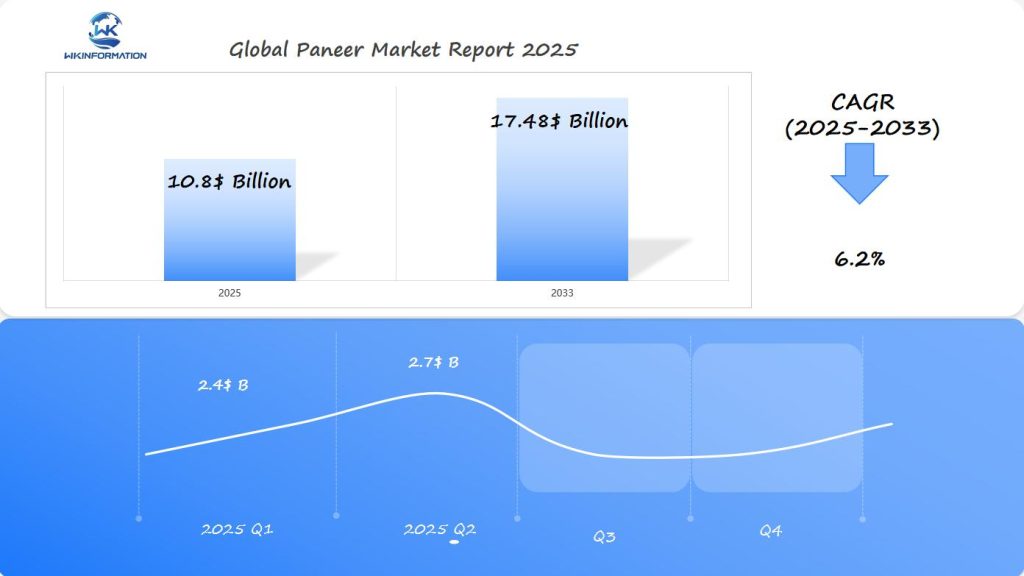

Paneer Market Set to Reach $10.8 Billion by 2025: Key Growth Drivers in the U.S., India, and Germany

Explore the dynamic paneer market forecast to reach $10.8B by 2025, analyzing key growth drivers, supply chain operations, and market trends across the U.S., India, and Germany. Discover how upstream and downstream forces shape this evolving dairy industry.

- Last Updated:

Paneer Market Forecast for Q1 and Q2 2025

The global paneer market is expected to reach $10.8 billion in 2025, with a CAGR of 6.2% projected through 2033. In the first half of 2025, the market is likely to experience steady growth, with Q1 estimated at $2.4 billion, followed by a slight increase to approximately $2.7 billion in Q2, driven by growing consumer demand for plant-based and ethnic foods.

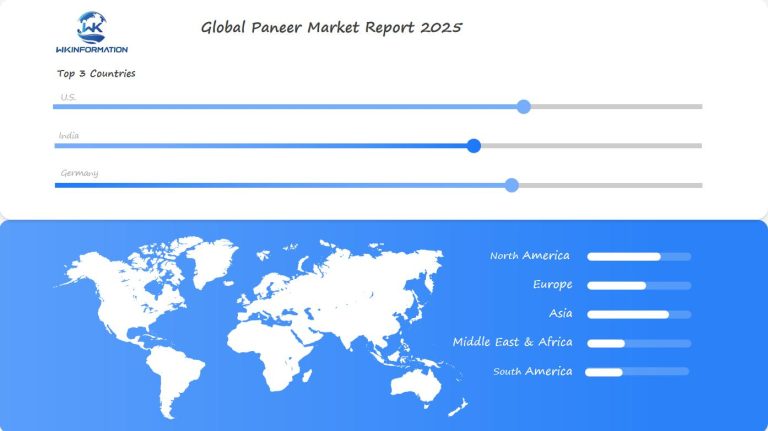

The U.S., India, and Germany are identified as key markets for paneer. India remains the largest producer and consumer, while the U.S. shows increasing demand due to the growing popularity of Indian cuisine, particularly in urban areas. Germany, with its expanding multicultural population, is expected to contribute to market growth, with paneer gaining traction in European households. These regions are essential for a deeper market analysis, reflecting both traditional and emerging consumption patterns.

Understanding the Upstream and Downstream Forces Shaping the Paneer Market

The paneer market’s success relies heavily on robust upstream and downstream supply chain operations. At the heart of upstream activities lies dairy farming – the foundation of quality paneer production.

Key Upstream Forces:

- Dairy farm management practices directly impact milk quality

- Implementation of modern milking technologies

- Storage and transportation of raw milk

- Quality control measures at collection centers

- Temperature-controlled environments for milk preservation

The quality of milk produced at dairy farms significantly influences the texture, taste, and nutritional value of paneer. Modern dairy farms now employ automated milking systems and strict hygiene protocols to ensure consistent milk quality.

Downstream Operations:

The distribution network plays a crucial role in making paneer accessible to consumers through various channels:

- Retail DistributionSupermarket chains

- Local grocery stores

- Specialty food markets

- Online retail platforms

- Food Service SectorRestaurants

- Hotels

- Catering services

- Cloud kitchens

Logistics and Supply Chain Management

The perishable nature of paneer demands sophisticated logistics solutions:

- Temperature-controlled vehicles for transportation

- Real-time tracking systems

- Cold storage facilities at distribution centers

- Last-mile delivery optimization

Advanced supply chain technologies help maintain product freshness and extend shelf life. GPS-enabled fleet management systems ensure timely deliveries while maintaining the cold chain integrity.

Quality Assurance Measures:

- Regular quality checks at production facilities

- Compliance with food safety regulations

- Implementation of HACCP principles

- Product traceability systems

The integration of these upstream and downstream elements creates a seamless supply chain network, essential for meeting the growing global demand for paneer products.

Key Trends That Are Driving the Paneer Industry Forward

Surge in Demand Due to Dietary Shifts

The rise of vegetarian and flexitarian diets has led to an unprecedented demand for paneer worldwide. Health-conscious consumers are actively looking for protein-rich alternatives to meat, making paneer an ideal choice with its impressive 18g of protein per 100g serving. This change in eating habits has resulted in a 15% year-over-year increase in paneer consumption among non-traditional consumers.

Integration of Indian Cuisine into Western Food Culture

Paneer’s popularity has extended beyond its traditional market due to the growing acceptance of Indian cuisine in Western countries. Restaurant chains in the U.S. and Germany now include paneer-based dishes on their regular menus, ranging from paneer tikka masala to innovative fusion creations like paneer tacos and paneer pizza.

Technological Advancements in Dairy Processing

Improvements in dairy processing technology have transformed the way paneer is produced and preserved. Modern manufacturing methods can now extend the shelf life of paneer from 2-3 days to over 90 days without compromising its nutritional value or taste. Key advancements such as ultra-filtration, modified atmosphere packaging, high-pressure processing, and temperature-controlled supply chains are driving this change.

Development of Specialty Variants

To cater to diverse consumer preferences, manufacturers are developing specialty variants of paneer. These include low-fat options, flavored varieties (with herbs and spices), organic and grass-fed alternatives, as well as ready-to-cook marinated paneer. Such innovations allow producers to meet the growing demand while maintaining product quality across different markets.

Implementation of Automated Production Lines

Leading facilities in the paneer industry are adopting automated production lines to increase their output capacity by 300%. This move not only helps manufacturers keep up with rising demand but also ensures consistency in product quality across international markets.

Exploring the Challenges and Barriers in the Paneer Market

The paneer market faces several critical challenges that impact its growth trajectory. Manufacturers grapple with maintaining consistent milk quality standards – a fundamental requirement for premium paneer production. Milk composition variations due to seasonal changes, feed quality, and animal health directly affect paneer texture, taste, and yield.

Quality Control Hurdles

- Inconsistent milk fat content affecting paneer texture

- Variable protein levels impacting curd formation

- Seasonal fluctuations in milk availability

- Storage temperature control issues during production

Regulatory compliance presents another significant challenge for paneer producers. Food safety standards vary across regions, creating complexity for international trade. Manufacturers must invest heavily in:

- HACCP certification requirements

- Quality testing infrastructure

- Documentation and traceability systems

- Regular staff training programs

Distribution Challenges

The perishable nature of paneer creates substantial logistical hurdles:

- Temperature-controlled transportation requirements

- Limited shelf life without preservatives

- Last-mile delivery complications

- Cold chain infrastructure gaps in rural areas

Supply chain disruptions pose additional challenges for paneer manufacturers. Raw material procurement becomes difficult during peak demand seasons, leading to price volatility. Small-scale producers struggle with:

- Limited cold storage facilities

- Inadequate preservation technology

- High transportation costs

- Market access barriers

The lack of standardization across production methods creates quality inconsistencies in the market. Different regional preferences and traditional manufacturing techniques result in varying product characteristics, making it difficult to establish uniform quality parameters.

Production Scale Limitations

- Artisanal production methods limiting output

- Equipment maintenance costs

- Labor-intensive manufacturing processes

- Energy consumption challenges

How Geopolitical Factors Are Influencing the Global Paneer Industry

Geopolitical factors play a significant role in shaping the global paneer industry. These factors include trade agreements, supply chain disruptions, cross-border quality requirements, regional trade blocs, and diplomatic relations between nations. Understanding how these elements impact the paneer market can help manufacturers navigate challenges and seize opportunities for growth.

Trade Agreements: Opportunities and Challenges

Trade agreements are crucial in determining the flow of goods between countries. They can create opportunities for paneer exporters by reducing tariffs and opening up new markets. However, they can also pose challenges if competing countries gain preferential access to certain markets.

The ongoing negotiations between India and the European Union regarding a Free Trade Agreement (FTA) have significant implications for the paneer industry. If successful, this agreement could lead to lower tariffs on Indian dairy products exported to Europe, making them more competitive against other suppliers.

Key Trade Agreement Impacts:

- India’s dairy sector benefits from preferential trade terms with ASEAN nations

- EU-India negotiations focus on dairy product standards harmonization

- US-India agricultural trade discussions include dairy product regulations

Supply Chain Disruptions: Rising Costs and Delays

Geopolitical tensions can disrupt established supply chains, leading to increased costs and delays in production and distribution. The ongoing conflict between Russia and Ukraine has had a ripple effect on global grain supplies, impacting cattle feed costs and subsequently milk prices.

Higher transportation costs due to fuel price volatility further exacerbate these challenges. Paneer manufacturers heavily rely on efficient logistics networks to transport their products across borders. Any disruptions in transportation routes or delays at customs can result in longer lead times and higher shipping expenses.

Supply Chain Disruptions:

- Transportation costs surge due to fuel price volatility

- Border restrictions impact delivery timelines

- Currency fluctuations affect import-export pricing

Cross-Border Quality Requirements: Meeting International Standards

When exporting paneer to foreign markets, manufacturers must comply with specific quality requirements set by importing countries. These requirements often involve obtaining certifications or documentation from relevant authorities.

For instance, German authorities require EU health and safety certifications for dairy imports, while U.S. Food and Drug Administration (FDA) regulations mandate rigorous testing protocols for paneer products. Failure to meet these standards can result in rejected shipments or fines imposed on exporters.

Cross-Border Quality Requirements:

- EU health and safety certifications

- USDA compliance documentation

- Indian FSSAI export standards

Regional Trade Blocs: Impact on Market Access

Regional trade blocs such as the European Union (EU) and North American Free Trade Agreement (NAFTA) successor USMCA have a significant influence on international trade dynamics.

The internal market regulations of the EU affect Germany’s ability to import paneer from non-EU countries. Similarly, USMCA impacts dairy trade flows within North America by establishing specific rules governing cross-border transactions.

Manufacturers looking to enter these markets must understand the intricacies of these trade agreements and ensure compliance with their provisions.

Diplomatic Relations: Navigating Trade Disputes

Diplomatic relations between nations directly affect market access for various products, including paneer. Trade disputes between major economies can lead to increased import duties or enhanced inspection requirements imposed on imported goods.

For example, tensions between India and the United States over agricultural issues have resulted in retaliatory tariffs being levied on certain Indian exports. Such measures can significantly impact the competitiveness of Indian paneer in the U.S. market.

It is crucial for manufacturers to stay informed about geopolitical developments that may affect their business operations and devise strategies accordingly.

These geopolitical factors create a complex web of challenges and opportunities for paneer manufacturers seeking to expand their international presence. Companies must navigate varying regulatory landscapes while adapting to rapidly changing political dynamics that influence market access and pricing strategies.

Breaking Down Paneer Market Segmentation: Types and Varieties

The paneer market offers a wide range of products designed to cater to specific consumer preferences and cooking needs. Here’s a detailed breakdown of the main categories of paneer available:

1. Fresh Paneer Varieties

- Traditional Fresh Paneer: Handcrafted using traditional methods, characterized by its soft texture and mild flavor

- Industrial Fresh Paneer: Manufactured using modern equipment, offering consistent quality and longer shelf life

- Low-fat Paneer: Contains reduced fat content, targeting health-conscious consumers

- Buffalo Milk Paneer: Known for its rich, creamy texture and higher protein content

2. Flavored Paneer Innovations

- Spiced Variants: Pre-seasoned with herbs and spices like black pepper, oregano, or mixed herbs

- Smoked Paneer: Infused with natural wood smoke for a distinctive flavor profile

- Marinated Paneer: Ready-to-cook varieties in popular marinades such as tikka or tandoori

3. Regional Consumption Patterns

North Indian Markets

- Prefer firm-textured paneer suitable for grilling and tandoor applications

- High demand for fresh, unseasoned varieties

- Strong preference for traditional preparation methods

South Indian Markets

- Growing acceptance of paneer in fusion dishes

- Rising popularity of ready-to-cook marinated variants

- Increasing demand for low-fat options

Western Markets

- Strong preference for organic and artisanal paneer

- High demand for flavored and pre-seasoned varieties

- Growing market for paneer-based convenience foods

4. Modern Applications

- Ready-to-eat paneer cubes for salads and snacks

- Crumbled paneer for spreads and dips

- Paneer-based meat alternatives

- Frozen paneer products for extended shelf life

The different types and varieties of paneer in the market reflect changing consumer preferences. Manufacturers are responding by creating innovative products to attract various market segments. Additionally, regional differences continue to shape product development strategies, resulting in a wide array of paneer options available in different markets.

What Applications Are Fueling Paneer Demand Across the Globe?

The versatility of paneer has sparked innovative applications across diverse culinary segments. This protein-rich dairy product serves as a cornerstone ingredient in both traditional recipes and modern fusion dishes.

Traditional Culinary Applications:

- Curry-based dishes: Classic preparations like Paneer Butter Masala and Palak Paneer

- Grilled specialties: Paneer Tikka and tandoori variations

- Street food: Paneer rolls, wraps, and stuffed bread varieties

Modern Food Industry Uses:

- Bakery products incorporating paneer as a protein-enriching ingredient

- Pizza toppings and sandwich fillings

- Salad mix-ins and protein bowl components

The ready-to-eat meals sector has embraced paneer as a key ingredient, responding to consumer demand for convenient yet nutritious options. Major food manufacturers now offer:

- Pre-marinated paneer cubes for quick cooking

- Frozen paneer-based meals

- Heat-and-eat curry portions

- Packaged paneer snacks and appetizers

Emerging Applications:

- Plant-based hybrid products combining paneer with vegetables

- High-protein fitness meals featuring paneer as the main protein source

- International fusion dishes incorporating paneer in non-traditional ways

- Gourmet restaurant applications in fine dining establishments

The food service industry has expanded its paneer offerings through:

- Quick-service restaurant chains featuring paneer-based menu items

- Food delivery platforms offering specialized paneer dishes

- Catering services including paneer options in vegetarian menus

- Cloud kitchen concepts focused on paneer-centric dishes

These diverse applications reflect paneer’s adaptability and its growing acceptance across different market segments. The food industry continues to develop new applications, driving innovation and market growth in the global paneer sector.

Regional Insights: Key Global Trends in the Paneer Market

The global paneer market showcases distinct regional patterns and consumption behaviors:

1. Asia-Pacific

- India leads regional consumption with traditional dietary preferences

- Rising urbanization drives demand for packaged paneer products

- Local manufacturers dominate market share through established distribution networks

- Growing middle-class population fuels premium paneer segment growth

2. North America

- Ethnic food stores serve as primary distribution channels

- Health-conscious consumers drive demand for organic paneer variants

- Restaurant chains incorporate paneer in fusion dishes

- Growing South Asian diaspora influences market expansion

3. Europe

- Germany and UK show strongest growth potential

- Plant-based alternatives compete with traditional paneer

- Artisanal paneer producers target specialty food markets

- Food service sector drives commercial paneer consumption

The remaining 5% market share spans regions including Latin America and Middle East, where paneer adoption continues to grow through cultural exchange and evolving dietary preferences.

Regional Growth Drivers

Asia-Pacific

- Cultural significance in daily diet

- Increasing disposable income

- Strong vegetarian population base

North America

- Rising interest in ethnic cuisines

- Growing vegetarian/flexitarian lifestyle

- Health and wellness trends

Europe

- Multicultural food preferences

- Demand for protein-rich alternatives

- Expanding South Asian restaurant chains

U.S. Paneer Market: Opportunities and Key Developments

The U.S. paneer market has great potential for growth, driven by changing consumer preferences and cultural diversity. American consumers are increasingly embracing ethnic cuisines, especially Indian dishes, which is creating a strong demand for authentic paneer products.

Key Market Drivers:

- Growing adoption of plant-based diets

- Rising popularity of Indian restaurants

- Increased awareness of protein-rich alternatives

- Expansion of specialty grocery stores

Health-conscious Americans are actively looking for protein-rich alternatives to traditional dairy products. Paneer’s versatility and nutritional profile – high protein content, low fat, and natural ingredients – perfectly match these preferences.

U.S. manufacturers are responding to this demand by developing innovative products:

- Pre-marinated paneer cubes

- Flavored paneer varieties

- Ready-to-cook paneer meals

- Organic and artisanal options

The retail landscape is also adapting to accommodate paneer products:

“Major supermarket chains now stock multiple paneer brands, reflecting the mainstream acceptance of this traditional Indian cheese” – U.S. Retail Market Analysis, 2023

Local artisanal producers are emerging in metropolitan areas, offering fresh, handcrafted paneer to meet the growing demand. These small-scale manufacturers are focusing on premium quality and authentic production methods to attract discerning consumers who are seeking genuine ethnic food experiences.

India’s Role in Accelerating the Paneer Market Growth

India is at the center of paneer production and consumption, with a rich cultural heritage that goes back thousands of years. Indian households have traditionally consumed paneer, making it a staple source of protein, especially in northern regions where dishes like palak paneer and shahi paneer are popular.

Factors Driving Domestic Demand for Paneer

The demand for paneer in India has seen significant growth due to several factors:

- Rising urban population – 34% of Indians now live in cities, creating a surge in demand for convenient, protein-rich foods

- Growing middle class – Increased disposable incomes enable consumers to purchase premium quality paneer products

- Health consciousness – Young professionals seeking high-protein vegetarian options

Response of Indian Manufacturers to Market Changes

Indian manufacturers have reacted to these changes in the market by:

- Introducing vacuum-packed paneer with extended shelf life

- Developing premium product lines with organic certification

- Launching flavored variants catering to regional taste preferences

Support from Dairy Infrastructure for Paneer Production

India’s strong dairy infrastructure supports large-scale production of paneer, with an estimated daily capacity of 200 metric tons. Local dairy cooperatives play a vital role in ensuring a steady supply of milk, which in turn guarantees consistent quality and availability of paneer.

Export Potential and Global Demand for Paneer

India’s potential for exporting paneer continues to grow as global demand increases, especially in areas with significant populations of Indian immigrants. Major cities like Mumbai, Delhi, and Bangalore are important distribution centers that facilitate efficient delivery of paneer both within India and to international markets.

Germany’s Influence on Paneer Demand and Market Dynamics

Germany’s dairy market has seen a significant change in what consumers prefer, with paneer becoming a promising segment. The way the German market is responding to paneer reflects broader European trends towards diverse protein sources and the integration of multicultural cuisine. This shift is part of a larger vegan revolution that is transforming dietary preferences across the continent.

Key Factors Driving the Market in Germany:

- The rising vegetarian population

- The growing interest in ethnic cuisines, particularly Indian restaurants

- Health-conscious consumers seeking high-protein alternatives

German consumers who are traditionally familiar with quark and cottage cheese have shown an increased acceptance of paneer, realizing its versatility in both traditional European and fusion dishes. Local supermarket chains now stock paneer alongside traditional cheese varieties, indicating mainstream market penetration.

Strategies for Adapting to the Market:

- Manufacturers are blending traditional German dairy expertise with Indian paneer-making techniques

- Product labeling emphasizes protein content and versatile cooking applications

- Paneer is being integrated into familiar German dishes to create cultural bridges

The German paneer market shows unique patterns of consumption, with consumers incorporating this Indian cheese into traditional dishes like spätzle and aufläufe. Local producers have responded by developing region-specific paneer variants, including herb-infused and smoked varieties that appeal to German tastes.

Recent market data reveals that German consumers place a high value on paneer’s firm texture and mild flavor profile, making it a versatile ingredient in both traditional and contemporary European cuisine. This adaptability has caught the attention of German food manufacturers, who are creating ready-to-eat meals featuring paneer as a primary source of protein. Additionally, there is a noticeable trend towards meatless options, which further supports the growing demand for high-protein alternatives like paneer.

What’s Next for the Paneer Market? Future Trends and Developments

The paneer market is about to undergo significant changes due to technological advancements and shifting consumer preferences. Smart manufacturing processes are expected to transform paneer production by incorporating AI-driven quality control systems and automated packaging solutions.

Key emerging trends include:

- Plant-Based Paneer Alternatives: Research and development in plant-based proteins mimicking paneer’s texture and nutritional profile

- Functional Paneer Products: Enhanced varieties fortified with vitamins, minerals, and probiotics

- Sustainable Packaging: Biodegradable materials and eco-friendly solutions gaining traction

- Direct-to-Consumer Models: Digital platforms enabling direct farm-to-table paneer delivery

The market anticipates a surge in premium paneer varieties catering to specific dietary requirements:

- Organic certified paneer

- Low-fat options

- Protein-enriched variants

- Specialty flavored selections

Technology integration in the supply chain will enable real-time tracking and temperature monitoring, ensuring product freshness and reducing waste. Blockchain implementation will enhance transparency in sourcing and production processes.

The rise of ghost kitchens and cloud-based food services presents new opportunities for paneer-based ready-to-eat meals. Manufacturers are investing in research to extend shelf life while maintaining traditional taste profiles through natural preservation methods.

Competitive Landscape: Key Players in the Paneer Market

The global paneer market features a mix of established dairy giants and specialized regional manufacturers. Key industry leaders include:

-

Amul – India

-

Mother Dairy – India

-

Britannia Industries – India

-

Nestlé S.A. – Switzerland

-

Hatsun Agro Product Ltd. – India

-

Parag Milk Foods Ltd. – India

-

Gujarat Cooperative Milk Marketing Federation (GCMMF) – India

-

Prabhat Dairy Ltd. – India

-

ID Fresh Food – India

-

Haldiram’s – India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Paneer Market Report |

| Base Year | 2024 |

| Segment by Type | · Fresh Paneer

· Processed Paneer · Specialty Paneers |

| Segment by Application | · Culinary Uses

· Industrial Applications |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The paneer market’s trajectory toward $10.8 billion by 2025 signals a transformative period in the global dairy industry. This growth stems from multiple factors:

- Rising health consciousness drives consumers toward protein-rich, vegetarian options

- Cultural fusion expands paneer’s reach beyond traditional markets

- Technological advancements enhance production efficiency and product quality

- E-commerce platforms improve accessibility and market penetration

The market’s evolution creates opportunities across regions:

Asia-Pacific

- Maintains market dominance with 70% share

- Traditional consumption patterns fuel steady growth

- Innovation in product varieties meets changing consumer preferences

Western Markets

- U.S. and Germany lead adoption through ethnic cuisine exploration

- Growing vegetarian and flexitarian populations expand consumer base

- Premium positioning attracts health-conscious demographics

The industry’s future hinges on:

- Sustainable production practices

- Supply chain optimization

- Product innovation

- Quality standardization

- Digital distribution channels

These market dynamics position paneer as a significant player in the global dairy industry, with potential for sustained growth through 2025 and beyond. The convergence of traditional appeal and modern market demands creates a robust foundation for continued expansion and innovation in the paneer sector.

Global Paneer Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Paneer Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Paneer Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalPaneer Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Paneer Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Paneer Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Paneer Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Paneer Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream forces affecting paneer production?

Upstream forces influencing paneer production include dairy farming practices, which significantly impact the quality and availability of milk used in making paneer. Sustainable farming methods and animal welfare standards can enhance production efficiency and product quality.

How do downstream forces shape the availability of paneer in the market?

Downstream forces consist of retail and food service distribution channels that affect how paneer is marketed and sold to consumers. The effectiveness of these channels directly influences paneer’s accessibility in supermarkets, restaurants, and online platforms.

What trends are driving the growth of the paneer industry?

Key trends driving the paneer industry include the rising consumer preference for vegetarian and flexitarian diets, increased interest in protein-rich foods, and the growing popularity of Indian cuisine in Western markets such as the U.S. and Germany.

What challenges do manufacturers face in the paneer market?

Manufacturers encounter several challenges including maintaining consistent quality standards for milk, ensuring compliance with food safety regulations, and overcoming logistical hurdles that impede efficient distribution across various regions.

How do geopolitical factors impact the global paneer industry?

Geopolitical factors affect the paneer industry through trade agreements that influence import/export dynamics, particularly among major players like India and Germany. Geopolitical tensions can disrupt supply chains, leading to price fluctuations in the global market.

What applications are increasing demand for paneer worldwide?

Paneer’s versatility as an ingredient fuels its demand across various culinary applications, from bakery products to savory snacks. Additionally, there is a growing trend towards convenient ready-to-eat meals that prominently feature paneer.