$1.94 Billion Demulsifier Market Expands in 2025: Saudi Arabia, U.S., and Brazil Drive Oil & Gas Industry Demand

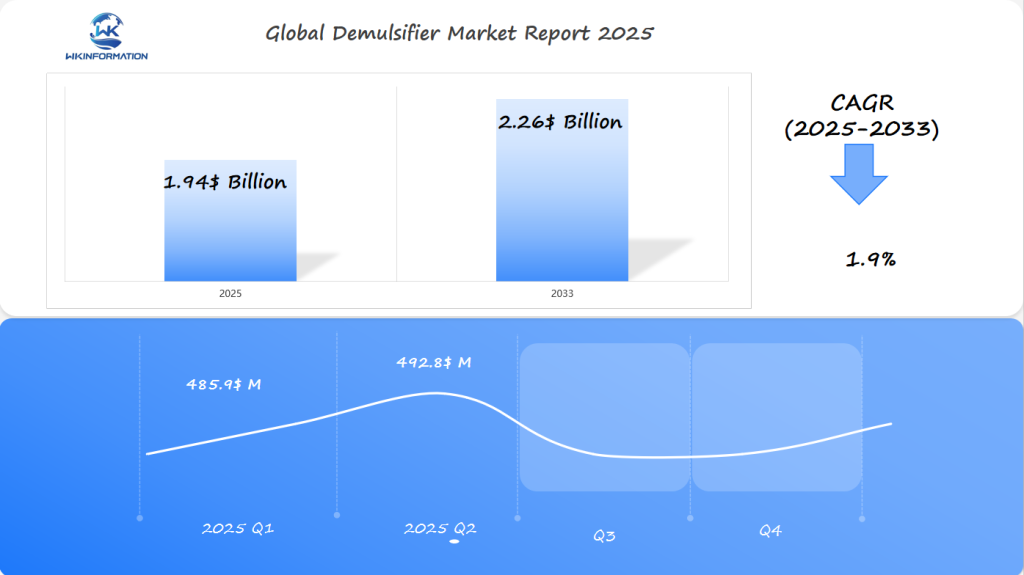

In 2025, the global Demulsifier market is estimated to reach an approximate value of $1.94 billion, with projections indicating growth to $2.26 billion by 2033, at a compound annual growth rate (CAGR) of 1.9% during the forecast period from 2025 to 2033. This growth is driven by increasing demand in the oil and gas industry for effective separation of water from crude oil, as well as applications in petrochemical refining and lubricant manufacturing. The rising focus on improving operational efficiency and adhering to environmental regulations further supports the adoption of demulsifiers across various sectors.

- Last Updated:

Demulsifier Market Q1 and Q2 2025 Forecast

The Demulsifier market is projected to reach $1.94 billion in 2025, with a CAGR of 1.9% from 2025 to 2033. In Q1 2025, the market is estimated to generate $485.9 million, driven by increased demand from the oil and gas industry in Saudi Arabia, the U.S., and Brazil. Demulsifiers are essential for breaking water-in-oil emulsions in petroleum production and refining processes, and their demand is closely tied to global oil prices and production volumes.

By Q2 2025, the market is forecast to reach $492.8 million, as the continued need for efficient oil recovery and refining processes in Saudi Arabia and Brazil drives demand for demulsifiers. The U.S., as a major producer of both conventional and shale oil, will continue to see robust demand for demulsifying agents in the oil extraction and refining sectors. Furthermore, environmental regulations encouraging better water separation from oil will add to the market growth.

The ongoing energy transition towards more sustainable and eco-friendly solutions in the oil and gas sector may lead to a shift in demand toward greener, more biodegradable demulsifiers.

Understanding the Upstream and Downstream Industry Chains for Demulsifiers

The demulsifier industry chain is key in the oil and gas world. It links many technological and industrial steps. These chemicals help separate water from crude oil, making production more efficient in both upstream and downstream areas.

Upstream Sector

The upstream sectors deal with getting raw materials and early processing. Important parts of the demulsifier chain include:

- Crude oil exploration sites

- Initial extraction platforms

- Offshore and onshore drilling operations

- Raw material suppliers for chemical formulations

Raw Material Sourcing and Production

Chemical manufacturers develop demulsifiers through extensive research and development. The production process involves selecting specific chemical compounds that effectively break water-oil emulsions. Suppliers collaborate with oil companies to create solutions for various extraction environments.

“Demulsifiers are the unsung heroes of oil production, enabling efficient separation and improved product quality.” – Energy Technology Insights

Downstream Application Sectors

Downstream sectors use demulsifiers in many important ways:

- Petroleum refining

- Wastewater treatment

- Petrochemical processing

- Industrial separation technologies

The demulsifier industry chain shows its big role in global energy and industry. It drives innovation and boosts efficiency in many areas.

Key Trends Driving the Demulsifier Market: Increasing Oil Production and Water Treatment Needs

The global demulsifier market is growing fast. This is because of new trends in oil production and water treatment. New technologies and higher energy needs are changing how demulsifiers are used in many areas.

Important trends in the demulsifier market show us a lot about the industry:

- Rising global oil production has made people want better demulsification technologies

- Water treatment in oil processing is getting more complex

- New chemical formulas are making separation better

Emerging Market Dynamics

The U.S. Energy Information Administration said we’ll use 101.3 million barrels of liquid fuel a day in 2022. This shows how important demulsifier trends are. More oil production has led to better separation technologies.

More industries are seeing the strategic importance of advanced demulsification techniques. Companies are spending on research to make better, greener chemicals. These solutions tackle tough separation problems.

Challenges in Demulsifier Production and Environmental Regulations

The demulsifier industry is facing big challenges. It must deal with tough environmental rules and keep production running smoothly. Companies need to find a balance between new technology and strict green standards.

Demulsifier production is getting harder as global rules get stricter. The main problems include:

- Lowering chemical toxicity in making formulas

- Reducing the environmental impact of making products

- Creating chemicals that break down easily

- Following international environmental laws

Regulatory Compliance Strategies

Companies are taking steps to meet environmental rules. They are focusing on green chemistry and sustainable demulsifier tech. This is a big investment for oil and gas firms.

“Sustainable innovation is no longer optional—it’s a mandatory pathway for chemical manufacturers,” says Dr. Emily Roberts, environmental chemistry expert.

Environmental rules are changing how demulsifiers are made. They require:

- Less chemical waste

- Lower carbon emissions

- Better safety for workers

- Clear information about chemical makeup

The industry is adapting to these changes. It’s working on making demulsifiers that are better for the planet. These products must still work well and meet strict rules.

Geopolitical Influence on the Demulsifier Market

The global demulsifier market is closely tied to complex geopolitical factors. These factors shape its dynamics. Oil-producing regions are key in driving demand and innovation in the industry.

Geopolitical landscapes directly affect the development and adoption of demulsifier technologies across different markets:

- Middle East & Africa’s dominant market position

- U.S. shale revolution’s transformative impact

- Emerging offshore drilling technologies

- Changing global energy production patterns

Regional Market Dynamics and Strategic Implications

The Middle East has a huge market potential. Countries like Saudi Arabia, Kuwait, and the United Arab Emirates are major players. They use their large oil reserves to shape global technology and market trends.

| Region | Market Influence | Key Drivers |

| Middle East | Largest Market Share | Massive Oil Reserves |

| United States | Technological Innovation | Shale Oil Production |

| Brazil | Emerging Market | Offshore Drilling Expansion |

Geopolitical factors keep changing the demulsifier market. They open up chances for new technologies and strategic investments worldwide.

Demulsifier Market by Type: Oil-Soluble and Water-Soluble Formulations

The demulsifier market has two main types: oil-soluble and water-soluble demulsifiers. These chemicals are key in oil and gas processing. They help separate water from oil in industrial settings.

Oil-soluble demulsifiers lead the market. They work well in separating water from crude oil during extraction and processing.

Characteristics of Demulsifier Formulations

- Oil-soluble demulsifiers excel in petroleum hydrocarbon environments

- Water-soluble demulsifiers offer enhanced performance in aqueous solutions

- Each formulation targets specific industrial separation challenges

Oil-Soluble Demulsifiers

Oil-soluble demulsifiers are good at breaking down water droplets in oil. They work by interacting with the water-oil mix, making separation easier.

Water-Soluble Demulsifiers

Water-soluble demulsifiers are great for industries needing different solutions. They work well in places with lots of water, offering flexibility across various sectors.

The choice between oil-soluble and water-soluble demulsifiers depends on specific needs and conditions.

Companies are always looking to improve demulsifiers. They focus on making them more efficient, eco-friendly, and cost-effective.

Applications of Demulsifiers in Crude Oil Processing, Refining, and Wastewater Treatment

Demulsifiers are key in the oil and gas world, especially in crude oil processing. They are special chemicals that break down emulsions. This makes it easy to separate water from oil.

The crude oil processing area is a big deal. Oil and gas companies use these chemicals to make their work more efficient and their products better.

Key Application Areas

- Crude Oil Separation

- Petroleum Refining

- Industrial Wastewater Treatment

- Enhanced Oil Recovery

Performance Characteristics in Crude Oil Processing

| Application | Efficiency | Key Benefits |

| Water Separation | 95-98% | Reduces processing time |

| Emulsion Breaking | 90-95% | Improves oil quality |

| Contaminant Removal | 85-90% | Enhances downstream processing |

Wastewater treatment is also a big area for demulsifiers. These chemicals help industries manage water better. This reduces harm to the environment and supports green practices.

“Demulsifiers are transforming crude oil processing by enabling more efficient separation and purification technologies.” – Energy Research Institute

New, eco-friendly demulsifier formulas are opening up more uses in different industries. They promise better, greener ways to process crude oil.

Global Insights into the Demulsifier Market

The global demulsifier market is full of growth and new tech. It covers North America, Europe, Asia-Pacific, and Middle East & Africa. This market has a lot of room to grow in the oil and gas world.

- North America leads with a a high market share in 2025

- Asia-Pacific is growing fast

- Europe keeps improving tech

- Middle East & Africa are full of investment chances

Market Dynamics by Region

The global demulsifier market varies significantly across different regions.

North America has a strong market due to its established petrochemical industry and ongoing research activities.

Asia-Pacific, on the other hand, is experiencing rapid growth, primarily driven by countries like China and India.

New trends indicate an increasing demand for specialized demulsifier technologies. Companies are also focusing on developing environmentally friendly products that comply with regulations while maintaining high performance.

Strategic Market Positioning

Research shows that each region needs its own strategy. Companies are changing their products to fit each area’s needs. They know a single solution doesn’t work for everyone in the global demulsifier market.

Saudi Arabia's Expansion in Oil Extraction and Separation Technologies

Saudi Arabia is leading the way in oil extraction with new technologies. The kingdom is making big strides in oil extraction. This has led to a big increase in the demand for demulsifiers worldwide.

Important changes in Saudi Arabia’s oil industry show the importance of advanced technologies:

- Aramco’s discovery of four new oil and gas fields in December 2020

- Substantial investments in cutting-edge demulsifier technologies

- Enhanced crude oil processing techniques

Technological Innovations in Oil Separation

The kingdom’s focus on better oil extraction has boosted demulsifier demand. Saudi Arabian scientists have created special chemicals. These chemicals cut down water in crude oil, making it better and more valuable.

New technologies aim at:

- Lowering water in oil streams

- Boosting separation efficiency

- Lessening environmental harm

Saudi Arabia’s strategic approach makes it a global leader in oil extraction and separation technologies. It sets new standards for the industry in performance and innovation.

The U.S.'s Demand for Demulsifiers in Oilfield Services and Petrochemical Processing

The United States is seeing a big increase in demand for demulsifiers. This is because of the growth in U.S. oilfield services and petrochemical processing. Industry analysts predict the demulsifier marke.

Key Factors Driving Demand

Several key factors are driving this surge in demand:

- Rapid expansion of shale oil production

- Increased crude oil export capabilities

- Advanced petrochemical processing technologies

- Rising demand for efficient emulsion separation

Innovations in Demulsifier Technology

The U.S. petrochemical industry is leading in demulsifier technology. They’ve created special formulas to tackle tough emulsion problems, especially in shale oil.

New technologies are making demulsifiers more precise and eco-friendly. These changes help the industry get more oil while being kinder to the environment.

Market Dynamics and Future Outlook

New technology and increased oil production are reshaping the demulsifier market. Investments in research and development are leading to advancements in separation technologies. These enhancements result in more efficient oil extraction processes.

Brazil's Growth in Offshore Oil Drilling and Emulsion Separation Technologies

Brazil’s offshore oil drilling has become a key player in the world’s energy scene. The country’s smart investments in offshore drilling have made it a major player in the global oil market. Petroleo Brasileiro S.A. (Petrobras) has led the way in new technologies for deep-sea oil exploration.

Developing advanced emulsion separation technologies is crucial for Brazil’s oil extraction. These new solutions help tackle the tough challenges of offshore oil production, especially in the pre-salt layers of the Brazilian continental shelf.

Key Technological Innovations

- Advanced subsea extraction equipment

- Cutting-edge emulsion separation technologies

Experts in the oil industry see Brazil as a game-changer in offshore oil extraction. The country’s unique geological conditions require special methods for oil production and processing.

“Brazil’s offshore technology represents a new frontier in petroleum engineering and extraction methods.” – Energy Research Institute

Economic Impact and Future Prospects

The Brazilian offshore drilling sector is attracting significant international investment. The emulsion separation technologies developed in Brazil are becoming increasingly advanced, resulting in more efficient oil extraction and processing.

According to studies, Brazil has the potential to become a leading provider of advanced petroleum technologies within the next decade. The combination of innovative technology and effective resource management positions Brazil as a frontrunner in offshore oil exploration.

The Future of Demulsifiers: Bio-Based and Eco-Friendly Formulations

The demulsifier industry is moving towards sustainable options. Researchers are looking into bio-based demulsifiers. These new solutions aim to change oil and gas processing and reduce harm to the environment.

New research shows exciting progress in eco-friendly formulations. Scientists are working on demulsifiers that work well and are good for the planet.

Key Innovations in Green Demulsifier Technology

- Natural plant extracts as primary demulsification agents

- Vegetable oil-based chemical compositions

- Biodegradable formulations with minimal ecological footprint

The Japan Petroleum Institute is leading in green demulsifier tech. They’re using natural stuff like green tea and vegetable oils in their research.

| Natural Source | Demulsification Potential | Environmental Impact |

| Coconut Oil | High Effectiveness | Low Carbon Footprint |

| Green Tea Extract | Moderate Separation Capability | Minimal Ecological Disruption |

| Olive Oil Derivatives | Promising Performance | Sustainable Production |

The future of bio-based demulsifiers is bright. More people want sustainable solutions in industry. Researchers keep finding ways to make eco-friendly demulsifiers that work well.

Competitive Landscape in the Demulsifier Market

The demulsifier market is getting more competitive. Big players are fighting for a strong spot in the global oil and gas world. They’re spending a lot on new tech to stay ahead and help the market grow.

Here are some of the major companies leading the demulsifier market:

- BASF SE —— Germany

- Baker Hughes Company —— United States

- Schlumberger Limited —— United States

- Clariant AG —— Switzerland

- Ecolab Inc. —— United States

- Halliburton Company —— United States

- Croda International PLC —— United Kingdom

- Dow Chemical Company —— United States

- Nouryon —— Netherlands

- Dorf Ketal Chemicals —— India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Acetone Sensor Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global demulsifier market is set for growth and new technologies. It’s expected to grow from USD 1.94 billion in 2024 to USD 2.26 billion by 2033. This growth is driven by more demand in oil extraction and water treatment.

Shift Towards Green Solutions

New technologies are changing the demulsifier market with green products. The move to renewable energy and stricter rules are making companies create eco-friendly solutions. This shift shows a big change towards green chemical technologies that are good for the planet and work well.

Major Players in the Market

Places like Saudi Arabia, the United States, and Brazil are big players in the market. They invest a lot in oil and new separation technologies. The market is looking at new chemical solutions for tough separation tasks, especially in offshore drilling and petrochemicals.

Importance of Research and Development

Investing in research and development is key for companies to grow in the demulsifier market. As industries want better and greener separation tech, quick innovators will lead the way. They will take a big share of the market and help the industry grow.

Global Demulsifier Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Demulsifier Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- DemulsifierMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Demulsifierplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Demulsifier Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Demulsifier Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Demulsifier Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Demulsifier Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value for demulsifiers by 2025?

The demulsifier market is expected to hit $1.94 billion by 2025. This growth is mainly due to countries like Saudi Arabia, the United States, and Brazil.

What are the primary types of demulsifiers in the market?

There are two main types: oil-soluble and water-soluble. Oil-soluble demulsifiers, are widely used in the oil and gas industry for the demulsification of oil-water emulsions.

How do demulsifiers impact oil production?

Demulsifiers are key in separating water from crude oil. This boosts production efficiency and improves product quality in the oil and gas sector.

What challenges do demulsifier manufacturers face?

Manufacturers face the challenge of making effective demulsifiers while following strict environmental rules. This pushes them to create more eco-friendly chemicals.

What are the emerging trends in demulsifier technology?

The market is moving towards bio-based and eco-friendly demulsifiers. This includes green demulsifiers made from plant extracts like green tea and vegetable oils.

How are geopolitical factors influencing the demulsifier market?

The Middle East, especially Saudi Arabia, Kuwait, and the UAE, along with the U.S. shale revolution, are major influences. They greatly increase demand and affect market trends.

What is the projected market value for demulsifiers by 2032?

The market is expected to grow to $2.26 billion by 2033. This shows a big increase in demand for advanced separation technologies in the oil and gas industry.

What are the key applications of demulsifiers?

Demulsifiers are mainly used in:

- Crude oil separation

- Petroleum refining

- Industrial wastewater treatment

Crude oil is the largest segment in industrial wastewater treatment, accounting for 30%.

Which companies are leading in the demulsifier market?

Leading companies include Baker Hughes, Clariant AG, and Ecolab Inc. They are innovating through research, strategic moves, and new product development.