Running Gear Market to Reach $12.9 Billion by 2025: Transformative Trends in the U.S., Japan, and Brazil

Discover comprehensive insights into the global running gear market’s evolution from 2025 to 2033. This analysis explores market trends, growth projections, key players, and emerging opportunities across regions. Learn about technological innovations, consumer preferences, and strategic developments shaping the future of running equipment and accessories. Essential reading for industry professionals, retailers, and fitness enthusiasts seeking to understand market dynamics and growth potential in the running gear sector.

- Last Updated:

Running Gear Market Q1 and Q2 2025 Forecast

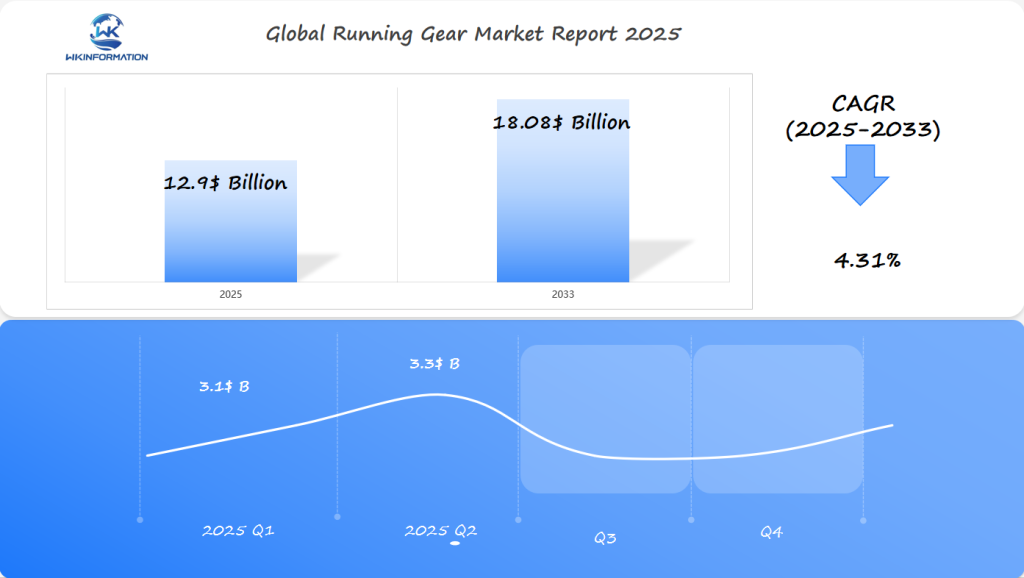

The Running Gear market is projected to reach $12.9 billion in 2025, with a CAGR of 4.31% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $3.1 billion, as the demand for performance-oriented and comfortable running gear remains steady. In the U.S., brands like Nike, Adidas, and Under Armour continue to innovate with smart shoes and wearable tech that tracks running performance.

By Q2 2025, the market is likely to grow to about $3.3 billion, driven by growing participation in running events and the rise of athleisure wear. Japan will lead in the adoption of high-tech running gear that incorporates advanced materials for lightweight comfort and injury prevention, while Brazil continues to show significant potential, especially with the increasing popularity of running as a sport in urban areas.

Upstream and Downstream Factors Driving the Running Gear Market

The growth of the running gear market is influenced by various factors that affect both the supply and demand sides of the industry.

Key Upstream Drivers

The following factors are driving the demand for running gear:

- Increasing awareness about health and fitness among millennials and Gen Z

- More people participating in organized running events

- Greater emphasis on preventive healthcare measures

- Rise in the number of running clubs and community activities

These trends have been further accelerated by the pandemic, which saw a 47% increase in running participation rates between 2019 and 2021. Medical professionals have also endorsed running as an affordable exercise option, adding to this momentum.

Downstream Market Effects

The following changes in consumer behavior are impacting the running gear market:

- Shift towards buying higher-end running gear

- Incorporation of athleisure elements in everyday clothing

- Preference for versatile running apparel that can be worn beyond workouts

- Increased demand for sustainable and eco-friendly products

The athleisure trend has significantly influenced purchasing decisions, with 68% of consumers now looking for running gear that can seamlessly transition from exercise to casual wear. In response, manufacturers are adapting their product lines to include versatile designs and innovative materials.

The impact of these factors can be seen in the widening range of products available in the market. Brands are now developing specialized gear tailored for specific running environments and intensity levels. Additionally, consumer spending patterns indicate a willingness to invest in high-quality running gear, particularly in urban areas where running has become an integral part of people’s lifestyles.

Trends Shaping the Future of Running Gear Industry

The athleisure trend has transformed running apparel sales, blending performance wear with casual clothing. Brands like Lululemon and Nike have embraced this change by designing versatile collections that effortlessly transition from running tracks to coffee shops. As a result, premium running apparel sales have surged by 47% since 2020.

Technological Innovations in Footwear

- Carbon fiber plates for enhanced energy return

- 3D-printed midsoles customized to individual foot shapes

- Smart sensors tracking running metrics and gait analysis

- Sustainable materials reducing environmental impact

Social media platforms have become powerful drivers of running gear trends. Instagram influencers and running communities influence buying decisions through genuine content and real-life testimonials. Brands use these platforms to highlight product features and engage specific consumer groups:

- Women aged 25-34 represent the highest engagement demographic

- User-generated content drives 5x higher conversion rates

- Virtual try-ons using AR technology increase purchase confidence

The integration of smart technology extends beyond footwear. Running apparel now includes:

- Moisture-wicking fabrics with temperature regulation

- Built-in UV protection

- Compression zones for muscle support

- Reflective elements for safety during night runs

These innovations reflect a growing demand for running gear that combines style, performance, and technological advancement in response to evolving consumer needs.

Barriers to Growth in the Running Gear Market

The running gear market faces significant challenges despite its projected growth to $12.9 billion by 2025. Economic downturns directly impact consumer spending patterns, particularly affecting discretionary purchases like premium running gear. During financial uncertainties, consumers often:

- Delay purchases of high-end running shoes

- Opt for lower-priced alternatives

- Extend the lifecycle of existing gear

- Choose multi-purpose athletic wear over specialized running equipment

Competitive Market Pressures

The market saturation creates intense competition from:

- Direct-to-consumer brands offering lower prices

- Private label products from retail chains

- Cross-training gear marketed as running alternatives

- Second-hand marketplaces for premium running gear

Rising manufacturing costs pose additional challenges for established brands, forcing them to:

- Increase retail prices

- Reduce profit margins

- Limit investment in research and development

- Scale back marketing initiatives

The entry of tech companies into the running gear space through smart wearables and connected devices creates additional competitive pressure. These new players often leverage existing customer bases and data analytics capabilities to capture market share from traditional running gear manufacturers.

Raw material shortages and supply chain disruptions present ongoing challenges for manufacturers, leading to production delays and increased operational costs that affect market growth potential.

Geopolitical Events and Their Impact on Running Gear Demand

Recent global events have significantly changed the running gear market. The COVID-19 pandemic caused major disruptions in manufacturing hubs across Asia, resulting in significant supply chain issues for major brands like Nike and Adidas.

Regional Impact Variations:

- North America experienced a 23% surge in running gear demand during lockdowns

- Asia Pacific saw initial decreases followed by rapid recovery

- European markets faced inventory shortages due to transportation delays

The Russia-Ukraine conflict has led to increased costs of raw materials, particularly synthetic fabrics used in performance wear. These price pressures have forced manufacturers to:

- Move production facilities

- Find alternative sources for materials

- Implement regional pricing strategies

Supply Chain Adaptations:

- Increased local manufacturing initiatives

- Development of backup supplier networks

- Investment in inventory management technology

Trade tensions between major economies have reshaped distribution networks, with companies adopting multi-regional manufacturing approaches. This strategy has helped brands maintain market presence despite geopolitical uncertainties.

The shift in consumer behavior varies significantly by region:

- U.S. markets show preference for premium gear despite economic pressures

- Asian markets demonstrate increased demand for mid-range products

- Emerging markets focus on value-oriented running gear

These geopolitical dynamics have pushed running gear manufacturers to develop more resilient supply chains and region-specific product strategies.

Exploring Running Gear Market Segmentation by Type

The running gear market divides into three distinct segments, each serving unique consumer needs:

1. Footwear

- Advanced cushioning systems using responsive foam technology

- Smart shoe designs incorporating GPS tracking

- Custom-fit options through 3D printing technology

- Carbon plate integration for enhanced speed performance

2. Apparel

- Women-specific designs dominate market growth

- Moisture-wicking fabrics with UV protection

- Compression wear for muscle support

- Sustainable materials meeting eco-conscious demands

3. Accessories

- Smart watches tracking performance metrics

- Hydration systems for long-distance running

- Anti-chafing products

- Specialized running socks with targeted cushioning

The footwear segment leads market share, driven by continuous technological advancements. Nike’s Vaporfly series exemplifies this innovation, featuring carbon-fiber plates that improve running efficiency by 4%.

Female consumers now account for 60% of running apparel purchases, pushing brands to expand their women’s collections. Lululemon’s running line demonstrates this shift, offering female-focused designs that blend performance with style.

The accessories market grows steadily, with smart technology integration playing a key role. Garmin’s running watches capture 30% of the fitness wearables market, showing strong consumer preference for data-driven training tools.

How Applications Are Shaping Running Gear Demand

The surge in organized running events has created distinct patterns in running gear consumption. Marathon participation rates have increased by 25% since 2020, driving demand for specialized equipment:

1. Event-Specific Gear

- Lightweight racing shoes for competitive events

- Moisture-wicking apparel for long-distance runs

- Performance tracking devices for race preparation

Running events influence purchase timing, with sales peaks occurring 8-12 weeks before major marathons. Data shows participants spend an average of $300 on new gear for significant races.

Lifestyle Integration The integration of running into daily routines shapes gear requirements:

- Urban commuter runners seek reflective clothing and compact gear storage

- Lunch-break runners demand quick-drying, office-appropriate attire

- Weekend warriors invest in durability-focused equipment

Social running groups have emerged as significant drivers of gear trends, with 65% of group runners reporting higher spending on specialized equipment compared to solo runners. These communities create micro-trends in gear preferences, influencing both casual and competitive runners’ purchasing decisions.

The rise of virtual races has sparked demand for smart running gear, with connected devices and performance-tracking accessories seeing a 40% growth in sales. This digital integration reflects the evolving nature of running activities and their impact on gear requirements.

A Global Look at the Running Gear Market and Its Evolution

The running gear market has undergone dramatic transformations since 2015. Sales data reveals a shift from basic athletic wear to specialized performance gear.

Key Market Evolution Indicators:

- Rise of technical fabrics replacing traditional cotton (2015-2017)

- Smart wearables integration into running apparel (2018-2020)

- Sustainable materials adoption (2020-present)

Consumer preferences have evolved significantly across different regions:

Asia Pacific

- Preference for lightweight, breathable materials

- Growing demand for locally-made products

- Strong focus on price-performance ratio

Europe

- High adoption of eco-friendly materials

- Premium pricing acceptance for innovative features

- Emphasis on minimalist design aesthetics

North America

- Early adoption of smart technology integration

- Brand loyalty driven by performance features

- Customization options gaining popularity

The market has seen a notable shift in distribution channels. Direct-to-consumer brands have captured significant market share, challenging traditional retail models and forcing established brands to adapt their strategies.

Price sensitivity varies by region, with emerging markets showing strong demand for mid-range products while developed markets trend toward premium segments. This regional variation has led to market-specific product development and pricing strategies by major manufacturers.

The U.S. Running Gear Market: Insights and Opportunities

The U.S. is the leader in the North American running gear market, holding a significant 65% share. This market dominance is due to a strong fitness culture and high disposable income levels among American consumers.

Key Factors Shaping the U.S. Running Gear Market

1. Robust Event Participation

- 1.1 million marathon finishers annually

- 2,000+ organized running events per year

- Average participant spending: $200 per event

2. Regional Market Distribution

- Northeast: 35% market share

- West Coast: 28% market share

- Midwest: 22% market share

- South: 15% market share

Unique Opportunities for Brands in the U.S. Market

The U.S. market offers distinct opportunities for brands through specialized product lines. Running clubs and training programs create consistent demand for performance gear, while urban running communities drive sales of reflective and safety equipment.

Brand Strategies Targeting the U.S. Market

Brand strategies targeting the U.S. market focus on:

- Custom shoe fitting services in retail locations

- Limited edition releases for major marathons

- Partnerships with local running communities

- Integration of technology for performance tracking

Evolving Fitness Landscape and Its Impact on Running Gear

The U.S. fitness landscape continues evolving with hybrid workout trends, creating opportunities for versatile running gear that adapts to multiple exercise formats. Brands succeeding in this market emphasize durability, style, and performance-enhancing features in their product development.

Japan's Role in Running Gear Market Growth

Japan’s running gear market is a unique blend of traditional values and modern fitness culture. The country’s long-standing ekiden relay racing tradition influences consumer preferences, creating a demand for specialized running equipment designed for team-based endurance events.

Distinctive Evolution of Urban Running Culture in Japan

Urban running culture in Japan has evolved in its own way:

- Morning Running Groups: Corporate wellness programs encourage employee participation in pre-work running sessions

- Urban Running Paths: Extensive networks of well-maintained paths in cities like Tokyo and Osaka support the growing running community

- Technology Integration: Japanese consumers show strong preference for smart running gear with built-in performance tracking capabilities

Unique Characteristics of Japanese Consumer Behavior

The Japanese market exhibits specific traits in consumer behavior:

- High emphasis on product quality and durability

- Strong brand loyalty, especially to domestic manufacturers

- Premium pricing acceptance for innovative features

Local Brands Responding to Cultural Nuances

Local brands like ASICS have understood these cultural nuances and developed products that meet the specific needs of Japanese runners:

- Lightweight designs suitable for compact urban environments

- Weather-resistant materials adapted for Japan’s humid climate

- Size specifications tailored to Asian body types

Key Drivers of Market Growth in Urban Areas

Significant market growth is being driven by urban areas through:

- Retail Experience: Specialized running stores offering gait analysis

- Community Events: Local running clubs organizing regular training sessions

- Smart City Integration: Running routes integrated with urban planning initiatives

The combination of traditional values and modern fitness trends positions Japan as a key influencer in Asian running gear markets, setting benchmarks for product innovation and market development.

Brazil's Running Gear Market: Key Insights

Brazil’s running gear market has a lot of potential for growth, thanks to the increasing number of people who love running in big cities like São Paulo and Rio de Janeiro. The Brazilian market has its own unique features influenced by different social and economic factors:

Key Market Drivers

- More people in Brazil’s growing middle class are becoming health conscious

- Running clubs and community events are on the rise

- Local marathons and street races are seeing more participants

The way Brazilian consumers buy running gear shows specific patterns:

- They are sensitive to prices and want affordable but durable running equipment

- They tend to stick to well-known international brands but also support local manufacturers

- They have specific quality requirements for gear that suits Brazil’s tropical climate

Local retailers have changed their strategies to meet the demands of the market:

- They now offer payment installment options

- They have developed product lines specifically for Brazil

- They have integrated online and physical retail experiences

The market is particularly strong in:

- Entry-level running shoes priced between $50-100

- Moisture-wicking apparel suited to tropical conditions

- Accessories with local design elements

Brazilian consumers are showing more interest in specialized running gear, with a 15% year-over-year growth in running shoe sales. Local manufacturers are gaining market share by offering products tailored to Brazilian runners’ needs and purchasing power.

Looking Ahead: The Future of Running Gear

The world of running gear is set to undergo significant changes by 2025 and beyond. Here’s what we can expect:

1. Smart Fabrics and Personalized Training

Innovations such as smart fabrics with built-in biometric sensors will allow for real-time tracking of vital signs, form, and performance metrics. This technology will enable personalized training experiences by adapting to individual running patterns and physical conditions.

2. Sustainable Materials and Circular Design

The focus on sustainability will drive product development in the running gear industry. Brands are increasingly investing in recycled materials and circular design principles while still meeting high-performance standards. This shift reflects a growing awareness among consumers about environmental impact and a demand for responsible manufacturing practices.

3. Hybrid Running Experiences

Post-pandemic consumer behavior indicates a rise in demand for hybrid running experiences. Virtual racing platforms combined with physical gear will continue to gain popularity, leading to the development of connected equipment that enhances both in-person and digital running activities.

4. Integration of Emerging Technologies

Several emerging technologies are expected to be integrated into running gear:

- 3D-printed custom insoles based on foot scanning

- Energy-return technology that harnesses kinetic movement

- Anti-bacterial and virus-resistant fabric treatments

- GPS-enabled safety features in running accessories

- Voice-activated performance coaching systems

These advancements aim to improve comfort, safety, and performance for runners.

5. Key Innovation Areas

In addition to the above trends, here are some key areas where we can expect innovation:

- Self-adjusting cushioning systems that respond to changes in terrain

- Climate-control fabrics that automatically regulate temperature

- Biodegradable materials to reduce environmental impact

- AI-powered gait analysis integrated into footwear

- Augmented reality displays in running eyewear

These innovations have the potential to revolutionize the way we run and interact with our gear.

As we look ahead, it’s clear that the future of running gear will be shaped by these technological advancements, sustainability efforts, and evolving consumer preferences.

Competitive Forces in the Running Gear Market

The running gear market showcases intense competition among established brands and emerging players.

Major brands:

-

Nike – USA

-

Adidas – Germany

-

Under Armour – USA

-

ASICS – Japan

-

New Balance – USA

-

Skechers USA Inc. – USA

-

Columbia Sportswear Company – USA

-

Puma (Kering) – Germany

-

Garmin – USA

-

Amer Sports – Finland

Overall

| Report Metric | Details |

|---|---|

|

Report Name |

Global Running Gear Market Report |

|

Base Year |

2024 |

|

Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units |

USD million in value |

|

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The running gear market is expected to grow to $12.9 billion by 2025, indicating strong opportunities in various regions and product categories. This growth is driven by several factors:

- Increasing health awareness leading to higher consumer demand

- Technological advancements improving product performance

- More people participating in organized running events

- Growing popularity of athleisure wear

Regional Growth Trends

The market’s growth trajectory suggests significant changes in consumer behavior and industry dynamics:

- North America continues to lead the market due to its strong fitness culture

- Asia Pacific is emerging as a high-growth region

- Brazil and Japan have distinct market characteristics influenced by local preferences

Key Factors for Success

Several key factors will determine success in the running gear industry:

- Product innovation focusing on comfort and performance

- Strategic pricing strategies to appeal to different consumer segments

- Social media marketing efforts driving brand engagement

- Integration of e-commerce platforms for improved accessibility

The running gear industry is at a critical juncture where health awareness, technological progress, and shifting lifestyle preferences converge. Companies that adapt to these changing market dynamics while prioritizing innovation and understanding consumer needs will be best positioned to capture a larger share of this growing market.

Global Running Gear Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Running Gear Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Running GearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Running Gearplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Running Gear Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Running Gear Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Running Gear Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Running Gear Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key factors driving the running gear market?

The running gear market is primarily driven by increasing health awareness and participation in marathons, alongside consumer behavior influenced by athleisure trends.

How is the athleisure trend impacting the running gear industry?

The athleisure trend significantly boosts apparel sales, as consumers seek stylish yet functional clothing for both athletic and casual wear, leading to increased demand for running gear.

What barriers are currently affecting growth in the running gear market?

Key barriers include economic downturns that impact discretionary spending and competitive pressures from emerging brands and alternative fitness options.

How do geopolitical events influence running gear demand?

Geopolitical events, such as pandemics, can disrupt supply chains and alter consumer demand across different regions, with varying effects observed between markets like North America and Asia Pacific.

What are the primary segments of the running gear market?

The running gear market is segmented into footwear, apparel, and accessories, with innovations in footwear technology enhancing performance and a growing focus on female consumers in apparel.

What future trends are expected in the running gear market?

Future trends may include innovative advancements in running gear technology, evolving consumer behaviors post-pandemic, and a continued emphasis on lifestyle choices that promote fitness activities.