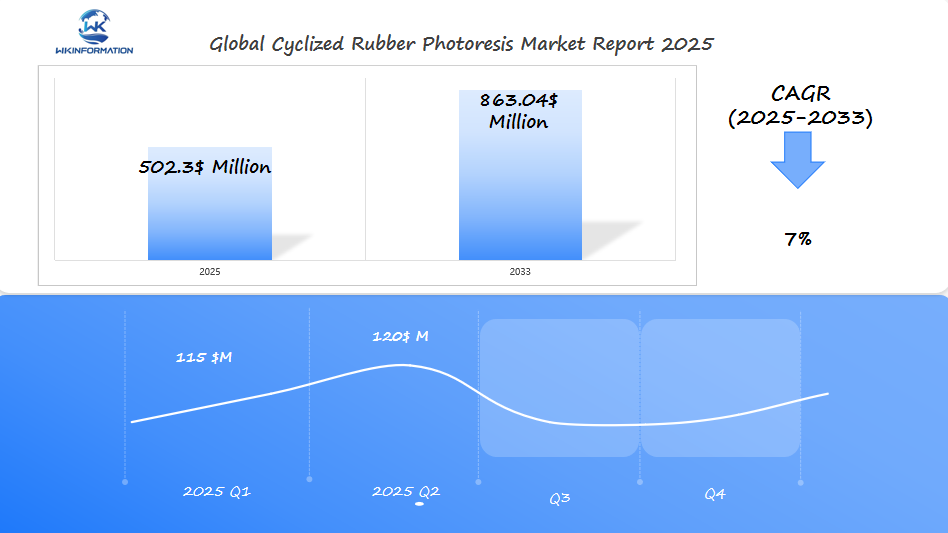

$502.3 Million Cyclized Rubber Photoresist Market to Advance Electronics and Coatings in the U.S., Japan, and China by 2025

Explore the cyclized rubber photoresist market trends, growth drivers, and challenges, with insights into its role in semiconductors and advanced manufacturing.

- Last Updated:

Cyclized Rubber Photoresist Market Q1 and Q2 2025 Outlook

The cyclized rubber photoresist market is projected to reach $502.3 million in 2025, with a 7% CAGR from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $115 million, driven by increasing demand for high-performance photoresists used in advanced manufacturing processes, particularly in the semiconductor and electronics industries.

The market is expected to expand as China, Japan, and the U.S. increase their investments in semiconductor production and advanced manufacturing technologies. By Q2 2025, the market is forecasted to grow to around $120 million, as China continues to ramp up semiconductor manufacturing, Japan focuses on precision manufacturing technologies, and the U.S. boosts its semiconductor production capacity in line with national strategies to increase domestic manufacturing in critical industries.

Key Takeaways

- Cyclized rubber photoresist market size reaches $502.3 million, fueled by electronics innovation needs.

- U.S., Japan, and China dominate regional market adoption for semiconductor and display applications.

- Material properties like thermal resistance and UV responsiveness support advanced manufacturing.

- Electronics innovation drives demand for precision coating solutions in high-tech sectors.

- Market growth aligns with global trends in miniaturization and sustainable material use.

Exploring the Upstream and Downstream Industry Chains for Cyclized Rubber Photoresist

Raw material suppliers and chemical producers are key in the U.S. electronics industry. They provide the rubber, solvents, and photoactive compounds for photoresist. These materials go through manufacturing where quality and efficiency are crucial.

| Upstream | Downstream |

| Chemical refineries | Semiconductor manufacturers |

| Specialty polymer labs | Consumer electronics brands |

Downstream, companies like Intel and Samsung need a steady supply for their products. Distribution networks help get these materials to plants across the U.S. Key factors include:

- Raw material cost changes

- Automation in manufacturing

- High demand for pure materials

Working together, suppliers and users push innovation. For example, improving rubber formulas helps in making microchips and displays. This balance helps the industry grow and stay competitive globally.

Key Trends in the Cyclized Rubber Photoresist Market: Electronics and Coatings Applications

The cyclized rubber photoresist market is driven by Japanese technology in electronics and coatings. Innovations like ultra-thin semiconductor layers and flexible displays rely on Japan’s R&D expertise. Companies like JSR and Tokyo Ohka Kogyo dominate this space, creating materials for high-precision manufacturing.

Electronics Trends

- Miniaturization: Japanese developers work on photoresists for 3nm chip production, balancing speed and stability.

- Durability: UV-curable resists from Japan are used in automotive and aerospace for scratch-resistant surfaces.

Coatings Trends

- High-resolution semiconductors: Using Japan’s low-defect resists.

- UV-curable films: For automotive and smartphone screens.

Sustainability Trend

- Reduced solvent-based resists cutting environmental impact.

These trends show Japan’s global leadership in material science. As demand grows for advanced displays and 5G components, Japanese technology remains key. Innovations here impact next-gen electronics and industrial coatings worldwide.

Challenges in the Development and Production of Cyclized Rubber Photoresist

Making cyclized rubber photoresist needs a lot of technical skill and quality control. Companies struggle with unstable materials during making and keeping the product pure. They need top-notch lab tools and experienced workers to solve these problems.

Technical Challenges

- Technical complexity in chemical formulation

- High cost of specialized raw materials

- Scalability issues in mass production

Solutions for Overcoming Challenges

| Challenge | Solution Pathway |

| Material instability | Advanced purification systems |

| Cost barriers | Regional partnerships for resource sharing |

| Quality inconsistencies | Automated monitoring systems |

Chinese factories have found ways to make things cheaper by using automation. Places like Shanghai and Guangzhou use quality checks as they make things. They aim to keep costs down while still making high-quality products.

New partnerships between tech companies and Asian makers are changing how things are made. They work to make the process from idea to product faster. This helps solve problems and keep quality up for things like electronics and semiconductors.

Geopolitical Influence on the Cyclized Rubber Photoresist Market

Global trade policies and regional alliances shape the market trends for cyclized rubber photoresist. U.S. sanctions on semiconductor exports, for instance, directly affect supply chains in Japan and South Korea, key producers of advanced materials. China’s push to dominate tech manufacturing amplifies demand for high-purity photoresist, creating both opportunities and bottlenecks.

Trade agreements like the U.S.-Japan Digital Trade Agreement incentivize collaboration in semiconductor tech, boosting joint R&D for photoresist. Meanwhile, tariffs on chemical imports into the EU raise production costs, shifting supplier strategies.

“Geopolitical shifts are now core to material sourcing strategies,” says a 2023 industry report, highlighting how political climates redefine supplier networks.

Key Geopolitical Factors Impacting the Cyclized Rubber Photoresist Market

- U.S. export controls limit access to critical materials for non-allied nations

- China’s Made in China 2025 initiative prioritizes domestic photoresist production

- Japan balances trade partnerships with tech security concerns

Regional economic blocs like ASEAN foster partnerships for raw material supply, while tensions over rare earth minerals disrupt production timelines. Companies now diversify suppliers to mitigate risks, reshaping global market trends toward localized manufacturing hubs. Understanding these dynamics is vital for businesses navigating this evolving landscape.

Types of Cyclized Rubber Photoresists: Properties and Characteristics

Cyclized rubber photoresists are made in different types for various uses. Positive-working and negative-working resists are created to fit different needs. Positive types get harder when exposed to light, while negative types dissolve, making detailed patterns for chips and screens.

Key Properties of Cyclized Rubber Photoresists

- Thermal Stability: High-temperature resists protect electronics during assembly.

- Chemical Resistance: Some formulations withstand harsh cleaning solvents in semiconductor manufacturing.

- UV Sensitivity: Optimized for short exposure times, reducing production delays.

Material scientists focus on finding cost-effective solutions without losing quality. They work hard to improve adhesion to materials like silicon or glass. They also aim to make UV-curable resists more energy-efficient while keeping high resolution.

For flexible electronics, bendable photoresists are needed. But making them durable without cracking is a big industry challenge. Researchers are testing nanocomposite additives to improve flexibility without losing etching precision.

Applications of Cyclized Rubber Photoresists in Electronics, Displays, and Coatings

Cyclized rubber photoresists play a big role in today’s industries. They help make electronics like semiconductors and printed circuit boards with high precision. They also make OLED and LCD screens brighter and more durable.

In coatings, they protect cars and planes from rust. These materials help reduce waste and save energy. This makes them key for sustainable solutions.

1. Electronics

Used in chip fabrication to reduce microchip defects, lowering material waste.

2. Displays

Enable thinner, lighter screens for smartphones and TVs, cutting energy consumption.

3. Coatings

Protect surfaces in automotive paints and solar panels, extending product lifespans.

“High-resolution patterning with cyclized rubber photoresists reduces chemical runoff, supporting eco-friendly production.” – SEMI Industry Report

Companies like JSR and TAIYO NIPPON KAGAKU use these materials for sustainable solutions. They meet global green manufacturing standards. Their low environmental impact helps industries reduce carbon footprints without losing performance.

Global Insights into the Cyclized Rubber Photoresist Market

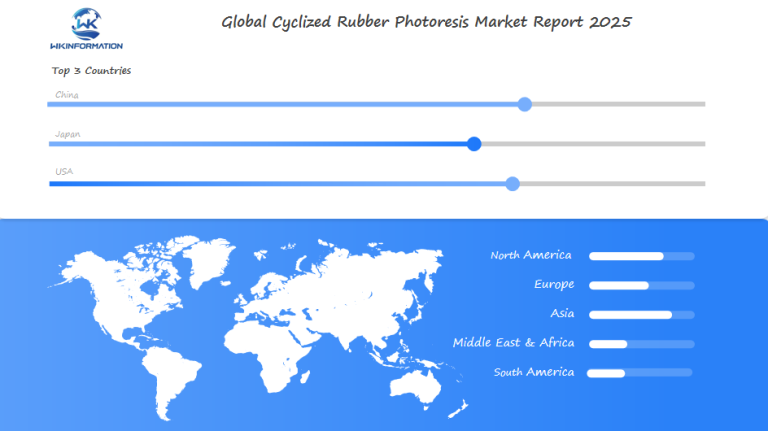

Global market insights show that cyclized rubber photoresist demand changes in different regions. North America, Asia-Pacific, and Europe are at the forefront of innovation. Japan and China are the top producers.

For U.S. businesses, knowing these trends is key. It helps spot chances in the electronics and semiconductor markets.

| Region | Market Share | Growth Driver |

| Asia-Pacific | 58% | High-tech manufacturing expansion |

| North America | 24% | Semiconductor R&D investment |

| Europe | 12% | EU green tech policies |

- Japan’s JSR Corporation dominates 30% of global exports

- U.S. companies like DuPont partner with Asian suppliers

- Emerging markets in Southeast Asia seek cost-effective solutions

There’s also a growing need for eco-friendly materials globally. China’s producers aim to cut costs while meeting quality standards. This competition affects U.S. import choices.

U.S. Market Demand for Cyclized Rubber Photoresists in Electronics Manufacturing

The U.S. electronics sector is driving up demand for cyclized rubber photoresists. Tech giants and startups are racing to innovate. These materials help in making semiconductors and advanced displays with precision. This shows a competitive landscape where U.S. companies focus on quality and speed.

Key Drivers of Demand

- Advanced semiconductor fabrication

- Rising need for high-resolution displays

- Government incentives for tech R&D

Big names like Intel and (TSMC)’s U.S. sites are big buyers. The competitive landscape includes both global and local suppliers. Suppliers must meet cost, reliability, and support needs to win contracts.

“U.S. manufacturers demand materials that align with strict industry standards,” says a 2023 industry report. “This shapes how suppliers adapt to regional needs.”

Future trends show closer ties between material providers and electronics companies. As demand increases, the competitive landscape will favor those investing in R&D and local production. The U.S. market’s focus on innovation makes it a key place for testing new photoresist solutions.

Japan’s Role in High-Tech Photoresist Development for Semiconductor Industry

Japan is leading the way in advanced photoresist technology for semiconductors. Companies like JSR, Tokyo Ohka Kogyo, and Shin-Etsu Chemical are pushing the boundaries in materials science. They focus on precision and scalability for the next generation of chips.

advanced photoresist technology in semiconductor manufacturing

“Japan’s R&D investments ensure our advanced photoresist solutions stay ahead of industry demands,” stated a researcher at JSR Corporation, emphasizing collaboration with global semiconductor firms.

Several factors contribute to Japan’s leadership:

- Decades of expertise in chemical engineering and nanotechnology

- Partnerships with semiconductor leaders like TSMC and Intel

- Focus on eco-friendly production methods reducing waste

Japan’s advancements allow for smaller chip sizes needed for 3D NAND and AI processors. Recent breakthroughs in EUV lithography-compatible advanced photoresist materials have cut defect rates by 30% in pilot projects. This progress meets global needs for better chip performance and tackles supply chain issues.

Investments in Tokyo and Kyoto research hubs keep Japan at the heart of semiconductor innovation. As demand for 5G and autonomous systems increases, these materials will be crucial for maintaining Japan’s technological edge.

China's Expanding Cyclized Rubber Photoresist Production for Global Markets

China is becoming a major force in making cyclized rubber photoresist. Factories in places like Zhejiang and Jiangsu provinces now make over 40% of the world’s supply. This helps the electronics and coating industries in the U.S. and Europe by offering affordable options.

Big companies like Wuhan Huarui Chemical and Shanghai Jinhui Materials are using new technology to make more. They are working on:

- Creating high-purity resin

- Partnering with semiconductor companies

- Increasing exports to North America and ASEAN

| Company | 2023 Capacity (tons) | Main Markets |

| Wuhan Huarui | 8,500 | U.S., South Korea |

| Shanghai Jinhui | 6,200 | Europe, Japan |

| Hangzhou Photopolymer | 4,800 | Global OEMs |

Exports to the U.S. went up 18% in 2023. This met the demand for flexible displays and car coatings. China’s new policies aim to improve technology while keeping prices low. This makes Chinese producers key players in the $502.3M global market.

The Future of Cyclized Rubber Photoresists: Sustainable and Efficient Solutions

As industries focus on being green, cyclized rubber photoresist makers are finding ways to be both effective and eco-friendly. Companies like JSR Corporation and Shipley are working hard to cut down on waste and energy. Green technologies are changing how these materials are created.

| Traditional Methods | Sustainable Innovations |

| High energy consumption | Solar-powered facilities |

| Chemical waste | Recycled solvent systems |

| Long production cycles | AI-driven process optimization |

- Recycling solvent systems cut waste by 40%

- Renewable energy reduces carbon footprints by 30%

- Biodegradable additives meet EU eco-label standards

Top brands are using efficient production methods that match global green goals. New partnerships between chemical companies and green groups aim to create materials that are both good for the planet and work well. The move to circular production means materials can be reused or disposed of safely.

Customers want products that are good for the environment without losing quality. This push for green options is driving more research into bio-based polymers and cleaner curing methods. By 2030, the industry expects a 25% rise in the use of sustainable photoresists in making semiconductors.

Competitive Landscape in the Cyclized Rubber Photoresist Market

- JSR Corporation – Tokyo, Japan

- Tokyo Ohka Kogyo Co., Ltd. – Kawasaki, Kanagawa, Japan

- Shin-Etsu Chemical Co., Ltd. – Tokyo, Japan

- FUJIFILM Electronic Materials – Yokohama, Kanagawa, Japan

- Sumitomo Chemical Co., Ltd. – Tokyo, Japan

- Dow Chemical Company – Midland, Michigan, United States

- DuPont – Wilmington, Delaware, United States

- Avantor – Radnor, Pennsylvania, United States

- Merck KGaA – Darmstadt, Germany

- Kempur

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Cyclized Rubber Photoresis Market Report |

| Base Year | 2024 |

| Segment by Type |

· Positive Photoresists · Negative Photoresists |

| Segment by Application |

· Semiconductor Manufacturing · Printed Circuit Boards (PCBs) · Optical Devices and Displays |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Cyclized Rubber Photoresist Market is key for electronics and advanced coatings. It’s driven by demand from the U.S., Japan, and China. Innovations in semiconductors and display tech are fueling this growth.

Companies like JSR and Shipley Chemical are leading the way in material advancements. Despite challenges like cost and supply chain issues, sustainable manufacturing is making progress. This shift towards eco-friendly practices is a big step forward.

For businesses, keeping up with global trends and tech breakthroughs is crucial. The future of this market depends on collaboration between manufacturers and researchers. They need to work together to meet the demand for high-performance materials in new electronics.

This market’s evolution will greatly influence tech innovation worldwide. It’s an exciting time for the industry.

Global Cyclized Rubber Photoresis Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Cyclized Rubber Photoresis Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Cyclized Rubber Photoresis Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Cyclized Rubber Photoresisplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Cyclized Rubber Photoresis Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Cyclized Rubber Photoresis Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Cyclized Rubber Photoresis Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Cyclized Rubber Photoresis Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the Cyclized Rubber Photoresist Market?

The Cyclized Rubber Photoresist Market is the sector that makes and sells special photoresist materials. These materials are used in electronics and coatings. The market is worth about $502.3 million.

How does the Cyclized Rubber Photoresist support electronics manufacturing?

Cyclized Rubber Photoresists help make electronics better. They are key for creating detailed patterns on semiconductor wafers. This is important for making high-performance electronic devices.

Major Regions Influencing the Cyclized Rubber Photoresist Market

The U.S., Japan, and China are significant contributors to the market. Each country brings its own innovations, technologies, and demand to the industry.

What challenges does the Cyclized Rubber Photoresist production face?

Making Cyclized Rubber Photoresists is tough. There are technical hurdles, keeping quality up, and scaling production.

What are the latest trends in the Cyclized Rubber Photoresist applications?

Currently, there are advancements in display technology and new coatings. These improvements enhance product performance and have a positive impact on the environment. This is driven by the demand for cutting-edge electronics.

How do geopolitical factors impact the Cyclized Rubber Photoresist Market?

Politics can affect trade and industry rules. This can change the market’s stability, supply chain, and growth.

What types of Cyclized Rubber Photoresists are available?

There are many types of Cyclized Rubber Photoresists. Each has special properties for different uses, like high heat or chemical resistance in electronics.

How are Cyclized Rubber Photoresists used in various industries?

Cyclized Rubber Photoresists are used in making electronics, display tech, and protective coatings. They drive innovation in many areas.

Why is Japan important in the development of Cyclized Rubber Photoresist?

Japan plays a crucial role in the production of high-tech photoresist solutions. They are at the forefront of innovations that cater to the requirements of semiconductors through advanced techniques.

How is China expanding its production in this market?

China is increasing its production by investing in technology and improving efficiency in its processes. This shift has an impact on the global supply chain in the Cyclized Rubber Photoresist industry.

What is the future outlook for Cyclized Rubber Photoresists?

The future of Cyclized Rubber Photoresists looks bright. There will be a focus on sustainable and efficient production as industries go green.

Who are the key players in the Cyclized Rubber Photoresist Market?

Key players in the Cyclized Rubber Photoresist Market include manufacturers and suppliers of photoresist materials and technology. They play a crucial role in shaping the market through their strategies and innovations.