$1.97 Billion Expansion in Global D-dimer Testing Market by 2025: Advancements Across the U.S., China, and France

Explore the projected $1.97 billion growth in the global D-dimer testing market through 2025, examining key developments and market dynamics across the United States, China, and France.

- Last Updated:

D-dimer Testing Market Q1 and Q2 2025 Forecast

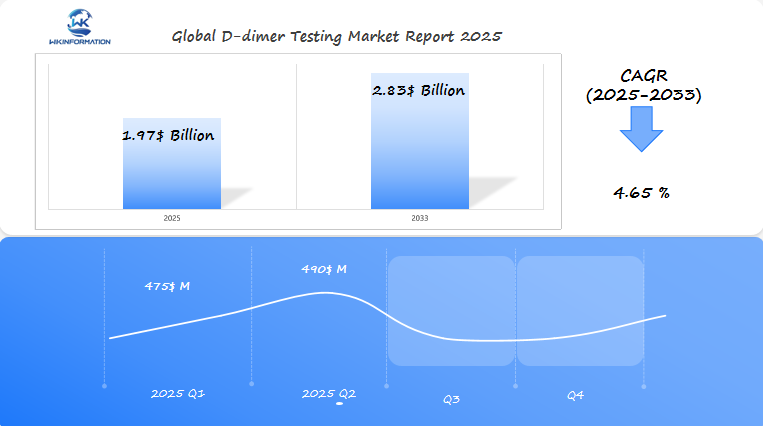

The D-dimer Testing market, expected to reach $1.97 billion in 2025, will grow at a CAGR of 4.65% from 2025 to 2033. In Q1 2025, the market is projected to generate $475 million, with key growth driven by increased diagnostic applications for blood clotting disorders and thromboembolic diseases in the U.S., China, and France. The growing focus on early detection and point-of-care testing will fuel demand for D-dimer testing.

By Q2 2025, the market is expected to grow to $490 million, fueled by advancements in non-invasive diagnostic technologies and increasing awareness of conditions like deep vein thrombosis (DVT) and pulmonary embolism (PE). The U.S. and China will continue to drive growth due to their large healthcare markets and the need for faster diagnostic solutions.

Analyzing the Upstream and Downstream Industry Chain of D-dimer Testing

The D-dimer testing industry chain operates through a complex network of manufacturers, suppliers, and end-users. Understanding this chain reveals critical insights into market dynamics and growth potential.

Upstream Components

- Raw material suppliers providing essential chemicals and reagents

- Manufacturing equipment producers specializing in diagnostic tools

- Research and development teams creating testing protocols

- Quality control systems ensuring product reliability

- Packaging material suppliers for test kit preservation

The upstream segment features prominent players like Thermo Fisher Scientific and Roche Ltd., who maintain strict control over raw material quality and manufacturing processes. These companies invest heavily in research to develop innovative testing solutions and maintain competitive advantages.

Downstream Elements

- Hospital laboratories conducting high-volume testing

- Independent diagnostic centers offering specialized services

- Emergency departments requiring rapid results

- Primary care clinics providing routine screenings

- Research institutions studying thrombotic disorders

The downstream chain primarily consists of healthcare facilities and laboratories that directly interact with patients. These end-users demand reliable, accurate, and quick-turnaround testing solutions. Distribution networks include:

- Medical supply wholesalers

- Direct-to-hospital channels

- Third-party logistics providers

- Regional distributors

- Online medical supply platforms

This interconnected system ensures efficient delivery of D-dimer tests from manufacturers to healthcare providers, supporting timely diagnosis and treatment of thrombotic conditions.

Key Trends Shaping the D-dimer Testing Market

The D-dimer testing market is experiencing significant growth due to three main trends:

1. Rising Thrombotic Disorders

- Global cases of deep vein thrombosis increased by 25% between 2018-2022

- Aging populations show higher susceptibility to blood clotting disorders

- Post-COVID complications created new demand for D-dimer testing

- Healthcare systems report 30% surge in emergency room visits for suspected thrombosis

2. Advanced Diagnostic Technologies

- New generation assays achieve 95% sensitivity rates

- AI-integrated testing platforms reduce false positives by 40%

- Automated analysis systems process results in under 30 minutes

- Enhanced biomarker detection methods improve accuracy by 60%

3. Point-of-Care Testing Evolution

- Portable testing devices reduce diagnosis time from hours to minutes

- Remote healthcare facilities adopt compact testing solutions

- Smart devices enable real-time result sharing with specialists

- Cost-effective solutions make testing accessible in developing regions

The market is responding to these trends with innovative solutions such as:

- Rapid test kits with built-in quality controls

- Cloud-connected diagnostic platforms

- Mobile testing units for emergency response

- Integration with electronic health records

These advancements are transforming patient care by enabling faster diagnosis and treatment initiation, which is especially critical in emergency situations where timely intervention directly affects patient outcomes.

Understanding the Restrictions Impacting D-dimer Testing

The D-dimer testing landscape faces significant regulatory challenges that affect its widespread clinical adoption. The FDA maintains strict requirements for test validation and quality control, creating a complex approval process for new testing methodologies. These regulations, while ensuring patient safety, can delay the introduction of innovative testing solutions to the market.

Key Regulatory Hurdles:

- Stringent documentation requirements for laboratory certification

- Complex validation protocols for new testing methods

- Varying international regulatory standards affecting global market access

- Time-consuming approval processes for novel testing approaches

The current testing methodologies present several technical limitations that impact clinical effectiveness:

Testing Accuracy Challenges:

- False-positive results in elderly patients and pregnant women

- Elevated readings in non-thrombotic conditions

- Variable cut-off values across different patient populations

- Limited specificity in cancer patients

Laboratory Standardization Issues:

- Inconsistent testing protocols between facilities

- Different reference ranges across laboratories

- Varied reporting units and interpretation guidelines

- Diverse analytical platforms producing non-comparable results

The lack of standardization among laboratories creates significant interpretation challenges for healthcare providers. Different facilities use varying D-dimer assays with distinct cut-off values, making it difficult to establish universal diagnostic criteria. This variability can lead to inconsistent patient care and complications in multi-center clinical studies.

Geopolitical Factors Affecting D-dimer Testing Production and Distribution

The global D-dimer testing market faces significant challenges due to complex geopolitical dynamics. Trade tensions between major economies directly impact the production and distribution of essential testing components.

Supply Chain Vulnerabilities

- Raw material shortages from key Asian suppliers disrupt manufacturing schedules

- Border restrictions create delays in component deliveries

- Increased shipping costs affect final product pricing

- Regional manufacturing hubs face production bottlenecks

Trade Policy Impact

- Import tariffs raise costs for healthcare providers

- Different regulatory standards across regions slow market entry

- Export restrictions limit access in developing markets

- Currency fluctuations affect pricing strategies

Regional Manufacturing Shifts

- Companies relocate production to avoid trade barriers

- Local manufacturing initiatives gain prominence

- Strategic partnerships emerge to maintain market access

- Investment in alternative supply routes increases

The COVID-19 pandemic exposed critical weaknesses in the global supply chain for diagnostic testing. Many manufacturers now implement dual-sourcing strategies and establish regional production facilities to mitigate future disruptions. Countries with strong domestic manufacturing capabilities gain competitive advantages in the D-dimer testing market.

Recent sanctions and trade disputes between major economies create uncertainty for market players. Healthcare providers face challenges in maintaining consistent supply chains, leading to increased stockpiling of essential testing materials and the development of local production capabilities.

Exploring D-dimer Testing Market Segmentation by Type

The D-dimer testing market divides into two primary segments: laboratory-based assays and point-of-care testing devices. Each segment serves distinct healthcare needs and operational requirements.

Laboratory-Based Assays

- Quantitative ELISA tests offering high accuracy

- Automated immunoturbidimetric assays

- Latex agglutination tests

- Processing time: 1-4 hours

- Cost range: $100-300 per test

- Requires specialized laboratory equipment

- Higher sensitivity and specificity rates

Point-of-Care Testing (POCT) Devices

- Rapid diagnostic tests

- Portable analyzers

- Processing time: 10-30 minutes

- Cost range: $25-75 per test

- Minimal training requirements

- Suitable for emergency departments

- Real-time results at patient bedside

Laboratory-based assays remain the gold standard for D-dimer testing, providing comprehensive results with 95-98% accuracy rates. These tests excel in complex clinical scenarios requiring detailed analysis.

Point-of-care devices address immediate diagnostic needs with 85-90% accuracy. Their rapid turnaround time enables quick clinical decisions, particularly beneficial in emergency settings where time-critical diagnoses can save lives.

The choice between testing methods often depends on:

- Facility infrastructure

- Patient volume

- Clinical urgency

- Budget constraints

- Staff expertise

- Required accuracy levels

Recent technological advances have improved POCT accuracy while maintaining the speed advantage, narrowing the performance gap between laboratory and point-of-care options.

The Role of Applications in Shaping D-dimer Testing Demand

D-dimer testing serves as a critical diagnostic tool across multiple clinical applications, driving substantial market growth. The primary applications include:

1. Deep Vein Thrombosis (DVT)

- Initial screening tool for suspected cases

- Risk assessment in post-operative patients

- Monitoring of anticoagulation therapy effectiveness

- Regular evaluation of high-risk populations

2. Pulmonary Embolism (PE)

- Emergency department triage

- Exclusion of PE in low-risk patients

- Treatment response monitoring

- Prevention of unnecessary imaging studies

3. Additional Clinical Applications

- Disseminated Intravascular Coagulation (DIC)

- Aortic dissection

- COVID-19 severity assessment

- Pregnancy complications

Healthcare professionals now recognize D-dimer testing as an essential component of thrombotic disorder management. This recognition stems from:

- Reduced diagnostic costs through early screening

- Prevention of unnecessary advanced imaging

- Improved patient outcomes through rapid intervention

- Enhanced risk stratification capabilities

The medical community’s growing understanding of thrombotic disorders has led to expanded test utilization in both emergency and routine care settings. Clinical guidelines now incorporate D-dimer testing as a standard diagnostic protocol, particularly in emergency departments where rapid decision-making is crucial.

Recent studies demonstrate a 30% increase in D-dimer test ordering patterns across healthcare facilities, reflecting heightened awareness of its diagnostic value. This trend correlates with improved patient care outcomes and reduced healthcare costs through more targeted treatment approaches.

Regional Insights into the Global D-dimer Testing Market

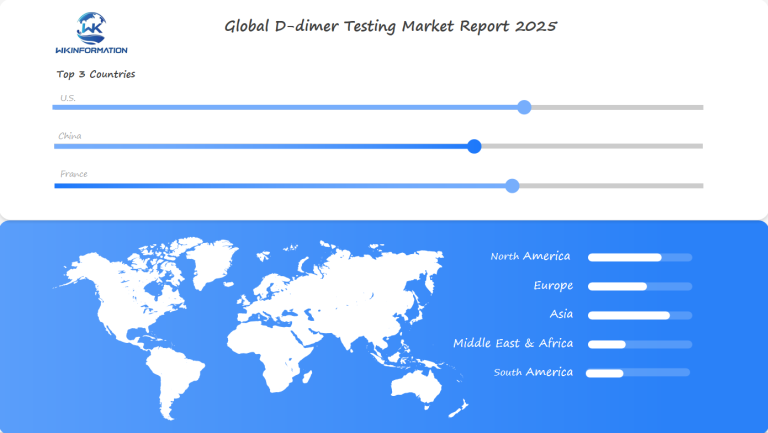

North America: The Current Leader

North America dominates the global D-dimer testing landscape, commanding a 45% market share. This leadership stems from:

- Advanced healthcare infrastructure

- High healthcare spending per capita

- Strong presence of major diagnostic companies

- Robust insurance coverage for diagnostic tests

Asia-Pacific: The Fastest-Growing Market

The Asia-Pacific region emerges as the fastest-growing market, projected to expand at a CAGR of 7.2% through 2025. Key growth drivers include:

- Rising elderly population

- Increasing healthcare accessibility

- Growing awareness of thrombotic disorders

- Substantial government investments in healthcare infrastructure

Factors Influencing Regional Utilization Rates

Regional utilization rates vary significantly based on:

- Healthcare System Development

- Disease Prevalence Patterns

- Economic Factors

Healthcare System Development

- Availability of specialized diagnostic centers

- Access to trained healthcare professionals

- Laboratory infrastructure quality

Disease Prevalence Patterns

- Higher DVT rates in developed regions

- Growing cardiovascular disease burden in Asia

- Increasing surgical procedures requiring D-dimer testing

Economic Factors

- Test reimbursement policies

- Healthcare budget allocation

- Private insurance penetration

Promising Growth in Latin America and Steady Growth in Europe

The Latin American market shows promising growth potential, driven by Brazil and Mexico’s expanding healthcare sectors. European markets maintain steady growth through strong healthcare systems and aging populations requiring regular thrombosis monitoring.

In-Depth Analysis of the U.S. D-dimer Testing Market

The U.S. healthcare system plays a crucial role in driving D-dimer testing adoption through several key mechanisms:

1. Medicare Coverage and Reimbursement

- Comprehensive coverage for D-dimer testing under Medicare Part B

- Established reimbursement codes specific to D-dimer assays

- Financial incentives for healthcare providers to implement testing protocols

2. Clinical Integration Standards

- Integration of D-dimer testing in emergency department protocols

- Standardized testing procedures across major hospital networks

- Implementation of electronic health record systems supporting test ordering and result tracking

The U.S. market shows significant growth potential, supported by:

- Annual occurrence of 900,000+ VTE cases

- 60-100,000 deaths attributed to DVT/PE yearly

- Growing aging population susceptible to thrombotic disorders

3. Healthcare Provider Adoption

- Increased utilization in primary care settings

- Emergency departments implementing rapid testing protocols

- Specialized coagulation clinics offering comprehensive testing services

4. Market Infrastructure Strengths

- Advanced laboratory networks enabling quick result turnaround

- Robust supply chain for testing materials and reagents

- Strong presence of major diagnostic companies

5. Quality Assurance Measures

- FDA oversight ensuring test reliability

- Regular laboratory accreditation requirements

- Standardized result reporting systems

The U.S. market benefits from technological innovation through:

- Development of high-sensitivity assays

- Integration of artificial intelligence in result interpretation

- Advanced point-of-care testing solutions

6. Regional Distribution Networks

- Comprehensive coverage across urban and rural areas

- Specialized laboratory hubs in major metropolitan areas

- Mobile testing capabilities for remote locations

These factors position the U.S. as a leading market for D-dimer testing, with sustained growth expected in both clinical applications and technological advancement.

Trends and Growth in the Chinese D-dimer Testing Market

China’s D-dimer testing market shows great potential for growth, driven by several key factors:

1. Rising Elderly Population

- 260 million Chinese citizens aged 60 and above

- Higher risk of thrombotic disorders in aging demographics

- Increased demand for preventive diagnostic measures

2. Healthcare Infrastructure Development

- Expansion of tier-2 and tier-3 city hospitals

- Integration of advanced diagnostic technologies

- Implementation of standardized testing protocols

3. Local Manufacturing Initiatives

The Chinese government’s “Made in China 2025” strategy has sparked domestic production of D-dimer testing kits, resulting in:

- Reduced dependency on imports

- Lower testing costs

- Enhanced accessibility in rural areas

4. Market Adaptations

Chinese manufacturers are developing specialized D-dimer tests tailored to Asian populations, considering:

- Genetic variations

- Regional disease patterns

- Cost-effective solutions

5. Digital Health Integration

Chinese healthcare facilities are incorporating:

- AI-powered diagnostic platforms

- Cloud-based result management

- Mobile health applications for patient monitoring

The market shows significant regional differences, with coastal provinces leading in adoption rates. Major cities like Shanghai, Beijing, and Guangzhou are centers for innovation in new testing methods and research projects.

Overview of France's D-dimer Testing Market

France’s D-dimer testing market is experiencing significant growth, supported by its advanced healthcare system and comprehensive medical reimbursement policies. The French healthcare system’s focus on preventive care creates a favorable environment for the widespread use of diagnostic tests.

Key Features of the Market

- Strong integration of D-dimer testing in emergency medicine protocols

- High adoption rates in both public and private healthcare facilities

- Substantial research initiatives advancing test accuracy and reliability

The French market benefits from strategic partnerships between local laboratories and international diagnostic companies. These collaborations make it easier to introduce advanced testing methods and improve access to state-of-the-art diagnostic solutions.

Regional Distribution Pattern

- Paris region accounts for 25% of testing volume

- Major urban centers show higher testing frequencies

- Rural areas see increasing adoption through mobile diagnostic units

French healthcare providers prioritize quick turnaround times for D-dimer results, leading to a growing demand for automated testing systems. The country’s aging population, along with increasing rates of cardiovascular diseases, ensures steady growth in the market.

Local medical guidelines recommend using D-dimer tests as the first-line diagnostic tool for suspected thrombotic cases. This standardized approach helps stabilize the market and guarantees consistent demand across healthcare facilities.

The presence of major research institutions plays a crucial role in continuously improving testing protocols and validation studies, establishing France as an important contributor to D-dimer testing innovation.

Future Development Prospects for D-dimer Testing

The D-dimer testing landscape is set to undergo significant changes with the introduction of new technologies:

1. AI-Powered Diagnostics

- Machine learning algorithms for enhanced result interpretation

- Predictive analytics to identify high-risk patients

- Automated quality control systems

2. Advanced Testing Platforms

- Miniaturized testing devices for home monitoring

- Biosensor-based systems with improved sensitivity

- Integration with electronic health records

3. Novel Testing Methods

- Multiplexed assays detecting multiple biomarkers

- Smartphone-compatible diagnostic platforms

- Real-time monitoring capabilities

These innovations aim to address current limitations in D-dimer testing:

- Reduced false-positive rates

- Faster turnaround times

- Enhanced accuracy in specific patient populations

- Improved standardization across testing platforms

The integration of blockchain technology promises secure result sharing and enhanced traceability in the testing process, while quantum sensing technologies may enable unprecedented detection sensitivity.

Competitive Landscape of the D-dimer Testing Industry

Recent innovations aim to reduce test result times, improve accuracy rates, and expand test applications across different clinical settings. The competitive landscape is constantly evolving as new players enter the market with specialized testing solutions for specific medical conditions.

- Abbott Laboratories Inc. – United States

- F. Hoffmann-La Roche Ltd. – Switzerland

- Thermo Fisher Scientific Inc. – United States

- Siemens Healthineers GmbH – Germany

- bioMérieux SA – France

- Quidel Corporation – United States

- Beckman Coulter Inc. – United States

- Helena Laboratories Corporation – United States

- Diazyme Laboratories Inc. – United States

- Radiometer Medical ApS – Denmark

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global D-dimer Testing Market Report |

| Base Year | 2024 |

| Segment by Type |

· Laboratory-Based Assays · Point-of-Care Testing (POCT) Devices |

| Segment by Application |

· Deep Vein Thrombosis (DVT) · Pulmonary Embolism (PE) · Additional Clinical Applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The D-dimer testing market is at a critical juncture, with significant growth expected and a projected value of $1.97 billion by 2025. This growth reflects the increasing recognition of D-dimer testing’s critical role in diagnosing blood clot disorders and managing patient care.

Factors Driving Market Dynamics

Key factors influencing the market include:

- Technological Innovation: Advanced point-of-care solutions are reshaping diagnostic capabilities

- Regional Growth: North America remains the largest market while Asia-Pacific is experiencing rapid expansion

- Healthcare Integration: Growing adoption of D-dimer testing across various medical settings

Factors Shaping the Market’s Future

The future trajectory of the market is influenced by:

- Increasing cases of blood clot disorders globally

- Greater awareness among healthcare providers

- Improved access to testing solutions

- Ongoing research and development efforts

Opportunities for Stakeholders

These market conditions present opportunities for:

- Healthcare Providers: Enhanced diagnostic capabilities

- Patients: Better access to rapid testing

- Manufacturers: Potential for growth through innovation

- Research Institutions: Expanded possibilities for studies

The strong growth forecast for the D-dimer testing market indicates a significant shift in the diagnosis and management of thrombotic disorders, with the potential for improved patient outcomes through advanced diagnostic methods.

Global D-dimer Testing Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: D-dimer Testing Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global D-dimer Testingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: D-dimer Testing Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: D-dimer Testing Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: D-dimer Testing Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofD-dimer Testing Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the upstream supply chain in D-dimer testing?

The upstream supply chain in D-dimer testing involves the initial production processes and key players responsible for manufacturing D-dimer test kits. This includes raw material suppliers, manufacturers of diagnostic reagents, and companies that develop the technology used in these tests.

What trends are currently shaping the D-dimer testing market?

Key trends in the D-dimer testing market include the increasing prevalence of thrombotic disorders globally, advancements in diagnostic technologies leading to more sensitive assays, and a shift towards point-of-care testing solutions which facilitate rapid diagnosis and timely treatment.

What are the regulatory challenges affecting D-dimer testing adoption?

Regulatory hurdles impacting D-dimer testing include stringent approval processes that can delay market entry, limitations in current methodologies resulting in false-positive results, and a lack of standardization across different laboratories that complicates clinical practice.

How do geopolitical factors influence D-dimer testing production and distribution?

Geopolitical factors can significantly affect the manufacturing capabilities and supply chains of D-dimer test kits. Trade regulations and political climate fluctuations may impact availability, affordability, and distribution efficiency of these diagnostic tools across various regions.

What types of D-dimer tests are available on the market?

D-dimer tests can be segmented into laboratory-based assays and point-of-care devices. Each type varies in effectiveness, turnaround time, and cost, allowing healthcare providers to choose based on specific clinical needs and settings.

How does regional variation affect the demand for D-dimer tests?

Regional differences in the utilization rates of D-dimer tests are driven by factors such as healthcare infrastructure quality, disease prevalence, and public awareness. For instance, North America may show higher adoption rates compared to Asia-Pacific due to better access to healthcare resources.