Property Tax Services Market Outlook: $8.3 Billion Global Expansion by 2025 with Key Insights from the U.S., Canada, and the U.K.

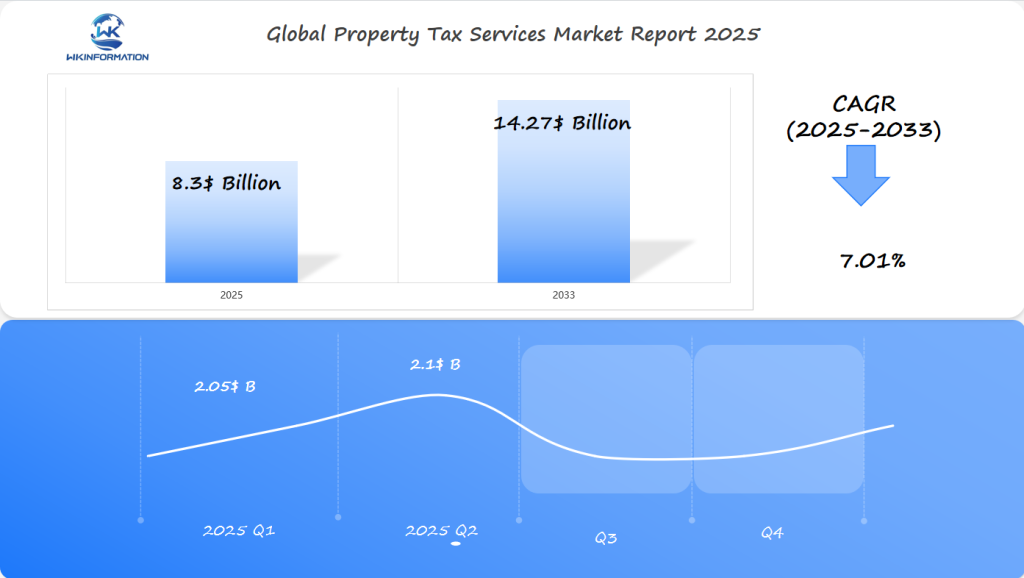

Discover comprehensive insights into the Global Property Tax Services Market from 2025-2033. This in-depth analysis explores market trends, competitive dynamics, technological innovations, and growth projections. Learn how AI, machine learning, and cloud solutions are transforming property tax assessments while navigating regulatory challenges. With a projected CAGR of 7.01% reaching USD 14.27 billion by 2033, understand the key drivers shaping this evolving industry landscape. Essential reading for stakeholders seeking strategic insights into property tax services market opportunities and challenges.

- Last Updated:

Property Tax Services Market Q1 and Q2 2025 Forecast

The Property Tax Services market is projected to reach $8.3 billion in 2025, with a CAGR of 7.01% from 2025 to 2033. In Q1 2025, the market will likely generate around $2.05 billion, driven by strong demand for property tax management services in the U.S., Canada, and the U.K. These regions are seeing increased real estate activity, alongside complex tax regulations that require expertise in property tax assessments and appeals.

By Q2 2025, the market is expected to reach $2.1 billion, with increased awareness of tax efficiency among property owners and businesses. Technological advancements in automation and digital platforms for tax management will help drive the growth of property tax services, particularly in the U.S. and Canada, where the real estate sector remains robust.

Regulatory changes in the U.K. will also play a role, as governments focus on updating property tax systems, creating a growing need for professional tax advisory services.

Understanding the Upstream and Downstream Dynamics of Property Tax Services

Property tax services operate within a complex ecosystem of interconnected activities and stakeholders. Understanding the upstream and downstream dynamics helps businesses optimize their tax management strategies and maximize value creation.

Upstream Property Tax Services

Upstream activities focus on data collection, assessment preparation, and initial property valuations. These foundational services include:

- Property assessment documentation

- Market value analysis

- Data gathering and verification

- Initial tax liability calculations

- Compliance documentation preparation

Key players in the upstream segment include:

- Property assessors

- Real estate appraisers

- Data analytics firms

- Municipal tax authorities

- Property documentation specialists

Downstream Property Tax Services

Downstream services build upon upstream activities, focusing on optimization, appeals, and strategic tax management:

- Tax appeal representation

- Payment processing

- Exemption management

- Strategic tax planning

- Ongoing compliance monitoring

The downstream segment features specialized service providers:

- Tax consultants

- Legal representatives

- Financial advisors

- Appeal specialists

- Technology solution providers

Market Growth Impact

The interaction between upstream and downstream segments creates significant market opportunities:

- Integration of services drives efficiency improvements

- Technology adoption accelerates service delivery

- Cross-segment collaboration enhances value proposition

- Specialized expertise development in both segments

- Enhanced data accuracy and reporting capabilities

Recent market developments highlight the growing importance of integrated service offerings. Ryan’s acquisition of Altus Group’s property tax services demonstrates how companies leverage both upstream and downstream capabilities to create comprehensive solutions.

The emergence of specialized software platforms enables seamless connection between upstream data collection and downstream strategic planning. These technological advancements help service providers:

- Reduce processing time by 40-60%

- Improve accuracy rates by 25-35%

- Enhance client communication efficiency

- Streamline appeals processes

- Generate detailed analytics reports

The continuous evolution of property tax services creates new opportunities for market expansion. Service providers who successfully integrate upstream and downstream capabilities position themselves for sustained growth in this dynamic market.

Key Trends Reshaping the Property Tax Services Market

The property tax services landscape is undergoing significant changes due to technological advancements and evolving client needs. Several key trends are reshaping how service providers operate and deliver value to their clients.

1. Digital Transformation

Technology has transformed the way property tax services are delivered. Service providers now use advanced software solutions to streamline processes and improve accuracy. Some of the digital tools being used include:

- AI-powered assessment tools for accurate property valuations

- Cloud-based platforms enabling real-time data access

- Automated compliance monitoring systems

- Blockchain technology for transparent property records

- Machine learning algorithms for predictive analytics

2. Data-Driven Decision Making

Data plays a crucial role in shaping strategies and making informed decisions in the property tax industry. Service providers are leveraging advanced analytics and predictive modeling techniques to gain insights into market trends, forecast tax liabilities, and benchmark performance across property portfolios. This data-driven approach allows them to provide customized reporting dashboards and real-time market intelligence integration for stakeholders.

3. Remote Service Delivery

The COVID-19 pandemic has accelerated the adoption of remote service delivery methods in various industries, including property tax services. To adapt to this new normal, service providers are implementing digital solutions that enable them to conduct property assessments, consultations, and document management remotely. This not only ensures business continuity but also enhances convenience for clients.

4. Advisory Services

As property tax regulations become more complex, companies are seeking expert guidance on strategic tax planning and risk management. Advisory services have emerged as a critical component of property tax management, with service providers offering tailored solutions such as portfolio optimization strategies, assessment appeal strategies, and compliance optimization techniques.

5. Integrated Solutions

The market is witnessing an increased demand for comprehensive service packages that combine traditional tax management with advanced advisory capabilities. These integrated solutions help organizations navigate complex tax landscapes while maximizing efficiency and minimizing risk.

6. Evolving Client Expectations

Client expectations continue to evolve, driving innovation in service delivery. Modern property tax services are incorporating features such as mobile-first solutions for accessibility, interactive client portals, personalized reporting systems, integrated communication platforms, and real-time progress tracking to meet the demands of tech-savvy clients.

These trends indicate a shift towards a more proactive and client-centric approach in the property tax services industry. Service providers who embrace these changes and adapt their offerings accordingly will be better positioned to thrive in this dynamic market.

Challenges and Regulatory Constraints Affecting Growth

The property tax services market faces significant regulatory hurdles that shape its operational landscape. These challenges create a complex environment where service providers must carefully navigate varying compliance requirements across different jurisdictions.

Global Regulatory Framework Complexities

- Inconsistent tax assessment methodologies between regions

- Varying appeal procedures and deadlines

- Different documentation requirements across jurisdictions

- Multiple layers of government oversight

- Frequent policy changes requiring constant adaptation

Property tax service providers encounter substantial regional variations in compliance requirements. In the U.S., each state maintains its own property tax laws, creating a patchwork of regulations that firms must master. The U.K.’s system presents unique challenges with its Council Tax bands and business rates, while Canada’s provincial variations add another layer of complexity.

Digital Compliance Tools

- Automated deadline tracking systems

- Real-time regulatory update notifications

- Centralized document management platforms

Regional Expertise Development

- Local market specialists

- Dedicated compliance teams

- Regular staff training programs

Risk Management Protocols

- Regular audits of compliance procedures

- Documentation standardization

- Quality control measures

The regulatory landscape continues to evolve with new technological requirements and data protection laws. Service providers must now ensure compliance with digital security standards while managing traditional property tax regulations. This dual compliance burden requires significant investment in both technology infrastructure and human expertise.

Market barriers particularly affect smaller firms attempting to enter the property tax services space. The cost of maintaining compliance across multiple jurisdictions creates high entry barriers, leading to market consolidation among larger players who can leverage economies of scale.

Geopolitical Influences on the Property Tax Services Industry

Global political dynamics shape the property tax services landscape through direct and indirect impacts on market stability and growth potential. The Russia-Ukraine conflict serves as a prime example, triggering ripple effects across international real estate markets and property valuations.

Key Geopolitical Factors Affecting Property Tax Services:

- Trade tensions between major economies

- Political regime changes

- International sanctions

- Cross-border investment restrictions

- Regional economic agreements

Economic conditions play a pivotal role in shaping property tax policies. The post-pandemic economic recovery has prompted governments to reassess their property tax frameworks, leading to significant policy adjustments:

Economic Impact on Property Tax Policies:

- Interest rate fluctuations affecting property values

- Inflation-driven assessment changes

- Currency exchange rate impacts on international property holdings

- Local market conditions influencing tax rates

- Employment trends affecting commercial property demand

Recent policy changes have reshaped the property tax services landscape across major markets:

Market Response to Geopolitical Changes:

- Increased focus on risk assessment services

- Development of cross-border compliance tools

- Enhanced data analytics capabilities

- Growth in advisory services for international properties

- Expansion of digital property assessment platforms

The intersection of geopolitical events and economic conditions creates complex challenges for property tax service providers. Companies must maintain agile service models to adapt to rapid policy changes while ensuring compliance across multiple jurisdictions.

The rise of remote work policies has triggered reassessment of commercial property values, leading to new service demands in urban centers. Property tax service providers now offer specialized solutions for hybrid workplace scenarios and changing

Segmentation Insights: Understanding Property Tax Services by Type

Property tax services encompass distinct categories designed to meet specific client needs across different market segments. Here’s a comprehensive breakdown of the primary service types:

1. Assessment Services

- Property valuation analysis

- Market value determinations

- Assessment review and validation

- Comparative market studies

- Cost approach evaluations

2. Appeal Services

- Documentation preparation

- Legal representation

- Expert testimony

- Negotiation with tax authorities

- Appeal strategy development

3. Advisory Services

- Tax planning and optimization

- Compliance guidance

- Risk assessment

- Portfolio management

- Budget forecasting

Each service category requires specific expertise and methodologies. The market shows a growing demand for integrated solutions that combine multiple service types, particularly in complex jurisdictions where property tax requirements frequently change. Companies investing in comprehensive service offerings gain competitive advantages through their ability to provide end-to-end solutions for clients with diverse property portfolios.

Exploring Applications and Their Impact on Demand for Property Tax Services

Property tax services applications have evolved significantly, driven by technological advancements and changing client requirements. Modern software solutions now offer:

1. Real-time Assessment Tracking

- Automated valuation monitoring

- Instant tax bill calculations

- Property portfolio management tools

2. Digital Documentation Management

- Cloud-based storage systems

- Automated filing systems

- Secure document sharing capabilities

3. Analytics and Reporting

- Custom report generation

- Data visualization tools

- Predictive analytics for tax forecasting

The integration of artificial intelligence has transformed traditional property tax services into dynamic digital solutions. You’ll find AI-powered applications handling:

- Tax payment scheduling

- Appeal deadline monitoring

- Jurisdiction-specific compliance checks

- Automated tax rate comparisons

Client demand continues to surge for mobile applications that provide:

- On-the-go portfolio access

- Real-time notification systems

- Digital payment processing

- Remote document submission

These technological applications have created new market opportunities, with property owners seeking integrated solutions that combine traditional tax services with digital convenience. The market responds with enhanced features such as:

- Multi-jurisdiction tax management

- Automated workflow systems

- Integration with existing accounting software

- Custom API development for enterprise clients

Regional Analysis: Key Growth Areas in the Property Tax Services Market

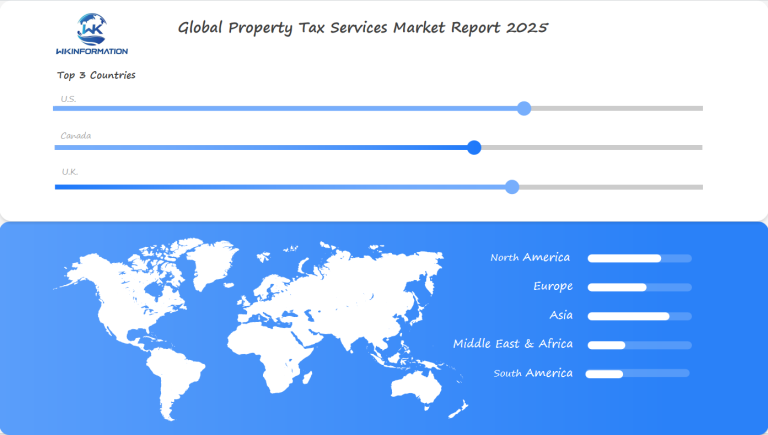

The property tax services market shows distinct growth patterns across different regions, with the U.S., Canada, and the U.K. emerging as key players in the global landscape.

1. North American Dominance

- The U.S. market holds the largest share, driven by complex property tax regulations

- Canada’s market shows steady growth, particularly in metropolitan areas

2. European Market Dynamics

- U.K. leads the European segment with 32% market share

- London remains the primary hub for property tax service providers

- Brexit-related property market adjustments create new service opportunities

3. Growth Indicators by Region

United States

- High demand in Texas, California, and New York

- 15% annual growth rate in commercial property tax services

- Strong technology adoption rates

Canada

- Rapid expansion in Toronto and Vancouver markets

- 12% year-over-year growth in residential tax services

- Rising demand for digital assessment tools

United Kingdom

- Concentrated growth in Greater London

- 8% increase in commercial property tax consulting

- Growing need for compliance services

These regions demonstrate strong market fundamentals, supported by robust property markets and increasing complexity in tax regulations. The presence of established service providers and sophisticated client bases creates fertile ground for continued expansion.

U.S. Market Overview: Trends, Policies, and Opportunities

The U.S. property tax services market has great potential for growth due to its complicated rules and changing market conditions. Property tax professionals face specific challenges in each state, as they have different methods of assessing properties and handling appeals.

Key Market Drivers

- Rising property values in metropolitan areas

- Increasing complexity of tax assessment methodologies

- Growing demand for specialized tax consulting services

- Digital transformation of property tax management

Policy Changes Impacting the Market

- State-level property tax caps

- Assessment frequency modifications

- Green building tax incentives

- Remote work impact on commercial property valuations

The U.S. market presents significant opportunities for service providers through specialized offerings:

1. Technology Integration

- AI-powered valuation tools

- Automated appeal management systems

- Real-time tax monitoring platforms

2. Advisory Services

- Portfolio optimization strategies

- Multi-jurisdiction compliance management

- Tax incentive identification programs

3. Data Analytics Solutions

- Predictive assessment modeling

- Comparative market analysis tools

- Risk assessment frameworks

Recent legislative changes have created new service opportunities, particularly in:

- Environmental compliance reporting

- Digital property documentation

- Remote assessment technologies

The market shows strong demand for specialized expertise in emerging areas:

“Property tax professionals with data analytics capabilities command premium rates, reflecting the industry’s shift toward technology-enabled services” – U.S. Property Tax Association Report 2024

Service providers focusing on regional specialization gain competitive advantages through:

- Deep understanding of local tax laws

- Established relationships with assessment offices

- Expertise in state-specific appeal procedures

- Custom solutions for regional market needs

Canada's Expanding Role in Property Tax Solutions

Canada’s property tax services market has its own unique features that make it different from other parts of the world.

Key Market Dynamics:

- Each province has the power to create its own tax policies, which leads to a wide range of service opportunities

- There is an increasing need for technology-based solutions to manage property taxes

- Complex assessment appeals require specialized knowledge

- Tax incentives for sustainable property development are becoming more important

The Canadian market benefits from a strong real estate industry and advanced property assessment systems. Property tax service providers are expanding their capabilities through:

- Integration of AI-driven valuation tools

- Development of province-specific compliance solutions

- Enhanced data analytics for appeal management

- Cross-border service coordination with U.S. operations

Strategic Growth Initiatives:

Canadian firms are implementing innovative approaches to capture market share:

- Digital transformation of traditional services

- Partnership development with local authorities

- Investment in specialized training programs

- Creation of customized solutions for different property types

The market shows particular strength in commercial and industrial property tax services. Major urban centers like Toronto, Vancouver, and Montreal drive substantial demand for professional property tax management.

Service Evolution:

Property tax service providers in Canada are adapting to changing market needs by:

- Offering real-time assessment monitoring

- Providing multilingual support services

- Developing specialized expertise in emerging property categories

- Creating integrated compliance management platforms

Canadian firms maintain a competitive edge through their deep understanding of local market conditions and strong relationships with municipal authorities. The growth trajectory of this market suggests that there will be continued expansion of service offerings and technological capabilities to meet the evolving needs of clients.

The U.K.'s Property Tax Services Landscape: Growth and Challenges

The U.K. property tax services market presents unique opportunities amid a complex regulatory environment. Recent market analysis reveals substantial growth potential, driven by increasing property values and evolving tax regulations.

Key Growth Drivers in the U.K. Market:

- Digital transformation of tax assessment processes

- Rising demand for specialized tax advisory services

- Integration of AI-powered valuation tools

- Growing need for cross-border tax expertise

The U.K.’s competitive landscape has experienced significant shifts, particularly with Ryan’s acquisition of Altus Group’s property tax services. This strategic move has reshaped market dynamics, creating new opportunities for service providers and clients alike.

Regulatory Challenges Facing U.K. Firms:

- Complex business rates system requiring specialized expertise

- Frequent policy changes affecting property valuations

- Brexit-related implications on cross-border property holdings

- Stringent compliance requirements for tax consultants

The U.K.’s property tax framework differs significantly from other markets, with business rates representing a substantial portion of local government funding. This system creates specific challenges for property owners and tax advisors:

“The U.K.’s business rates system generates approximately £25 billion annually, making it one of the highest property-based taxes in the developed world”

Local authorities’ increasing focus on digital transformation has sparked innovation in property tax services. Firms now offer advanced technological solutions for:

- Real-time property value monitoring

- Automated appeals management

- Digital documentation handling

- Predictive analytics for tax liability

The market has seen a surge in demand for specialized services, particularly in:

- Rate mitigation strategies

- Empty property relief

- Heritage property assessments

- Sustainable building tax incentives

These developments signal a transformative period in the U.K.’s property tax services sector, with technology and expertise driving market evolution.

The Future of Property Tax Services: What's Next?

The property tax services industry is about to undergo significant changes due to advancements in technology and shifting market demands. Here’s what you can expect in the coming years:

1. AI-Powered Assessment Tools

- Machine learning algorithms for accurate property valuations

- Automated tax liability predictions

- Real-time market value adjustments based on dynamic data

- Smart anomaly detection in assessment calculations

2. Blockchain Integration

- Transparent property ownership records

- Immutable transaction histories

- Automated smart contracts for tax payments

- Reduced fraud through decentralized verification

3. Digital Twin Technology

- Virtual replicas of physical properties

- Real-time monitoring of property conditions

- Precise valuation adjustments based on property changes

- Enhanced visualization for appeals processes

The market will see increased adoption of cloud-based platforms offering end-to-end property tax management solutions. These platforms will integrate with existing enterprise systems, creating seamless workflows for tax professionals and property owners.

Artificial Intelligence will play a crucial role in automating routine tasks, allowing tax professionals to focus on strategic advisory services. Machine learning algorithms will analyze historical data to identify patterns and predict future tax implications.

The rise of 5G technology will enable real-time property monitoring and instant updates to valuation models. This connectivity will support augmented reality applications for property inspections and remote assessments.

Cybersecurity measures will become increasingly sophisticated to protect sensitive property and tax data. Biometric authentication and advanced encryption will become standard features in property tax management systems.

Competitive Landscape: Leading Players and Key Strategies

Key Market Leaders:

1. Deloitte —— United States

2. KPMG —— Netherlands

3. PwC —— United Kingdom

4. Cherry Bekaert —— United States

5. Kroll, LLC —— United States

6. Moss Adams LLP —— United States

7. CohnReznick LLP —— United States

8. Baker Tilly —— United Kingdom

9. BDO USA, P.C. —— United States

10. Grant Thornton Advisors LLC —— United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Property Tax Services Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The property tax services market is at a crucial point of change, and it is expected to reach $8.3 billion by 2025. This growth is driven by several important factors:

- Technology Integration: Digital solutions reshape service delivery, with AI and automation becoming standard features

- Market Consolidation: Strategic acquisitions create stronger, more capable service providers

- Geographic Expansion: Key players extend their reach across the U.S., Canada, and U.K. markets

- Service Evolution: Advisory services gain prominence alongside traditional compliance offerings

The future success of the market depends on providers’ ability to:

- Adapt to changing regulatory landscapes

- Leverage data analytics for improved decision-making

- Deliver personalized solutions at scale

- Maintain compliance while driving innovation

The path forward demands a delicate balance between technological advancement and human expertise. Companies that successfully blend these elements will capture larger market shares and deliver enhanced value to their clients.

As property tax complexities increase across jurisdictions, the demand for specialized services continues to grow. The market’s expansion to $8.3 billion represents not just financial growth, but a fundamental shift in how property tax services are delivered and consumed globally.

Global Property Tax Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Property Tax Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Property Tax ServicesMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Property Tax Services players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Property Tax Services Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Property Tax Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Property Tax Services Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofProperty Tax Services Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected valuation of the property tax services market by 2025?

The property tax services market is projected to reach a valuation of $8.3 billion by 2025, indicating significant growth and expansion opportunities for stakeholders in this sector.

What are the upstream and downstream dynamics in property tax services?

Upstream dynamics refer to the processes involved in the creation and management of property tax services, while downstream dynamics focus on the delivery and implementation of these services to clients. Key players in each segment include technology providers, advisory firms, and local government agencies.

What trends are currently reshaping the property tax services market?

Key trends driving demand for property tax services include technology integration to enhance service delivery, an increasing need for advisory services, and a growing emphasis on compliance with regulatory frameworks globally.

What challenges does the property tax services market face due to regulatory constraints?

The property tax services market faces various regulatory challenges such as compliance issues and market barriers that can hinder growth. Firms must navigate complex regulatory environments that vary by region, which requires strategic planning and adaptation.

How do geopolitical factors influence the property tax services industry?

Geopolitical factors significantly impact market stability and growth potential within the property tax services industry. Economic conditions, policy changes, and international relations can affect property tax policies and ultimately influence service demand.

What are the key growth areas for property tax services in specific regions like the U.S., Canada, and the U.K.?

High-growth regions within the global property tax services market include the U.S., Canada, and the U.K. Each region presents unique opportunities driven by local market dynamics, policy impacts, and emerging service needs that shape their respective landscapes.