$82.4 Billion Growing Mobile Gaming Market in the U.S., South Korea, and China by 2025

Discover the explosive growth of the mobile gaming market, projected to reach $82.4 billion by 2025. This comprehensive analysis explores market dynamics across key regions, including the United States, South Korea, and China, examining technological innovations, competitive gaming trends, and the evolving landscape of digital entertainment.

- Last Updated:

Mobile Gaming Market Q1 and Q2 2025 Forecast

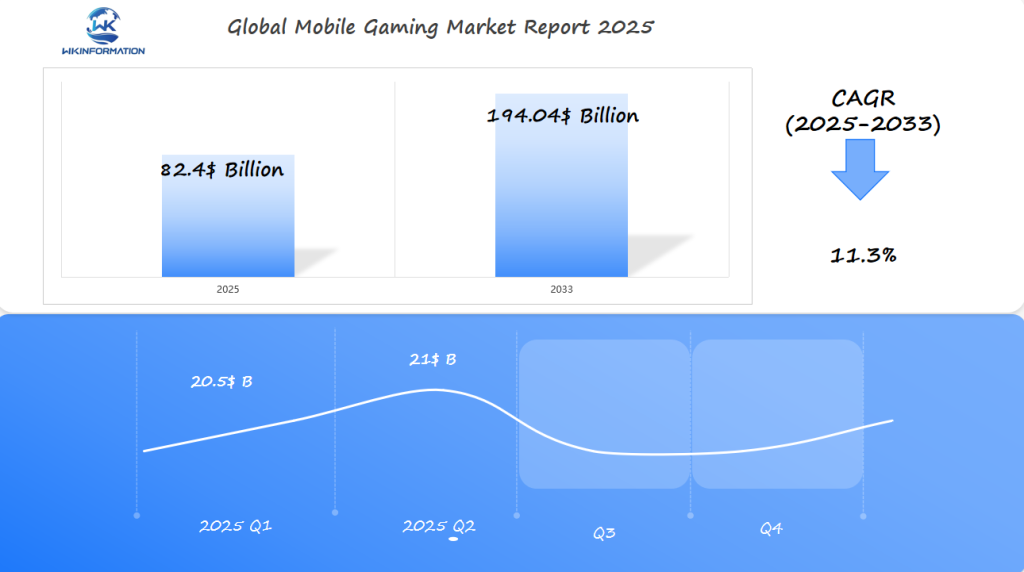

The Mobile Gaming market, projected to reach $82.4 billion in 2025, is expected to grow at an 11.3% CAGR from 2025 to 2033. In Q1 2025, the market is anticipated to generate approximately $20.5 billion, driven by the growing smartphone penetration and the increasing popularity of mobile games in the U.S., South Korea, and China. Mobile gaming continues to attract a wide range of demographics, with a focus on casual and competitive gaming experiences.

By Q2 2025, the market is expected to reach $21 billion, fueled by the rise of cloud gaming services and continued advancements in mobile technology that enable richer game environments. South Korea’s strong gaming culture and China’s growing mobile internet infrastructure will contribute to this growth.

The mobile gaming market will continue to benefit from the rapid technological advancements in 5G connectivity and the integration of augmented reality and artificial intelligence in gaming experiences.

Exploring the Mobile Gaming Supply Chain and Industry Trends

The mobile gaming supply chain operates through a complex network of interconnected stakeholders, each playing a crucial role in bringing games from concept to market.

Key Players in the Supply Chain:

- Game Developers – Create game concepts, design mechanics, and build the actual game code

- Publishers – Handle marketing, distribution, and funding for game development

- Platform Providers – App Store (iOS) and Google Play Store (Android) serve as primary distribution channels

- Technology Partners – Supply essential tools, engines, and middleware solutions

- Payment Processors – Enable in-app purchases and monetary transactions

- Analytics Companies – Track user behavior and provide valuable market insights

Current Industry Trends Shaping Growth:

- Cross-platform compatibility becoming standard practice

- Rise of hyper-casual games with simple mechanics

- Integration of social features and multiplayer modes

- Adoption of subscription-based revenue models

- Implementation of cloud gaming services

The revenue streams have diversified beyond traditional paid downloads. In-app purchases now generate 95% of mobile game revenue, while advertising and sponsorships create additional income channels. Game developers increasingly focus on creating sustainable monetization strategies through battle passes, seasonal content, and limited-time events.

The supply chain continues to evolve with emerging technologies. Cloud gaming services reduce the need for powerful hardware, while blockchain technology introduces new possibilities for in-game economies and digital ownership.

Key Trends in the Mobile Gaming Market: Cloud Gaming and Esports

1. Cloud Gaming: Breaking Barriers

Cloud gaming is changing the game for mobile gamers by removing hardware limitations. With cloud gaming, players can stream graphically demanding games directly to their mobile devices without worrying about storage space or processing power. This means that even if you don’t have a high-end gaming device, you can still enjoy console-quality games on your smartphone.

Popular platforms like Xbox Cloud Gaming and Google Stadia are leading the way in this shift, proving that cloud technology has the potential to revolutionize the gaming industry.

Advantages of Cloud Gaming for Mobile

The integration of cloud technology brings several advantages to mobile gaming:

- Instant access to extensive game libraries

- Reduced battery consumption

- Cross-platform gameplay capabilities

- Lower entry barriers for high-end gaming

2. Esports: Fueling Growth

Esports has become a major driving force behind the growth of mobile gaming. Games like PUBG Mobile and Mobile Legends have attracted millions of viewers and generated significant revenue through various channels.

Revenue Streams from Mobile Esports

Here are some ways in which mobile esports generates revenue:

- Tournament sponsorships

- In-game purchases

- Live streaming rights

- Professional player contracts

The competitive nature of esports also influences game development priorities.

Impact of Esports on Game Development

Developers are now focusing on enhancing multiplayer features, improving spectator modes, and regularly balancing gameplay to cater to the needs of professional players and teams.

3. The Rise of Mobile Esports Tournaments

Mobile esports tournaments are starting to offer prize pools that rival those of traditional PC competitions. The Mobile Legends World Championship, for example, regularly awards millions in prizes, attracting professional teams and organizations to invest in mobile gaming divisions.

This influx of investment further fuels the growth of the mobile gaming industry, as more resources are allocated towards creating high-quality games and supporting competitive ecosystems.

4. The Future: Opportunities Ahead

The combination of cloud gaming accessibility and esports popularity presents new opportunities for developers and players alike. As these technologies continue to evolve, we can expect:

- Increased collaboration between cloud service providers and game developers

- Expansion of esports tournaments into emerging markets

- Diversification of revenue streams through partnerships with brands and sponsors

These developments have the potential to reshape how games are played, consumed, and monetized on mobile devices.

Challenges in Mobile Gaming Development: Monetization and User Retention

Mobile game developers face critical challenges in balancing monetization strategies with user satisfaction. The most successful monetization models include:

1. In-app Purchases (IAP)

- Virtual currency

- Character customization

- Power-ups and boosters

- Premium content unlocks

2. Advertising Revenue Streams

- Rewarded video ads

- Interstitial displays

- Banner placements

- Native advertising integration

User retention presents unique challenges in the competitive mobile gaming landscape. Successful retention strategies focus on:

1. Engagement Mechanics

- Daily rewards and login bonuses

- Limited-time events

- Social features and multiplayer modes

- Regular content updates

2. Player Experience Optimization

- Personalized difficulty scaling

- Tutorial refinement

- Loading time optimization

- Bug-free gameplay environment

The balance between monetization and user experience remains delicate. Games implementing aggressive monetization tactics risk higher churn rates, while those with minimal revenue streams struggle with sustainability. Data analytics play a crucial role in identifying optimal monetization points and predicting user behavior patterns.

Successful mobile games maintain user retention through:

- Clear progression systems

- Achievement-based rewards

- Community building features

- Regular performance optimization

- Balanced difficulty curves

These elements create engaging experiences that encourage long-term player investment while generating sustainable revenue streams.

Geopolitical Impact on the Mobile Gaming Industry

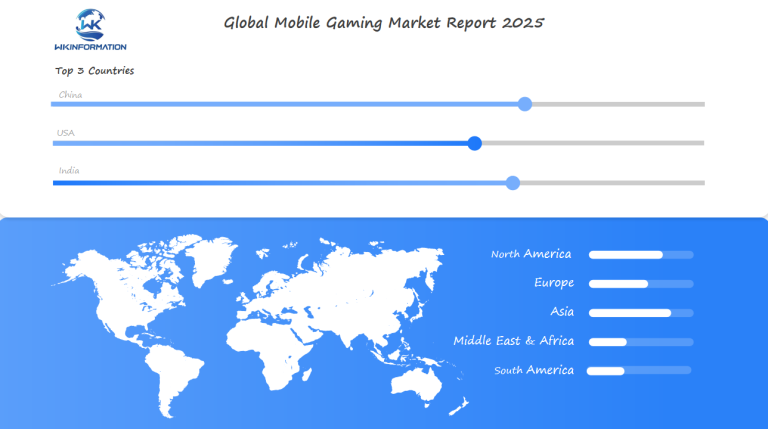

Geopolitical tensions create significant ripples across the mobile gaming landscape, shaping how games are developed, distributed, and monetized across borders. The U.S.-China trade relations have sparked notable changes in app store policies and data handling requirements, affecting how mobile game companies operate in these markets.

Key Regional Impacts:

1. Data Privacy Regulations

- GDPR in Europe requires specific user consent mechanisms

- China’s data localization laws mandate local server hosting

- South Korea’s age verification requirements for gaming accounts

2. Market Access Restrictions

- Limited access to Chinese markets through strict licensing systems

- Required partnerships with local publishers in certain regions

- Mandatory content reviews and cultural compliance checks

The regulatory landscape varies significantly across key gaming markets:

U.S. Market:

- Light-touch regulation approach

- Focus on consumer protection and microtransaction disclosure

- Emerging concerns about loot box mechanics

Chinese Market:

- Strict content approval process

- Limited number of gaming licenses issued annually

- Mandatory playtime restrictions for minors

South Korean Market:

- Strong focus on age verification

- Regulated probability disclosure for gacha mechanics

- Strict anti-addiction measures

These geopolitical factors force gaming companies to adopt region-specific strategies, often maintaining separate game versions for different markets. Development teams must navigate complex international relations while ensuring compliance with local regulations and cultural sensitivities.

Types of Mobile Games: Casual, Strategy, and Role-Playing Games

Mobile gaming offers a wide variety of genres to choose from, each designed to suit different player tastes and levels of involvement. The market can be divided into two main categories:

1. Casual Games

These games are easy to pick up and play, making them perfect for short gaming sessions. Some popular examples include:

- Match-3 puzzles like Candy Crush Saga

- Endless runners such as Temple Run

- Hyper-casual titles like Flappy Bird

- Time management games such as Diner Dash

2. Hardcore Games

These games often require more time and commitment to master. They appeal to players looking for deeper gameplay experiences. Examples include:

- Complex RPGs like Genshin Impact

- Strategy titles such as Clash of Clans

- MOBA games like Mobile Legends

- Battle Royale experiences such as PUBG Mobile

Regional Preferences in Mobile Gaming

Different regions have their own unique preferences when it comes to mobile games. Here are some key insights:

United States

Players in the U.S. tend to favor casual puzzle games and social gaming experiences. In fact, 65% of mobile gamers in this region prefer games that can be played in short sessions.

South Korea

South Korean audiences show a strong interest in MMORPGs (Massively Multiplayer Online Role-Playing Games) and competitive titles. This aligns with the country’s thriving esports culture.

China

Chinese players have diverse gaming preferences, enjoying both casual and hardcore experiences. Some specific genres that are particularly popular in this market include character-collection RPGs, strategy games with social elements, competitive multiplayer titles, and traditional card games with modern twists.

Implications for Game Development

Understanding these regional preferences is crucial for game studios looking to create successful titles in specific markets. It allows them to prioritize certain features or mechanics that resonate with local gaming communities.

For example:

- If a studio wants to target the U.S. market, they might focus on creating puzzle games with social features that encourage multiplayer interactions.

- To appeal to South Korean players, developers could incorporate elements of competition or teamwork into their MMORPGs or strategy games.

- In China, studios may find success by combining traditional game mechanics (such as card gameplay) with innovative twists or online multiplayer capabilities.

By blending different genre elements together while still staying true to core gameplay mechanics loved by local audiences, studios can create hybrid experiences that attract wider audiences without alienating existing fans.

Applications Beyond Entertainment: Exploring Educational Potential & Marketing Strategies Leveraging Mobile Gaming

Mobile games have gone beyond just being fun and entertaining. They are now being used as powerful tools for education and marketing.

Educational Potential of Mobile Gaming

Duolingo has changed the way we learn languages by turning lessons into fun mini-games. As a result, it has been downloaded 500 million times. Other successful examples include DragonBox, which teaches math through games, and Minecraft: Education Edition, which introduces coding concepts in an interactive way.

Measurable Results of Educational Mobile Games

Educational mobile games have shown significant improvements in learning outcomes:

- 23% increase in student engagement

- 18% higher retention rates compared to traditional teaching methods

- 15% boost in problem-solving abilities

Marketing Opportunities with Mobile Gaming

Mobile games also offer unique opportunities for brands to connect with their audience. Nike created “Nike+ Run Club,” a game that makes fitness tracking fun while promoting their brand. Similarly, Starbucks incorporated their rewards program into a mobile game, resulting in a 32% increase in customer involvement.

Successful In-Game Advertising Strategies

Here are some effective strategies used in advertising within mobile games:

- Rewarded video ads: Players earn rewards in the game by watching advertisements

- Playable ads: Short playable versions of advertised games or products

- Native advertising: Seamless integration of brands within the game world

The Future of Educational Gaming and Branded Mobile Games

The market for educational gaming is expected to reach $17 billion by 2025. Companies like McDonald’s and Coca-Cola have already jumped on this trend by creating their own branded mobile games, resulting in up to 40% increase in brand recognition among younger audiences.

Research indicates that gamified learning apps hold users’ attention 60% longer than traditional methods, making mobile games an effective platform for both education and marketing efforts.

Global Insights into the Mobile Gaming Market

The U.S. mobile gaming landscape has transformed dramatically with 94% smartphone penetration among adults. This high adoption rate creates fertile ground for game developers to reach diverse audiences across age groups and demographics.

Key market drivers include:

- Extended screen time: Americans spend an average of 4.8 hours daily on mobile devices

- 5G connectivity: Enhanced network capabilities enable complex multiplayer experiences

- Cross-platform integration: Seamless gameplay between mobile and other devices

The success of augmented reality (AR) games demonstrates the market’s appetite for innovative experiences. Pokémon GO generated $1.2 billion in revenue in 2022, showcasing the potential of location-based gaming. Similar AR titles like Harry Potter: Wizards Unite and Minecraft Earth have paved the way for immersive mobile experiences.

U.S. consumer preferences highlight distinct patterns:

- 65% prefer casual games

- 43% engage with puzzle games

- 38% play action/adventure titles

Game developers adapt to these preferences through:

- Simplified controls: One-handed gameplay optimization

- Quick sessions: Games designed for 5-10 minute playtime

- Social features: Built-in sharing and multiplayer capabilities

The integration of advanced technologies shapes new gaming experiences. Cloud gaming services reduce device storage requirements, while AI-powered personalization creates adaptive difficulty levels based on player behavior.

U.S. Mobile Gaming Market: Consumer Preferences and Technological Advances

The U.S. mobile gaming landscape reflects a growing appetite for competitive gaming experiences, with South Korean-inspired design elements reshaping player expectations. American gamers show particular interest in:

- Competitive Ranking Systems: Games like League of Legends: Wild Rift incorporate sophisticated tier-based matchmaking

- Social Integration Features: Built-in chat systems, team formation tools, and community hubs

- Regular Tournament Structures: Weekly and monthly competitive events with real-world prizes

Influence of South Korean Developers

South Korean developers have pioneered several features now standard in U.S. mobile games:

- Real-time PvP combat systems

- Character customization with social status elements

- Achievement-based progression mechanics

Success of Netmarble Corporation

Netmarble Corporation’s success in the U.S. market demonstrates the power of strategic localization. Their title Marvel Future Fight combines Western IP with South Korean game design principles, achieving:

- 120 million+ downloads globally

- $100 million+ annual revenue

- Strong player retention through competitive seasonal events

Growth Driven by eSports Elements

The integration of eSports elements continues to drive market growth, with professional mobile gaming tournaments drawing significant viewership. U.S. players now expect:

- Live streaming integration

- Professional league structures

- In-game spectator modes

These features create deeper engagement levels and stronger community ties, driving both player retention and monetization opportunities in the U.S. market.

South Korea's Mobile Gaming Market: Innovations in Gameplay and Global Reach

South Korea’s mobile gaming market is a leader in innovation, thanks to its advanced 5G infrastructure and tech-savvy population. The country’s gaming industry has introduced several groundbreaking features:

Unique Market Characteristics:

- Integration of K-pop culture into mobile games

- Advanced social features including real-time voice chat

- Sophisticated player-matching systems

- Cross-platform compatibility between mobile and PC games

South Korean developers are skilled at creating games with complex progression systems and competitive mechanics. Titles such as Lineage M and Black Desert Mobile demonstrate this expertise through their detailed character customization and guild warfare systems.

The market’s global influence is achieved through strategic partnerships with international publishers. Companies like Pearl Abyss and Krafton have successfully brought their mobile games to Western and Southeast Asian markets, adapting them to local tastes while retaining key Korean gaming elements.

China’s Mobile Gaming Market: Regulatory Landscape and Market Growth

Key Regulatory Requirements:

- Mandatory real-name registration for players

- Time restrictions for minors (3 hours per week)

- Content compliance with cultural values

- Data localization requirements

Despite these challenges, the market has shown remarkable strength. Chinese developers have adapted by creating innovative gameplay mechanics that align with regulatory guidelines while maintaining player engagement.

Market Growth Indicators:

Local tech giants like Tencent and NetEase have mastered the art of navigating these regulations while expanding their global footprint. Their success stems from developing games that blend Chinese cultural elements with universal appeal.

The regulatory framework has inadvertently fostered unique monetization strategies. Chinese developers excel at creating free-to-play models with culturally appropriate microtransactions, setting new standards for player engagement and revenue generation.

Chinese players show strong preferences for mobile-first experiences, particularly in multiplayer online battle arena (MOBA) games and social gaming platforms. This consumer behavior drives continuous innovation in mobile game development and marketing strategies.

The Future of Mobile Gaming: AR/VR Integration and Gamification

The integration of AR/VR technologies into mobile gaming creates immersive experiences that blur the lines between digital and physical worlds. Companies like Apple and Meta are investing heavily in mixed reality gaming experiences, pushing the boundaries of what’s possible on mobile devices.

Key AR/VR Developments:

- Advanced haptic feedback systems

- Real-time environment scanning

- Spatial audio integration

- Hand and gesture tracking capabilities

The gamification trend extends beyond traditional gaming applications. Businesses implement game-like elements in non-gaming contexts:

- Education: Language learning apps using AR for object recognition

- Fitness: Virtual running companions and achievement systems

- Corporate Training: VR simulations for skill development

- Retail: Virtual try-on experiences and reward systems

The market sees a rise in cross-platform experiences where AR/VR features enhance traditional mobile gameplay. Games like Pokémon GO and Harry Potter: Wizards Unite demonstrate successful AR integration, while VR-capable mobile devices open new possibilities for immersive gaming on the go.

Emerging Technologies Shaping the Future:

- Cloud-rendered VR streaming

- 5G-enabled multiplayer AR experiences

- AI-powered dynamic content generation

- Blockchain integration for virtual asset ownership

These technological advancements create opportunities for developers to craft unique gaming experiences that combine physical movement, social interaction, and digital entertainment. The rise of metaverse concepts further drives innovation in mobile AR/VR gaming, with companies developing persistent virtual worlds accessible through mobile devices.

Competitive Landscape in the Mobile Gaming Industry

The mobile gaming industry is a dynamic and rapidly evolving sector, characterized by intense competition among established giants and emerging innovators. As of 2024, the global market has seen significant shifts influenced by technological advancements, strategic acquisitions, and changing consumer preferences.

-

Activision Blizzard – United States

-

Tencent Games – China

-

Supercell – Finland

-

Niantic – United States

-

Zynga – United States

-

Gameloft – France

-

Electronic Arts (EA) – United States

-

NetEase Inc. – China

-

Nintendo Co. Ltd. – Japan

-

Square Enix – Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Mobile Gaming Market Report |

| Base Year | 2024 |

| Segment by Type |

· Casual · Strategy · Role-Playing Games |

| Segment by Application |

· Educational applications · Marketing applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The mobile gaming industry has evolved significantly, transforming from simple entertainment to a complex ecosystem that spans education, marketing, and social connectivity. This comprehensive analysis reveals several key insights about the future of mobile gaming.

The integration of emerging technologies like AR/VR, cloud gaming, and 5G connectivity is reshaping how games are developed, distributed, and played. These advancements are creating new opportunities for developers while enhancing user experiences across different platforms and demographics.

Regional preferences continue to play a crucial role in shaping game development strategies. From casual games in Western markets to competitive esports in Asia, understanding local gaming cultures is essential for success in the global marketplace.

Global Mobile Gaming Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Mobile Gaming Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Mobile GamingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Mobile Gamingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Mobile Gaming Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Mobile Gaming Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Mobile Gaming Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMobile GamingMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected revenue of the mobile gaming market by 2025?

The mobile gaming market is projected to generate a revenue of $82.4 billion by 2025, highlighting significant growth and expansion in this sector.

Which regions are driving the growth of the mobile gaming market?

Key regions driving the growth of the mobile gaming market include the United States, South Korea, and China, each contributing uniquely to the industry’s expansion.

What are some current trends influencing the mobile gaming industry?

Current industry trends influencing the mobile gaming market include the rise of cloud gaming technologies, increased popularity of esports, and evolving monetization strategies that enhance user retention.

How do geopolitical factors affect the mobile gaming industry?

Geopolitical factors can significantly impact game development and distribution practices, as well as regulatory landscapes in key markets, influencing how companies operate within international trade regulations.

What types of mobile games are popular among different demographics?

The mobile gaming sector features a diverse range of genres including casual games, strategy games, and role-playing games. Preferences vary across demographics with casual games being particularly popular in regions like the U.S., South Korea, and China.

How are mobile games utilized beyond entertainment?

Mobile games are increasingly being leveraged for educational purposes and innovative marketing strategies. Successful case studies demonstrate their effectiveness in enhancing brand engagement through in-game advertising and educational content.