$9.1 Billion Expansion in Global Cream Cheese Market by 2025: Advancements Across the U.S., Germany, and Japan

Explore the comprehensive analysis of the global cream cheese market, including industry chain dynamics, market segmentation, regional insights, and future prospects. Discover key trends shaping the industry, from innovative flavors to health-conscious shifts, while examining market opportunities across the U.S., Germany, and Japan.

- Last Updated:

Cream Cheese Market Q1 and Q2 2025 Forecast

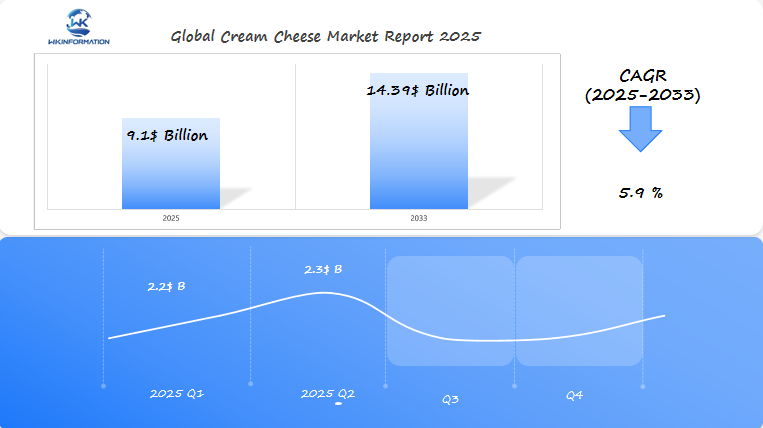

The Cream Cheese market, valued at $9.1 billion in 2025, is projected to grow at a CAGR of 5.9% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $2.2 billion, driven by high demand in the U.S., Germany, and Japan, where it is a popular ingredient for both home cooking and food service industries. The growth in plant-based and low-fat alternatives will also play a role in expanding the market in these regions.

By Q2 2025, the market is forecasted to reach $2.3 billion, with continued demand in the U.S. due to increased use in various dishes and desserts, as well as a growing preference for gourmet and flavored cream cheeses. Germany and Japan will continue to drive growth through the popularity of traditional dairy products and increasing incorporation of cream cheese into local cuisines.

Analyzing the Upstream and Downstream Industry Chain of Cream Cheese

The cream cheese industry operates through a complex network of interconnected stakeholders, from dairy farmers to end consumers. At the upstream level, dairy farmers supply fresh milk to processing facilities, where specialized equipment transforms raw materials into cream cheese through pasteurization, homogenization, and fermentation processes.

Key Players in Production:

- Dairy farms and cooperatives

- Milk collection centers

- Processing facilities

- Quality control laboratories

- Packaging manufacturers

The downstream segment involves multiple distribution channels that bring cream cheese products to consumers. Modern retail chains serve as primary distribution points, while foodservice operators represent a significant market segment.

Distribution Channels:

- Supermarkets and hypermarkets

- Specialty food stores

- Online retailers

- Food service distributors

- Restaurant suppliers

The supply chain integration between manufacturers and retailers plays a crucial role in maintaining product quality. Temperature-controlled storage and transportation systems ensure cream cheese products reach consumers in optimal condition. Major manufacturers like Kraft Heinz and Arla Foods maintain dedicated distribution networks to serve different market segments efficiently.

Retail partnerships drive product visibility and sales through strategic shelf placement and promotional activities. The foodservice sector demands bulk packaging options and consistent supply chains to meet commercial kitchen requirements.

Key Trends Shaping the Cream Cheese Market

The cream cheese market is undergoing a significant change due to shifting consumer preferences and innovations in the industry.

Innovative Flavor Profiles

- Artisanal varieties featuring truffle, herbs, and spices

- Sweet-savory fusion combinations like honey-walnut and fig-balsamic

- Limited-edition seasonal flavors capturing market attention

- Cultural fusion flavors inspired by global cuisines

Premium and Clean-Label Products

- Organic cream cheese options with transparent sourcing

- Grass-fed dairy products commanding higher price points

- Natural preservative-free formulations

- Small-batch production methods emphasizing quality

- Sustainable packaging solutions attracting eco-conscious consumers

Health-Conscious Market Shifts

- Plant-based alternatives using nuts and legumes

- Protein-enriched varieties catering to fitness enthusiasts

- Reduced-fat options maintaining creamy texture

- Probiotic-enhanced formulations for gut health benefits

The market is responding to these trends through product innovation and strategic positioning. Major manufacturers are investing in research and development to create unique offerings that align with consumer preferences. Small-scale producers are carving out niches by focusing on specialty products and local sourcing. These dynamics in the market are creating opportunities for both established brands and newcomers to capture market share through differentiated products.

Understanding the Restrictions Impacting the Cream Cheese Industry

The cream cheese industry operates under strict regulatory frameworks designed to maintain product safety and quality standards. The FDA mandates specific requirements for cream cheese production, including:

- Minimum milkfat content of 33%

- Maximum moisture content of 55%

- pH level regulations for safety

- Detailed ingredient declarations

Labeling requirements present significant challenges for manufacturers. Products must display:

- Accurate nutritional information

- Allergen warnings

- Country of origin

- Production facility details

Trade policies create complex dynamics in the international cream cheese market. The U.S. implements tariffs ranging from 15% to 35% on imported dairy products, while the EU maintains strict quotas on dairy imports. These measures directly influence pricing strategies and market accessibility.

Food safety standards impose rigorous quality control measures:

- Temperature Control: Strict monitoring during production and transportation

- Microbial Testing: Regular sampling for pathogen detection

- HACCP Compliance: Mandatory hazard analysis protocols

- Facility Certification: Regular audits and inspections

Recent updates to international food safety regulations have introduced new requirements for:

- Supply chain traceability

- Cross-contamination prevention

- Equipment sanitation protocols

- Employee hygiene standards

These regulatory frameworks significantly impact production costs and operational procedures, shaping the industry’s competitive landscape and market dynamics.

Geopolitical Factors Affecting Cream Cheese Production and Distribution

Geopolitical dynamics shape the global cream cheese market through complex international relationships and economic policies. The North American market benefits from stable political conditions and established trade networks between the U.S., Canada, and Mexico under USMCA, creating a robust regional dairy ecosystem.

European cream cheese production faces challenges from Brexit-related trade barriers, affecting supply chains between the UK and EU member states. The European Union’s strict agricultural policies influence pricing strategies and market access for non-EU producers attempting to enter the market.

The Asia-Pacific region demonstrates varying levels of market accessibility:

- China’s expanding middle class drives demand, yet strict import regulations limit foreign brand penetration

- Japan’s trade agreements with the EU and U.S. reduce tariffs on dairy products

- Southeast Asian markets show potential but face infrastructure limitations

Trade Agreement Impact on Pricing:

- USMCA: 0-3% tariff rates within North America

- EU-Japan EPA: Reduced duties on European dairy exports

- RCEP: Streamlined trade processes in Asia-Pacific

Recent global events have triggered shifts in dairy supply chains:

- Supply chain disruptions lead to localized production emphasis

- Currency fluctuations affect cross-border trade profitability

- Energy costs influence production and transportation expenses

Regional protectionist measures create market entry barriers through:

- Import quotas

- Quality certification requirements

- Local content requirements

- Country-specific labeling standards

Exploring Cream Cheese Market Segmentation by Type

The cream cheese market divides into distinct categories based on product formulation and consumer preferences:

1. Traditional Cream Cheese

- Full-fat varieties (33% fat content)

- Reduced-fat options (21% fat content)

- Light versions (13% fat content)

- Double-cream indulgent products (60-75% fat content)

2. Plant-Based Alternatives

- Nut-based varieties (cashew, almond)

- Soy-based formulations

- Coconut oil blends

- Legume-derived options

3. Specialty Categories

- Lactose-free cream cheese

- Protein-enriched varieties

- Probiotic-enhanced formulations

- Organic certified products

The plant-based segment shows remarkable growth, with a 15% year-over-year increase in market share. These alternatives mirror traditional cream cheese’s texture through advanced food science techniques, using natural stabilizers and emulsifiers.

Lactose-free options capture an expanding consumer base, particularly in regions with high lactose intolerance rates. These products maintain the classic cream cheese taste while eliminating lactose through enzyme treatment processes.

Market data indicates a shift toward specialized dietary options, with 23% of consumers actively seeking cream cheese alternatives that align with their dietary restrictions or lifestyle choices. Manufacturers respond by developing new formulations that cater to specific nutritional needs while maintaining the familiar taste and texture profiles consumers expect.

The Role of Applications in Shaping Cream Cheese Demand

Cream cheese’s versatility drives its market growth through diverse culinary applications. The spread segment dominates market share, with consumers using cream cheese as a breakfast staple on bagels, sandwiches, and toast. Professional chefs and home cooks incorporate cream cheese into savory dips, creating popular appetizers like spinach-artichoke dip and buffalo chicken dip.

Key Applications of Cream Cheese in Baking

The baking industry represents a significant demand driver for cream cheese. Key applications include:

- Cheesecakes and dessert bars

- Frosting for carrot cakes and red velvet cakes

- Danish pastries and sweet rolls

- Savory bread spreads

- No-bake desserts

Boosting Cream Cheese Consumption in Foodservice

Restaurant chains and cafes boost cream cheese consumption through signature menu items. Starbucks’ cream cheese-filled bagels and The Cheesecake Factory’s extensive cheesecake menu demonstrate the ingredient’s commercial value.

Impact of Home Baking and Social Media on Retail Demand

The rise of home baking during recent years has sparked increased retail demand. Social media platforms showcase creative cream cheese applications, inspiring new usage patterns among consumers. Recipe websites report high engagement for cream cheese-based dishes, particularly in categories like:

- Party dips and appetizers

- Holiday desserts

- Quick breakfast recipes

- Keto-friendly meals

Expanding Applications through Product Development

Food manufacturers continue developing new products featuring cream cheese as a primary ingredient, expanding its applications beyond traditional uses. Ready-to-eat dips and spreads represent a growing market segment, catering to convenience-seeking consumers.

Regional Insights into the Global Cream Cheese Market

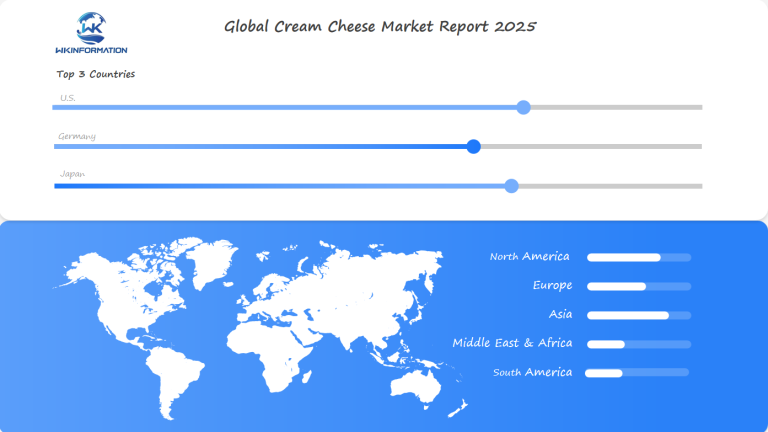

The global cream cheese market shows different characteristics in each region, influenced by local consumer preferences and cultural factors.

North America

- Highest per capita consumption of cream cheese

- Strong preference for flavored varieties

- Robust retail distribution networks

- Growing demand for organic options

Europe

- Focus on artisanal production methods

- Premium positioning of cream cheese products

- High demand for traditional dairy craftsmanship

- Strict quality control standards

Asia-Pacific

- Rapid market growth in urban centers

- Increasing adoption in fusion cuisine

- Rising popularity in bakery applications

- Adaptation to local taste preferences

Each region’s market structure reflects unique consumption patterns. North American consumers gravitate toward convenience-focused packaging and spreadable varieties. European markets emphasize heritage and authenticity, with strong demand for PDO (Protected Designation of Origin) products. Asia-Pacific consumers embrace cream cheese as both a standalone product and a versatile ingredient in local cuisines.

Market penetration varies significantly across regions. Urban areas in developing markets show accelerated adoption rates, while established markets focus on product innovation and premiumization. Regional dietary preferences influence product formulations, with Asia-Pacific markets featuring lighter textures and Europe maintaining traditional full-fat varieties.

In-Depth Analysis of the U.S. Cream Cheese Market

The U.S. cream cheese market is experiencing strong growth, with annual sales exceeding $2.3 billion. Philadelphia Brand (Kraft Heinz) is the leading brand in the market, controlling approximately 68% of retail sales through strategic product innovations and marketing campaigns.

Key Market Characteristics:

- Strong presence in retail channels, with supermarkets accounting for 45% of distribution

- Growing demand for portion-controlled packaging options

- Increasing preference for reduced-fat variants among health-conscious consumers

The U.S. market shows different consumption patterns across regions:

East Coast Markets

- Higher consumption rates linked to bagel culture

- Premium product preferences in urban centers

- Strong demand for flavored varieties

Midwest and Southern Regions

- Traditional plain cream cheese dominates sales

- Price sensitivity influences purchasing decisions

- Growing interest in local artisanal brands

Recent market data reveals significant shifts in consumer behavior:

- 32% increase in online purchases of cream cheese products

- 25% growth in demand for organic options

- 18% rise in sales of specialty flavored varieties

Private label brands have gained traction, now representing 22% of market share through competitive pricing and quality improvements. The foodservice sector remains a crucial growth driver, with quick-service restaurants and bakeries contributing to sustained demand.

Trends and Growth in the German Cream Cheese Market

Germany’s cream cheese market has unique features influenced by local consumer preferences and cultural factors. The market has been steadily growing, fueled by the increasing demand for organic and premium dairy products.

Key Factors Driving the Market:

- Strong preference for locally sourced dairy products

- Growing demand for organic cream cheese varieties

- Increasing adoption of plant-based alternatives

- Rising interest in artisanal and specialty cream cheese

German consumers have a particular liking for Frischkäse (fresh cheese) products, with regional variations becoming more popular. Local producers have responded by creating distinct flavors and textures that appeal to German tastes.

The market is witnessing significant innovation in:

- Protein-enriched varieties

- Reduced-fat options

- Clean-label products

- Sustainable packaging solutions

German retailers have expanded their private-label cream cheese offerings, creating competitive pressure on established brands. This competition has led to product innovation and price optimization strategies throughout the industry.

The rise of flexitarian diets has prompted manufacturers to develop hybrid products that combine dairy and plant-based ingredients. These innovations cater to both traditional dairy consumers and those seeking alternative options.

Local dairy cooperatives play a crucial role in the German cream cheese market by maintaining strong relationships with regional farmers and ensuring high-quality raw materials for production.

An Overview of Japan's Cream Cheese Market

Japan’s cream cheese market is unique, influenced by consumer preferences and cultural factors. It has been steadily growing, especially in the premium segment, where consumers prioritize quality and innovative flavors.

Key Features of the Market:

- High demand for individually wrapped portions

- Focus on premium positioning with emphasis on texture and mouthfeel

- Incorporation of traditional Japanese flavors like matcha and yuzu

Japanese consumers particularly enjoy using cream cheese in desserts, leading to the creation of specialized products for patisseries and bakeries. Local manufacturers have taken advantage of this trend by producing cream cheese variants specifically made for cheesecake production.

Popular Uses of Cream Cheese in Japan:

- Sweet dishes: Japanese-style cheesecakes, cream cheese-filled mochi

- Savory dishes: Sushi rolls, Japanese-style dips

- Convenient options: Single-serve portions for busy professionals

The market is witnessing significant innovation in packaging design, with manufacturers prioritizing convenience and portion control. Japanese brands have successfully introduced cream cheese products that blend Western dairy traditions with local taste preferences, resulting in one-of-a-kind fusion offerings.

Local dairy companies are partnering with international brands to create products tailored to Japanese preferences, resulting in distinct flavors and textures that appeal to the refined Japanese palate. This market shows great potential for premium, innovative cream cheese products that align with Japanese consumers’ appreciation for quality and newness.

Future Development Prospects for Cream Cheese

The cream cheese market is on the verge of a major transformation, driven by changing consumer preferences and technological innovations. Market projections indicate a strong growth trajectory reaching $11.3 billion by 2035, with several key developments shaping its evolution:

Emerging Market Opportunities

- Rising middle-class populations in Southeast Asia and Latin America create new market potential

- Increased urbanization drives demand for convenience foods incorporating cream cheese

- Growing adoption of Western dietary habits in developing nations expands market reach

Innovation in Product Development

- Smart packaging solutions with extended shelf life capabilities

- Probiotic-enriched varieties addressing gut health concerns

- Customized formulations for specific dietary requirements

Technological Advancements

- AI-powered production processes optimizing yield and quality

- Automated packaging systems reducing contamination risks

- Advanced filtration techniques improving product consistency

Sustainability Initiatives

- Bio-based packaging materials reducing environmental impact

- Energy-efficient processing methods

- Waste reduction strategies in production cycles

The integration of Industry 4.0 technologies in dairy processing plants promises enhanced production efficiency and product quality. Manufacturers investing in automated systems report up to 30% improvement in production capacity and significant reduction in processing time.

Plant-based alternatives continue gaining market share, with innovative ingredients like cashews and almonds providing texture profiles closely matching traditional cream cheese. These developments signal a market ready to embrace both traditional and novel product offerings.

Competitive Landscape of the Cream Cheese Industry

The cream cheese market has a lot of competition, with established brands and new players fighting for their share. Big companies like Kraft Heinz’s Philadelphia brand are able to stay on top by offering a wide range of products and having strong distribution networks.

- The Kraft Heinz Company (Philadelphia Cream Cheese) – United States

- Arla Foods – Denmark

- Fonterra Co-operative Group – New Zealand

- Lactalis Group – France

- Daiya Foods Inc. – Canada

- Kite Hill – United States

- Miyoko’s Creamery – United States

- Tofutti Brands Inc. – United States

- Franklin Foods – United States

- Alouette Cheese USA LLC – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Cream Cheese Market Report |

| Base Year | 2024 |

| Segment by Type |

· Traditional Cream Cheese · Lactose-free Cream Cheese · Others |

| Segment by Application |

· Home Baking · Foodservice |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The cream cheese market is undergoing a significant transformation, with the potential for substantial growth reaching $9.1 billion by 2025. Stakeholders in this dynamic industry face both challenges and opportunities.

To succeed, stakeholders must find a balance between traditional cream cheese production methods and the preferences of modern consumers. This means embracing new technologies, sustainability initiatives, and dietary needs.

The future of the cream cheese industry depends on its ability to adapt and respond to market signals. Manufacturers who combine product innovation with a strong market presence will create resilient business models that can thrive in this competitive landscape.

The projected growth of the market indicates promising opportunities for stakeholders who can effectively navigate these industry changes while prioritizing product quality, consumer satisfaction, and sustainable practices.

Global Cream Cheese Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Cream Cheese Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Cream Cheeseplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Cream Cheese Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Cream Cheese Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Cream Cheese Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofCream Cheese Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the cream cheese supply chain?

The cream cheese supply chain includes essential elements such as dairy processing, production, and distribution channels. Key players in this industry encompass dairy farms, manufacturers, and distributors who work together to deliver cream cheese to retail and foodservice sectors.

What trends are currently shaping the cream cheese market?

The cream cheese market is being influenced by rising consumer demand for innovative flavors and unique products. Additionally, there is an increasing interest in premium and clean-label offerings, alongside a growing focus on health trends that impact dairy consumption patterns.

How do regulations affect the cream cheese industry?

Regulatory frameworks significantly impact cream cheese production through labeling requirements and import/export regulations. These regulations ensure product safety and quality while also influencing trade policies that affect international distribution.

What geopolitical factors influence cream cheese production and distribution?

Geopolitical stability, trade agreements, and tariffs play crucial roles in the global dairy production landscape. These factors can affect regions such as North America, Europe, and Asia-Pacific, impacting market accessibility and pricing strategies for cream cheese.

How is the cream cheese market segmented by product type?

The cream cheese market can be segmented into traditional versus plant-based varieties, with a notable growth trend in lactose-free options that cater to specific dietary needs. This segmentation highlights key differences in consumer preferences across various demographics.

What applications drive the demand for cream cheese?

Cream cheese is used in various culinary applications such as spreads, dips, and baked goods like cheesecakes and bagels. Its versatility as an ingredient drives significant consumption across different food categories.