U.S. continues to dominate with a robust logistics infrastructure, while China is expected to see rapid growth in e-commerce-driven freight demands, and Germany focuses on sustainability in air freight operations.

Understanding the Global Upstream and Downstream Industry Chains of Air Freight

The air freight industry involves a complex system of interconnected activities that are crucial for its functioning. These activities can be categorized into two main parts: upstream operations and downstream activities.

Upstream Operations

Upstream operations refer to the initial stages of handling cargo before it is transported by air. These operations include:

- Cargo collection from manufacturers

- Warehouse management

- Ground transportation to airports

- Customs clearance procedures

- Aircraft loading operations

Downstream Activities

Downstream activities focus on the processes that take place after the cargo has been transported by air. These activities include:

- Cargo unloading and sorting

- Last-mile delivery services

- Distribution center operations

- End-customer delivery coordination

- Returns management

Key Players in the Air Freight Supply Chain

Several key players are involved in the supply chain ecosystem of air freight:

- Airlines and cargo carriers

- Freight forwarders

- Ground handling agents

- Customs brokers

- Warehousing providers

- Last-mile delivery partners

The Role of Logistics Networks in Air Cargo Operations

Logistics networks play a vital role in the smooth functioning of air cargo operations. They serve as the backbone connecting various stakeholders involved in the process through integrated systems.

Technological Advancements in Modern Air Freight

To ensure efficiency throughout the supply chain, modern air freight operations heavily rely on advanced technologies such as:

- Sophisticated tracking systems for real-time monitoring of shipments

- Communication platforms that enable instant communication between different parties involved

- Automated sorting facilities for quick and accurate processing of cargo

The Importance of Coordination for Success

The success of air cargo operations depends on how well these different elements work together in harmony.

Benefits of Advanced Logistics Networks

With the help of advanced logistics networks, several benefits can be achieved:

- Real-time visibility into shipment status through tracking mechanisms

- Streamlined documentation processes with automation tools

- Efficient planning and scheduling using predictive analytics techniques

- Specialized handling capabilities for temperature-sensitive goods or perishable items

- Compliance management across borders to ensure smooth movement of goods

Key Trends Driving Growth in the Air Freight Market

The air freight market’s rapid expansion is shaped by three transformative forces that are changing cargo transportation.

1. E-commerce Revolution

The explosive growth of online shopping has created unprecedented demand for air freight services. Major platforms like Amazon, Alibaba, and eBay require rapid cross-border shipping capabilities to meet consumer expectations for fast delivery. This shift has led to:

- 24/7 cargo operations at major hubs

- Integration of warehouse-to-doorstep logistics

- Development of specialized e-commerce fulfillment centers near airports

2. Express Logistics Evolution

Time-sensitive deliveries have become the new standard, pushing carriers to enhance their express service offerings:

- Same-day delivery options for urgent shipments

- Temperature-controlled containers for perishable goods

- Track-and-trace systems for real-time shipment monitoring

3. Technology-Driven Efficiency

Digital transformation is reshaping air freight operations through:

- AI-powered route optimization reducing fuel consumption

- Blockchain technology enhancing cargo tracking accuracy

- IoT sensors monitoring shipment conditions in real-time

- Automated sorting systems speeding up warehouse operations

The integration of these technologies has resulted in a 15-20% improvement in operational efficiency across major carriers. Digital platforms now connect shippers directly with carriers, streamlining booking processes and reducing administrative overhead.

Challenges Facing the Air Freight Industry: Logistics and Sustainability

The air freight industry faces significant operational hurdles that impact service delivery and growth potential.

Airport Congestion

Airport congestion stands as a primary challenge, with major hubs experiencing substantial delays during peak periods. These bottlenecks create ripple effects throughout the supply chain, leading to:

- Increased fuel consumption from aircraft holding patterns

- Extended storage requirements at cargo facilities

- Missed connections and delivery deadlines

- Higher operational costs

Trade Barriers

Trade barriers create complex obstacles for international shipping operations. Current regulations and restrictions affect:

- Custom clearance procedures

- Documentation requirements

- Route accessibility

- Cargo handling protocols

Infrastructure Modernization

The pressing need for infrastructure modernization affects air freight efficiency across multiple areas:

- Aging cargo handling equipment

- Limited warehouse automation

- Outdated tracking systems

- Insufficient cold chain facilities

Environmental Sustainability

Environmental sustainability presents additional challenges as the industry grapples with:

- Carbon emission reduction targets

- Noise pollution regulations

- Waste management requirements

- Resource conservation measures

These operational constraints drive the need for substantial investments in technology and infrastructure upgrades. The industry requires modernized facilities capable of handling increased cargo volumes while maintaining environmental compliance standards. Airports worldwide need expanded cargo terminals, automated sorting systems, and enhanced digital infrastructure to process shipments efficiently.

Geopolitical Impact on the Air Freight Market and International Trade

Geopolitical developments have a significant impact on global trade patterns, which in turn affect the air freight industry. When trade tensions arise between major economies, it directly influences the volume of cargo being transported and the routes taken by airlines. As a result, carriers are forced to make adjustments to their networks and operations in order to adapt to these changes.

Key Geopolitical Influences on Air Freight:

- Trade Route Alterations: Political conflicts force airlines to reroute cargo flights, increasing operational costs and delivery times

- Regulatory Changes: Sudden policy shifts affect landing rights, overflight permissions, and cargo screening requirements

- Market Access: Diplomatic relations determine which carriers can operate in specific regions

Cross-border agreements play a crucial role in streamlining air freight operations. Countries with established trade partnerships benefit from:

- Reduced customs processing times

- Simplified documentation requirements

- Lower tariffs and fees

- Standardized security protocols

Recent geopolitical tensions have created significant disruptions:

- Supply Chain Shifts: Companies relocating manufacturing bases to avoid trade restrictions

- Capacity Constraints: Restricted access to certain airspace leading to longer routes

- Cost Implications: Additional security measures and alternative routing increasing operational expenses

The air freight industry’s resilience depends on its ability to navigate these geopolitical challenges while maintaining efficient service delivery. Carriers must balance security requirements with operational efficiency, often requiring sophisticated risk management strategies and contingency planning.

Types of Air Freight Services: Express vs. Standard

Air freight services split into two distinct categories: express and standard shipping. Each option serves specific business needs and time requirements.

Express Services

- Delivery within 1-3 business days

- Door-to-door tracking capabilities

- Priority handling and dedicated aircraft

- Higher cost structure

- Ideal for time-sensitive shipments

- Guaranteed delivery times

Standard Services

- Delivery within 5-7 business days

- Airport-to-airport transportation

- Shared cargo space

- Cost-effective pricing

- Suitable for regular shipments

- Flexible scheduling options

Your choice between express and standard services depends on several key factors:

- Time Sensitivity: Medical supplies and perishable goods require express shipping

- Budget Constraints: Standard services cost 40-60% less than express options

- Shipment Size: Larger shipments benefit from standard service economies of scale

- Destination: Remote locations might limit express service availability

- Value of Goods: High-value items often justify express shipping costs

The reliability of both services continues to improve through technological advancements in tracking systems and route optimization. Airlines and freight carriers invest in specialized equipment and facilities to handle different cargo types, enhancing service quality across both categories.

Applications of Air Freight in E-Commerce, Manufacturing, and Retail

Air freight services play a crucial role in various industries, revolutionizing how businesses deliver products and oversee their supply chains.

1. E-commerce Fulfillment

- Next-day and same-day delivery promises require robust air freight networks

- Cross-border e-commerce relies on air transport for rapid international shipping

- Strategic placement of fulfillment centers near major air hubs enables faster delivery times

2. Manufacturing Supply Chain

- Just-in-time manufacturing depends on air freight for critical component delivery

- High-value electronics and automotive parts utilize air transport to minimize inventory costs

- Emergency shipments prevent costly production line shutdowns

- Aerospace manufacturers ship time-sensitive replacement parts globally

3. Retail Distribution

- Fast-fashion retailers use air freight to respond quickly to trending items

- Seasonal merchandise reaches stores ahead of peak shopping periods

- Luxury brands maintain exclusivity through limited inventory and rapid replenishment

- Perishable goods reach international markets while maintaining freshness

Air freight enables businesses to maintain lean inventories while ensuring product availability. Companies like Amazon and Alibaba have built extensive air networks, establishing dedicated cargo fleets to support their distribution needs. The pharmaceutical industry relies on temperature-controlled air cargo for life-saving medications, while technology companies use air freight to launch new products simultaneously across global markets.

Global Air Freight Market Insights: Demand and Growth Projections 2024-2030

The global air freight market shows great potential for growth, with current valuations reaching $319.4 billion in 2025.

Key Growth Drivers:

- Rising cross-border trade volumes

- Increased adoption of just-in-time inventory management

- Expansion of specialized cargo handling facilities

- Growing demand for temperature-sensitive pharmaceuticals

- Integration of digital tracking technologies

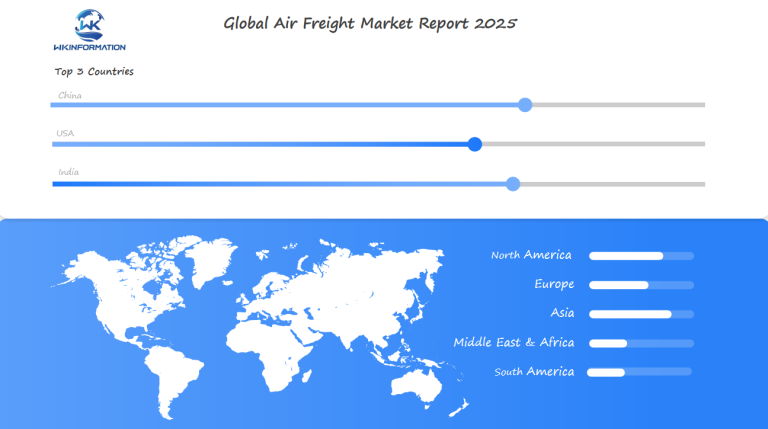

The Asia-Pacific region leads market growth, driven by:

- Rapid industrialization

- Growing middle-class population

- Enhanced airport infrastructure

- Strategic trade agreements

Market Segment Performance:

- Express delivery services: 45% market share

- General cargo: 35% market share

- Special cargo handling: 20% market share

Regional airports expand cargo handling capabilities to meet increasing demand, with investments focusing on:

- Automated sorting systems

- Cold chain facilities

- Digital documentation processes

- Enhanced security measures

The market shows resilience against economic fluctuations through diversification of service offerings and adoption of innovative technologies. Industry stakeholders implement strategic partnerships to strengthen market presence and enhance operational efficiency across global supply chains.

U.S. Air Freight Market: Trends and Key Factors Driving Growth to $34.2 billion by 2024

The U.S. air freight market is experiencing significant growth, with expectations of reaching a market value of $34.2 billion by 2024. This growth can be attributed to several key factors:

Domestic Market Drivers

- The rise of e-commerce leading to increased demand for next-day delivery services

- Growing shipments of pharmaceuticals and healthcare products

- Expansion of cross-border trade with Canada and Mexico

- Increase in exports of high-value electronics and technology products

Regional Market Characteristics

- Major cargo hubs such as Memphis, Louisville, and Miami driving high cargo volumes

- Implementation of advanced tracking systems and Internet of Things (IoT) solutions

- Construction of specialized facilities for handling temperature-sensitive goods

- Improvement of last-mile delivery networks

The U.S. air freight market has certain advantages that position it for ongoing growth:

Key Growth Indicators

- 15% year-over-year increase in express delivery services

- 23% rise in pharmaceutical air shipments

- 30% growth in e-commerce related air cargo

- $5.2 billion investment in upgrading cargo facilities

These factors demonstrate how the U.S. air freight industry is adapting to changing consumer needs and technological advancements, supported by significant investments in infrastructure and strategic positioning within the market.

China's Air Freight Market: Expansion at a Forecasted Growth Rate with Infrastructure Development Support

China’s air freight market has significant growth potential, expected to reach $43.9 billion by 2030 with a 9.5% CAGR – higher than the global industry average by 3.2 percentage points.

The Chinese government’s ambitious infrastructure development initiatives support this growth through:

- Building 215 new airports by 2035

- Expanding existing cargo terminals

- Introducing automated handling systems

- Creating specialized cold chain facilities

The market also benefits from strategic investments in major logistics hubs:

- Beijing Capital International Airport – $3.2 billion expansion

- Shanghai Pudong International Airport – Enhanced cargo handling capacity

- Guangzhou Baiyun International Airport – New smart logistics centers

China’s domestic infrastructure developments align with the Belt and Road Initiative, creating an integrated network of air freight corridors connecting Asia, Europe, and Africa. These developments position Chinese airports as central nodes in global supply chains.

The market’s technological advancement focuses on:

- AI-powered cargo tracking systems

- Automated customs clearance

- Digital documentation processes

- Smart warehouse management

Chinese air freight carriers are using these infrastructure improvements to expand their international routes, especially in emerging markets like Southeast Asia and Central Asia, where trade volumes and e-commerce demand are increasing.

Germany's Air Freight Market: Logistics Hub for Europe Facilitated by Key Airports

Germany is the leading logistics hub in Europe, strategically located at the center of the continent’s air freight network. The country’s air cargo infrastructure handles around 4.5 million tons of freight each year, accounting for 31% of the European Union’s total air freight volume.

Key German Air Freight Hubs:

- Frankfurt Airport (FRA) – Handles 2.1 million tons annually

- Leipzig/Halle Airport (LEJ) – DHL’s European hub

- Munich Airport (MUC) – Specialized in high-value cargo

- Cologne Bonn Airport (CGN) – UPS’s European hub

The German air freight market benefits from:

- Advanced automated cargo handling systems

- Extensive road and rail connections

- 24/7 operational capabilities at major hubs

- Strategic partnerships with global carriers

German airports have made significant investments in specialized facilities such as:

- Temperature-controlled storage for pharmaceuticals

- Live animal handling centers

- Dangerous goods facilities

- E-commerce processing centers

These investments have a positive impact on European supply chains, enabling faster distribution across the continent. German efficiency standards set industry benchmarks, with average cargo processing times 40% faster than competing European hubs.

The market’s strength comes from its integration with manufacturing sectors, particularly the automotive and pharmaceutical industries. This synergy creates a self-reinforcing ecosystem where manufacturing demand drives logistics innovation, attracting more cargo volume to German hubs.

The Future of Air Freight: Automation, Sustainability, Innovation Shaping Operational Efficiency and Landscape

1. Automation Technologies Revolutionizing Operations

Automation technologies are transforming air freight operations in various ways:

- Robotic Sorting Systems: AI-powered robots handle package sorting, reducing human error by 85%

- Automated Guided Vehicles (AGVs): Smart vehicles navigate warehouses autonomously, streamlining cargo movement

- Predictive Analytics: Machine learning algorithms optimize route planning and load distribution

2. Sustainable Practices in the Industry

The air freight industry is also moving towards more sustainable practices, such as:

- Electric ground support equipment

- Sustainable aviation fuel (SAF) adoption

- Carbon offset programs

- Smart packaging solutions reducing waste

3. Emerging Innovations Transforming Operations

Several new innovations are set to transform air freight operations:

- Digital Twins: Virtual replicas of physical operations enable real-time monitoring and optimization

- Blockchain Integration: Enhanced transparency and security in documentation

- IoT Sensors: Real-time tracking and condition monitoring of sensitive cargo

- Drone Integration: Last-mile delivery solutions for remote areas

These technological advancements are expected to drive a 23% increase in operational efficiency while reducing carbon emissions by 15%. The integration of smart warehouses equipped with automated storage and retrieval systems (AS/RS) is projected to cut handling time by 40%.

4. Benefits Reported by Air Freight Companies

Air freight companies that invest in these innovations have reported significant benefits:

- 30% reduction in operational costs

- 25% improvement in delivery accuracy

- 20% decrease in fuel consumption

- 35% enhancement in warehouse efficiency

Competitive Landscape: Major Players in the Air Freight Industry

The air freight industry is a dynamic and highly competitive market driven by global trade, e-commerce, and international logistics needs. Several key players dominate the sector, each contributing unique strengths in terms of network coverage, infrastructure, and services. Here’s an overview of the major players:

-

FedEx Express – United States

-

UPS Airlines – United States

-

Qatar Airways Cargo – Qatar

-

Emirates SkyCargo – United Arab Emirates

-

DHL Aviation – Germany

-

Cargolux Airlines International SA – Luxembourg

-

China Southern Cargo – China

-

Korean Air Cargo – South Korea

-

Atlas Air Worldwide Holdings Inc. – United States

-

Singapore Airlines Cargo – Singapore

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Air Freight Market Report |

| Base Year | 2024 |

| Segment by Type |

· Express Services · Standard Services |

| Segment by Application |

· E-commerce Fulfillment · Manufacturing Supply Chain · Retail Distribution |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The air freight industry is poised for significant transformation and growth, with projections indicating a robust expansion to $319.4 billion across key markets by 2025. This comprehensive analysis reveals several critical aspects shaping the industry’s future:

The increasing integration of advanced technologies, particularly in automation and AI-driven solutions, is revolutionizing operational efficiency and service delivery. Sustainability initiatives are becoming central to industry operations, with companies investing in green technologies and carbon-neutral shipping options.

Global Air Freight Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Air Freight Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Air Freight Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Air Freightplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Air Freight Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Air Freight Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Air Freight Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Air Freight Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream and downstream components of the air freight industry?

In the air freight industry, upstream refers to the initial stages of the supply chain, including suppliers and manufacturers, while downstream encompasses the distribution and delivery aspects, such as logistics networks and end-users. Understanding these components is crucial for optimizing air cargo operations.

How is e-commerce impacting the demand for air freight services?

The expansion of e-commerce has significantly increased demand for air freight services due to the need for rapid delivery solutions. Consumers expect fast shipping options, which drives logistics companies to utilize air cargo for timely fulfillment.

What challenges does the air freight industry face regarding sustainability?

The air freight industry faces several challenges related to sustainability, including trade barriers that complicate international shipping, airport congestion that affects operational efficiency, and the necessity for infrastructure modernization to accommodate growing demand.

How do geopolitical tensions affect the air freight market?

Geopolitical tensions can disrupt trade routes and volumes in the air freight market. These tensions may lead to changes in cross-border agreements, which can either hinder or facilitate trade by affecting tariffs and shipping regulations.

What are the key differences between express and standard air freight services?

Express air freight services prioritize speed and typically offer faster delivery times compared to standard services. While express options are ideal for urgent shipments, standard services may be more cost-effective for less time-sensitive deliveries.

What role does automation play in shaping the future of the air freight industry?

Automation technologies are predicted to enhance operational efficiency in the air freight industry by streamlining processes such as sorting, tracking, and cargo handling. Additionally, sustainable practices are being integrated into operations to reduce environmental impact.