$2.15 Billion Soaring Demand for Outdoor Cooking Equipment in the U.S., Australia, and Germany by 2025

Comprehensive analysis of the outdoor cooking equipment market, exploring growth trends, technological innovations, and market dynamics across the U.S., Australia, and Germany. Detailed insights into market expansion, consumer preferences, and industry challenges, with a focus on sustainability and smart technology integration. Key highlights include market projections, supply chain analysis, and competitive landscape overview.

- Last Updated:

Outdoor Cooking Equipment Market Q1 and Q2 2025 Forecast

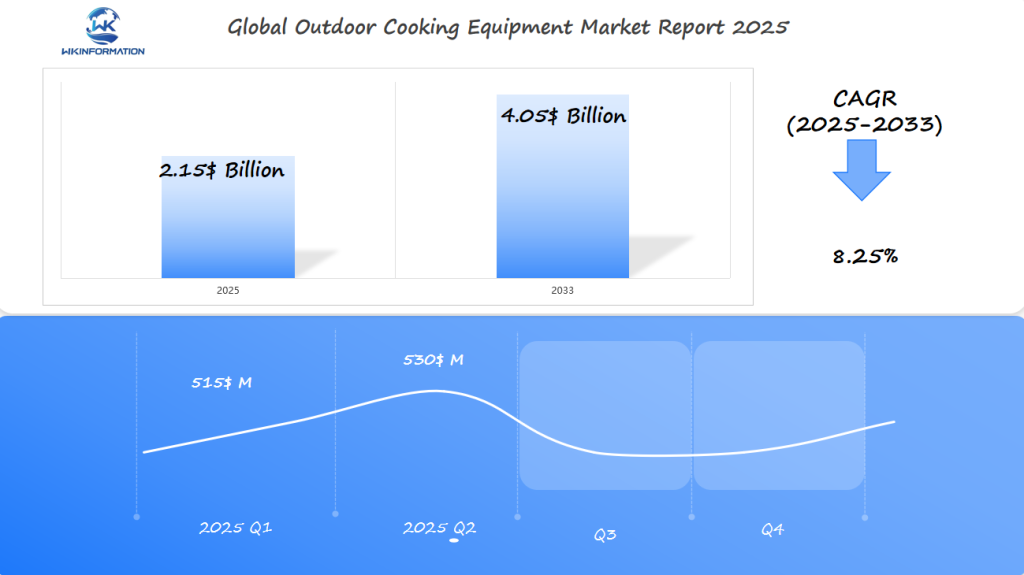

The Outdoor Cooking Equipment market is projected to reach $2.15 billion in 2025, with a CAGR of 8.25% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $515 million, driven by growing interest in outdoor activities, backyard cooking, and barbecue culture in the U.S., Australia, and Germany. The market benefits from increasing consumer interest in camping, tailgating, and outdoor grilling experiences.

By Q2 2025, the market is forecasted to reach $530 million, supported by the adoption of portable cooking appliances like grills, smokers, and pizza ovens, as well as the growing trend of sustainable and eco-friendly cooking solutions. The U.S. remains the largest market for grilling equipment, while Australia sees a rise in camping and outdoor cooking equipment, and Germany focuses on innovative, high-quality products.

Exploring the Outdoor Cooking Equipment Supply Chain

The outdoor cooking equipment supply chain operates through a complex network of manufacturers, suppliers, distributors, and retailers. Here’s a detailed breakdown of the key players and their roles:

1. Raw Material Suppliers

- Steel and aluminum providers for grill bodies and frames

- Heat-resistant materials for cooking surfaces

- Electronic components for temperature controls

- Specialized metals for burners and heating elements

2. Manufacturing Process

- Primary manufacturing facilities in Asia (China, Taiwan)

- Secondary production hubs in North America and Europe

- Quality control checkpoints at each production stage

- Assembly line optimization for seasonal demand spikes

3. Distribution Network

- Regional distribution centers in major markets

- Third-party logistics partners for international shipping

- Warehouse management systems for inventory tracking

- Just-in-time delivery systems for retailers

4. Retail Channels

- Big-box home improvement stores

- Specialty outdoor living retailers

- E-commerce platforms

- Direct-to-consumer sales

The logistics infrastructure plays a vital role in maintaining product availability. Modern tracking systems and inventory management software help predict demand patterns and prevent stockouts during peak seasons. Real-time data analytics enable supply chain managers to optimize shipping routes and reduce transportation costs.

Supply chain resilience has become increasingly important, with manufacturers implementing dual-sourcing strategies and maintaining buffer inventory levels. Local warehousing solutions near major markets help reduce delivery times and meet consumer expectations for rapid fulfillment.

Smart container tracking and blockchain technology are revolutionizing supply chain transparency, allowing manufacturers to monitor product movement from factory floor to retail shelf. These innovations help maintain product quality and ensure authentic products reach consumers.

Trends Shaping the Future of Outdoor Cooking Equipment

The COVID-19 pandemic has transformed outdoor spaces into essential living areas, creating a lasting impact on the outdoor cooking equipment market. Homeowners now view their backyards as extensions of their indoor kitchens, driving unprecedented demand for sophisticated outdoor cooking solutions.

Post-Pandemic Market Shifts:

- 67% increase in outdoor kitchen installations since 2020

- Rising demand for weather-resistant cooking equipment

- Surge in social media-driven outdoor cooking content

The market has responded with innovative multifunctional products designed for diverse cooking needs. Modern outdoor kitchen units now combine:

- Grilling stations with built-in smokers

- Pizza ovens that double as rotisserie stations

- Modular systems adaptable to limited spaces

- Smart technology integration for temperature control

- Storage solutions with weather protection

Consumer spending patterns reveal a strong willingness to invest in premium outdoor cooking setups. The average investment in outdoor kitchen equipment has increased from $2,000 to $5,000+ since 2021, with luxury installations reaching up to $30,000.

Popular Premium Features:

- Built-in refrigeration units

- Professional-grade cooking surfaces

- Smart device connectivity

- Custom lighting systems

- Weather-resistant materials

Space optimization remains a key consideration, particularly in urban areas. Manufacturers now offer compact yet versatile cooking stations that maximize functionality without compromising on cooking capabilities. These units often include:

- Fold-down prep stations

- Vertical storage solutions

- Convertible cooking surfaces

- Mobile components for flexible arrangements

The integration of smart technology has become a standard feature in premium outdoor cooking equipment, allowing users to monitor and control their cooking processes through smartphone apps.

Challenges in Outdoor Cooking Equipment Manufacturing

Manufacturing outdoor cooking equipment presents unique challenges that directly impact product quality, availability, and market prices. Manufacturers face significant hurdles in creating durable products that withstand diverse weather conditions.

Weather Resistance Requirements

- UV-resistant materials selection for prolonged sun exposure

- Rust-proof coating applications for high-moisture environments

- Temperature-resistant components for extreme weather variations

- Special protective finishes against salt air in coastal regions

Supply Chain Complexities

- Raw material shortages affecting stainless steel and aluminum supplies

- 30-40% increase in shipping container costs since 2021

- Extended lead times for critical components

- Limited availability of specialized parts and materials

The global supply chain disruptions have created a ripple effect across the outdoor cooking equipment industry. Manufacturers report production delays of 3-6 months, leading to increased prices and limited product availability. These delays particularly affect premium outdoor kitchen components, where specialized materials and precise specifications are essential.

Quality Control Challenges

- Implementing comprehensive testing protocols for weather resistance

- Maintaining consistent quality across global manufacturing facilities

- Meeting varied international safety standards and certifications

- Conducting rigorous durability testing under extreme conditions

Brand reputation hinges on product reliability in real-world conditions. Manufacturers must invest in advanced testing facilities and quality control processes. A single product failure can result in costly recalls and damaged brand perception, pushing companies to maintain strict quality standards despite production pressures.

Recent industry data shows that manufacturers who invest 15-20% of their budget in quality control measures experience 60% fewer product returns and maintain higher customer satisfaction rates. These investments become crucial as market competition intensifies and consumer expectations for product durability rise.

Geopolitical Factors Impacting Outdoor Cooking Equipment Demand

The outdoor cooking equipment market is significantly influenced by global political dynamics. Trade tensions between major manufacturing countries and consumer markets create ripple effects throughout the industry.

Trade Policy Impacts:

- Tariff changes on raw materials like steel and aluminum directly affect production costs

- Import restrictions influence product availability in key markets

- Shifting trade agreements reshape manufacturing location decisions

- Currency fluctuations impact pricing strategies across borders

Regional Political Stability Effects:

The varying levels of political stability across regions create distinct market patterns:

- Stable Regions: Consistent consumer spending on premium outdoor equipment, long-term investment in outdoor living spaces, reliable supply chain operations

- Volatile Regions: Fluctuating consumer confidence affects purchasing decisions, limited stock availability due to import/export restrictions, higher risk premiums on shipping and logistics

Recent trade disputes between China and Western nations have pushed manufacturers to diversify their production bases. Companies now establish manufacturing facilities in countries like Vietnam and Mexico to mitigate geopolitical risks.

Market Response Strategies:

- Development of localized production facilities

- Strategic stockpiling of essential components

- Implementation of flexible pricing models

- Creation of region-specific product lines

Political sanctions and diplomatic relationships between countries shape market access. For instance, restrictions on technology transfers can limit innovation in smart outdoor cooking equipment, while preferential trade agreements can open new market opportunities.

Types of Outdoor Cooking Equipment: Grills, Stoves, and More

The outdoor cooking equipment market offers diverse options to match every cooking style and preference. Here’s a comprehensive look at the main categories dominating the market:

1. Gas Grills

- High-end models with multiple burners and temperature zones

- Smart technology integration for remote monitoring

- Built-in rotisserie systems

- Side burners for additional cooking space

2. Pizza Ovens

- Wood-fired options reaching temperatures up to 900°F

- Portable gas-powered alternatives

- Hybrid models combining gas and wood fuel sources

- Quick heating capabilities (15-20 minutes)

3. Smokers

- Electric smokers with digital controls

- Pellet smokers for consistent temperature

- Offset smokers for traditional smoking

- Vertical water smokers for moisture retention

4. Specialty Equipment

- Kamado grills for versatile cooking methods

- Flat top griddles for breakfast and Asian cuisine

- Portable camp stoves for outdoor adventures

- Built-in outdoor kitchen systems

Wood-fired pizza ovens have seen a remarkable surge in popularity, with sales increasing 300% since 2020. These ovens attract home chefs seeking authentic Neapolitan-style pizzas with characteristic leopard-spotted crusts. The rapid cooking time – 90 seconds for a perfect pizza – adds to their appeal.

The market has responded to this demand with innovations in portability and fuel efficiency. Manufacturers now offer compact pizza ovens that maintain professional-grade performance while fitting into smaller outdoor spaces. These units often feature dual-fuel capabilities, allowing users to switch between wood and gas depending on their cooking preferences.

Applications of Outdoor Cooking Equipment in Leisure and Professional Use Cases

Outdoor cooking equipment is versatile and can be used for both recreational and commercial purposes. This creates separate market segments with their own specific needs and requirements.

Leisure Applications:

- Backyard Entertainment: Homeowners use premium grills and smokers for family gatherings, weekend barbecues, and holiday celebrations

- Camping and Outdoor Adventures: Portable stoves and compact grills enable wilderness cooking experiences

- Community Events: Neighborhood block parties and community festivals utilize large-scale grilling stations

Professional Use Cases:

- Food Trucks: Mobile vendors rely on commercial-grade griddles and specialized cooking equipment

- Restaurants: Open-air dining spaces feature built-in grills and pizza ovens

- Catering Services: Professional outdoor cooking setups for weddings, corporate events, and large gatherings

- Hotels and Resorts: Poolside grilling stations and beachfront cooking areas enhance guest experiences

The professional segment demands equipment with specific features:

- Higher durability standards

- Larger cooking capacities

- Enhanced safety features

- NSF certification for commercial use

- Extended warranty coverage

The leisure market prioritizes:

- User-friendly interfaces

- Aesthetic appeal

- Storage solutions

- Portability options

- Smart technology integration

These distinct applications drive manufacturers to develop specialized product lines that cater to each market segment’s unique requirements and preferences.

Global Insights into the Outdoor Cooking Equipment Market Beyond Key Regions

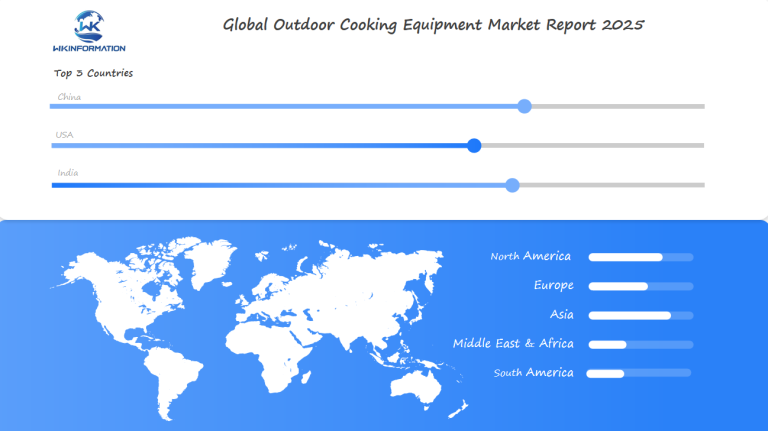

The outdoor cooking equipment market shows promising growth potential in emerging regions beyond the U.S., Australia, and Germany. The Asia Pacific region stands out with its rapid urbanization and changing lifestyle preferences.

Key Growth Markets:

- South Korea: High adoption rates of smart outdoor cooking equipment

- Japan: Strong demand for compact, space-efficient grilling solutions

- Singapore: Rising popularity of rooftop barbecue areas in residential complexes

- India: Growing middle-class population driving sales of portable cooking equipment

The Latin American market presents unique opportunities, with Brazil and Mexico leading regional growth through increased outdoor dining culture. Middle Eastern countries demonstrate strong demand for high-end outdoor kitchen setups, particularly in luxury residential developments.

Regional Market Characteristics:

- Compact design preferences in densely populated Asian cities

- Weather-resistant features for tropical climates

- Smart technology integration in developed Asian markets

- Price-sensitive solutions for emerging economies

The African market shows potential through rising urbanization rates and growing middle-class populations in countries like South Africa, Nigeria, and Kenya.

U.S. Outdoor Cooking Equipment Market: Trends and Consumer Preferences

The U.S. market is a leader in outdoor cooking equipment demand, with an 8% CAGR projected through 2030. American consumers have specific preferences influenced by lifestyle changes and evolving entertainment needs.

Key Market Drivers:

- Social media influence driving premium grill purchases

- Rising demand for smart, WiFi-enabled cooking equipment

- Integration of outdoor kitchens with home automation systems

Popular Equipment Categories:

- Gas grills (42% market share)

- Pellet smokers

- Built-in pizza ovens

- Modular outdoor kitchen systems

U.S. consumers spend an average of $5,000+ on outdoor cooking setups, with coastal regions showing higher investment rates. The market sees strong seasonal peaks during summer months, yet year-round cooking trends are emerging in southern states.

Regional Preferences:

- Northeast: Compact, multi-functional units

- Southeast: Large smokers and traditional BBQ equipment

- West Coast: High-end smart grills and sustainable options

- Midwest: All-weather durability features

Baby boomers lead premium equipment purchases, while millennials drive innovation in portable and space-efficient solutions. The market shows a clear shift toward customizable outdoor kitchen spaces that mirror indoor cooking capabilities, with 84% of sales occurring through specialized retail stores where personalized design services are available.

Australia's Growing Outdoor Cooking Equipment Market

Australia’s outdoor cooking culture has created a thriving market for specialized equipment, driven by the country’s year-round barbecue-friendly climate and outdoor lifestyle. The market shows distinctive characteristics unique to the Australian context:

Key Market Drivers

- Climate Advantage: Australia’s temperate weather enables outdoor cooking activities throughout the year

- Backyard Culture: 87% of Australian homes feature outdoor living spaces suitable for cooking equipment

- Social Traditions: Strong “barbie” culture influences purchasing decisions for high-end grills and smokers

Popular Equipment Categories

- Built-in BBQ systems

- Portable gas grills

- Wood-fired pizza ovens

- Kamado-style ceramic cookers

The Australian market demonstrates strong regional variations in equipment preferences. Coastal areas show higher demand for corrosion-resistant stainless steel products, while inland regions prefer traditional offset smokers and charcoal grills.

Market Growth Indicators

- 15% annual increase in premium outdoor kitchen installations

- $450 million spent on outdoor cooking equipment in 2023

- 35% rise in smart grill purchases featuring WiFi connectivity

Local retailers report significant growth in the mid to high-end segment, with consumers willing to invest $3,000-$7,000 in complete outdoor cooking setups. Australian manufacturers have responded by developing weather-resistant products specifically designed for the harsh local conditions.

Germany's Outdoor Cooking Equipment Market: Technology and Innovation

German engineering excellence drives the outdoor cooking equipment market with cutting-edge technological advancements. The market showcases a strong emphasis on precision-controlled grilling systems and smart connectivity features.

Key Technological Innovations:

- Smart temperature control systems with mobile app integration

- Energy-efficient heating elements using proprietary German technology

- Advanced materials research for better heat distribution

- IoT-enabled monitoring and automated cooking functions

German manufacturers prioritize sustainability alongside innovation, developing eco-friendly materials and energy-saving features. This commitment resonates with environmentally conscious German consumers who seek both performance and sustainability.

The market sees significant investment in research and development, particularly in:

- Smart Grilling Technology: WiFi-enabled controls and cooking assistance

- Material Innovation: Heat-resistant ceramics and specialized metals

- Energy Management: Optimized fuel consumption systems

- Safety Features: Advanced automatic shut-off mechanisms

Local brands like Miele and Gaggenau lead the premium segment with high-end outdoor cooking solutions. These manufacturers integrate home automation systems, allowing users to control their outdoor cooking equipment through smart home networks.

The German market’s focus on precision engineering and technological integration sets new standards for outdoor cooking equipment globally. This innovation-driven approach continues to attract investment and foster development of next-generation cooking solutions.

The Future of Outdoor Cooking Equipment: Eco-Friendly Solutions

Sustainable outdoor cooking equipment is becoming a game-changing trend in response to growing environmental awareness. Manufacturers are now prioritizing eco-friendly materials and energy-efficient designs to meet consumer demands for sustainable outdoor cooking solutions.

Key Eco-Friendly Innovations:

- Solar-Powered Grills: Advanced photovoltaic technology enables emission-free cooking while maintaining consistent temperatures

- Recycled Material Construction: Durable outdoor cooking equipment made from reclaimed metals and sustainable composites

- Bio-Based Fuel Options: New grills designed to work with renewable fuel sources like compressed wood pellets and biodiesel

Energy Efficiency Features:

- Heat retention technology reducing fuel consumption

- Smart temperature controls preventing energy waste

- Improved insulation materials minimizing heat loss

Manufacturers have introduced water-saving cleaning systems and biodegradable maintenance products to reduce the environmental impact of outdoor cooking equipment maintenance. These innovations align with consumer preferences for sustainable lifestyle choices without compromising cooking performance.

The integration of smart technology in eco-friendly outdoor cooking equipment allows users to monitor energy consumption and optimize resource usage through mobile apps. This data-driven approach helps users reduce their carbon footprint while maintaining precise cooking control.

Recent market research indicates consumers are willing to pay a premium for outdoor cooking equipment with proven environmental benefits, driving continued investment in sustainable manufacturing processes and materials.

Competitive Landscape: Key Players in the Outdoor Cooking Market

The outdoor cooking equipment market features several dominant manufacturers shaping industry standards and innovation. Weber-Stephen Products leads the pack with its extensive range of grills and accessories, commanding approximately 35% market share in North America.

-

AB Electrolux – Sweden

-

Summerset Grills – United States

-

Wolf Steel Ltd. (Napoleon) – Canada

-

DCS Appliances (a brand of Fisher & Paykel) – New Zealand

-

Danver Stainless Outdoor Kitchens – United States

-

Brown Jordan Outdoor Kitchens – United States

-

Kalamazoo Outdoor Gourmet LLC – United States

-

Bull Outdoor Products Inc. – United States

-

Alfresco Grills – United States

-

Coyote Outdoor Living Inc. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Outdoor Cooking Equipment Market Report |

| Base Year | 2024 |

| Segment by Type |

· Gas Grills · Pizza Ovens · Smokers · Specialty Equipment |

| Segment by Application |

· Leisure Applications · Community Events |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The outdoor cooking equipment market continues to evolve, driven by changing consumer preferences, technological innovations, and growing demand across both leisure and professional segments. As sustainability becomes increasingly important, manufacturers are adapting with eco-friendly solutions and energy-efficient designs. The market shows strong growth potential, particularly in key regions like the U.S., Australia, and Germany, where outdoor cooking culture remains deeply embedded in lifestyle choices.

The industry’s future appears promising, with continued innovation in smart technology integration, sustainable materials, and versatile cooking solutions. As consumers seek more sophisticated outdoor cooking experiences and professionals demand higher-performance equipment, the market is likely to see sustained growth and evolution. The successful balance of traditional cooking methods with modern technology and environmental consciousness will be crucial for manufacturers and retailers in meeting future market demands.

Global Outdoor Cooking Equipment Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Outdoor Cooking Equipment Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Outdoor Cooking Equipment Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Outdoor Cooking Equipmentplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Outdoor Cooking Equipment Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Outdoor Cooking Equipment Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Outdoor Cooking Equipment Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Outdoor Cooking Equipment Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the outdoor cooking equipment market by 2025?

The outdoor cooking equipment market is projected to reach $2.15 billion by 2025 in key regions such as the U.S., Australia, and Germany.

What consumer trends are influencing the outdoor cooking equipment market?

Consumer trends include a surge in interest for outdoor living spaces post-COVID-19, a preference for multifunctional products, and a willingness to invest in premium outdoor cooking setups for enhanced experiences.

What challenges do manufacturers face in producing outdoor cooking equipment?

Manufacturers encounter challenges such as ensuring product durability against harsh weather conditions, dealing with global supply chain disruptions, and maintaining stringent quality control measures to uphold brand reputation.

How do geopolitical factors impact the demand for outdoor cooking equipment?

Geopolitical tensions can influence trade policies which affect the outdoor cooking market. Additionally, varying levels of political stability across regions can impact consumer demand for outdoor cooking products.

What types of outdoor cooking equipment are popular among consumers?

Popular types of outdoor cooking equipment include gas grills, pizza ovens, smokers, and portable stoves, with wood-fired pizza ovens gaining popularity for those seeking authentic culinary experiences outdoors.

How does outdoor cooking equipment serve both leisure and commercial purposes?

Outdoor cooking equipment caters to personal enjoyment through backyard gatherings and also serves commercial purposes such as food trucks, highlighting its versatility in various settings.