Data Center Cables Market Outlook: $34.26 Billion Global Expansion by 2025 with Key Insights from the U.S., China, and Brazil

Explore the global data center cables market analysis, including supply chain dynamics, technological trends, regional insights, and future projections. Learn about key players, challenges, and growth opportunities in this essential digital infrastructure sector.

- Last Updated:

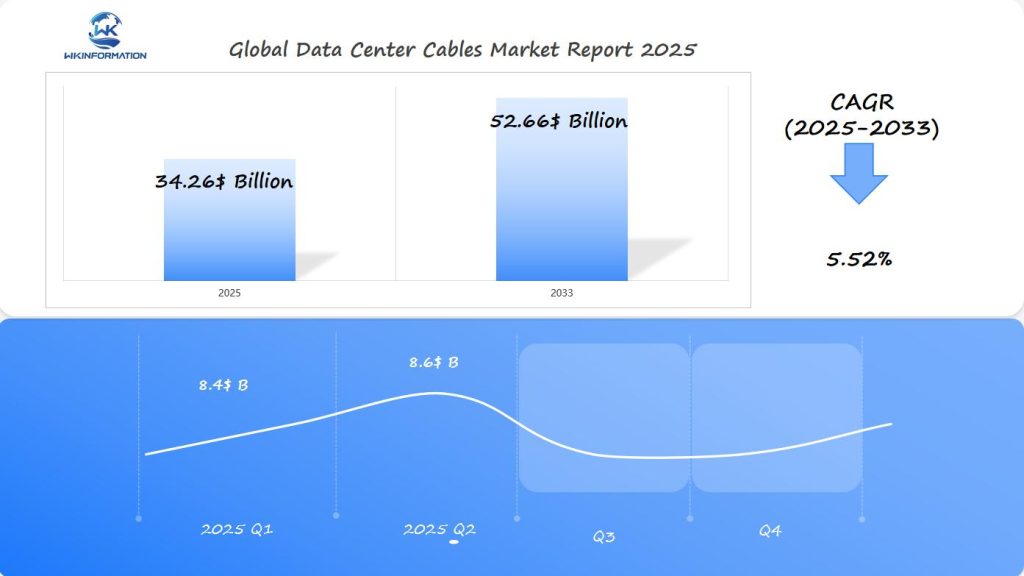

Data Center Cables Market Q1 and Q2 2025 Forecast

The Data Center Cables market is projected to reach $34.26 billion in 2025, growing at a CAGR of 5.52% from 2025 to 2033. In Q1 2025, the market is expected to generate around $8.4 billion, driven by the increasing demand for data center infrastructure globally, especially in the U.S., China, and Brazil. The proliferation of cloud services, 5G networks, and big data analytics is pushing the need for high-quality cables in data centers.

By Q2 2025, the market will likely reach $8.6 billion, driven by the expansion of data center capacity and the rise in AI-driven workloads. As cloud computing continues to experience rapid growth, there will be increasing requirements for high-bandwidth data center cables, which are critical to support the transfer of massive amounts of data efficiently.

The demand for fiber optic cables, copper cables, and high-speed connections will be a key driver in the U.S., China, and Brazil—all of which are heavily investing in digital infrastructure.

Exploring the Upstream and Downstream Supply Chain of Data Center Cables

The supply chain for data center cables involves a network of various players, including suppliers of raw materials, manufacturers, distributors, and end-users. It can be divided into two main parts: upstream and downstream.

Upstream Supply Chain

The upstream supply chain consists of the following:

- Raw Material Suppliers: These are the companies that provide the basic materials needed to manufacture data center cables. They include:

- Copper mining companies

- Fiber optic material producers

- Plastic and insulation manufacturers

- Component Manufacturers: These are the businesses that produce specific parts or components used in cable production. They include:

- Cable core producers

- Connector manufacturers

- Testing equipment providers

Downstream Supply Chain

The downstream supply chain includes the following:

- Distribution Channels: These are the various ways in which data center cables are distributed to end-users. They include:

- Direct sales to data centers

- System integrators

- Value-added resellers

Leading manufacturers such as CommScope, Prysmian Group, and Belden have established strategic partnerships with raw material suppliers to ensure consistent quality and supply. These relationships prove crucial during supply chain disruptions, as seen during recent global events.

Quality control measures at each stage of the supply chain directly impact market growth, with manufacturers implementing rigorous testing protocols. The integration of automation and smart manufacturing processes has streamlined production, reducing lead times and improving product consistency.

Technological Trends Transforming the Data Center Cables Market

The rapid evolution of cloud computing, AI, and IoT technologies creates unprecedented demands on data center cable infrastructure. These emerging technologies require:

- Higher Bandwidth Capabilities

- AI workloads demand 400G and 800G cables

- Cloud computing pushes for enhanced fiber optic solutions

- IoT networks require robust connectivity options

- Advanced Cable Specifications

- Low-latency transmission for real-time AI processing

- Enhanced thermal management for dense computing environments

- Improved signal integrity for complex IoT deployments

The integration of smart sensors within cable systems enables:

- Real-time performance monitoring

- Predictive maintenance capabilities

- Automated cable management solutions

Data center operators now implement hybrid cable solutions that combine copper and fiber optics to support diverse technological requirements. This adaptation includes specialized cables designed for edge computing installations and AI-specific data processing units.

The push toward quantum computing introduces new cable design requirements, focusing on minimal interference and maximum data transmission speeds. Cable manufacturers respond with innovative materials and construction techniques to meet these evolving technological demands.

Challenges Facing the Data Center Cables Industry

The data center cables industry faces significant hurdles amid rapid market expansion. Supply chain disruptions create persistent bottlenecks in cable manufacturing and distribution, leading to extended lead times and increased costs.

Key Infrastructure Challenges:

- Limited physical space for cable installations in existing facilities

- Heat management issues affecting cable performance

- Compatibility concerns with legacy systems

- Growing power density requirements

Cost-Related Obstacles:

- Rising raw material prices, particularly copper and fiber optic components

- High installation and maintenance expenses

- Investment requirements for new cable technologies

Regulatory Complexities:

- Varying international standards and certifications

- Environmental compliance requirements

- Data security regulations affecting cable specifications

The industry also grapples with skilled labor shortages for installation and maintenance. Cable manufacturers must balance durability with flexibility while meeting stringent performance requirements. The need for frequent upgrades to support higher data transmission speeds creates additional pressure on both manufacturers and data center operators.

Geopolitical Influences on Data Center Cable Production and Trade

The data center cables market operates within a complex web of international relations and trade policies. Recent geopolitical tensions have created significant shifts in supply chain dynamics and market access:

1. Trade Restrictions Impact

- Tariffs between major economies affect raw material costs

- Export controls limit technology transfer

- Regional manufacturing hubs face disruption

2. Supply Chain Diversification

- Companies establish multiple production facilities

- Strategic partnerships with local manufacturers

- Investment in alternative sourcing locations

3. Market Response Strategies

- Development of domestic production capabilities

- Increased focus on regional self-sufficiency

- Implementation of risk mitigation measures

The shifting diplomatic landscape between the U.S. and China has particularly influenced market dynamics, with both countries implementing policies that affect cable production and distribution. These changes have led to price volatility and altered traditional supply routes, pushing manufacturers to adapt their strategies and explore new markets.

Regional trade agreements now play a crucial role in shaping market access and competitive advantages. Countries with stable diplomatic relations often benefit from preferential trade terms, creating new opportunities for cable manufacturers and distributors within these networks.

Segmentation Analysis: Types of Data Center Cables and Their Demand

The data center cable market divides into two primary categories: fiber optic cables and copper cables, each serving the distinct operational needs.

Fiber Optic Cables

- Dominate high-speed data transmission requirements

- Support speeds up to 400G and beyond

- Preferred for long-distance connections

- Lower latency and signal loss

- Growing demand in hyperscale facilities

Copper Cables

- Cost-effective for short-distance connections

- Essential for power distribution

- Popular in small to medium-sized data centers

- Reliable performance in legacy systems

- Steady demand in retrofit projects

Market data shows fiber optic cables capturing 65% of new installations, driven by increasing bandwidth demands and data processing requirements. The remaining 35% belongs to copper cables, maintaining relevance through power delivery applications and cost advantages in specific use cases.

Recent adoption trends indicate a 40% year-over-year increase in fiber optic cable deployment, particularly in edge computing facilities. Copper cables maintain a stable 15% growth rate, primarily in power distribution and short-range connectivity applications.

Applications Driving Growth in Data Center Cables

The rapid acceleration of digital transformation across industries creates diverse applications driving data center cable demand. Key enterprise applications include:

1. High-Performance Computing (HPC)

- Scientific research facilities

- Financial modeling systems

- AI/ML processing centers

2. Cloud Service Providers

- Public cloud platforms

- Private cloud networks

- Hybrid cloud solutions

3. Telecommunications Infrastructure

- 5G network deployments

- Edge computing facilities

- Internet exchange points

The healthcare sector emerges as a significant growth driver, requiring robust data center infrastructure for:

- Electronic health records

- Medical imaging storage

- Telemedicine platforms

Gaming and streaming services push cable requirements through:

- Live streaming capabilities

- Cloud gaming platforms

- Content delivery networks

The financial services industry demands specialized cabling solutions for:

- High-frequency trading

- Real-time transaction processing

- Secure data transmission

These applications shape cable specifications, driving innovations in speed, bandwidth capacity, and signal integrity across the data center cables market.

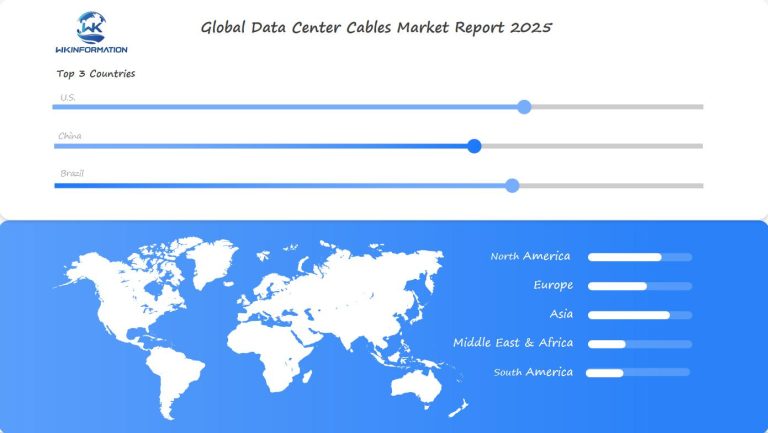

Regional Insights into the Global Data Center Cables Market

The global data center cables market has different patterns in each region, influenced by local infrastructure development and digital transformation initiatives. The specific demands for data center cables in each region are driven by their unique characteristics:

Asia-Pacific

- Rapid urbanization fuels demand for high-speed connectivity

- Investment in 5G infrastructure creates need for specialized cables

- Growing cloud adoption rates require robust cable networks

Europe

- Strict data sovereignty laws influence cable infrastructure

- Green initiatives drive demand for energy-efficient cable solutions

- Cross-border connectivity needs shape cable specifications

Middle East & Africa

- Smart city projects accelerate cable infrastructure growth

- Rising mobile internet penetration increases cable requirements

- Investment in submarine cables enhances regional connectivity

Latin America

- Digital banking expansion drives fiber optic cable demand

- E-commerce growth necessitates reliable data center connections

- Government digitization programs boost infrastructure needs

These regional differences create unique market opportunities. Cable manufacturers are adapting their products to meet specific geographical requirements and regulatory standards.

U.S. Market: Advancements in Data Center Cable Technology

Northern Virginia is the leading hub for data center innovation in the United States, responsible for 70% of global internet traffic. The technological advancements in this region are shaping the future of data center cable infrastructure throughout the country.

Key Technological Developments in the U.S. Market

Some of the significant technological developments in the U.S. market include:

- 400G/800G Ethernet Cables: Northern Virginia leads the adoption of high-speed ethernet cables, pushing boundaries in data transmission capabilities

- Silicon Photonics Integration: Advanced cables incorporating silicon photonics technology enable faster data transfer rates with reduced power consumption

- Smart Cables with Built-in Diagnostics: New generation cables feature embedded sensors for real-time performance monitoring and predictive maintenance

Growth of Northern Virginia’s Real Estate Sector

The real estate sector in Northern Virginia is experiencing remarkable growth, particularly in relation to data center infrastructure:

- 1,800+ megawatts of data center capacity

- $8.4 billion in real estate investments dedicated to data center infrastructure

- 4.6 million square feet of data center space under active construction

Predictions for Future Technological Advancements

Looking ahead, there are several predictions for future technological advancements in cable technology:

- AI-Optimized Cables: Specialized cable designs supporting artificial intelligence workloads

- Quantum-Ready Infrastructure: Cable systems prepared for quantum computing requirements

- Green Cable Solutions: Energy-efficient cables reducing power consumption by up to 30%

The U.S. market’s innovation in cable technology directly influences global standards, with Northern Virginia serving as a testing ground for next-generation solutions.

China’s Role in the Growing Data Center Cable Industry

China’s data center cable market is experiencing unprecedented growth, driven by massive infrastructure investments and technological advancement initiatives. The country’s large-scale operations have positioned it as a dominant force in the global data center landscape.

Key Market Drivers in China:

- Strategic government support through the “Eastern Data, Western Computing” initiative

- Rapid deployment of 5G infrastructure

- Rising demand for cloud services and digital transformation

The Chinese market exhibits unique characteristics in its investment patterns. Local manufacturers have scaled up production capabilities, with companies like Hengtong Group and Yangtze Optical Fibre and Cable leading domestic cable manufacturing. These manufacturers have implemented advanced automation systems and quality control measures to meet international standards.

Investment Trends:

- $2.5 billion allocated to data center infrastructure in 2023

- Focus on high-speed fiber optic cables for improved data transmission

- Integration of AI-driven cable management systems

The future of Chinese data center operations points toward sustainable growth. Projections indicate a 15% annual increase in cable demand through 2025, supported by:

- Development of smart cities requiring enhanced connectivity

- Expansion of edge computing facilities

- Growing adoption of hyperscale data centers

Chinese manufacturers are investing in R&D to develop next-generation cables capable of handling increased data loads. These innovations include improved thermal management properties and enhanced signal integrity for high-speed data transmission.

Brazil Market: Digital Infrastructure and Data Center Connectivity

Brazil’s data center market is leading the way in Latin America’s digital transformation. It is expected to grow significantly. This rapid growth is driven by a rising demand for digital services within the country and Brazil’s strategic position as a technology hub in the region.

Key Infrastructure Investments:

Some major investments in Brazil’s data center infrastructure include:

- Google’s expansion plan involving $1.2 billion investment in Brazilian data centers

- Oracle’s establishment of dedicated cloud regions in São Paulo

- Microsoft’s initiatives focused on building sustainable data centers

Factors Attracting Tech Giants to Brazil

The Brazilian market appeals to these large technology companies due to several reasons:

- Its strategic geographic location

- The growing number of digital consumers

- A regulatory environment that is favorable for business operations

- Availability of skilled professionals in the technical field

Importance of Local Solutions

Local solutions are crucial for the success of Brazil’s data center ecosystem. Brazilian companies are actively involved in developing specialized cable infrastructure that can withstand:

- High levels of humidity

- Fluctuating temperature conditions

- Specific requirements set by the local power grid

- Unique network architectures present in different regions

Collaborations Between Domestic Providers and International Manufacturers

The market exhibits distinct features where domestic providers collaborate with international manufacturers to design tailored solutions. These partnerships have resulted in:

- Reduced latency for users located within Brazil

- Improved compliance with data sovereignty regulations

- Enhanced capabilities for recovering from disasters

- Stronger interconnectivity between different regions

Adoption of Hybrid Solutions by Brazilian Data Centers

Brazilian data centers are increasingly embracing hybrid solutions that combine their local infrastructure with international cloud services. This strategy not only optimizes performance but also ensures cost-effectiveness for businesses operating throughout Latin America.

Future Projections: Where Is the Data Center Cables Market Heading?

The data center cables market is expected to grow significantly after 2025, driven by several emerging trends:

1. AI and Machine Learning Integration

- Demand for high-performance cables supporting AI workloads

- Need for specialized cooling solutions requiring advanced cable infrastructure

- Integration of smart cable management systems

2. Sustainability Focus

- Rise of eco-friendly cable materials

- Energy-efficient cable designs reducing power consumption

- Implementation of recyclable cable components

3. 5G Network Expansion

- Enhanced fiber optic cable requirements

- Higher bandwidth capacity needs

- Low-latency cable solutions

4. Edge Computing Growth

- Distributed data center architectures requiring robust cable networks

- Increased demand for flexible cable solutions

- Rapid deployment capabilities

The market anticipates a shift toward hybrid infrastructure solutions, combining traditional copper cables with advanced fiber optics. Cable manufacturers are investing in R&D to develop solutions capable of handling data speeds exceeding 800G, preparing for next-generation computing demands.

Price volatility in raw materials and supply chain disruptions will shape manufacturing strategies, pushing companies to adopt regional production models and alternative material sourcing.

Competitive Landscape: Key Industry Players and Strategies

The data center cables market has several major players who are shaping the industry through strategic actions and technological advancements:

-

Belden Inc. – United States

-

Panduit Corporation – United States

-

Nexans S.A. – France

-

CommScope Holding Company, Inc. – United States

-

Corning Incorporated – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Data Center Cables Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The data center cables market is at a crucial point, ready for significant growth to reach $34.26 billion by 2025. This growth shows how important the market is in supporting digital transformation across industries. The market has strong fundamentals:

1. Sustained Growth Drivers

- Rising cloud computing adoption

- AI and IoT implementation

- 5G network expansion

- Digital infrastructure modernization

2. Regional Development Patterns

- U.S. leadership through technological innovation

- China’s rapid infrastructure scaling

- Brazil’s emergence as a Latin American hub

The market’s evolution depends on several key factors:

✓ Technological advancements in cable design

✓ Sustainable manufacturing practices

✓ Supply chain resilience

✓ Regulatory compliance

Companies that adapt to these market changes while addressing environmental concerns and maintaining high-quality standards will find significant growth opportunities. The data center cables sector is crucial for global digital infrastructure development, supporting increased connectivity demands and technological advancement in different regions.

The market’s strong growth forecast indicates good investment potential, especially in emerging markets where digital transformation initiatives are driving infrastructure expansion.

Global Data Center Cables Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Data Center Cables Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Data Center Cables Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalData Center Cables Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Data Center Cables Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Data Center Cables Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Data Center Cables Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Data Center Cables Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the global data center cables market by 2025?

The global data center cables market is projected to reach a value of $34.26 billion by 2025, highlighting its significance in the digital age.

What are the key factors driving growth in the data center cables market?

Key factors driving growth in the data center cables market include advancements in cloud computing, the rise of AI and IoT technologies, as well as increasing demand for digital transformation across various industries.

How do geopolitical influences affect data center cable production and trade?

Geopolitical factors such as trade policies and international relations significantly impact cable production and trade dynamics, influencing market stability and supply chain efficiency.

What are the main challenges facing the data center cables industry today?

The main challenges include infrastructure limitations, cost factors affecting manufacturing, and regulatory issues that impact both manufacturers and consumers in the evolving market.

What types of cables are commonly used in data centers, and what are their demand trends?

The two primary types of cables used in data centers are fiber optic cables and copper cables. Each type has distinct demand trends based on technological advancements and application needs.

How is Brazil’s data center market expected to grow by 2029?

Brazil’s data center market is forecasted to experience rapid growth by 2029, driven by significant investments in digital infrastructure to enhance connectivity within Latin America.