Geomechanics Software and Services Market Set to Reach $1.53 Billion by 2025: Key Insights from the U.S., Canada, and Australia

In 2025, the global market reached an estimated value of USD 1.87 billion, with projections indicating growth to USD 4.08 billion by 2033 at a compound annual growth rate (CAGR) of 10.23%. This growth is attributed to increasing demand for sophisticated software solutions in various sectors such as oil and gas, mining, and civil engineering, which require advanced modeling and simulation capabilities to analyze geotechnical behavior effectively.

- Last Updated:

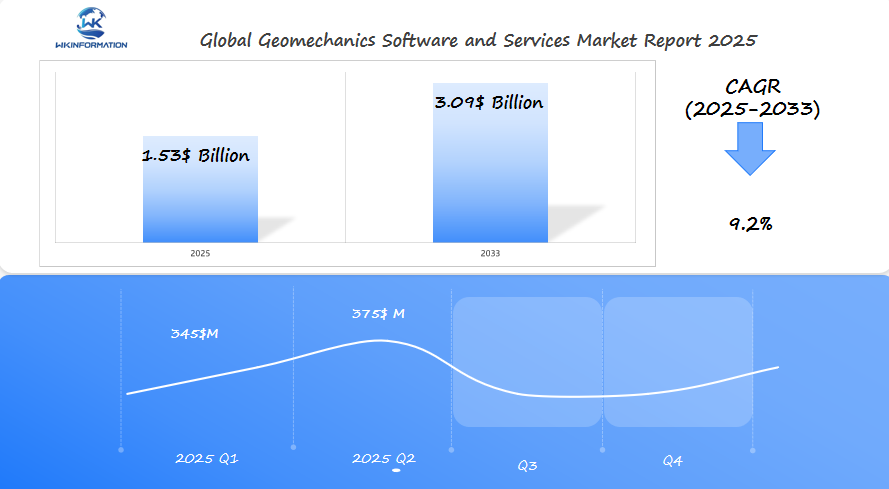

Geomechanics Software and Services Market Forecast for Q1 and Q2 2025

The global geomechanics software and services market is projected to reach $1.53 billion in 2025, with a CAGR of 9.2% through 2033. The first half of 2025 is expected to show steady growth, with Q1 estimated at around $345 million, and Q2 forecasted to reach approximately $375 million as demand for advanced simulation and analysis tools in mining, oil, and gas industries increases.

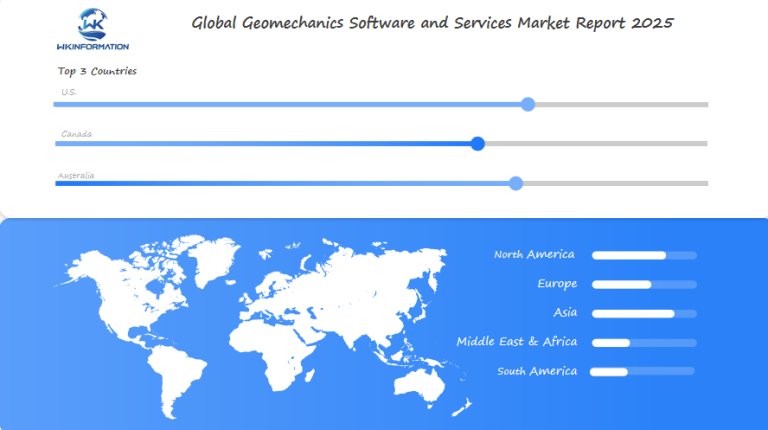

The U.S., Canada, and Australia are expected to be key regions for this market. The U.S. continues to lead in innovation and adoption of geomechanics technologies, driven by its large-scale energy and resource extraction sectors. Canada, with its resource-heavy economy, follows closely, especially in the oil sands and mining industries. Australia is expected to see strong growth due to its expanding mining sector, making these regions crucial for a deeper understanding of market dynamics in the geomechanics software and services industry.

Understanding the Upstream and Downstream Forces in Geomechanics Software and Services

The geomechanics software industry operates within a complex ecosystem of interconnected forces that shape its development, implementation, and evolution. These forces can be categorized into two primary streams: upstream and downstream influences.

Upstream Forces in Geomechanics Software

Upstream forces represent the foundational elements that enable software development and implementation:

- Raw computational power and hardware capabilities

- Access to geological data and research findings

- Availability of skilled developers and engineers

- Research and development funding

- Technical infrastructure requirements

The availability and quality of these upstream components directly impact software capabilities. For instance, advanced sensor technology enables more precise data collection, leading to enhanced software accuracy in soil analysis and structural stability predictions.

Downstream Forces Shaping Service Delivery

Downstream forces reflect market demands and end-user requirements:

- Project specifications from construction companies

- Regulatory compliance requirements

- Client budget constraints

- Timeline pressures

- Site-specific challenges

These forces drive software customization and service adaptation. When construction companies require specific soil stability analyses, software providers must adjust their solutions to meet these exact needs.

Industry Dynamic Interactions

The interaction between upstream and downstream forces creates a dynamic feedback loop:

“Software development responds to market demands, while available technology shapes what’s possible in service delivery”

This relationship manifests in practical applications:

- Real-time monitoring systems adapt to both hardware capabilities and client safety requirements

- Software interfaces evolve based on user feedback and available programming tools

- Service packages combine technical possibilities with market pricing expectations

Understanding these forces helps stakeholders navigate the geomechanics software landscape effectively. Companies that successfully balance upstream capabilities with downstream demands position themselves for sustainable growth in this expanding market.

Key Trends in Geomechanics Software Driving Market Expansion

The integration of sustainable construction practices has changed geomechanics software development. Modern solutions now include green building standards and environmental impact assessments directly into their analytical frameworks. These software platforms enable engineers to:

- Evaluate carbon footprint during construction phases

- Analyze soil composition for sustainable foundation designs

- Model environmental impact scenarios

- Calculate resource optimization metrics

Transformation through Artificial Intelligence and Machine Learning

Artificial Intelligence and machine learning capabilities have changed traditional geomechanical analysis methods. Advanced algorithms now process large amounts of data to:

- Predict soil behavior patterns

- Identify potential structural risks

- Automate complex calculations

- Generate adaptive design recommendations

Enhancing Site Assessment with Real-Time Soil Monitoring Sensors

The use of real-time soil monitoring sensors has improved the accuracy of site assessments. These sophisticated sensor networks provide:

- Continuous ground movement data

- Instant stress-strain measurements

- Live subsurface condition updates

- Early warning systems for potential failures

Evolving Software Platforms for Handling Real-Time Data

Software platforms have developed to manage this influx of real-time data through:

- Cloud-based processing systems

- Mobile-friendly interfaces

- Automated alert mechanisms

- Dynamic reporting features

The Impact of Technological Advancements on Market Expansion

The rapid growth of the market reflects these technological advancements, with companies investing heavily in smart monitoring solutions. Project managers now rely on integrated platforms that combine:

- Digital twin technology

- Predictive maintenance systems

- Risk assessment modules

- Performance optimization tools

These innovations have greatly improved project outcomes by enabling precise decision-making and reducing uncertainty in geotechnical assessments. The continued adoption of these advanced technologies is driving market growth, especially in areas with complex geological conditions and demanding infrastructure needs.

Barriers to Growth in the Geomechanics Software Industry

The geomechanics software industry faces several significant challenges that impact its growth trajectory. These barriers create complex hurdles for both established players and new entrants in the market.

1. Regulatory Compliance Challenges

- Strict building codes and safety regulations require constant software updates

- Different jurisdictional requirements necessitate multiple versions of the same software

- Time-consuming approval processes for new software implementations

- Complex certification requirements across various regions

2. Technical Implementation Barriers

- High costs associated with software development and maintenance

- Integration challenges with existing infrastructure systems

- Need for specialized expertise to operate sophisticated software tools

- Limited availability of qualified professionals for software support

3. Market Competition Dynamics

- Intense price competition from established players

- Market saturation in developed regions

- Rising costs of research and development

- Pressure to maintain competitive pricing while investing in innovation

4. Data Management Issues

- Security concerns regarding sensitive geological data

- Large data storage requirements for complex calculations

- Need for robust backup systems

- Challenges in data standardization across different platforms

The high initial investment required for developing comprehensive geomechanics software solutions creates a significant entry barrier for new companies. Existing players must continuously invest in research and development to maintain their market position, putting pressure on profit margins.

Small and medium-sized enterprises face particular challenges in accessing advanced geomechanics software due to budget constraints. The specialized nature of these tools often requires substantial training investments, creating additional financial burdens for companies.

The fragmented nature of the construction industry also presents challenges for software providers. Different stakeholders – from contractors to consultants – have varying requirements and expectations, making it difficult to create standardized solutions that meet all needs effectively.

How Geopolitical Factors Are Influencing Geomechanics Software Solutions

Geopolitical dynamics have a significant impact on the geomechanics software market. They influence investment patterns and technological adoption rates worldwide. Political stability is crucial for infrastructure development projects, as it directly affects the demand for geomechanical software solutions.

Key Geopolitical Influences on Infrastructure Investment:

- Trade agreements between nations affect material costs and software licensing

- Regional conflicts can delay or accelerate infrastructure development

- Political alliances influence technology sharing and development partnerships

- Economic sanctions impact software availability and technical support services

Government policies also play a crucial role in shaping market dynamics:

- Regulatory Framework ChangesBuilding code updates

- Environmental protection measures

- Safety standard requirements

- Financial InitiativesInfrastructure development funds

- Research grants for software development

- Tax incentives for technology adoption

The relationship between political stability and infrastructure investment is evident:

“Countries with stable political environments typically see 15-20% higher infrastructure investment rates compared to politically volatile regions” – Global Infrastructure Report 2023

Political tensions between major economies have led to:

- Increased localization of software development

- Rise in regional software providers

- Enhanced focus on domestic technology capabilities

- Stricter data security requirements

Government infrastructure policies directly influence software adoption through:

- Mandatory digital transformation initiatives

- Requirements for specific analysis capabilities

- Standardization of geotechnical assessment methods

- Integration of sustainability metrics

These geopolitical factors create different market conditions across regions. Some areas experience accelerated growth while others face temporary slowdowns. Countries with strong diplomatic ties often share technological advances, creating clusters of innovation in geomechanical software development.

Geomechanics Software and Services Market Segmentation

The geomechanics software and services market divides into distinct categories based on service types and end-user sectors, each serving specific industry needs.

Primary Service Types:

- Site Investigation Services: Soil composition analysis, ground water assessment, subsurface mapping, geological hazard identification

- Slope Stabilization Solutions: Retaining wall design, erosion control systems, landslide risk assessment, slope reinforcement planning

- Foundation Analysis Tools: Load-bearing capacity calculations, settlement prediction, deep foundation design, soil-structure interaction modeling

Key End-User Sectors:

- Municipal Projects: Urban infrastructure development, public transportation systems, utility network installations, waste management facilities

- Commercial Construction: High-rise buildings, shopping complexes, industrial facilities, warehouses

- Energy Sector: Oil and gas exploration, renewable energy installations, power plant construction, pipeline infrastructure

- Transportation Infrastructure: Highway construction, bridge development, railway systems, airport facilities

The market segmentation reflects a growing specialization within the geomechanics industry. Software providers tailor their solutions to address specific challenges in each sector. Municipal projects represent the largest end-user segment, driven by increasing urbanization and infrastructure modernization needs.

Custom software solutions now integrate multiple service types, allowing users to perform comprehensive analyses within a single platform. This integration trend responds to the industry’s demand for streamlined workflows and improved project efficiency.

The segmentation structure enables software providers to develop targeted solutions that meet specific industry requirements while maintaining flexibility for cross-sector applications. This approach has created new opportunities for specialized software development and service delivery across different market segments.

The Role of Applications in Geomechanics Software Demand

Geomechanics software applications are essential tools used in various engineering projects. These specialized applications contribute to the growth of the market by effectively addressing complex geological problems and improving project results.

Key Application Areas:

1. Ground Improvement Analysis

- Soil stabilization calculations

- Settlement predictions

- Compaction control modeling

- Liquefaction assessment tools

2. Foundation Design Solutions

- Deep foundation analysis

- Bearing capacity calculations

- Settlement analysis

- Pile group behavior modeling

3. Tunnel Design Applications

- Rock mass classification

- Support system design

- Deformation analysis

- Stress distribution modeling

4. Slope Stability Software

- Risk assessment tools

- Failure surface analysis

- Seismic stability evaluation

- Groundwater flow modeling

These applications enhance project outcomes through data-driven decision making. Ground improvement applications help engineers determine optimal soil treatment methods, reducing construction costs by up to 30%. Foundation design software enables precise load calculations, minimizing structural risks and extending infrastructure lifespan.

The demand for these applications continues to rise as projects become increasingly complex. Mining companies rely on tunnel design applications to ensure worker safety and operational efficiency. Construction firms use slope stability software to protect infrastructure investments in challenging terrains.

Recent technological advances have expanded application capabilities:

- Real-time monitoring integration

- Cloud-based collaboration features

- 3D visualization tools

- Machine learning algorithms for prediction

Project success rates have improved significantly through these specialized applications. Construction companies report a 40% reduction in design time and a 25% decrease in material costs when using comprehensive geomechanics software solutions.

The integration of these applications with Building Information Modeling (BIM) systems has created new opportunities for streamlined workflow processes. Engineers can now seamlessly transfer geotechnical data across different project phases, reducing errors and improving collaboration efficiency.

Key Regional Insights into the Geomechanics Software Market

North America: The Current Leader

North America dominates the geomechanics software market with a 45% market share, driven by extensive infrastructure development and substantial investments in construction projects. The region’s leadership stems from:

- Advanced technological adoption rates

- High concentration of major software developers

- Strong presence of engineering consulting firms

- Robust regulatory framework for construction safety

Asia-Pacific: The Rising Star

The Asia-Pacific region presents the highest growth potential, with a projected CAGR of 12.3% through 2025. Key growth drivers include:

- Rapid urbanization in developing economies

- Massive infrastructure development initiatives

- Rising foreign direct investments

- Growing awareness of geotechnical safety measures

Understanding Regional Differences

The market dynamics between these regions show distinct patterns in software adoption. North American clients prioritize advanced features and integration capabilities, while Asia-Pacific users seek cost-effective solutions with essential functionalities.

Characteristics of the North American Market

- Mature market with established players

- Focus on software innovation and integration

- High adoption of AI and machine learning solutions

- Strong emphasis on sustainable construction practices

Characteristics of the Asia-Pacific Market

- Emerging market with untapped potential

- Price-sensitive customer base

- Growing demand for basic geotechnical solutions

- Increasing government infrastructure spending

Key Players in Growth Markets

China and India lead the Asia-Pacific growth story, with their construction sectors expanding at unprecedented rates. These markets demonstrate particular interest in:

- Foundation analysis tools

- Soil stability assessment software

- Underground construction solutions

- Earthquake resistance modeling

The U.S. and Canada maintain their market leadership through:

- Continuous software updates and improvements

- Strong technical support infrastructure

- Customized solutions for specific industries

- Research and development investments

This regional disparity creates unique opportunities for software providers to develop market-specific solutions that address local needs while maintaining global standards.

U.S. Geomechanics Software Market: Trends and Opportunities

The U.S. geomechanics software market is experiencing unique growth patterns due to significant investments in infrastructure and the adoption of new technologies. The Biden administration’s $1.2 trillion Infrastructure Investment and Jobs Act presents unprecedented opportunities for software providers in the geomechanical sector.

Key Market Trends

- Digital Twin Integration: U.S. construction firms embrace digital twin technology for infrastructure projects, creating virtual replicas of physical assets to optimize performance

- Cloud-Based Solutions: Rising adoption of cloud platforms enables real-time collaboration and data sharing across multiple project stakeholders

- Mobile Applications: Increased demand for field-ready mobile solutions that allow engineers to access geomechanical data on-site

- Sustainability Focus: Growing emphasis on green infrastructure drives the need for specialized software tools measuring environmental impact

Investment Opportunities

The U.S. market presents lucrative opportunities across various sectors:

- Transportation Infrastructure

- Bridge assessment and maintenance software

- Railway foundation analysis tools

- Airport runway stability monitoring systems

- Urban Development

- Underground construction analysis

- High-rise foundation design software

- Soil-structure interaction modeling

- Energy Sector

- Renewable energy installation analysis

- Power plant foundation assessment

- Transmission line stability software

Market Drivers

- Aging infrastructure requiring assessment and rehabilitation

- Increased natural disaster resilience requirements

- Stricter building codes and regulations

- Growing adoption of BIM (Building Information Modeling)

- Rising demand for automated monitoring systems

The U.S. market shows great potential for software providers who can offer specialized solutions to meet these emerging needs. Companies that invest in AI-powered analytics and predictive maintenance capabilities will have a competitive advantage in this growing market.

Canada's Impact on the Geomechanics Software Market

Canada’s significant investments in infrastructure are shaping the geomechanics software market in North America. This is happening through strategic government initiatives and large-scale projects. The Canadian market has its own unique features that drive the demand for specialized geomechanical solutions:

1. Government-Funded Infrastructure Projects

- Transportation infrastructure upgrades valued at $180 billion

- Public transit system expansions in major metropolitan areas

- Port facility modernization programs across coastal regions

2. Regional Development Initiatives

- Northern Territory development projects requiring cold-weather geomechanical analysis

- Resource extraction projects in remote locations

- Urban renewal programs in major cities

The Canadian government’s commitment to infrastructure development creates significant opportunities for geomechanics software providers. These projects require:

- Advanced soil stability analysis

- Frost heave prediction models

- Permafrost behavior simulation

- Seismic risk assessment tools

Canadian projects often have specific requirements that necessitate specialized geomechanical solutions. These include:

- Extreme weather conditions affecting soil behavior

- Complex geological formations in mining regions

- Strict environmental protection regulations

- Urban density challenges in major cities

The integration of Indigenous consultation requirements into project planning has created demand for specialized geomechanical assessment tools. These tools help evaluate traditional land use impacts and environmental preservation concerns.

Canadian engineering firms are showing a strong preference for certain technologies in geomechanical analysis. These include:

- Cloud-based platforms for conducting geomechanical analysis

- Real-time monitoring solutions for ongoing projects

- Mobile-friendly tools for field assessments

- Data integration capabilities with existing infrastructure management systems

Public-private partnerships (P3s) in Canada are driving innovation in the development of geomechanics software. These partnerships require sophisticated risk assessment capabilities and long-term performance prediction models, which are pushing software providers to enhance their offerings.

Australia's Role in Geomechanics Software Market Growth

Australia’s infrastructure development landscape has emerged as a significant driver in the geomechanics software market. The country’s commitment to large-scale projects has created substantial demand for advanced geotechnical solutions.

Key Infrastructure Investments

- A$110 billion transport infrastructure pipeline

- Western Sydney Airport development

- Melbourne Metro Tunnel Project

- Brisbane Cross River Rail

The Australian government’s focus on sustainable infrastructure has sparked increased adoption of sophisticated geomechanics software. These tools play a crucial role in:

- Soil stability analysis

- Foundation design optimization

- Environmental impact assessments

- Risk mitigation strategies

Notable Project Applications

The Western Sydney Airport development demonstrates the extensive use of geomechanical software for:

- Site characterization

- Ground improvement planning

- Earthworks optimization

- Settlement monitoring

Mining sector expansions across Western Australia have intensified the need for specialized geomechanics solutions. These projects require:

- Rock mass characterization

- Slope stability analysis

- Underground excavation design

- Groundwater modeling

The Melbourne Metro Tunnel project showcases advanced applications of geomechanics software through:

- Real-time ground movement monitoring

- Tunnel boring machine guidance

- Settlement prediction

- Structural integrity assessments

Australian engineering firms have adopted integrated geomechanics platforms that combine:

- 3D modeling capabilities

- Advanced numerical analysis

- Real-time monitoring systems

- Data visualization tools

The country’s unique geological challenges have pushed software developers to enhance their products with features specifically designed for Australian conditions. These adaptations include specialized modules for:

- Complex soil profiles

- Variable weather conditions

- Seismic considerations

- Coastal environment factors

The Future Outlook for Geomechanics Software and Services

The geomechanics software and services market shows promising growth potential through 2030, with several key innovations reshaping the industry landscape:

AI-Powered Predictive Analytics

- Real-time risk assessment capabilities

- Automated geological modeling

- Enhanced decision-making algorithms

Digital Twin Integration

- Virtual replicas of physical infrastructure

- Continuous monitoring and simulation

- Improved maintenance scheduling

Cloud-Based Solutions

- Remote access to complex computational tools

- Collaborative project management

- Scalable resource allocation

The market is experiencing a shift toward integrated platform solutions that combine multiple functionalities:

- Advanced 3D visualization

- Multi-physics simulation capabilities

- Cross-platform compatibility

- Mobile-first applications

Emerging technologies like quantum computing and edge processing are set to revolutionize computational capabilities in geomechanical analysis. These advancements will enable processing of larger datasets and more complex simulations in shorter timeframes.

The rise of smart cities and sustainable infrastructure projects will drive demand for specialized geomechanics software. Companies are investing in developing tools that support green building initiatives and environmental compliance requirements.

Market leaders are focusing on developing user-friendly interfaces while maintaining robust analytical capabilities. This trend aims to bridge the gap between expert users and field technicians, expanding the software’s accessibility across different skill levels.

Competitive Landscape of Geomechanics Software and Services

- Schlumberger Limited — Houston, Texas, USA (officially incorporated in Curaçao)

- Baker Hughes Company — Houston, Texas, USA

- IHS Markit Ltd. — London, England, UK (now part of S&P Global)

- Itasca Consulting Group Inc. — Minneapolis, Minnesota, USA

- Rocscience Inc. — Toronto, Ontario, Canada

- Bentley Systems Incorporated — Exton, Pennsylvania, USA

- GeoStru S.R.L. — Reggio Calabria, Italy

- Plaxis B.V. — Delft, Netherlands (now part of Seequent, a Bentley company)

- RockWare Inc. — Golden, Colorado, USA

- Dassault Systèmes — Vélizy-Villacoublay, France

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Geomechanics Software and Services Market Report |

| Base Year | 2024 |

| Segment by Type | · Software

· Services |

| Segment by Application | · Oil and Gas

· Mining · Civil Construction · Nuclear Waste Disposal · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Geomechanics Software and Services Market is set to grow significantly, highlighting the importance of using advanced geomechanical solutions. These developments are crucial for creating safer infrastructure in different industries. Stakeholders should stay alert and knowledgeable about the new trends that are shaping this ever-changing market. By keeping themselves informed, industry professionals can use this information for strategic planning and take advantage of opportunities in this evolving field. This proactive method will help them stay competitive and relevant in the future of geomechanical applications.

The geomechanics software and services market is undergoing a significant transformation, with an expected value of $1.53 billion by 2025, indicating strong growth in the industry. This expansion is driven by several key factors:

- Infrastructure Development: Major investments in the U.S., Canada, and Australia are driving market growth.

- Technological Integration: AI, machine learning, and real-time monitoring capabilities are changing how services are delivered.

- Sustainable Practices: There is a growing focus on environmental considerations in construction projects.

The market is evolving in the following ways:

- The Asia-Pacific region is becoming more influential in the market.

- There is an increasing demand for specialized services in municipal projects.

- Integrated software solutions are being adopted more widely.

To succeed in this industry, stakeholders need to:

- Stay technologically ahead by continuously innovating.

- Form strategic partnerships to improve service offerings.

- Understand and adapt to regional regulatory requirements.

- Create tailored solutions for specific end-user needs.

As we move towards 2025, there will be both opportunities and challenges. Companies that can effectively combine technological advancements with practical application needs will gain a significant share of the market. The future of the industry lies in developing solutions that tackle complex geotechnical problems while also meeting sustainability goals and regulatory requirements.

Global Geomechanics Software and Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Geomechanics Software and Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Geomechanics Software and ServicesMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Geomechanics Software and Servicesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Geomechanics Software and Services Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Geomechanics Software and Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Geomechanics Software and Services Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofGeomechanics Software and ServicesMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are upstream and downstream forces in the geomechanics software industry?

Upstream forces refer to factors such as raw material availability that impact the development of geomechanics software, while downstream forces involve customer demand and project requirements that influence service delivery.

How is sustainable construction driving market expansion for geomechanics software?

The rising demand for sustainable construction practices is significantly impacting software development, leading to innovative solutions that adhere to environmental standards and promote efficient resource use.

What barriers does the geomechanics software industry face for growth?

The industry faces several barriers, including regulatory challenges, competitive pressures, and market dynamics that can hinder the expansion of geomechanics software and services.

How do geopolitical factors affect geomechanics software solutions?

Geopolitical stability influences infrastructure investments, which directly affects the demand for geomechanical software. Additionally, government policies shape market dynamics and project execution in this field.

What applications drive demand for geomechanics software?

Applications such as ground improvement and foundation design are key drivers of demand for geomechanics software, enhancing project outcomes through specialized solutions tailored to specific engineering needs.

What are the key trends in the U.S. geomechanics software market?

Current trends in the U.S. market include a strong focus on infrastructure development and emerging investment opportunities for software providers, particularly in response to government initiatives aimed at improving infrastructure.