$37.51 Billion Rising Demand for Licensed Merchandise Market in the U.S., China, and Germany by 2025

Explore the thriving licensed merchandise market, projected to reach $37.51 billion by 2025, with insights into U.S., China, and Germany markets. Learn about growth drivers, consumer trends, and how brand partnerships shape this dynamic industry across entertainment, sports, and retail sectors.

- Last Updated:

Licensed Merchandise Market Q1 and Q2 2025 Forecast

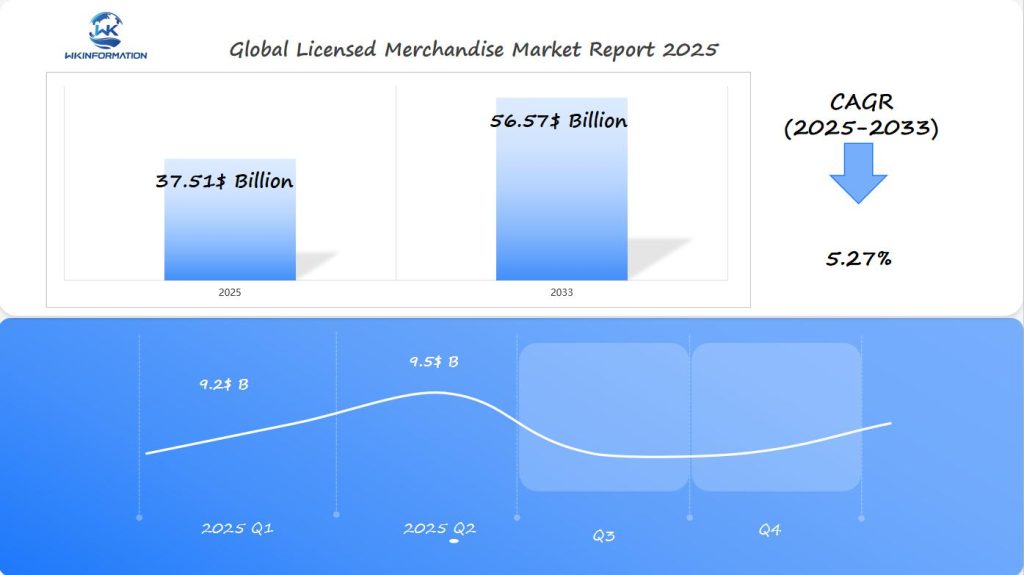

The Licensed Merchandise market is expected to reach $37.51 billion in 2025, with a CAGR of 5.27% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $9.2 billion, driven by growing consumer demand for branded merchandise in the U.S., China, and Germany. The increasing popularity of character-themed products, sports merchandise, and entertainment licensing is fueling growth.

By Q2 2025, the market is forecasted to reach $9.5 billion, supported by strong sales in apparel, toys, and collectibles. China continues to lead in the production of licensed merchandise, while the U.S. and Germany remain key consumers and distributors.

The licensed merchandise market will continue to grow as consumers seek to express their brand preferences through licensed apparel, toys, and accessories.

Exploring the Upstream and Downstream Industry Chains of Licensed Merchandise

Licensing agreements play a vital role in shaping the development of licensed merchandise. These legal contracts establish clear guidelines that all parties involved must follow to maintain brand integrity and consistency. The key aspects covered by licensing agreements include:

- Brand representation

- Quality standards

- Distribution territories

- Revenue sharing models

- Production timelines

How Supply Chain Logistics Affect Product Availability

Supply chain logistics directly impact the availability of licensed merchandise in the market. Efficient management of various logistical components ensures that products are delivered on time and in optimal condition to retailers and consumers alike. The following factors within supply chain logistics influence product availability:

- Inventory management systems

- Transportation networks

- Warehouse operations

- Order fulfillment processes

- Stock replenishment strategies

The Importance of Coordination Between Industry Stakeholders

The complexity of the upstream and downstream processes requires effective coordination among licensors, manufacturers, and retailers involved in the licensed merchandise industry chain.

Maintaining Transparency Throughout the Supply Chain

To ensure smooth operations and minimize disruptions, companies must implement robust tracking systems that provide real-time visibility into product movement at every stage of production and distribution.

Leveraging Technology for Optimization

Modern supply chain technologies such as inventory management software, demand forecasting tools, and transportation management systems can greatly enhance efficiency by enabling brands to make data-driven decisions regarding their distribution strategies.

Overcoming Challenges in Global Supply Networks

Global supply networks face unique challenges when it comes to maintaining consistent quality standards across different regions.

Building Strong Relationships with Partners

Successful licensed merchandise operations depend on establishing strong relationships with key supply chain partners such as manufacturers, logistics providers, and retailers.

Ensuring Effective Communication Channels

Efficient communication systems throughout the entire process are crucial for addressing any issues or delays that may arise during production or delivery.

By understanding these upstream and downstream processes along with their interdependencies, stakeholders in the licensed merchandise industry can work together more effectively towards achieving mutual goals of quality products, satisfied customers, and profitable businesses.

Key Trends in the Licensed Merchandise Market: Pop Culture and Brand Partnerships

Pop culture’s influence on licensed merchandise creates unprecedented market opportunities. Recent collaborations between Nike and Travis Scott generated $1 billion in sales, demonstrating the power of strategic brand partnerships.

Successful brand partnerships drive consumer interest through:

- Limited-edition releases creating scarcity

- Cross-platform marketing campaigns

- Exclusive designs and unique product offerings

- Celebrity and influencer endorsements

Notable Success Stories:

- Pokemon x Levi’s collection sold out within hours

- LEGO x Adidas sneaker line sparked collector demand

- Supreme x Louis Vuitton redefined luxury streetwear

Fan engagement translates directly to sales through:

- Social media interactions

- Pre-release hype building

- Community-driven product development

- Interactive digital experiences

The rise of digital platforms enables brands to track fan preferences and adjust merchandise strategies in real-time. Data shows that engaged fans spend 3x more on licensed products compared to casual consumers.

Brand partnerships now extend beyond traditional retail:

- Virtual merchandise in gaming platforms

- AR/VR shopping experiences

- Fan-designed product collections

- Subscription-based exclusive merchandise drops

These collaborations create unique value propositions, attracting both dedicated fans and new consumer segments to the licensed merchandise market.

Challenges in Licensed Merchandise Production and Distribution

The Licensed Merchandise Market faces significant hurdles in maintaining profitable operations. Production costs present a substantial barrier, with manufacturers required to invest heavily in:

- Initial licensing fees

- Quality control measures

- Manufacturing equipment

- Skilled labor force

- Material sourcing

Distribution challenges add another layer of complexity. Brands must navigate:

- Warehouse storage costs

- Shipping logistics

- Inventory management

- Market-specific regulations

- Last-mile delivery expenses

Counterfeit products pose a critical threat to brand integrity. The global counterfeit market:

- Reduces legitimate sales revenue by 25%

- Damages brand reputation

- Creates safety concerns for consumers

- Increases legal expenses

- Requires investment in anti-counterfeiting measures

Rapid shifts in consumer preferences create additional pressure on manufacturers. Companies must:

- Monitor market trends continuously

- Adjust production quantities quickly

- Update designs frequently

- Maintain flexible manufacturing processes

- Balance inventory levels

The rise of digital shopping has forced brands to adapt their distribution strategies. Modern consumers demand:

- Same-day delivery options

- Multiple purchasing channels

- Easy return processes

- Real-time inventory visibility

- Personalized shopping experiences

These challenges require constant innovation and substantial financial investment from licensed merchandise producers to maintain market competitiveness and meet evolving consumer expectations.

Geopolitical Impact on the Global Licensing Landscape

The global licensing landscape experiences significant shifts due to changing geopolitical dynamics. Trade tensions between major economies directly impact licensing agreements and market access. The U.S.-China trade relationship creates ripple effects across the licensed merchandise industry, affecting production costs and market entry strategies.

Trade Policy Effects:

- Import tariffs influence pricing strategies

- Regional trade agreements shape market access

- Intellectual property protection varies by jurisdiction

- Local content requirements affect production decisions

Different regions implement distinct licensing strategies based on their regulatory environments. The European Union maintains strict standards for licensed merchandise, while emerging markets often operate with more flexible frameworks. This variation creates unique challenges for global brands seeking consistent market presence.

Market-Specific Considerations:

- U.S. market emphasizes strong IP protection

- China focuses on domestic brand development

- EU prioritizes consumer safety standards

- Emerging markets adapt licensing models to local needs

Political relationships between countries shape licensing opportunities. Diplomatic tensions can limit market access, while positive relations often lead to expanded licensing agreements. Companies must navigate these complex dynamics through strategic partnerships and localized approaches.

Regional Adaptation Strategies:

- Local market partnerships

- Cultural customization of products

- Compliance with regional regulations

- Strategic timing of market entry

The shifting geopolitical landscape requires brands to maintain flexible licensing strategies. Success depends on understanding local market dynamics and adapting to changing political environments while protecting brand integrity across borders, as highlighted in this scholarly article which delves into the intricate relationship between geopolitics and global licensing practices.

Types of Licensed Merchandise: Apparel, Toys, and Collectibles

Licensed merchandise includes a wide range of products, each designed to appeal to different consumer preferences and market demands. The way products are distributed in the market shows clear patterns in how consumers spend their money and engage with brands.

1. Sports Apparel: Market Leader

Sports apparel holds the top spot in the world of licensed merchandise, making up 65% of all sales. This category includes:

- Team jerseys and replica uniforms

- Training wear and athleisure collections

- Performance gear with team branding

- Fan accessories (caps, scarves, wristbands)

2. Toys and Games

The toys segment also has a significant share of the market, featuring:

- Action figures from popular franchises

- Board games with licensed themes

- Building sets and construction toys

- Interactive gaming merchandise

3. Collectibles Market

Collectibles attract dedicated fans and investors through:

- Limited edition figurines

- Trading cards

- Commemorative items

- Autographed memorabilia

4. Emerging Categories

New product segments continue to gain traction:

- Tech accessories (phone cases, laptop skins)

- Home décor items

- School supplies

- Personal care products

The wide variety of licensed merchandise available today reflects changing consumer interests and brand expansion strategies. Each category targets specific market segments while also playing a role in the overall growth of the industry.

Applications of Licensed Merchandise in Entertainment, Sports, and Retail

Licensed merchandise serves as a powerful revenue stream across multiple sectors. The entertainment industry harnesses fan enthusiasm through strategic product releases tied to movie premieres and TV show launches. Marvel’s merchandise sales reached $41.2 billion in 2021, showcasing the lucrative nature of entertainment licensing.

Entertainment Franchise Applications:

- Time-sensitive product releases coinciding with movie premieres

- Character-based merchandise collections

- Limited edition collectibles for TV show milestones

Sports merchandising creates deep connections between teams and fans through branded products.

Sports Marketing Integration:

- Game-day apparel and accessories

- Player-specific merchandise lines

- Championship commemorative items

Retail spaces have evolved to maximize licensed merchandise visibility and sales. Strategic product placement and immersive displays create engaging shopping experiences.

Retail Implementation Strategies:

- Dedicated brand zones within stores

- Interactive display elements

- Cross-category merchandising

- Pop-up shops during major events

- Digital integration with physical retail spaces

The gaming industry has emerged as a significant driver of licensed merchandise sales, with platforms like Roblox and Fortnite launching physical product lines based on virtual experiences. This convergence of digital and physical retail spaces represents an innovative approach to merchandise marketing.

Global Insights into the Licensed Merchandise Market

The licensed merchandise market is undergoing dynamic transformation, fueled by evolving consumer preferences, technological innovation, and region-specific buying behaviors. As brands increasingly embrace digital ecosystems, the landscape for licensed products is shifting toward more interactive, personalized, and experience-driven offerings.

Emerging Market Trends Driving Industry Growth

1. Digital-First Shopping Experiences

Digital platforms have become central to how consumers discover and purchase licensed merchandise. The rise of mobile commerce, social media integration, and interactive retail technologies has reshaped the consumer journey:

-

Mobile commerce now serves as the primary purchasing channel for a majority of consumers, offering speed, convenience, and app-driven loyalty programs.

-

Social media platforms like Instagram, TikTok, and WeChat play a critical role in influencing purchase decisions, especially among Gen Z and millennials.

-

Virtual try-on tools and augmented reality (AR) are enhancing user engagement, particularly in apparel, accessories, and character-themed merchandise.

These innovations are not only expanding access but also elevating the overall retail experience, encouraging impulse purchases and deeper brand affinity.

2. Regional Consumer Preferences and Behaviors

Each major region exhibits unique characteristics in licensed merchandise consumption:

-

United States: Consumers prioritize exclusivity, gravitating toward limited-edition collectibles, autographed items, and sports memorabilia. Brand storytelling and authenticity are crucial to engagement.

-

China: There is a rising demand for high-end, luxury-branded licensed products, often tied to fashion, entertainment, and pop culture icons. Crossovers between international brands and local influencers drive visibility and appeal.

-

Germany: Sustainability and ethical sourcing are central. Eco-conscious consumers increasingly seek merchandise made from recycled or biodegradable materials, especially in apparel and household goods.

Understanding these localized nuances allows brands to tailor their strategies and product offerings to align with cultural values and lifestyle preferences.

Evolving Market Dynamics and Future Outlook

As the industry matures, several key shifts are shaping its trajectory:

-

Personalization at Scale: Consumers now expect custom experiences, from monogrammed products to tailored subscription boxes. This trend is pushing brands to invest in flexible supply chains and digital printing technologies.

-

Digital Licensing Platforms: Traditional licensing models are being disrupted by digital-first approaches. NFT-based collectibles, blockchain verification for limited runs, and virtual merchandise in gaming ecosystems (like metaverse apparel) are opening new revenue streams.

-

Global Expansion with Local Relevance: While Asia-Pacific is registering the fastest growth, fueled by rising middle-class spending and digital penetration, North America continues to hold the largest share of the global market. European markets are also showing resilience, particularly in sectors like fashion and home décor, with strong interest in licensed collaborations.

U.S. Licensed Merchandise Market: Consumer Trends and Brand Influence

The U.S. licensed merchandise market shows strong consumer spending patterns, with average annual spending on sports merchandise reaching $725 per fan. Online shopping platforms have changed the way people buy, with 68% of consumers now preferring to purchase licensed merchandise online.

Key Factors Driving Brand Loyalty in the U.S. Market

Brand loyalty in the U.S. market comes from several important reasons:

- Emotional Connection: 73% of consumers say their main reason for buying is because they support a team

- Product Quality: 82% of consumers value durable and genuine licensed merchandise

- Limited Edition Releases: Exclusive drops generate 3.2x higher engagement rates

- Social Media Influence: Brand-athlete partnerships drive 45% of youth market purchases

The Dominance of Professional Sports Leagues in U.S. Licensed Merchandise

Professional sports leagues are the major players in the U.S. licensed merchandise market:

- NFL: $3.5 billion annual merchandise revenue

- Super Bowl merchandise spikes 400% during championship season

- NBA: $2.1 billion yearly sales

- Player jerseys represent 40% of total revenue

- MLB: $1.8 billion in merchandise

- Baseball caps remain the highest-selling item

The Impact of Generation Z on Licensed Merchandise Spending

Recent data shows that Generation Z consumers are spending 15% more on licensed merchandise compared to previous generations, with a particular focus on customizable products and sustainable manufacturing practices.

The Growth of Direct-to-Consumer Sales Channels

Direct-to-consumer sales channels have seen a significant growth rate of 125%, indicating a shift in retail preferences among U.S. buyers.

China’s Licensed Merchandise Market: Popularity and Growth Potential

China’s licensed merchandise market shows great potential for growth, fueled by an increase in sports participation and a rise in viewership of international leagues.

Key Growth Indicators:

- 27% year-over-year increase in sports participation rates

- 45% rise in international sports league viewership

- 300 million active basketball enthusiasts

- 200% growth in e-commerce sales of licensed merchandise

The NBA is the most popular international sports league in China, with licensed merchandise sales hitting new heights. Chinese consumers are particularly interested in basketball jerseys, signature shoes, and collectible items featuring star players.

Popular Licensed Categories in China:

- Basketball merchandise (NBA, CBA)

- Soccer items (European leagues)

- E-sports team merchandise

- Entertainment franchise products

Chinese consumers’ purchasing behavior shows a strong preference for authentic licensed products, especially among younger age groups (18-35). This trend has led international brands to create merchandise lines specifically for China and collaborate with local designers.

The rise of digital platforms and mobile payment systems has changed the way Chinese consumers buy licensed merchandise. Leading e-commerce platforms like Tmall and JD.com are seeing significant growth in sales of licensed products, with mobile purchases making up 80% of transactions.

Germany’s Licensed Merchandise Market: Industry Trends and Consumer Preferences

Germany’s licensed merchandise market thrives on the nation’s deep-rooted sports heritage, particularly in football. The Bundesliga, Germany’s premier football league, drives substantial merchandise sales through team jerseys, scarves, and collectibles. Bayern Munich, Borussia Dortmund, and other prominent clubs generate significant revenue through licensed product sales.

Distinct Purchasing Behaviors of German Consumers

German consumers display distinct purchasing behaviors in the licensed merchandise sector:

- Quality-Focused: German buyers prioritize high-quality materials and craftsmanship, willing to pay premium prices for authentic licensed products

- Brand Loyalty: Strong allegiance to local teams translates into consistent merchandise purchases

- Sustainable Options: Growing demand for eco-friendly licensed products, including recycled materials and ethical production methods

Expanding Beyond Football: Other Sports Merchandise Trends

The market extends beyond football to other popular sports:

- Formula 1 merchandise sees steady demand, driven by successful German drivers

- Winter sports equipment and apparel maintain consistent sales

- Olympic-themed merchandise peaks during international competitions

Understanding Consumer Purchasing Patterns

Understanding consumer purchasing patterns is crucial for businesses operating in this market:

- 73% prefer in-store purchases for authentic merchandise

- Online sales show 15% year-over-year growth

- Peak sales periods align with major sporting events

- Youth market (ages 14-24) represents the fastest-growing consumer segment

Adapting Strategies to Meet Consumer Preferences

German retailers adapt to these preferences through dedicated fan shops, exclusive collections, and limited-edition releases. The combination of traditional retail presence and digital platforms caters to diverse shopping preferences across age groups.

The Future of Licensed Merchandise: Digital Licensing and Sustainability

Digital licensing has transformed the merchandise market with the introduction of NFTs (Non-Fungible Tokens). These one-of-a-kind digital assets empower brands to create exclusive virtual collectibles, attracting tech-savvy consumers in innovative ways. Sports teams are now offering digital trading cards, virtual jerseys, and game highlights as NFTs, opening up new avenues for revenue generation.

How Blockchain Technology Enhances Digital Merchandise

The integration of blockchain technology brings several benefits to digital merchandise:

- Authenticity verification: Ensuring that each digital item is genuine and cannot be duplicated.

- Limited edition drops: Creating scarcity by releasing a fixed number of digital items.

- Smart contracts: Automating royalty payments through self-executing agreements.

- Direct fan engagement: Allowing fans to truly own and trade their digital assets.

Eco-Friendly Practices in Licensed Merchandise Production

Sustainability has become a key focus in the production of licensed merchandise. Brands are adopting environmentally friendly practices such as:

- Using recycled materials in apparel manufacturing

- Implementing water conservation techniques

- Reducing packaging waste

- Developing biodegradable alternatives

Major sports leagues have also initiated green initiatives:

“Our commitment to sustainability extends beyond the field. We’re reimagining how licensed products are made, distributed, and consumed.” – NFL Environmental Program Director

Investments in Sustainable Solutions

Companies are making investments in various areas to promote sustainability:

- Renewable energy: Utilizing clean energy sources for production facilities.

- Circular economy: Incorporating principles of reusability and recyclability in product design.

- Local manufacturing: Reducing transportation emissions by producing goods closer to their point of sale.

- Eco-friendly dyes: Using environmentally friendly coloring agents and printing processes.

These sustainable practices resonate with consumers who prioritize environmental consciousness, particularly younger demographics that value brands aligned with their beliefs.

Competitive Overview in the Licensed Merchandise Industry

The licensed merchandise sector features several dominant players who shape market dynamics through strategic partnerships and innovative product offerings. Key industry leaders include:

-

Nike Inc. – United States

-

Adidas AG – Germany

-

Puma SE – Germany

-

Under Armour Inc. – United States

-

VF Corporation – United States

-

G-III Apparel Group Ltd. – United States

-

DICK’S Sporting Goods Inc. – United States

-

Iconix Brand Group – United States

-

ASICS Corporation – Japan

-

Li Ning (China) Sports Goods Co. Ltd. – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Licensed Merchandise Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The licensed merchandise industry represents a dynamic market characterized by strategic partnerships, digital innovation, and evolving consumer preferences. From entertainment franchises to sports leagues, the sector spans multiple product categories including apparel, toys, and collectibles.

Global market trends indicate strong growth potential, particularly in key regions like the U.S., China, and Germany, each with distinct consumer behaviors and market dynamics. Supply chain management plays a crucial role, with stakeholders focusing on upstream and downstream processes, logistics optimization, and maintaining transparency.

Technology integration, especially blockchain and digital licensing solutions, is reshaping traditional business models while addressing authentication and distribution challenges.

Sustainability has emerged as a critical focus area, with companies investing in eco-friendly practices, renewable energy, and circular economy principles. Market leaders like Disney Consumer Products, Nike, and Fanatics continue to drive innovation through strategic partnerships and digital initiatives.

The industry faces various challenges, including geopolitical factors affecting global trade, production and distribution complexities, and the need to adapt to rapidly changing consumer preferences, particularly among Generation Z consumers. However, opportunities exist in direct-to-consumer channels, digital merchandise, and emerging markets, suggesting continued growth potential for the sector.

Global Licensed Merchandise Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Licensed Merchandise Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Licensed Merchandise Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalLicensed Merchandise Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Licensed Merchandise Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Licensed Merchandise Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Licensed Merchandise Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Licensed Merchandise Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the licensed merchandise market by 2025?

The licensed merchandise market is projected to grow to USD 37.51 billion by 2025, driven by increasing consumer demand and brand partnerships.

How do licensing agreements impact the production of licensed merchandise?

Licensing agreements play a crucial role in product development within the licensed merchandise market, ensuring that brands can legally produce and sell products associated with popular franchises.

What are some key trends influencing the licensed merchandise market?

Key trends include the influence of pop culture on merchandise popularity, successful brand partnerships, and heightened fan engagement, all of which drive sales in various product categories.

What challenges does the licensed merchandise industry face in production and distribution?

Challenges include high investment costs, distribution issues, and the threat of counterfeit products, which can undermine brand integrity and affect consumer trust.

How do geopolitical factors affect the global licensing landscape?

Geopolitical factors influence licensing opportunities through trade policies and regional differences, impacting how brands strategize their market entry and operations globally.

What types of products are commonly found in the licensed merchandise market?

Common types of licensed merchandise include apparel (especially sports apparel), toys, and collectibles, with sports apparel leading as a significant segment accounting for 65% of sales.