Avocado Market Set to Reach $21.32 Billion by 2025: Surging Demand in the U.S., Mexico, and Spain

Discover an in-depth analysis of the global avocado market from 2025 to 2033, exploring market trends, growth factors, and industry dynamics. Learn about regional market performance, key players, and future projections in this comprehensive guide to the evolving avocado industry, including insights on consumer preferences, processing innovations, and sustainability initiatives.

- Last Updated:

Avocado Market Q1 and Q2 2025 Forecast

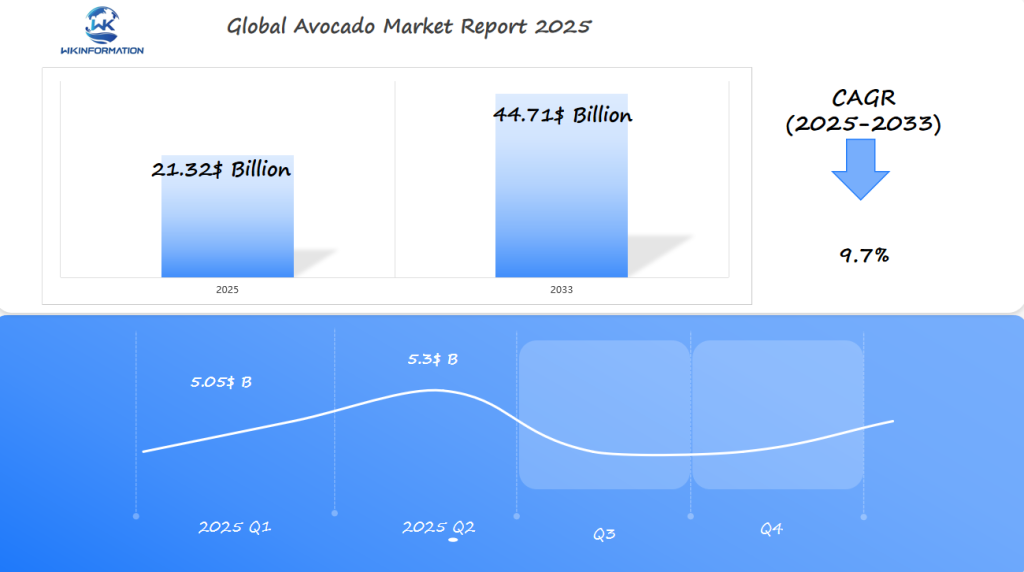

The Avocado market is projected to reach $21.32 billion in 2025, growing at a robust CAGR of 9.7% from 2025 to 2033. In Q1 2025, the market is expected to generate around $5.05 billion, with increasing global demand for avocados due to their health benefits, especially in markets like the U.S., Mexico, and Spain. The U.S. remains a leading consumer of avocado-based products, including guacamole, smoothies, and salads, driving strong demand in both retail and foodservice sectors.

By Q2 2025, the market will likely grow to approximately $5.3 billion, with Mexico continuing to dominate as the largest exporter of avocados globally, while Spain sees a surge in production for both domestic consumption and export markets across Europe.

Understanding the Avocado Market: Upstream and Downstream Dynamics

The avocado supply chain is a complex system that involves multiple stages, starting from the cultivation of avocados to their delivery to consumers. Let’s take a closer look at the various stages involved in this supply chain.

Key Stages in the Avocado Supply Chain

- Pre-harvest: This stage includes activities such as preparing the soil, maintaining the avocado trees, and applying fertilizers.

- Harvest: During this stage, avocados are manually picked, inspected for quality, and sorted initially.

- Post-harvest: After harvesting, avocados go through processes like cleaning, grading, and packaging.

- Distribution: This stage involves logistics activities such as maintaining a cold chain during transportation and storing avocados in warehouses.

- Retail: Finally, avocados are placed in stores where their ripeness is managed until they are sold to consumers.

Role of Major Distributors in the Avocado Supply Chain

Major distributors play a crucial role in ensuring that avocados reach retailers at the right time and in optimal condition. Companies like Mission Produce and Calavo Growers have established advanced ripening facilities in strategic locations to achieve this.

These facilities utilize controlled atmosphere technology to regulate the ripening process of avocados. By doing so, they can ensure that the fruits arrive at retail outlets when they are perfectly ripe and ready for sale.

Production Distribution Network

The movement of avocados from one entity to another within the supply chain can be described as follows:

- Growers send their harvested avocados to packing houses.

- Packing houses then work with import/export companies to transport the avocados.

- Regional distributors receive the avocados from these import/export companies.

- Finally, retail chains obtain their supply of avocados from regional distributors.

Key Trends Shaping the Avocado Industry

The avocado industry’s remarkable growth stems from powerful consumer-driven trends reshaping the market landscape.

Health-Conscious Consumers Embrace Avocados

Health-conscious consumers now prioritize nutrient-dense foods, positioning avocados as a superfood rich in:

- Heart-healthy monounsaturated fats

- Essential vitamins (K, C, B6, E)

- Minerals (potassium, magnesium)

- High fiber content

- Antioxidants

The Rise of Plant-Based Diets

The rise of plant-based diets has catapulted avocados into spotlight, with consumers seeking natural, whole-food alternatives to traditional dairy and meat products. This shift has sparked innovation in avocado-based products, from dairy-free spreads to protein-rich meat substitutes.

Sustainability Consciousness Drives Demand

Sustainability consciousness drives demand for organically grown avocados. Consumers increasingly seek:

- Pesticide-free cultivation methods

- Water conservation practices

- Fair trade certifications

- Eco-friendly packaging

- Local sourcing options

Social Media’s Influence on Avocado Culture

Social media platforms have transformed avocados into a cultural phenomenon. Instagram’s #avocado hashtag boasts over 14 million posts, while TikTok’s viral food trends regularly feature creative avocado recipes. This digital exposure has:

- Created new consumption occasions

- Sparked innovative serving suggestions

- Influenced restaurant menu development

- Generated demand among younger demographics

- Established avocado toast as a cultural icon

Avocados in Wellness and Beauty Industries

The wellness industry’s embrace of avocados extends beyond food, with beauty and skincare brands incorporating avocado oil into their product lines. This cross-industry adoption reflects the fruit’s versatility and consumer appeal across multiple market segments.

Retail Trends: Organic Avocado Sales on the Rise

Health food retailers report steady increases in organic avocado sales, with premium pricing justified by growing consumer willingness to pay for quality and sustainability. Major supermarket chains now dedicate significant shelf space to various avocado varieties and ripeness stages, responding to sophisticated consumer preferences.

Challenges and Barriers in Avocado Production and Trade

The avocado industry faces significant hurdles that impact production, distribution, and market stability. Climate change stands as a primary threat to avocado cultivation, creating unpredictable growing conditions across major producing regions.

1. Climate Change Effects:

- Extreme temperature fluctuations damage flowering patterns

- Irregular rainfall disrupts fruit development cycles

- Increased pest prevalence affects crop quality

- Drought conditions in California reduce yield potential by 20-30%

2. Logistical Complexities:

- Limited shelf life requires precise temperature control

- Transportation delays risk product spoilage

- Port congestion affects timely delivery

- Cold chain maintenance costs increase operational expenses

The delicate nature of avocados demands sophisticated handling throughout the supply chain. Producers must maintain strict temperature controls between 4-7°C (39-45°F) during transportation to prevent premature ripening.

3. Price Volatility Factors:

- New market entrants from Morocco and Kenya create pricing pressure

- Seasonal production gaps cause supply fluctuations

- Weather-related crop failures lead to unexpected shortages

- Currency exchange rate variations affect international trade

The emergence of new suppliers from regions like Morocco and Kenya introduces additional market dynamics. These countries leverage lower production costs to gain market share, creating price competition in traditional markets.

4. Supply Chain Disruptions:

- Labor shortages affect harvest schedules

- Container availability issues delay shipments

- Rising fuel costs impact transportation expenses

- Border crossing delays compromise product freshness

Recent global events have exposed vulnerabilities in the avocado supply chain. Producers face increased costs for essential materials, including packaging and fertilizers, while dealing with unreliable transportation schedules that affect delivery commitments to retailers.

The combination of these challenges requires industry stakeholders to develop resilient strategies. Investments in technology, infrastructure improvements, and diversified sourcing help mitigate risks associated with production and distribution uncertainties.

Geopolitical Influence on the Global Avocado Market

Trade agreements shape the landscape of international avocado commerce, creating both opportunities and barriers for market participants. The USMCA (United States-Mexico-Canada Agreement) plays a pivotal role in North American avocado trade, establishing specific protocols for Mexican exports to the U.S. market.

Key trade agreement impacts:

- Reduced tariffs between participating nations

- Standardized quality control measures

- Streamlined border inspection processes

- Enhanced phytosanitary requirements

Political stability directly affects avocado production and distribution. Mexico’s Michoacán region, responsible for 80% of U.S. avocado imports, has experienced disruptions due to cartel activities. These security concerns led to temporary U.S. import bans in 2022, causing significant market volatility.

Regional political dynamics create ripple effects across the supply chain:

- Security Issues: Armed groups affecting harvest schedules

- Labor Relations: Worker strikes impacting picking and packing

- Local Regulations: Changes in water rights and land use policies

International relations between major trading partners influence market access and pricing. Recent examples include:

- EU-Morocco trade disputes affecting Spanish producers

- Peru-China bilateral agreements opening new Asian markets

- Brexit’s impact on UK-EU avocado trade flows

Supply chain vulnerabilities emerge from geopolitical tensions:

- Border delays due to diplomatic disagreements

- Currency fluctuations affecting trade terms

- Changes in food safety inspection protocols

- Transportation route disruptions

The Belt and Road Initiative has created new opportunities for avocado trade between Latin American producers and Asian markets. Countries like Chile and Peru leverage these infrastructure developments to expand their export reach.

Regional trade blocs continue to shape market dynamics through:

- Preferential access agreements

- Joint quality standards

- Coordinated logistics networks

- Shared market intelligence

Market Segmentation by Avocado Type and Form

The avocado market divides into distinct segments based on variety and processing methods, each serving specific consumer preferences and culinary applications.

Popular Avocado Varieties

- Hass Avocados: Dominating 80% of global production, these dark-skinned fruits offer:

- Rich, creamy texture

- Year-round availability

- Extended shelf life

- Superior shipping durability

- Fuerte Avocados: Known for their:

- Pear shape

- Smooth, green skin

- Lighter flavor profile

- Oil content of 18-26%

- Reed Avocados: Distinguished by their:

- Large, round shape

- Thick, pebbled skin

- Nutty flavor notes

- Late-season harvesting

Market Forms and Processing

The avocado market splits into two primary segments:

- Fresh Avocados

- Whole fruits for direct consumption

- Premium pricing

- Dominant retail presence

- Short shelf life

- Processed Products

- Pre-made guacamole

- Avocado oil

- Frozen chunks

- Pulp and puree

The processed segment grows rapidly, driven by convenience-seeking consumers and foodservice demands. Manufacturers now offer innovative products like avocado-based spreads, dips, and sauces, expanding market reach beyond traditional uses.

The fresh segment maintains its market leadership, particularly in regions with established avocado consumption habits. Retail chains increasingly offer “ready-to-eat” and “ripening at home” options, addressing different consumer preferences and usage occasions.

Applications Driving Demand for Avocados Worldwide

The versatility of avocados in global cuisine has sparked unprecedented demand across diverse culinary landscapes. From traditional Mexican guacamole to Japanese avocado sushi rolls, chefs worldwide incorporate this fruit into innovative dishes that captivate food enthusiasts.

Popular Culinary Applications:

- Asian fusion restaurants feature avocado in poke bowls and specialty rolls

- Mediterranean cafes blend it into smoothies and spread it on artisanal toasts

- Latin American eateries use it in traditional dishes like arepas and ceviche

- European restaurants incorporate it into salads and gourmet sandwiches

The health benefits of avocados drive significant market growth, attracting health-conscious consumers seeking nutrient-dense foods.

Key Nutritional Benefits:

- Rich in heart-healthy monounsaturated fats

- High potassium content (40% more than bananas)

- Contains fiber for digestive health

- Packed with vitamins E, K, and B-complex

- Natural source of antioxidants

The beauty and skincare industry has embraced avocados, creating another avenue for market expansion. Manufacturers use avocado oil in:

- Premium hair care products

- Natural moisturizers

- Anti-aging creams

- Massage oils

The food service industry capitalizes on avocados’ creamy texture and neutral flavor profile, incorporating them into:

- Plant-based alternatives to dairy products

- Natural food colorings

- Egg substitutes in vegan baking

- Nutritional supplements

Research institutions continue to uncover new applications for avocados in functional foods and nutraceuticals, expanding their potential uses beyond traditional consumption methods.

Global Avocado Market Trends and Insights

Regional Variations in Avocado Consumption

Global avocado consumption patterns reveal significant regional variations and emerging opportunities. The European market demonstrates steady growth, with countries like Germany, France, and the Netherlands leading consumption rates. Annual per capita consumption in these regions ranges from 2.5 to 3.2 kg, reflecting a mature market with established distribution channels.

Emerging Markets in Asia

- China’s avocado imports grew by 250% between 2017-2023

- South Korea’s market size doubled in the past five years

- Japan shows steady demand growth, particularly in urban areas

- Singapore positions itself as a regional hub for avocado distribution

The Asian market presents unique characteristics:

- Premium pricing strategies due to limited local production

- Strong preference for perfectly shaped, blemish-free fruits

- Growing demand from health-conscious young urban professionals

- Increasing incorporation into local cuisine fusion dishes

Regional Consumption Patterns

- North America: 3.5-4.2 kg per capita annually

- Europe: 2.5-3.2 kg per capita annually

- Asia-Pacific: 0.5-1.2 kg per capita annually

- Latin America: 3.8-4.5 kg per capita annually

Market Penetration Strategies in Emerging Regions

Market penetration strategies in emerging regions focus on educational campaigns highlighting nutritional benefits and versatility. Retailers in Asian markets adapt presentation methods, offering pre-ripened avocados and single-fruit packaging options to appeal to local preferences. E-commerce platforms play a crucial role in distribution, with online sales of avocados growing 180% in Southeast Asian markets during 2022-2023.

Growth Opportunities in the Middle East

The Middle East emerges as a promising market, with UAE and Saudi Arabia showing annual growth rates exceeding 15% in avocado imports. These markets demonstrate strong demand for premium varieties and organic options.

The U.S. Avocado Market: Trends and Consumer Preferences

The U.S. is the world’s largest avocado import market, with annual consumption reaching 2.9 billion pounds in 2023. American households consume an average of 8.5 pounds of avocados per year, representing a 278% increase since 2000.

Key consumption patterns in the U.S. market:

- 77% of U.S. households regularly purchase avocados

- Peak consumption occurs during Super Bowl weekend, with sales exceeding 100 million pounds

- California accounts for 15% of domestic production, while imports from Mexico fulfill 81% of demand

Consumer behavior insights:

- Price sensitivity remains moderate, with 65% of consumers willing to pay premium prices for high-quality avocados

- 82% of purchases are driven by ripeness level at point of sale

- 73% of consumers cite health benefits as primary purchase motivation

The millennial demographic leads avocado consumption, with 72% reporting weekly purchases. Restaurant chains have capitalized on this trend, with avocado-based menu items increasing by 45% between 2020-2023.

Regional variations show strongest demand in Western states, particularly California, where per capita consumption reaches 12 pounds annually. The Northeast market demonstrates rapid growth, with consumption rates rising 25% year-over-year.

Digital purchasing platforms have transformed buying patterns, with online grocery services reporting a 156% increase in avocado sales since 2020. Subscription-based avocado delivery services have emerged, targeting urban professionals and health-conscious consumers.

The organic segment commands 23% of U.S. avocado sales, growing at twice the rate of conventional avocados. This shift reflects increasing consumer preference for sustainably sourced produce and environmental consciousness.

Mexico's Dominance in the Global Avocado Market

Mexico is the largest producer of avocados in the world, with expected production reaching 2.77 million metric tons in 2024 – a 5% increase from the previous year. Several factors contribute to Mexico’s success in avocado farming:

1. Strategic Growing Regions

Michoacán state is responsible for producing 80% of Mexico’s avocados. The region benefits from ideal climate conditions and has rich volcanic soil composition, making it an ideal place for avocado cultivation.

2. Export Performance

In 2023, Mexico exported 1.4 million metric tons of avocados, showing a year-over-year growth of 17%. The majority of these exports, around 81%, were sent to U.S. markets.

The Mexican avocado industry directly employs over 300,000 people and generates approximately $2.5 billion in annual export revenue. Unlike seasonal producers, Mexican growers have developed advanced farming techniques that allow them to harvest avocados throughout the year.

Recent investments in technology and infrastructure have further strengthened Mexico’s position:

- Implementation of advanced irrigation systems

- Improvement in pest management practices

- Enhancement of cold chain logistics

- Modernization of packing facilities

The country’s avocado sector continues to grow, with new growing regions being developed in states like Jalisco and Estado de México to meet increasing global demand.

Spain's Growing Role in the Avocado Market

Spain’s avocado industry has become an important player in the European market, with plans to increase cultivation by 30% in the next few years. The country’s Mediterranean climate, especially in areas like Andalusia and Valencia, is perfect for growing avocado trees.

Investment in Farming Infrastructure

Spanish farmers are making significant investments in:

- Advanced irrigation systems

- Sustainable farming practices

- Cold storage facilities

- Modern processing plants

Advantages of Spain’s Location

Spain’s strategic location offers key advantages for distributing avocados across Europe:

- Reduced transportation costs

- Faster delivery times

- Lower carbon footprint

- Fresh product availability

Focus on Hass Avocado Production

Most of Spain’s avocado production is dedicated to the Hass variety, with annual yields reaching 15,000 tons. Local producers are actively expanding their orchards and converting traditional citrus farms into avocado plantations to meet the increasing demand from Europe.

Recent Developments in Spanish Avocado Cultivation

Recent developments in Spanish avocado cultivation include:

- Implementation of water-efficient drip irrigation

- Introduction of high-density planting techniques

- Development of protected geographical indications

- Establishment of farmer cooperatives

Government Support for Agricultural Expansion

The Spanish government is supporting this agricultural expansion through subsidies and technical assistance programs, which help farmers transition to avocado production. These initiatives have attracted both domestic and international investment, strengthening Spain’s position as a reliable supplier of avocados to the European market.

Future Prospects for the Avocado Industry

Market projections indicate substantial growth in the avocado industry beyond 2025, with analysts predicting a compound annual growth rate (CAGR) of 9.7% from 2025 to 2033. The global avocado market value is expected to surpass $44.71 billion by 2033, driven by several key factors:

1. Emerging Market Opportunities

- Asia-Pacific regions show potential for 200% consumption growth by 2028

- Middle Eastern countries are developing specialized avocado cultivation programs

- European markets are expanding beyond traditional consumption patterns

2. Technological Advancements

- Smart farming techniques could increase yield efficiency by 40%

- Blockchain implementation in supply chain management

- Advanced ripening technologies extending shelf life up to 15 days

3. Product Innovation Trends

- Development of avocado-based cosmetics market

- Expansion of processed avocado products

- Integration into plant-based meat alternatives

The industry faces transformation through vertical integration, with major producers investing in direct-to-consumer channels. Research indicates a 25% increase in sustainable farming practices adoption by 2027, responding to consumer demands for environmentally conscious production methods.

Market analysts project a 35% increase in global production capacity by 2028, with new growing regions in Southeast Asia and Africa contributing significantly to supply diversification. These developments suggest a robust future for the avocado industry, characterized by technological innovation and market expansion.

Competitive Dynamics in the Avocado Market

The global avocado trade is dominated by several major players who control significant portions of production, distribution, and marketing channels. These industry leaders have established robust supply chains and strategic partnerships across multiple regions.

-

Mission Produce Inc. – United States

-

Calavo Growers, Inc. – United States

-

Avocados From Mexico (AFM) – United States / Mexico (binational marketing organization)

-

Fresh Del Monte Produce Inc. – United States

-

The Kraft Heinz Company – United States

-

Yucatan Foods – United States

-

AvoLov – United States

-

The Good Fat Company – United States

-

GuacAmore – United States

-

Del Monte Fresh Produce – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name |

Global Avocado Market Report |

| Base Year |

2024 |

| Segment by Type |

· Hass Avocados · Fuerte Avocados · Reed Avocados |

|

Segment by Application |

· Culinary · Beauty and skincare · Food service |

|

Geographies Covered |

·North America (United States, Canada)

·Europe (Germany, France, UK, Italy, Russia) ·Asia-Pacific (China, Japan, South Korea, Taiwan) ·Southeast Asia (India) ·Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

|

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global avocado market stands as a testament to agricultural innovation, consumer evolution, and sustainable development. As demonstrated throughout this analysis, avocados have transcended their traditional role as a simple fruit to become a versatile commodity with applications across multiple industries.

Global Avocado Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Avocado Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- AvocadoMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Avocadoplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Avocado Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Avocado Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Avocado Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofAvocado Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current state of the avocado market and its projected growth?

The avocado market is experiencing significant growth, driven by increasing global demand and changing dietary preferences. Key producing countries include Mexico, the U.S., and Spain, which play a crucial role in meeting this rising demand.

How does the avocado supply chain operate from farm to table?

The avocado supply chain involves various key players including farmers, distributors, and retailers. The dynamics of production and export trends are essential for ensuring that avocados reach consumers efficiently while maintaining quality.

What are the key trends influencing consumer demand for avocados?

Rising health food trends are significantly boosting avocado demand, with consumers increasingly seeking organic and sustainably sourced options. Additionally, social media influences consumer preferences, promoting avocados as a trendy health food.

What challenges does the avocado industry face in production and trade?

The avocado industry faces several challenges including climate change impacts on yields, logistical hurdles for exporters, and price fluctuations due to competition from emerging suppliers. These factors can affect overall market stability.

How do geopolitical factors impact the global avocado market?

Geopolitical factors such as trade agreements and political stability directly influence avocado exports and imports. Tensions between countries can disrupt supply chains, affecting market availability and prices.

What types of avocados are available in the market and what are their applications?

There are various types of avocados available, including Hass and Fuerte. Avocados can be consumed fresh or processed into products like guacamole. Their culinary versatility and health benefits drive global demand.