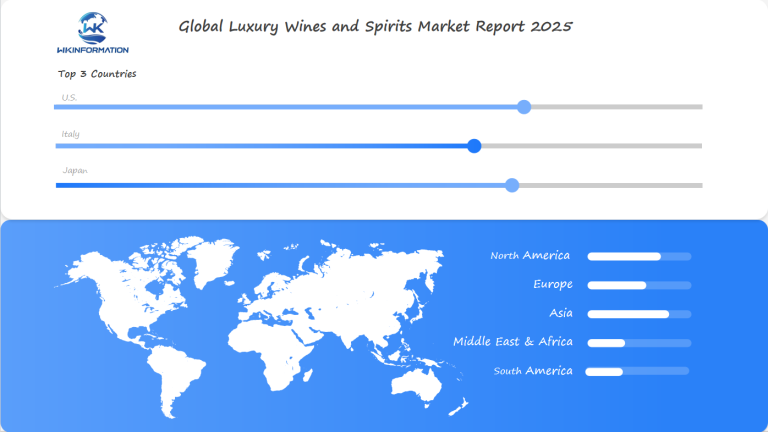

Luxury Wines and Spirits Market Projection: $273.88 Billion Global Growth by 2025 with Key Insights from the U.S., Italy, and Japan

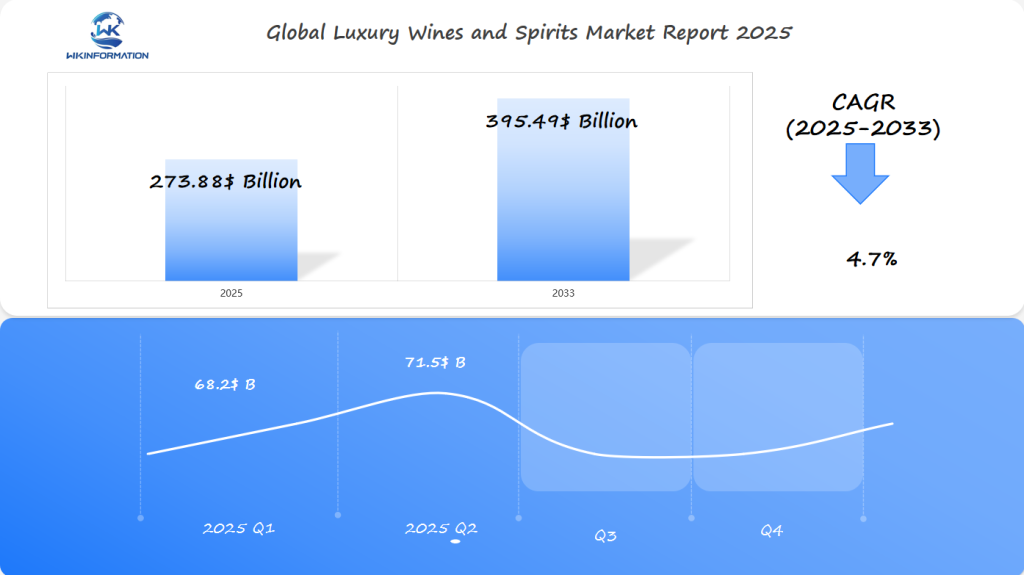

As of 2025, the global luxury wines and spirits market is estimated to reach a value of approximately USD 273.88 billion, with projections indicating growth to USD 395.49 billion by 2033 at a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2033. This growth is driven by increasing consumer demand for high-end, distinctive products, as well as a rising interest in premium alcoholic beverages across various demographics and regions. The market is particularly influenced by trends in e-commerce, which enhance accessibility to luxury items, and the growing affluence of consumers, especially in emerging markets.

- Last Updated:

Luxury Wines and Spirits Market Q1 and Q2 2025 Forecast

The Luxury Wines and Spirits market, forecast to reach $273.88 billion in 2025, is expected to grow at a CAGR of 4.7% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $68.2 billion, driven by strong demand in the U.S., Italy, and Japan for high-end wines, whiskeys, champagnes, and other premium spirits.

By Q2 2025, the market is expected to reach $71.5 billion, with continued growth fueled by an increasing number of affluent consumers in key markets, particularly in the U.S. and Japan, where luxury spending is robust. The Italy market will continue to benefit from the growing demand for Italian wines and regional spirits as international recognition grows.

The luxury wines and spirits market will continue its growth trajectory, driven by premiumization trends, increased disposable income in key regions, and the growing desire for exclusive, limited-edition products.

Analyzing the Upstream and Downstream Industry Chain of Luxury Wines and Spirits

The luxury wines and spirits industry chain operates through intricate upstream and downstream processes that ensure product excellence and market success.

Upstream Activities: Raw Materials Excellence

- Premium grape varieties from renowned vineyards

- High-grade grains and botanicals for spirits production

- Specialized aging barrels and storage facilities

- Quality water sources and filtration systems

Production Processes

- Traditional distillation methods

- Extended aging periods

- Strict quality control measures

- Master blenders’ expertise

- Small-batch production runs

Downstream Operations

- Specialized packaging and labeling

- Temperature-controlled transportation

- Direct-to-consumer channels

- High-end retail partnerships

- Exclusive distribution agreements

The supply chain efficiency directly impacts product quality and market positioning. Luxury brands maintain strict control over their distribution networks to protect brand exclusivity and authenticity. Many premium spirits producers work with selected importers and distributors who understand proper handling requirements and target market dynamics.

Supply chain transparency has become increasingly important, with luxury brands implementing tracking systems from source to sale. These systems help combat counterfeiting while providing consumers with detailed product information. The rise of digital platforms has created new opportunities for direct consumer engagement, allowing brands to share production stories and build stronger relationships with their audience.

Key Trends Shaping the Luxury Wines and Spirits Market

The luxury wines and spirits market is undergoing a major change due to shifting consumer preferences and demographic changes. Premiumization has become a key driving force, with consumers willing to pay more for high-quality, exclusive products that provide unique experiences and serve as status symbols.

Premium product offerings now include:

- Single-barrel selections

- Limited batch releases

- Aged varieties

- Craft distillations

- Rare vintage wines

Millennial and Gen Z consumers are reshaping market dynamics through their distinct preferences and purchasing behaviors. These younger demographics show strong interest in:

- Ready-to-drink cocktails

- Sustainable production methods

- Digital purchasing platforms

- Brand storytelling

- Social media-worthy packaging

The market has adapted to meet these evolving demands with innovative product launches featuring:

Sustainable Packaging Solutions

- Recyclable materials

- Eco-friendly designs

- Reduced carbon footprint

Unique Flavor Profiles

- Botanical infusions

- Regional taste variations

- Experimental aging processes

Limited Edition Collections

- Artist collaborations

- Seasonal releases

- Exclusive brand partnerships

The rise of direct-to-consumer sales channels has created new opportunities for brands to connect with luxury consumers, offering personalized experiences and exclusive access to premium products.

Understanding the Restrictions Impacting the Luxury Wines and Spirits Industry

The luxury wines and spirits industry faces significant regulatory challenges that shape its operational landscape. Each region implements distinct production requirements, creating a complex web of compliance standards:

Key Regional Regulations:

- EU regulations mandate specific grape varieties and production methods for premium wines

- U.S. three-tier distribution system restricts direct-to-consumer sales

- Japanese alcohol tax laws impose higher rates on imported luxury spirits

Production costs present substantial barriers for new market entrants. A single barrel of premium whiskey requires:

- $10,000-15,000 initial investment

- 5-12 years aging period

- Specialized storage facilities

- Expert craftspeople

These high operational expenses directly influence pricing strategies. Luxury brands must balance:

- Raw material costs (premium grapes, rare botanicals)

- Storage and aging expenses

- Distribution and marketing investments

- Regulatory compliance costs

The regulatory environment impacts consumer accessibility through:

- Limited distribution channels

- Age restrictions

- Import/export quotas

- Marketing limitations

Recent changes in global trade policies have intensified these challenges. The implementation of new tariffs in key markets has forced luxury brands to adjust their pricing structures, affecting their market penetration strategies and profit margins.

Small-batch producers face particular difficulties navigating these restrictions, leading to market consolidation as larger companies acquire boutique brands to maintain their competitive edge.

Geopolitical Factors Affecting the Global Alcohol Trade

Trade policies shape the landscape of luxury wines and spirits distribution across international markets. Recent shifts in global relations have created significant impacts on the industry’s trade dynamics:

Brexit’s Impact on Wine Trade

- UK’s separation from EU resulted in new tariffs on European wines

- Additional documentation requirements increased costs by 10-15%

- British merchants report 30% decrease in EU wine imports since 2021

U.S.-China Trade Relations

- 25% tariffs on American spirits entering Chinese markets

- Reduced exports of premium bourbon and whiskey by 40%

- Shift in Chinese consumer preferences toward domestic alternatives

Russia-Ukraine Conflict Effects

- Disruption of grain supply chains affecting spirit production

- Ban on Russian vodka imports in Western markets

- Redistribution of market share to neutral-country producers

Regional Trade Agreements

- CPTPP benefits for Japanese whisky exports

- EU-Japan Economic Partnership boosting European wine sales

- Latin American trade pacts opening new luxury spirit corridors

Current diplomatic tensions between major trading partners continue to reshape distribution networks. Luxury brands adapt through:

- Diversification of production locations

- Strategic stockpiling in key markets

- Development of alternative supply routes

- Investment in local production facilities

These adaptations create resilience against geopolitical uncertainties while maintaining market presence in affected regions.

Exploring Luxury Wines and Spirits Market Segmentation by Type

The luxury wines and spirits market divides into two primary segments: premium wines and high-end spirits. Each category presents unique characteristics and market dynamics.

Luxury Wines Segment

- Red Wines: Dominate with 45% market share

- White Wines: Hold 30% market share

- Sparkling Wines: Represent 15% market share

- Rosé and Other Varieties: Account for 10% market share

Premium Spirits Categories

- Whisky/Whiskey: 35% market share

- Single Malt Scotch

- Premium Bourbon

- Japanese Whisky

- Cognac/Brandy: 25% market share

- Vodka: 20% market share

- Rum: 12% market share

- Gin: 8% market share

The whisky segment leads the spirits category, driven by collector demand and investment potential. Premium vodka brands have gained significant traction through innovative marketing and luxury positioning. Cognac maintains strong performance in Asian markets, particularly China.

Market data indicates a shift in consumer preferences toward aged spirits and reserve wines. Limited-edition releases and vintage collections command premium prices, with some rare whisky expressions selling for $100,000+ per bottle. Japanese whisky has emerged as a significant player, with brands like Yamazaki and Hibiki achieving record auction prices.

The wine segment sees strong performance from prestigious regions such as Bordeaux, Burgundy, and Champagne. Rare vintages and small-production wines create high-value opportunities for collectors and investors.

The Role of Applications in Shaping Luxury Wines and Spirits Demand

Digital applications are changing the way consumers interact with luxury wines and spirits, leading to new buying habits and consumption patterns. Mobile apps focused on discovering wines and spirits are helping users:

- Track their personal collections

- Rate and review high-end beverages

- Access expert tasting notes

- Receive tailored recommendations

- Verify the authenticity of products

Direct-to-Consumer (DTC) Applications

The emergence of DTC apps allows luxury brands to bypass traditional distribution methods, providing:

- Limited edition releases

- Exclusive membership access

- Virtual tasting experiences

- Premium concierge services

Smart Label Technology

NFC-enabled labels and QR codes embedded in luxury spirits offer:

- Product authentication

- Detailed production information

- Food pairing suggestions

- Brand storytelling experiences

Social Sharing Platforms

Specialized social networks for wine and spirit lovers are driving demand through:

- User-generated content

- Expert recommendations

- Virtual collecting communities

- Real-time auction participation

These digital tools are fostering a more involved consumer base, with 73% of luxury spirit buyers utilizing at least one specialized app throughout their purchasing journey. The incorporation of AR and VR technologies is further enhancing the digital experience, enabling consumers to virtually explore distilleries and vineyards prior to making high-end purchases.

Regional Insights into the Global Luxury Wines and Spirits Market

The global luxury wines and spirits market displays distinct regional characteristics across North America, Europe, and Asia Pacific, each shaped by unique consumer preferences and distribution strategies.

North America

- Dominates the global market with a strong preference for premium spirits

- Direct-to-consumer sales through digital platforms show significant growth

- High emphasis on craft spirits and artisanal production methods

Europe

- Traditional wine consumption culture drives market stability

- Strong focus on heritage brands and appellations of origin

- Well-established distribution networks through specialized retailers

- Premium on-trade channels remain crucial for market penetration

Asia Pacific

- Rapid growth driven by rising disposable incomes

- Gift-giving culture fuels luxury spirits purchases

- Strong e-commerce presence, particularly in China and South Korea

- Growing appreciation for wine education and tasting experiences

The distribution landscape varies significantly across regions:

- North America relies heavily on the three-tier distribution system

- Europe maintains a mix of traditional retailers and direct sales

- Asia Pacific sees strong growth in digital marketplace platforms

Consumer behavior patterns show marked regional differences:

- North American consumers prioritize brand recognition and exclusivity

- European buyers focus on provenance and traditional production methods

- Asian Pacific customers value packaging presentation and limited editions

These regional distinctions create unique opportunities for market players to tailor their strategies to local preferences while maintaining global brand consistency.

In-Depth Analysis of Key Markets: U.S., Italy, and Japan

U.S. Luxury Wines and Spirits Market

The U.S. luxury wines and spirits market is a major player in global consumption. It has unique preferences in different regions and well-established distribution networks. American consumers are increasingly showing interest in high-quality spirits, especially in cities like New York, Los Angeles, and Miami.

Key Factors Driving the U.S. Market

- More disposable income for millennials

- Growing popularity of craft spirits

- Expansion of direct-to-consumer sales channels

- Increase in premium retail locations

LVMH and Diageo, two industry leaders, dominate the U.S. market and control about 40% of the luxury segment. These companies utilize extensive distribution networks and strategic partnerships with upscale retailers to maintain their position in the market.

Distribution Breakdown

- Specialized luxury retailers: 35%

- High-end restaurants and bars: 28%

- Direct-to-consumer channels: 22%

- Other retail outlets: 15%

Importers and exporters play a vital role in the U.S. market. Companies such as Southern Glazer’s Wine & Spirits and Republic National Distributing Company manage complex supply chains by connecting international suppliers with local retailers. This ensures that products are readily available in different states, even with varying regulations.

Recent market data shows that U.S. consumers are shifting towards premium tequila and Japanese whisky, with sales increasing by 15% each year. As a response to this trend, major players are expanding their premium offerings through strategic acquisitions and new product launches.

Trends and Growth in Italy's Wine and Spirits Industry

Italy’s wine and spirits industry is experiencing significant growth, thanks to its rich history of grape cultivation and innovative production techniques. The luxury wine sector in the country is growing at an impressive 5.2% per year, with high-end brands gaining a larger share of the market.

Key Growth Indicators:

- Prosecco Production: Premium Prosecco sales have increased by 15% year-over-year

- Super Tuscans: Limited edition releases from prestigious vineyards command prices exceeding €500 per bottle

- Craft Spirits: Small-batch distilleries report 20% growth in luxury spirit production

The Italian luxury spirits market has embraced sustainability practices, with 75% of premium producers implementing eco-friendly packaging solutions. Traditional family-owned distilleries blend centuries-old techniques with modern technology, creating unique product offerings that appeal to luxury consumers.

Market Innovations:

- Integration of blockchain technology for authenticity verification

- Adoption of organic and biodynamic farming practices

- Development of exclusive wine tourism experiences

Regional denominations like Barolo and Brunello di Montalcino maintain their prestigious status while exploring new market opportunities through digital platforms and direct-to-consumer channels. Italian luxury brands leverage their heritage status to capture emerging markets, particularly in Asia Pacific regions where Italian wines represent 30% of premium wine imports.

An Overview of Japan's Luxury Spirits Market

Japan’s luxury spirits market is a fascinating mix of traditional preferences and changing consumer tastes. The market shows a strong love for high-quality whisky, with Japanese distilleries like Suntory and Nikka gaining worldwide recognition for their outstanding products.

Key Features of Japan’s Luxury Spirits Market

Here are some key features that define Japan’s luxury spirits market:

- Whisky Takes the Lead: Japanese whisky is in high demand and commands premium prices, with rare bottles selling for thousands of dollars at auctions.

- Craft Gin Revival: Local distilleries are experiencing a revival by producing unique gins that incorporate Japanese botanicals such as yuzu and sakura.

- Premium Sake Expansion: Traditional sake producers are entering the luxury segment by introducing aged and limited-edition releases.

Preferences of Japanese Consumers

The Japanese consumers have sophisticated preferences when it comes to luxury spirits:

- They place great importance on the authenticity and craftsmanship of the product.

- They are willing to spend money on rare and limited-edition releases.

- There is a growing interest in luxury ready-to-drink cocktails.

Distribution Channels in Japan

Distribution channels in Japan maintain strict quality standards to ensure that luxury spirits are delivered to consumers in the best possible condition:

- Department stores have dedicated sections for luxury spirits.

- Specialized liquor shops provide personalized customer service.

- Exclusive membership clubs offer direct-to-consumer sales.

Recent Developments in the Market

There have been some recent developments in the Japanese luxury spirits market:

- Partnerships between Japanese distilleries and international luxury brands have resulted in unique products that combine Japanese craftsmanship with global appeal.

- There is an increase in investment towards aging facilities and premium packaging solutions to meet the rising demand both domestically and internationally.

Future Development Prospects for Luxury Wines and Spirits: Innovations Shaping Tomorrow's Offerings

Market forecasts predict the luxury wines and spirits sector will experience substantial growth through 2033, driven by innovative product developments and shifting consumer preferences. The projected CAGR of 4.7% signals robust expansion opportunities across global markets.

Key Growth Drivers:

- Digital integration in production processes

- Sustainable packaging solutions

- Personalized product offerings

- Smart bottle technology

- Blockchain-based authenticity verification

Untapped markets in Africa and South America present significant investment potential. South Africa’s wine industry shows promising growth, while Brazil’s expanding middle class creates new opportunities for luxury spirit brands.

Innovative Product Development:

- Zero-alcohol premium spirits

- CBD-infused luxury beverages

- Bio-engineered alternatives

- Craft spirits with local ingredients

- AI-powered flavor combinations

Brands are investing heavily in research and development to meet evolving consumer demands. The rise of health-conscious consumers has sparked development in premium non-alcoholic alternatives, with companies like Diageo launching alcohol-free versions of popular spirits.

Emerging Market Opportunities:

- Direct-to-consumer platforms

- Virtual tasting experiences

- NFT-linked limited editions

- Sustainable production methods

- Augmented reality packaging

These innovations reshape traditional consumption patterns while maintaining the exclusivity associated with luxury brands. The integration of technology enhances both production efficiency and consumer engagement, creating new revenue streams for industry players.

Competitive Landscape of the Luxury Wines and Spirits Industry: Strategies for Success

The luxury wines and spirits industry features several dominant players shaping market dynamics through strategic initiatives and brand positioning.

1. LVMH Moët Hennessy Louis Vuitton —— France

2. Diageo —— UK

3. Pernod Ricard —— France

4. Rémy Cointreau —— France

5. Bacardi Limited —— Bermuda

6. Brown-Forman Corporation —— USA

7. The Edrington Group —— UK

8. Constellation Brands —— USA

9. Campari Group —— Italy

10. Beam Suntory —— USA (subsidiary of Suntory Holdings, Japan)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Luxury Wines and Spirits Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Consumers are increasingly favoring artisanal blends, which offer unique flavors and exclusive products. This shift in preference is prompting brands to introduce limited editions and craft-focused selections.

Industry players are likely to take advantage of these changing trends by expanding their product offerings with exclusive, high-quality options. As markets mature, understanding consumer preferences for authenticity and craftsmanship will be crucial in gaining market share. Additionally, emphasizing sustainability and authenticity can attract environmentally conscious consumers, aligning with global consumption patterns.

The future of the luxury wines and spirits market will involve a combination of traditional luxury values and modern consumer expectations, creating opportunities for innovative growth strategies.

Global Luxury Wines and Spirits Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Luxury Wines and Spirits Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Luxury Wines and SpiritsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Luxury Wines and Spiritsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Luxury Wines and Spirits Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Luxury Wines and Spirits Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Luxury Wines and Spirits Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Luxury Wines and SpiritsMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current state of the luxury wines and spirits market?

The luxury wines and spirits market is experiencing significant growth, with key insights emerging from major markets like the U.S., Italy, and Japan. Market projections indicate a robust future driven by premiumization trends and evolving consumer preferences.

How do upstream and downstream activities impact the luxury wines and spirits industry?

Upstream activities involve raw materials sourcing, which is crucial for maintaining product quality. Downstream activities encompass distribution and retail, shaping market dynamics. Supply chain efficiency is vital for ensuring the exclusivity and quality that consumers expect from luxury products.

What are the key trends influencing consumer behavior in the luxury wines and spirits market?

Key trends include premiumization, where consumers seek higher-quality offerings, as well as a growing influence from younger demographics who favor unique flavors, sustainable packaging, and limited-edition releases.

What regulatory challenges does the luxury wines and spirits industry face?

The industry faces strict regulatory frameworks that affect production practices across different regions. High production costs pose barriers to entry for new players, while regulations can impact pricing strategies and consumer accessibility.

How do geopolitical factors affect the global trade of luxury wines and spirits?

Geopolitical factors such as trade policies and tariffs significantly influence imports and exports of luxury wines and spirits. Tensions between countries can alter trade dynamics, impacting market availability and pricing.

What are the future development prospects for the luxury wines and spirits market?

Future development prospects look promising with forecasts indicating growth through 2030. Innovations such as non-alcoholic alternatives are being explored to meet evolving consumer demands, alongside potential investment opportunities in untapped markets like Africa and South America.