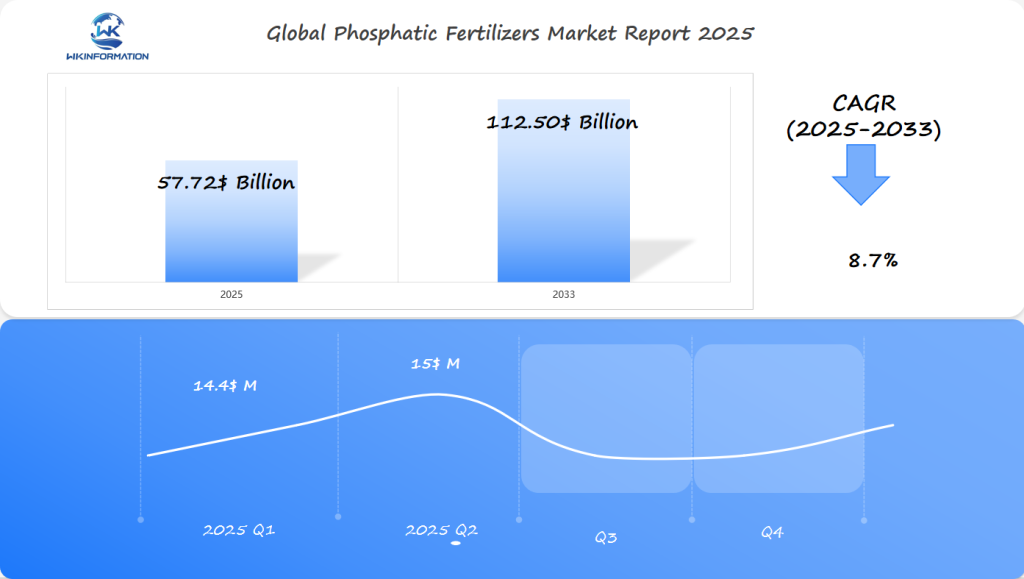

Phosphatic Fertilizers Market Forecast: $57.72 Billion Global Growth by 2025 with Key Insights from the U.S., China, and Brazil

Discover comprehensive insights into the global phosphatic fertilizers market trends, growth projections, and industry analysis from 2025-2033. This report examines key market drivers, technological innovations, regional dynamics, and environmental challenges shaping the future of agricultural fertilizers. Learn about market leaders, sustainable practices, and strategic opportunities in this essential agricultural sector.

- Last Updated:

Phosphatic Fertilizers Market Q1 and Q2 2025 Forecast

The Phosphatic Fertilizers market is projected to reach $57.72 billion in 2025, growing at a CAGR of 8.7% from 2025 to 2033. In Q1 2025, the market will likely generate approximately $14.4 billion, bolstered by strong agricultural activities in the U.S., China, and Brazil as these regions continue to face increasing demand for crop productivity and soil health improvements.

By Q2 2025, the market is expected to reach $15 billion, driven by the rising need for fertilizers to meet the growing global demand for food production. The U.S. and Brazil markets will continue to benefit from fertilizer subsidies and agriculture modernization, while China will remain a major consumer as it seeks to enhance its agriculture output and sustainability efforts.

The phosphatic fertilizers market will experience steady growth, particularly with the focus on efficient fertilizer use and environmentally sustainable practices in agriculture. The Brazilian and Chinese markets will continue to expand, driven by the demand for high-yield crops and improved agricultural efficiency.

Analyzing the Upstream and Downstream Industry Chain of Phosphatic Fertilizers

The phosphatic fertilizers industry operates through a complex network of upstream and downstream processes that shape market dynamics and product availability.

Upstream Production Process

- Mining of phosphate rock from deposits

- Beneficiation to remove impurities

- Chemical processing to create phosphoric acid

- Reaction with ammonia to produce final fertilizer products

The quality of raw materials directly impacts the final product’s effectiveness and market value. Phosphate rock mining operations concentrate in regions like Morocco, China, and the United States, creating strategic supply hubs.

Downstream Distribution Channels

- Traditional Offline SalesAgricultural cooperatives

- Local dealers and retailers

- Direct farm sales

- Wholesale distributors

- Digital Distribution MethodsE-commerce platforms

- Mobile apps for direct ordering

- Digital marketplaces

- Subscription-based delivery services

Market Dynamics and Pricing Factors

- Raw material availability

- Transportation costs

- Energy prices

- Seasonal demand fluctuations

- Regional agricultural cycles

Supply chain disruptions can trigger significant price volatility. When phosphate rock supplies tighten, manufacturers often adjust production schedules, leading to downstream price increases. Agricultural seasons create predictable demand patterns, with peak ordering periods typically occurring before planting seasons.

The integration of digital technologies has streamlined distribution processes, enabling real-time inventory management and faster order fulfillment. Manufacturers increasingly adopt hybrid distribution models, combining traditional dealer networks with direct-to-farm digital sales platforms.

Key Trends Shaping the Phosphatic Fertilizers Market

The global population surge drives unprecedented demand for phosphatic fertilizers. This demographic pressure creates a direct impact on crop production requirements, pushing farmers to adopt intensive agricultural practices.

Population-Driven Market Growth

- World population expected to reach 9.7 billion by 2050

- Rising middle class in developing nations demanding higher food quality

- Increased meat consumption requiring more grain for livestock feed

Technological Innovations

RhizoSorb technology represents a breakthrough in phosphatic fertilizer efficiency. This innovative solution reduces phosphorus application rates by up to 30% while maintaining crop yields. Similar emerging technologies include:

- Smart coating technologies for controlled nutrient release

- Precision agriculture systems for optimal fertilizer application

- Digital soil testing tools for accurate phosphorus measurement

Sustainability Initiatives

Environmental consciousness shapes modern fertilizer production practices:

- Circular economy approaches in phosphorus recovery

- Development of bio-based phosphatic fertilizers

- Integration of renewable energy in production processes

- Water-efficient manufacturing techniques

The industry’s shift toward sustainable practices includes phosphorus recycling from waste streams and the adoption of green manufacturing processes. These initiatives align with global environmental regulations while meeting growing market demands.

Understanding the Restrictions Impacting the Phosphatic Fertilizers Industry

The phosphatic fertilizers industry faces strict regulatory frameworks designed to protect environmental and public health. In the United States, the Environmental Protection Agency (EPA) enforces specific guidelines through the Clean Water Act, limiting phosphorus discharge levels and mandating waste management protocols.

Key regulatory standards include:

- Maximum phosphorus content restrictions in fertilizer formulations

- Mandatory environmental impact assessments

- Strict labeling requirements for product composition

- Regular facility inspections and compliance audits

Environmental concerns have sparked additional restrictions due to phosphorus runoff issues. When excess phosphorus enters water bodies, it triggers:

- Algal blooms in lakes and rivers

- Decreased oxygen levels in aquatic ecosystems

- Contamination of drinking water sources

- Damage to marine life populations

These regulations create significant challenges for manufacturers:

Cost Implications:

- Investment in pollution control equipment

- Higher operational expenses for compliance monitoring

- Increased research and development costs

- Additional waste treatment requirements

Production Limitations:

- Restrictions on raw material sourcing

- Constraints on production capacity

- Modified manufacturing processes

- Limited product formulation options

The Chinese market faces particularly stringent controls, with the government implementing a “zero-increase” policy for chemical fertilizer use, pushing manufacturers to develop more efficient products while maintaining profitability under these constraints.

Geopolitical Factors Affecting Phosphatic Fertilizer Production and Trade

Global phosphatic fertilizer markets are facing major disruptions due to geopolitical tensions. Recent conflicts between key producing countries have caused supply chain issues, resulting in price fluctuations and uncertainty in the market.

Trade Policy Impact

- Export restrictions imposed by major producers such as China and Russia have created artificial supply shortages.

- Import tariffs ranging from 15-30% in various regions are affecting market accessibility.

- Sanctions on specific countries are limiting their involvement in global phosphate trade.

Supply Chain Vulnerabilities

- Political disputes between Morocco and Western Sahara are impacting 70% of global phosphate rock reserves.

- Border closures during regional conflicts are causing delays of 2-3 months in shipments.

- Diplomatic tensions are influencing bilateral trade agreements for phosphate resources.

Regional Production Challenges

- Conflicts in the Middle East are disrupting transportation routes through the Suez Canal.

- Trade wars between major economies are leading to retaliatory measures that affect fertilizer commerce.

- Political instability in areas rich in phosphate is creating uncertainties in production.

Market Price Dynamics

- Geopolitical events can cause price spikes of 30-40% within weeks.

- Currency fluctuations in producing countries are impacting global market rates.

- Strategic stockpiling by nations during times of tension is creating artificial demand.

The interconnectedness of global phosphate markets makes them particularly vulnerable to international relations. Countries with significant phosphate reserves often use their resources as a means of diplomatic influence, while importing nations strive to diversify their sources of supply in order to mitigate geopolitical risks.

Exploring Phosphatic Fertilizers Market Segmentation by Type

The phosphatic fertilizers market features three primary product categories, each serving distinct agricultural needs:

1. Diammonium Phosphate (DAP)

- Highest phosphorus content (46% P2O5)

- Commands 45% market share globally

- Preferred for row crops and grain production

- Rapid nutrient release characteristics

- Ideal for alkaline soil conditions

2. Monoammonium Phosphate (MAP)

- Contains 52% phosphorus and 11% nitrogen

- Represents 35% of global market share

- Suitable for starter fertilizer applications

- Lower salt index than DAP

- Effective in both acidic and neutral soils

3. Superphosphate

- Available in single (SSP) and triple (TSP) formulations

- Holds 20% market share

- SSP: 16-20% phosphorus content

- TSP: 44-46% phosphorus content

- Popular in developing agricultural markets

Each fertilizer type demonstrates specific soil interaction patterns. DAP excels in broad-acre farming, while MAP proves invaluable for precision agriculture applications. Superphosphate variants offer cost-effective solutions for smaller-scale operations.

Recent market analysis reveals shifting preferences toward MAP products, particularly in regions adopting advanced farming techniques. This trend reflects growing demand for balanced nutrient profiles and enhanced crop-specific formulations.

The application spectrum spans diverse crop categories:

- Cereals: DAP dominates usage

- Fruits/Vegetables: MAP preferred

- Cash Crops: Combined MAP/DAP applications

- Specialty Crops: Custom superphosphate blends

The Role of Applications in Shaping Phosphatic Fertilizers Demand

Phosphatic fertilizers play a vital role across diverse agricultural applications, with demand patterns closely tied to specific crop requirements and growing seasons.

Key Crop Applications:

1. Cereals and Grains

- Rice cultivation requires significant phosphorus during the tillering stage

- Wheat demands peak phosphorus application during early growth phases

- Corn shows enhanced yield response with strategic phosphatic fertilizer timing

2. Oilseeds

- Soybeans utilize phosphorus for pod development and oil content

- Canola demonstrates improved seed quality with adequate phosphorus levels

- Sunflower crops require sustained phosphorus supply throughout growing season

3. Specialty Crops

- Fruit trees benefit from phosphorus for root development and fruit setting

- Vegetable crops show increased disease resistance with proper phosphorus levels

- Cotton relies on phosphatic fertilizers for boll development

The application timing varies significantly across these crop categories:

Pre-planting application: Essential for cereals and grains

Split application: Common in fruit and vegetable production

Maintenance application: Critical for perennial crops

Recent market data indicates cereals and grains account for 45% of global phosphatic fertilizer consumption, followed by oilseeds at 30%. Specialty crops, including fruits and vegetables, represent 25% of market demand, with regional variations based on crop patterns and soil conditions.

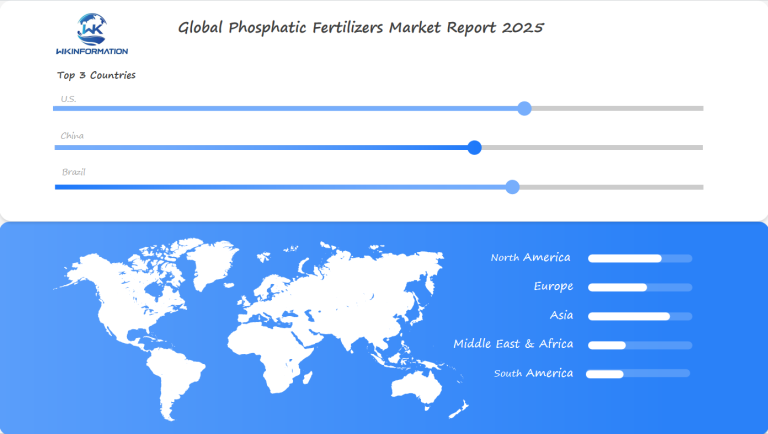

Regional Insights into the Global Phosphatic Fertilizers Market

The Asia-Pacific region is the leader in the global phosphatic fertilizers market, holding the largest market share. This dominance can be attributed to several factors:

- High Agricultural Activity: Countries like India and China are at the forefront of agricultural production.

- Population Density: The increasing demand for food drives up the usage of fertilizers.

- Government Support: Agricultural subsidies play a significant role in promoting fertilizer adoption.

North America: The Second-Largest Market

North America comes in second, with its own unique characteristics:

- Advanced farming technologies are widely used.

- Precision agriculture practices are highly adopted.

- Strong research and development initiatives are in place.

Key Regional Market Characteristics

Here are some key characteristics of the phosphatic fertilizers market in different regions:

Asia-Pacific

- Rapid industrialization of farming practices

- Rising disposable income driving food demand

- Extensive rice and wheat cultivation

North America

- Focus on sustainable agriculture

- Large-scale commercial farming operations

- Strong distribution networks

In-Depth Analysis Of The U.S., China And Brazil's Phosphate Fertilizer Markets

U.S. Phosphate Fertilizer Market

The U.S. phosphate fertilizer market demonstrates robust growth. Key industry players like OCP SA and Nutrien Ltd. dominate the competitive landscape through strategic partnerships and innovative product development. These companies maintain strong distribution networks across agricultural regions, serving both small-scale farmers and large commercial operations.

China’s Phosphate Fertilizer Sector

China’s phosphate fertilizer sector projects significant expansion. The Chinese government’s agricultural policies actively support:

- Increased fertilizer usage in rural areas

- Research and development initiatives

- Sustainable farming practices

- Technology integration in fertilizer production

Brazil’s Role in the Global Market

Brazil stands as a critical player in the global phosphate fertilizer market, driven by its extensive agricultural sector. The country’s consumption patterns reflect its position as a major producer of:

- Soybeans

- Corn

- Sugarcane

- Coffee

Brazilian farmers utilize approximately 5.5 million tonnes of phosphate fertilizers annually, with domestic production meeting roughly 60% of local demand. The remaining requirements are fulfilled through imports from major global suppliers.

Regional Influence on Global Markets

The agricultural powerhouse status of these three nations shapes regional market dynamics, influencing global pricing structures and trade patterns. Their combined market influence extends beyond domestic boundaries, affecting international supply chains and product innovation trajectories.

Trends and Growth in China's Phosphatic Fertilizers Industry

China’s phosphatic fertilizers industry is experiencing significant growth due to strategic initiatives and market forces. The country’s agricultural modernization programs have led to an increased demand for efficient phosphatic fertilizers.

Key Growth Drivers:

- Implementation of precision farming techniques

- Rising adoption of smart agriculture practices

- Government subsidies for fertilizer production

- Integration of digital technologies in fertilizer distribution

The Chinese market has unique consumption patterns, with a strong preference for customized fertilizer blends designed for specific crop needs. Local manufacturers have responded by creating formulations that cater to different soil conditions in various agricultural regions.

Innovation Trends:

- Development of slow-release phosphatic fertilizers

- Introduction of nano-enhanced fertilizer products

- Integration of bio-stimulants with traditional phosphates

- Advanced coating technologies for improved nutrient absorption

Chinese agricultural policies have created a favorable environment for domestic production of phosphatic fertilizers. The establishment of demonstration zones for modern agriculture has accelerated the adoption of advanced fertilizer technologies. These zones serve as testing grounds for new product formulations and application methods.

The market shows strong vertical integration, with major producers controlling operations from mining to distribution. This integration has strengthened supply chain resilience and enabled better price control mechanisms in the domestic market.

An Overview of Brazil's Agricultural Fertilizer Market

Brazil is a major player in global food production, and its agricultural sector has a significant need for phosphatic fertilizers. With its extensive farmlands and intensive farming practices, Brazil ranks among the top consumers of fertilizers worldwide.

Key Features of the Market:

- Brazil relies heavily on fertilizer imports, accounting for 85% of its total consumption.

- The country places a strong emphasis on soybean and corn production.

- Demand for fertilizers peaks seasonally during planting seasons.

The market for phosphatic fertilizers in Brazil presents both challenges and opportunities:

Challenges:

- Limited local reserves of phosphate rock

- Need for strategic investments in mining operations

- Desire for self-sufficiency in fertilizer production

Opportunities:

- Expansion of port infrastructure to facilitate imports

- Increased investments in domestic production facilities

- Adoption of precision agriculture techniques by Brazilian farmers

Recent developments in Brazil’s fertilizer industry include improvements in port infrastructure to support imports and greater investments in facilities for producing fertilizers within the country. The agricultural regions of Brazil, particularly Mato Grosso and Paraná, are major drivers of demand for phosphatic fertilizers.

Brazilian farmers have embraced precision agriculture methods to optimize their use of fertilizers, resulting in more efficient application techniques and higher crop yields. This shift towards technology has also influenced purchasing habits and preferences for fertilizer products in the local market.

Future Development Prospects For The Global Phosphate Fertilizer Market

The phosphatic fertilizers market is on the verge of a major technological transformation. Smart farming technologies are being integrated with fertilizer application systems, allowing for precision agriculture practices that optimize phosphorus usage. Here are some of the key innovations driving this change:

1. AI-Powered Application Systems

Advanced algorithms are being developed to predict the optimal rates at which fertilizers should be applied, taking into account factors such as soil conditions and crop requirements.

2. IoT Sensors

Real-time monitoring devices known as Internet of Things (IoT) sensors are being used to track phosphorus levels in the soil. This helps prevent over-application of fertilizers, ensuring that nutrients are used efficiently.

3. Nano-Enhanced Formulations

Researchers are working on developing phosphatic fertilizers at the nano-scale level. These nano-enhanced formulations have shown promise in improving nutrient absorption by plants.

Sustainability is also playing a crucial role in shaping new product development within the phosphatic fertilizers sector. Companies are investing in various initiatives aimed at reducing their environmental impact and promoting sustainable practices:

- Bio-based alternatives derived from organic waste materials

- Phosphorus recovery technologies that extract nutrients from wastewater treatment processes

- Controlled-release formulations designed to minimize nutrient losses and improve efficiency

As the market expands, it is increasingly aligning itself with circular economy principles:

“The industry’s future hinges on developing closed-loop systems where phosphorus waste becomes a valuable resource for new fertilizer production.”

Research initiatives are focusing on several key areas:

- Enhanced Efficiency Fertilizers (EEFs) that contain built-in inhibitors to reduce nutrient losses during application

- Microbial Technologies involving beneficial bacteria strains that enhance phosphorus availability to plants

- Smart Coating Materials with time-release mechanisms that synchronize nutrient delivery with specific crop growth stages

These technological advancements position the phosphatic fertilizers market for sustainable growth while addressing pressing environmental concerns and meeting demands for resource efficiency.

Competitive Landscape of the Phosphatic Fertilizers Industry

The phosphatic fertilizers market has several major players who influence the industry through strategic actions and their presence in the market.

Key Market Leaders:

1. Agrium Inc. —— Canada

2. California Organic Fertilizers Inc. —— United States

3. CF Industries Holdings Inc. —— United States

4. Chuanxi Xingda Chemical Plant —— China

5. Coromandel International Ltd. —— India

6. EuroChem —— Switzerland

7. Israel Chemicals Limited —— Israel

8. JESA —— Morocco

9. Minera Formas —— Mexico

10. Mosaic Co. —— United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Phosphatic Fertilizers Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The phosphatic fertilizers market is currently undergoing a significant transformation due to factors such as technological innovation, increasing demands for sustainability, and changing global agricultural needs. It is expected to grow to $57.72 billion by 2025, indicating strong market dynamics and untapped opportunities in various regions.

Key Market Dynamics:

- Rising global population pressures continue to drive demand for enhanced crop yields

- Technological advancements reshape production efficiency and environmental impact

- Regional markets show distinct growth patterns, with Asia-Pacific leading the expansion

The future success of the industry depends on:

- Sustainable Practices

- Development of eco-friendly fertilizer alternatives*

- Implementation of precision agriculture techniques*

- Reduction of phosphorus runoff and environmental impact*

- Market Adaptability

- Response to changing regulatory landscapes*

- Integration of digital solutions in distribution*

- Balance between productivity and environmental stewardship*

- Strategic Growth

- Investment in research and development*

- Expansion into emerging markets*

- Strengthening of supply chain resilience*

The phosphatic fertilizers market is crucial for ensuring global food security and improving agricultural productivity. Companies that embrace innovation, prioritize sustainability, and remain flexible in their operations will be better positioned to seize growth opportunities in this evolving market landscape.

Global Phosphatic Fertilizers Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Phosphatic Fertilizers Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Phosphatic FertilizersMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Phosphatic Fertilizers players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Phosphatic Fertilizers Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Phosphatic Fertilizers Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Phosphatic Fertilizers Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPhosphatic Fertilizers Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the significance of the phosphatic fertilizers market in agriculture?

The phosphatic fertilizers market plays a crucial role in supporting agricultural productivity by providing essential nutrients that enhance crop growth and yield. These fertilizers are vital for meeting the increasing global food demand driven by population growth.

What are the projected growth statistics for the global phosphatic fertilizers market from 2025 to 2033?

The global phosphatic fertilizers market is expected to experience significant growth, with projections indicating an increase from $57.72 billion in 2025 to approximately $112.50 billion by 2033, driven by rising agricultural demands and technological advancements.

How do upstream and downstream processes impact the phosphatic fertilizers market?

Upstream processes involve raw material sourcing and production techniques that affect the availability and cost of phosphatic fertilizers. Downstream distribution channels, including online and offline sales methods, influence how these products reach consumers, impacting overall market dynamics and pricing.

What are the key trends shaping the phosphatic fertilizers market today?

Key trends include rising crop production demands due to population growth, technological innovations enhancing fertilizer efficiency, such as RhizoSorb, and sustainability practices influencing production methods within the industry.

What regulatory restrictions impact the phosphatic fertilizers industry?

Regulatory frameworks govern phosphatic fertilizer production, focusing on environmental standards to mitigate risks such as water pollution from phosphorus application. Manufacturers face challenges related to compliance costs and limitations on product formulations due to these regulations.

How do geopolitical factors affect the production and trade of phosphatic fertilizers?

Geopolitical tensions can disrupt fertilizer supply chains, impacting pricing dynamics. Trade policies like tariffs or export restrictions shape global trade patterns for phosphatic fertilizers, while regional conflicts may hinder production capacities in affected areas.