Nut Butters Market to Reach $3.86 Billion by 2025: Accelerating Growth in the U.S., Canada, and the U.K.

Explore the dynamic global nut butters market in this comprehensive analysis covering trends, market share, and industry insights from 2025-2033. Discover key growth drivers, regional dynamics, and competitive strategies shaping this expanding sector, projected to reach USD 6.45 billion by 2033. Learn about consumer preferences shifting towards natural and organic options, e-commerce impacts, and opportunities in emerging markets like Asia-Pacific, while understanding challenges and innovations in this health-focused food segment.

- Last Updated:

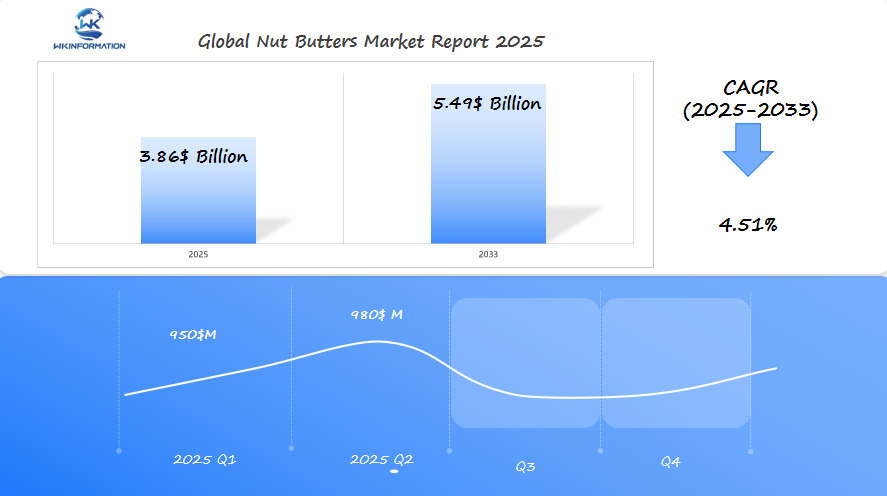

Nut Butters Market Q1 and Q2 2025 Forecast

The Nut Butters market is expected to reach $3.86 billion in 2025, with a CAGR of 4.51% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $950 million, driven by the increasing popularity of healthy snacks and the growing demand for plant-based foods. The market will be led by the U.S., Canada, and the U.K., where nut butter products are becoming an integral part of the health-conscious food culture.

By Q2 2025, the market will likely grow to around $980 million, as demand for almond butter, peanut butter, and cashew butter rises in both retail and online channels. The trend towards natural ingredients and organic nut butters will continue to drive growth, especially among consumers looking for alternatives to traditional spreads with fewer additives.

Upstream and Downstream Industry Chain of Nut Butters

The nut butters industry operates through a complex network of suppliers, manufacturers, and distributors working together to deliver products to consumers. At the upstream level, farmers and agricultural producers grow various nuts like peanuts, almonds, and cashews under specific conditions.

Key Components of the Supply Chain:

Raw Material Sourcing

- Direct partnerships with nut farmers

- Agricultural cooperatives

- International commodity traders

- Quality control inspectors

Processing and Manufacturing

- Cleaning and sorting facilities

- Roasting operations

- Grinding and processing plants

- Packaging units

Distribution Network

- Wholesale distributors

- Retail chains

- E-commerce platforms

- Specialty food stores

The supply chain has multiple quality control checkpoints to ensure food safety and product consistency. Manufacturers work with certified suppliers who follow strict agricultural practices and food safety standards. The distribution phase involves temperature-controlled storage facilities and specialized transportation to maintain product quality.

Modern nut butter producers are increasingly using vertical integration strategies, controlling multiple stages of production from farm to shelf. This approach helps companies maintain quality standards, lower costs, and respond quickly to market demands.

Key Trends Shaping the Nut Butters Market

The nut butters market has experienced a significant shift toward clean-label products and organic offerings. Health-conscious consumers now actively seek products with:

- Natural ingredients

- No artificial preservatives

- Minimal processing

- Transparent sourcing practices

This demand has prompted manufacturers to reformulate their products, removing artificial additives and focusing on single-ingredient nut butters. Many brands now highlight their organic certifications and sustainable sourcing practices on product packaging.

Product Innovation in the Nut Butter Space

Product innovation in the nut butter space includes:

- Unique flavor combinations – maple almond butter, chocolate hazelnut spread, vanilla cashew butter

- Functional additions – protein-enriched varieties, omega-3 fortified options

- Alternative sweeteners – honey, coconut sugar, date paste

- Texture variations – chunky, ultra-smooth, whipped

Development of Specialized Products Driven by Consumer Preferences

Consumer preferences have also driven the development of specialized products:

- Low-sugar options for diabetic consumers

- High-protein varieties for fitness enthusiasts

- Single-serve packaging for convenience

- Glass jar alternatives for eco-conscious buyers

The market has seen a rise in artisanal and small-batch producers who create premium nut butters with locally sourced ingredients. These craft producers often experiment with unique nut combinations and innovative flavoring techniques to differentiate their products from mainstream offerings.

Challenges and Barriers Facing Nut Butter Manufacturers

Nut butter manufacturers face significant challenges in keeping their production steady and making a profit. The main issue they deal with is the unpredictable prices of raw materials, especially nuts. These prices can go up and down due to various reasons such as weather conditions affecting crops, disruptions in the global supply chain, speculation in the market, and outbreaks of agricultural diseases.

Impact of Price Fluctuations

When nut prices fluctuate, it directly affects the cost of production for manufacturers. They have two options: either absorb the losses themselves or increase the retail prices of their products. However, raising prices may not be well-received by consumers and could lead to a decrease in demand.

Allergen Management Complexities

Food safety regulations require strict allergen control protocols:

- Dedicated production lines

- Enhanced cleaning procedures

- Separate storage facilities

- Comprehensive staff training

- Regular allergen testing

The cost of implementing these measures adds substantial overhead to manufacturing operations.

Production Challenges

Manufacturers must navigate technical hurdles in nut butter production:

- Maintaining consistent texture across batches

- Managing oil separation

- Controlling moisture content

- Ensuring proper grinding temperature

- Meeting shelf-life requirements

Cross-contamination risks pose additional challenges, particularly for facilities producing multiple nut butter varieties. Manufacturers must invest in sophisticated equipment and protocols to prevent allergen cross-contact, adding complexity to production processes and increasing operational costs.

Geopolitical Factors Influencing Nut Butter Supply and Trade

Trade policies significantly shape the nut butter market landscape across major economies. The U.S. maintains strict import regulations on nut-based products, requiring extensive documentation and safety certifications. These requirements directly impact pricing structures and market accessibility for international manufacturers.

Recent global events have created notable disruptions in the nut butter supply chain:

- Transportation Bottlenecks: Port congestions and container shortages have led to delayed shipments, affecting stock availability

- Rising Freight Costs: Shipping expenses have increased by 300% since 2020, pushing retail prices higher

- Raw Material Access: Political tensions have restricted access to key nut-growing regions

Trade tariffs play a crucial role in market dynamics:

- 25% tariff on European nut butter products entering the U.S. market

- Reciprocal duties from EU countries affecting North American exports

- Brexit-related changes impacting U.K.’s trade relationships with EU suppliers

The Russia-Ukraine conflict has created additional pressure points:

- Disrupted Black Sea shipping routes

- Increased energy costs affecting production

- Supply chain re-routing leading to longer delivery times

These geopolitical factors have prompted manufacturers to adopt strategic measures:

- Building larger inventory reserves

- Diversifying supplier networks

- Establishing local production facilities in key markets

- Implementing dynamic pricing models to manage cost fluctuations

Exploring Nut Butters Market Segmentation by Type

The nut butters market features distinct segments, each catering to specific consumer preferences and nutritional needs:

1. Peanut Butter

- Dominates the market with 80% share

- Highest protein content at 25g per 100g

- Most affordable option for consumers

- Available in smooth, chunky, and natural varieties

2. Almond Butter

- Second-largest market segment

- Rich in vitamin E and healthy fats

- Premium pricing reflects higher production costs

- Appeals to health-conscious consumers

3. Cashew Butter

- Growing niche market

- Creamy texture and mild flavor profile

- Lower protein content but high in heart-healthy fats

- Popular in specialty recipes and vegan alternatives

Consumer preferences drive market segmentation through:

1. Dietary Requirements

- Keto-friendly options

- Vegan certifications

- Low-sugar varieties

2. Price Sensitivity

- Premium vs. budget options

- Bulk purchasing behavior

- Private label alternatives

3. Usage Patterns

- Spread applications

- Cooking ingredients

- Protein supplements

The market continues to expand with innovative blends combining multiple nut varieties and unique flavors to meet evolving consumer demands. Manufacturers respond to these preferences by developing specialized products targeting specific dietary needs and taste preferences.

Applications Driving the Demand for Nut Butters

The versatility of nut butters has led to their use in various culinary and nutritional applications, going beyond just being a spread for sandwiches.

Culinary Applications

Nut butters are used in many ways in cooking and baking, such as:

- Being an ingredient in baked goods like cookies, brownies, and muffins

- Serving as a base for savory sauces and dressings

- Topping smoothie bowls or being mixed into them

- Providing protein-rich filling for energy balls and homemade bars

Health and Fitness Uses

In the health and fitness world, nut butters have several uses:

- Giving an energy boost before workouts

- Supplying protein after exercise

- Acting as an ingredient in meal replacements

- Being a source of plant-based protein for vegetarian and vegan diets

Snacking Solutions

Nut butters also offer convenient snacking solutions:

- Acting as a dip for fresh fruits and vegetables

- Being spread on rice cakes and crackers

- Adding flavor and nutrition to overnight oats and breakfast bowls

- Providing a quick energy boost between meals

The food service industry has embraced nut butters as ingredients in signature dishes, with restaurants incorporating these versatile spreads into both sweet and savory menu items. Health-focused establishments feature nut butters in protein shakes, acai bowls, and specialized toast offerings.

Professional athletes and fitness enthusiasts rely on nut butters as natural energy sources, creating a strong presence in sports nutrition. The supplement industry has developed specialized nut butter formulations enhanced with additional proteins, vitamins, and functional ingredients to target specific dietary needs.

Recent innovations include single-serve packets for on-the-go consumption and specialized blends combining multiple nut varieties with superfoods like chia seeds, hemp hearts, and dried fruits.

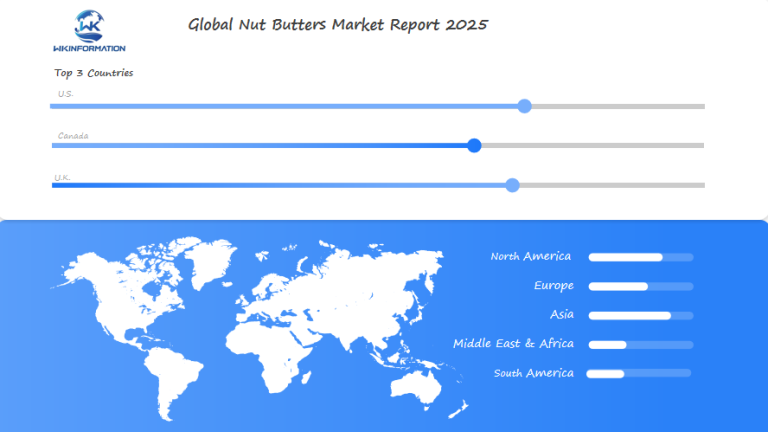

Regional Insights into the Global Nut Butters Market

The global nut butters market showcases distinct regional patterns and consumer preferences across key geographical areas:

North America

- U.S. and Canadian markets lead consumption with a 40% market share

- Strong preference for organic and natural varieties

- Rising demand for alternative nut butters beyond traditional peanut butter

- Local artisanal producers gaining market share through specialty offerings

European Market

- U.K. and Germany drive regional growth with health-conscious consumers

- Premium pricing strategies successful in Western European nations

- Private label brands hold significant market share

- Growing interest in sustainable and ethically sourced products

Asia-Pacific Growth

- Rapid market expansion in China and India

- 15% year-over-year growth in urban areas

- Rising disposable income fueling premium product adoption

- Local manufacturers adapting Western-style products for Asian tastes

The distribution landscape varies significantly across regions:

- North America: Dominated by supermarket chains

- Europe: Mix of specialty stores and mainstream retail

- Asia-Pacific: Growing e-commerce presence

Regional production capabilities also shape market dynamics:

- North America maintains robust domestic production

- European markets rely on both local and imported products

- Asia-Pacific region increasing local manufacturing capacity

U.S. Nut Butters Market: Key Drivers and Growth Opportunities

The U.S. nut butters market shows strong potential for growth, driven by changing consumer preferences and market innovations. More and more Americans are incorporating nut butters into their daily diets, pushing the market value to over $7.4 billion in 2021.

Key Growth Drivers:

- Rising adoption of ketogenic and paleo diets

- Growing demand for protein-rich, plant-based alternatives

- Increased focus on sustainable and environmentally conscious products

- Expansion of private label offerings in major retail chains

Significant Opportunities in the Market:

Product Innovation

- Unique flavor combinations

- Single-serve packaging options

- Sugar-free varieties

Distribution Channels

- Direct-to-consumer sales platforms

- Specialty health food stores

- E-commerce expansion

Market Segments Showing Promise:

- Premium Organic Options: Growing at 4.2% annually

- Specialty Blends: Incorporating superfoods and adaptogens

- Allergen-Free Alternatives: Targeting sensitive consumers

U.S. manufacturers are taking advantage of local sourcing initiatives by partnering with domestic nut producers. This ensures stability in the supply chain and meets consumer demands for transparency. The market is particularly strong in urban areas, where health-conscious millennials are driving purchasing patterns.

Canada's Nut Butters Industry and Export Trends

Canada’s nut butters industry has established itself as a significant player in the global market, with export values reaching CAD 98.7 million in 2022. The country’s strategic position in North America, combined with its robust food safety standards, has created favorable conditions for nut butter manufacturers.

Key Advantages for Canadian Producers

Canadian producers have capitalized on several key advantages:

- Advanced Processing Facilities: State-of-the-art manufacturing plants meeting international quality standards

- Strong Agricultural Partnerships: Direct relationships with nut suppliers ensuring consistent raw material quality

- Research & Development: Investment in product innovation and sustainable practices

Export Destinations for Canadian Nut Butters

Export destinations for Canadian nut butters include:

- United States (primary market)

- European Union

- Asia-Pacific countries

- Middle Eastern nations

Domestic Market Preferences

The domestic market shows distinct preferences, with organic and locally-produced nut butters gaining significant traction. Canadian consumers have demonstrated a willingness to pay premium prices for products featuring:

- Clean label ingredients

- Sustainable packaging

- Local sourcing

- Artisanal production methods

Impact of Trade Agreements

Trade agreements, particularly the CUSMA (Canada-United States-Mexico Agreement), have facilitated easier market access for Canadian nut butter manufacturers. The industry has seen a 15% year-over-year growth in export volume, with specialized products like maple-flavored nut butters creating unique market positioning for Canadian brands.

The U.K. Market for Nut Butters: Trends and Consumer Preferences

British consumers show distinct preferences in the nut butter market, with a strong inclination toward premium and artisanal products. The U.K. market has seen a 15% year-over-year growth in specialty nut butter sales, driven by health-conscious millennials and Gen Z consumers.

Key Market Characteristics

- Premium positioning: U.K. consumers prioritize high-quality, small-batch productions over mass-market alternatives

- Flavor experimentation: British brands introduce unique combinations like maple-pecan and chocolate-hazelnut spreads

- Sustainable packaging: Glass jars and recyclable materials resonate strongly with U.K. shoppers

Specific Consumer Preferences

Recent market research reveals specific consumer preferences:

- 68% of U.K. consumers read nutritional labels before purchasing

- 42% actively seek products with reduced sugar content

- 35% prefer organic certification

Strategies of Local British Brands

Local British brands have captured significant market share by focusing on:

- Transparent sourcing practices

- Limited ingredient lists

- Clear sustainability commitments

The rise of flexitarian diets in the U.K. has pushed nut butters into mainstream retail channels, with major supermarket chains expanding their shelf space for these products. Private label offerings from retailers like Tesco and Sainsbury’s now compete directly with established brands, offering premium nut butter alternatives at competitive price points.

Market Outlook and Future Prospects

The nut butters market is at an important stage, with expected growth to $3.86 billion by 2025 showing strong consumer demand and market development. Key indicators of growth suggest a positive outlook:

- Increasing health awareness drives consumers to prefer plant-based protein sources

- Innovative product formulations cater to various dietary needs

- Wider distribution channels make the market more accessible

- Environmentally friendly sourcing practices appeal to eco-conscious consumers

The market’s growth shows particular strength in:

Regional Growth Centers

- North America leads market expansion through established distribution networks

- U.K. market demonstrates robust growth in premium segment

- Asia-Pacific emerges as a high-potential growth region

Industry Development Areas

- Clean label products gain market share

- Organic certification becomes increasingly important

- Alternative nut varieties create market differentiation

- Digital marketing strategies boost brand awareness

The nut butters sector continues to adapt to changing consumer preferences, with manufacturers investing in product development and sustainable practices. Market success increasingly depends on addressing health concerns, maintaining price competitiveness, and ensuring consistent product quality. Companies that balance these factors while maintaining innovation in their product lines position themselves for sustained growth in this dynamic market environment.

Competitive Landscape: Leading Nut Butters Producers

The J.M. Smucker Company — Orrville, Ohio, USA

Hormel Foods Corporation (Justin’s LLC) — Austin, Minnesota, USA

Conagra Brands, Inc. (Peter Pan) — Chicago, Illinois, USA

Nestlé S.A. — Vevey, Switzerland

Once Again Nut Butter Collective, Inc. — Nunda, New York, USA

Justin’s — Boulder, Colorado, USA

Funky Nut Company — Liverpool, England, UK

Futters Nut Butters — Dover, Delaware, USA

Vermont Peanut Butter — Morrisville, Vermont, USA

Nuttzo — San Diego, California, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Nut Butters Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global nut butters market is constantly changing, with more and more people wanting healthy, plant-based choices. Consumers are moving towards natural and organic products, highlighting the importance of clean-label options. This preference not only affects what people buy but also pushes brands to adopt sustainable practices.

- E-commerce is changing the way products are sold, giving smaller brands a chance to compete with established industry giants. Online platforms make it easy for these brands to reach consumers quickly.

- Regional dynamics show that North America is currently in the lead, mainly due to its high consumption rates of peanut butter. On the other hand, the Asia-Pacific region has potential for significant growth as Western dietary influences enter local markets.

There are challenges like maintaining quality and strict food safety regulations, but these also create opportunities for innovation and improvement. The increasing demand for processed cashew products opens doors for diversification within the market. Furthermore, government initiatives supporting farmers have a positive impact on sustainable production.

Industry leaders such as The Hershey Company and Unilever plc are adapting through strategic innovation. Their focus on developing new products and forming partnerships demonstrates their commitment to meeting changing consumer preferences. As this market continues to evolve, it looks promising with health-conscious trends and innovative strategies driving its growth.

Global Nut Butters Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Nut Butters Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Nut ButtersMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Nut Butters players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Nut Butters Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Nut Butters Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Nut Butters Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofNut Butters Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the nut butters supply chain?

The nut butters supply chain includes several key components such as sourcing raw materials, processing, and distribution channels. Major players involved range from farmers who grow nuts to manufacturers who produce nut butters and retailers who sell them to consumers.

What trends are currently shaping the nut butters market?

Key trends in the nut butters market include increasing consumer demand for clean-label and organic products. Health-conscious consumers are driving these trends, leading to innovations in product offerings that cater to diverse preferences, including flavored and functional nut butters.

What challenges do nut butter manufacturers face?

Nut butter manufacturers encounter several challenges, including price volatility of raw materials, allergen concerns related to certain nut varieties, and production challenges. These factors can significantly impact profitability and consumer choices.

How do geopolitical factors influence the nut butter supply and trade?

Geopolitical factors such as trade policies, tariffs, and global supply chain disruptions can greatly affect the import and export dynamics of nut butters. Major markets like the U.S., Canada, and the U.K. are particularly influenced by these factors, impacting availability and pricing.

What types of nut butters are available in the market?

The nut butters market is segmented into various types including peanut butter, almond butter, and cashew butter. Consumer preferences play a significant role in determining which type of nut butter is favored at any given time.

What applications drive the demand for nut butters?

Nut butters are increasingly popular for various applications including culinary uses (such as spreads and cooking), health supplements due to their protein content, and as snack alternatives. This versatility contributes to their growing demand among consumers.