Poultry Automation System Market to Reach $5.6 Billion by 2025: Key Growth Insights from the U.S., Brazil, and China

Discover comprehensive insights into the expanding poultry automation system market, projected to reach $5.6 billion by 2025. This analysis covers key growth drivers, technological trends, and market dynamics across the U.S., Brazil, and China, exploring how automation is revolutionizing the poultry industry through smart integration, IoT solutions, and sustainable practices.

- Last Updated:

Poultry Automation System Market Q1 and Q2 2025 Forecast

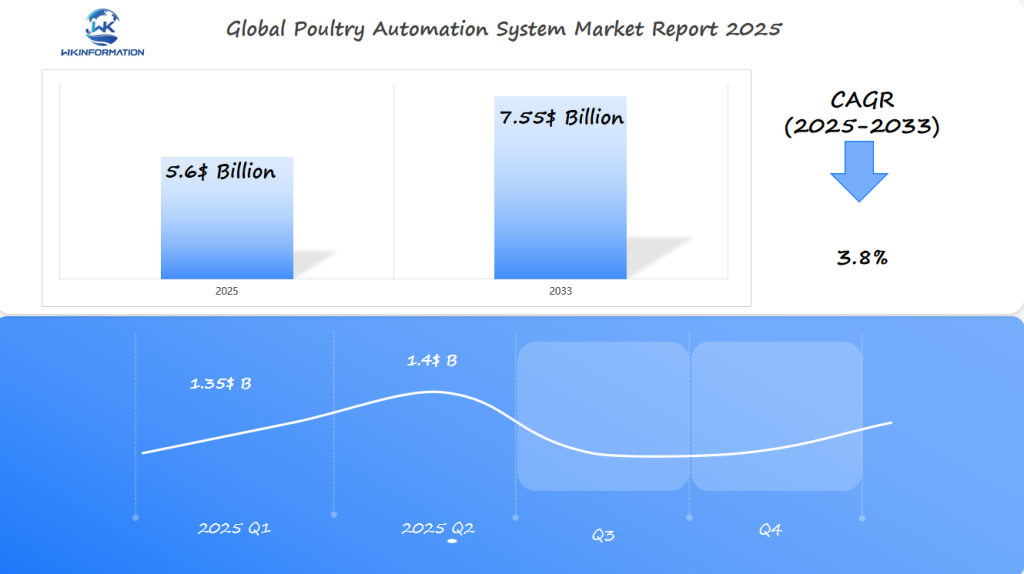

The Poultry Automation System market is projected to reach $5.6 billion in 2025, growing at a CAGR of 3.8% from 2025 to 2033. In Q1 2025, the market is expected to generate around $1.35 billion, as automation technologies in the poultry sector are increasingly being adopted to improve productivity, animal welfare, and efficiency. The U.S., Brazil, and China will continue to be major players, given their large-scale poultry industries and focus on optimizing operations.

By Q2 2025, the market is expected to grow to approximately $1.4 billion, with the adoption of smart farming technologies, including automated feeding systems, egg collection systems, and environmental control systems. Brazil and China will see heightened demand for such systems as the industry seeks to meet growing domestic and export demands while improving operational efficiencies.

Understanding the Upstream and Downstream Dynamics of Poultry Automation

The poultry automation supply chain consists of two critical components: upstream and downstream dynamics, each playing a distinct role in market growth.

Upstream Dynamics

The upstream segment of the poultry automation supply chain includes various activities involved in the production and development of automation equipment. These activities are crucial for ensuring a steady supply of innovative solutions to meet the growing demands of the industry. The key components of upstream dynamics are:

- Raw material procurement for automation equipment

- Research and development of sensor technologies

- Manufacturing of automated systems

- Integration of IoT components

- Software development for control systems

The upstream segment faces significant pressure from rising material costs, particularly in semiconductor components essential for smart automation systems. Manufacturing facilities must maintain strict quality control while meeting increased demand for customized solutions.

Downstream Dynamics

On the other hand, downstream dynamics refer to the activities involved in delivering automation solutions to end-users and providing ongoing support services. This segment focuses on creating value through specialized offerings that enhance the performance and longevity of automated systems. The key aspects of downstream operations include:

- Distribution networks

- Installation services

- Maintenance and support

- End-user training programs

- Data analytics services

Downstream operations focus on creating value through specialized services. Distributors now offer comprehensive packages including:

- 24/7 technical support

- Predictive maintenance schedules

- Performance optimization services

- Remote monitoring capabilities

Opportunities for Vertical Integration

The integration between upstream and downstream segments creates opportunities for vertical integration. Companies controlling both aspects gain competitive advantages through:

- Cost optimization

- Quality control

- Supply chain efficiency

- Market responsiveness

- Innovation implementation

Recent market data shows a 15% increase in companies adopting integrated upstream-downstream strategies, indicating a shift toward consolidated business models in poultry automation.

Key Market Trends Reshaping Poultry Automation Systems

The poultry automation landscape is experiencing rapid transformation driven by technological advancements and changing market demands. Here are the key trends shaping the industry:

1. Smart Integration and IoT Solutions

- Real-time monitoring systems tracking bird health

- Automated climate control with precision sensors

- Data analytics for predictive maintenance

- Mobile apps for remote farm management

2. Robotics and AI Implementation

- Robotic systems for egg collection and sorting

- AI-powered feeding systems adjusting nutrient levels

- Automated vaccination and health screening

- Machine learning algorithms for behavior analysis

3. Sustainability-Focused Solutions

- Energy-efficient lighting and ventilation systems

- Water conservation through smart drinking systems

- Waste management automation

- Solar-powered equipment integration

4. Enhanced Biosecurity Measures

- Automated disinfection systems

- Contactless monitoring and management

- UV sterilization technology

- Integrated pest control systems

These innovations are driving efficiency gains of 25-30% in modern poultry operations. The adoption of cloud-based management platforms enables farmers to optimize operations through data-driven decision making. Manufacturers are developing modular systems allowing farms to scale automation gradually, addressing the need for flexible implementation strategies.

The integration of 5G technology is enabling faster data transmission and improved connectivity between automated systems, creating seamless operation workflows. These advancements are particularly beneficial for large-scale commercial farms seeking to maximize productivity while maintaining high animal welfare standards.

Challenges Impacting Growth in Poultry Automation

The poultry automation system market faces several significant hurdles that affect its expansion rate and adoption across different regions:

High Initial Investment Costs

- Advanced automation systems require substantial upfront capital

- Small and medium-sized farms struggle with financing options

- Return on investment periods can extend beyond 3-5 years

Technical Barriers

- Complex integration with existing farm infrastructure

- Need for specialized maintenance and technical support

- Limited availability of skilled operators in rural areas

Market-Specific Challenges

- Fluctuating feed prices impact automation investment decisions

- Energy costs affect operational expenses

- Regional variations in regulatory compliance requirements

Infrastructure Limitations

- Unreliable power supply in developing regions

- Internet connectivity issues for IoT-based systems

- Limited access to replacement parts and service networks

Farm-Level Resistance

- Traditional farming practices remain deeply rooted

- Concerns about job displacement

- Skepticism about technology reliability

- Cultural barriers to modernization

The poultry automation industry must address these challenges through innovative financing solutions, improved technical support networks, and enhanced system reliability. Manufacturers are developing more user-friendly interfaces and modular systems to facilitate gradual automation adoption, allowing farms to scale their technological implementation according to their capabilities and needs.

Geopolitical Influences on Poultry Automation Systems

Global political dynamics significantly shape the poultry automation systems market through:

1. Trade Relations and Tariffs

- Shifting trade agreements impact equipment costs

- Import/export restrictions affect technology access

- Currency fluctuations influence purchasing power

2. Regional Regulatory Standards

- Varying compliance requirements across borders

- Different animal welfare regulations by country

- Food safety standards affecting automation choices

3. Political Tensions Impact

- Supply chain disruptions in key markets

- Technology transfer limitations

- Market access restrictions

4. Cross-Border Investment Climate

- Foreign direct investment policies

- Joint venture opportunities

- Technology licensing agreements

The Russia-Ukraine conflict has created ripple effects through:

- Disrupted grain supplies affecting feed costs

- Energy price volatility impacting operations

- Limited access to Eastern European markets

China’s Belt and Road Initiative influences automation adoption through:

- Infrastructure development in partner countries

- Technology transfer agreements

- New market access opportunities

These geopolitical factors create both challenges and opportunities for automation system manufacturers, affecting market entry strategies and technology deployment across different regions.

Segmenting the Poultry Automation System Market by Type

The poultry automation system market divides into distinct categories based on functionality and application areas. Each segment addresses specific operational needs within modern poultry farming.

Primary Market Segments:

- Feeding Systems: Automatic feed dispensers, feed line systems, feed weighing equipment, smart feed monitoring tools

- Climate Control Solutions: Ventilation systems, temperature regulation, humidity control, air quality management

- Egg Collection Systems: Automated collection belts, egg sorting machines, packaging automation, quality control systems

- Monitoring Equipment: Surveillance cameras, biosecurity systems, health tracking devices, environmental sensors

- Cleaning and Waste Management: Automated cleaning systems, manure removal equipment, sanitization tools, waste processing units

The market shows strong growth in integrated systems that combine multiple functionalities. Smart systems with IoT capabilities represent the fastest-growing segment, allowing farmers to control operations through mobile applications and cloud platforms. These technological advancements drive efficiency improvements of up to 40% in daily operations while reducing labor costs by 25-30%.

Applications Driving Demand for Poultry Automation Systems

The poultry automation market responds to specific industry demands across different application segments:

1. Broiler Production

- Automated feeding systems with precision nutrition control

- Environmental monitoring for optimal growth conditions

- Weight tracking and flock management solutions

- Disease prevention through automated sanitization

2. Layer Management

- Automated egg collection and grading systems

- Nest box monitoring and management

- Belt cleaning and maintenance automation

- Climate control for optimal laying conditions

3. Breeder Operations

- Specialized feeding systems for breeding stock

- Automated hatching and incubation control

- Genetic tracking and monitoring systems

- Breeding performance analytics

4. Processing Facilities

- High-speed processing line automation

- Quality control and inspection systems

- Packaging and labeling automation

- Waste management solutions

These applications reflect the industry’s push toward efficiency and quality control. Data from the International Poultry Council shows automated systems can increase production efficiency by 25-30% while reducing labor costs by up to 40%.

The demand surge stems from:

- Rising labor costs in developed markets

- Increased focus on food safety standards

- Growing consumer demand for traceable poultry products

- Need for consistent product quality

- Pressure to optimize resource utilization

Regional Market Insights: Poultry Automation Systems Globally

The global poultry automation landscape reveals distinct regional patterns shaped by local market dynamics and technological readiness.

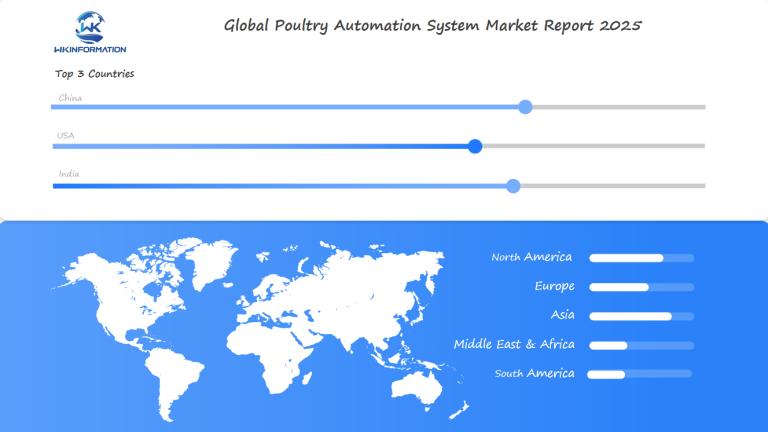

Asia-Pacific leads market growth with a 35% share, driven by:

- Rapid industrialization of poultry farming

- Rising protein consumption

- Government support for agricultural modernization

Europe maintains a strong 28% market presence through:

- Strict animal welfare regulations

- High labor costs pushing automation adoption

- Advanced technological infrastructure

North America demonstrates steady growth characterized by:

- Large-scale commercial farming operations

- Early adoption of smart farming technologies

- Strong focus on efficiency optimization

Latin America shows emerging potential with:

- Expanding export markets

- Increasing foreign investments

- Growing domestic consumption

Middle East & Africa represents an untapped market featuring:

- Rising demand for processed poultry

- Increasing focus on food security

- Growing investment in agricultural technology

Each region’s automation adoption rate correlates with factors such as labor availability, production costs, and regulatory requirements. Market penetration varies significantly between developed and developing regions, creating diverse opportunities for automation system providers.

The regional distribution of automation technology reflects local farming practices, climate conditions, and economic capabilities. Countries with established poultry industries typically show higher automation rates, while emerging markets focus on basic automation solutions with gradual advancement toward sophisticated systems.

U.S. Poultry Automation: Key Growth Areas and Trends

The U.S. poultry automation market is experiencing strong growth due to technological advancements and rising labor costs. American poultry producers are making significant investments in smart farming solutions, especially in the following areas:

- Advanced monitoring systems using AI and machine learning

- Robotic processing equipment for meat handling

- Automated egg collection and grading systems

- Climate control technologies with IoT integration

Increasing Adoption of Automated Solutions

Labor shortages in rural areas have prompted U.S. farms to embrace automated solutions, resulting in a 35% increase in automation implementation from 2020 to 2023.

Growing Interest in Data-Driven Systems

The shift towards precision farming has generated interest in data-driven systems that optimize various aspects of poultry production, including:

- Feed conversion ratios

- Energy consumption

- Water usage

- Waste management

Leading States in Automation Adoption

Several U.S. states, such as Georgia, Arkansas, and North Carolina, are at the forefront of automation adoption rates. These regions are witnessing significant investments in integrated control systems that combine:

- Real-time health monitoring

- Predictive maintenance alerts

- Environmental parameter adjustments

- Production tracking metrics

Support from the U.S. Department of Agriculture

The U.S. Department of Agriculture’s support through grants and research funding has further accelerated automation adoption, particularly among medium-sized operations looking to expand their production capabilities.

Brazil's Role in Poultry Automation System Growth

Brazil’s poultry automation market shows great potential for growth, primarily due to its status as the largest poultry exporter in the world. Since 2020, the country has seen a 35% increase in its adoption of automation, indicating a significant move towards modern farming methods.

Key Factors Driving Growth in Brazil:

- Increasing labor costs pushing farms towards automated solutions

- Strict export quality requirements demanding precision control

- Government incentives for agricultural technology adoption

- Growing domestic demand for poultry products

Brazilian poultry farms are investing heavily in smart feeding systems and environmental controls. These automated solutions help maintain consistent product quality while reducing operational costs by 25-30%.

The country’s automation landscape has some unique features:

- Regional Innovation Hubs: Concentrated automation clusters in São Paulo and Santa Catarina

- Local Manufacturing: Domestic production of automation equipment reducing import dependencies

- Custom Solutions: Tailored systems addressing specific climate challenges

Brazilian poultry producers are focusing on automating:

- Egg collection systems

- Climate control technology

- Feed distribution mechanisms

- Waste management solutions

The market shows strong integration between local technology providers and international automation companies, creating a robust ecosystem for continued growth. Brazilian farms implementing full automation systems report productivity increases of up to 40%, positioning the country as a key driver in global poultry automation advancement.

China's Expanding Poultry Automation Market Landscape

China’s poultry automation market is experiencing unprecedented growth, driven by rapid urbanization and increasing protein consumption patterns. The country’s shift towards modernized farming practices has created a strong demand for automated solutions across the poultry sector.

Key Market Drivers in China:

- Rising labor costs pushing farms toward automation

- Government initiatives supporting agricultural modernization

- Growing food safety concerns requiring precise monitoring

- Increasing scale of poultry operations

The Chinese market particularly emphasizes smart farming technologies, with local manufacturers developing AI-powered solutions for poultry management. These systems integrate:

- Real-time monitoring of bird health

- Automated temperature control

- Precision feeding systems

- Data analytics for production optimization

Recent developments show Chinese poultry farms adopting cloud-based platforms to manage multiple facilities remotely. The integration of 5G technology has enabled faster data transmission and improved response times in automated systems.

Local companies like New Hope Group and Guangdong Wen’s Foodstuff Group have invested heavily in automation technologies, setting industry standards for domestic operations. These investments reflect China’s broader strategy to achieve food security through technological advancement.

The market demonstrates strong potential in second-tier cities, where poultry farms are rapidly modernizing their operations to meet urban demand. Chinese manufacturers are also developing cost-effective automation solutions tailored to small and medium-sized farms, expanding market accessibility.

The Future of Poultry Automation: What to Expect

The poultry automation industry is expected to undergo significant changes by 2025 and beyond. With the help of artificial intelligence (AI) and machine learning algorithms, predictive maintenance systems will be implemented, leading to a reduction in equipment downtime by up to 30%.

Key technological advancements on the horizon:

- Real-time health monitoring through AI-powered cameras

- Blockchain integration for supply chain transparency

- Autonomous robots for precise feed distribution

- Smart sensors for environmental control optimization

- Quantum computing applications for genetic selection

The introduction of 5G technology will bring about a major shift in data transmission speeds, enabling farmers to monitor multiple facilities at once using their mobile devices. Additionally, virtual reality (VR) and augmented reality (AR) applications will improve worker training and allow for remote management of facilities.

Emerging market developments:

- Cloud-based management systems adoption rate projected at 65% by 2025

- Investment in sustainable energy solutions expected to grow by 40%

- Implementation of precision farming techniques across 80% of large-scale operations

The next generation of poultry automation systems will prioritize sustainability, incorporating solar-powered components and water recycling mechanisms. These innovations are expected to lower operational costs by around 25% while also reducing environmental impact.

Furthermore, edge computing solutions will enable local processing of data, resulting in quicker decision-making and minimal delays in automated responses to changes in the environment or health issues within poultry facilities.

Competitive Landscape of Poultry Automation System Companies

The poultry automation system market features several dominant players shaping industry innovation and market dynamics. Big Dutchman leads with comprehensive automation solutions, specializing in feeding systems and climate control technology. Tyson Foods Inc. maintains its position through vertical integration and advanced processing automation.

- LiVi Machinery – China

- Hebei Weizhengheng Animal Husbandry Machinery Equipment Co., Ltd. – China

- Liaocheng Motong Machinery Equipment Co., Ltd. – China

- Dynamic Automation – United States

- Big Dutchman – Germany

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Poultry Automation System Market Report |

| Base Year | 2024 |

| Segment by Type |

· Feeding Systems · Climate Control Solutions · Egg Collection Systems · Monitoring Equipment · Cleaning and Waste Management |

| Segment by Application |

· Broiler Production |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The poultry automation system market demonstrates significant growth potential, with projections indicating continued expansion through 2025 and beyond. As technology advances and global demand for poultry products increases, the industry is poised for substantial transformation. Key markets in the U.S., Brazil, and China are leading this evolution, each contributing unique innovations and adoption patterns.

Global Poultry Automation System Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Poultry Automation System Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Poultry Automation SystemMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Poultry Automation Systemplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Poultry Automation System Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Poultry Automation System Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Poultry Automation System Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPoultry Automation SystemMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream and downstream dynamics affecting poultry automation?

Upstream dynamics refer to the supply chain factors influencing poultry automation, including equipment manufacturing and raw material sourcing. Downstream dynamics involve market demand, consumer preferences, and distribution channels that affect how poultry automation systems are implemented and utilized.

What key market trends are reshaping poultry automation systems?

Key market trends include advancements in technology, increased demand for efficiency in poultry production, and a growing focus on animal welfare and sustainability which are driving innovations in poultry automation systems.

What challenges are impacting growth in the poultry automation sector?

Challenges impacting growth in poultry automation include high initial investment costs, technological complexities, regulatory compliance issues, and varying levels of adoption across different regions.

How do geopolitical influences affect poultry automation systems?

Geopolitical influences can impact poultry automation systems through trade policies, tariffs, and international relations that affect supply chains and market access for poultry products.

What applications are driving demand for poultry automation systems?

Applications driving demand for poultry automation systems include enhanced feeding systems, climate control solutions, egg handling technologies, and automated monitoring systems that improve operational efficiency in poultry production.