$6.09 Billion Almond Milk Market Grows in 2025: U.S., India, and Brazil Lead Demand for Plant-Based Alternatives

Explore the comprehensive analysis of the global almond milk market, covering market dynamics, growth projections, and industry trends from 2025-2033. This in-depth report examines regional market shares, key drivers of growth, competitive landscape, and strategic initiatives shaping the industry. Discover how factors like increasing health consciousness, environmental awareness, and product innovations are driving market expansion. Learn about major players, market segmentation, and emerging opportunities in this rapidly growing plant-based beverage sector.

- Last Updated:

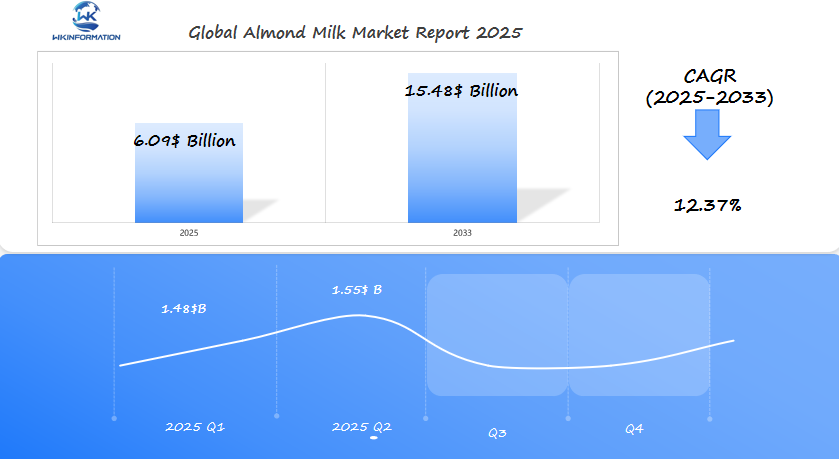

Almond Milk Market Q1 and Q2 2025 Forecast

The Almond Milk market is forecasted to reach $6.09 billion in 2025, growing at a CAGR of 12.37% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $1.48 billion, driven by increasing consumer demand for plant-based milk alternatives in the U.S., India, and Brazil. The rising popularity of dairy-free diets, veganism, and lactose intolerance awareness is fueling market growth.

By Q2 2025, the market is projected to reach $1.55 billion, supported by the expansion of almond milk product lines, including flavored, organic, and fortified variants. The U.S. leads in plant-based beverage consumption, while India is witnessing rapid growth due to rising health consciousness. Brazil, with its strong demand for nutrient-rich dairy alternatives, is emerging as a key market.

With growing investments in sustainable almond farming, eco-friendly packaging, and functional almond milk products (such as high-protein or probiotic-infused variants), the industry is set to expand further, catering to health-conscious and environmentally aware consumers.

Key Takeaways

- Market value hits $6.09 billion by 2025.

- U.S., India, and Brazil are top markets.

- Almond milk benefits include nutrition and dietary flexibility.

- Sustainability trends boost demand for plant-based products.

- Innovation and distribution shape growth in key regions.

Understanding the Almond Milk Industry: Upstream and Downstream

The plant-based beverage market involves various players, including suppliers, processors, and retailers. It all begins with almond growers, such as California’s Blue Diamond Growers, who are responsible for producing 80% of the world’s almonds. These almonds are then processed for cold pressing and fortified with vitamins by companies like Tree Nut Industries.

Upstream Players

These are the key participants involved in the production and supply of almond milk:

- Farmers: Almond growers who cultivate and harvest almonds.

- Processors: Companies that handle the processing of almonds for various uses.

- Ingredient suppliers: Suppliers who provide additional ingredients used in almond milk production.

Downstream Players

These are the entities involved in the manufacturing and distribution of almond milk:

- Manufacturers: Companies like Silk and Califia Farms that produce almond milk.

- Retailers: Stores such as Walmart and Whole Foods that sell almond milk products.

Manufacturers combine almonds with other ingredients to create products that have a longer shelf life. These products are then transported to stores, where logistics companies ensure they remain refrigerated. Retailers display these products alongside dairy alternatives, targeting health-conscious consumers. Currently, suppliers are prioritizing sustainable practices, such as water-saving farming techniques, to meet consumer demands.

“Sustainable sourcing is critical for maintaining trust in the plant-based beverage market,” stated a 2024 Almond Board of California report.

Every stage of the supply chain, from the orchard to the store, influences both the quantity and price we pay for almond milk products. This interconnected system fosters innovation while striving to strike a balance between environmental sustainability and economic viability.

Key Trends Driving the Almond Milk Market: Health Consciousness and Sustainability

Today, people want to buy things that match their values. They look for products that are good for their health and the planet. This is why almond milk is becoming more popular as a dairy alternative innovation.

More and more people are choosing products that help them stay healthy. They also want to know that their choices are good for the environment.

1. Health Focus

Almond milk is low in calories and doesn’t have lactose or cholesterol. It’s a favorite among those who care about their health. Brands offer versions with extra vitamins to meet different dietary needs.

2. Sustainability Shift

Companies like Califia Farms and Silk focus on being eco-friendly. They use water-efficient farming and make packaging that can be recycled.

“Sustainability is no longer a niche trend—it’s a market driver,” says a 2023 report by Grand View Research. “Consumers reward brands balancing nutrition and environmental responsibility.”

Innovation in dairy alternative innovation is also driving growth. Companies are trying new things like almond milk with less sugar, plant-based blends, and carbon-neutral supply chains. For example, Blue Diamond Growers works with almond farmers to use less water. This shows that making products ethically can make customers loyal.

These trends show a clear direction. Almond milk is more than just a drink. It’s a sign of moving towards healthier and greener choices. As trends change, expect more brands to focus on being open and eco-friendly.

Challenges in Almond Milk Production and Supply Chain Management

Making almond milk is tough because of complex supply chains and production problems. Farmers and makers face high demand for non-dairy milk trends but struggle with environmental and operational issues. Issues include unpredictable almond crops, water shortages in California, and changing raw material prices.

Key Challenges

- Supply Chain Delays: Droughts and labor shortages mess up almond harvests, leading to delays in getting raw materials.

- Quality Fluctuations: Keeping taste and texture the same in every batch is a big challenge for brands like Califia Farms and Silk.

- Sustainability Costs: Making eco-friendly packaging costs 15-20% more, according to reports.

| Challenge Solution Water scarcity in almond farming | Investing in drip irrigation tech and drought-resistant almond varieties |

| Fluctuating almond prices | Long-term contracts with California growers |

| Global shipping delays | Regional distribution hubs to reduce reliance on single ports |

Companies like Blue Diamond Co-op are working with tech firms to check crop health with satellite imaging. Despite ongoing challenges, the industry is finding ways to meet non-dairy milk trends without sacrificing quality or price.

Geopolitical Influence on the Almond Milk Market

Global trade policies play a big role in the almond milk market. Tariffs and import rules can block the flow of almond milk. But, free trade agreements can open up new markets.

For example, U.S. exporters get a boost from deals with Latin American countries. This lowers costs and makes almond milk more available.

“Trade barriers don’t just affect prices—they redefine who gets to enjoy plant-based products,” said Maria Chen, a food trade analyst.

Factors Affecting Almond Milk Production

Several geopolitical factors can impact almond milk production:

- Regional conflicts can disrupt almond supplies, raising production costs.

- Climate policies in the EU push for sustainable farming, impacting almond sourcing.

- Political tensions between almond-producing countries may limit cross-border cooperation.

Effects on Specific Countries

Different countries are experiencing various effects due to these geopolitical influences:

- In India, efforts to cut dairy imports have boosted vegan milk demand.

- Brazil’s deals with U.S. suppliers keep ingredient supplies steady.

- The stability of California’s almond farms directly affects global production.

As countries focus on food security, geopolitical changes will keep shaping the almond milk market. This will influence where it’s made and sold.

Almond Milk Market by Type: Sweetened, Unsweetened, and Flavored Variants

Almond milk comes in three main types: sweetened, unsweetened, and flavored. Each type meets different dietary needs and fits the growing demand for sustainable milk alternatives. Sweetened almond milk is perfect for those who want a touch of sweetness without added sugars. On the other hand, unsweetened almond milk is great for those watching their calorie intake.

| Type Flavor Profile Target Audience Sweetened | Natural almond sweetness with added cane sugar | Families, casual drinkers |

| Unsweetened | Blunt almond taste, zero added sugar | Health-conscious consumers, fitness enthusiasts |

| Flavored | Vanilla, chocolate, or coffee-infused options | Trendsetters, vegan diets, coffee shops |

Flavored almond milks are where innovation meets taste. Brands like Califia Farms offer unique flavors like coconut-almond blends or turmeric-spiced milks. These products also focus on eco-friendly packaging, fitting the sustainable milk alternatives trend.

Consumer preferences show 68% choose unsweetened for cooking, and 55% prefer flavored for smoothies.

Today, manufacturers combine taste with ethics. They use organic ingredients and recyclable cartons. This meets the demand for quality and sustainability. As trends evolve, these categories will grow, offering more choices that balance taste and environmental care.

Applications of Almond Milk in Beverages, Dairy Alternatives, and Food Processing

Almond-based products are now in lattes, smoothies, and even baked goods. Starbucks uses unsweetened almond milk in its oat milk lattes, and Silk offers vanilla-flavored versions for baking.

Almond Milk in Beverages

- Coffee shops blend almond milk for vegan espresso drinks.

- Starbucks uses unsweetened almond milk in its oat milk lattes.

Almond Milk in Dairy Alternatives

- Chefs use it to make dairy-free sauces and ice creams.

- Manufacturers fortify it with vitamins for nutrition-focused almond-based products.

Almond Milk in Food Processing

Food processors love almond milk’s neutral taste. It thickens soups, replaces milk in recipes, and extends shelf life in packaged goods. A 2023 study by the Plant-Based Foods Association found 68% of U.S. households use almond milk in cooking. Brands like Califia Farms now sell it in cans for commercial kitchens.

“Its adaptability makes almond milk a kitchen essential,” says a food scientist at the Institute of Plant-Based Innovation. “From protein-rich shakes to gluten-free pastries, it’s versatile without sacrificing taste.”

As demand grows, expect more almond-based products in aisles near you.

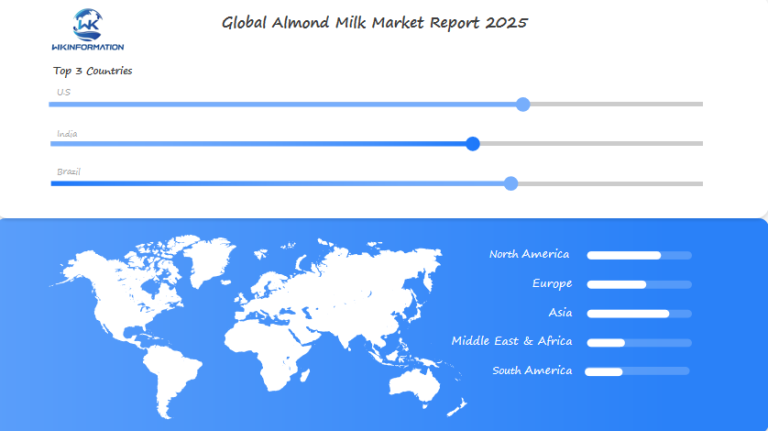

Global Insights into the Almond Milk Market

Organic almond milk trends are changing how we drink globally. In North America, people prefer high-end organic options. But in Asia and Latin America, they look for affordable and easy-to-get choices.

Regional Preferences

- North America: In the U.S., people want organic almond milk with extra vitamins. This fits with their healthy living goals.

- Asia-Pacific: India is seeing more people choose dairy-free options. This is especially true in cities, where veganism is growing.

- Europe: The European Union is pushing for farming that’s good for the planet. This is helping organic almond milk grow in popularity.

“Global almond milk growth hinges on organic certification and eco-friendly packaging,” noted a 2024 market analysis.

Challenges in Supply Chain

Weather changes affect almond crops in places like California and Spain. This creates problems for getting enough organic almond milk. Farmers are now using methods that help them grow almonds even when it’s dry.

Retailers are working with farmers to keep prices stable. This helps everyone involved in the almond milk business.

Flavor Trends

In Europe and North America, you can find many flavors of organic almond milk. Vanilla and chocolate are popular. But in the Middle East and Africa, almond milk is becoming a favorite because it’s lactose-free.

Big brands like Califia Farms and Rude Health focus on organic. They want to meet the growing demand. People around the world are looking for products that are good for the planet and honest about where they come from.

U.S. Leading the Plant-Based Beverage Market with Innovation and Distribution Channels

U.S. companies lead in almond milk innovation, combining technology and distribution for growth. Brands like Silk, Califia Farms, and Blue Diamond Almonds focus on taste, convenience, and being eco-friendly. They introduce new products with extra vitamins or less sugar for health-focused consumers.

Strong supply chains ensure almond milk is available everywhere. Partnerships with big names like Kroger and Amazon Fresh keep stores well-stocked. This network supports 65% of the global almond milk market, as reported in 2023.

Despite almond production challenges like water scarcity, technology offers solutions. Smart irrigation in California farms saves 30% of water, a crucial area for almond growth. Automated packing systems also reduce waste, making production more efficient.

| Innovation | Impact |

| Water-saving tech | Cuts water use by 30% |

| Climate-resilient crops | Stabilizes harvest yields |

| AI-driven logistics | Cuts delivery times by 25% |

These efforts turn almond production challenges into chances for growth. U.S. leadership shows how innovation and infrastructure shape the future of plant-based drinks.

India’s Growing Demand for Dairy-Free and Vegan Alternatives

India is changing how it views global almond consumption. Cities like Mumbai and Delhi are leading the way. People there want healthier options, and they’re turning to almond milk and vegan products.

Big names like Parle Products and Nestlé India are stepping up. They’re making almond-based drinks to meet this growing need.

Global almond consumption trends in India

“India’s plant-based market grew 23% in 2023, driven by sustainability and dietary preferences,” reported a 2024 report by Allied Market Research.

There’s also a cultural shift happening. Almond milk fits well with Ayurvedic health practices. And, many Indians can’t digest lactose, so these alternatives are a big help.

Companies are now adding calcium and vitamins to almond milk. This makes it a better choice for nutrition.

Stores like BigBasket and D Mart are stocking these products. This makes them easy to find all over the country. India’s demand is not just local—it’s also boosting global almond consumption.

India’s choices are affecting the world. Brands are focusing on sustainable almond farming. This includes using less water. India’s story shows how local tastes can change global markets.

Brazil’s Role in Expanding Plant-Based Consumption in Latin America

Brazil is becoming a major force in the almond market growth in Latin America. More people in cities like São Paulo and Rio de Janeiro are choosing plant-based foods. This is because of growing health awareness and urbanization.

Several factors are driving this change:

- Strong focus on sustainable farming practices

- Rising middle-class disposable income

- Government support for agro-industrial innovation

Local brands like Natura Foods and Brazil Nuts Co. are working hard to meet this demand. But, there are challenges like climate issues and inconsistent almond supply from California. Experts warn that these problems could slow down production unless fixed.

“Brazil’s tropical climate offers unique opportunities for developing plant-based products tailored to regional tastes,” said Ana Silva, a food trends analyst at Mercosur Research.

As the largest economy in Latin America, Brazil’s decisions affect the whole region. Working with U.S. almond growers and investing in local R&D could boost almond market growth. With 62% of Brazilians under 30 caring about eco-friendly packaging, it’s key to innovate in this area.

The Future of Almond Milk: Organic, Fortified, and Sustainable Packaging Solutions

Healthy almond beverages are about to undergo a significant transformation. Brands are now prioritizing organic ingredients to cater to the increasing demand for clean labels. Experts predict that we will witness a rise in products fortified with vitamins D and B12, turning them into nutritional powerhouses.

Key Developments on the Horizon

Here are some key developments we can expect in the future of almond milk:

- Organic Farming Practices: These practices will minimize the use of chemicals, ensuring greater product safety.

- Fortified Versions: Almond milk products may be fortified with specific nutrients to address dietary requirements, such as calcium for promoting bone health.

- Sustainable Packaging Solutions: Companies are actively seeking biodegradable packaging options and recyclable cartons to reduce their environmental impact.

Leading the Way in Sustainability

Brands like Califia Farms and Silk are at the forefront of this sustainability movement, exploring compostable containers as part of their packaging strategy. It is important to note that sustainability is no longer merely a passing trend; it has become a crucial factor for success in the industry.

Meeting Consumer Demands

Today’s consumers are increasingly conscious about the products they choose. They want transparency regarding every aspect of almond milk production, including:

- The origin of the almonds

- The transportation methods used

Driving Forces Behind Innovation

Several factors are driving innovation within the almond milk sector:

- Health-conscious families seeking nutritious alternatives

- The rise of vegan lifestyles embracing plant-based diets

A Vision for 2030

Looking ahead to 2030, it is possible that almond milk will come to represent both personal wellness and environmental stewardship. This aligns with broader societal shifts towards healthier living and sustainable practices.

The future appears bright for those who prioritize not only taste but also nutrition and responsibility in their choices.

Competitive Landscape in the Almond Milk Market

- Blue Diamond Growers – Sacramento, California, USA

- Califia Farms LLC – Los Angeles, California, USA

- Daiya Foods Inc. – Burnaby, British Columbia, Canada

- Earth’s Own Food Company Inc. – Vancouver, British Columbia, Canada

- Hain Celestial Group –Hoboken, New Jersey, USA

- Hiland Dairy Foods – Springfield, Missouri, USA

- Malk Organics LLC –Austin, Texas, USA

- Pacific Foods of Oregon LLC – Tualatin, Oregon, USA

- Sanitarium – New South Wales, Australia

- SunOpta Inc. – 7078 Shady Oak Road, Eden Prairie, Minnesota, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Almond Milk Market Report |

| Base Year | 2024 |

| Segment by Type | · Organic Almond Milk

· Conventional Almond Milk |

| Segment by Application | · Hypermarkets and Supermarkets

· Convenience Stores · Food and Drink Specialty Stores · Others |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The almond milk market hit $6.09 billion in 2025, showing a big move towards plant-based options. In the U.S., India, and Brazil, there’s a big push for sustainable and healthy products. Brands like Silk and Califia Farms lead the way, mixing great taste with good ethics.

But, there are still big challenges like supply chain issues and climate change. Yet, the focus on organic and eco-friendly packaging shows a way forward. Today, people want products that match their values, like less sugar and green packaging.

As trends change, it’s key to watch how companies balance green efforts with taste. In the U.S. and worldwide, choosing brands that care about the planet and are open can make a big difference. The future of almond milk is about more than just drinks. It’s about making a positive impact on both people and the planet.

Global Almond Milk Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Almond Milk Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Almond Milk Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Almond Milkplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Almond Milk Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Almond Milk Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Almond Milk Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Almond Milk Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the almond milk market?

The almond milk market is growing because people are more health-conscious. They want options that are good for the planet and their bodies. This shift towards plant-based choices is driving the demand.

Why are countries like the U.S., India, and Brazil leading almond milk consumption?

The U.S., India, and Brazil are the top consumers of almond milk. This is because these countries have a large number of people who care about health and the environment. The trend towards veganism and dairy-free diets is also contributing to the demand.

What are some challenges faced in almond milk production?

Making almond milk can be tricky. There are issues with supply chains, quality, and consistency. Companies also face the challenge of growing while staying green.

How does geopolitics affect the almond milk market?

Politics can have a significant impact on the almond milk market. Factors such as trade policies, tariffs, and stability in almond-producing regions can influence prices and availability of almond milk. These factors play a crucial role in determining how easily raw materials, such as almonds, can be sourced for production.

What types of almond milk are available in the market?

You can find many types of almond milk out there. There’s sweetened, unsweetened, and flavored. Each type meets different tastes and health needs.

How is almond milk used beyond being a beverage?

Almond milk is super versatile. It’s used in coffee, smoothies, cooking, and as a dairy substitute in food. It’s used in both home recipes and commercial products.

What are the emerging trends in almond milk?

New trends in almond milk include:

- Organic ingredients

- Fortified nutrition

- Sustainable packaging

These changes meet the growing demand for healthier and greener products.

Who are the major players in the almond milk market?

Big names in the almond milk market include Blue Diamond’s Almond Breeze, Silk, and So Delicious. They lead with innovation and a wide variety of products.

How does almond milk compare to other dairy alternatives?

Almond milk stands out for its low calories and nutritional value. It’s also popular for its taste and versatility in cooking. This makes it a favorite among those looking for dairy-free options.