$11.21 Billion Growth in Student Housing Market by 2025: Key Insights from the U.S., Canada, and UK

Discover the projected $11.21 billion growth in the global student housing market through 2025. Explore key market dynamics, trends, and opportunities across the U.S., Canada, and UK regions.

- Last Updated:

Student Housing Market Q1 and Q2 2025 Forecast

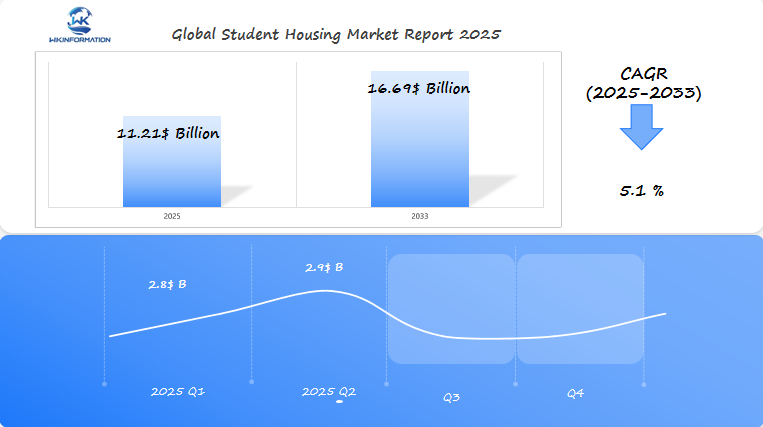

The Student Housing market is projected to reach $11.21 billion in 2025, growing at a CAGR of 5.1% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $2.8 billion, driven by the increasing number of international students and the rising demand for purpose-built student accommodation (PBSA) in the U.S., Canada, and the U.K.. As universities and colleges expand their enrollment, the need for high-quality, student-focused housing will continue to increase.

By Q2 2025, the market is expected to reach $2.9 billion, with growth spurred by the continued internationalization of higher education, especially in Canada and the U.K., where student mobility is increasing. The U.S. will also see continued demand for on-campus and off-campus housing solutions that cater to both local and international students.

The student housing market will grow as education institutions expand, and students increasingly seek modern, affordable housing options close to campuses, boosting demand for purpose-built student housing.

Exploring the Upstream and Downstream Industry Chains for Student Housing

The student housing industry functions through interconnected activities both upstream and downstream that drive market growth and development.

Upstream Activities

These are the activities that occur before the actual construction and operation of student housing:

- Land acquisition and development rights

- Raw material procurement for construction

- Architectural planning and design

- Construction and development services

- Infrastructure development

Downstream Activities

These activities take place after the student housing has been built:

- Property management services

- Student leasing and rental operations

- Facility maintenance

- Marketing and tenant acquisition

- Student support services

The supply chain in the student housing industry relies on three main stakeholders:

- Developers: Companies responsible for property construction, renovation, and expansion of student housing facilities

- Investors: Private equity firms, REITs, and institutional investors providing capital for development and acquisitions

- Universities: Educational institutions that either partner with private developers or manage their own housing facilities

These industry chains have a significant impact on the market through:

- Increased property values in university neighborhoods

- Job creation across construction and service sectors

- Economic growth in university towns

- Enhanced student living standards

- Development of specialized service providers

The coordination between upstream and downstream activities has led to the emergence of purpose-built student accommodation (PBSA), which is changing the traditional dormitory model and is expected to contribute to a market growth of $11.21 billion by 2025.

Key Trends Shaping the Student Housing Market

The student housing market is experiencing significant growth due to changing demographics and evolving preferences among students. One of the main driving forces behind this growth is the increasing number of international students.

Regional Rental Growth Rates

Rental growth rates vary across different regions, with key markets showing diverse trends:

United States

- The national average rental growth rate is 9.78%.

- The Northeast region is leading with a growth rate of 9.97%.

- There are currently 164,820 new beds in development.

United Kingdom

- The private sector rental growth rate is exceeding 9%.

- There is a critical shortage of beds, with 1.5 million needed but only 8,760 planned.

- Rental rates are higher compared to maintenance loan allocations.

Canada

- Both domestic and international enrollment numbers are steadily increasing.

- There is a rising demand for specialized student accommodations.

- Urban-centric developments are becoming increasingly important.

The Rise of Purpose-Built Student Accommodation (PBSA)

Purpose-built student accommodation (PBSA) is emerging as a game-changer in the market. These facilities are designed specifically for students and offer various features that cater to their needs:

- Enhanced security measures

- Amenities focused on studying

- Spaces for building communities

- Technology solutions integrated into the living experience

- Sustainable design elements

The PBSA sector aims to meet the expectations of modern students while also addressing the housing shortages near educational institutions. As a result, there has been a continuous increase in investment towards these properties, indicating strong confidence in the market and sustained growth in demand.

Challenges and Restrictions in the Student Housing Market

The student housing market faces significant hurdles across the U.S., Canada, and UK regions. Rising costs present a critical challenge for students, with average monthly rents in major university cities exceeding 70% of typical student income.

Key Affordability Issues:

- Student loan debt burden limiting housing choices

- Increasing utility costs and additional fees

- Limited part-time work opportunities in university areas

- Rising insurance and maintenance costs

Regulatory Barriers to Development:

- Strict zoning laws restricting new construction

- Height limitations in university districts

- Minimum parking requirements

- Extended approval processes for new developments

Local policies create additional complexities in different markets. In the U.S., rent control measures in cities like Boston and San Francisco impact development feasibility. Canadian municipalities enforce strict density requirements, limiting bed capacity in new projects. UK planning authorities impose specific design standards that increase construction costs.

Housing availability remains constrained by:

- Limited land near campus locations

- Infrastructure capacity restrictions

- Community opposition to student housing projects

- Preservation requirements in historic districts

The gap between demand and supply continues to widen as universities increase enrollment without corresponding housing expansion. Private developers face heightened scrutiny from local authorities, leading to delayed project timelines and increased development costs.

Geopolitical Influences on the Student Housing Market

Global political dynamics shape student mobility patterns and directly impact student housing markets across the U.S., Canada, and UK. Recent geopolitical shifts have created new patterns in international student flows:

1. Political Stability Impact

- Countries with stable political environments attract higher numbers of international students

- Universities in politically stable regions report 15-20% higher international enrollment rates

- Student housing developers prioritize investments in politically stable markets

2. Immigration Policy Effects

- U.S. visa restrictions have reduced Chinese student enrollment by 8% since 2020

- Canada’s streamlined study permit process has increased international enrollment by 75%

- UK’s post-Brexit policies have shifted EU student demographics, affecting housing demands

3. Regional Tensions

- Middle East conflicts have redirected student flows to alternative study destinations

- Trade disputes between major economies influence student migration patterns

- Diplomatic relationships between countries affect bilateral student exchange programs

4. Market Implications

- Developers adapt housing strategies based on shifting international student demographics

- Investment patterns follow regions with favorable immigration policies

- Purpose-built student accommodation (PBSA) providers target markets with stable international relations

The student housing sector responds to these geopolitical shifts through strategic location selection and amenity offerings tailored to changing student populations. Housing providers now incorporate geopolitical risk assessment into their development planning processes.

Types of Student Housing: On-Campus, Off-Campus, and Private Accommodation

Student housing options present distinct advantages and challenges for different student needs:

On-Campus Housing

- Built-in community atmosphere

- Proximity to classes and campus facilities

- Meal plans included

- Higher costs compared to alternatives

- Limited privacy

- Strict rules and regulations

Off-Campus Housing

- Greater independence

- Cost-effective options available

- Flexibility in choosing roommates

- Transportation challenges

- Additional utility expenses

- Property maintenance responsibilities

Private Accommodation

- Premium amenities

- Professional management

- Purpose-built facilities

- Highest price point

- Limited availability

- Often requires long-term commitments

Recent data shows 71% of students prefer private accommodation options, citing enhanced privacy and modern amenities as key factors. This shift has driven rental prices up by 15-20% in private student housing developments across major university cities.

The price variations between housing types are significant:

- On-campus: $10,000-15,000/academic year

- Off-campus: $7,000-12,000/academic year

- Private accommodation: $12,000-20,000/academic year

Location plays a crucial role in these price differences, with urban centers commanding premium rates across all housing types. Student preferences now lean toward private accommodations offering study spaces, high-speed internet, and social areas, reflecting evolving needs in modern education environments.

Applications of Student Housing in Educational and Real Estate Sectors

Student housing plays a vital role in shaping educational outcomes. Research shows institutions with quality on-campus housing report 15-20% higher student retention rates compared to those without dedicated accommodation facilities.

How Educational Institutions Benefit from Student Housing

Educational institutions leverage student housing as a strategic asset:

- Increased student engagement through living-learning communities

- Enhanced campus culture and community building

- Higher enrollment rates driven by housing guarantees

- Additional revenue streams from room and board fees

Investment Opportunities in the Purpose-Built Student Accommodation (PBSA) Sector

The Purpose-Built Student Accommodation (PBSA) sector presents lucrative investment opportunities:

- Average yields of 5.5-6.5% in prime locations

- Recession-resistant income streams

- Steady cash flow from academic year contracts

- Diversification benefits for real estate portfolios

Success Story: University of British Columbia

UBC’s Student Housing and Hospitality Services demonstrates the power of strategic housing development:

- $450 million investment in new residences

- 5,000 additional beds created

- 50% increase in first-year retention rates

- Sustainable building practices reducing operational costs

Private developers have recognized these opportunities, with companies like American Campus Communities reporting consistent annual returns above 8%. Their portfolio of over 200 properties serves as a blueprint for successful student housing investment strategies.

The integration of technology and modern amenities in student housing developments has created premium rental opportunities, with some properties commanding 20-30% higher rates than traditional off-campus options.

Global Insights into the Student Housing Market

The student housing market shows different trends in major educational centers. The U.S. market is growing strongly with a national average rental increase of 9.78%, driven by a steady number of international students enrolling, which is expected to reach 1.09 million students in 2023-24.

Key Differences in Each Market:

United States

- 164,820 new student housing units are being planned

- International students contribute $17.6 billion to the market

- The Northeast region has the highest return on investment rates at 9.97%

United Kingdom

- There is a critical shortage of student housing beds: 1.5 million are needed but only 8,760 are planned

- The private sector is experiencing rental growth of over 9%

- Student maintenance loans are not enough to cover average rents

Canada

- More domestic students are enrolling in colleges and universities

- There is an increasing demand for purpose-built student accommodation (PBSA)

- Development projects are being affected by strict regulations

The balance between supply and demand differs greatly in these areas. While the U.S. has a steady number of new student housing units being built, the UK is facing serious limitations on supply. Canada is somewhere in between, with growing demand being met by moderate construction activity.

The level of maturity in each market also affects investment trends. In the U.S., the market is showing signs of stability with institutional investors dominating large-scale projects. In the UK, there is intense competition for existing properties, pushing investors to explore alternative development strategies. Canadian markets are attracting more international investment interest due to strong fundamentals and growth potential.

U.S. Student Housing Market Outlook

The U.S. student housing market has experienced significant growth, driven by increasing enrollment in higher education institutions and a rising demand for off-campus housing options. As students seek more independent living arrangements, the market for private student housing continues to expand. This segment, which encompasses purpose-built student housing (PBSH) and off-campus rentals, has seen steady demand across key university towns and metropolitan areas.

Trends and Drivers

Several factors are fueling growth in the student housing market:

-

Rising Enrollment: Despite economic challenges, U.S. universities continue to see strong enrollment numbers, particularly in urban centers, which boosts demand for student housing.

-

Preference for Amenities: Modern student housing offers amenities like high-speed internet, fitness centers, and study lounges, making it more attractive than traditional dormitories.

-

Investment Growth: Real estate investors, including institutional funds and private equity firms, have increasingly focused on student housing as a stable asset class due to its resilience during economic downturns.

Challenges

The market faces challenges such as rising construction costs and competition from alternative housing options like co-living spaces. Additionally, fluctuating enrollment numbers in certain regions and the impact of remote learning trends pose potential risks to long-term growth.

Canada’s Role in Student Housing Demand

Canada has become a prominent destination for students, both domestic and international, leading to increased demand for student housing. The country’s high-quality education system and diverse cities contribute to the expansion of this market.

International Students Driving Demand

International students make up a significant portion of the demand for student housing in Canada. Popular cities like Toronto, Vancouver, and Montreal attract students from around the world, who often seek private off-campus housing due to proximity to universities and high-quality living standards.

Domestic Student Migration

Domestic students are also fueling the demand for student housing, particularly in urban centers. Students from rural areas are increasingly moving to cities for better educational opportunities, further intensifying the need for both on-campus and private student housing.

Supply Constraints and Opportunities

Despite rising demand, there is often a shortage of purpose-built student housing (PBSH) in major university cities. This supply-demand imbalance creates a significant opportunity for developers to invest in and build more purpose-built student housing projects.

Modernization and Amenities

Today’s student housing in Canada is evolving to meet the demands of modern students. Properties now include high-speed internet, gyms, study rooms, and communal spaces, attracting students seeking more comfortable, flexible living environments.

The UK’s Contribution to the Student Housing Market

The UK student housing market is facing a serious shortage of supply, with demand reaching 1.5 million beds and limited new developments. Recent data shows that only 8,760 additional beds are planned for the upcoming academic year, which will lead to fierce competition among students for available places to live.

Rising Rental Prices in UK University Cities

Rental prices in the private sector have soared across UK university cities:

- London: Average monthly rent £1,200+

- Manchester: 12% year-over-year increase

- Edinburgh: 15% surge in premium student accommodations

Financial Pressure on Students

The financial burden on students has worsened as rental costs exceed maintenance loans. A typical student outside London receives £9,978 in maintenance support, yet average accommodation costs take up 70-80% of this amount. This gap has led to demands for more investment in affordable student housing developments and regulations to control rental price increases.

Strong Demand for Purpose-Built Student Accommodation

Developers of purpose-built student accommodation (PBSA) are reporting record occupancy rates of 98%, indicating strong investment opportunities despite challenges in the market. Cities like Birmingham and Leeds have seen a 25% rise in PBSA applications, showing increasing investor confidence in this sector.

The Future of Student Housing: Trends and Predictions

The student housing market is expected to undergo significant changes after 2025 due to demographic shifts and changing student preferences. According to market analysts, the industry will grow at a rate of 5.1% per year until 2030, driven by factors such as:

- More international students traveling for education

- Higher demand for flexible living arrangements

- Adoption of smart technology solutions

- Increased focus on mental health and wellness facilities

Sustainability Initiatives Take Center Stage

Green building practices are becoming standard requirements in new student housing developments:

- Solar panel installations

- Energy-efficient HVAC systems

- Water conservation technologies

- Waste reduction programs

- Bike storage and electric vehicle charging stations

Tech-Forward Living Spaces

The next generation of student accommodation will feature:

- IoT-enabled room controls

- AI-powered security systems

- Smart energy management

- Virtual reality touring capabilities

- Digital community engagement platforms

These advancements align with changing demographic patterns, as Generation Alpha enters higher education. This tech-native generation demands accommodations that reflect their values: sustainability, connectivity, and community engagement.

Property developers are adapting their blueprints to include:

- Flexible study spaces

- Wellness centers

- Collaborative areas

- Sustainable gardens

- Mental health support facilities

The market’s evolution reflects a broader shift toward purpose-built student accommodation that prioritizes both environmental responsibility and student wellbeing.

Competitive Landscape in the Student Housing Market

The student housing market is becoming increasingly competitive as demand rises across major global education hubs. Developers, property managers, and investors are vying to meet the growing need for student accommodations, particularly in urban areas with large universities and colleges.

- American Campus Communities – United States

- Harrison Street – United States

- The Scion Group – United States

- Greystar – United States

- Core Spaces – United States

- Blackstone – United States

- Newmark – United States

- The Preiss Company – United States

- Campus Advantage – United States

- CA Ventures – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Student Housing Market Report |

| Base Year | 2024 |

| Segment by Type |

· On-Campus Housing · Off-Campus Housing · Private Accommodation |

| Segment by Application |

· Large Enterprises · Small and Medium-sized Enterprises(SMEs) |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Adapting to the evolving demands of the student housing market is crucial in today’s rapidly changing landscape. With globalization, digitalization, and environmental consciousness reshaping the industry, stakeholders—be it developers, investors, or universities—are encouraged to embrace innovation.

- Globalization: As international student mobility grows, providing accommodation that caters to diverse cultural and educational needs becomes essential.

- Digitalization: Integrating smart technology not only improves student living experiences but also enhances operational efficiency for property managers.

- Environmental Consciousness: Sustainable design and construction practices are increasingly important as environmental awareness rises among students and institutions.

A call-to-action for stakeholders is clear: prioritize affordability and accessibility when planning new projects or initiatives. This focus will enhance the overall quality within this vital segment of the real estate industry, ensuring its resilience and relevance in the future. The path forward lies in balancing innovative approaches with practical solutions to meet the demands of tomorrow’s students effectively.

Global Student Housing Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Student Housing Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Student Housingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Student Housing Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Student Housing Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Student Housing Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofStudent Housing Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key players in the student housing supply chain?

The key players in the student housing supply chain include developers, investors, and universities. Each of these stakeholders plays a crucial role in shaping the market dynamics and overall growth of the student housing industry.

What trends are currently driving demand in the student housing market?

Current trends driving demand in the student housing market include increased international student enrollment, demographic shifts, and variations in rental growth rates across regions such as the U.S., Canada, and the UK.

What challenges does the student housing market face?

The student housing market faces several challenges including affordability issues for students, regulatory changes affecting housing availability, and local policies that impact market dynamics.

How do geopolitical influences affect international student mobility?

Geopolitical stability significantly influences international student mobility. Immigration policies can impact enrollment numbers in different countries, while regional tensions may affect students’ decisions to study abroad.

What types of student accommodation are available?

Students have various accommodation options including on-campus housing, off-campus living arrangements, and private accommodations. Each type has its benefits and drawbacks which can influence students’ preferences and rental prices.

What is the outlook for the U.S. and Canadian student housing markets from 2023 to 2025?

The outlook for the U.S. and Canadian student housing markets includes anticipated growth driven by increased enrollment rates, although challenges related to affordability and regulatory restrictions remain prevalent. Key statistics will be monitored to assess construction pipelines and domestic vs. international enrollment trends.