Premium Cosmetics Market Growth: $194.2 Billion Global Surge by 2025 with Key Insights from the U.S., France, and Japan

Discover an in-depth analysis of the global premium cosmetics market, exploring market trends, growth projections, and industry dynamics from 2025 to 2033. This comprehensive report examines key factors driving market expansion, including rising disposable incomes, social media influence, and changing consumer preferences. Learn about regional market leadership, product segmentation across skincare, haircare, makeup, and fragrances, and understand the challenges facing industry players in this evolving sector. Perfect for industry professionals, investors, and anyone interested in the luxury beauty market’s future.

- Last Updated:

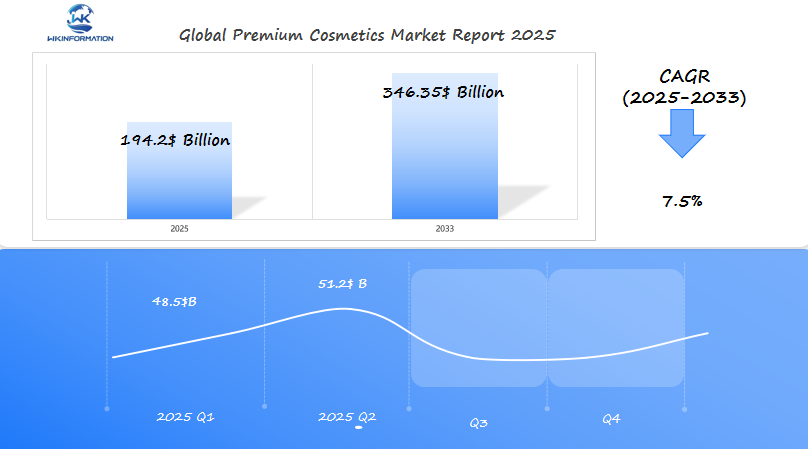

Premium Cosmetics Market Q1 and Q2 2025 Forecast

The Premium Cosmetics market is forecasted to reach $194.2 billion in 2025, with a steady CAGR of 7.5% from 2025 to 2033. In Q1 2025, the market will generate approximately $48.5 billion, driven by strong consumer demand for high-quality skincare, makeup, and fragrance products. The U.S., France, and Japan are expected to dominate the market, where established brands continue to innovate and promote premium beauty solutions.

By Q2 2025, the market is expected to grow to $51.2 billion, fueled by rising disposable incomes, growing self-care trends, and the increasing popularity of natural and organic cosmetics. The U.S. will lead in online retail sales for cosmetics, while France will maintain its reputation as a hub for luxury beauty brands. Japan will see continued growth due to its strong skincare culture and preference for high-tech beauty solutions.

The rising trend in personalized and sustainable cosmetics will further accelerate growth, as premium cosmetics brands focus on clean beauty, sustainable packaging, and customized skincare.

Understanding the Upstream and Downstream Processes in Premium Cosmetics Production

The supply chain of premium cosmetics involves a series of intricate steps, starting from sourcing raw materials to delivering products to consumers. Let’s break down the key components of both the upstream and downstream processes.

Upstream Production: Sourcing and Manufacturing

The upstream production phase is primarily concerned with acquiring high-quality ingredients and manufacturing the cosmetics. Here are the main activities involved:

- Ingredient Procurement: Manufacturers seek out specialized suppliers who can provide top-notch raw materials.

- Research and Development: Innovative formulations are created through extensive research and experimentation.

- Quality Testing: Rigorous testing is conducted to ensure that all ingredients meet regulatory standards and quality requirements.

- Raw Material Processing: Once sourced, the raw materials undergo processing and refinement to prepare them for production.

- Batch Production: The actual manufacturing takes place in batches, where specific quantities of products are produced at a time.

- Quality Control: Throughout the production process, quality control measures are implemented to maintain consistency and excellence.

Downstream Flow: Getting Products to Consumers

Once the cosmetics are manufactured, the focus shifts to delivering them to consumers. This involves various distribution channels through which products reach their final destination:

- Direct-to-Consumer (DTC): Brands sell their products directly to customers through their own websites or online platforms.

- High-End Department Stores: Premium cosmetics are often featured in upscale department stores, attracting affluent shoppers.

- Specialty Beauty Retailers: Stores that specialize in beauty products carry a wide range of premium cosmetics brands.

- Luxury Boutiques: Exclusive boutiques offer a curated selection of high-end beauty products.

- Professional Salons and Spas: Salons and spas that cater to luxury clientele stock premium cosmetics for use in their services or retail.

The Role of Technology in Enhancing Efficiency

Technology plays a vital role in optimizing both upstream and downstream processes within the premium cosmetics supply chain:

- Automated Manufacturing Systems: These systems ensure precise formulation consistency by automating various stages of production.

- AI-Powered Quality Control: Artificial intelligence is used to detect any defects or deviations from quality standards during manufacturing.

- Smart Inventory Management: Advanced inventory management systems track product movement across different locations and predict demand patterns.

By leveraging these technological advancements, manufacturers can achieve greater efficiency, reduce costs, and maintain the high standards expected in premium cosmetics.

Creating a Seamless Flow from Production to Delivery

The integration of various systems is key to creating a smooth transition between production and consumer delivery:

- Real-time production monitoring allows manufacturers to keep track of their output and make adjustments as needed.

- Automated packaging systems streamline the packing process, ensuring that products are securely packaged for transport.

- Digital supply chain tracking provides visibility into the movement of goods at every stage, from manufacturing to distribution.

- Predictive maintenance helps identify potential issues with equipment before they cause disruptions in production.

- Quality assurance automation reduces manual inspection efforts while maintaining consistent quality checks.

These interconnected processes not only enhance operational efficiency but also uphold the reputation associated with premium cosmetics brands.

Key Trends Reshaping the Premium Cosmetics Market

The premium cosmetics market has changed significantly due to changing consumer preferences and advancements in technology.

1. The Rise of Clean Beauty

Clean beauty has become a major trend, with consumers seeking products that are free from synthetic chemicals and artificial preservatives. Leading brands like La Mer and Tatcha have responded by introducing natural ingredient lines that feature botanical extracts, organic compounds, and sustainable formulations.

2. The Power of Personalization

Personalization has emerged as a key factor that sets premium brands apart from their competitors. These brands now offer a range of personalized options such as:

- Custom-blended foundations that perfectly match individual skin tones

- AI-powered skincare recommendations based on detailed skin analysis

- DNA-based product formulations specifically designed for each individual’s genetic profile

- Personalized packaging and monogramming services to add a unique touch

3. Digital Marketing Revolution

Digital marketing has completely transformed the way premium cosmetics brands interact with their customers. Social media platforms have become virtual beauty counters where brands can showcase their products and engage with consumers directly. Some notable strategies being employed include:

- Instagram’s augmented reality (AR) filters that allow users to virtually try on products before making a purchase

- TikTok’s beauty influencers who have the power to make products go viral through creative content creation

- Live streaming sessions featuring renowned makeup artists and skincare experts sharing tips and tricks

- Direct-to-consumer channels that provide personalized shopping experiences tailored to individual preferences

4. The Impact of Conscious Consumerism

The rise of conscious consumerism has prompted brands to adopt transparent practices in order to build trust with their customers. Premium cosmetics companies are now actively showcasing:

- Documentation on how ingredients are sourced to ensure ethical practices

- Reports on the environmental impact of their operations and products

- Certifications for ethical manufacturing processes that uphold fair labor practices

- Cruelty-free testing protocols that guarantee no animals were harmed in the development of their products

These changes reflect a larger shift in consumer values, where premium beauty is increasingly intertwined with personal wellness and environmental responsibility.

Challenges Facing the Premium Cosmetics Industry

The premium cosmetics industry faces significant hurdles in maintaining growth and market stability. Economic downturns directly impact consumer spending patterns, with luxury beauty products often experiencing reduced sales during financial uncertainties. The 2020 global crisis demonstrated this vulnerability, causing a 30% decline in premium cosmetics sales.

Sustainability and Ethical Sourcing

- Raw material traceability requirements

- Plastic packaging reduction mandates

- Fair trade compliance costs

- Carbon footprint reduction pressures

Market Competition Dynamics

- Direct-to-consumer brands disrupting traditional retail

- Social media-driven indie brands gaining market share

- Price competition from mid-range products

- Market saturation in key demographics

The rise of conscious consumerism creates additional pressure on established brands. Premium cosmetics companies must invest heavily in sustainable practices while maintaining luxury product quality. This dual requirement increases production costs and impacts profit margins.

Brand differentiation becomes increasingly challenging as the market sees new entrants weekly. Premium cosmetics manufacturers face pressure to innovate while maintaining their luxury positioning. The saturation of premium offerings leads to price sensitivity, even among luxury consumers, forcing brands to justify their premium pricing through enhanced value propositions.

The industry’s supply chain vulnerabilities have become apparent, with raw material shortages and transportation disruptions affecting production schedules. These challenges require significant investments in supply chain resilience and alternative sourcing strategies.

Geopolitical Influences on Premium Cosmetics Production and Trade

Trade agreements shape the global premium cosmetics landscape in significant ways. The EU-Japan Economic Partnership Agreement has eliminated tariffs on cosmetics exports, creating new opportunities for luxury brands in both markets. Similar agreements between South Korea and the U.S. have fostered increased trade flows in premium beauty products.

Political stability directly affects market confidence and investment decisions. Recent examples include:

- Supply Chain Disruptions: Brexit’s impact on UK-EU cosmetics trade

- Market Access Changes: China’s altered regulations for cross-border e-commerce

- Production Relocations: Shifts in manufacturing bases due to trade tensions

Tariffs significantly influence pricing strategies across international markets. Premium cosmetics companies adapt their approaches through:

- Local manufacturing facilities to bypass import duties

- Strategic pricing adjustments in different regions

- Partnership development with domestic distributors

Regional Market Dynamics

- North America: USMCA agreement facilitates smoother trade flows

- European Union: Harmonized regulations enhance internal market efficiency

- Asia-Pacific: RCEP agreement creates new opportunities for premium brands

The current geopolitical climate has prompted beauty conglomerates to diversify their production bases and distribution networks. Companies like LVMH and L’Oréal have established multiple manufacturing hubs across different continents to mitigate political risks and optimize market access.

Premium Cosmetics Market Segmentation: Types and Demand

The premium cosmetics market divides into distinct product categories, each serving specific consumer needs and preferences:

Skincare Segment

- Anti-aging treatments: 35% market share

- Facial serums and essences: 28% market share

- Premium moisturizers: 22% market share

- Specialized treatments: 15% market share

Makeup Segment

- Luxury foundations and bases: 30% market share

- Premium lip products: 25% market share

- High-end eye makeup: 23% market share

- Prestige cheek products: 22% market share

Consumer demand varies significantly across these segments, with skincare products experiencing rapid growth at 13.5% annually. The rise in skincare popularity stems from increased focus on skin health and preventative aging treatments.

Premium makeup products maintain steady demand, particularly in long-wearing formulations and multi-benefit products. Luxury foundations with skincare benefits see heightened interest, reflecting consumers’ desire for products that offer both immediate and long-term results.

The fastest-growing sub-segment includes specialized treatments targeting specific skin concerns, such as hyperpigmentation and environmental damage. This growth aligns with consumers’ increasing knowledge of skincare ingredients and their willingness to invest in targeted solutions.

Regional preferences shape product demand, with Asian markets showing strong interest in brightening treatments while Western markets prioritize anti-aging solutions. These distinct preferences drive product development and marketing strategies across different geographical locations.

Applications Driving Growth in the Premium Cosmetics Market

The skincare segment dominates premium cosmetics applications, with anti-aging products leading market growth. Advanced formulations targeting specific aging concerns have gained significant traction:

- Retinol-based treatments – Professional-grade products with concentrated active ingredients

- Peptide serums – Advanced solutions for collagen production

- DNA repair creams – Scientific innovations in cellular regeneration

Makeup applications have evolved beyond traditional cosmetic functions, incorporating skincare benefits and technological innovations:

- Smart foundations with UV protection, pollution shields, hydrating properties, and color-matching technology

Premium brands are revolutionizing application methods through:

- Digital shade matching systems

- Custom-blend foundations created in-store

- AI-powered skincare diagnostic tools

The rise of hybrid products has created new market opportunities:

- BB creams with anti-aging properties

- Lip products with collagen-boosting peptides

- Primers with environmental protection

These innovations reflect changing consumer preferences for multi-functional premium products that deliver both immediate results and long-term benefits. The market continues to expand through specialized treatments targeting specific skin concerns and advanced makeup formulations that combine beauty with skincare benefits.

Regional Insights into the Global Premium Cosmetics Market

The global premium cosmetics market displays distinct regional patterns shaped by cultural preferences, economic conditions, and consumer behaviors.

Asia-Pacific Region

- Leads market growth at 13.2% CAGR

- Strong demand for luxury skincare products

- Rising middle-class population driving sales

- Significant influence from K-beauty and J-beauty trends

North America

- Second-largest market share globally

- High demand for organic and natural premium products

- Strong presence of luxury retail chains

- Digital-first shopping preferences

European Market

- Traditional stronghold for premium beauty

- Dominated by heritage luxury brands

- Strict regulatory standards for ingredients

- Tourism-driven sales in major cities

Emerging Markets

- Latin America: Growing demand for premium makeup

- Middle East: Strong preference for luxury fragrances

- Africa: Expanding market for premium skincare

Sales Distribution Dynamics

- Department stores: 35% of global sales

- Specialty retailers: 28% market share

- Online channels: Fastest-growing segment at 18% yearly growth

- Travel retail: Significant contributor in tourist-heavy regions

Regional performance variations reflect local economic conditions, with developed markets showing stable growth patterns and emerging markets displaying rapid expansion rates. Digital adoption rates, local beauty standards, and regulatory frameworks create unique market characteristics across different geographical areas.

U.S. Premium Cosmetics Market: Trends and Growth Drivers

The U.S. premium cosmetics market is experiencing significant growth due to technological innovation and changing consumer preferences. AI-powered beauty solutions are transforming the shopping experience, with virtual try-on tools and personalized product recommendations boosting sales across online platforms.

Key Technological Advancements

Some of the key technological advancements driving this growth include:

- Smart mirrors that allow customers to test makeup virtually

- AI-powered skin analysis tools that provide tailored skincare recommendations

- Mobile applications that offer augmented reality experiences

- Digital shade-matching technology for accurate product selection

Influence of Younger Demographics

The younger demographic, particularly Gen Z and Millennials, is influencing the market through their demand for:

- Transparent ingredient sourcing

- Sustainable packaging solutions

- Cruelty-free certifications

- Social responsibility initiatives

These conscious consumers actively research product ingredients and manufacturing processes before making purchases. Brands responding to this trend implement:

- QR codes for ingredient traceability

- Blockchain technology for supply chain transparency

- Recycling programs

- Carbon footprint reduction initiatives

Growth in Clean Beauty Products

The U.S. market is witnessing significant growth in clean beauty products, with sales increasing 27% year-over-year. This surge reflects a broader shift toward health-conscious consumption patterns, pushing premium brands to reformulate products with natural, sustainable ingredients while maintaining luxury appeal.

France's Role in the Global Premium Cosmetics Industry

France is the undisputed center of the global luxury cosmetics industry, with a history that goes back to the courts of Versailles. The French cosmetics industry generates over €45 billion in revenue each year, making it a key player in the worldwide beauty market.

Historical Leadership

- The French perfume tradition dates back to the 17th century

- Paris became the beauty capital during the Belle Époque era

- French beauty standards influenced global cosmetic development

- Traditional artisanal methods combined with modern innovation

Key Market Shapers

French luxury brands are leaders in the premium cosmetics industry:

- L’Oréal Luxe: Leading the market with brands like Lancôme and YSL Beauty

- LVMH: Housing prestigious names including Dior and Guerlain

- Chanel: Setting beauty trends with iconic fragrances and skincare

The French premium cosmetics industry benefits from:

- Strong research and development infrastructure

- Established beauty education institutions

- Protected geographical indications for key ingredients

- Strategic partnerships with luxury fashion houses

Tourist spending plays a significant role in driving market growth, especially from Asian consumers who are looking for authentic French luxury experiences. The “Made in France” label carries a lot of significance in premium cosmetics, allowing for higher prices and building consumer trust worldwide.

French brands are known for consistently introducing new beauty technologies while still embracing their traditional craftsmanship. This combination of innovation and heritage appeals to luxury consumers around the globe.

Japan's Premium Cosmetics Landscape: Consumer Preferences

Japanese consumers have specific preferences when it comes to premium cosmetics. They prioritize skincare and look for high-quality formulations. The market shows distinct buying patterns:

Skincare Prioritization

- Multi-step routines with specialized products

- Prevention-focused treatments

- Advanced anti-aging solutions

Quality-Driven Purchases

- Premium packaging expectations

- Natural ingredient preferences

- Scientific formulation demand

The tax-free shopping trend has had a significant impact on Japan’s luxury beauty market. Recent data reveals a 15% increase in tax-free cosmetics purchases, driven by:

- Domestic shoppers seeking premium brands

- Tourist influx from neighboring Asian countries

- Strategic pricing advantages through duty-free channels

Japanese consumers’ sophisticated approach to beauty has created a highly competitive market space. Local preferences lean toward:

- Lightweight textures

- Innovative delivery systems

- Hybrid beauty solutions

The growth of the market is further boosted by Japan’s unique retail environment, where department stores and specialty beauty shops offer immersive shopping experiences. These venues have seen significant sales increases through tax-free programs, especially in major cities like Tokyo and Osaka.

Recent market analysis shows that Japanese consumers spend three times more on premium skincare compared to makeup products, reflecting their cultural beauty priorities and advanced consumer knowledge.

Future Outlook: Premium Cosmetics Innovations and Trends

The premium cosmetics industry is on the brink of significant changes, driven by technological advancements and evolving consumer demands. Here’s what we can expect in the future:

1. AI-Powered Personalization

- Custom-blended foundations matched to individual skin tones

- Smart skincare devices that analyze and adapt to daily skin conditions

- Personalized product recommendations based on genetic testing

2. Sustainable Innovation

- Waterless beauty products reducing environmental impact

- Biodegradable packaging solutions

- Zero-waste luxury formulations

3. Digital Shopping Experience

- Virtual try-on technology using advanced AR capabilities

- AI-powered skin analysis through smartphone cameras

- Digital beauty advisors providing real-time consultations

4. Next-Generation Ingredients

- Lab-grown collagen for anti-aging products

- Bioengineered alternatives to rare natural ingredients

- Microbiome-friendly formulations

The integration of biotechnology in premium cosmetics will create products with unprecedented efficacy. Brands are investing in:

- Stem cell technology for skin regeneration

- DNA-based skincare solutions

- Nano-encapsulation for enhanced ingredient delivery

These innovations will reshape how consumers interact with premium beauty products. The market will see a surge in hybrid products combining skincare benefits with color cosmetics, while virtual reality will transform the in-store shopping experience through interactive digital mirrors and smart beauty counters.

Competitive Landscape: Major Players in the Premium Cosmetics Market

- L’Oréal Group – Clichy, France

- Kao Corporation – Tokyo, Japan

- Shiseido Company Limited – Tokyo, Japan

- Estée Lauder Companies Inc. – New York City, USA

- LVMH SE (Christian Dior) – Paris, France

- Revlon Inc. – New York City, USA

- The Procter & Gamble Company – Cincinnati, USA

- Coty Inc. – New York City, USA

- Ralph Lauren Corporation – New York City, USA

- Chanel S.A. – London, United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Premium Cosmetics Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The premium cosmetics market is undergoing a significant transformation and is projected to reach $194.2 billion by 2025. This growth is driven by changes in consumer behavior and industry dynamics:

- Technology integration has transformed production processes and consumer experiences

- Clean beauty and sustainability have become essential market drivers

- The U.S., France, and Japan continue to influence global market dynamics

The market’s strong growth rate of 11.4% CAGR through 2033 indicates high consumer confidence and demand. To succeed, brands need to:

- Invest in research and development for innovative formulations

- Adopt sustainable practices and transparent supply chains

- Utilize digital platforms for personalized customer engagement

Despite economic challenges, the premium cosmetics industry has shown resilience by adapting to changing consumer preferences while retaining its luxury appeal. As the industry evolves, combining traditional luxury values with modern sustainability demands opens up new opportunities for growth and innovation. The future of premium cosmetics depends on finding a balance between heritage and innovation, exclusivity and accessibility, as well as luxury and responsibility.

Global Premium Cosmetics Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Premium Cosmetics Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Premium CosmeticsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Premium Cosmetics players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Premium Cosmetics Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Premium Cosmetics Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Premium Cosmetics Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPremium Cosmetics Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream production processes in premium cosmetics?

Upstream production processes in premium cosmetics involve sourcing high-quality raw materials, formulating products, and ensuring compliance with regulatory standards. This stage is crucial for maintaining the quality and efficacy of cosmetic products.

How do consumer trends influence the premium cosmetics market?

Consumer trends such as the rise of clean beauty and the demand for personalized beauty solutions significantly shape the premium cosmetics market. Brands are increasingly focusing on natural ingredients and tailored products to meet consumer preferences.

What challenges does the premium cosmetics industry currently face?

The premium cosmetics industry faces several challenges, including economic fluctuations affecting luxury spending, sustainability concerns regarding ethical sourcing, and intense competition from emerging brands leading to market saturation.

How do geopolitical factors affect premium cosmetics production and trade?

Geopolitical factors such as trade agreements, political stability, and tariffs play a vital role in shaping the production and trade of premium cosmetics. These elements can influence export/import dynamics and pricing strategies within international markets.

What are the key segments within the premium cosmetics market?

The premium cosmetics market can be segmented into various categories, primarily skincare products and makeup. Understanding consumer demand across these segments helps brands tailor their offerings to meet specific preferences.

What future trends are expected to shape the premium cosmetics industry?

Future trends in the premium cosmetics industry include innovations in product development, such as anti-aging solutions and augmented reality applications in beauty shopping. These trends aim to enhance consumer engagement and drive market growth.