$1.61 Billion Expansion in Smart Irrigation Market by 2025: Advancements Across the U.S., Australia, and Brazil

Discover the comprehensive analysis of the smart irrigation market’s expansion to $1.61 billion by 2025, exploring technological advancements and market developments across the U.S., Australia, and Brazil. The article examines key innovations in precision agriculture, water conservation strategies, and IoT integration, highlighting how these technologies are revolutionizing agricultural practices worldwide. Learn about market trends, competitive dynamics, and future prospects in smart irrigation technology.

- Last Updated:

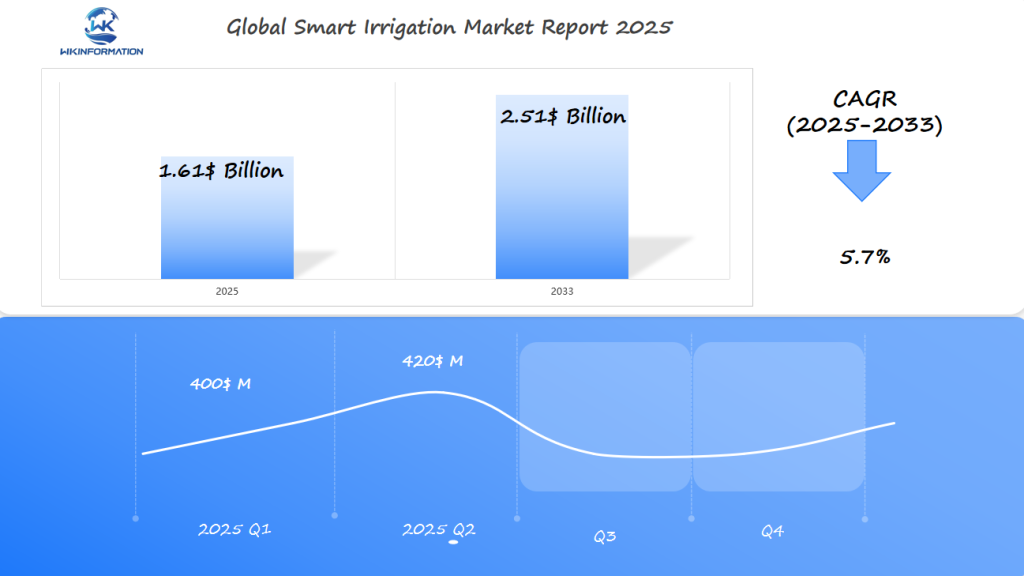

Smart Irrigation Market Q1 and Q2 2025 Forecast

The Smart Irrigation market is projected to reach $1.61 billion in 2025, growing at a CAGR of 5.7% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $400 million, driven by increasing adoption of water-efficient irrigation technologies in the U.S., Australia, and Brazil. As the agriculture sector increasingly adopts smart technologies to optimize water usage, demand for intelligent irrigation systems—which utilize weather data, soil sensors, and automation—will continue to grow.

By Q2 2025, the market is forecast to reach $420 million, fueled by strong growth in Brazil, where agriculture plays a significant role in the economy, and Australia, which faces water scarcity issues, encouraging investment in water-saving irrigation solutions. The U.S. will continue to lead due to significant investments in precision agriculture and sustainable farming practices.

The smart irrigation market will grow as farmers and property owners seek to optimize water usage, reduce waste, and increase crop yields using automated and sensor-driven irrigation systems.

The Global Smart Irrigation Industry: Upstream and Downstream Processes and Innovation Trends

The smart irrigation industry consists of interconnected processes that work together to make the market more efficient. These processes can be divided into two main segments: upstream and downstream.

Upstream Segment

The upstream segment of the smart irrigation industry focuses on the suppliers of raw materials and manufacturers of components. They play a crucial role in producing the essential elements required for smart irrigation systems. Some of the key components produced in this segment include:

- Controllers: Advanced microprocessors and circuit boards

- Sensors: Soil moisture, weather, and flow detection components

- Water Flow Meters: Precision measurement instruments

- Communication Modules: IoT connectivity components

Downstream Segment

On the other hand, the downstream processes involve activities that directly serve the end-users of smart irrigation systems. This includes various services and networks that facilitate the implementation and operation of these systems. Some examples of downstream processes are:

- Agricultural implementation services

- Residential installation networks

- Commercial deployment systems

- Technical support infrastructure

Innovation Trends Shaping the Industry Chain

Innovation plays a significant role in shaping both upstream and downstream segments of the smart irrigation industry chain. Several technological advancements have emerged as key drivers of this innovation:

- AI-powered control systems for precise water distribution

- Cloud-based data analytics for real-time monitoring

- Smart sensors with extended battery life

- Wireless communication protocols for remote management

These innovations are not only enhancing the capabilities of existing products but also opening up new possibilities for sustainable agriculture practices.

Impact on Manufacturing Sector

The manufacturing sector has also been impacted by these innovation trends. Automation and robotics are being embraced in production lines, leading to reduced costs and improved reliability of components used in smart irrigation systems.

Customization by System Integrators

System integrators are now offering customized solutions tailored to specific agricultural needs. This allows farmers to implement smart irrigation practices that align with their unique requirements.

Digital Platforms for Distribution Efficiency

Distributors in the industry are leveraging digital platforms for efficient order management and delivery tracking. This ensures timely availability of components at various locations, supporting seamless integration into existing agricultural operations.

Ongoing Research and Development Efforts

Research and development teams continue to push boundaries in sensor technology, creating more accurate and durable components used in smart irrigation systems.

These ongoing efforts aim to address challenges faced by farmers such as water scarcity, climate change impacts, and increasing food production demands.

By developing innovative solutions that cater specifically to these challenges, R&D initiatives contribute towards achieving sustainable agricultural practices globally.

Key Trends in Smart Irrigation: Automation, Water Conservation, and IoT Integration

1. Automation in Smart Irrigation

Smart irrigation automation is transforming water management with the help of AI-powered systems that adjust watering schedules based on real-time data. These systems analyze various factors such as:

- Soil moisture levels

- Weather patterns

- Plant water requirements

- Evapotranspiration rates

2. Government Water Conservation Programs

Government Water Conservation Programs play a significant role in shaping the industry’s direction by implementing various initiatives such as:

- Tax incentives for adopting smart irrigation practices

- Rebate programs for purchasing water-efficient equipment

- Mandatory restrictions on water usage

- Educational campaigns promoting sustainable practices

3. IoT Integration in Irrigation Systems

The integration of Internet of Things (IoT) technologies is creating interconnected irrigation networks that provide precise water management solutions. Smart sensors are used to collect and transmit data on:

- Soil conditions

- Weather forecasts

- Plant health metrics

- Water pressure levels

These IoT-enabled systems offer several benefits, including:

- Remote monitoring capabilities

- Automated detection of leaks

- Real-time adjustments to the irrigation system

- Decision making based on data analysis

4. Advanced Control through IoT Platforms

With the help of advanced IoT platforms, farmers and landscapers can now control their irrigation systems using mobile applications. This allows them to have immediate access to system controls and performance metrics, making it easier to manage water resources efficiently.

The combination of automation, water conservation measures, and IoT integration is establishing a robust framework for promoting sustainable water management practices in both agricultural and urban environments.

Challenges in Smart Irrigation: High Initial Costs and Adoption Barriers

The Smart Irrigation Market faces significant hurdles that slow down widespread adoption across agricultural sectors. Implementation costs present a substantial barrier, with initial system setup ranging from $2,000 to $10,000 per acre depending on complexity. These expenses include:

- Hardware components (sensors, controllers, meters)

- Professional installation services

- Software licensing fees

- Regular maintenance costs

User education barriers create resistance among traditional farmers. Many potential users lack:

- Technical knowledge to operate smart systems

- Understanding of ROI potential

- Awareness of available government subsidies

- Training resources for system maintenance

Rural connectivity issues pose persistent challenges for smart irrigation deployment. Common problems include:

- Limited internet coverage in remote farming areas

- Unreliable cellular networks affecting real-time data transmission

- Signal interference from terrain and weather conditions

- Inconsistent power supply for system operation

System efficiency suffers from these connectivity constraints, leading to:

- Delayed response times in automated systems

- Incomplete data collection for analysis

- Reduced accuracy in weather-based adjustments

- Increased risk of system failures

The combination of high costs, knowledge gaps, and technical limitations creates a complex barrier to entry for many potential adopters in the smart irrigation sector.

Geopolitical Impact on the Smart Irrigation Market

Government policies shape the adoption rates of smart irrigation technologies across different regions. Countries with strict water conservation regulations, like Israel and Singapore, have witnessed accelerated implementation of smart irrigation systems through targeted subsidies and incentives.

Trade relationships and their influence

Trade relationships between nations directly influence the accessibility and cost of smart irrigation technologies:

- Tariffs and Import Duties: Countries imposing high tariffs on agricultural technology imports create barriers for local farmers seeking advanced irrigation solutions

- Technology Transfer Agreements: Bilateral partnerships between developed and developing nations facilitate knowledge sharing and technology adoption

- Regional Economic Blocks: Trade agreements like NAFTA and EU partnerships affect pricing and availability of smart irrigation components

Global events affecting production

The global semiconductor shortage has impacted the production and distribution of smart irrigation controllers and sensors. Countries with strong diplomatic ties to chip manufacturing nations maintain advantages in securing essential components.

Local policies shaping the market

Local agricultural policies play a crucial role in market development:

- Water pricing regulations

- Environmental protection laws

- Agricultural modernization initiatives

- Rural development programs

Impact of trade sanctions

Trade sanctions between major economies affect the supply chain of smart irrigation technologies. Restrictions on technology exports and imports between countries like the U.S. and China create regional variations in product availability and innovation adoption rates.

Types of Smart Irrigation: Drip Systems, Sprinkler-Based Systems, and Sensor-Based Automation

Smart irrigation systems come in three primary configurations, each designed for specific agricultural and landscaping needs:

1. Drip Systems

- Delivers water directly to plant roots

- Uses minimal water through slow, precise application

- Reduces water waste by up to 60%

- Ideal for row crops, orchards, and greenhouses

2. Sprinkler-Based Systems

- Broadcasts water over large areas

- Features rotating heads or fixed spray patterns

- Suitable for lawns, sports fields, and broad-acre farming

- Includes weather-based adjustments for optimal coverage

3. Sensor-Based Automation

- Integrates soil moisture sensors

- Monitors weather conditions in real-time

- Adjusts water flow based on plant needs

- Connects to smartphone apps for remote control

The choice between these systems depends on specific factors:

- Terrain type: Drip systems work best on flat surfaces, while sprinklers adapt to varied topography

- Crop requirements: Root-sensitive plants benefit from drip irrigation’s precision

- Scale of operation: Large fields often require sprinkler systems for efficient coverage

- Budget considerations: Sensor-based systems offer long-term savings despite higher initial costs

Recent innovations combine these technologies, creating hybrid systems that maximize efficiency while maintaining optimal soil moisture levels. These smart solutions integrate weather forecasting, soil data, and crop-specific algorithms to deliver precise irrigation schedules.

Applications of Smart Irrigation in Agriculture, Landscaping, and Sports Fields

Smart irrigation systems are changing the way water is managed in various industries, each with its own specific needs and advantages.

1. Agricultural Applications

- Greenhouse SystemsPrecise control of humidity levels

- Automated nutrient delivery

- Year-round growing capabilities

- Open-Field SystemsWeather-responsive irrigation scheduling

- Crop-specific watering patterns

- Real-time soil moisture monitoring

The agricultural sector sees up to 30% reduction in water consumption through smart irrigation implementation.

2. Residential and Commercial Landscaping

- Custom zone programming for different plant types

- Automatic adjustment to seasonal changes

- Remote monitoring through mobile apps

- Water usage tracking and reporting

Landscaping applications report 45% savings in water usage while maintaining optimal plant health.

3. Sports Field Management

- Targeted irrigation for high-traffic areas

- Customized programs for different playing surfaces

- Drainage optimization

- Turf health monitoring

Sports facilities using smart irrigation systems reduce maintenance costs by 25% while improving playing surface quality.

These applications demonstrate smart irrigation’s versatility in meeting specific needs across different environments. The technology’s ability to adapt to various conditions makes it an invaluable tool for water conservation and resource management.

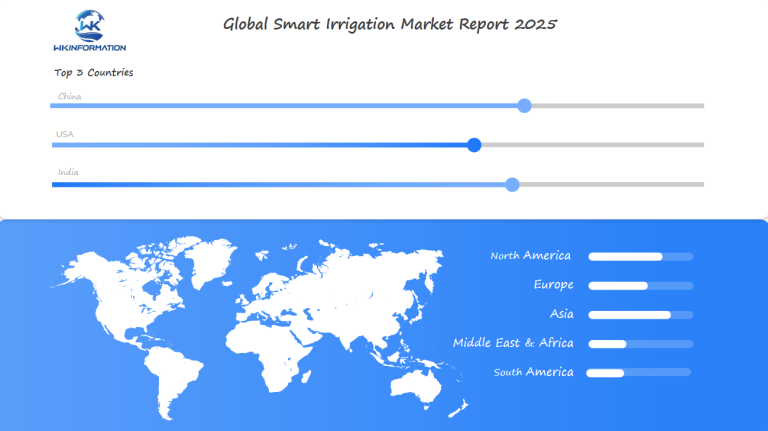

Global Insights into the Smart Irrigation Market

The global smart irrigation landscape reveals distinct regional patterns in market dominance and adoption rates. North America currently holds a 40% market share, leading the global smart irrigation sector through extensive implementation of advanced irrigation technologies and robust infrastructure development.

Asia-Pacific emerges as the fastest-growing region, driven by:

- Rapid agricultural modernization

- Rising population demands

- Government-backed sustainability initiatives

- Increasing awareness of water conservation

Regional market distribution highlights:

- North America: 40%

- Europe: 25%

- Asia-Pacific: 20%

- Rest of World: 15%

Market analysts project significant shifts in these percentages by 2025, with Asia-Pacific expected to capture up to 30% of the market share. This growth stems from accelerated adoption rates in countries like China and India, where agricultural transformation initiatives receive substantial government support.

Latin America shows promising growth potential, particularly in Brazil and Mexico, where smart irrigation adoption rates have increased by 15% annually since 2020. The Middle East and Africa regions demonstrate steady growth, focusing on water-efficient technologies to combat scarce water resources.

The market demonstrates strong regional variations in technology preferences:

- North America: Weather-based systems

- Europe: Sensor-based solutions

- Asia-Pacific: Mobile-controlled irrigation systems

- Latin America: Hybrid technologies

U.S. Smart Irrigation Market: Growing Demand for Water-Efficient Farming

The U.S. holds a commanding 40% market share in the global smart irrigation sector, driven by robust technological infrastructure and substantial agricultural investments. American farmers increasingly adopt smart irrigation solutions to combat water scarcity and rising operational costs.

Key factors propelling U.S. market growth:

- Government Incentives: Federal and state-level programs offer tax benefits and subsidies for implementing water-efficient farming technologies

- Rising Labor Costs: Automated irrigation systems reduce dependency on manual labor

- Drought Conditions: Persistent water shortages in states like California and Arizona push farmers toward precision irrigation

Recent technological advancements in U.S. smart irrigation include:

- AI-powered soil moisture sensors detecting plant stress levels

- Drone-based thermal imaging for precise water distribution

- Mobile apps enabling remote irrigation management

- Weather-integrated systems adjusting water schedules automatically

The U.S. agricultural sector demonstrates remarkable success with smart irrigation implementation. California vineyards report up to 30% water savings using sensor-based systems, while Midwest corn farmers achieve 25% higher yields through precision irrigation techniques.

Leading U.S. companies like Rain Bird Corporation and The Toro Company continue developing innovative solutions, including solar-powered controllers and blockchain-based water trading platforms. These advancements strengthen North America’s position as the global smart irrigation technology hub.

Australia's Smart Irrigation Market: Combating Drought with Technology

Australia’s agricultural sector is facing significant challenges due to water scarcity, with drought conditions affecting 85% of agricultural land in recent years. The country’s unique climate patterns and rising temperatures have forced farmers to adopt smart irrigation solutions.

Specialized Drought-Resistant Systems Developed by Australian AgTech Companies

Australian agricultural technology companies have created specialized systems to combat drought:

- Smart soil moisture probes that measure water content at different soil depths

- Weather-based irrigation controllers adapted to Australia’s distinct climate zones

- Remote monitoring systems enabling farmers to manage multiple properties from central locations

Success Stories in the Murray-Darling Basin

The Murray-Darling Basin, Australia’s largest agricultural region, has witnessed impressive success stories. Local farmers report water savings of up to 40% through the implementation of smart irrigation practices. Additionally, the Victorian government’s initiative to modernize irrigation infrastructure has resulted in over 5,000 farms being equipped with automated irrigation systems.

Recent Innovations in Smart Irrigation

Recent advancements in smart irrigation technology include:

- AI-powered crop stress detection

- Solar-powered irrigation controllers

- Automated water delivery scheduling

Impact of Smart Technology Adoption in Murrumbidgee Irrigation Area

The Murrumbidgee Irrigation Area serves as a prime example of the positive impact brought about by the adoption of smart technology. Farmers who have implemented smart irrigation systems in this region have experienced a remarkable increase in crop yields by 30% while simultaneously reducing water consumption by 25%. These outcomes highlight how Australian agriculture is adapting to water scarcity through innovative technological solutions.

Government Support for Smart Irrigation Technologies

The Australian government’s Water Efficiency Program has allocated $1.5 billion to support farmers in implementing smart irrigation technologies, reinforcing the country’s commitment to sustainable water management.

Brazil's Smart Irrigation Market: Boosting Agricultural Yield with Innovation

Brazil’s agricultural sector is a major contributor to the country’s economy, accounting for 26.6% of its GDP and ranking among the top food producers globally. The introduction of smart irrigation technologies has transformed farming practices in Brazil, especially in areas such as São Paulo and Mato Grosso.

Key Agricultural Developments:

- Smart irrigation systems have increased soybean yields by 35% in pilot programs

- Coffee plantations using precision irrigation report 28% water savings

- Sugar cane production efficiency improved by 42% with automated systems

The Brazilian government’s Agricultura 4.0 initiative provides substantial support for agricultural innovation:

- Tax incentives for farmers adopting smart irrigation systems

- Technical training programs reaching 50,000 farmers annually

- Research partnerships with agricultural technology companies

Local success stories demonstrate the transformative impact of smart irrigation:

- Fazenda Santa Rita achieved 45% water reduction while increasing corn yields

- Grupo São Martinho’s sugarcane operations reduced water consumption by 3.2 billion liters annually

- Small-scale farmers in Bahia reported 40% cost savings through cooperative smart irrigation programs

Brazilian agricultural technology companies are developing region-specific solutions, incorporating weather pattern analysis and soil composition data to optimize irrigation schedules. These innovations align with Brazil’s commitment to sustainable agriculture while maintaining its position as a global agricultural leader.

The Future of Smart Irrigation: AI-Powered Precision Agriculture and Sustainability

AI technology reshapes smart irrigation through predictive analytics and machine learning algorithms. These systems analyze historical weather patterns, soil conditions, and crop performance data to make real-time irrigation decisions.

Key AI-Powered Advancements:

- Deep learning models predict optimal watering schedules

- Computer vision systems detect plant stress and disease

- Automated drone monitoring for crop health assessment

- Smart sensors with AI-driven decision making capabilities

The integration of AI brings unprecedented precision to water management. You’ll see systems that can:

- Reduce water waste by up to 50%

- Increase crop yields by 20-30%

- Cut energy consumption by 25%

Sustainability Innovations

Advanced smart irrigation solutions incorporate:

- Solar-powered sensors and controllers

- Biodegradable soil moisture probes

- Water recycling and filtration systems

- Carbon footprint tracking capabilities

These technological developments create tangible benefits for farmers and ecosystems:

- Decreased groundwater depletion

- Reduced chemical runoff

- Lower operational costs

- Enhanced soil health preservation

The combination of AI and sustainable practices positions smart irrigation as a cornerstone of future farming. Research indicates that AI-powered systems will manage 40% of agricultural water usage by 2030, marking a significant shift toward data-driven farming practices.

Competitive Landscape in the Smart Irrigation Industry

The smart irrigation market has several key players who are influencing the industry through innovation and strategic partnerships.

-

The Toro Company – United States

-

Rain Bird Corporation – United States

-

Netafim Ltd. – Israel

-

Hunter Industries Inc. – United States

-

HydroPoint Data Systems Inc. – United States

-

Lindsay Corporation – United States

-

Jain Irrigation Systems Ltd. – India

-

Rachio Inc. – United States

-

Orbit Irrigation Products LLC – United States

-

Valmont Industries Inc. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name |

Global Smart Irrigation Market Report |

| Base Year |

2024 |

| Segment by Type |

· Drip Systems · Sprinkler-Based Systems · Sensor-Based Automation |

|

Segment by Application |

· Agriculture · Landscaping · Sports Fields |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The smart irrigation market is experiencing transformative growth, projected to reach USD 2.51 billion by 2033, driven by increasing global awareness of water conservation needs and technological advancements in agriculture. This expansion represents a significant shift towards sustainable farming practices and efficient water management.

Global Smart Irrigation Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Smart Irrigation Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Smart Irrigation Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Smart Irrigation players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Smart Irrigation Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Smart Irrigation Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Smart Irrigation Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Smart Irrigation Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of smart irrigation systems?

Key components of smart irrigation systems include controllers, sensors, and water flow meters, which play a crucial role in optimizing water usage and enhancing system efficiency.

How does IoT integration influence smart irrigation technology?

IoT integration enhances smart irrigation systems by enabling real-time data collection and analysis, which optimizes water usage and improves overall system performance.

What challenges does the smart irrigation market face?

The smart irrigation market faces challenges such as high initial implementation costs, user education barriers regarding new technologies, and connectivity issues in rural areas that can impact system efficiency.

What types of smart irrigation systems are available in the market?

The main types of smart irrigation systems include drip systems, sprinkler-based systems, and sensor-based automation, each with its own advantages for different agricultural and landscaping applications.

How is the U.S. market for smart irrigation evolving?

The U.S. market for smart irrigation is experiencing growing demand for water-efficient farming practices due to advancements in technology and a focus on sustainable agriculture initiatives.