Luxury Goods Market Outlook: $67.9 Billion Global Expansion by 2025 with Key Insights from the U.S., France, and China

Comprehensive analysis of the luxury goods market’s projected growth to $67.9 billion by 2025, exploring key luxury goods market dynamics, consumer trends, regional insights, and industry challenges across major markets including the U.S., France, and China.

- Last Updated:

Luxury Goods Market Q1 and Q2 2025 Forecast

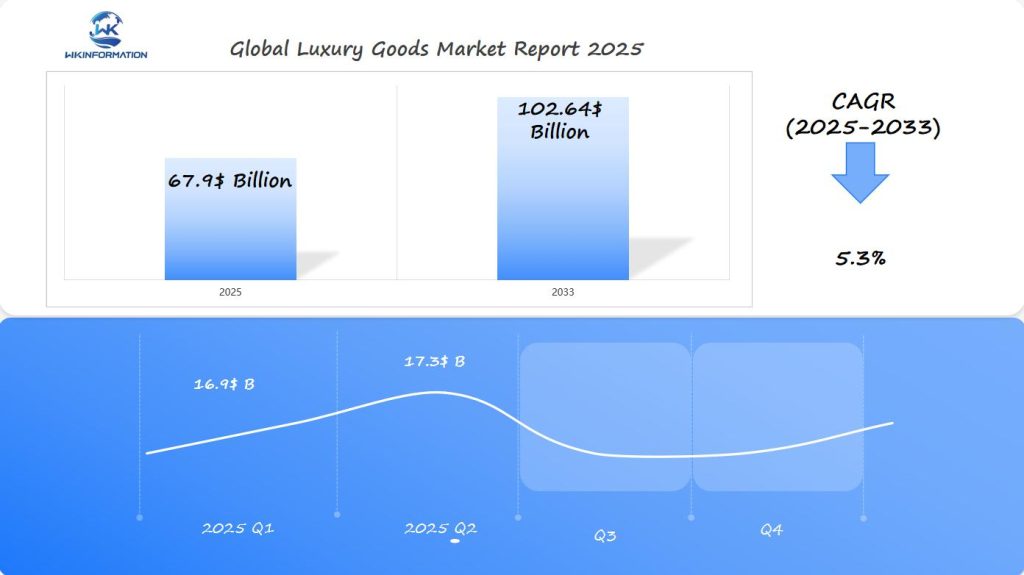

The Luxury Goods market is projected to reach $67.9 billion in 2025, growing at a steady CAGR of 5.3% from 2025 to 2033. In Q1 2025, the market will generate around $16.9 billion, with high-end fashion, jewelry, watches, and luxury vehicles driving sales. The U.S., France, and China are expected to lead the market, with significant contributions from both online retail and brick-and-mortar luxury outlets.

By Q2 2025, the market is expected to grow to $17.3 billion, driven by the resilience of the luxury sector post-pandemic and the increasing importance of sustainability and ethical consumption. China will remain a dominant market due to a growing affluent class and strong consumer interest in luxury goods, especially in fashion and fine wines. The U.S. and France will continue to show robust demand, with growth driven by tourism and premium goods.

Upstream and Downstream Dynamics of the Luxury Goods Market

The luxury goods supply chain operates on a delicate balance of exclusivity and accessibility. High-end brands maintain strict control over their production processes, often keeping manufacturing in-house or working with select artisanal workshops to preserve quality standards and brand heritage.

Supply Chain Excellence

- Carefully selected raw material suppliers

- Limited production facilities in strategic locations

- Rigorous quality control measures

- Specialized distribution networks

Consumer behavior in the luxury market has shifted dramatically, creating new demands on production and distribution systems. Digital-savvy customers now expect seamless omnichannel experiences, pushing brands to adapt their traditional supply chains.

Key Consumer Trends Affecting Production

- Demand for sustainable materials and transparent sourcing

- Preference for personalized products

- Interest in limited editions and exclusive releases

- Growing importance of digital authentication

Production dynamics directly influence market pricing and availability. Luxury brands deliberately control their output to maintain scarcity and exclusivity. This strategic limitation affects both pricing power and brand perception:

Production Impact on Market

- Controlled inventory levels to preserve brand value

- Strategic product launches to create demand

- Artisanal production methods affecting lead times

- Regional production hubs serving specific markets

The integration of technology in luxury supply chains has enabled better inventory management and production planning. Brands now use advanced analytics to predict demand patterns and optimize their manufacturing schedules while maintaining their commitment to craftsmanship and quality.

Key Trends Reshaping the Luxury Goods Industry

The luxury goods industry is witnessing a dramatic shift in consumer preferences, driven by three major trends that are redefining the market landscape.

1. Personalization Takes Center Stage

Luxury brands now offer bespoke services that allow customers to create unique products. Gucci’s DIY service lets clients personalize handbags with their initials, while Louis Vuitton provides custom painting on leather goods. This trend extends to digital platforms where AI-powered recommendations create personalized shopping experiences.

2. Sustainability Drives Purchase Decisions

Modern luxury consumers demand transparency in:

- Ethical sourcing of materials

- Fair labor practices

- Environmental impact reduction

- Circular economy initiatives

3. The Rise of Experiential Luxury

Traditional product-based luxury is evolving into experience-focused offerings:

- Private shopping appointments

- VIP fashion show access

- Limited-edition collection previews

- Exclusive brand events

Luxury hotels exemplify this trend, with properties like Aman Resorts creating unique cultural immersions and personalized adventures for their guests.

These emerging patterns signal a fundamental transformation in how luxury brands engage with their customers. Digital innovation enables deeper personalization, while sustainability concerns shape product development and manufacturing processes. The integration of memorable experiences with physical products creates a new definition of luxury that resonates with modern consumers.

Challenges and Restrictions Facing Luxury Goods Market Growth

The luxury goods market faces significant challenges due to global economic uncertainties. Economic volatility directly impacts consumer confidence, leading to cautious spending behaviors even among high-net-worth individuals. Market data shows a 15% decrease in discretionary spending during economic downturns, affecting luxury purchases across all segments.

Post-Pandemic Changes in Consumer Behavior

The post-pandemic world has brought about changes in how consumers prioritize their spending:

- Shift in spending patterns

- Reduced impulse purchases of luxury items

- Increased focus on value-driven investments

- Growing preference for digital shopping experiences

Increased Competition Among Luxury Brands

As luxury brands adjust to these changes, they are facing tougher competition:

- Heritage brands struggle to maintain exclusivity while expanding digital presence

- New luxury startups disrupt traditional market segments

- Price sensitivity affects brand loyalty, even in premium segments

Operational Challenges from the Pandemic

The lasting effects of the pandemic have created operational hurdles for the industry:

- Supply chain disruptions affecting product availability

- Rising production costs cutting into profit margins

- Labor shortages in specialized craftsmanship sectors

Shifts in Luxury Buyer Demographics

Recent market analysis reveals a 12% decline in first-time luxury buyers, while established customers show more selective purchasing behaviors. Luxury brands face pressure to maintain their premium positioning while adapting to new market realities, including reduced foot traffic in physical stores and changing demographics of luxury consumers.

The Impact of Digital Transformation on Competition

The ongoing digital transformation has added another layer of competitive pressure. Luxury brands are investing heavily in online platforms while trying to preserve their traditional exclusive appeal. This shift towards digital requires significant resources, making it challenging for smaller luxury houses to compete effectively.

Geopolitical Influences on Luxury Goods Production and Distribution

Global Trade Policies and Their Impact

Global trade policies create a complex web of challenges for luxury brands’ distribution networks. Trade tensions between major economies directly impact the movement of high-end goods across borders. The U.S.-China trade dispute has forced luxury brands to restructure their supply chains, with many companies relocating production facilities to Vietnam and other Southeast Asian countries.

Key Trade Policy Impacts:

- Import-export restrictions affecting raw material sourcing

- Changes in customs procedures causing delivery delays

- Intellectual property protection variations across regions

- Cross-border e-commerce regulations

Tariffs and Pricing Strategies

Tariffs play a crucial role in luxury brands’ pricing strategies. When faced with increased import duties, companies must decide whether to:

- Absorb the additional costs

- Pass the costs to consumers

- Adjust their product mix

- Relocate production facilities

Brexit Challenges for European Luxury Brands

The European luxury sector faces unique challenges with Brexit-related trade barriers. British luxury brands now navigate new customs requirements and VAT implications when selling to EU customers. Chinese luxury consumers encounter different pricing structures due to import duties, leading to price variations of up to 40% between mainland China and international markets.

Sanctions and Disruption in Distribution Channels

Recent sanctions on Russia have disrupted luxury goods distribution channels, prompting brands to develop alternative routes to serve specific markets. These geopolitical dynamics force luxury companies to maintain flexible distribution strategies and diverse manufacturing locations to mitigate risks.

Exploring Luxury Goods Market Segmentation by Type

The luxury goods market divides into distinct categories, each catering to specific consumer desires and lifestyle aspirations:

1. Personal Luxury Goods

- Fashion and leather goods

- Watches and jewelry

- Premium cosmetics and fragrances

- Designer accessories

2. High-End Automobiles

- Ultra-luxury vehicles

- Limited edition sports cars

- Custom-built automobiles

3. Exclusive Experiences

- Luxury hospitality

- Private jet services

- Yacht charters

- Fine dining

Personal luxury goods remain the market’s cornerstone, generating approximately 22% of total luxury sales. The segment’s success stems from its accessibility and frequent purchase cycles compared to other categories.

Luxury automobiles represent the fastest-growing segment, with a 23% year-over-year increase in sales. Brands like Rolls-Royce and Bentley report record deliveries, driven by wealthy consumers seeking unique mobility experiences.

The luxury experiences sector has emerged as a significant competitor to traditional goods. High-net-worth individuals now allocate 40% of their luxury spending to exclusive experiences, reflecting a shift in consumption patterns. This trend particularly resonates with younger generations who value memorable experiences over material possessions.

Each segment’s performance varies across regions:

- Personal luxury goods dominate Asian markets

- Automotive luxury leads European sales

- Experiential luxury shows strongest growth in North America

Applications Driving the Demand for Luxury Goods

The gifting culture plays a significant role in the luxury goods market, driving substantial sales worldwide. Occasions for giving gifts like weddings, anniversaries, and cultural celebrations create a steady demand for high-end products throughout the year.

Key Gifting Trends in Luxury Markets:

- Limited edition items spark heightened interest during festive seasons

- Personalized luxury gifts command premium prices

- Corporate gifting programs boost B2B luxury sales

- Cultural celebrations like Chinese New Year generate peak demand periods

The desire to showcase status remains deeply ingrained in luxury purchasing behaviors. Wealthy consumers actively seek out products that symbolize their social standing and personal accomplishments. This psychological motivation manifests in various ways:

Status-Driven Purchase Patterns:

- Investment in visible luxury items (watches, jewelry, designer bags)

- Preference for recognizable brand logos and signatures

- Acquisition of rare or limited-production items

- Selection of products endorsed by influential figures

The digital age has transformed how status symbols are perceived and displayed. Social media platforms create new opportunities for luxury brands to showcase their products, with influencers and celebrities amplifying their desirability. This digital visibility has intensified the role of luxury goods as markers of social status, particularly among younger affluent consumers.

Research indicates that 76% of luxury purchases are influenced by the item’s potential as a status symbol, while gifting accounts for approximately 40% of luxury sales during major holiday seasons.

Regional Insights into the Global Luxury Goods Market

The global luxury goods market has different characteristics in each region, with three main markets leading the way: the United States, France, and China. Each of these areas plays a unique role in driving the market’s growth and influencing global luxury trends.

Market Distribution by Region:

- North America: 35% market share

- Europe: 28% market share

- Asia-Pacific: 32% market share

- Rest of World: 5% market share

1. The United States: Resilience and Consumer Preferences

The U.S. market shows strong resilience during economic ups and downs, staying on top as the largest consumer of luxury goods. American buyers are particularly interested in premium automotive brands and high-end fashion accessories.

2. France: The Heart of Luxury Fashion

France is the center of luxury fashion and cosmetics, with Paris being the global capital for haute couture. The French market benefits from significant spending by tourists, especially in flagship stores along the Champs-Élysées and Avenue Montaigne.

3. China: Rapid Growth and Changing Preferences

China’s luxury market is experiencing rapid growth, fueled by a rising middle class and increasing disposable income. Chinese consumers have a strong preference for prestigious Western brands, with considerable purchasing power concentrated in major cities like Shanghai and Beijing.

Regional Consumer Preferences:

- U.S.: Designer handbags, luxury vehicles

- France: High fashion, premium wines

- China: Jewelry, watches, designer clothing

These regional differences create unique opportunities for luxury brands to customize their strategies based on local market demands and cultural preferences.

In-Depth Analysis of the U.S. Luxury Goods Market

The U.S. luxury goods market presents a complex landscape in 2023, marked by an 8% decline in sales compared to the previous year. Personal luxury goods sales have reached approximately €101 billion, maintaining the country’s position as the largest luxury market globally.

Key Market Indicators:

- Shifting consumer preferences toward digital-first shopping experiences

- Growing demand for sustainable and ethically produced luxury items

- Increased interest in resale and pre-owned luxury goods

Recovery Strategies by Major Brands:

- Implementation of AI-powered personalization

- Enhanced omnichannel presence

- Investment in sustainable production methods

- Development of exclusive product lines

The U.S. luxury market has witnessed significant changes in consumer behavior, with millennials and Gen Z driving new purchasing patterns. These demographics show strong preferences for brands that align with their values, particularly in sustainability and social responsibility.

Brand Adaptation Measures:

- Virtual try-ons and augmented reality experiences

- Subscription-based luxury services

- Limited-edition collaborations with artists and designers

- Enhanced digital storytelling and content creation

Despite recent sales challenges, luxury brands in the U.S. market are innovating through technology integration and experiential retail. Companies are investing in data analytics to understand consumer preferences better and create targeted marketing campaigns that resonate with specific customer segments.

France’s Role in Shaping Luxury Goods Demand and Trends

France is the center of the luxury market, with Paris as the leading city for luxury worldwide. The French luxury industry earns over €150 billion each year, which is a significant part of the country’s economy.

Key French Luxury Market Indicators:

- There are more than 130 luxury fashion brands in France.

- The luxury industry employs over 600,000 people in the country.

- France attracts 90 million international tourists every year.

The French luxury industry combines various elements to create a unique experience:

- Expertise in traditional craftsmanship

- Influence of fashion weeks

- High-end retail experiences

French luxury brands have become skilled at creating desire through limited editions and exclusive collections. This approach has been particularly successful with Asian consumers, who make up 35% of luxury purchases in France.

The growth of the market is also supported by France’s infrastructure for luxury tourism. The Avenue Montaigne and Rue du Faubourg Saint-Honoré in Paris are renowned global shopping destinations for luxury goods, where international visitors spend an average of €1,600 on each shopping trip.

Market Innovation Drivers:

- Digital transformation of heritage brands

- Sustainable initiatives in the luxury industry

- Integration of traditional craftsmanship with modern technology

France’s luxury sector continues to evolve while still appealing to its traditional roots. It sets global standards for quality and exclusivity in the market for luxury goods. By combining cultural heritage with innovation, French luxury brands position themselves as leaders in industry trends and consumer preferences.

China’s Impact on the Global Luxury Goods Market

China’s luxury market is showing impressive strength. The recovery from the pandemic has led to a significant increase in domestic spending, as Chinese consumers shift their international shopping habits towards local markets.

Key Factors Driving Growth:

- Rising middle-class population

- Digital-first shopping experiences

- Enhanced domestic retail infrastructure

- Growing preference for heritage luxury brands

The change in how Chinese consumers behave has forced luxury brands to change their plans. Big names like Louis Vuitton and Gucci have opened more stores in major cities and smaller cities while improving their online capabilities through collaborations with platforms such as WeChat and Tmall Luxury Pavilion.

Macroeconomic Influences:

- Youth unemployment rates affecting discretionary spending

- Real estate market fluctuations impacting wealth perception

- Currency exchange rate variations

- Government policies on luxury goods taxation

Chinese millennials and Gen-Z consumers now account for 40% of luxury purchases, showing strong preferences for:

- Limited edition collections

- Collaborations with local artists

- Sustainable luxury items

- Digital-first shopping experiences

The market has seen a significant rise in popularity of “accessible luxury” brands, especially among younger consumers who are looking for entry-level luxury products. This age group appreciates brand history but also expects innovative online experiences and personalized services.

Future Outlook: The Next Decade of Luxury Goods Trends

The luxury goods landscape of the 2030s will witness transformative technological innovations reshaping consumer experiences. Digital integration stands at the forefront of this evolution, with virtual try-ons powered by augmented reality becoming standard practice for luxury retailers.

Key technological developments expected by 2030:

- Blockchain Authentication: Digital passports for luxury items will track authenticity, ownership history, and sustainability credentials

- AI-Driven Personalization: Advanced algorithms will create ultra-personalized products based on individual customer data

- Metaverse Retail Spaces: Virtual showrooms will offer immersive shopping experiences with exclusive digital-only collections

- Smart Luxury Items: Integration of IoT technology in luxury products for enhanced functionality and user interaction

The rise of conscious luxury will drive innovation in sustainable materials and production methods. Luxury brands are investing in:

- Lab-grown diamonds and alternative leather materials

- Zero-waste manufacturing processes

- Carbon-neutral supply chains

- Biodegradable packaging solutions

The digital-physical hybrid model will dominate retail strategies, with luxury brands creating seamless experiences across both spaces. Physical stores will transform into experiential centers, while digital platforms will offer sophisticated virtual shopping environments.

These technological advancements will redefine luxury’s traditional boundaries, creating new categories and consumption patterns that blend digital innovation with artisanal craftsmanship.

Competitive Landscape: Major Luxury Goods Industry Players

The luxury goods market is dominated by several key players who consistently shape industry trends through innovative strategies and brand management:

-

Louis Vuitton – France

-

Chanel – France

-

Gucci – Italy

-

Dior – France

-

Hermès – France

-

Rolex – Switzerland

-

Cartier – France

-

Balenciaga – France

-

Prada – Italy

-

Versace – Italy

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Luxury Goods Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global luxury goods market is undergoing a profound transformation as it adapts to the evolving demands of modern consumers, advances in technology, and the complex interplay of global economic factors. This overview outlines the key dynamics, regional developments, and strategic trends shaping the future of the luxury industry.

Key Market Dynamics

The luxury goods sector continues to demonstrate resilience and adaptability, with several major trends driving its evolution:

-

Robust Growth Trajectory: The market is expected to reach $67.9 billion by 2025, propelled by a renewed appetite for high-end products and experiences.

-

Personalization and Customization: Consumers now seek products tailored to their identities, values, and lifestyles, prompting brands to invest in bespoke offerings.

-

Sustainability as a Core Value: Eco-conscious consumers are pushing luxury brands to adopt ethical sourcing, circular fashion models, and transparent production methods.

-

Experiential Luxury on the Rise: Consumers are shifting from ownership to experience, favoring immersive, service-based luxury such as bespoke travel, private events, and wellness retreats.

-

Digital Transformation: E-commerce, virtual storefronts, and augmented reality are redefining customer engagement and competitive advantage.

-

Post-Pandemic Recalibration: The pandemic has altered spending patterns, with greater focus on quality, values, and emotional connection to brands.

Regional Market Insights

Major Global Players

-

United States: The U.S. remains the largest luxury market, characterized by strong consumer spending, innovative retail models, and rapid digital adoption.

-

France: As a historic epicenter of luxury fashion and craftsmanship, France continues to lead in heritage branding and cutting-edge design.

-

China: China is the fastest-growing market, driven by a rising middle class, younger affluent consumers, and a strong preference for digital-first luxury experiences.

Market Segmentation

The luxury sector is diverse, encompassing several interconnected segments:

-

Personal Luxury Goods: Fashion, accessories, jewelry, and cosmetics remain the cornerstone of luxury consumption.

-

High-End Automobiles: Continued demand for premium vehicles reflects status, innovation, and performance.

-

Exclusive Experiences: Fine dining, private events, and curated travel are gaining prominence among luxury consumers.

-

Hospitality Services: Luxury hotels and resorts are emphasizing wellness, privacy, and personalized service to attract high-end clientele.

Industry Challenges

Despite promising growth, the industry faces several headwinds:

-

Supply Chain Vulnerabilities: Global disruptions have highlighted the need for greater agility and local sourcing.

-

Demographic Shifts: New generations—particularly Millennials and Gen Z—demand authenticity, digital fluency, and social responsibility.

-

Geopolitical Tensions: International conflicts, tariffs, and trade restrictions can affect consumer sentiment and cross-border sales.

-

Intensifying Competition: Emerging brands and direct-to-consumer models are challenging traditional players with innovation and agility.

Future Outlook

The luxury market is expected to evolve rapidly, with the following trends taking center stage:

-

Advanced Digital Integration: AI, AR, and blockchain are enabling hyper-personalized shopping, immersive product experiences, and enhanced brand transparency.

-

Sustainable Innovation: Circular fashion, upcycled materials, and carbon-neutral production are becoming key differentiators.

-

Heightened Personalization: Brands are investing in clienteling strategies, including one-on-one consultations and data-driven customization.

-

Experiential Expansion: More brands are blurring the lines between product and experience, offering VIP events, immersive brand spaces, and exclusive lifestyle services.

-

Emerging Market Influence: Markets in Southeast Asia, the Middle East, and Africa are gaining relevance, creating new opportunities for expansion and localization.

Global Luxury Goods Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Luxury Goods Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Luxury Goods Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalLuxury Goods Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Luxury Goods Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Luxury Goods Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Luxury Goods Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Luxury Goods Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the luxury goods market by 2025?

The luxury goods market is projected to grow to $67.9 billion by 2025, reflecting a robust expansion driven by various key segments within the industry.

How do consumer trends impact the demand for luxury products?

Consumer trends significantly influence the demand for luxury products, as shifts towards personalization, sustainability, and experiential luxury drive purchasing decisions among affluent consumers.

What challenges does the luxury goods market face post-pandemic?

Post-pandemic, the luxury goods market faces challenges such as economic fluctuations, changes in consumer spending behavior, and increased competition within the industry.

How do global trade policies affect luxury goods distribution?

Global trade policies can heavily impact the distribution channels utilized by luxury brands, while tariffs can play a crucial role in shaping pricing strategies for these companies.

What are the key segments within the luxury goods market?

Key segments within the luxury goods market include personal luxury items, high-end automobiles, hospitality experiences, and more, each with distinct performance metrics and consumer appeal.

What role does gifting culture play in driving sales for luxury brands?

Gifting culture serves as a significant driver for sales in the luxury goods sector, influencing purchase decisions as consumers often seek status symbols that reflect their affluence.