$6.38 Billion Freight & Logistics Market Poised for Breakthrough in the U.S., Germany, and China by 2025

Comprehensive analysis of the global freight and logistics market from 2025-2033, exploring market dynamics, technological advancements, and industry trends. Discover key growth drivers, regional insights, and emerging opportunities in connected logistics, e-commerce impact, and sustainable practices. Essential reading for stakeholders seeking strategic market understanding.

- Last Updated:

Freight and Logistics Market Q1 and Q2 2025 Forecast

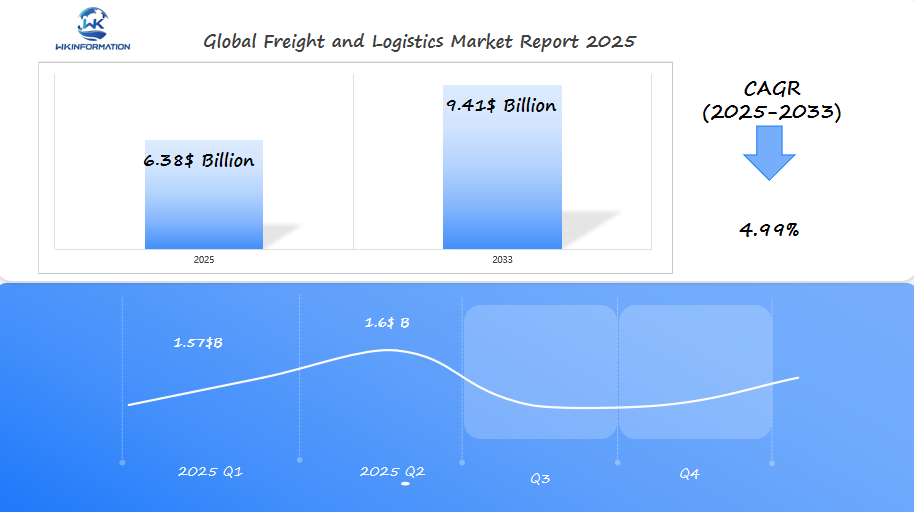

The Freight and Logistics market is projected to reach $6.38 billion in 2025, with a CAGR of 4.99% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $1.57 billion, driven by the rapid expansion of e-commerce logistics, cross-border trade, and smart supply chain solutions in the U.S., Germany, and China. The growth of autonomous trucking, AI-powered route optimization, and warehouse automation is shaping the industry.

By Q2 2025, the market is projected to reach $1.6 billion, fueled by increasing investments in green logistics, digital freight platforms, and last-mile delivery innovations. The U.S. dominates with high freight volume and advanced logistics networks, Germany leads in efficient transport infrastructure, and China remains a key driver with its Belt and Road Initiative (BRI) expansion.

With the adoption of blockchain for supply chain transparency, electric vehicle fleets, and AI-driven predictive analytics, the freight and logistics sector is set for transformative growth, enhancing efficiency and sustainability in global trade.

How Freight and Logistics Power Global Trade: A Deep Dive into the Upstream and Downstream Industry Chains

The freight and logistics industry operates through interconnected upstream and downstream chains that drive global trade efficiency. Understanding these chains is crucial for businesses aiming to optimize their supply chain operations.

Upstream Industry Chains

Upstream Industry Chains encompass:

- Raw material sourcing

- Manufacturing processes

- Initial transportation from production sites

- Warehouse management systems

- Supplier relationship management

Downstream Industry Chains

Downstream Industry Chains include:

- Distribution networks

- Retail logistics

- Last-mile delivery

- Customer service operations

- Return logistics management

A prime example of successful supply chain integration comes from Apple’s logistics network. The tech giant manages over 200 suppliers across 43 countries, demonstrating the power of coordinated upstream and downstream operations. Their system enables just-in-time manufacturing while maintaining product availability worldwide.

The role of freight in international trade becomes evident through these integrated chains. Modern freight systems connect manufacturers to consumers across continents, enabling:

- Real-time shipment tracking

- Cost-effective transportation options

- Flexible routing solutions

- Seamless customs clearance

- Integrated inventory management

The success of companies like Amazon highlights the importance of mastering both upstream and downstream logistics. Their investment in fulfillment centers, delivery fleets, and supplier relationships has created a logistics ecosystem that sets industry standards for efficiency and reliability.

Key Market Trends Driving Innovation in Freight and Logistics

The freight and logistics industry is undergoing a significant transformation due to technological advancements. AI-powered transportation management systems are now able to optimize route planning and delivery schedules in real-time, resulting in operational cost savings of up to 20%.

Key Innovations Reshaping the Industry

Several key innovations are reshaping the freight and logistics industry:

- Autonomous Vehicles: Self-driving trucks and delivery drones are streamlining last-mile operations.

- Blockchain Technology: Supply chain documentation is benefiting from enhanced transparency and security.

- IoT Sensors: Shipment conditions can now be tracked and monitored in real-time.

- Predictive Analytics: Demand forecasting and inventory optimization are being improved.

How Data Analytics Platforms Are Revolutionizing Supply Chain Efficiency

Data analytics platforms have brought about a revolution in supply chain efficiency through various means:

- Delivery times have been reduced by 15-20%.

- Warehouse management has been enhanced.

- Fleet utilization rates have improved.

- Fuel consumption has decreased.

The Role of Predictive Modeling in Logistics

The integration of predictive modeling is proving to be beneficial for logistics companies in multiple ways:

- Potential disruptions can be anticipated.

- Inventory levels can be optimized.

- Pricing strategies can be adjusted dynamically.

- Maintenance schedules can be planned proactively.

The Impact of Technological Advancements on Warehouse Automation

Technological advancements have led to a surge of innovation in warehouse automation. Smart warehouses that are equipped with robotic systems and AI-driven inventory management are now able to process orders 50% faster than traditional facilities.

The Rise of API-First Platforms

The emergence of API-first platforms has facilitated seamless integration between various logistics services. This has resulted in real-time data exchange and improved coordination among supply chain partners, leading to faster decision-making and greater operational flexibility in an increasingly complex global market.

Logistical Challenges and Bottlenecks Affecting Market Growth

The Freight and Logistics Market faces significant operational hurdles that impact efficiency and growth. Here are the key challenges disrupting the industry:

1. Infrastructure Limitations

- Aging port facilities unable to handle increased cargo volumes

- Limited warehouse space in prime locations

- Outdated rail networks struggling with modern freight demands

- Insufficient cold storage facilities for temperature-sensitive goods

2. Recent Market Disruptions

- Red Sea shipping crisis causing 10-14 day route diversions

- Port congestion in major Asian hubs increasing wait times by 300%

- Container shortages driving up spot rates by 200% on key routes

- Labor strikes affecting European port operations

3. Strategic Solutions

- Implementation of 24/7 port operations to reduce congestion

- Investment in digital twin technology for predictive maintenance

- Development of alternative shipping routes and transport modes

- Creation of regional distribution networks to spread capacity

Companies are adopting real-time tracking systems to identify potential bottlenecks before they escalate. The integration of AI-powered logistics platforms helps optimize route planning and resource allocation, reducing the impact of disruptions. Smart warehousing solutions, including automated storage and retrieval systems, are being deployed to maximize limited space and improve throughput efficiency.

Geopolitical Factors Reshaping Freight and Logistics Networks

Global shipping networks are facing major disruptions due to increasing geopolitical tensions. A recent example is the Red Sea crisis, which has forced ships to take longer routes around Africa’s Cape of Good Hope, adding 14 days to their usual travel times.

Key Regional Impacts:

- Middle East tensions have caused shipping insurance premiums to rise by 300%

- The conflict between Ukraine and Russia has disrupted grain transportation in the Black Sea region

- US-China trade relations are affecting the pricing of transpacific shipping routes

Red Sea Crisis Case Study:

“Container spot rates from Asia to Northern Europe jumped from $1,500 to $5,000 per forty-foot equivalent unit (FEU) in January 2024, directly linked to Red Sea diversions.” – Maritime Industry Report

The drought affecting the Panama Canal has worsened these problems, leading to a 40% decrease in vessel capacity and causing further disruptions in global supply chains. In response, companies are finding new ways to transport goods by using multiple modes of transportation, expanding warehouses in different regions, and diversifying their supply chains.

Political instability in important logistics hubs continues to change traditional shipping routes. The Belt and Road Initiative is facing increased scrutiny as countries reevaluate their reliance on single-source supply chains. Concerns about maritime security have also led to more investment in alternative routes and transportation methods, especially in Southeast Asian areas.

These geopolitical changes are resulting in lasting shifts in global logistics patterns, with companies placing a higher priority on making their supply chains more resilient rather than solely focusing on reducing costs.

Understanding Freight and Logistics Categories: Market Differentiation and Scope

The freight and logistics market has different segments, each catering to specific business requirements:

1. Core Transportation Segments

- Air Freight: Rapid delivery for time-sensitive cargo

- Ocean Freight: Cost-effective bulk shipping

- Road Transport: Flexible door-to-door delivery

- Rail Freight: Efficient land-based bulk transportation

2. Service Categories

- Freight Forwarding: Coordination of shipments between origin and destination

- Warehousing Services: Storage, inventory management, distribution

- Value-Added Services: Packaging, labeling, customs clearance

Understanding these categories is essential for businesses to optimize their supply chain operations. For instance:

- A manufacturer might use ocean freight for transporting raw materials and air freight for delivering finished products.

- An e-commerce company could prioritize warehousing services and focus on efficient last-mile delivery.

Service differentiation is crucial for companies to remain competitive in the market. While global players like DHL provide specialized solutions such as temperature-controlled shipping for pharmaceuticals, regional companies may excel in local distribution networks.

The integration of various services leads to the creation of comprehensive logistics solutions:

- Cross-docking facilities that connect different modes of transport

- Multi-modal transport combinations

- Custom warehousing solutions with real-time inventory tracking

- Specialized handling techniques tailored to meet industry-specific requirements

These categories are constantly evolving in response to market demands, presenting new opportunities for service providers and enhancing efficiency for clients.

Expanding Applications of Freight and Logistics in Modern Industry

The rise of e-commerce has transformed freight and logistics applications in various industries. Amazon’s same-day delivery model has set new standards, forcing retailers to adjust their supply chains for quick order fulfillment. This change has led to an increase in specialized logistics services designed specifically for online retail.

Last-Mile Delivery Solutions

Last-mile delivery solutions are now crucial for ensuring customer satisfaction. Companies like DoorDash and Instacart have raised the bar for local delivery expectations by offering:

- Real-time tracking capabilities

- Flexible delivery windows

- Contactless delivery options

- Integration with retail point-of-sale systems

Cold Chain Logistics Innovations

Cold chain logistics, which involves transporting temperature-sensitive products, has also seen significant advancements. This is particularly true in the pharmaceutical and food delivery sectors where maintaining specific temperatures is critical. Some notable innovations include:

Temperature-Controlled Solutions

- Smart containers equipped with Internet of Things (IoT) sensors

- Blockchain technology used for temperature monitoring

- Artificial intelligence (AI) algorithms optimizing routes for perishable goods

- Environmentally-friendly cooling methods being implemented

The Importance of Logistics in Healthcare

The healthcare industry showcases the vital role that modern logistics applications play. The distribution of COVID-19 vaccines emphasized the need for precise temperature controls throughout the entire supply chain process. For instance, Pfizer developed specialized shipping containers capable of sustaining temperatures as low as -70°C, thereby establishing new benchmarks for pharmaceutical logistics.

E-commerce Giants Driving Change

E-commerce leaders are pushing the boundaries of logistics through innovative strategies such as:

- Implementing automated systems in warehouses

- Conducting trials with drone deliveries

- Setting up micro-fulfillment centers closer to urban areas

- Creating networks of smart lockers for package pickups

These advancements are continuously reshaping traditional delivery models, improving efficiency, and meeting the ever-changing demands of consumers across various industries.

Global Freight and Logistics Market: Growth Patterns and Regional Insights

Regional Market Distribution:

1. Asia-Pacific

- Remains the largest market holder

- Driven by China’s investments in infrastructure

- Demand fueled by the e-commerce boom

- Consumption patterns of the rising middle class

2. North America

- Fastest-growing region in 2024

- Technology adoption leading to market evolution

- Strong focus on optimizing supply chains

- Growth boosted by cross-border trade agreements

The regional dynamics of the market show different patterns across major economic areas. Asia-Pacific’s dominance is due to rapid industrialization and population growth, while North America’s progress relies on technological innovation and efficiency improvements.

Market Size by Region (2024)

- Asia-Pacific: 35%

- North America: 28%

- Europe: 22%

- Rest of World: 15%

Each region has its own characteristics that shape its growth trajectory. Asia-Pacific benefits from increasing manufacturing activities and expanding trade routes. North America’s growth comes from advanced logistics solutions and a strong e-commerce infrastructure. The interaction between these regions creates a dynamic global market landscape, with partnerships across regions driving innovation and expansion.

U.S. Freight and Logistics Market: Navigating Demand and Supply Trends

The U.S. freight market has undergone significant transformations, shaped by evolving consumer behaviors and market dynamics. E-commerce acceleration has created unprecedented demand for last-mile delivery services, with 73% of consumers now expecting faster delivery times than pre-pandemic levels.

Key Market Shifts

- Nearshoring initiatives gaining momentum as companies relocate manufacturing operations closer to U.S. borders

- Rising demand for temperature-controlled logistics due to growth in pharmaceutical and food delivery sectors

- Increased adoption of real-time tracking systems to enhance supply chain visibility

Supply Chain Resilience Strategies

Supply chain resilience strategies have emerged as critical priorities:

1. Inventory Management Evolution

- Shift from just-in-time to safety stock models

- Implementation of AI-driven demand forecasting

- Strategic warehouse location optimization

2. Transportation Network Adaptation

- Multi-carrier partnerships to reduce single-point dependencies

- Investment in alternative delivery modes

- Development of regional distribution hubs

The U.S. market has witnessed a 15% increase in warehouse automation investment, with companies prioritizing robotics and automated storage systems. This technological integration helps address labor shortages while improving operational efficiency. Regional carriers have gained market share, offering specialized services and flexible delivery options to meet changing customer expectations.

The U.S. freight market has undergone significant transformations, shaped by evolving consumer behaviors and market dynamics. E-commerce acceleration has created unprecedented demand for last-mile delivery services, with 73% of consumers now expecting faster delivery times than pre-pandemic levels.

Key Market Shifts

- Nearshoring initiatives gaining momentum as companies relocate manufacturing operations closer to U.S. borders

- Rising demand for temperature-controlled logistics due to growth in pharmaceutical and food delivery sectors

- Increased adoption of real-time tracking systems to enhance supply chain visibility

Supply Chain Resilience Strategies

Supply chain resilience strategies have emerged as critical priorities:

1. Inventory Management Evolution

- Shift from just-in-time to safety stock models

- Implementation of AI-driven demand forecasting

- Strategic warehouse location optimization

2. Transportation Network Adaptation

- Multi-carrier partnerships to reduce single-point dependencies

- Investment in alternative delivery modes

- Development of regional distribution hubs

The U.S. market has witnessed a 15% increase in warehouse automation investment, with companies prioritizing robotics and automated storage systems. This technological integration helps address labor shortages while improving operational efficiency. Regional carriers have gained market share, offering specialized services and flexible delivery options to meet changing customer expectations.

Germany's Strategic Role in the Freight and Logistics Sector

Germany is the leading logistics hub in Europe, thanks to its central location and strong infrastructure. This strategic position allows for efficient connections to various regions, including Eastern Europe, the Nordic countries, and Western European markets.

Advanced Multi-Modal Infrastructure

Germany has developed an advanced multi-modal infrastructure that includes:

- 230,000 km of roads

- 33,000 km of railway tracks

- 7,300 km of inland waterways

- Major ports like Hamburg and Bremen

This extensive network enables seamless transportation of goods using different modes of transport such as trucks, trains, ships, and barges.

Innovative Solutions by German Logistics Companies

German logistics companies have been at the forefront of innovation in the industry. They have introduced groundbreaking solutions that have set new standards worldwide. For example:

- Deutsche Post DHL Group is leading the way in sustainable logistics practices with its zero-emission delivery programs and automated sorting facilities.

- Other major players like DB Schenker, Kuehne + Nagel, and Hapag-Lloyd are also implementing innovative strategies to enhance their operations.

Embracing Digital Transformation

The German logistics sector is actively embracing digital transformation to stay competitive in today’s fast-paced business environment. This includes:

- Implementing smart technology integration such as automated warehousing systems and AI-driven route optimization.

- Utilizing blockchain technology for supply chain transparency and IoT sensors for real-time tracking.

These digital solutions not only improve efficiency but also enhance visibility and accountability throughout the supply chain.

Commitment to Sustainability

Germany’s commitment to sustainability is a driving force behind its logistics innovation. Companies in the country are investing in eco-friendly initiatives such as:

- Transitioning to electric vehicle fleets for last-mile deliveries.

- Implementing green warehousing solutions powered by renewable energy sources.

- Exploring alternative fuel technologies like hydrogen or biofuels.

By prioritizing sustainability, Germany aims to reduce carbon emissions associated with freight transportation and contribute towards global climate goals.

Attracting International Businesses

The expertise of German logistics professionals has attracted international businesses looking for efficient distribution networks in Europe. Many companies choose to establish their operations in Germany due to its well-developed infrastructure and strategic location.

For instance, Hamburg’s port serves as a crucial gateway for Asian trade routes, making it an ideal hub for shipping goods between Asia and Europe. This further strengthens Germany’s position as a key player in global logistics.

China's Freight and Logistics Evolution: Infrastructure and Market Potential

China’s ambitious infrastructure development has transformed the global logistics landscape. The Belt and Road Initiative (BRI) stands as a cornerstone of this evolution, connecting Asia, Europe, and Africa through:

- 6 economic corridors

- Maritime shipping routes

- Railway networks spanning 140,000 kilometers

- 34 major ports and harbor developments

The country’s investment in logistics infrastructure reaches beyond traditional transportation networks. China has developed:

- Smart ports utilizing AI and automation

- Digital logistics platforms

- Advanced warehouse management systems

- Cross-border e-commerce zones

These investments have reshaped global trade patterns. Chinese logistics companies now handle:

- 41% of global container traffic

- 50% of domestic express deliveries worldwide

- Significant portions of cross-border e-commerce shipments

The market potential continues to expand through strategic developments:

“China’s logistics sector is projected to grow at 13.2% annually, driven by digital transformation and infrastructure expansion” – China Federation of Logistics & Purchasing

The country’s logistics innovation extends to:

- Autonomous delivery vehicles

- Drone delivery systems

- Blockchain-based supply chain solutions

- Green logistics initiatives reducing carbon emissions

These advancements position China as a pivotal force in global logistics, with its infrastructure developments creating new trade routes and opportunities for international commerce.

The Future of Freight and Logistics: Smart Technology and Automation

The freight and logistics industry is on the brink of a technological revolution. Smart logistics solutions are reshaping traditional operations through innovative applications:

1. Internet of Things (IoT) Integration

- Real-time cargo tracking

- Temperature monitoring for sensitive shipments

- Predictive maintenance for fleet vehicles

- Smart warehouse management systems

Automation technologies are transforming workforce dynamics across the supply chain:

2. Robotics Applications

- Autonomous mobile robots (AMRs) for warehouse operations

- Automated sorting systems

- Robotic process automation for documentation

- Drone delivery systems for last-mile solutions

The implementation of artificial intelligence brings enhanced decision-making capabilities:

3. AI-Powered Solutions

- Route optimization algorithms

- Demand forecasting

- Risk assessment models

- Automated customer service systems

These technological advancements create new roles while phasing out traditional positions. The industry projects a 30% reduction in manual labor tasks by 2030, balanced by a 25% increase in technical positions maintaining automated systems.

Companies investing in smart technologies report:

- 40% improvement in operational efficiency

- 35% reduction in human error

- 28% decrease in operational costs

- 45% faster order processing times

The rise of blockchain technology enables secure, transparent supply chain operations, with smart contracts automating payment processes and verification procedures. Digital twins technology simulates supply chain scenarios, allowing companies to optimize operations before physical implementation.

Competitive Landscape: Who's Leading the Freight and Logistics Market?

- DHL Global Forwarding – Bonn, Germany

- Kuehne + Nagel – Schindellegi, Switzerland

- DB Schenker – Essen, Germany

- DSV Panalpina – Hedehusene, Denmark

- Expeditors International – Seattle, Washington, USA

- UPS Supply Chain Solutions – Atlanta, Georgia, USA

- Nippon Express – Tokyo, Japan

- Sinotrans Limited – Beijing, China

- CEVA Logistics – Marseille, France

- GEODIS – Levallois-Perret, France

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Freight and Logistics Market Report |

| Base Year | 2024 |

| Segment by Type | · Roadways

· Waterways · Railways · Air |

| Segment by Application | · Manufacturing and Automotive

· Oil and Gas, Mining, and Quarrying · Agriculture, Fishing, and Forestry · Construction · Distributive Trade · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The freight and logistics market is on the verge of significant change as it approaches 2033. With the growing need for efficient supply chain solutions, this industry is expected to experience unprecedented growth. Important areas such as Third-Party Logistics (3PL) and connected logistics markets are set to expand significantly, indicating a promising future for those involved in the industry.

Technological innovations play a crucial role in shaping the future of this market. The use of advanced technologies like AI, IoT, and blockchain not only improves operational efficiency but also drives the industry towards more sustainable practices. Innovations in green logistics, such as the use of electric vehicles, further demonstrate the sector’s commitment to sustainability.

As these trends emerge, businesses in the freight and logistics market must adapt strategically to these changes. Embracing technological advancements will be essential for staying competitive and seizing new opportunities in this evolving landscape.

Global Freight and Logistics Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Freight and Logistics Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Freight and Logistics Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Freight and Logisticsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Freight and Logistics Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Freight and Logistics Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Freight and Logistics Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Freight and Logistics Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

FAQ

1. What is driving the growth of the global freight and logistics market from 2025 to 2033?

Key factors include increasing demand for efficient supply chain solutions, technological advancements such as AI, IoT, and blockchain, as well as the rise in e-commerce activities.

2. How significant is the Third-Party Logistics (3PL) segment within this market?

The 3PL segment is crucial, projected to grow from USD 1239.33 billion in 2024 to USD 2691.69 billion by 2033, with a CAGR of approximately 9%.

3. What role does technology play in shaping the future of freight and logistics?

Technologies like AI enhance operational efficiency, IoT enables real-time tracking, and blockchain improves supply chain transparency. These innovations are pivotal in driving market transformation.

4. Which regions are expected to experience the most growth?

North America holds a substantial market share due to advanced infrastructure, while rapid expansion is anticipated in the Asia-Pacific region driven by urbanization and industrialization.

5. What are some challenges facing the freight and logistics industry today?

High operational costs, inadequate infrastructure in emerging markets, and fluctuating demand present significant hurdles that need addressing for sustained growth.

6. Are there sustainable practices being adopted in logistics operations?

Yes, there’s an increasing adoption of electric vehicles and other green logistics practices aimed at sustainability within the industry.