$3.26 Billion Exploding Demand in Automotive Thermostat Market in the U.S., China, and Japan by 2025

Explore the rapid growth of the automotive thermostat market across the U.S., China, and Japan, projected to reach $3.26 billion by 2025. Learn about key market drivers, technological innovations, and regional developments shaping this essential automotive component industry.

- Last Updated:

Automotive Thermostat Market Q1 and Q2 2025 Forecast

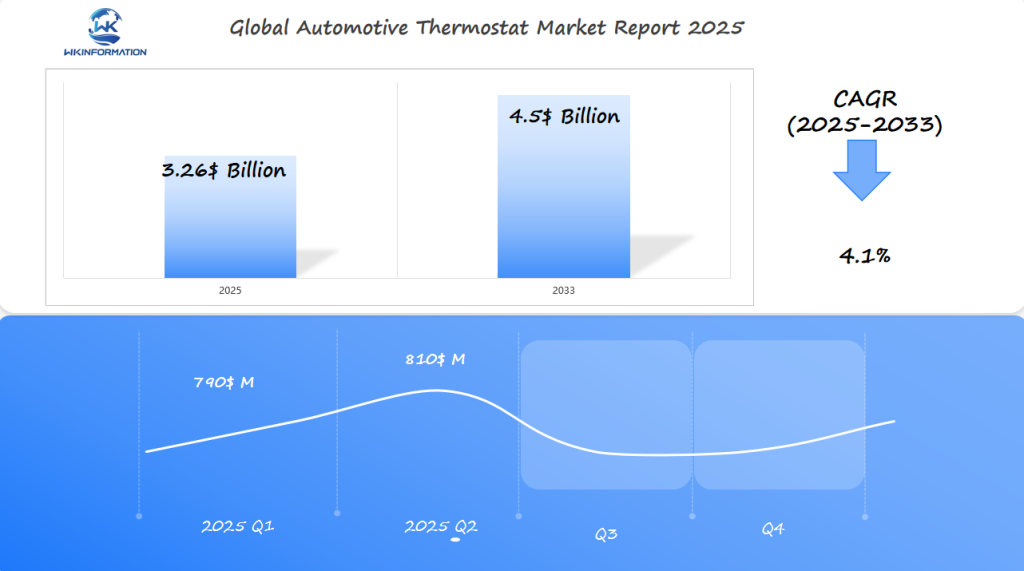

The Automotive Thermostat market is expected to reach $3.26 billion in 2025, with a CAGR of 4.1% from 2025 to 2033. In Q1 2025, the market is forecasted to generate approximately $790 million, driven by the increasing adoption of advanced thermal management systems in vehicles, particularly in the U.S., China, and Japan. The need for energy-efficient cooling solutions and emission reduction technologies in internal combustion engines (ICE) and electric vehicles (EVs) are key growth drivers.

By Q2 2025, the market is projected to reach $810 million, supported by the continued automotive industry expansion and the introduction of electric and hybrid vehicles that require efficient thermal regulation. The U.S. remains a leader in the market due to its robust automotive manufacturing sector, while China leads in EV adoption, and Japan remains a key player with its focus on innovative automotive technologies.

Understanding the Automotive Thermostat Supply Chain

The automotive thermostat supply chain involves various players working together to bring thermostats from production to end-users. Let’s break down the different stages of this supply chain.

1. Raw Materials Suppliers

Raw materials suppliers are responsible for providing the essential components needed to manufacture thermostats. These components include brass, steel, and specialized wax elements. Some of the key players in this stage are:

- Mahle GmbH

- BorgWarner Inc.

- Gates Corporation

- Vernet SAS

- Stant Corporation

2. Primary Manufacturers

Primary manufacturers are companies that take the raw materials supplied by the suppliers and transform them into finished thermostats. This process involves precision engineering techniques to ensure high-quality products. The primary manufacturers mentioned earlier, such as Mahle GmbH and BorgWarner Inc., play a crucial role in this stage.

3. Quality Control Testing

Before the finished thermostats are packaged and sent out for distribution, they undergo rigorous quality control testing. This testing is conducted to ensure that each unit meets strict performance standards set by the industry.

4. Distribution Phase

Once the thermostats have passed the quality control testing, they move on to the distribution phase. During this stage, there are several channels through which the products reach their final destination:

- Direct supply to automotive manufacturers (OEMs)

- Regional distributors for aftermarket sales

- Local auto parts retailers

- Online marketplaces

5. Supplier Segmentation

Within the supply chain, there is a segmentation of suppliers based on their roles:

- Tier-1 suppliers: These suppliers handle large-volume orders directly from vehicle manufacturers.

- Tier-2 suppliers: These suppliers focus on component assembly and provide parts to Tier-1 suppliers or directly to OEMs.

6. Aftermarket Segment

The aftermarket segment of the supply chain relies on wholesale distributors who maintain extensive warehousing networks. This allows them to ensure quick delivery of thermostats to repair shops and retail outlets.

7. End-Users

The final stage of the supply chain involves end-users who ultimately use the thermostats in vehicles or other applications. The end-users can be categorized as follows:

- Vehicle manufacturers: Companies that produce vehicles and require thermostats as part of their manufacturing process.

- Repair facilities: Workshops or garages that specialize in fixing vehicles and need thermostats for repairs.

- DIY consumers: Individuals who prefer to do their own vehicle maintenance or repairs and purchase thermostats directly.

8. Inventory Management

To efficiently manage inventory throughout the supply chain, just-in-time (JIT) inventory systems are implemented. JIT helps maintain optimal stock levels by ensuring that products arrive at each stage of the supply chain exactly when they are needed, thereby reducing storage costs across the distribution network.

By understanding these various stages and players involved in the automotive thermostat supply chain, we can gain insights into how these products make their way from production to end-use.

Key Trends Driving the Automotive Thermostat Market Forward

The automotive thermostat market is undergoing significant changes due to three main factors:

1. Enhanced Engine Performance

- Advanced thermal management systems boost engine efficiency by 15-20%

- Smart thermostats adapt to driving conditions in real-time

- Integration with engine control units optimizes fuel consumption

2. Regulatory Compliance

- Strict emission standards push manufacturers to develop precision-controlled thermostats

- Euro 7 regulations require enhanced temperature monitoring capabilities

- U.S. EPA guidelines mandate improved fuel efficiency through better thermal management

3. Environmental Innovation

- Electric vehicle thermal management systems demand specialized thermostat solutions

- Development of eco-friendly materials reduces environmental impact

- Smart cooling systems decrease carbon emissions by up to 5%

The market is witnessing a significant shift towards electronic thermostats equipped with IoT capabilities, allowing for predictive maintenance and remote diagnostics. Manufacturers are now prioritizing the development of lightweight components that enhance vehicle efficiency while adhering to durability standards. These advancements are in line with the automotive industry’s efforts towards sustainable transportation solutions and improved vehicle performance metrics.

Overcoming Production Challenges in Automotive Thermostats

Automotive thermostat manufacturers face significant production challenges in meeting market demands while maintaining quality standards. The complex nature of thermostat components requires precise manufacturing processes and specialized equipment.

Key Manufacturing Challenges:

- Material inconsistencies affecting component durability

- Complex assembly processes leading to production bottlenecks

- Temperature calibration variations between batches

- Supply chain disruptions impacting raw material availability

Manufacturers implement advanced automation systems and real-time monitoring tools to enhance production efficiency. These systems track component assembly, identify potential defects, and maintain consistent quality across production lines.

Quality Control Measures:

- Automated testing stations for temperature response verification

- X-ray inspection systems to detect internal structural defects

- Thermal imaging for performance validation

- Statistical process control to maintain manufacturing consistency

Leading manufacturers invest in predictive maintenance programs to minimize equipment downtime. This proactive approach includes regular calibration of assembly tools, systematic equipment upgrades, and comprehensive staff training programs to ensure optimal production output.

Geopolitical Influences on the Automotive Thermostat Industry

Global trade tensions are reshaping the automotive thermostat industry’s landscape. Recent tariffs between major economies directly impact manufacturing costs and supply chain efficiency. The U.S.-China trade relationship affects raw material pricing, with aluminum and steel costs fluctuating by 15-25% in 2023.

Regional Challenges in the Automotive Thermostat Industry

Different regions face unique challenges in the automotive thermostat industry:

North America

- USMCA regulations require 75% North American content

- Increased domestic production to reduce supply chain vulnerabilities

- Strengthened partnerships with Mexican manufacturing hubs

Asia-Pacific

- China’s Belt and Road Initiative expands distribution networks

- Japanese manufacturers prioritize regional supply chain integration

- Southeast Asian countries emerge as alternative production bases

Europe

- Brexit impacts UK-EU component movement

- Stricter environmental regulations drive production standards

- Eastern European countries attract manufacturing investment

Adapting to Geopolitical Risks

As manufacturers adapt to changing trade policies, supply chain diversification strategies are becoming more important. Companies are using dual-sourcing methods and setting up regional production facilities to reduce geopolitical risks. Local content requirements are pushing automotive thermostat producers to build regional manufacturing capabilities.

Exploring Different Types of Automotive Thermostats

The automotive thermostat market features three distinct categories, each serving specific needs in modern vehicles:

1. Electronic Thermostats

- Precise temperature control through digital sensors

- Integration with engine management systems

- Higher cost but superior efficiency

- Market share: 45% (2023)

- Expected growth rate: 5.2% annually

2. Mechanical Thermostats

- Simple wax-pellet operation

- Cost-effective and reliable

- Limited temperature adjustment range

- Market share: 40% (2023)

- Popular in older vehicle models

3. Programmable Thermostats

- Custom temperature settings

- Advanced diagnostic capabilities

- Remote monitoring features

- Market share: 15% (2023)

- Fastest-growing segment at 6.8% annually

The electronic thermostat segment dominates current market dynamics, driven by increasing demand for fuel-efficient vehicles and stricter emission standards. Mechanical thermostats maintain steady demand in replacement markets and budget-friendly vehicles. Programmable thermostats represent an emerging technology, gaining traction in premium vehicle segments where precise temperature control enhances engine performance and fuel efficiency.

Applications of Automotive Thermostats in Modern Vehicles

Modern vehicles use automotive thermostats in advanced ways that go beyond just controlling temperature. These applications serve multiple purposes in today’s complex engine systems:

1. Engine Protection Systems

- Prevents engine damage by maintaining optimal operating temperatures

- Triggers automatic engine shutdown in severe overheating scenarios

- Coordinates with oil temperature sensors for comprehensive protection

2. Performance Enhancement

- Enables dynamic temperature adjustment based on driving conditions

- Optimizes fuel consumption through precise thermal management

- Supports turbocharger systems with dedicated cooling circuits

3. Emission Control

- Maintains catalytic converter efficiency through temperature regulation

- Reduces cold-start emissions by accelerating engine warm-up

- Supports exhaust gas recirculation systems

4. Climate Control Integration

- Works with HVAC systems for cabin temperature management

- Controls engine temperature for efficient heater operation

- Balances cooling needs between engine and passenger comfort

5. Smart Vehicle Features

- Provides real-time temperature data to onboard diagnostics

- Enables predictive maintenance alerts

- Integrates with start-stop systems for improved efficiency

These applications show how automotive thermostats have evolved from basic mechanical devices to vital parts of modern vehicle technology. Their integration with different vehicle systems highlights their important role in today’s automotive engineering.

Global Growth in the Automotive Thermostat Market

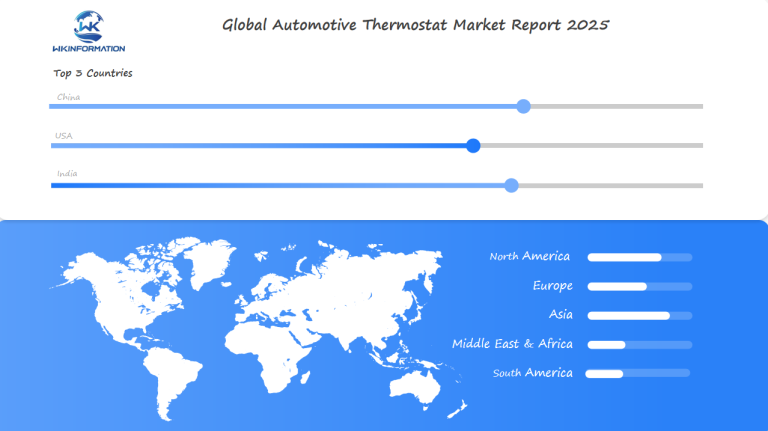

The automotive thermostat market is experiencing strong growth in major regions, with an expected value of $4.5 billion by 2033. This growth represents a steady CAGR of 4.1% from 2025 to 2033.

Key Growth Indicators

North American Market

- Strong automotive manufacturing base

- High adoption of advanced thermal management systems

- Strict emission regulations driving innovation

European Region

- Leading technological advancements

- Focus on electric vehicle integration

- Premium automotive segment growth

Asia-Pacific Growth

- Rapid industrialization

- Increasing vehicle production capacity

- Rising demand for passenger vehicles

The market expansion is directly linked to vehicle production rates and technological advancements in thermal management systems. Manufacturing hubs in emerging economies are showing faster growth rates, especially in countries like India, Thailand, and Indonesia.

Regional Market Preferences

The preferences in different regions are as follows:

- North America: High demand for electronic thermostats

- Europe: Focus on smart thermal management solutions

- Asia-Pacific: Mixed demand for both mechanical and electronic variants

These growth patterns indicate that the automotive industry is moving towards more advanced temperature control systems, with a specific focus on improving fuel efficiency and reducing emissions technologies.

U.S. Market Insights: Trends in Automotive Thermostat Demand

The U.S. automotive thermostat market is influenced by consumer preferences and industry developments. Recent data shows a 15% increase in demand for electronic thermostats compared to last year, especially in luxury and high-performance vehicles.

Key Factors Driving the U.S. Market

The following factors are driving the growth of the automotive thermostat market in the United States:

- Increasing use of smart engine management systems

- Strict EPA regulations on vehicle emissions

- Expanding aftermarket segment for replacement parts

- Greater emphasis on improving fuel efficiency

American Consumers’ Preference for OEM Thermostats

American consumers have a strong preference for OEM (Original Equipment Manufacturer) thermostats, with 73% opting for manufacturer-certified components instead of aftermarket options. This trend indicates a growing awareness among consumers about vehicle maintenance and optimizing performance.

Regional Variations in the U.S. Market

The U.S. automotive thermostat market exhibits regional differences:

- West Coast: Leading in the adoption of electronic thermostats

- Midwest: High demand for heavy-duty thermostats

- Northeast: Significant replacement rates due to extreme weather conditions

- Southeast: Expanding market for temperature-sensitive cooling systems

Contribution of Manufacturing Hubs to Domestic Production

Manufacturing hubs such as Detroit, Tennessee, and South Carolina play a crucial role in domestic thermostat production. Local manufacturers are investing in research and development (R&D) facilities, with $157 million allocated specifically for thermostat technology development in 2023.

Opportunities Arising from the Shift Toward Electric Vehicles

The transition towards electric vehicles presents new opportunities for specialized thermal management solutions. U.S. manufacturers are actively working on developing advanced cooling systems specifically designed for EV batteries and powertrains.

China's Growing Automotive Thermostat Market: Key Developments

China’s automotive thermostat market showcases remarkable growth potential, driven by the country’s expanding automotive manufacturing capabilities and domestic market demand. The sector has experienced a 15% year-over-year growth in 2023, marking significant developments in both production and technological innovation.

Strategic Partnerships and Investments

Chinese manufacturers have established strategic partnerships with global thermostat producers, enabling technology transfer and local production capabilities. Companies like Ningbo Xingchen Automotive and Zhejiang Youngman have invested heavily in R&D facilities dedicated to thermostat development.

Key Market Developments

Key market developments include:

- Introduction of smart manufacturing processes in thermostat production facilities

- Integration of IoT capabilities in newer thermostat models

- Development of cost-effective electronic thermostats for domestic vehicles

- Implementation of automated quality control systems

Rise of Electric Vehicles and Specialized Solutions

The rise of electric vehicles in China has sparked innovation in thermal management systems. Local manufacturers now produce specialized thermostats designed for EVs, capturing a growing market segment.

Production Hubs and Global Supply Chain Contribution

Chinese cities like Guangzhou and Shanghai have become major production hubs, hosting advanced manufacturing facilities equipped with state-of-the-art technology. These facilities supply both domestic automakers and international markets, contributing to China’s position as a significant player in the global automotive thermostat supply chain.

Government Support and Technological Advancement

The government’s support through initiatives like “Made in China 2025” has accelerated technological advancement in thermostat manufacturing, emphasizing quality improvement and innovation in the sector.

Japan's Technological Leadership in Automotive Thermostats

Japan’s automotive thermostat industry is leading the way in technological innovation, thanks to companies like Denso Corporation and TAMA Manufacturing. These manufacturers have been at the forefront of developing advanced electronic thermostat systems that offer precise temperature control.

Innovative Smart Thermostat Technologies

Japanese manufacturers have created smart thermostat technologies that work in conjunction with vehicle ECUs (Engine Control Units) to optimize various aspects of vehicle performance:

- Real-time temperature adjustments

- Fuel consumption reduction

- Engine performance enhancement

- Emissions control

Breakthrough Innovations from Japan

The country’s dedication to research and development has led to significant breakthroughs such as:

- Variable-temperature thermostats that adjust based on driving conditions

- Hybrid-specific thermal management systems for electric-combustion powertrains

- Smart sensors with predictive maintenance capabilities

Uncompromising Quality Standards

Japanese automotive thermostat manufacturers uphold rigorous quality control standards, achieving defect rates below 0.001%. This exceptional level of quality has made Japan a preferred supplier for premium automotive brands around the world.

Recent Advancements in Japanese Thermostat Technology

Recent developments in Japanese thermostat technology include the integration of AI-powered thermal management systems. These systems utilize machine learning algorithms to anticipate optimal operating temperatures based on driving patterns and environmental factors.

The Japanese market has also taken the lead in creating miniaturized thermostat designs, resulting in a reduction of component weight by up to 30% while still meeting performance requirements. This progress aligns with the global movement towards lighter, more fuel-efficient vehicles.

Looking Ahead: The Future of Automotive Thermostats

The automotive thermostat industry is set for major technological advancements by 2030. Smart thermostats with AI integration will allow for predictive temperature management, adjusting to driving conditions and weather patterns in real-time.

Key Innovations on the Horizon:

1. Internet of Things (IoT) Integration

- Remote temperature monitoring

- Smartphone-based engine management

- Predictive maintenance alerts

2. Advanced Materials Development

- Shape-memory alloys for enhanced response

- Nano-engineered components for durability

- Eco-friendly material alternatives

The rise of electric vehicles (EVs) is reshaping thermostat technology. Battery thermal management systems require sophisticated temperature control mechanisms, driving the development of specialized thermostat solutions for EV applications.

Market Evolution Drivers:

- Battery thermal management demands

- Autonomous vehicle requirements

- Stricter emission regulations

- Connected car ecosystems

Research indicates a shift toward modular thermostat designs that accommodate multiple vehicle platforms. This adaptability reduces manufacturing costs while maintaining performance standards across different vehicle types.

The integration of artificial intelligence will enable thermostats to learn from driving patterns and optimize temperature regulation. These smart systems will contribute to improved fuel efficiency and reduced emissions through precise thermal management.

Competitive Landscape in the Automotive Thermostat Market

The automotive thermostat market has several key players who are influencing the industry through innovation and strategic partnerships. Mahle GmbH is currently the leader with its advanced electronic thermostat systems, holding about 25% of the global market share. BorgWarner Inc. is another significant player known for its modular thermostat designs that can be customized for various vehicle platforms.

-

MAHLE GmbH – Germany

-

Stant Manufacturing Inc. – United States

-

BorgWarner Inc. – United States

-

Hella KGaA Hueck & Co. – Germany

-

Vernet Inc. – France

-

TAMA Enterprises Co. Ltd. – Japan

-

Nippon Thermostat Co. Ltd. – Japan

-

Gates Corporation – United States

-

BG Automotive – United Kingdom

-

MotoRad – Israel / United States (HQ in Israel, operations in U.S.)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Automotive Thermostat Market Report |

| Base Year | 2024 |

| Segment by Type |

· Electronic Thermostats · Mechanical Thermostats · Programmable Thermostats |

| Segment by Application |

· Engine Protection Systems · Performance Enhancement · Emission Control · Climate Control Integration · Smart Vehicle Features |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The automotive thermostat industry continues to evolve rapidly, driven by technological advancements and changing market demands. From basic temperature control to sophisticated smart systems, these devices play an increasingly critical role in modern vehicle performance, efficiency, and environmental compliance.

Key developments in engine protection, performance enhancement, emission control, and smart integration demonstrate the expanding capabilities of automotive thermostats. As vehicles become more complex and environmentally conscious, the importance of precise thermal management grows correspondingly.

The market shows strong growth potential across major regions, with electronic and programmable thermostats leading innovation. Manufacturers who can adapt to changing regulations, embrace new technologies, and maintain high quality standards will be well-positioned for future success.

Global Automotive Thermostat Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Automotive Thermostat Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Automotive ThermostatMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Automotive Thermostatplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Automotive Thermostat Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Automotive Thermostat Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Automotive Thermostat Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofAutomotive ThermostatMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market valuation of the automotive thermostat market by 2025?

The automotive thermostat market is projected to reach a valuation of $3.26 billion by 2025, driven by increasing demand in key regions such as the U.S., China, and Japan.

What are the key trends driving growth in the automotive thermostat market?

Key trends include a heightened focus on engine performance and longevity, compliance with regulatory standards, and environmental concerns that are fostering innovation in thermostat design.

What challenges do manufacturers face in the production of automotive thermostats?

Manufacturers encounter several production challenges including quality control issues, manufacturing hurdles, and the need for improved production efficiency and reliability.

How do geopolitical factors influence the automotive thermostat industry?

Geopolitical factors, such as global trade policies, significantly impact thermostat manufacturing and distribution, affecting supply chains across regions like North America, Asia-Pacific, and Europe.

What types of automotive thermostats are available in the market?

The automotive thermostat market features various types including electronic thermostats, mechanical thermostats, and programmable thermostats. Each type has its own advantages and disadvantages along with distinct market shares.

What applications do automotive thermostats have in modern vehicles?

Automotive thermostats play a crucial role in regulating engine temperature, enhancing fuel efficiency, and ensuring optimal vehicle performance across various modern vehicle applications.